Professional Documents

Culture Documents

Mindanao Bus Co. vs. City Assessor, L-17870, Sept. 28, 1962

Uploaded by

Kimmy0 ratings0% found this document useful (0 votes)

77 views3 pagesOriginal Title

3. Mindanao Bus Co. vs. City Assessor, L-17870, Sept. 28, 1962.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

77 views3 pagesMindanao Bus Co. vs. City Assessor, L-17870, Sept. 28, 1962

Uploaded by

KimmyCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Republic of the Philippines Pagadian, Zamboanga del Sur; Davao City and Kibawe, Bukidnon

SUPREME COURT Province;

Manila

3. That the machineries sought to be assessed by the respondent as

EN BANC real properties are the following:

G.R. No. L-17870 September 29, 1962 (a) Hobart Electric Welder Machine, appearing in the attached

photograph, marked Annex "A";

MINDANAO BUS COMPANY, petitioner,

vs. (b) Storm Boring Machine, appearing in the attached photograph,

THE CITY ASSESSOR & TREASURER and the BOARD OF TAX marked Annex "B";

APPEALS of Cagayan de Oro City, respondents.

(c) Lathe machine with motor, appearing in the attached photograph,

Binamira, Barria and Irabagon for petitioner. marked Annex "C";

Vicente E. Sabellina for respondents.

(d) Black and Decker Grinder, appearing in the attached photograph,

LABRADOR, J.: marked Annex "D";

This is a petition for the review of the decision of the Court of Tax (e) PEMCO Hydraulic Press, appearing in the attached photograph,

Appeals in C.T.A. Case No. 710 holding that the petitioner Mindanao marked Annex "E";

Bus Company is liable to the payment of the realty tax on its

(f) Battery charger (Tungar charge machine) appearing in the

maintenance and repair equipment hereunder referred to.

attached photograph, marked Annex "F"; and

Respondent City Assessor of Cagayan de Oro City assessed at

(g) D-Engine Waukesha-M-Fuel, appearing in the attached

P4,400 petitioner's above-mentioned equipment. Petitioner appealed

photograph, marked Annex "G".

the assessment to the respondent Board of Tax Appeals on the

ground that the same are not realty. The Board of Tax Appeals of the 4. That these machineries are sitting on cement or wooden platforms

City sustained the city assessor, so petitioner herein filed with the as may be seen in the attached photographs which form part of this

Court of Tax Appeals a petition for the review of the assessment. agreed stipulation of facts;

In the Court of Tax Appeals the parties submitted the following 5. That petitioner is the owner of the land where it maintains and

stipulation of facts: operates a garage for its TPU motor trucks; a repair shop; blacksmith

and carpentry shops, and with these machineries which are placed

Petitioner and respondents, thru their respective counsels agreed to

therein, its TPU trucks are made; body constructed; and same are

the following stipulation of facts:

repaired in a condition to be serviceable in the TPU land

1. That petitioner is a public utility solely engaged in transporting transportation business it operates;

passengers and cargoes by motor trucks, over its authorized lines in

6. That these machineries have never been or were never used as

the Island of Mindanao, collecting rates approved by the Public

industrial equipments to produce finished products for sale, nor to

Service Commission;

repair machineries, parts and the like offered to the general public

2. That petitioner has its main office and shop at Cagayan de Oro indiscriminately for business or commercial purposes for which

City. It maintains Branch Offices and/or stations at Iligan City, Lanao; petitioner has never engaged in, to date.1awphîl.nèt

The Court of Tax Appeals having sustained the respondent city connection with any industry or trade being carried on therein and

assessor's ruling, and having denied a motion for reconsideration, which are expressly adapted to meet the requirements of such trade

petitioner brought the case to this Court assigning the following errors: or industry."

