Professional Documents

Culture Documents

Employees Provident Fund Organization: - Declaration Form

Uploaded by

Pratik MukulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employees Provident Fund Organization: - Declaration Form

Uploaded by

Pratik MukulCopyright:

Available Formats

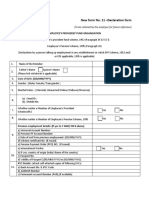

New Form No.

11- Declaration Form

(To be retained by the employer for future reference)

EMPLOYEES PROVIDENT FUND ORGANIZATION Emp Code: _________________________

Employees provident funds scheme, 1952 (paragraph 34 & 57) &

Employees pension scheme 1995 (paragraph 24)

Company: __________________________

(Declaration by a person taking up employment in any establishment on which EPF Scheme, 1952 end /of EPS1995 is applicable)

1 Name of the member

2 Father’s Name ( ) Spouse’s Name ( )

(Please Tick Whichever Is Applicable)

3 Date of Birth (DD/MM/YYYY)

4 Gender: ( male / Female /Transgender )

5 Marital Status (married /Unmarried /widow/divorce)

6 (a)Email ID: ____________________________

(b)Mobile No:

7* Whether earlier a member of Employees ‘provident Fund Scheme 1952 Yes No

8* Whether earlier a member of Employees ‘Pension Scheme ,1995 Yes No

If response to any or both of (7) & (8) above is yes. MANDATORY FILL UP THE (COLUMN 9)

a) Universal Account Number(UAN)

b) Previous PF a/c No AP HYD EST.CODE EXTN PF NO.

9 c) Date of exit from previous employment (DD/MM/YYY)

d) Scheme Certificate No (if Issued )

e) Pension Payment Order (PPO)No (if Issued)

a) International Worker: Yes No

b) If Yes , State Country Of Origin (India /Name of Other Country)

10

c) Passport No

d) Validity Of Passport (DD/MM/YYY) to(DD/MM/YYY)

KYC Details: (attach Self attested copies of following KYCs) **

a) Bank Account No .& IFS code

11

b) AADHAR Number (12 Digit)

c) Permanent Account Number (PAN),If available

UNDERTAKING

1) Certified that the Particulars are true to the best of my Knowledge

2) I authorize EPFO to use my Aadhar for verification / e KYC purpose for service delivery

3) Kindly transfer the funds and service details, if applicable if applicable, from the previous PF account as declared above to the

present P.F Account(The Transfer Would be possible only if the identified KYC details approved by previous employer has

been verified by present employer

4) In case of changes In above details the same Will be intimate to employer at the earliest

Date:

Place Signature of Member

DECLARATION BY PRESENT EMPLOYER

A) The member Mr./Ms./Mrs ………………..has joined on …………….and has been allotted PF Number……………………………….

B) In case person was earlier not a member of EPF Scheme ,1952 and EPS,1995

(Post allotment of UAN ) The UAN Allotted for the member is…………..

Please tick the Appropriate Option:

The KYC details of the above member in the UAN database

Have not been uploaded

Have been uploaded but not approved

Have been uploaded and approved with DSC

C) In case the person was earlier a member of EPF Scheme ,1952 and EPS, 1995:

The above PF account number /UAN of the member as mentioned in (a) above has been tagged with his /her UAN/previous member ID as

declared by member

Please Tick the Appropriate Option

The KYC details of the above member in the UAN database have been approved with digital signature Certificate and transfer request

has been generated on portal.

As the DSC of establishment are not registered With EPFO the member has been informed to file physical claim (Form13) for transfer

of funds from his previous establishment.

Date

Signature of Employer With seal of Establishment

You might also like

- MBA - 20 Part-3 Unit3Document10 pagesMBA - 20 Part-3 Unit3priya srmNo ratings yet

- Read BMR, Stay Ahead! - Building Material Reporter MagazineDocument82 pagesRead BMR, Stay Ahead! - Building Material Reporter MagazineBuilding Material ReporterNo ratings yet

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- Josh Trade Classic Chart PatternsDocument5 pagesJosh Trade Classic Chart Patternsmarcocahuas95% (21)

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Solution Manual Advanced Financial Accounting 8th Edition Baker Chap008 PDFDocument63 pagesSolution Manual Advanced Financial Accounting 8th Edition Baker Chap008 PDFYopie Chandra100% (1)

