Professional Documents

Culture Documents

Q Should Takeover Take Place

Uploaded by

Riya GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q Should Takeover Take Place

Uploaded by

Riya GuptaCopyright:

Available Formats

1

Q. Harmony Limited is intending to acquire the Taikon Limited. In this connection, the

Harmony Limited is seeking your suggestion as to whether acquire or not the Taikon Limited.

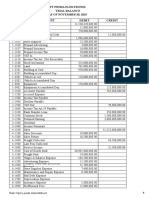

The Balance Sheet of the Taikon Limited as on March 31, 2016 is as follows:

Liabilities Amount (Rs. Lakh) Assets Amount (Rs. Lakh)

Equity Share Capital (4 Lakh

400 Plant and Machinery 800

Shares of Rs. 100 each)

Retained Earnings 200 Inventory 150

11% Debentures 300 Receivables 100

Creditors 200 Cash 50

Total 1100 Total 1100

The following additional information is supplied to you:

(i) The shareholders of Taikon Limited will get 1.5 shares in Harmony Limited for

every 2 shares,

(ii) The shares of the Harmony Limited will be issued at current market price of Rs.

200 per share,

(iii) The debenture holders will get 12% debentures of the same amount,

(iv) The creditors are to be settled at Rs. 190 Lakh,

(v) Acquisition expenses of Rs. 20 Lakh are to be met by the Harmony Limited,

(vi) The projected free cash flows from the acquisition are as follows:

Year 1 Rs. 150 Lakh Year 4 Rs. 280 Lakh

Year 2 Rs. 180 Lakh Year 5 Rs. 350 Lakh

Year 3 Rs. 220 Lakh Year 6 Rs. 350 Lakh

(vii) The free cash flow of the Taikon Limited is expected to grow at 3% per annum

after the sixth year,

(viii) There is a contingent liability of Rs. 25 Lakh which will devolve on the Harmony

Limited consequent to acquisition,

(ix) The relevant PV factors are as follows:

Year 1 0.885 Year 2 0.783 Year 3 0.693

Year 4 0.613 Year 5 0.543 Year 6 0.480

Solution:

Calculation of Number and Value of Shares Issued:

1.5 shares for every two shares (1.5/2)X4,00,000 = 3,00,000 shares @ Rs. 200 per share

totaling to shares of Rs. 600 Lakh

Calculation of Cost of Acquisition: Shares 600 Lakh

12% Debentures 300 Lakh

Creditors 190 Lakh

Acquisition Exp. 20 Lakh

Contingent Liability 25 Lakh

1135 Lakh

2

Calculation of Gross Present Value of Free Cash Flows:

Year FCF FCF X PV Factor PV

Year 1 Rs. 150 Lakh 150 X .885 132.75

Year 2 Rs. 180 Lakh 180 X .783 140.94

Year 3 Rs. 220 Lakh 220 X .693 152.46

Year 4 Rs. 280 Lakh 280 X .613 171.64

Year 5 Rs. 350 Lakh 350 X .543 190.05

Year 6 Rs. 350 Lakh 350 X .480 168.00

Gross Present Value 955.84

Calculation of K =

PV factor for Year 1 as given in the question = .885

As per Discounting Formula PV = 1 / (1+r)

.885 = 1 / (1+r)

.885 X (1+r) = 1

.885 + .885r = 1

.885r = 1 - .885 = .115

r = .115 / .885 = .1299 = .13 = 13%

Calculation of Terminal Value:

FCF of the Year 6 (1+G) 350 (1 +.03 )

Terminal Value = =

K–G .13 - .03

350 X 1.03 360.5

= = = 3605

.10 .10

Present Value of Terminal Value = TermiValue X PV Factor of 6th Year

= 3605 X .480

= 1730.4

Total PV of FCFs = 955.84 + 1730.40 = 2686.24

NPV = Total PV – Cost of Acquisition = 2686.24 – 1135.00 = 1551.24

Since the NPV from the acquisition is positive, therefore the acquisition serves the objective of

wealth maximization. As such, the Harmony Ltd. is advised to acquire the Taikon Ltd.

