Professional Documents

Culture Documents

Company: Berjaya Corporation Berhad Users of Ratios Formula Group 2015 RM'000 Ratios

Uploaded by

Jia Yi0 ratings0% found this document useful (0 votes)

11 views6 pagesOriginal Title

Combined Q(b) Berjaya

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views6 pagesCompany: Berjaya Corporation Berhad Users of Ratios Formula Group 2015 RM'000 Ratios

Uploaded by

Jia YiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

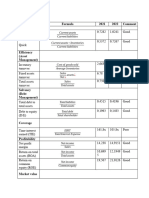

COMPANY: BERJAYA CORPORATION BERHAD

Users of Formula Group Ratios

Ratios 2015

RM’000

Liquidity

Ratios

Current Ratio Current Assets RM 5,871,443 1.23

Current Liabilities RM 4,774,905

Quick Ratio Current Assets−Inventory RM 5,871,443−RM 935,081 1.03

Current Liabilities RM 4,774,905

Asset

Management

/ Efficiency

Ratios

Inventory Cost of goods sold RM 6,616,351 7.08

Turnover Inventory RM 935,081

Average Account Receivable RM 1,284,452 49 days

Collection Sales/365 days RM 9,514,106/365

Period

Average Account Payable RM 2,391,676 132 days

Payment Cost of goods sold /365 days RM 6,616,351/365

Period

Total Assets Sales RM 9,514,106 0.43

Turnover Total Assets RM 22,294,054

Leverage

Ratios

Debt Ratio Total Liabilities RM 10,276,028 0.46

Total Assets RM 22,294,054

Debt-to- Total Liabilities RM 10,276,028 0.86

Equity Ratio Shareholder s' Equity RM 12,018,026

Times Interest EBIT RM 1,898,026 4.92

Earned Ratio Interest Expense RM 385,711

Profitability

Ratios

Net Profit Net Profit RM 1,242,256 0. 13

Margin Sales RM 9,514,106

Return on Net Profit RM 1,242,256 0.0 56

Total Assets Total Assets RM 22,294,054

(ROA)

Return on Net Profit RM 1,242,256 0. 10

Equity (ROE) Total Shareholder s' Equity RM 12,018,026

Market

Value Ratios

Earnings per Net Profit RM 1,242,256 RM 0. 25

share (EPS) Number of common shares RM 5,004,496

outstanding

Price/ Earning Market Price per share RM 0.51 0.028

(P/E) Earnings per share RM 18.09

Market/ Book Market Price per share RM 0.51 RM 0.51

Ratio (M/B) Book value per share RM 1

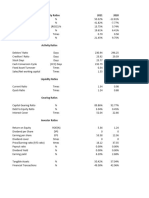

COMPANY: BERJAYA CORPORATION BERHAD

Users of Formula Group Ratios

Ratios 2016

RM’000

Liquidity

Ratios

Current Ratio Current Assets RM 6,043,404 1.04

Current Liabilities RM 5,801,489

Quick Ratio Current Assets−Inventory RM 6,043,404−RM 1,052,957 0.86

Current Liabilities RM 5,801,489

Asset

Management

/ Efficiency

Ratios

Inventory Cost of goods sold RM 6,204,842 5.90

Turnover Inventory RM 1,052,957

Average Account Receivable RM 1,467,378 59 days

Collection Sales/365 days RM 9,016,774 /365

Period

Average Account Payable RM 2,757,941 162 days

Payment Cost of goods sold /365 days 6,204,842/365

Period

Total Assets Sales RM 9,016,774 0.39

Turnover Total Assets RM 23,359,051

Leverage

Ratios

Debt Ratio Total Liabilities RM 12,302,345 0. 53

Total Assets RM 23,359,051

Debt-to- Total Liabilities RM 12,302,345 1.11

Equity Ratio Shareholder s' Equity RM 11,056,706

Times Interest EBIT RM 600,946 1.42

Earned Ratio Interest Expense RM 423,383

Profitability

Ratios

Net Profit Net Profit ( RM 117,089) −0.0 13

Margin Sales RM 9,016,774

Return on Net Profit ( RM 117,089) −0.005

Total Assets Total Assets RM 23,359,051

(ROA)