1. The Honorable Court of Tax Appeals erred in upholding If the installation of the machinery and equipment in question in the

respondents' contention that the questioned assessments are valid; central of the Mabalacat Sugar Co., Inc., in lieu of the other of less

and that said tools, equipments or machineries are immovable taxable capacity existing therein, for its sugar and industry, converted them

real properties. into real property by reason of their purpose, it cannot be said that

their incorporation therewith was not permanent in character

2. The Tax Court erred in its interpretation of paragraph 5 of Article

because, as essential and principle elements of a sugar central,

415 of the New Civil Code, and holding that pursuant thereto the

without them the sugar central would be unable to function or carry on

movable equipments are taxable realties, by reason of their being

the industrial purpose for which it was established. Inasmuch as the

intended or destined for use in an industry.

central is permanent in character, the necessary machinery and

3. The Court of Tax Appeals erred in denying petitioner's contention equipment installed for carrying on the sugar industry for which it has

that the respondent City Assessor's power to assess and levy real been established must necessarily be permanent. (Emphasis ours.)

estate taxes on machineries is further restricted by section 31,

So that movable equipments to be immobilized in contemplation of the

paragraph (c) of Republic Act No. 521; and

law must first be "essential and principal elements" of an industry or

4. The Tax Court erred in denying petitioner's motion for works without which such industry or works would be "unable to

reconsideration. function or carry on the industrial purpose for which it was

established." We may here distinguish, therefore, those movable

Respondents contend that said equipments, tho movable, are which become immobilized by destination because they are essential

immobilized by destination, in accordance with paragraph 5 of Article and principal elements in the industry for those which may not be so

415 of the New Civil Code which provides: considered immobilized because they are merely incidental, not

Art. 415. — The following are immovable properties: essential and principal. Thus, cash registers, typewriters, etc., usually

found and used in hotels, restaurants, theaters, etc. are merely

xxx xxx xxx incidentals and are not and should not be considered immobilized by

destination, for these businesses can continue or carry on their

(5) Machinery, receptacles, instruments or implements intended by

functions without these equity comments. Airline companies use

the owner of the tenement for an industry or works which may be

forklifts, jeep-wagons, pressure pumps, IBM machines, etc. which are

carried on in a building or on a piece of land, and which tend directly

incidentals, not essentials, and thus retain their movable nature. On

to meet the needs of the said industry or works. (Emphasis ours.)

the other hand, machineries of breweries used in the manufacture of

Note that the stipulation expressly states that the equipment are liquor and soft drinks, though movable in nature, are immobilized

placed on wooden or cement platforms. They can be moved around because they are essential to said industries; but the delivery trucks

and about in petitioner's repair shop. In the case of B. H. Berkenkotter and adding machines which they usually own and use and are found

vs. Cu Unjieng, 61 Phil. 663, the Supreme Court said: within their industrial compounds are merely incidental and retain their

movable nature.

Article 344 (Now Art. 415), paragraph (5) of the Civil Code, gives the

character of real property to "machinery, liquid containers, instruments Similarly, the tools and equipments in question in this instant case

or implements intended by the owner of any building or land for use in are, by their nature, not essential and principle municipal elements of

petitioner's business of transporting passengers and cargoes by WHEREFORE, the decision subject of the petition for review is hereby

motor trucks. They are merely incidentals — acquired as movables set aside and the equipment in question declared not subject to

and used only for expediency to facilitate and/or improve its service. assessment as real estate for the purposes of the real estate tax.

Even without such tools and equipments, its business may be carried Without costs.

on, as petitioner has carried on, without such equipments, before the

So ordered.

war. The transportation business could be carried on without the

repair or service shop if its rolling equipment is repaired or serviced in Bengzon, C.J., Padilla, Bautista Angelo, Reyes, J.B.L., Paredes,

another shop belonging to another. Dizon and Makalintal, JJ., concur.

Regala, Concepcion and Barrera JJ., took no part.

The law that governs the determination of the question at issue is as

follows:

Art. 415. The following are immovable property:

xxx xxx xxx

(5) Machinery, receptacles, instruments or implements intended by

the owner of the tenement for an industry or works which may be

carried on in a building or on a piece of land, and which tend directly

to meet the needs of the said industry or works; (Civil Code of the

Phil.)

Aside from the element of essentiality the above-quoted provision also

requires that the industry or works be carried on in a building or on a

piece of land. Thus in the case of Berkenkotter vs. Cu Unjieng, supra,

the "machinery, liquid containers, and instruments or implements" are

found in a building constructed on the land. A sawmill would also be

installed in a building on land more or less permanently, and the

sawing is conducted in the land or building.

