Professional Documents

Culture Documents

Gani Sheikh Wipro PDF

Uploaded by

Gani SheikhOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gani Sheikh Wipro PDF

Uploaded by

Gani SheikhCopyright:

Available Formats

WIPRO FINANCIAL STATEMENT

AND ANALYSIS

ASSIGNMENT 2

SEPTEMBER 15, 2020

PROF. SUDARSHANA

GANI SHAIKH

WIPRO

S . No. TYPES OF RATIOS FORMULA 2019-2020 2018-2019 2017-2018

Current Assets/

1 CURRENT RATIO Current Liabilities 2.7:1 0.71:1 2.85:1

Current year profit-

Previous Year

GROWTH RATE OF profit) / Previous

2 PROFITS Year profit *100 14% -1.40% -5.37%

Profit before

Interest & Tax /

RETURN ON ASSETS OR Capital Employed

3 CAPITAL EMPLOYED *100 22.52% 19.40% 23.00%

Profit available for

equity

shareholders / No.

4 EPS of equity shares 14.88 12.67 12.19

RETURN ON Profit after

EQUITY/SHAREHOLDER'S tax/shareholders

5 FUNDS fund * 100 18.68% 15.41% 18.27%

Current Year

Value-Previous

Year Value) /

BUSINESS GROWTH RATE Previous Year

6 RATIO Value *100 4.30% 7.40% -3.08%

Long term

Liabilities/

Shareholder's

7 DEBT-EQUITY RATIO Fund 0.051 0.029 0.032

PERCENTAGE OF CSR TO CSR/ net

8 NET PROFITS RATIO profit*100 2.09% 2.43% 2.41%

TOTAL OPERATING operating

EXPENSES TO TOTAL expenses/ total

9 ASSETS RATIO assets*100 64% 60% 63%

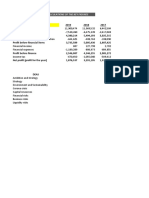

Year 2020 2019 2018 2017

Total Current Assets 4,57,133 477,304 429,673

Total Current Liabilities 1,64,438 669,981 150,359

Total liabilities 188,527 176,061 164,087

Total assets 653,064 669,981 586,713

Profit before Interest & Tax 110,077 98,705 100,343

Capital Employed 488,626 508,535 436,354

Earnings per equity share(given) 14.88 12.67 12.19

Total tax expense 23,270 22,565 23,115

profit after tax 86,807 76,140 77,228 81,617

shareholder's funds 464,537 493,920 422,626

Growth rate 528,836 506,924 471,896 486,937

Corporate Social Responsibility 1,818 1,853 1,866

Long term liability 24,089 14,615 13,728

Total expenses 418,759 408,219 371,553

You might also like

- Ar STTP 2022Document218 pagesAr STTP 2022GABRIELLA GUNAWANNo ratings yet

- Ratio Analysis: Current Ratio Current Assets/ Current LiabilitiesDocument2 pagesRatio Analysis: Current Ratio Current Assets/ Current LiabilitiestanyaNo ratings yet

- Fin 811-Inv AnalysisDocument4 pagesFin 811-Inv AnalysisYusuf ShotundeNo ratings yet

- 2020 06 20 FDC Annual Report 2019 v4 Email Fa PDFDocument70 pages2020 06 20 FDC Annual Report 2019 v4 Email Fa PDFJulmar MisaNo ratings yet

- Financing DecisionsDocument5 pagesFinancing DecisionsMr. Pravar Mathur Student, Jaipuria LucknowNo ratings yet

- STTP - Annual Report 2019Document192 pagesSTTP - Annual Report 2019reroll exosNo ratings yet

- Cash Flow Statement Data 2018 2019 2020Document10 pagesCash Flow Statement Data 2018 2019 2020ficiveNo ratings yet