- Annexure-IV Form For Furnishing Pensioner / Family Pensioner DetailsDocument4 pagesAnnexure-IV Form For Furnishing Pensioner / Family Pensioner DetailsSrinivasavaradan EsNo ratings yet

- Leave FormDocument3 pagesLeave FormJudith SulongsawaNo ratings yet

- Aristo Interactive Geography 2nd Edition Book C5Document81 pagesAristo Interactive Geography 2nd Edition Book C5thomas011122100% (1)

- Mandi Tra PDFDocument1 pageMandi Tra PDFsantoshNo ratings yet

- Form 2 - Subsidy Update and SA Application (1 Aug 2020)Document13 pagesForm 2 - Subsidy Update and SA Application (1 Aug 2020)aarthi aarthiNo ratings yet

- Product Audit FormDocument2 pagesProduct Audit Formcong da0% (1)

- 01 PF Declaration Form 11Document1 page01 PF Declaration Form 11Vijayavelu AdiyapathamNo ratings yet

- Composite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationDocument2 pagesComposite Declaration Form - 11: (To Be Retained by Employer For Future Reference) Employees' Provident Fund OrganizationManasNo ratings yet

- E Nomination PDFDocument2 pagesE Nomination PDFSagar RajputNo ratings yet

- National Cadet Corps: Appendix A' (Revised 2013) Form IDocument8 pagesNational Cadet Corps: Appendix A' (Revised 2013) Form IAnkit AnandNo ratings yet

- PF Nomination and Declaration Form 2ADocument2 pagesPF Nomination and Declaration Form 2Aमनीष सिंहNo ratings yet

- PWWF-TS-Certificate From Head of Administration of EmployerDocument1 pagePWWF-TS-Certificate From Head of Administration of EmployerWaqas Lucky100% (1)

- MCI Eligibility CertificateDocument11 pagesMCI Eligibility CertificateAlka SangwanNo ratings yet

- Hba FormDocument3 pagesHba FormAteeqNo ratings yet

- Form: Pay01 (Applicable For Both Payroll and GP Fund) : Date of Marriage/since (If Applicable) Dd/MM/YYYYDocument2 pagesForm: Pay01 (Applicable For Both Payroll and GP Fund) : Date of Marriage/since (If Applicable) Dd/MM/YYYYZia100% (1)

- Dezpkjh Hkfo' Fuf/K, Oa Fofo/K Izdh - KZ Mica/K Vf/Kfu E) 1952 Ds /KKJK 1 4 Ds Varxzr Losǔnk Ls O Kfir Ds Fy, Vf/Kdka"K Dezpkfj Ksa DK Lgefr IDocument5 pagesDezpkjh Hkfo' Fuf/K, Oa Fofo/K Izdh - KZ Mica/K Vf/Kfu E) 1952 Ds /KKJK 1 4 Ds Varxzr Losǔnk Ls O Kfir Ds Fy, Vf/Kdka"K Dezpkfj Ksa DK Lgefr Imd zakiNo ratings yet

- PF - Form - 2Document2 pagesPF - Form - 2Mohan Kumar YLG100% (1)

- Check List E-TransferDocument1 pageCheck List E-TransferSher MuhammadNo ratings yet

- Consent Form For PCB Age Group TournamentsDocument1 pageConsent Form For PCB Age Group TournamentsMAK100% (2)

- Notice Under Clause (B) of Section 148A of The Income-Tax Act, 1961Document4 pagesNotice Under Clause (B) of Section 148A of The Income-Tax Act, 1961infoNo ratings yet

- Asst. Line Man ALM BS 5 7 Registration and Bank Challan FormDocument4 pagesAsst. Line Man ALM BS 5 7 Registration and Bank Challan FormAsif Ullah Khan100% (1)

- Ir8a (M) 2010Document1 pageIr8a (M) 2010gk9f5e6ho1owcldxNo ratings yet

- Employees' Provident Fund Organization: Form No. 11 (New) Declaration FormDocument3 pagesEmployees' Provident Fund Organization: Form No. 11 (New) Declaration FormDANo ratings yet