But in the case at bar the equipments in question are destined only to

repair or service the transportation business, which is not carried on

in a building or permanently on a piece of land, as demanded by the

law. Said equipments may not, therefore, be deemed real property.

Resuming what we have set forth above, we hold that the equipments

in question are not absolutely essential to the petitioner's

transportation business, and petitioner's business is not carried on in

a building, tenement or on a specified land, so said equipment may

not be considered real estate within the meaning of Article 415 (c) of

the Civil Code.

You might also like

- 2011 Sales OutlineDocument52 pages2011 Sales OutlineRegina Fentener van VlissingenNo ratings yet

- Defences On Negligence TutorialDocument3 pagesDefences On Negligence Tutorialsajetha sezliyanNo ratings yet

- Garcia v. Salvador G.R. NO. 168512, March 20, 2007Document9 pagesGarcia v. Salvador G.R. NO. 168512, March 20, 2007ChatNo ratings yet

- Villarico V Sarmiento DIGESTDocument2 pagesVillarico V Sarmiento DIGESTJaypoll DiazNo ratings yet

- Navarro vs. Pineda, (G.R. No. L-18456, November 30, 1963)Document3 pagesNavarro vs. Pineda, (G.R. No. L-18456, November 30, 1963)Kimberly SendinNo ratings yet

- The United States vs. Ignacio CarlosDocument8 pagesThe United States vs. Ignacio CarlosJayzell Mae FloresNo ratings yet

- No-Umbrella (Literature)Document6 pagesNo-Umbrella (Literature)Ella DavisNo ratings yet

- Air France V CarrascosaDocument2 pagesAir France V Carrascosamercy rodriguezNo ratings yet

- Metro Iloilo Water District vs. Court of AppealsDocument8 pagesMetro Iloilo Water District vs. Court of AppealsManuel DancelNo ratings yet

- Supreme Court: Thos. D. Aitken, For Appellant. Rosado, Sanz, and Opisso, For AppelleesDocument5 pagesSupreme Court: Thos. D. Aitken, For Appellant. Rosado, Sanz, and Opisso, For AppelleesGretch MaryNo ratings yet

- SNDT WOMEN’S UNIVERSITY LAW SCHOOL COMPUTERIZED LEGAL RESEARCHDocument4 pagesSNDT WOMEN’S UNIVERSITY LAW SCHOOL COMPUTERIZED LEGAL RESEARCHTrupti DabkeNo ratings yet

- FF Cruz Vs CA G.R. No. L-52732Document3 pagesFF Cruz Vs CA G.R. No. L-52732JetJuárezNo ratings yet

- (Torts) 21 - Wright V Manila Electric - LimDocument3 pages(Torts) 21 - Wright V Manila Electric - LimJosiah LimNo ratings yet

- Evidence of illegal fishing activity leads to convictionDocument9 pagesEvidence of illegal fishing activity leads to convictioncode4saleNo ratings yet

- Villafuerte Et Al Vs SEC, Et AlDocument12 pagesVillafuerte Et Al Vs SEC, Et AlDon FreecssNo ratings yet

- Lasam Vs SmithDocument4 pagesLasam Vs SmithDaryl Noel TejanoNo ratings yet

- Philex Mining Case DigestDocument1 pagePhilex Mining Case DigestMyla RodrigoNo ratings yet

- Bus Company Equipment Not Subject to Real Estate TaxDocument1 pageBus Company Equipment Not Subject to Real Estate TaxRaym Trabajo100% (1)

- Tagaytay Highlands International Golf Club IncDocument3 pagesTagaytay Highlands International Golf Club Incianmaranon2No ratings yet

- Modes of Acquiring Ownership and DonationDocument5 pagesModes of Acquiring Ownership and DonationYour Public ProfileNo ratings yet

- Case No. 173 National Federation of Sugar Workers (NFSW) vs. OvejeraDocument40 pagesCase No. 173 National Federation of Sugar Workers (NFSW) vs. OvejeraCarlos JamesNo ratings yet

- Agrarian Reform Law CodalDocument24 pagesAgrarian Reform Law CodalChengChengNo ratings yet