You might also like

- Paper 1Document16 pagesPaper 1anjudeshNo ratings yet

- COA Unit 4 Amalgamation ProblemsDocument7 pagesCOA Unit 4 Amalgamation ProblemsGayatri Prasad BirabaraNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034Harish KapoorNo ratings yet

- Paper Finance IVDocument3 pagesPaper Finance IVAbhijeetNo ratings yet

- Corporate AccountingDocument7 pagesCorporate AccountingskirubaarunNo ratings yet

- Company Account SuggestionDocument34 pagesCompany Account SuggestionAYAN DATTANo ratings yet

- Cost of Capital QuestionsDocument4 pagesCost of Capital QuestionsNDIFREKE UFOTNo ratings yet

- Ratio Analysis Liquidity Ratios Solvency RatiosDocument55 pagesRatio Analysis Liquidity Ratios Solvency Ratiossarika gurjarNo ratings yet

- Question SFM GMDocument10 pagesQuestion SFM GMPraDeepMspNo ratings yet

- MA Probls - Gr2Document10 pagesMA Probls - Gr2Himanshu GuptaNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDocument17 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNo ratings yet

- Lease Financing1Document28 pagesLease Financing1PANDHARE SIDDHESHNo ratings yet

- Class Questions - Cap BudgetingDocument4 pagesClass Questions - Cap BudgetingMANSA MUDGALNo ratings yet

- NumericalsDocument10 pagesNumericalsswapnil tiwariNo ratings yet

- Test 2 QPDocument8 pagesTest 2 QPDharmateja ChakriNo ratings yet

- Weschool: PGDM/RM/e-Biz I (2016-18)Document12 pagesWeschool: PGDM/RM/e-Biz I (2016-18)Ayushi SrivastavaNo ratings yet

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaNo ratings yet

- Revision Test Paper: Cap-Ii: Advanced Accounting: QuestionsDocument158 pagesRevision Test Paper: Cap-Ii: Advanced Accounting: Questionsshankar k.c.No ratings yet

- Cost of CapitalDocument3 pagesCost of CapitalkimjethaNo ratings yet

- CRV - Valuation - ExerciseDocument15 pagesCRV - Valuation - ExerciseVrutika ShahNo ratings yet

- Ch11 PDFDocument6 pagesCh11 PDFnagendra reddy panyamNo ratings yet

- Share & Business Valuation Case Study Question and SolutionDocument6 pagesShare & Business Valuation Case Study Question and SolutionSarannyaRajendraNo ratings yet

- FM2 EndtermDocument22 pagesFM2 EndtermSuraj RanaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- Accounting and Financial ManagementDocument7 pagesAccounting and Financial ManagementMelokuhle MhlongoNo ratings yet

- Vijaygarh Jyotish Ray College: Financial Accounting - Ii Internal Examinations-2021Document2 pagesVijaygarh Jyotish Ray College: Financial Accounting - Ii Internal Examinations-2021Aditya GanoriaNo ratings yet

- OCTOBER 2019: Reg. No.Document6 pagesOCTOBER 2019: Reg. No.Selvi SelviNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingDocument16 pagesTest Series: April, 2021 Mock Test Paper 2 Final (Old) Course Paper 1: Financial ReportingPraveen Reddy DevanapalleNo ratings yet

- CA Final SFM - New Scheme - Dawn 2022 - Merger & AcquisitionsDocument23 pagesCA Final SFM - New Scheme - Dawn 2022 - Merger & Acquisitionsideasthat worthNo ratings yet

- RTP Dec 18 QNDocument21 pagesRTP Dec 18 QNbinu100% (1)

- CTM Tutorial 3Document4 pagesCTM Tutorial 3crsNo ratings yet

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013No ratings yet

- Notes Holding CompanyDocument4 pagesNotes Holding CompanySaurav NasaNo ratings yet

- Revision Ntragroup Transactions Sundry Aspects TaxationDocument52 pagesRevision Ntragroup Transactions Sundry Aspects TaxationValerie Verity MarondedzeNo ratings yet