Return on Net Profit ( RM 117,089) −0.011

Equity (ROE) Total Shareholder s' Equity RM 11,056,706

Market

Value Ratios

Earnings per Net Profit (RM 117,089) −0.023

share (EPS) Number of common shares 5,095,946

outstanding

Price/ Earning Market Price per share RM 0.44 −0.14

(P/E) Earnings per share (RM 3.22)

Market/ Book Market Price per share RM 0.44 RM 0.44

Ratio (M/B) Book value per share RM 1

COMPANY: BERJAYA CORPORATION BERHAD

Users of Formula Group Ratios

Ratios 2016

RM’000

Liquidity

Ratios

Current Ratio Current Assets RM 6,106,288 1.08

Current Liabilities RM 5,648,172

Quick Ratio Current Assets−Inventory RM 6,106,288−RM 1,156,715 0.88

Current Liabilities RM 5,648,172

Asset

Management

/ Efficiency

Ratios

Inventory Cost of goods sold RM 6,402,222 5.53

Turnover Inventory RM ,156,715

Average Account Receivable RM 2,134,43 85 days

Collection Sales/365 days RM 9,182,394 /365

Period

Average Account Payable RM 2,283,177 130 days

Payment Cost of goods sold /365 days RM 6,402,222/365

Period

Total Assets Sales RM 9,182,394 0. 43

Turnover Total Assets RM 21,532,548

Leverage

Ratios

Debt Ratio Total Liabilities RM 10,713,879 0. 50

Total Assets RM 21,532,548

Debt-to- Total Liabilities RM 10,713,879 1.00

Equity Ratio Shareholder s' Equity RM 10,818,669

Times Interest EBIT RM 1,001,720 2.51

Earned Ratio Interest Expense RM 398,305

Profitability

Ratios

Net Profit Net Profit RM 662,628 0.072

Margin Sales RM 9,182,394

Return on Net Profit RM 662,628 0.0 31

Total Assets Total Assets RM 21,532,548

(ROA)

Return on Net Profit RM 662,628 0.0 61

Equity (ROE) Total Shareholder s' Equity RM 10,818,669

Market

Value Ratios

Earnings per Net Profit RM 662,628 0.12

share (EPS) Number of common shares RM 5,501,087

outstanding

Price/ Earning Market Price per share RM 0.39 0.133

(P/E) Earnings per share RM 2.93

Market/ Book Market Price per share RM 0.39 RM 0.39

Ratio (M/B) Book value per share RM 1

You might also like

- Company: Analabs Resources Berhad Users of Ratios Formula Group 2015 RM'000 RatiosDocument5 pagesCompany: Analabs Resources Berhad Users of Ratios Formula Group 2015 RM'000 RatiosJia YiNo ratings yet

- Hitungan Ta - RevDocument8 pagesHitungan Ta - Revfajar aljogjaNo ratings yet

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Acc117 Group Project 2 (Sparkle Light)Document6 pagesAcc117 Group Project 2 (Sparkle Light)NUR WIRDANI ALANINo ratings yet

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- 23090167@student Iumw Edu MyDocument18 pages23090167@student Iumw Edu MyShazryl Rifqi Shamsul NizamNo ratings yet

- NAS Financial RatiosDocument6 pagesNAS Financial RatiosAzdzharulnizzam AlwiNo ratings yet

- Balance Sheet Assets: Cash Accounts Receivable Inventories Other Current Assets Fixed AssetsDocument16 pagesBalance Sheet Assets: Cash Accounts Receivable Inventories Other Current Assets Fixed AssetsPRIYA GNAESWARANNo ratings yet