- PLDT v. CADocument2 pagesPLDT v. CAKatrina FregillanaNo ratings yet

- RABADILLA Vs CADocument3 pagesRABADILLA Vs CARain Agdeppa CatagueNo ratings yet

- Law On CopyrightDocument11 pagesLaw On CopyrightBin MandaNo ratings yet

- Sales Case Nos. 71 To 90Document85 pagesSales Case Nos. 71 To 90Arlando G. ArlandoNo ratings yet

- Arellano Vs PascualDocument2 pagesArellano Vs PascualnathNo ratings yet

- 003 NPC v. Campos, GR 143643 June 27, 2003Document2 pages003 NPC v. Campos, GR 143643 June 27, 2003IJ SaavedraNo ratings yet

- Alconera vs. PallananDocument2 pagesAlconera vs. PallananAnton FortichNo ratings yet

- Ned Lloyd v. Glow LaksDocument1 pageNed Lloyd v. Glow LaksCy PanganibanNo ratings yet

- General Banking Law: Edem, Michael Joy San Pedro, Juan Miguel Viguilla, JervisDocument54 pagesGeneral Banking Law: Edem, Michael Joy San Pedro, Juan Miguel Viguilla, JervisJuan Miguel San PedroNo ratings yet

- 06 Sesbreño vs. CADocument2 pages06 Sesbreño vs. CAGlenn Francis GacalNo ratings yet

- Agapay V PalangDocument13 pagesAgapay V PalangSuho KimNo ratings yet

- AverageDocument2 pagesAverageChin MartinzNo ratings yet

- PROVREM MidtermDocument27 pagesPROVREM MidtermKharrel GraceNo ratings yet

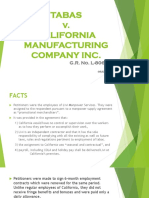

- Tabas v. California Manufacturing Company Inc.: Employer-Employee Relationship FoundDocument6 pagesTabas v. California Manufacturing Company Inc.: Employer-Employee Relationship FoundJesse Myl MarciaNo ratings yet

- Equitable Leasing Corp. v. Suyom Case DigestDocument8 pagesEquitable Leasing Corp. v. Suyom Case Digestmichelle_calzada_1No ratings yet

- (A. Subject Matter) Paramount Insurance Corporation vs. Remondeulaz, 686 SCRA 567, G.R. No. 173773 November 28, 2012Document6 pages(A. Subject Matter) Paramount Insurance Corporation vs. Remondeulaz, 686 SCRA 567, G.R. No. 173773 November 28, 2012Alexiss Mace JuradoNo ratings yet

- Pasay+City+v +CFIDocument2 pagesPasay+City+v +CFICarl Vincent QuitorianoNo ratings yet

- PFR - Conflict of Laws ProvisionsDocument4 pagesPFR - Conflict of Laws ProvisionsCathyrine JabagatNo ratings yet

- 793 SCRA 610 (Tan vs. Cinco)Document2 pages793 SCRA 610 (Tan vs. Cinco)Louvanne Jessa Orzales BesingaNo ratings yet

- Pre-Week Handbook - Civil Law - ParasDocument2 pagesPre-Week Handbook - Civil Law - ParasVen VenNo ratings yet

- Agbayani v. Lupa Realty Holding CorporationDocument13 pagesAgbayani v. Lupa Realty Holding CorporationAnonymousNo ratings yet

- Jurisdiction - Lecture Notes Sy 2011-2012Document33 pagesJurisdiction - Lecture Notes Sy 2011-2012Nimpa PichayNo ratings yet

- Hicks V Manila HotelDocument2 pagesHicks V Manila HotelEmilio PahinaNo ratings yet

- SaksessionDocument8 pagesSaksessiongavy cortonNo ratings yet

- Fundamental Principles Cases UpdatedDocument27 pagesFundamental Principles Cases UpdatedWinston John Paul BlancoNo ratings yet

- 2 in Re Cunanan (1954)Document1 page2 in Re Cunanan (1954)Judy Ann ShengNo ratings yet

- Villanueva vs. Velasco Legal Easement CaseDocument2 pagesVillanueva vs. Velasco Legal Easement CaseMarifel LagareNo ratings yet