- Solved Answers For Payback PeriodDocument9 pagesSolved Answers For Payback Periodwihanga100% (2)

- FINANCIAL MANAGEMENT CAT ClintonDocument6 pagesFINANCIAL MANAGEMENT CAT ClintonClinton MugendiNo ratings yet

- FM 2019 SolutionsDocument6 pagesFM 2019 Solutionsaditikotere92No ratings yet

- M and A ExercisesDocument4 pagesM and A ExercisesSweet tripathiNo ratings yet

- Endterm Mergers 21170Document7 pagesEndterm Mergers 21170suraj nairNo ratings yet

- CBSE Class 12 Accountancy Sample Papers 2014 - 15Document7 pagesCBSE Class 12 Accountancy Sample Papers 2014 - 15Karthick KarthickNo ratings yet

- G Awa Mil 5 D ADIi FZ DJ HV ADocument10 pagesG Awa Mil 5 D ADIi FZ DJ HV APriyankadevi PrabuNo ratings yet

- 7918final Adv Acc Nov06Document20 pages7918final Adv Acc Nov06ஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- Problems On Redemption of Pref SharesDocument7 pagesProblems On Redemption of Pref SharesYashitha CaverammaNo ratings yet

- Mar./Apr. 2017: Instructions For Assignment SubmissionDocument11 pagesMar./Apr. 2017: Instructions For Assignment SubmissionShubham DhokNo ratings yet

- Share Based PaymentsDocument17 pagesShare Based PaymentsDave GoNo ratings yet

- M3 - Valuation Question SetDocument13 pagesM3 - Valuation Question SetHetviNo ratings yet

- Unit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationDocument17 pagesUnit III Amalgamation With Respect To A.S - 14 Purchase ConsiderationPaulomi LahaNo ratings yet

- 2 Finalnew Suggans Nov09Document16 pages2 Finalnew Suggans Nov09spchheda4996No ratings yet

- FIN 213 Review Questions: Question OneDocument16 pagesFIN 213 Review Questions: Question OneJustus MusilaNo ratings yet

- The Following Financial Data Have Been Furnished by A Ltd. and B LTDDocument10 pagesThe Following Financial Data Have Been Furnished by A Ltd. and B LTDNaveen SatiNo ratings yet

- ACT1106-Midterm Quiz No. 3 With AnswerDocument6 pagesACT1106-Midterm Quiz No. 3 With AnswerPj Dela VegaNo ratings yet

- Dwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingDocument4 pagesDwaraka Doss Goverdhan Doss Vaishnav College (Autonomous) Arumbakkam, Chennai - 600 106. Department of Corporate Secretaryship Core Paper V-Corporate AccountingNeeraj DNo ratings yet

- Week 8 Material - BEPDocument105 pagesWeek 8 Material - BEPDevashish PathakNo ratings yet

- IAS 36 CFAP UpdatedDocument17 pagesIAS 36 CFAP UpdatedUmmar FarooqNo ratings yet

- RTP CA Final New Course Paper 2 Strategic Financial ManagemeDocument26 pagesRTP CA Final New Course Paper 2 Strategic Financial ManagemeTusharNo ratings yet

- 8-Security-Valuation 2Document29 pages8-Security-Valuation 2saadullah98.sk.skNo ratings yet

- Financial Decision MakingDocument4 pagesFinancial Decision MakingHarsh DedhiaNo ratings yet

- SFM New Sums AddedDocument78 pagesSFM New Sums AddedRohit KhatriNo ratings yet

- Accounting ProjectDocument2 pagesAccounting ProjectAngel Grefaldo VillegasNo ratings yet

- 6018 p2p3 SPK PD Subur AverageDocument21 pages6018 p2p3 SPK PD Subur AverageNadyaNo ratings yet

- Determinants of Profitability of Non Bank Financial Institutions' in A Developing Country: Evidence From BangladeshDocument12 pagesDeterminants of Profitability of Non Bank Financial Institutions' in A Developing Country: Evidence From BangladeshNahid Md. AlamNo ratings yet