- RatioDocument22 pagesRatioKashmi VishnayaNo ratings yet

- Ta Hunan 2021Document201 pagesTa Hunan 2021panji arikNo ratings yet

- Excel01 PDFDocument1 pageExcel01 PDFanupam rahman srizonNo ratings yet

- FMDocument233 pagesFMparika khannaNo ratings yet

- Final Finance Report (Sara Nabil + Sadika Hnadi + Yasmin Hany Elfar)Document12 pagesFinal Finance Report (Sara Nabil + Sadika Hnadi + Yasmin Hany Elfar)Yasmine hanyNo ratings yet

- UBL Analysis 2018Document4 pagesUBL Analysis 2018Zara ImranNo ratings yet

- Uts Finance IvanDocument28 pagesUts Finance IvanIvan ZackyNo ratings yet

- Anmols AssignmentDocument9 pagesAnmols AssignmenttusharNo ratings yet

- Ar Lpin 2020Document202 pagesAr Lpin 2020Fahmi RanggalaNo ratings yet

- Ankush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileDocument8 pagesAnkush Gupta Financial Management and Valuation MBA DBF DEC 2020 Excel FileAnkush GuptaNo ratings yet

- Greenply Industries Ltd. - Result Presentation Q2H1 FY 2019Document21 pagesGreenply Industries Ltd. - Result Presentation Q2H1 FY 2019Peter MichaleNo ratings yet

- Ezz Steel Financial AnalysisDocument31 pagesEzz Steel Financial Analysismohamed ashorNo ratings yet

- Saif Powetc Ltd. - Aameer 23068 (C)Document13 pagesSaif Powetc Ltd. - Aameer 23068 (C)Aameer ShahansahNo ratings yet

- Annual Report of Sackit - Calculations of The Key FiguresDocument17 pagesAnnual Report of Sackit - Calculations of The Key FiguresFrederikke LarsenNo ratings yet

- Gross Profit Margin: MeaningDocument7 pagesGross Profit Margin: Meaningthai hoangNo ratings yet

- Lã Minh Ngọc - 18071385 - INS3007Document15 pagesLã Minh Ngọc - 18071385 - INS3007Ming NgọhNo ratings yet

- Financial Statement PresentationDocument17 pagesFinancial Statement PresentationAbdul RehmanNo ratings yet

- Financial Analysis of Pakistan State Oil For The Period July 2017-June 2020Document9 pagesFinancial Analysis of Pakistan State Oil For The Period July 2017-June 2020Adil IqbalNo ratings yet

- Analysis of Financial Statements - VICO Foods CorporationDocument19 pagesAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNo ratings yet

- AHAP - Annual Report - 2013Document77 pagesAHAP - Annual Report - 2013Yunita PutriNo ratings yet

- Textile Industry Financial Analysis Report (321 Project)Document34 pagesTextile Industry Financial Analysis Report (321 Project)hamnah lateefNo ratings yet

- Capital Structure Analysis of ITC LTDDocument4 pagesCapital Structure Analysis of ITC LTDAnuran Bordoloi0% (1)

- Financial Analysis Report: Luiz Mottin - Marco Albuquerque - Lara KleeneDocument20 pagesFinancial Analysis Report: Luiz Mottin - Marco Albuquerque - Lara KleeneLuiz Gustavo Mottin100% (1)

- L&T Financial Health AssessmentDocument12 pagesL&T Financial Health AssessmentSudhir SalunkeNo ratings yet

- Term Paper On Premier Cement Mills Ltd. - Group 7Document19 pagesTerm Paper On Premier Cement Mills Ltd. - Group 7Jannatul TrishiNo ratings yet

- Expleo 2Document12 pagesExpleo 2g_sivakumarNo ratings yet

- ITC Financial AnalysisDocument21 pagesITC Financial AnalysisDeepak ChandekarNo ratings yet

- MGT-105 Final ProjectDocument7 pagesMGT-105 Final ProjectRandeep ChathaNo ratings yet

- Acc Ca3Document7 pagesAcc Ca3Shay ShayNo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- BD FinanceDocument5 pagesBD Financesibgat ullahNo ratings yet

- Case 5 - What Are We Really WorthDocument7 pagesCase 5 - What Are We Really WorthMariaAngelicaMargenApe100% (2)

