Professional Documents

Culture Documents

Computational Problems 15-1

Uploaded by

Luthfi Arya BagaskaraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computational Problems 15-1

Uploaded by

Luthfi Arya BagaskaraCopyright:

Available Formats

Nama Kelompok: Abdi Dzil Ikram (B1031181117)

Reza Winata (B1031181126)

Thareq AlMujib (B1031181127)

Syahrul Umam (B1031181128)

Computational Problems

15-1

a. Operating income as percentage of revenue would by operating margin, which would by

operating margin, which would be as follows for the following years:

Formula for that would be: Operating margin = Operating income/Revenue*100

2008 = 524/5472*100 = 9.58%

2009 = 534/5960*100 = 9.58%

2010 = 565/6601*100 = 8.56%

2011 = 694/8351*100 = 8.31%

2012 = 721/8256*100 = 8.73%

b. Net profit after tax as a percentage of revenue would by net profit margin, which would be as

follows for the following years:

Formula: Net profit after tax/Revenue*100

2008 = 232/5472*100 = 4.24%

2009 = 256/5960*100 = 4.30%

2010 = 255/6601*100 = 3.86%

2011 = 221/8351*100 = 2.65%

2012 = 721/8256*100 = 3.5%

You can also refer to the below table for reference, I have created this table in MS Excel

2008 2009 2010 2011 2012

Revenue 5472 5960 6601 8351 8256

Operating income 524 534 565 694 721

Operating income as a % of 9.58% 8.96% 8.56% 8.31% 8.73%

revenue

Net profits after tax 232 256 255 221 289

PaT as a % of revenue 4.24% 4.30% 3.86% 2.65% 3.50%

c. After-tax profit per share outstanding would be:

Formula = Net profit after tax / no of shares outstanding

2008 = 232/49.94 = $4.64

2009 = 256/49.97 = %5.12

2010 = 255/49.43 = $5.15

2011 = 221/49.45 = $4.46

2012 = 289/51.92 = $5.56

d. Ratio of current assets to current liabilities is also called current ratio

Formula: Current ratio = Current asset/Current liabilities

2008 = 1736/845 = 2.05 times

2009 = 1951/1047 = 1.86

2010 = 2019/929 = 2.17

2011 = 2254/1215 = 1.85

2012 = 2315/1342 = 1.72

e. Long-term debt as a percentage of common equity

2008 = 251/1321 = 0.19

2009 = 255/1480 = 0.17

2010 = 391/1610 = 0.24

2011 = 731/1626 = 0.44

2012 = 736/1872 = 0.39

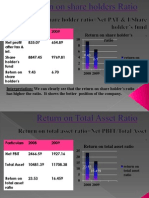

f. Book value per share = Common equity/no of shares outstanding

2008 = 1321/49.93 = 26.45

2009 = 1480/49.97 = 29.61

2010 = 1610/49.43 = 32.57

2011 = 1626/49.54 = 32.88

2012 = 1872/51.92 = 36.05

ROE = Net income or profit after tax / Total shareholders equity*100

ROA = Net income or profit after tax / Total assets*100

2008 2009 2010 2011 2012

g. ROE 17.56% 17.30% 15.84% 13.59% 15.44%

h. ROA 9.04% 8.60% 8.22% 5.72% 6.71%

i. Leverage would be the ratio of total liabilities to total assets. So before that, we will have to

calculate the value of Total liabilities which would be

Total liabilities = Total assets – Common equity

2008 2009 2010 2011 2012

Total assets 2565 2978 3103 3861 4310

Common equity 1321 1480 1610 1626 1872

Total liabilities 1244 1498 1493 2235 2438

Leverage 0.48499 0.5023022 0.481147 0.578866 0.565661

j. Net income margin would be the same as after-tax profit as a percentage of revenue which is

already calculated in the question B. Please refer question B

k. For calculating the turnover (Assuming inventory turnover among other turnover ratios) value of

inventory is required which is not given in the question.

l. EBIT is similar to Operating Income. So EBIT can also be called operating income which is nothing

but (income before interest and tax)

Operating income is given for all the periods

Operating Income 524 534 565 694 721

m. Income ratio is Debt to income ratio

This can be calculated as = Long-term/Profit after tax*100

2008 2009 2010 2011 2012

Long-term debt 251 255 391 731 736

Net profits after tax 232 256 255 221 289

108% 100% 153% 331% 255%

This means the company has more long-term debt than the income it is generating.

n. Operating efficiency = Operating expenses/Revenue*100

Operating expenses = Revenue – Operating Income

2008 2009 2010 2011 2012

Revenue 5472 5960 6601 8351 8256

Operating revenue 524 534 565 694 721

Operating expense 4948 5426 6036 7657 7535

Operating efficiency 90% 91% 91% 92% 91%

o. Based upon the above calculations, it can be inferred that the company is doing good and having

sound operations.

