Professional Documents

Culture Documents

MANDANAS V. OCHOA G.R. No. 199802 (2018)

Uploaded by

JushiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MANDANAS V. OCHOA G.R. No. 199802 (2018)

Uploaded by

JushiCopyright:

Available Formats

MANDANAS V. OCHOA G.R. No.

199802 (2018)

Congress enacted RA 7160 (Local Government Code) in implementing the constitutional mandate for

decentralization and local economy, in order to guarantee fiscal autonomy of LGUs. According to the Local

government code, The IRA is determined based on the actual collections of the national internal revenue taxes

(NIRTs), as certified by the Bureau of Internal Revenue (BIR)

Two cases were filed before the supreme court anent the above. G.R. No. 199802 (Mandanas, et al.), a special

civil action for certiorari, prohibition and mandamus assailing the manner the General Appropriations Act (GAA)

for FY 2012 computed the IRA for the LGUs and G.R. No. 208488, filed by Congressman Enrique Garcia, Jr., the

lone petitioner, seeks the writ of mandamus to compel the respondents thereat to compute the just share of

the LGUs on the basis of all national taxes. Both cases were consolidated on October 22, 2013.

You might also like

- Taxation Law Updates by Atty. OrtegaDocument21 pagesTaxation Law Updates by Atty. Ortegavillanueva9guapster9100% (1)

- 1 Mandanas vs. OchoaDocument2 pages1 Mandanas vs. OchoaShaine ArellanoNo ratings yet

- PP V MacadaegDocument2 pagesPP V MacadaegJushi100% (1)

- 12 G.R. Nos. 199802 & 208488 - Mandanas v. Ochoa, JRDocument119 pages12 G.R. Nos. 199802 & 208488 - Mandanas v. Ochoa, JRCamille CruzNo ratings yet

- Mandanas V OchoaDocument29 pagesMandanas V OchoaPrinceNo ratings yet

- Mandanas vs. OchoaDocument2 pagesMandanas vs. OchoaShaine ArellanoNo ratings yet

- Mandanas RulingDocument23 pagesMandanas RulingKarah JaneNo ratings yet

- DISCUSSIONS ON THE MANDANAS RULING PPT 202122Document20 pagesDISCUSSIONS ON THE MANDANAS RULING PPT 202122John Christopher ReguindinNo ratings yet

- Law On Local Governments CasesDocument186 pagesLaw On Local Governments CasesEugene bolarNo ratings yet

- Suntay V CojuancoDocument2 pagesSuntay V CojuancoJushiNo ratings yet

- Suntay V CojuancoDocument2 pagesSuntay V CojuancoJushiNo ratings yet

- Mercado V PeopleDocument2 pagesMercado V PeopleJushiNo ratings yet

- Mercado V PeopleDocument2 pagesMercado V PeopleJushiNo ratings yet

- Mandanas vs. OchoaDocument1 pageMandanas vs. OchoaMarco RenaciaNo ratings yet

- Batangas City vs. ShellDocument1 pageBatangas City vs. ShellXiana ENo ratings yet

- Mandanas v. Executive Secretary Ochoa DigestDocument4 pagesMandanas v. Executive Secretary Ochoa DigestTherese Espinosa83% (12)

- Legal Research - Case DigestDocument5 pagesLegal Research - Case DigestMA. TRISHA RAMENTONo ratings yet

- Case 5 - Mandanas vs. GarciaDocument17 pagesCase 5 - Mandanas vs. GarciaJuliet Ghaile Ann BenicoNo ratings yet

- Mandanas LawDocument2 pagesMandanas LawJayson Mirambel100% (1)

- Case Digest G.R. No. L-10520 Feb 8, 1957Document2 pagesCase Digest G.R. No. L-10520 Feb 8, 1957Jushi100% (1)

- G.R. No. 203754Document2 pagesG.R. No. 203754JushiNo ratings yet

- G.R. No. 203754Document2 pagesG.R. No. 203754JushiNo ratings yet

- Congressman Hermilando I. Mandanas, Et Al. vs. Executive Secretary Paquito N. Ochoa (DIGEST)Document4 pagesCongressman Hermilando I. Mandanas, Et Al. vs. Executive Secretary Paquito N. Ochoa (DIGEST)adam niel corvera63% (8)

- G.R. No. 199802Document28 pagesG.R. No. 199802Michael MartinNo ratings yet

- G.R. No. 199802Document31 pagesG.R. No. 199802DILG XIII- Atty. Robelen CallantaNo ratings yet

- Full Text GR No. 199802Document62 pagesFull Text GR No. 199802Jean Jamailah TomugdanNo ratings yet