- Financial-Assignment - Nagarjuna Reddy (18MBARB025)Document16 pagesFinancial-Assignment - Nagarjuna Reddy (18MBARB025)Raghava JinkaNo ratings yet

- Accounting ASM2 Front SheetDocument16 pagesAccounting ASM2 Front Sheetgọi tôi là phúNo ratings yet

- Amadeus Export 1 Whitbread Tma1 Part2Document16 pagesAmadeus Export 1 Whitbread Tma1 Part2Hamza RamzanNo ratings yet

- Students Name Instructor Course Title Date of Submission: Financial Ratio AnalysisDocument8 pagesStudents Name Instructor Course Title Date of Submission: Financial Ratio AnalysisJeff AtuaNo ratings yet

- CHB Jun19 PDFDocument14 pagesCHB Jun19 PDFSajeetha MadhavanNo ratings yet

- Financial Analysis: Nestle India Ltd. ACC LTDDocument20 pagesFinancial Analysis: Nestle India Ltd. ACC LTDrahil0786No ratings yet

- BOB Analyst Presentation Q4 FY 2019 27052019 PDFDocument77 pagesBOB Analyst Presentation Q4 FY 2019 27052019 PDFSandeep KumarNo ratings yet

- ALLIDocument16 pagesALLIAbdullah KhanNo ratings yet

- Analisa Eva Wacc STTPDocument11 pagesAnalisa Eva Wacc STTPAnggih Nur HamidahNo ratings yet

- Securities and Exchange Commission: Sec Form 17-QDocument3 pagesSecurities and Exchange Commission: Sec Form 17-QMarion Jermaine CalunsagNo ratings yet

- Wipro: Presented To: M SRIRAMDocument9 pagesWipro: Presented To: M SRIRAMashish sunnyNo ratings yet

- Final AssignmentDocument54 pagesFinal AssignmentValentin PicavetNo ratings yet

- System LimitedDocument11 pagesSystem LimitedNabeel AhmadNo ratings yet

- USAA Growth and Tax Strategy Fund - 2Q '22Document2 pagesUSAA Growth and Tax Strategy Fund - 2Q '22ag rNo ratings yet

- Valuation Report: JD SportsDocument10 pagesValuation Report: JD SportsJunaid IqbalNo ratings yet

- Finman Chapter 5 EditedDocument4 pagesFinman Chapter 5 EditedCarlo BalinoNo ratings yet

- Securities and Exchange Commission: Sec Form 17-QDocument3 pagesSecurities and Exchange Commission: Sec Form 17-QJamil MacabandingNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Case Study Analysis: 20121543 Dilara Rasulova 20121072 Sandra Obiora 20121789 Mwangala MulamataDocument19 pagesCase Study Analysis: 20121543 Dilara Rasulova 20121072 Sandra Obiora 20121789 Mwangala MulamataGani SheikhNo ratings yet

- Case Study - Lufthansa PDFDocument2 pagesCase Study - Lufthansa PDFGani SheikhNo ratings yet

- Case Studies - Production and Operations: Make Versus Buy CaseDocument4 pagesCase Studies - Production and Operations: Make Versus Buy CaseGani SheikhNo ratings yet

- Lufthansa Case StudyDocument5 pagesLufthansa Case StudyGani SheikhNo ratings yet

- 0efd540ca24e3b7470a3673d1307d5adDocument93 pages0efd540ca24e3b7470a3673d1307d5adAtiaTahiraNo ratings yet

- Corporate Social ResponsibilityDocument9 pagesCorporate Social ResponsibilityAnonymous rcntB2nNZNo ratings yet

- CSR ScriptDocument2 pagesCSR ScriptRACHELLE MAE LLAGASNo ratings yet

- Social Relevance Project-2Document62 pagesSocial Relevance Project-2DivyeshNo ratings yet

- Obure Judy - Corporate Social Responsibility and Organizational Growth - A Case of Equity BankDocument73 pagesObure Judy - Corporate Social Responsibility and Organizational Growth - A Case of Equity BankZion BryantNo ratings yet