15-2

a.

You might also like

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisAli Gokhan Kocan100% (1)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- New Heritage Doll CompanyDocument11 pagesNew Heritage Doll CompanyLightning SalehNo ratings yet

- ACCT 2301 PP CH 1Document41 pagesACCT 2301 PP CH 1Ela PelariNo ratings yet

- Airthread DCF Vs ApvDocument6 pagesAirthread DCF Vs Apvapi-239586293No ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Business Analysis and Valuation Using Financial Statements Text and Cases 5th Edition Palepu Solutions ManualDocument18 pagesBusiness Analysis and Valuation Using Financial Statements Text and Cases 5th Edition Palepu Solutions Manualdaviddulcieagt6100% (34)

- Match My Doll Clothing: Working Capital AssumptionsDocument4 pagesMatch My Doll Clothing: Working Capital Assumptionsb_style210No ratings yet

- IMT CeresDocument7 pagesIMT CeresHarsha HoneyNo ratings yet

- Write Your Answer For Part A HereDocument8 pagesWrite Your Answer For Part A Heresuraj dhruvNo ratings yet

- Ceres Gardening Company Submission TemplateDocument9 pagesCeres Gardening Company Submission TemplateAkshay RoyNo ratings yet

- Name Karandeep Singh: $226 (In Thousands)Document5 pagesName Karandeep Singh: $226 (In Thousands)Rishabh TiwariNo ratings yet

- Profitability & Turnover Ratios AnalysisDocument19 pagesProfitability & Turnover Ratios AnalysisVivek RajNo ratings yet

- A) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011Document4 pagesA) Stock Performance of Ahold and Tesco Between Jan-2008 and Dec-2011MANAV ROY100% (2)

- Bus FinDocument9 pagesBus FinRene Castillo JrNo ratings yet

- Chapter 7 Prospective Analysis: Valuation Theory and ConceptsDocument7 pagesChapter 7 Prospective Analysis: Valuation Theory and ConceptsWalm KetyNo ratings yet

- Assignment, Wmba Group TwoDocument8 pagesAssignment, Wmba Group TwoSamuel kwateiNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisOmar abdulla AlkhanNo ratings yet

- Assignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementDocument10 pagesAssignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementIshu AroraNo ratings yet

- Presentation On Ratio Analysis On Maruti SuzukiDocument20 pagesPresentation On Ratio Analysis On Maruti SuzukiNaveen SahaNo ratings yet

- Ratio Analysis: Pakistan State OilDocument19 pagesRatio Analysis: Pakistan State OilMUHAMMAD MUDASSAR TAHIR NCBA&ENo ratings yet

- 1st Quarter Exam in Business Finance 12Document4 pages1st Quarter Exam in Business Finance 12Jinkee F. Sta MariaNo ratings yet

- CH 3 FCFF MODELDocument11 pagesCH 3 FCFF MODELJaya Mamta ProsadNo ratings yet

- CBM RatioDocument9 pagesCBM RatioImran HossainNo ratings yet

- Investment Appraisal AssignmentDocument15 pagesInvestment Appraisal AssignmentPranesh KhaleNo ratings yet

- Coca-Cola Financial AnalysisDocument6 pagesCoca-Cola Financial AnalysisAditya Pal Singh Mertia RMNo ratings yet

- Chapter 2 - Analysis of Financial StatementDocument43 pagesChapter 2 - Analysis of Financial StatementtheputeriizzahNo ratings yet

- IMT CeresDocument7 pagesIMT CeresAditya RounakNo ratings yet

- Working Capital Financials and Operating Results 2008-2012Document5 pagesWorking Capital Financials and Operating Results 2008-2012saket ranaNo ratings yet

