Professional Documents

Culture Documents

Illustration: Formation of Partnership Valuation of Capital A B

Illustration: Formation of Partnership Valuation of Capital A B

Uploaded by

Arian AmuraoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration: Formation of Partnership Valuation of Capital A B

Illustration: Formation of Partnership Valuation of Capital A B

Uploaded by

Arian AmuraoCopyright:

Available Formats

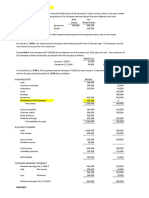

ILLUSTRATION: FORMATION OF PARTNERSHIP VALUATION OF CAPITAL

A and B formed a partnership. The following are their contributions

A B

Cash 100,000

Accounts Receivable 50,000

Inventory 80,000

Land 50,000

Building 120,000

Total 230,000 170,000

Note payable 60,000

A, Capital 170,000

B, Capital 170,000

total 230,000 170,000

Additional information:

Included in accounts receivable is an account amounting to 20, 000 which IS

deemed uncollectible

The inventory has an estimated selling price of 100,000 and estimated costs

to sell of P10, 000

An unpaid mortgage of P10, 000 on the land IS assumed by the partnership.

The building is under-depreciated by 25,000.

The building also has an unpaid mortgage amounting to 15,000, but the

mortgage is not assumed by the partnership. B agreed to settle the mortgage

using his personal funds.

The note payable is stated at face amount. A proper valuation requires the

recognition of a P15, 000 discount on note payable

A and B shall share in profits and losses 60% and 40% respectively.

You might also like

- Answers On Quiz 6 and 7 For DiscussionDocument34 pagesAnswers On Quiz 6 and 7 For Discussionglenn langcuyan71% (7)

- NISM VI - LAST DAY REVISION TEST 1 - UnlockedDocument42 pagesNISM VI - LAST DAY REVISION TEST 1 - UnlockedPriya Moorthy100% (1)

- Mastering Adjusting Entries Homework..Document32 pagesMastering Adjusting Entries Homework..lea100% (1)

- ACCTSPTRANS All About PartnershipDocument7 pagesACCTSPTRANS All About PartnershipShailene David0% (1)

- Retirement of A Partner 1Document1 pageRetirement of A Partner 1Vonna TerribleNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Aa 3Document4 pagesAa 3Unknown 01No ratings yet

- Ass 2 in AuditingDocument5 pagesAss 2 in Auditingarnel gallarteNo ratings yet

- Unmodified ReportDocument2 pagesUnmodified ReportErica CaliuagNo ratings yet

- Define Business Combination, Identify Its ElementsDocument4 pagesDefine Business Combination, Identify Its ElementsAljenika Moncada GupiteoNo ratings yet

- Solution Chapter 6Document10 pagesSolution Chapter 6Clarize R. MabiogNo ratings yet

- Chapter 17 AnswersDocument45 pagesChapter 17 AnswersJester SarabiaNo ratings yet

- Cases (Cabrera)Document5 pagesCases (Cabrera)Queenie100% (1)

- Ira Shalini M. YbañezDocument5 pagesIra Shalini M. YbañezIra YbanezNo ratings yet

- SAMPLEDocument3 pagesSAMPLEkrizzmaaaayNo ratings yet

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerAubreyNo ratings yet

- 8 - PFRS 15 Five Step Model PDFDocument6 pages8 - PFRS 15 Five Step Model PDFDarlene Faye Cabral RosalesNo ratings yet

- AFAR 03 Partnership DissolutionDocument4 pagesAFAR 03 Partnership DissolutionDerick jorgeNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- Basic Eps Praac Valix 2018pdf DDDocument20 pagesBasic Eps Praac Valix 2018pdf DDCaptain ObviousNo ratings yet

- Topic 1 Corporate Liquidation - ModuleDocument11 pagesTopic 1 Corporate Liquidation - ModuleJenny LelisNo ratings yet

- Chapter 4 - Partnership LiquidationDocument4 pagesChapter 4 - Partnership LiquidationMikaella BengcoNo ratings yet

- Drill#1Document5 pagesDrill#1Leslie BustanteNo ratings yet

- Key Quiz 3 1st 2022 20223Document4 pagesKey Quiz 3 1st 2022 20223Leslie Mae Vargas ZafeNo ratings yet

- 3004 Home Office and BranchesDocument6 pages3004 Home Office and BranchesTatianaNo ratings yet

- Chapter 12-14Document18 pagesChapter 12-14Serena Van Der WoodsenNo ratings yet

- Home Office Chap. 1Document20 pagesHome Office Chap. 1Rei GaculaNo ratings yet

- MULTIPLE CHOICE - THEORIES - (Write You Letter Choice Only, in Upper Case, and On A Yellow PaperDocument1 pageMULTIPLE CHOICE - THEORIES - (Write You Letter Choice Only, in Upper Case, and On A Yellow Paperalmira garcia100% (1)