- Pollution Adjudication BoardDocument10 pagesPollution Adjudication Boardmaanyag6685No ratings yet

- DigestsDocument6 pagesDigestsRio AborkaNo ratings yet

- 19-Mondano Vs Silvosa 97 Phil 143Document3 pages19-Mondano Vs Silvosa 97 Phil 143enan_intonNo ratings yet

- Judicial Department Cases (Consti 1)Document179 pagesJudicial Department Cases (Consti 1)Jezen Esther PatiNo ratings yet

- Corliss V Manila Railroad Co.Document2 pagesCorliss V Manila Railroad Co.lovekimsohyun89No ratings yet

- 25 Phimco Industries, Inc. v. Phimco Industries Labor AssocDocument4 pages25 Phimco Industries, Inc. v. Phimco Industries Labor AssockathrynmaydevezaNo ratings yet

- San Beda College of Law: 6 M A C LDocument24 pagesSan Beda College of Law: 6 M A C LRaymart Zervoulakos IsaisNo ratings yet

- RTC ruling on motorcycle seizure overturned due to lack of search warrantDocument5 pagesRTC ruling on motorcycle seizure overturned due to lack of search warrantLuigi JaroNo ratings yet

- Mindanao Bus Comp v. City AssessorDocument3 pagesMindanao Bus Comp v. City AssessorAsaiah WindsorNo ratings yet

- Property CasesDocument62 pagesProperty CasesJa VillaromanNo ratings yet

- Supreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentsDocument3 pagesSupreme Court: Binamira, Barria and Irabagon For Petitioner. Vicente E. Sabellina For RespondentssollskiNo ratings yet

- Leung Yee vs. Strong Machinery, 37 Phil. 644Document4 pagesLeung Yee vs. Strong Machinery, 37 Phil. 644KimmyNo ratings yet

- Laurel vs. Abogar, 576 SCRA 11, Capitol Wireless vs. Provincial Treasurer, 701 SCRA 272Document6 pagesLaurel vs. Abogar, 576 SCRA 11, Capitol Wireless vs. Provincial Treasurer, 701 SCRA 272KimmyNo ratings yet

- Tagatac v. JimenezDocument5 pagesTagatac v. JimenezKimmyNo ratings yet

- de Garcia vs. CADocument4 pagesde Garcia vs. CAKimmyNo ratings yet

- PLDT sues ISR provider for theft of international callsDocument11 pagesPLDT sues ISR provider for theft of international callsKimmyNo ratings yet

- Mindanao Bus Co. vs. City Assessor, L-17870, Sept. 28, 1962Document3 pagesMindanao Bus Co. vs. City Assessor, L-17870, Sept. 28, 1962KimmyNo ratings yet

- 8.provincial Assessor vs. Filipinas Palm Oil Plantation, 805 SCRA 112Document12 pages8.provincial Assessor vs. Filipinas Palm Oil Plantation, 805 SCRA 112KimmyNo ratings yet

- Philippines Supreme Court Rules Lots Belong to GovernmentDocument4 pagesPhilippines Supreme Court Rules Lots Belong to GovernmentKimmyNo ratings yet

- Standard Oil Co. of New York vs. Jaranillo, 44 Phil. 630Document3 pagesStandard Oil Co. of New York vs. Jaranillo, 44 Phil. 630KimmyNo ratings yet

- Chavez vs. Public Lands Authority, 415 SCRA 403Document24 pagesChavez vs. Public Lands Authority, 415 SCRA 403KimmyNo ratings yet

- Philippines Supreme Court Rules Lots Belong to GovernmentDocument4 pagesPhilippines Supreme Court Rules Lots Belong to GovernmentKimmyNo ratings yet

- 4.board of Assessment Appeals vs. Meralco, 10 SCRA 68Document3 pages4.board of Assessment Appeals vs. Meralco, 10 SCRA 68KimmyNo ratings yet

- Philippines Supreme Court Rules Lots Belong to GovernmentDocument4 pagesPhilippines Supreme Court Rules Lots Belong to GovernmentKimmyNo ratings yet

