Professional Documents

Culture Documents

Ratio Analysis: Current Ratio Current Assets/ Current Liabilities

Uploaded by

tanyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis: Current Ratio Current Assets/ Current Liabilities

Uploaded by

tanyaCopyright:

Available Formats

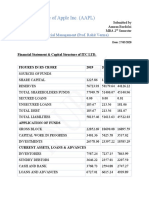

RATIO ANALYSIS

CURRENT RATIO = CURRENT ASSETS/ CURRENT LIABILITIES

PARTICULARS 2018 2019 2020 2021

CURRENT 3639.05 2390.65 3847.31 4141.87

ASSETS

CURRENT 2987.55 3087.82 3415.63 2585.8

LIABILITIES

CURRENT 1.22 0.7 1.12 1.6

RATIO

QUICK RATIO = (CURRENT ASSETS – INVENTORIES)/CURRENT LIABILITIES

PARTICULARS 2018 2019 2020 2021

CURRENT 3639.05 2390.65 3847.31 4141.88

ASSETS

INVENTORIES 1299.40 1358.3 1507.76 1911.74

CURRENT 2987.55 3087.82 3415.53 2585.8

LIABILITIES

QUICK RATIO 0.78 0.33 0.68 0.86

DEBT TO EQUITY RATIO = TOTAL LIABILITIES / SHAREHOLDERS’ FUND

PARTICULARS 2018 2019 2020 2021

TOTAL 7263.58 7012 6791.55 5730.94

LIABILITIES

TOTAL 4556.49 5015.27 5120.97 6030.1

SHAREHOLDERS

FUNDS

DEBT TO 1.59 1.39 1.32 0.95

EQUITY RATIO

RETURN ON EQUITY RATIO = (NET PROFIT /SHAREHOLDERS’ FUND) *100

PARTICULRARS 2018 2019 2020 2021

NET PROFIT 562.13 935.12 1116.77 1366.11

SHAREHOLDERS 4556.49 5015.97 5120.97 6030.1

’ FUND

RETURN ON 12.34 18.64 21.80 22.65

EQUITY RATIO

NET PROFIT MARGIN = (NET PROFIT / NET SALES) * 100

PARTICULARS 2018 2019 2020 2021

NET PROFIT 562.13 935.12 1116.77 1366.11

NET SALES 4580.55 6144.44 6405.37 6568.91

NET PROFIT 12.27% 15.22% 17.43% 20.79%

MARGIN

CONCLUSION FROM RATIO ANALYSIS

1. Current ratio is also called as Liquidity Ratio. In Torrent pharma in the year 2019 current ratio was

lowest that is 0.77and Year 2021 Current ratio highest that is 1.6.

2. Quick Ratio of Torrent pharma shows that company does have liquid assets to cover current

liabilities. In Year 2021 company can pay 86% of current debt.

3. Debt To Equity Ratio of Torrent pharma indicates in Year 2018 borrowed more funds from

shareholders that is 1.59. But as seen from year 2019 to 2021 there is downward trend in borrowed

funds from shareholder that is from 1.39 to 0.95.

4. Return on equity is seen to showing a continuous rise in these 4 years from 12.34% to 22.65%

5. Net profit margin of torrent pharma has been seeing a constant rise in the past years with highest

going up to 20.79% in 2021, indicating that COVID -19 did not hamper the company and instead gave

a boom from 17.43% to 20.79%.

You might also like

- Letter of AdviceDocument3 pagesLetter of AdviceGreg Wilder100% (13)

- Social Security Benefit Verification LetterDocument2 pagesSocial Security Benefit Verification LetterPeter MouldenNo ratings yet

- Essential Oils Business PlanDocument35 pagesEssential Oils Business PlanSwagat R Pyakurel73% (15)

- CSR PresentationDocument19 pagesCSR PresentationBhavi007No ratings yet

- Raghee Horner Daily Trading EdgeDocument53 pagesRaghee Horner Daily Trading Edgepsoonek100% (8)

- Used Car Dealers Convicted - The AFC & DSC ConspiracyDocument2 pagesUsed Car Dealers Convicted - The AFC & DSC ConspiracyzacallfordNo ratings yet

- IU Student Bank StatementDocument1 pageIU Student Bank StatementHasnain AliNo ratings yet

