Professional Documents

Culture Documents

R R + (B X (R - R) ) : Required Return On Asset I Risk-Free Rate of Return Beta Coefficient Market Return

Uploaded by

Vergel MartinezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

R R + (B X (R - R) ) : Required Return On Asset I Risk-Free Rate of Return Beta Coefficient Market Return

Uploaded by

Vergel MartinezCopyright:

Available Formats

CAPITAL ASSET PRICING MODEL (CAPM)

Capital Asset Pricing Model (CAPM) is a model based on the proportion that any stock’s

required rate of return is equal to the risk-free rate of return plus a risk premium that reflects

only the risk remaining after diversification.

Expected Portfolio Returns-The weighted average of the expected returns of the individual

assets in the portfolio, with the weights being the percentage of the total portfolio invested in

each asset.

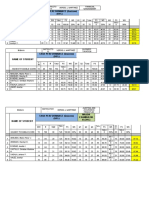

Sample Problem No. 1

Stock (1) Expected Return Amount Invested Percent of Total Product (2) x (4)

(2) (3) (4) (5)

Microsoft 7.75% 25,000,000

IBM 7.25% 25,000,000

GE 8.75% 25,000,000

Exxon Mobil 7.75% 25,000,000

7.88% 100,000,000

Portfolio- Generally smaller than the average of the stock’s standard deviation because

diversification lowers the portfolio’s risk.

The Beta Coefficient, b- A metric that shows the extent to which a given stock’s return move

up and down with the stock market.

The equation

Ri=RF+ [bi x (rm –RF)]

ri= required return on asset i

Rf = risk-free rate of return

bi= beta coefficient

rm= market return

Seatwork- CAPM

Problem 1

Assuming that Apple was included in the listed stocks, how much is the expected return on a

portfolio?

Stock (1) Expected Return (2) Amount Invested (3)

Microsoft 7.75% 25,000,000

IBM 7.25% 25,000,000

GE 8.75% 25,000,000

Exxon Mobil 7.75% 25,000,000

Apple 15.50% 25,000,000

Problem 2

Portfolio P consists of two (2) stocks: 50% is invested in Stock A, and 50% is invested in Stock

B. Stock A has a standard deviation of 25% and a beta of 1.2, and a Stock B has a standard

deviation of 35% and a beta of 0.80. The correlation between these stocks is 0.4.

a. What is the beta of Portfolio P?

b. Which stock is riskier to a diversified investor?

Problem 3

The risk free rate is 3%, and the market risk premium is 4%. Stock A has a beta of 1.2, and

Stock B has a beta of 0.8.

a. What is the required rate of return on each stock?

b. Investors become more risk-averse, so the market risk premium rises from 4% to 6%.

Assuming that the risk-free rate remains constant, what effect will this have on the

required rates of return on the two?

You might also like

- Finding Alphas: A Quantitative Approach to Building Trading StrategiesFrom EverandFinding Alphas: A Quantitative Approach to Building Trading StrategiesRating: 4 out of 5 stars4/5 (1)

- Risk and Return (Part II)Document22 pagesRisk and Return (Part II)mimiNo ratings yet

- Financial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskFrom EverandFinancial Risk Management: Applications in Market, Credit, Asset and Liability Management and Firmwide RiskNo ratings yet

- Risk and Return - Capital Market TheoryDocument37 pagesRisk and Return - Capital Market TheoryHelen TuberaNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Risk ReturnDocument13 pagesRisk ReturnMishal ArifNo ratings yet

- TarasDocument3 pagesTarasSudipto KunduNo ratings yet

- Risk, Returns and WACC: CAPM and The Capital BudgetingDocument41 pagesRisk, Returns and WACC: CAPM and The Capital Budgetingpeter sumNo ratings yet

- Week 2 Tutorial Questions and SolutionsDocument3 pagesWeek 2 Tutorial Questions and Solutionsmuller1234No ratings yet

- Assignment Ch.8Document3 pagesAssignment Ch.8Fatimah HamadNo ratings yet

- Shapiro CHAPTER 6 SolutionsDocument10 pagesShapiro CHAPTER 6 SolutionsjzdoogNo ratings yet

- Financial Management - Theory & Practice by Brigham-266-273Document8 pagesFinancial Management - Theory & Practice by Brigham-266-273Muhammad AzeemNo ratings yet

- Risk and Return - Capital Marketing TheoryDocument19 pagesRisk and Return - Capital Marketing TheoryKEZIAH REVE B. RODRIGUEZNo ratings yet

- Cov (R, R) = β β σ Cov (R, R) = 0.8 *0.9*0.35^2 Cov (R, R) =0.07717Document5 pagesCov (R, R) = β β σ Cov (R, R) = 0.8 *0.9*0.35^2 Cov (R, R) =0.07717killerNo ratings yet