- ALMI Annual Report 2014Document90 pagesALMI Annual Report 2014ReginaNo ratings yet

- Why Need Performance MeasurementDocument8 pagesWhy Need Performance MeasurementKhalil ManiarNo ratings yet

- Ringkasan Laporan Keuangan Ratio Analysis PT Nippon Indosari Corpindo Tbk. PT Nippon Indosari Corpindo Tbk. Dec-14 Dec-13Document14 pagesRingkasan Laporan Keuangan Ratio Analysis PT Nippon Indosari Corpindo Tbk. PT Nippon Indosari Corpindo Tbk. Dec-14 Dec-13Anna KholibbiyahNo ratings yet

- 01HMIDocument104 pages01HMImahalNo ratings yet

- Bright Packaging Industry Berhad 2015 Financial RatiosDocument2 pagesBright Packaging Industry Berhad 2015 Financial RatiosJoanna JacksonNo ratings yet

- Name of RatioDocument4 pagesName of RatioRianna Reham UsmanNo ratings yet

- FCFE CalculationDocument23 pagesFCFE CalculationIqbal YusufNo ratings yet

- Financial RatiosDocument7 pagesFinancial RatiosJan TruongNo ratings yet

- Corporate Finance - Assignment 1 - 11.02.23Document10 pagesCorporate Finance - Assignment 1 - 11.02.23Nabila Abu BakarNo ratings yet

- Financial Management FinalDocument14 pagesFinancial Management FinalNeal KNo ratings yet

- CLA KPI BOD MayDocument248 pagesCLA KPI BOD MaySiluman UlarNo ratings yet

- Financial Analysis Ratios For The Year Ended 31 DecDocument6 pagesFinancial Analysis Ratios For The Year Ended 31 DecAmirah MaisarahNo ratings yet

- Permata SDN BHDDocument2 pagesPermata SDN BHDIntan Farihah Binti Matali A20A1369No ratings yet

- Ratios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosDocument5 pagesRatios Unit Formula December 31, 2015 December 31, 2014 December 31, 2013 December 31, 2012 December 31, 2011 Profitability RatiosYasir AamirNo ratings yet

- Chapter 1Document27 pagesChapter 1Eldar AlizadeNo ratings yet

- Acc Assignment GP 2Document3 pagesAcc Assignment GP 2KHALID ALWALID MOHD TARMIZENo ratings yet

- Financial Management 1Document18 pagesFinancial Management 1Ketz NKNo ratings yet

- Question 1Document8 pagesQuestion 1premsuwaatiiNo ratings yet

- Total Assets 6,100,000 3,800,000 2,350,000Document10 pagesTotal Assets 6,100,000 3,800,000 2,350,000Sofía MargaritaNo ratings yet

- Financial RatiosDocument4 pagesFinancial RatiosNguyễn Như NgọcNo ratings yet

- Tutorial Questions On Financial Ratio AnalysisDocument9 pagesTutorial Questions On Financial Ratio AnalysisSyazliana Kasim100% (9)

- (Pso) Pakistan State OilDocument4 pages(Pso) Pakistan State OilSalman AtherNo ratings yet

- Year 2007 Liquidity Ratios: Current Assets Current LiabilitiesDocument5 pagesYear 2007 Liquidity Ratios: Current Assets Current Liabilitiesckin_1609No ratings yet

- Airtel Ratio AnalysisDocument8 pagesAirtel Ratio AnalysishjiyoNo ratings yet

- Enterprise Value AnalysisDocument9 pagesEnterprise Value AnalysissanjayNo ratings yet

- Confidence Cement LTD Financial Ratios For The Years 2016 & 2017Document2 pagesConfidence Cement LTD Financial Ratios For The Years 2016 & 2017Bishal SahaNo ratings yet

- Financial Accounting Group Assignment 2Document2 pagesFinancial Accounting Group Assignment 2diveshNo ratings yet