- F9 RM QuestionsDocument14 pagesF9 RM QuestionsImranRazaBozdar0% (1)

- EZZ Steel Financial AnalysisDocument31 pagesEZZ Steel Financial Analysismohamed ashorNo ratings yet

- Business Combinations AccountingDocument22 pagesBusiness Combinations AccountingDaisy TañoteNo ratings yet

- 1 - Gaite Vs FonacierDocument2 pages1 - Gaite Vs FonacierPauPau Abut100% (1)

- Solvency Analysis of "Advanced Chemical IndustriesDocument44 pagesSolvency Analysis of "Advanced Chemical IndustriesShaikat D. AjaxNo ratings yet

- FM - Project - Report - I - (AB02) - (274840) RevisionDocument21 pagesFM - Project - Report - I - (AB02) - (274840) Revisionmaulana anjasmaraNo ratings yet

- NAV ComputationDocument130 pagesNAV ComputationamiNo ratings yet

- ALLIDocument16 pagesALLIAbdullah KhanNo ratings yet

- Analyzing Financing Decisions and Ratios for IDFC FIRST BANKDocument5 pagesAnalyzing Financing Decisions and Ratios for IDFC FIRST BANKMr. Pravar Mathur Student, Jaipuria LucknowNo ratings yet

- Textile Industry Financial Analysis Report (321 Project)Document34 pagesTextile Industry Financial Analysis Report (321 Project)hamnah lateefNo ratings yet

- Coca-Cola Financial AnalysisDocument6 pagesCoca-Cola Financial AnalysisAditya Pal Singh Mertia RMNo ratings yet

- Financial Ratios FinaaaaaaalDocument8 pagesFinancial Ratios FinaaaaaaalHeidi Estuye MarceloNo ratings yet

- Corporate Finance: Submitted By: - Submitted ToDocument9 pagesCorporate Finance: Submitted By: - Submitted ToMahima BhatnagarNo ratings yet

- Financial Statement AnalysisDocument9 pagesFinancial Statement Analysishashim shahNo ratings yet

- WIPRO FINANCIAL STATEMENT AND ANALYSIS ASSIGNMENT 2Document4 pagesWIPRO FINANCIAL STATEMENT AND ANALYSIS ASSIGNMENT 2Gani SheikhNo ratings yet

- Financial Analysis 2.0Document6 pagesFinancial Analysis 2.0Jammie Rose MallariNo ratings yet

- Final Finance Report (Sara Nabil + Sadika Hnadi + Yasmin Hany Elfar)Document12 pagesFinal Finance Report (Sara Nabil + Sadika Hnadi + Yasmin Hany Elfar)Yasmine hanyNo ratings yet

- Ratio Analysis in Real TimeDocument5 pagesRatio Analysis in Real TimeYogha Lakshmi.SNo ratings yet

- Corporate Finance Corporate Finance: 2020-22 - By: Purvi Jain JSW Steel Ltd. JSW Steel LTDDocument11 pagesCorporate Finance Corporate Finance: 2020-22 - By: Purvi Jain JSW Steel Ltd. JSW Steel LTDpurvi jainNo ratings yet

- SWOT of EIH Ltd.Document13 pagesSWOT of EIH Ltd.Sahil AhammedNo ratings yet

- PhValuation Free Cash FlowDocument9 pagesPhValuation Free Cash Flowtsunami133100100020No ratings yet

- Himanshu Rawat (Leverage Analysis of Crompton Greaves)Document10 pagesHimanshu Rawat (Leverage Analysis of Crompton Greaves)HIMANSHU RAWATNo ratings yet

- Financial Analysis Ratio - Formula ElaborationDocument11 pagesFinancial Analysis Ratio - Formula ElaborationBen AzarelNo ratings yet

- Acc Project by Nitu KumariDocument46 pagesAcc Project by Nitu Kumarifunkypeoples63No ratings yet

- IndusInd BankDocument9 pagesIndusInd BankSrinivas NandikantiNo ratings yet

- FMDocument233 pagesFMparika khannaNo ratings yet

- Financial Ratio Analysis ReportDocument8 pagesFinancial Ratio Analysis ReportJeff AtuaNo ratings yet

- Mini Project Financial Reporting Statements and Analysis MB20104Document11 pagesMini Project Financial Reporting Statements and Analysis MB20104KISHORE KRISHNo ratings yet