- Asset Pricing Models PDFDocument2 pagesAsset Pricing Models PDFsakshi68No ratings yet

- Chapter 23 - AnswerDocument11 pagesChapter 23 - AnswerwynellamaeNo ratings yet

- RecitationDocument10 pagesRecitationAshish MalhotraNo ratings yet

- Chapter 9 - SolutionsDocument53 pagesChapter 9 - SolutionsLILYANo ratings yet

- FIN 301 B Porter Rachna Soln.Document3 pagesFIN 301 B Porter Rachna Soln.Seema KiranNo ratings yet

- There Are 20 Questions in This Part. Please Choose ONE Answer For Each Question. Each Question Is Worth 0.2 PointsDocument8 pagesThere Are 20 Questions in This Part. Please Choose ONE Answer For Each Question. Each Question Is Worth 0.2 PointsThảo Như Trần NgọcNo ratings yet

- Chapter12 - Estimating Cost of CapitalDocument29 pagesChapter12 - Estimating Cost of CapitalAntonio Jose DuarteNo ratings yet

- D - Tutorial 7 (Solutions)Document10 pagesD - Tutorial 7 (Solutions)AlfieNo ratings yet

- Diversification of RisksDocument14 pagesDiversification of RisksManisha MehtaNo ratings yet

- Safari - 25 Nov 2022 at 07 - 32Document1 pageSafari - 25 Nov 2022 at 07 - 32Tonie NascentNo ratings yet

- Reading 50 Portfolio Risk and Return Part II AnswersDocument46 pagesReading 50 Portfolio Risk and Return Part II AnswersK59 Nguyen Thao LinhNo ratings yet

- Lecture 8.1 (Beta and CAPM)Document17 pagesLecture 8.1 (Beta and CAPM)Devyansh GuptaNo ratings yet

- Old Exam 2Document5 pagesOld Exam 2clementNo ratings yet

- PS 4Document7 pagesPS 4Gilbert Ansah YirenkyiNo ratings yet

- Sample 2012 Practice L1.T1 - 57-61 - v3 - 0119Document5 pagesSample 2012 Practice L1.T1 - 57-61 - v3 - 0119Doc MashalNo ratings yet

- Finance 1 For IBA - Tutorial 5: Pranav Desai Joren Koëter Lingbo ShenDocument15 pagesFinance 1 For IBA - Tutorial 5: Pranav Desai Joren Koëter Lingbo ShenLisanne Ploos van AmstelNo ratings yet

- 2nd Session - Chapter 6 - Risk, Return, and The Capital Asset Pricing ModelDocument51 pages2nd Session - Chapter 6 - Risk, Return, and The Capital Asset Pricing Model'Osvaldo' RioNo ratings yet

- IM FInal Exam Practice Test 3Document13 pagesIM FInal Exam Practice Test 3Ngoc Hoang Ngan NgoNo ratings yet

- Tutorial 5 - SolutionsDocument8 pagesTutorial 5 - SolutionsHa PhiNo ratings yet

- Capital Asset Pricing ModelDocument25 pagesCapital Asset Pricing ModelShiv Deep Sharma 20mmb087No ratings yet

- 03 Bond Portfolio OptimizationDocument23 pages03 Bond Portfolio Optimizationaaronouyang1No ratings yet

- FM 8th Edition Chapter 12 - Risk and ReturnDocument20 pagesFM 8th Edition Chapter 12 - Risk and ReturnKa Io ChaoNo ratings yet

- ECN 3422 - Lecture 5 - 2021.10.5Document23 pagesECN 3422 - Lecture 5 - 2021.10.5Cornelius MasikiniNo ratings yet

- Session 5 - Cost of CapitalDocument49 pagesSession 5 - Cost of CapitalMuhammad HanafiNo ratings yet

- Coursework 1-Corporate FinanceDocument3 pagesCoursework 1-Corporate Financeyitong zhangNo ratings yet

- Return, Risk, and The Security Market LineDocument62 pagesReturn, Risk, and The Security Market LineTushar AroraNo ratings yet

- PS 2Document6 pagesPS 2WristWork EntertainmentNo ratings yet

- Tutorial 5 - SolutionsDocument8 pagesTutorial 5 - SolutionsNguyễn Phương ThảoNo ratings yet

- Practice Exam 2020 2.0 in Corporate FinanceDocument5 pagesPractice Exam 2020 2.0 in Corporate FinanceNikolai PriessNo ratings yet

- Investment and Portfolio AnalysisDocument24 pagesInvestment and Portfolio Analysis‘Alya Qistina Mohd ZaimNo ratings yet