- Mandanas Vs Exec SecretaryDocument26 pagesMandanas Vs Exec Secretarycloudstorm-1No ratings yet

- Local Autonomy Cases FullDocument65 pagesLocal Autonomy Cases FullJamiah Obillo HulipasNo ratings yet

- 2018 Mandanas - v. - Ochoa - Jr.20181023 5466 1q8746a PDFDocument96 pages2018 Mandanas - v. - Ochoa - Jr.20181023 5466 1q8746a PDFBrian Kelvin PinedaNo ratings yet

- G.R. No. 199802 Mandanas Vs OchoaDocument25 pagesG.R. No. 199802 Mandanas Vs OchoaroigtcNo ratings yet

- PUBCORP Full Text CasesDocument34 pagesPUBCORP Full Text Casesp95No ratings yet

- Mandanas V Ochoa DecisionDocument24 pagesMandanas V Ochoa DecisionCharisse ToledoNo ratings yet

- Garcia Vs Mandanas, G.R. No. 199802, July 03, 2018Document39 pagesGarcia Vs Mandanas, G.R. No. 199802, July 03, 2018Quinciano MorilloNo ratings yet

- Mandanas v. Ochoa 2018 - G.R. No. 199802Document35 pagesMandanas v. Ochoa 2018 - G.R. No. 199802Hannah Keziah Dela CernaNo ratings yet

- Cong Mandanas V Executive Sec OchoaDocument23 pagesCong Mandanas V Executive Sec OchoaJane CuizonNo ratings yet

- Cong. Mandanas vs. Executive Secretary GR 199802 July 3 2018 DecisionDocument67 pagesCong. Mandanas vs. Executive Secretary GR 199802 July 3 2018 DecisionSherily CuaNo ratings yet

- Petitioners: en BancDocument412 pagesPetitioners: en BancRAFAEL FRANCESCO SAAR GONZALESNo ratings yet

- Mandanas V Executive SecretaryDocument95 pagesMandanas V Executive SecretaryRona Jane Fugaban AbadillaNo ratings yet

- Congressman Hermilando CASE STUDYDocument19 pagesCongressman Hermilando CASE STUDYJessé SolisNo ratings yet

- Mandanas v. Ochoa-G.R. No. 199802Document25 pagesMandanas v. Ochoa-G.R. No. 199802Dianne Hannaly AquinoNo ratings yet

- Income Tax CasesDocument143 pagesIncome Tax CasesWarly PabloNo ratings yet

- Mandanaz v. OchoaDocument2 pagesMandanaz v. OchoaCharles BayNo ratings yet

- Polirev - July 18, 2019Document208 pagesPolirev - July 18, 2019Jillian AsdalaNo ratings yet

- CasesDocument235 pagesCasesChasmere MagloyuanNo ratings yet

- Mandanas v. Ochoa, Jr.Document110 pagesMandanas v. Ochoa, Jr.suis generisNo ratings yet

- Mandanas Vs Exective SecretaryDocument29 pagesMandanas Vs Exective SecretaryPea ChubNo ratings yet

- DigestDocument20 pagesDigestEunice AlmogueraNo ratings yet

- Mandana Garcia RulingDocument109 pagesMandana Garcia RulingBrgy6 Zone 1 District1No ratings yet

- Taxation Law Case Digests Hernando Bar 2023 - CompressDocument43 pagesTaxation Law Case Digests Hernando Bar 2023 - Compressshaileen reyes-macalinoNo ratings yet

- Mandanas v. Ochoa, G.R. Nos. 199802 & 208488Document2 pagesMandanas v. Ochoa, G.R. Nos. 199802 & 208488julie.lagareNo ratings yet

- 2 - Mandanas v. OchoaDocument1 page2 - Mandanas v. OchoaNelsie JoyceNo ratings yet

- Income Taxation CasesDocument23 pagesIncome Taxation CasesSachieCasimiroNo ratings yet

- Exception On The Non Delgation of The PowerDocument14 pagesException On The Non Delgation of The PowerRomero MelandriaNo ratings yet

- Gaw, Jr. v. Commissioner of Internal Revenue, G.R. No. 222837, (July 23, 2018)Document20 pagesGaw, Jr. v. Commissioner of Internal Revenue, G.R. No. 222837, (July 23, 2018)Pastel Rose CloudNo ratings yet

- G.R. No. 197945Document18 pagesG.R. No. 197945Ran NgiNo ratings yet

- Digest of Sele T Supreme Court On Ta Ation,: CasesDocument31 pagesDigest of Sele T Supreme Court On Ta Ation,: Casesric tanNo ratings yet