- Philippine Deposit Insurance Corporation (PDIC) LawDocument11 pagesPhilippine Deposit Insurance Corporation (PDIC) LawElmer JuanNo ratings yet

- Practical Accounting 1 First Pre-Board ExaminationDocument14 pagesPractical Accounting 1 First Pre-Board ExaminationKaren EloisseNo ratings yet

- Audit ReviewDocument9 pagesAudit ReviewephraimNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Quiz No. 2Document5 pagesQuiz No. 2VernnNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- Midterm ExaminationDocument6 pagesMidterm ExaminationJamie Rose Aragones100% (1)

- ACCTGDocument13 pagesACCTGCabardo Maria RegilynNo ratings yet

- Differentiate Confirmation and InquiryDocument3 pagesDifferentiate Confirmation and InquiryJasmine LimNo ratings yet

- Unit 1 Audit of Property PLant and EquipmentDocument5 pagesUnit 1 Audit of Property PLant and EquipmentJustin SolanoNo ratings yet

- AFAR Question PDFDocument16 pagesAFAR Question PDFNhel AlvaroNo ratings yet

- Decided To Open A Branch in ManilaDocument2 pagesDecided To Open A Branch in Manilaasdfghjkl zxcvbnmNo ratings yet

- Advacc 1 Quiz VIIIDocument4 pagesAdvacc 1 Quiz VIIIJason GubatanNo ratings yet

- Solution Chapter 14Document26 pagesSolution Chapter 14grace guiuanNo ratings yet

- ACC401 Quiz2Document7 pagesACC401 Quiz287StudentNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- Answer-Key Chapter-6 RevisedDocument5 pagesAnswer-Key Chapter-6 RevisedMcy CaniedoNo ratings yet

- Assessment Activities Module 1: Intanible AssetsDocument16 pagesAssessment Activities Module 1: Intanible Assetsaj dumpNo ratings yet

- Partnership Formation Discussion ProblemsDocument2 pagesPartnership Formation Discussion ProblemsMicca AndraeNo ratings yet

- Buang Ang TaxDocument17 pagesBuang Ang TaxEdeksupligNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Auditing Problems SOLUTION v.1 - 2018Document12 pagesAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNo ratings yet

- P1 1Document12 pagesP1 1Donna Mae Hernandez0% (1)

- Chapter 14 Other SolutionDocument18 pagesChapter 14 Other SolutionChristine BaguioNo ratings yet

- Reviewer - ParCorDocument13 pagesReviewer - ParCoramiNo ratings yet

- Diagnostic Test - Audit TheoryDocument13 pagesDiagnostic Test - Audit TheoryYenelyn Apistar CambarijanNo ratings yet

- MODULE 9 - Partnership Liquidation (Installment)Document9 pagesMODULE 9 - Partnership Liquidation (Installment)Gab Ignacio100% (1)

- FAR2 CHAPTER 1 (PG 1-13)Document13 pagesFAR2 CHAPTER 1 (PG 1-13)Layla MainNo ratings yet

- CMPC131Document15 pagesCMPC131Nhel AlvaroNo ratings yet

- 2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Document8 pages2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Melanie SamsonaNo ratings yet

- Illustration: Formation of Partnership Valuation of Capital A BDocument2 pagesIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNo ratings yet

- Activity 1Document1 pageActivity 1Cris TineNo ratings yet

- Partnership FormationDocument12 pagesPartnership FormationAbc xyzNo ratings yet

- 5 55ddDocument6 pages5 55ddArian AmuraoNo ratings yet

- Audtheo Fbana AnswersDocument8 pagesAudtheo Fbana AnswersArian AmuraoNo ratings yet

- 3 33ddDocument3 pages3 33ddArian AmuraoNo ratings yet

- Problem 31.2Document4 pagesProblem 31.2Arian AmuraoNo ratings yet

- Problem 31.2Document4 pagesProblem 31.2Arian AmuraoNo ratings yet

- 77Document2 pages77Arian AmuraoNo ratings yet

- Problem 66Document2 pagesProblem 66Arian AmuraoNo ratings yet

- Problem 29.2Document2 pagesProblem 29.2Arian AmuraoNo ratings yet

- Problem 11Document1 pageProblem 11Arian AmuraoNo ratings yet

- Assets Liabilities and EquityDocument1 pageAssets Liabilities and EquityArian AmuraoNo ratings yet

- Problem 44Document2 pagesProblem 44Arian AmuraoNo ratings yet

- Problem 66Document2 pagesProblem 66Arian AmuraoNo ratings yet

- Problem 22Document1 pageProblem 22Arian AmuraoNo ratings yet

- 1 EdDocument1 page1 EdArian AmuraoNo ratings yet

- Noncash Investments: VVVVVVDocument1 pageNoncash Investments: VVVVVVArian AmuraoNo ratings yet