- CAPM HandoutDocument37 pagesCAPM HandoutShashank ReddyNo ratings yet

- CAPMDocument51 pagesCAPMDisha BakshiNo ratings yet

- Application of Capital Market TheoryDocument19 pagesApplication of Capital Market TheoryMaryam NuurNo ratings yet

- Financial Management 2: Prepared By: Eunice Meanne B. SiapnoDocument26 pagesFinancial Management 2: Prepared By: Eunice Meanne B. SiapnoJesa SinghbalNo ratings yet

- Bus3026w Obj4Document5 pagesBus3026w Obj4api-3708231No ratings yet

- Extra Calculation For Fina Exams (Answers)Document6 pagesExtra Calculation For Fina Exams (Answers)SooXueJiaNo ratings yet

- Portfolio Theory and The Capital Asset Pricing ModelDocument32 pagesPortfolio Theory and The Capital Asset Pricing ModelIgorNo ratings yet

- Tutorial 4Document10 pagesTutorial 4Yaonik HimmatramkaNo ratings yet

- Final Practice Questions and SolutionsDocument12 pagesFinal Practice Questions and Solutionsshaikhnazneen100No ratings yet

- Warm Up Chapter 8Document5 pagesWarm Up Chapter 8abdulraufdghaybeejNo ratings yet

- 00 Assignment 2 QuestionnaireDocument6 pages00 Assignment 2 QuestionnaireBharat KoiralaNo ratings yet

- Risk & Return: Risk of A Portfolio-Uncertainty Main ViewDocument47 pagesRisk & Return: Risk of A Portfolio-Uncertainty Main ViewKazi FahimNo ratings yet

- Finance BIS & FMI SheetDocument13 pagesFinance BIS & FMI SheetSouliman MuhammadNo ratings yet

- CAPM2Document31 pagesCAPM2ELISHA OCAMPONo ratings yet

- Session 16: Practice Problems: 30017 Corporate Finance Lecture SlidesDocument16 pagesSession 16: Practice Problems: 30017 Corporate Finance Lecture SlidesGiuseppeNo ratings yet

- Lecture 4 Index Models 4.1 Markowitz Portfolio Selection ModelDocument34 pagesLecture 4 Index Models 4.1 Markowitz Portfolio Selection ModelL SNo ratings yet

- Final Midterm GradesDocument10 pagesFinal Midterm GradesVergel MartinezNo ratings yet

- Seatwork On Income Taxation NameDocument2 pagesSeatwork On Income Taxation NameVergel MartinezNo ratings yet

- Name of Student Task Performance (Quizzes) (50%)Document4 pagesName of Student Task Performance (Quizzes) (50%)Vergel MartinezNo ratings yet

- Name of Student TASK PERFORMANCE (Quizzes) (50%) Class Participation (20%) Major Examination (30%)Document10 pagesName of Student TASK PERFORMANCE (Quizzes) (50%) Class Participation (20%) Major Examination (30%)Vergel MartinezNo ratings yet

- Time Value of MoneyDocument16 pagesTime Value of MoneyVergel MartinezNo ratings yet

- Quiz-FS AnalysisDocument3 pagesQuiz-FS AnalysisVergel MartinezNo ratings yet

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Financial Statements AnalysisDocument9 pagesFinancial Statements AnalysisVergel MartinezNo ratings yet

- BondsDocument8 pagesBondsVergel MartinezNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- Marketable Securities + Receivable: Increase. IncreaseDocument4 pagesMarketable Securities + Receivable: Increase. IncreaseVergel MartinezNo ratings yet

- Quiz-Pre Engagement & Audit PlanningDocument5 pagesQuiz-Pre Engagement & Audit PlanningVergel MartinezNo ratings yet

- Seatwork: Final Tax and Fringe Benefits TaxDocument6 pagesSeatwork: Final Tax and Fringe Benefits TaxVergel MartinezNo ratings yet

- Course Outline Example For BS AccountancyDocument5 pagesCourse Outline Example For BS AccountancyVergel MartinezNo ratings yet

- Cases) - Retrieved From: References Production ManagementDocument2 pagesCases) - Retrieved From: References Production ManagementVergel MartinezNo ratings yet

- 2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsDocument2 pages2nd Term, SY 2019-2020 Quiz On Income Taxation Name: - Section: - Date: - Identification Identify The Following StatementsVergel MartinezNo ratings yet

- Quizzer-Donor's TaxDocument4 pagesQuizzer-Donor's TaxVergel Martinez33% (3)