- Personal Stocks RecordDocument5 pagesPersonal Stocks RecordZulhasri WahapNo ratings yet

- Maple Leaf CementDocument2 pagesMaple Leaf CementChampyNo ratings yet

- Consistent research future innovationDocument120 pagesConsistent research future innovationcpasl123No ratings yet

- Attock Cement Ratio Analysis 2019 by RizwanDocument8 pagesAttock Cement Ratio Analysis 2019 by RizwanHayat budhoooNo ratings yet

- 03.trading Journal by @MNN 2022Document18 pages03.trading Journal by @MNN 2022Mohd Nor NajamudinNo ratings yet

- Group 7 - Assignment 2Document2 pagesGroup 7 - Assignment 2diveshNo ratings yet

- Cost Mgmt Accounting Lenskart FranchiseDocument12 pagesCost Mgmt Accounting Lenskart Franchisepriyanka MORE100% (2)

- Calculation of Financial Ratios and Its Analysis: Advance Performance ManagemntDocument8 pagesCalculation of Financial Ratios and Its Analysis: Advance Performance ManagemntZeeshan AbdullahNo ratings yet

- Magp 2012Document146 pagesMagp 2012Maria Petra AngelinaNo ratings yet

- Earnings based-ROEDocument15 pagesEarnings based-ROERahul SinghNo ratings yet

- Spritzer Berhad: Results ReportDocument3 pagesSpritzer Berhad: Results ReportohjayeeNo ratings yet

- Financial Ratio Analysis Reveals Declining PerformanceDocument15 pagesFinancial Ratio Analysis Reveals Declining PerformanceMOHAMAD IZZANI OTHMANNo ratings yet

- Ratio Calc (Lucky Cement)Document18 pagesRatio Calc (Lucky Cement)Usama GaditNo ratings yet

- Tutorial Questions - Trimester - 2210.Document26 pagesTutorial Questions - Trimester - 2210.premsuwaatiiNo ratings yet

- Acquisition valuation of Talbros AutomotiveDocument9 pagesAcquisition valuation of Talbros Automotivetech& GamingNo ratings yet

- FSA CompleteDocument41 pagesFSA Completeabdul moizNo ratings yet

- Financial Analysis of Nestle India and ACC LtdDocument20 pagesFinancial Analysis of Nestle India and ACC Ltdrahil0786No ratings yet

- Equivalent YieldDocument11 pagesEquivalent YieldELVEVIYONA JOOTNo ratings yet

- Adam Kleen's Profit and Loss for 2020Document4 pagesAdam Kleen's Profit and Loss for 2020Kharul AzharNo ratings yet

- Acc466 - Group G - Project 1Document28 pagesAcc466 - Group G - Project 1Nur SyafiqahNo ratings yet

- Date of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J ContactDocument11 pagesDate of Report Tuesday, April 29, 2008 SRF Limited - Quick & Dirty Analysis Analyst Dhananjayan J Contactapi-3702531No ratings yet

- Assignement 1 Finance.Document17 pagesAssignement 1 Finance.farwa shahidNo ratings yet

- Krakatau Steel A - Syndicate 5Document12 pagesKrakatau Steel A - Syndicate 5I Nyoman Sujana GiriNo ratings yet

- Form No 16Document2 pagesForm No 16Chasa raviNo ratings yet

- CEBU CFI COMMUNITY COOPERATIVE LOAN APPLICATIONDocument6 pagesCEBU CFI COMMUNITY COOPERATIVE LOAN APPLICATIONEn-en FrioNo ratings yet

- CVP AnalysisDocument36 pagesCVP AnalysisNadian100% (1)

- Case Digests 2019Document3 pagesCase Digests 2019ALVIAH ATILANONo ratings yet

- L8 Self Assessment QsDocument3 pagesL8 Self Assessment QsDouglas Leong Jian-HaoNo ratings yet

- Session 2Document8 pagesSession 2Muhammad Haris100% (1)