- 4.board of Assessment Appeals vs. Meralco, 10 SCRA 68Document3 pages4.board of Assessment Appeals vs. Meralco, 10 SCRA 68KimmyNo ratings yet

- MIAA vs. Court of Appeals, 495 SCRA 591Document17 pagesMIAA vs. Court of Appeals, 495 SCRA 591KimmyNo ratings yet

- City of Manila Wins Land Dispute CaseDocument4 pagesCity of Manila Wins Land Dispute CaseKimmyNo ratings yet

- People vs. Ritter, G.R. No. 88582, March 5, 1991Document16 pagesPeople vs. Ritter, G.R. No. 88582, March 5, 1991KimmyNo ratings yet

- MIAA vs. Court of Appeals, 495 SCRA 591Document17 pagesMIAA vs. Court of Appeals, 495 SCRA 591KimmyNo ratings yet

- Republic of the Philippines land dispute over possession of Lot No. 4457Document6 pagesRepublic of the Philippines land dispute over possession of Lot No. 4457KimmyNo ratings yet

- City of Manila Wins Land Dispute CaseDocument4 pagesCity of Manila Wins Land Dispute CaseKimmyNo ratings yet

- Fullido. vs. Grilli, 785 SCRA 278Document7 pagesFullido. vs. Grilli, 785 SCRA 278KimmyNo ratings yet

- B.F. Metal Corporation v. Lamotan, G.R. No. 170813, April 16, 2008Document4 pagesB.F. Metal Corporation v. Lamotan, G.R. No. 170813, April 16, 2008KimmyNo ratings yet

- Fullido. vs. Grilli, 785 SCRA 278Document7 pagesFullido. vs. Grilli, 785 SCRA 278KimmyNo ratings yet

- Filomena Urbano v. IAC, G.R. No. 72964, January 7, 1988Document6 pagesFilomena Urbano v. IAC, G.R. No. 72964, January 7, 1988KimmyNo ratings yet

- Zenaida R. Gregorio v. Court of Appeals, G.R. No. 179799, September 11, 2009Document4 pagesZenaida R. Gregorio v. Court of Appeals, G.R. No. 179799, September 11, 2009KimmyNo ratings yet

- Padua v. Robles, G.R. No. L-40486, August 29, 1975Document2 pagesPadua v. Robles, G.R. No. L-40486, August 29, 1975Kimmy100% (1)

- Republic of the Philippines Supreme Court land title registration decisionDocument13 pagesRepublic of the Philippines Supreme Court land title registration decisionKimmyNo ratings yet

- Philippine Supreme Court rules on civil liability despite criminal acquittalDocument4 pagesPhilippine Supreme Court rules on civil liability despite criminal acquittalKimmyNo ratings yet

- Safeguard Security Agency, Inc. v. Tangco, G.R. No. 165732, December 14, 2006Document6 pagesSafeguard Security Agency, Inc. v. Tangco, G.R. No. 165732, December 14, 2006KimmyNo ratings yet

- Lesson 3.3: The Third Wave: The Information/Knowledge AgeDocument3 pagesLesson 3.3: The Third Wave: The Information/Knowledge AgeFaith PrachayaNo ratings yet

- Installation Instruction: Q/fit Piping On Base MachineDocument11 pagesInstallation Instruction: Q/fit Piping On Base MachineJULY VIVIANA HUESO VEGANo ratings yet

- Conduct CardsDocument9 pagesConduct Cardsapi-248309459No ratings yet

- Theory of Planned Behaviour (TPB)Document18 pagesTheory of Planned Behaviour (TPB)Afiq Wahyu AjiNo ratings yet

- CCST+Cybersecurity+Objecitve+Domain Cisco Final wCiscoLogoDocument3 pagesCCST+Cybersecurity+Objecitve+Domain Cisco Final wCiscoLogoQazi ZayadNo ratings yet

- Tata Consulting Engineers Design Guide For Auxiliary Steam HeaderDocument10 pagesTata Consulting Engineers Design Guide For Auxiliary Steam HeadervijayanmksNo ratings yet