- Ottoman Empire EssayDocument8 pagesOttoman Empire Essayd3gn731z100% (2)

- 03-CU AL Building Wire CatalogDocument92 pages03-CU AL Building Wire CatalogJoel Agrota PereyraNo ratings yet

- Write A Critical Paper On The Status of Employment in The Philippines at The Present, With Emphasis On Working Conditions and Wages. Explain.Document2 pagesWrite A Critical Paper On The Status of Employment in The Philippines at The Present, With Emphasis On Working Conditions and Wages. Explain.Adrian Yao100% (1)

- Annual Report F6fce7Document344 pagesAnnual Report F6fce7Mit AdhvaryuNo ratings yet

- DP PumaDocument42 pagesDP Pumadeepikyadav0% (1)

- Corporate CitizenshipDocument7 pagesCorporate CitizenshipTashNo ratings yet

- Strategy and Society: The Link Between Competitive Advantage and Corporate Social ResponsibilityDocument11 pagesStrategy and Society: The Link Between Competitive Advantage and Corporate Social ResponsibilitySiddharth PatroNo ratings yet

- CSR PolicyDocument3 pagesCSR PolicyRamesh JadhavNo ratings yet

- Concept Note - CSRDocument2 pagesConcept Note - CSRvinishikhabhandariNo ratings yet

- Company Profile: Surya Roshni Limited (Formerly Prakash Surya Roshni Limited) IsDocument11 pagesCompany Profile: Surya Roshni Limited (Formerly Prakash Surya Roshni Limited) IsMahesh KumarNo ratings yet

- Creating Entrepreneurial Change - Disney JUNE 2019 PDFDocument51 pagesCreating Entrepreneurial Change - Disney JUNE 2019 PDFHeshan AsithaNo ratings yet

- Mydin Study Case PDFDocument5 pagesMydin Study Case PDFNur Ain AtirahNo ratings yet

- IBE Assignment DHRM2 (Group 4) - DONEDocument26 pagesIBE Assignment DHRM2 (Group 4) - DONENur Fateha NajwaNo ratings yet

- P1 - Study GuideDocument17 pagesP1 - Study GuidehoyokeweiNo ratings yet

- Slides CSRDocument28 pagesSlides CSRZeKy30No ratings yet

- Britannia Annual Report 2016-17 PDFDocument232 pagesBritannia Annual Report 2016-17 PDFAditya ramaiahNo ratings yet

- EVM Assignment 2Document2 pagesEVM Assignment 2TanNo ratings yet

- Assignment Ib JurnalDocument15 pagesAssignment Ib JurnalAnida AhmadNo ratings yet

- Skill India-A Catalyst To Nation Buildingwith Technology: CA Neelam PendharkarDocument7 pagesSkill India-A Catalyst To Nation Buildingwith Technology: CA Neelam PendharkarAnupama JawaleNo ratings yet

- Ethics - Merk & Co. Inc.Document3 pagesEthics - Merk & Co. Inc.Andy RiosNo ratings yet

- Corporate Social Responsibility Practices of Commercial Banks - Southeast Bank LTDDocument6 pagesCorporate Social Responsibility Practices of Commercial Banks - Southeast Bank LTDAsifNo ratings yet

- ACC-EFQM Excellence Model 2003 ENGDocument44 pagesACC-EFQM Excellence Model 2003 ENGTakis RappasNo ratings yet

- Strategic Management. Global Competition. John A. Pearce II. Richard B. Robinson, Jr. Villanova School of Business Villanova University PDFDocument6 pagesStrategic Management. Global Competition. John A. Pearce II. Richard B. Robinson, Jr. Villanova School of Business Villanova University PDFKartikey SinghNo ratings yet

- Amul - PPT DhrutiDocument15 pagesAmul - PPT Dhrutimir22793No ratings yet

- Women EmpowermentDocument14 pagesWomen EmpowermentProfessor HappyNo ratings yet