- Test Bank For Government and Not For Profit Accounting 8th by GranofDocument20 pagesTest Bank For Government and Not For Profit Accounting 8th by GranofHorace Renfroe100% (40)

- ACC501 Mod 1 Case Financial StatementsDocument12 pagesACC501 Mod 1 Case Financial StatementsNoble S WolfeNo ratings yet

- In Re Rennie's Estate. Addie B. Taggart, Administratrix of The Last Will and Testament and The Estate of Mary Isabella Rennie, Deceased v. United States, 430 F.2d 1388, 10th Cir. (1970)Document5 pagesIn Re Rennie's Estate. Addie B. Taggart, Administratrix of The Last Will and Testament and The Estate of Mary Isabella Rennie, Deceased v. United States, 430 F.2d 1388, 10th Cir. (1970)Scribd Government DocsNo ratings yet

- Business plan benefitsDocument4 pagesBusiness plan benefitsAshu AshwiniNo ratings yet

- Tax Amnesty Filing ProceduresDocument15 pagesTax Amnesty Filing ProceduresIML2016No ratings yet

- Basic Real Estate Appraisal Powerpoint Presentation For CH 10Document23 pagesBasic Real Estate Appraisal Powerpoint Presentation For CH 10Wibowo 'woki' Siswo NNo ratings yet

- MEMBERSHIP AND PARTNERSHIP GUIDEDocument5 pagesMEMBERSHIP AND PARTNERSHIP GUIDErhea agnesNo ratings yet

- Udah Bener'Document4 pagesUdah Bener'Shafa AzahraNo ratings yet

- Financial Statement Analysis of OGDCLDocument8 pagesFinancial Statement Analysis of OGDCLZohaib GondalNo ratings yet

- ACCA P2 Sample Q&As PDFDocument10 pagesACCA P2 Sample Q&As PDFEssay MaintenantNo ratings yet

- IAS 20 Accounting For Government Grants and Disclosure of Government AssistanceDocument5 pagesIAS 20 Accounting For Government Grants and Disclosure of Government Assistancemanvi jain100% (1)

- Chapter 7 Lecture NotesDocument8 pagesChapter 7 Lecture NotesumerubabNo ratings yet

- Chapter6 - Trial balance and Preparation of Final Accounts яDocument13 pagesChapter6 - Trial balance and Preparation of Final Accounts яshreya taluja100% (1)

- Managerial Accounting 08Document55 pagesManagerial Accounting 08Dheeraj SunthaNo ratings yet

- Feizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed FirmsDocument10 pagesFeizi 2016 The Impact of The Financial Distress On Tax Avoidance in Listed Firmsgiorgos1978No ratings yet

- PropertyDocument8 pagesPropertyVaibhav MukhraiyaNo ratings yet

- Christopher Columbus Was Not The First To "Discover" AmericaTwitter4.5.19Document34 pagesChristopher Columbus Was Not The First To "Discover" AmericaTwitter4.5.19karen hudes100% (2)

- CAMEL Ratios ExplainedDocument2 pagesCAMEL Ratios Explainedsrinath121No ratings yet

- Glainier Industríal CorporationDocument43 pagesGlainier Industríal CorporationGraceila CalopeNo ratings yet

- Quiz Adjusting Entries Multiple Choice WithoutDocument5 pagesQuiz Adjusting Entries Multiple Choice WithoutRakzMagaleNo ratings yet

- CIR Vs Next MobileDocument2 pagesCIR Vs Next Mobilegeorge almeda100% (1)

- Audit of Inventory Chapter 5 ExercisesDocument1 pageAudit of Inventory Chapter 5 ExercisesMariz Julian Pang-aoNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument59 pagesChapter 4 - Completing The Accounting CycleTâm Lê Hồ HồngNo ratings yet

- Jurisprudence On Stock DividendDocument4 pagesJurisprudence On Stock Dividendfrancis_asd2003No ratings yet