- RR 12 QuizDocument2 pagesRR 12 QuizVergel MartinezNo ratings yet

- Quiz-Professional Standards-ARDocument4 pagesQuiz-Professional Standards-ARVergel MartinezNo ratings yet

- ListDocument5 pagesListVergel MartinezNo ratings yet

- PILOsDocument2 pagesPILOsVergel MartinezNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument20 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueVergel MartinezNo ratings yet

- Nidec Philippines Corporation Company ProfileDocument35 pagesNidec Philippines Corporation Company ProfileVergel MartinezNo ratings yet

- Markscheme: November 2016Document25 pagesMarkscheme: November 2016api-529669983No ratings yet

- Winter ExamDocument4 pagesWinter ExamJuhee SeoNo ratings yet

- 2.technical Analysis Part 2Document20 pages2.technical Analysis Part 2trisha chandrooNo ratings yet

- Kinfo Import TemplateDocument4 pagesKinfo Import Templatemaik practiceNo ratings yet

- Monthly Test - I: JULY 2020Document7 pagesMonthly Test - I: JULY 2020me no oneNo ratings yet

- Landmark Judgement - Company Law - Percival V Wright 1902 2 CH 421 - Print 2Document2 pagesLandmark Judgement - Company Law - Percival V Wright 1902 2 CH 421 - Print 2Shri Kant CLCNo ratings yet

- Lecture 5Document22 pagesLecture 5sanjana dasaNo ratings yet

- Managerial Economics: Suzanne Sobhy GharibDocument10 pagesManagerial Economics: Suzanne Sobhy GharibSuzanne S. GharibNo ratings yet

- 09 - Transfer Prices - Theoretical - Ex. 1Document3 pages09 - Transfer Prices - Theoretical - Ex. 1Ahmed Ameen Nour EldinNo ratings yet

- CMS Business Standards: Selling Price Cost Price / (1-GP%) Eg. 40% 0.4Document2 pagesCMS Business Standards: Selling Price Cost Price / (1-GP%) Eg. 40% 0.4heleno rodriguesNo ratings yet

- EconomicsDocument108 pagesEconomicsSen RinaNo ratings yet

- Mohd. Moktasid Hossain Bhuiyan ID: 19304024Document2 pagesMohd. Moktasid Hossain Bhuiyan ID: 19304024Moktasid HossainNo ratings yet

- Consumer Theory ExerciseDocument9 pagesConsumer Theory ExerciseJeremiah Sunnawa SinggihNo ratings yet

- QUIZDocument5 pagesQUIZNastya MedlyarskayaNo ratings yet

- Export-Import Management PDFDocument1 pageExport-Import Management PDFNidhi BahotNo ratings yet

- Marcos, Jayven B.Document7 pagesMarcos, Jayven B.Marcos, Jayven B.No ratings yet

- Handouts 03 EfficiencyDocument2 pagesHandouts 03 Efficiencygugercin80No ratings yet

- Chapter 1: Financial Management and Financial ObjectivesDocument15 pagesChapter 1: Financial Management and Financial ObjectivesAmir ArifNo ratings yet

- Magdaraog Ass3econDocument8 pagesMagdaraog Ass3econDanielle Aubrey TerencioNo ratings yet

- Business Math q3 w5 Markon, Markup, MarkdownDocument9 pagesBusiness Math q3 w5 Markon, Markup, MarkdownJoyce Marie Dichoson0% (1)

- Valuation of BondsDocument5 pagesValuation of BondsSAURAVNo ratings yet

- Case Analysis - Ice Fili - Group 12 - BM-CDocument10 pagesCase Analysis - Ice Fili - Group 12 - BM-CSravani_N_091No ratings yet

- Analysis ReportDocument5 pagesAnalysis ReportAsif AliNo ratings yet

- Microeconomics Problem Set 3Document10 pagesMicroeconomics Problem Set 3Thăng Nguyễn BáNo ratings yet

- PL APArmaFlex - Fabricatedfittings.en - US.2019Document13 pagesPL APArmaFlex - Fabricatedfittings.en - US.2019adrianioantomaNo ratings yet

- Test Bank For Microeconomics, 8th Edition David ColanderDocument106 pagesTest Bank For Microeconomics, 8th Edition David ColanderFatimaNo ratings yet

- Mechanics of Trading and Types of OrdersDocument21 pagesMechanics of Trading and Types of OrdersJade EdajNo ratings yet

- CmonthlyDocument5 pagesCmonthlyVST SiteNo ratings yet

- Moody's Weekly OutlookDocument23 pagesMoody's Weekly OutlookAceNo ratings yet

- George Soros and His Speculative Activities: Assignment OnDocument3 pagesGeorge Soros and His Speculative Activities: Assignment OndebojyotiNo ratings yet