- AMDPN0995Q - Issue Letter - 1049262090 (1) - 31012023Document2 pagesAMDPN0995Q - Issue Letter - 1049262090 (1) - 31012023krishnaNo ratings yet

- Registration of Additional Qualification 26 1 BDocument8 pagesRegistration of Additional Qualification 26 1 BAnup Kumar BhattacharyaNo ratings yet

- Ahp Claim Form 2017Document1 pageAhp Claim Form 2017David S. P. SmutsNo ratings yet

- Bidding Documents - Solarization of Schools Merged Areas - FinalDocument235 pagesBidding Documents - Solarization of Schools Merged Areas - FinalFaridoon AhmedNo ratings yet

- Surety FormDocument1 pageSurety FormDesikanNo ratings yet

- E-Nomination Facility by Epfo On Unified Member PortalDocument10 pagesE-Nomination Facility by Epfo On Unified Member PortalUpasana Talapady100% (2)

- Bandhan Bank: Govt. Reg. No.-75008: 56738Document2 pagesBandhan Bank: Govt. Reg. No.-75008: 56738ronit patra100% (1)

- Asst. Line Man ALM BS 5 7 Registration and Bank Challan FormDocument4 pagesAsst. Line Man ALM BS 5 7 Registration and Bank Challan FormAbid KhanNo ratings yet

- HDFC Bank Application FormDocument5 pagesHDFC Bank Application FormhimanshuNo ratings yet

- Wipro in PF Settle FormDocument2 pagesWipro in PF Settle Formumesh100% (1)

- Admitcard-12 SSB, Bangalore-SGP206M001614Document1 pageAdmitcard-12 SSB, Bangalore-SGP206M001614SHAKHT FAUJI FAUJI100% (1)

- Call Up Letter: INDIAN AIR FORCE, Government of IndiaDocument5 pagesCall Up Letter: INDIAN AIR FORCE, Government of IndiaAbhay ThakurNo ratings yet

- Income Tax Department: Challan ReceiptDocument1 pageIncome Tax Department: Challan ReceiptamgII hqrNo ratings yet

- EPF Book PDFDocument47 pagesEPF Book PDFKrishnarao MadhurakaviNo ratings yet

- Staff Selection Commission, Southern Region, ChennaiDocument6 pagesStaff Selection Commission, Southern Region, ChennaiRavi KiranNo ratings yet

- Form Gen Ews Undertaking PDFDocument1 pageForm Gen Ews Undertaking PDFVijay Laxmi Chamoli100% (1)

- BHU Application PDFDocument13 pagesBHU Application PDFg20kpNo ratings yet

- Form - B - Register of EmployeesDocument1 pageForm - B - Register of Employeeshdpanchal86No ratings yet

- Saudi Employment Visa - Process & RequirementsDocument10 pagesSaudi Employment Visa - Process & RequirementsRamesh Kumar100% (1)

- PFForm 11Document1 pagePFForm 11sanjith_shelly290No ratings yet

- PFForm 11Document1 pagePFForm 11mohan vamsiNo ratings yet

- Employees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Document1 pageEmployees Provident Fund Organization: (To Be Retained by The Employer For Future Reference)Yash SellsNo ratings yet

- Employees' Provident Fund OrganisationDocument1 pageEmployees' Provident Fund Organisationvikas kunduNo ratings yet

- P.F. Form 11Document1 pageP.F. Form 11DattaNo ratings yet

- PF Form11 & Declaration FormDocument2 pagesPF Form11 & Declaration Formalapati NagalaxmiNo ratings yet

- Employees Provident Fund Organization: Emp Code: CompanyDocument2 pagesEmployees Provident Fund Organization: Emp Code: CompanyAmit RuikarNo ratings yet

- Employees Provident Fund Organization: - Declaration FormDocument1 pageEmployees Provident Fund Organization: - Declaration FormPAINNo ratings yet

- PFForm 11Document1 pagePFForm 11chvsrajNo ratings yet

- Form No. - 11 - Declaration FormDocument2 pagesForm No. - 11 - Declaration FormDharshan ChandrasekaranNo ratings yet

- 7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Document1 page7 Yes/ No Yes/ No: Previous Employment Details: Yes To 7 AND/OR 8, 1bove)Vakati HemasaiNo ratings yet