- Commissioner of Income Tax Vs Virtual Soft Systems Ltd. Supreme Court of IndiaDocument16 pagesCommissioner of Income Tax Vs Virtual Soft Systems Ltd. Supreme Court of IndiaHimmat SinghNo ratings yet

- Serendra CTA DecisionDocument42 pagesSerendra CTA DecisionrobiNo ratings yet

- Taxation LawDocument40 pagesTaxation Lawnelzahumiwat0No ratings yet

- Review of The Case of AG Rivers State v. FIRSDocument9 pagesReview of The Case of AG Rivers State v. FIRSKilli Nancwat0% (1)

- G.R. No. L-28896 February 17, 1988 Commissioner of Internal Revenue, PetitionerDocument10 pagesG.R. No. L-28896 February 17, 1988 Commissioner of Internal Revenue, PetitionerfinserglenNo ratings yet

- 79 Accord V ZamoraDocument4 pages79 Accord V ZamoraRein GallardoNo ratings yet

- NFIB V Sebilius To 31. CIR V CA & FortuneDocument8 pagesNFIB V Sebilius To 31. CIR V CA & FortuneJsa GironellaNo ratings yet

- Laws On Local Govt ReviewerDocument17 pagesLaws On Local Govt ReviewerthekhaleesithecatNo ratings yet

- Mandanas CaseDocument1 pageMandanas CaseBaisy VillanozaNo ratings yet

- MANDANAS V. OCHOA G.R. No. 199802 (2018)Document1 pageMANDANAS V. OCHOA G.R. No. 199802 (2018)JushiNo ratings yet

- Sheker Vs ShekerDocument1 pageSheker Vs ShekerJushiNo ratings yet

- Lejano Vs PeopleDocument1 pageLejano Vs PeopleJushiNo ratings yet

- MANDANAS V. OCHOA G.R. No. 199802 (2018)Document1 pageMANDANAS V. OCHOA G.R. No. 199802 (2018)JushiNo ratings yet

- Recuerdo de Amor Vs PeopleDocument1 pageRecuerdo de Amor Vs PeopleJushiNo ratings yet

- Recuerdo de Amor Vs PeopleDocument1 pageRecuerdo de Amor Vs PeopleJushiNo ratings yet

- Sheker Vs ShekerDocument1 pageSheker Vs ShekerJushiNo ratings yet

- Lejano Vs PeopleDocument1 pageLejano Vs PeopleJushiNo ratings yet

- People Vs SabalonesDocument33 pagesPeople Vs SabalonesJushiNo ratings yet

- Talampas Vs PeopleDocument5 pagesTalampas Vs PeopleJushiNo ratings yet

- Employment Div Vs SmithDocument1 pageEmployment Div Vs SmithJushiNo ratings yet

- Recuerdo de Amor Vs PeopleDocument1 pageRecuerdo de Amor Vs PeopleJushiNo ratings yet

- Plaintiff-Appellee Vs Vs Defendant-Appellant Francisco Ortigas Solicitor-General HarveyDocument2 pagesPlaintiff-Appellee Vs Vs Defendant-Appellant Francisco Ortigas Solicitor-General HarveykitakatttNo ratings yet

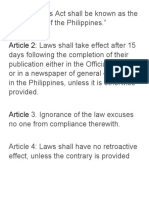

- Civil Code Visual AidsDocument7 pagesCivil Code Visual AidsJushiNo ratings yet

- Facts:: Brother Mariano "Mike" Z. Velarde V. Social Justice Society, GR No. 159357, 2004-04-28Document4 pagesFacts:: Brother Mariano "Mike" Z. Velarde V. Social Justice Society, GR No. 159357, 2004-04-28JushiNo ratings yet

- CRIM 1 Digests PDFDocument7 pagesCRIM 1 Digests PDFAbdul Nasifh Bn HamsaNo ratings yet

- Facts:: Brother Mariano "Mike" Z. Velarde V. Social Justice Society, GR No. 159357, 2004-04-28Document4 pagesFacts:: Brother Mariano "Mike" Z. Velarde V. Social Justice Society, GR No. 159357, 2004-04-28JushiNo ratings yet

- Advantages of Quasi ExperimentsDocument1 pageAdvantages of Quasi ExperimentsJushiNo ratings yet

- Quasi Experimental StudiesDocument1 pageQuasi Experimental StudiesJushiNo ratings yet

- Different Kinds of Drug NamesDocument1 pageDifferent Kinds of Drug NamesJushiNo ratings yet

- Introduction To Quality ControlDocument3 pagesIntroduction To Quality ControlJushi0% (1)