- Tata Cellular V UOI: So Unreasonable That No Reasonable Person Acting Reasonably Could Have Made It)Document2 pagesTata Cellular V UOI: So Unreasonable That No Reasonable Person Acting Reasonably Could Have Made It)heretostudyNo ratings yet

- Partial Full Volume of TankDocument8 pagesPartial Full Volume of TankBabita GuptaNo ratings yet

- DES-3611.prepaway - Premium.exam.65q: Number: DES-3611 Passing Score: 800 Time Limit: 120 Min File Version: 1.1Document22 pagesDES-3611.prepaway - Premium.exam.65q: Number: DES-3611 Passing Score: 800 Time Limit: 120 Min File Version: 1.1Emre Halit POLATNo ratings yet

- Regional Sustainability: Tewodros Abuhay, Endalkachew Teshome, Gashaw MuluDocument12 pagesRegional Sustainability: Tewodros Abuhay, Endalkachew Teshome, Gashaw MuluAbuhay TediNo ratings yet

- Nursing Grand Rounds Reviewer PDFDocument17 pagesNursing Grand Rounds Reviewer PDFAlyssa Jade GolezNo ratings yet

- EJN-00625 Installation of Manual Pull Valves in Deluge Systems For SOLPEDocument4 pagesEJN-00625 Installation of Manual Pull Valves in Deluge Systems For SOLPESARAVANAN ARUMUGAMNo ratings yet

- Trimapanel® Brochure PDFDocument36 pagesTrimapanel® Brochure PDFyasserNo ratings yet

- Data Protection Act (DPA)Document14 pagesData Protection Act (DPA)Crypto SavageNo ratings yet

- Dhaka Epz Factory List & List of Inspected Factories by EIMS For AllianceDocument12 pagesDhaka Epz Factory List & List of Inspected Factories by EIMS For Alliancearman chowdhury100% (4)

- Engine Tune-UpDocument43 pagesEngine Tune-UpЮра ПетренкоNo ratings yet

- Due Diligence InvestmentsDocument6 pagesDue Diligence InvestmentselinzolaNo ratings yet

- Checklist For T&C of Chemical Fire Suppression SystemDocument2 pagesChecklist For T&C of Chemical Fire Suppression Systembeho2000No ratings yet

- Hedonomics: Bridging Decision Research With Happiness ResearchDocument20 pagesHedonomics: Bridging Decision Research With Happiness ResearchgumelarNo ratings yet

- Champions MindsetDocument48 pagesChampions MindsetDIRECTIA INVATAMINT HINCESTI100% (1)

- TUTO 4 PU Sol PDFDocument21 pagesTUTO 4 PU Sol PDFVievie Le BluewberrietrufflesNo ratings yet

- Seasonal Work Brochure 05Document2 pagesSeasonal Work Brochure 05R-lau R-pizNo ratings yet

- Test IMO EnglezaDocument4 pagesTest IMO EnglezaCristina PopovNo ratings yet

- Market Segmentation Targeting Strategy and Positioning Strategy Performance Effects To The Tourists Satisfaction Research in Pangandaran Beach Pangandaran DistrictDocument10 pagesMarket Segmentation Targeting Strategy and Positioning Strategy Performance Effects To The Tourists Satisfaction Research in Pangandaran Beach Pangandaran DistrictRizki Kurnia husainNo ratings yet

- Filling Out Forms Detailed Lesson Plan in English VDocument9 pagesFilling Out Forms Detailed Lesson Plan in English VAIAN CALIBAYAN0% (1)

- Task 7 Family Disaster Risk Reduction and Management PlanDocument7 pagesTask 7 Family Disaster Risk Reduction and Management PlanHaise SasakiNo ratings yet

- Importance of Social Administration for Social WorkersDocument7 pagesImportance of Social Administration for Social Workersanderson mahundiNo ratings yet

- TD102 Conductor - Standard ConductorsDocument2 pagesTD102 Conductor - Standard ConductorsHFandino1No ratings yet

- PKG Materials Standards IIP A A JoshiDocument45 pagesPKG Materials Standards IIP A A JoshiDeepak VermaNo ratings yet

- B.Tech Digital Principles and System Design Exam Question BankDocument24 pagesB.Tech Digital Principles and System Design Exam Question Bankdigital1206No ratings yet