- EPF - FormDocument1 pageEPF - FormBavithraNo ratings yet

- Form 11 - PF Declaration1Document2 pagesForm 11 - PF Declaration1ADITYA R P 1937302No ratings yet

- PF Declaration Form No.-11Document2 pagesPF Declaration Form No.-11soumodip chakrabortyNo ratings yet

- IN Form 11Document1 pageIN Form 11Chetan DhuriNo ratings yet

- PF Membership Details in Form 11Document2 pagesPF Membership Details in Form 11AbhilashNo ratings yet

- QTPL Form 11Document2 pagesQTPL Form 11PreritNo ratings yet

- Epf Form No 11Document1 pageEpf Form No 11Narayanprasad GhosalNo ratings yet

- Marketing Plan With TPDocument5 pagesMarketing Plan With TPJanesha KhandelwalNo ratings yet

- UNIT 10-PRA-HS-30qsDocument2 pagesUNIT 10-PRA-HS-30qsHung TrinhNo ratings yet

- 18 A FYP Stakeholder ManagementDocument10 pages18 A FYP Stakeholder ManagementAsif HameedNo ratings yet

- 01 - Fundamentals of Auditng and Assurance EngagementsDocument5 pages01 - Fundamentals of Auditng and Assurance EngagementsMaybelle BernalNo ratings yet

- Group 1 - Cost Volume Profit AnalysisDocument21 pagesGroup 1 - Cost Volume Profit AnalysisPHILL BITUINNo ratings yet

- AD-AS Sunil Panda SirDocument19 pagesAD-AS Sunil Panda SirAnanya GuptaNo ratings yet

- Matrix of Curriculum Standards (Competencies) With Corresponding Recommended Flexible Learning Delivery Mode and Materials Per Grading PeriodDocument11 pagesMatrix of Curriculum Standards (Competencies) With Corresponding Recommended Flexible Learning Delivery Mode and Materials Per Grading PeriodJessie SanchezNo ratings yet

- Print 1Document22 pagesPrint 1Huỳnh HuỳnhNo ratings yet

- Developing A Project CharterDocument1 pageDeveloping A Project CharterGheyDelaCuevaNo ratings yet

- 10th Maths EM 1st Revision Exam 2023 Original Question Paper Salem District English Medium PDF DownloadDocument7 pages10th Maths EM 1st Revision Exam 2023 Original Question Paper Salem District English Medium PDF Downloadmadhucharu2020No ratings yet

- FNB Free Number - Google SearchDocument1 pageFNB Free Number - Google SearchbozzalearningNo ratings yet

- Procurement Methods in Use by Telecommunication Companies in LagosfinaleDocument95 pagesProcurement Methods in Use by Telecommunication Companies in LagosfinaleGbemisola TakuroNo ratings yet

- 23 Mar 23 Kotak DailyDocument64 pages23 Mar 23 Kotak DailyAbhijitChandraNo ratings yet

- Lesson 2 Conducting SurveyDocument53 pagesLesson 2 Conducting SurveyJAMES GABRIEL REGONDOLANo ratings yet

- Certcube - Cyber Security ServicesDocument16 pagesCertcube - Cyber Security ServicesSimran PuriNo ratings yet

- Fin701 Module3Document22 pagesFin701 Module3Krista CataldoNo ratings yet

- Set A - Professional PracticeDocument23 pagesSet A - Professional PracticerachelleNo ratings yet

- BCR CompilerDocument171 pagesBCR Compilershethdipati2No ratings yet

- Contracting and Contract Law - Nilima BhadbhadeDocument102 pagesContracting and Contract Law - Nilima BhadbhadeAngadKamathNo ratings yet

- How Silicon Valley Turned On Its Financier: Bank Run Doomed FinancierDocument5 pagesHow Silicon Valley Turned On Its Financier: Bank Run Doomed FinancierVictor Huaranga CoronadoNo ratings yet

- Product MarketingDocument52 pagesProduct Marketingrakesh19865No ratings yet

- BOD Job DescriptionDocument2 pagesBOD Job DescriptionJay LiNo ratings yet

- Towards Disruptions in Earth ObservationDocument19 pagesTowards Disruptions in Earth ObservationphanirajinishNo ratings yet

- Uniglobe Case StudyDocument7 pagesUniglobe Case StudyHarish G RautNo ratings yet