- Lang - Culculate Case StudyDocument6 pagesLang - Culculate Case StudyTrang ĐàiNo ratings yet

- AnalysispdfDocument15 pagesAnalysispdfMalevolent IncineratorNo ratings yet

- Dabur Balance Sheet and P&L Ratio Analysis 2017-2021Document10 pagesDabur Balance Sheet and P&L Ratio Analysis 2017-2021Amal SNo ratings yet

- SABIC AnalysisDocument18 pagesSABIC AnalysisAreej Riaz uNo ratings yet

- FSA Assignment 2Document16 pagesFSA Assignment 2Daniyal ZafarNo ratings yet

- Mid Term Exam - FACD - 19P186Document12 pagesMid Term Exam - FACD - 19P186Aditya AnandNo ratings yet

- Capital Structure Analysis of ITC LTDDocument4 pagesCapital Structure Analysis of ITC LTDAnuran Bordoloi0% (1)

- RATIO ANALYSIS 2 NewDocument20 pagesRATIO ANALYSIS 2 New67SYBMORE SHUBHAMNo ratings yet

- Tata Motors .Document14 pagesTata Motors .Shweta MaltiNo ratings yet

- CH-3 Finance (Parth)Document11 pagesCH-3 Finance (Parth)princeNo ratings yet

- (Current Assets) / (Current Liabilities) : Liquidity RatiosDocument7 pages(Current Assets) / (Current Liabilities) : Liquidity RatiossiddheshNo ratings yet

- FMUE Group Assignment - Group 4 - Section B2CDDocument42 pagesFMUE Group Assignment - Group 4 - Section B2CDyash jhunjhunuwalaNo ratings yet

- Vinamilk Liquidity And Efficiency Ratios 2019-2020Document2 pagesVinamilk Liquidity And Efficiency Ratios 2019-2020Nguyen Le Anh (K14HL)No ratings yet

- Profitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089Document19 pagesProfitability Analysis On Ultratech Cement: By, M.Praneeth Reddy 22397089PradeepNo ratings yet

- Akash 5yr PidiliteDocument9 pagesAkash 5yr PidiliteAkash DidhariaNo ratings yet

- Company Financial Analysis and Ratio Comparison Over 5 YearsDocument6 pagesCompany Financial Analysis and Ratio Comparison Over 5 YearsAanchal MahajanNo ratings yet

- SYD Income Statement and RatiosDocument2 pagesSYD Income Statement and RatiosclendeavourNo ratings yet

- Research Paper On Working Capital Management Made by Satyam KumarDocument3 pagesResearch Paper On Working Capital Management Made by Satyam Kumarsatyam skNo ratings yet

- Ratio Analysis of Ambuja CementDocument16 pagesRatio Analysis of Ambuja CementTusarkant BeheraNo ratings yet

- PRM Assignment 3Document18 pagesPRM Assignment 3ABDULNo ratings yet

- Ratio Formulas for Financial Statement AnalysisDocument22 pagesRatio Formulas for Financial Statement AnalysisKashmi VishnayaNo ratings yet

- Intrinsic Value Calculator by MeDocument6 pagesIntrinsic Value Calculator by Menkw123No ratings yet

- Tgs Ar2020 Final WebDocument157 pagesTgs Ar2020 Final Webyasamin shajiratiNo ratings yet

- Laporan Keuangan dan Kinerja Perusahaan Tahun 2020 dan 2019Document11 pagesLaporan Keuangan dan Kinerja Perusahaan Tahun 2020 dan 2019Anggih Nur HamidahNo ratings yet

- Cash Flow Statement Data 2018 2019 2020Document10 pagesCash Flow Statement Data 2018 2019 2020ficiveNo ratings yet

- Comparative Analysis of DLF Ltd's FinancialsDocument6 pagesComparative Analysis of DLF Ltd's FinancialsAbimanyu ShenilNo ratings yet

- Analysis For The Profit Margin For SAIF POWERTEC LIMITEDDocument20 pagesAnalysis For The Profit Margin For SAIF POWERTEC LIMITEDAameer ShahansahNo ratings yet

- Return on Invested Capital Analysis for NISHAT POWER LTDDocument10 pagesReturn on Invested Capital Analysis for NISHAT POWER LTDSaeed MahmoodNo ratings yet