- Security Agreement - Secured PartyDocument7 pagesSecurity Agreement - Secured PartyCo100% (33)

- MGMT 565 Assignment 3 TeamDocument3 pagesMGMT 565 Assignment 3 TeamPierce CassidyNo ratings yet

- Insurance Law ProjectDocument14 pagesInsurance Law Projectlokesh4nigamNo ratings yet

- F&A Best - SAPOSTDocument23 pagesF&A Best - SAPOSTsheikh arif khan100% (2)

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- IFRS 9 Training Slides For MLDC - DAY 1Document43 pagesIFRS 9 Training Slides For MLDC - DAY 1Onche Abraham100% (1)

- Obligations and Contracts Case Digests Chapter IIDocument5 pagesObligations and Contracts Case Digests Chapter IIVenice Jamaila DagcutanNo ratings yet

- TRAVELERS INDEMNITY COMPANY OF ILLINOIS Et Al v. CLARENDON AMERICAN INSURANCE COMPANY Et Al ComplaintDocument41 pagesTRAVELERS INDEMNITY COMPANY OF ILLINOIS Et Al v. CLARENDON AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchNo ratings yet

- Kumpulan Quiz UAS AkmenDocument23 pagesKumpulan Quiz UAS AkmenPutri NabilahNo ratings yet

- An Appraisal of Banker Customer Relationship in NigeriaDocument60 pagesAn Appraisal of Banker Customer Relationship in NigeriaAkin Olawale Oluwadayisi87% (15)

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- Completing The Tests in The Acquisition and Payment Cycle: Verification of Selected AccountsDocument8 pagesCompleting The Tests in The Acquisition and Payment Cycle: Verification of Selected Accountsዝምታ ተሻለNo ratings yet

- Optimal Capital Structure Is The Mix of Debt and Equity ThatDocument29 pagesOptimal Capital Structure Is The Mix of Debt and Equity ThatdevashneeNo ratings yet

- GCG MC No. 2012-07 - Code of Corp Governance PDFDocument31 pagesGCG MC No. 2012-07 - Code of Corp Governance PDFakalamoNo ratings yet

- Column 24 Understanding The Kelly Criterion 2Document7 pagesColumn 24 Understanding The Kelly Criterion 2TraderCat SolarisNo ratings yet

- Multinational, International, Transnational CorporationsDocument13 pagesMultinational, International, Transnational CorporationsDeepa Suresh100% (1)

- Hull Moving Average Filter Trading Strategy (Entry & Exit)Document10 pagesHull Moving Average Filter Trading Strategy (Entry & Exit)Mannem SreenivasuluNo ratings yet

- Brand ExtensionDocument6 pagesBrand Extensionmukhtal8909No ratings yet

- Advance Paper Corporation V Arma Traders Corporation G.R. 176897Document11 pagesAdvance Paper Corporation V Arma Traders Corporation G.R. 176897Dino Bernard LapitanNo ratings yet

- Agreed Upn Procedures Report 3 PDFDocument4 pagesAgreed Upn Procedures Report 3 PDFirfanNo ratings yet

- Direct Deposit Authorization Form - Controlled PDFDocument2 pagesDirect Deposit Authorization Form - Controlled PDFNatilee CampbellNo ratings yet

- 07 IFRS 16 LeasesDocument45 pages07 IFRS 16 LeasesAung Zaw Htwe50% (2)

- L6M5 Tutor Notes 1.0 AUG19Document22 pagesL6M5 Tutor Notes 1.0 AUG19Timothy Manyungwa IsraelNo ratings yet

- Philippine Deposit Insurance CorporationDocument19 pagesPhilippine Deposit Insurance CorporationGuevarra AngeloNo ratings yet

- 48168321-2013-International Hotel Corp. v. Joaquin Jr.Document16 pages48168321-2013-International Hotel Corp. v. Joaquin Jr.Christine Ang CaminadeNo ratings yet

- Membership Updated Form 06.10.22Document5 pagesMembership Updated Form 06.10.22Sirajia CngNo ratings yet

- Nyu Real EstateDocument9 pagesNyu Real EstateRaghuNo ratings yet