- Required: Prepare The Journal Entries To Record The Formation of The PartnershipDocument2 pagesRequired: Prepare The Journal Entries To Record The Formation of The PartnershipArian AmuraoNo ratings yet

- Assets Liabilities and EquityDocument2 pagesAssets Liabilities and EquityArian Amurao50% (2)

- 1 Aa 1Document3 pages1 Aa 1Arian AmuraoNo ratings yet

- Part - Formation FATDocument2 pagesPart - Formation FATArian AmuraoNo ratings yet

- 2 BB 2Document2 pages2 BB 2Arian AmuraoNo ratings yet

- Illustration: Formation of Partnership Valuation of Capital A BDocument2 pagesIllustration: Formation of Partnership Valuation of Capital A BArian AmuraoNo ratings yet

- Artzner 1999 Coherent Measures of RiskDocument1 pageArtzner 1999 Coherent Measures of RiskMahfudhotinNo ratings yet

- FIN 354 Ca2Document13 pagesFIN 354 Ca2Jashim AhammedNo ratings yet

- ANS KEY - QUIZ ON RECEIVABLE FINANCING 12 OctDocument4 pagesANS KEY - QUIZ ON RECEIVABLE FINANCING 12 OctAzzariah DeniseNo ratings yet

- Bank-Reconciliation-Statement-Notes Class 11Document21 pagesBank-Reconciliation-Statement-Notes Class 11DhruvNo ratings yet

- Message Type 200Document6 pagesMessage Type 200Falokun Martins OluwafemiNo ratings yet

- Final Examination On Compound InterestDocument22 pagesFinal Examination On Compound InterestROSARIO, Juliet Marie V.No ratings yet

- StateofFintech Executive SummaryDocument14 pagesStateofFintech Executive SummaryNiveditaNo ratings yet

- Perseus FintechDocument13 pagesPerseus Fintechishiki arataNo ratings yet

- RatiosDocument6 pagesRatiosWindee CarriesNo ratings yet

- Growth & Changing Structure of Non-Banking Financial InstitutionsDocument12 pagesGrowth & Changing Structure of Non-Banking Financial InstitutionspremdeepsinghNo ratings yet

- Financial Instruments-Equity Instruments of Another EntityDocument7 pagesFinancial Instruments-Equity Instruments of Another EntityElla MontefalcoNo ratings yet

- Cost Accounting 2018 Edition Pedro Guerrero Solution Manual Cost Accounting 2018 Edition Pedro Guerrero Solution ManualDocument47 pagesCost Accounting 2018 Edition Pedro Guerrero Solution Manual Cost Accounting 2018 Edition Pedro Guerrero Solution ManualKant ColoradoNo ratings yet

- Is Fednow Real - Google SearchDocument1 pageIs Fednow Real - Google SearchMiguel AttiehNo ratings yet

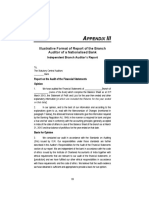

- Illustrative Branch Audit Report FormatDocument5 pagesIllustrative Branch Audit Report FormatCA K Vijay SrinivasNo ratings yet

- 1 Financial MarketDocument32 pages1 Financial MarketBindal Heena100% (2)

- NCCMP ProjectDocument76 pagesNCCMP Projectaman_luthra1611No ratings yet

- Activity 3Document5 pagesActivity 3breymartjohnNo ratings yet

- Narration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Trailing Best Case Worst CaseSaiteja NukalaNo ratings yet

- Bhaskar NegiDocument1 pageBhaskar NegiAbhinav TripathiNo ratings yet

- (Debit Mandate Form NACH/ ECS/ Direct Debit) : Request ForDocument2 pages(Debit Mandate Form NACH/ ECS/ Direct Debit) : Request Forssgentis100% (1)

- Ketan Parekh ScamDocument5 pagesKetan Parekh ScamafzalkhanNo ratings yet

- GMCU Monthly Spotlight May 2010Document2 pagesGMCU Monthly Spotlight May 2010Peter MastersonNo ratings yet

- Towards A Resilient and Inclusive Financial SectorDocument36 pagesTowards A Resilient and Inclusive Financial SectorSpare ManNo ratings yet

- Chuẩn mực - YODocument35 pagesChuẩn mực - YOGiang Thái HươngNo ratings yet

- Computer Age Management Services LimitedDocument8 pagesComputer Age Management Services LimitedLatha SurajNo ratings yet

- BKash Performance Analysis & ValuationDocument12 pagesBKash Performance Analysis & ValuationZeehenul IshfaqNo ratings yet

- Example Subsidiary Journals FACDocument3 pagesExample Subsidiary Journals FACNonhlanhla DlaminiNo ratings yet

- Assignment 1 LEGAL FRAMEWORK OF BANKING.Document5 pagesAssignment 1 LEGAL FRAMEWORK OF BANKING.Sports & Gaming zone kidaNo ratings yet