- Vietjet Aviation Joint Stock Company: Financial Statement AnalysisDocument4 pagesVietjet Aviation Joint Stock Company: Financial Statement AnalysisMinh ThưNo ratings yet

- Bakiache CitiDocument8 pagesBakiache CitiMalevolent IncineratorNo ratings yet

- Year DPS EPS Growth Rate Cost of Equity Walter Dividend PayoutDocument5 pagesYear DPS EPS Growth Rate Cost of Equity Walter Dividend PayoutRam SinghNo ratings yet

- Euronav Annual Report 2019 Version 20 April PDFDocument102 pagesEuronav Annual Report 2019 Version 20 April PDFfrcaNo ratings yet

- Group Assignment FIN 410 - Group #3Document22 pagesGroup Assignment FIN 410 - Group #3ShahikNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Business Combinations (Part 2) : Name: Date: Professor: Section: ScoreDocument2 pagesBusiness Combinations (Part 2) : Name: Date: Professor: Section: ScoreHaynah YusophNo ratings yet

- Opening New Markets To The WorldDocument36 pagesOpening New Markets To The WorldZiad LalmiNo ratings yet

- Chapter 2 The Accounting EquationDocument15 pagesChapter 2 The Accounting EquationDahlia Fernandez Bt Mohd Farid FernandezNo ratings yet

- RẤT HAY Top 5 Advanced Forex Trading Strategies in 2020Document10 pagesRẤT HAY Top 5 Advanced Forex Trading Strategies in 2020Elap ElapNo ratings yet

- Problems 1 - Accounting Cycle PDFDocument17 pagesProblems 1 - Accounting Cycle PDFEliyah JhonsonNo ratings yet

- Final Accounts ProblemsDocument7 pagesFinal Accounts ProblemsTushar SahuNo ratings yet

- Sworojgar Laghu Bitta Bikas Bank Limited Valid/Invalid Applicants List (Kitta Wise)Document30 pagesSworojgar Laghu Bitta Bikas Bank Limited Valid/Invalid Applicants List (Kitta Wise)Sahil NepaliNo ratings yet

- FinancialManagement Mplte ChoiceDocument18 pagesFinancialManagement Mplte ChoiceCrish NaNo ratings yet

- Muzammil Qadeer Qureshi Phs Trainee Officer PAY ROLL NO: 21705-0Document25 pagesMuzammil Qadeer Qureshi Phs Trainee Officer PAY ROLL NO: 21705-0Muzammil QureshiiNo ratings yet

- A Study On The Role and Importance of Treasury Management SystemDocument6 pagesA Study On The Role and Importance of Treasury Management SystemPAVAN KumarNo ratings yet

- Monetary Policy and The Federal Reserve: Current Policy and ConditionsDocument25 pagesMonetary Policy and The Federal Reserve: Current Policy and ConditionsJithinNo ratings yet

- The Virgin Group: An Innovative Corporate StructureDocument25 pagesThe Virgin Group: An Innovative Corporate Structurerohanag25% (4)

- Questionnaire For CustomersDocument5 pagesQuestionnaire For CustomersAkhilNo ratings yet

- One Step Beyond Is The Public Sector Ready PDFDocument27 pagesOne Step Beyond Is The Public Sector Ready PDFMuhammad makhrojalNo ratings yet

- PLR, SLR and CRR Project by Swati SharmaDocument50 pagesPLR, SLR and CRR Project by Swati SharmaPranay SawantNo ratings yet

- Transaction Statement: Account Number: 1632104000026770 Date: 2023-11-08 Currency: INRDocument5 pagesTransaction Statement: Account Number: 1632104000026770 Date: 2023-11-08 Currency: INRwww.manjsahuNo ratings yet

- Ca Rohit Chola: ProfileDocument2 pagesCa Rohit Chola: ProfileThe Cultural CommitteeNo ratings yet

- QUIZ 1 Partnership Formation: Mona Lisa Statement of Financial Position October 1, 2019Document2 pagesQUIZ 1 Partnership Formation: Mona Lisa Statement of Financial Position October 1, 2019simontambisNo ratings yet

- HOBA2019QUIZ1MCDocument10 pagesHOBA2019QUIZ1MCjasfNo ratings yet

- Problems Involving Consumer Loans-2Document10 pagesProblems Involving Consumer Loans-2Shaine AbellaNo ratings yet