- Accounts Financial Ratios of KFCDocument20 pagesAccounts Financial Ratios of KFCMalathi Sundrasaigaran91% (11)

- JyotiNishad CeresDocument7 pagesJyotiNishad CeresDancing DopeNo ratings yet

- Quiz 1 Practice ProblemsDocument8 pagesQuiz 1 Practice ProblemsUmaid FaisalNo ratings yet

- Mba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Document9 pagesMba8101: Financial and Managerial Accounting Financial Statement Analysis BY Name: Reg No.: JULY 2014Sammy Datastat GathuruNo ratings yet

- DhirajDey IMT CeresDocument5 pagesDhirajDey IMT CeresDhirajNo ratings yet

- CHIEDZA MARIME Financial Management ExamDocument16 pagesCHIEDZA MARIME Financial Management Examchiedza MarimeNo ratings yet

- Abm Presentai0nDocument9 pagesAbm Presentai0nadnan_708nNo ratings yet

- A Project On "Economic Value Added" in Kirloskar Oil Engines LTDDocument19 pagesA Project On "Economic Value Added" in Kirloskar Oil Engines LTDPrayag GokhaleNo ratings yet

- United Bank Limited (Ubl) Complete Ratio Analysis For Internship Report YEAR 2008, 2009, 2010Document0 pagesUnited Bank Limited (Ubl) Complete Ratio Analysis For Internship Report YEAR 2008, 2009, 2010Elegant EmeraldNo ratings yet

- Mahindra and Mahindra AnalysisDocument17 pagesMahindra and Mahindra Analysisrahul_raj198815220% (2)

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Accounts AssignmentDocument7 pagesAccounts Assignmentmanpreet1415No ratings yet

- 31 RatiosDocument9 pages31 RatiosMd. Shazedul islamNo ratings yet

- Afs Assignment Profitability RatiosDocument9 pagesAfs Assignment Profitability RatiosMohsin AzizNo ratings yet

- MeharVerma IMT Ceres 240110 163643Document9 pagesMeharVerma IMT Ceres 240110 163643Mehar VermaNo ratings yet

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- Financial Statistical Summary: Attock Refinery LimitedDocument2 pagesFinancial Statistical Summary: Attock Refinery Limitedabrofab123No ratings yet

- Excel Setup and Imp FunctionsDocument27 pagesExcel Setup and Imp FunctionsAfzaal KaimkhaniNo ratings yet

- Income Statement Operating Profit Margin CalculatorDocument2 pagesIncome Statement Operating Profit Margin Calculatorkarthik sNo ratings yet

- Chapter 1. Exhibits y AnexosDocument15 pagesChapter 1. Exhibits y AnexoswcornierNo ratings yet

- AbuDhabi Hotels - Case ExhibitsDocument14 pagesAbuDhabi Hotels - Case ExhibitsNandini RayNo ratings yet

- The Coca Cola Company Financial Risk AssessmentDocument6 pagesThe Coca Cola Company Financial Risk AssessmentAshmit RoyNo ratings yet

- DU Pont AnalysisDocument9 pagesDU Pont Analysisshani2010No ratings yet

- Financial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisDocument16 pagesFinancial Analysis of Exxonmobil 2016-2018: Francisco Orta Oksana Zakharova Savvas SapalidisFranciscoNo ratings yet

- Financial Statement Analysis Ratios ExplainedDocument20 pagesFinancial Statement Analysis Ratios ExplainedRoxieNo ratings yet

- L&T operating performance comparisonDocument5 pagesL&T operating performance comparisoninduNo ratings yet

- Hul Eva PDFDocument2 pagesHul Eva PDFPraveen NNo ratings yet

- Trend Analysis of Ice Cream FirmDocument16 pagesTrend Analysis of Ice Cream FirmAnkitesh Kumar TiwariNo ratings yet

- AnalysispdfDocument15 pagesAnalysispdfMalevolent IncineratorNo ratings yet

- Chapter 10: Analyzing Performance and ROICDocument11 pagesChapter 10: Analyzing Performance and ROICSandra NavarreteNo ratings yet

- 87522Document17 pages87522Kateryna TernovaNo ratings yet

- EVA ExampleDocument27 pagesEVA Examplewelcome2jungleNo ratings yet

- Amaha Advanced 3 - StatementModelDocument6 pagesAmaha Advanced 3 - StatementModelamahaktNo ratings yet

- Mutual Funds ProjectDocument44 pagesMutual Funds ProjectSun ShineNo ratings yet

- Name: Date: Course: Schedule:: Business Finance SeatworkDocument2 pagesName: Date: Course: Schedule:: Business Finance SeatworkJugsb thhdjNo ratings yet

- Chapter 3 Partnership DissolutionDocument32 pagesChapter 3 Partnership DissolutionmochiNo ratings yet

- Auditing.: A. B. C. DDocument12 pagesAuditing.: A. B. C. DbiniamNo ratings yet

- Cash Flow - InvestopediaDocument4 pagesCash Flow - InvestopediaBob KaneNo ratings yet

- A Comparison of The Two Largest Austrian Corporate Banks (Erste Bank and Raiffeisen Bank International)Document7 pagesA Comparison of The Two Largest Austrian Corporate Banks (Erste Bank and Raiffeisen Bank International)Patrick MayerNo ratings yet

- A. Chart of Accounts Artful Dodger Supply Chain DateDocument26 pagesA. Chart of Accounts Artful Dodger Supply Chain DateYungkee ChowNo ratings yet

- Week 06 2022 Topic 6 Lecture Financial Instruments Part CDocument26 pagesWeek 06 2022 Topic 6 Lecture Financial Instruments Part CErnest LeongNo ratings yet

- CAPM Model ExplainedDocument4 pagesCAPM Model ExplainedBasit AzizNo ratings yet

- A Practical Guide To Capitalisation of Borrowing Costs: November 2008Document23 pagesA Practical Guide To Capitalisation of Borrowing Costs: November 2008adi darmawanNo ratings yet

- Finance Chapter+3Document38 pagesFinance Chapter+3Rouvenn LaoNo ratings yet

- Auditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFDocument51 pagesAuditing and Assurance Services 7Th Edition Louwers Solutions Manual Full Chapter PDFrickeybrock6oihx100% (11)

- PFRS 12 MergedDocument45 pagesPFRS 12 MergedRojie Ann AmorNo ratings yet

- F9FM RQB Qs - D08ojnpDocument62 pagesF9FM RQB Qs - D08ojnpErclan25% (4)

- ch16 Fin303Document28 pagesch16 Fin303Bui Thi Thu Hang (K13HN)No ratings yet

- Tugas Asdos AklDocument6 pagesTugas Asdos AklNicholas AlexanderNo ratings yet

- Bharat Forge financialsDocument2 pagesBharat Forge financialsAnkit SinghNo ratings yet

- Netscape: Simulation Techniques For Company Valuation: AD-351-E May 2016Document4 pagesNetscape: Simulation Techniques For Company Valuation: AD-351-E May 2016Rochitex HomeNo ratings yet

- UL Refresher course in Accountship Accounting DrillDocument5 pagesUL Refresher course in Accountship Accounting DrillMakisa YuNo ratings yet

- What Have WE Learned So FarDocument4 pagesWhat Have WE Learned So FarKrystel Erika Tarre100% (1)

- Pay Back Period, NPV, ROIDocument7 pagesPay Back Period, NPV, ROIAshwini shenolkarNo ratings yet

- Interest Rates and Bond ValuationDocument35 pagesInterest Rates and Bond ValuationAhmad WattooNo ratings yet

- Statement of Cash Flows ClassificationsDocument2 pagesStatement of Cash Flows ClassificationsJessalyn DaneNo ratings yet

- Responsiveamguide PDFDocument586 pagesResponsiveamguide PDFNader OkashaNo ratings yet

- 2011 Za Exc CFDocument13 pages2011 Za Exc CFChloe ThamNo ratings yet

- Types of Business Organizations in Arabic and EnglishDocument6 pagesTypes of Business Organizations in Arabic and EnglishMuhammad AtallahNo ratings yet

- Exercises 270919Document3 pagesExercises 270919Kim AnhNo ratings yet

- Fundamentals of Entrepreneurial Finance 2019Document800 pagesFundamentals of Entrepreneurial Finance 2019joshuagohejNo ratings yet