Professional Documents

Culture Documents

1.sales Tax-Mehak-2020

Uploaded by

Mahnoor Shahbaz0 ratings0% found this document useful (0 votes)

12 views1 pageOriginal Title

1.Sales Tax-Mehak-2020- (1).docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 page1.sales Tax-Mehak-2020

Uploaded by

Mahnoor ShahbazCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

GC UNIVERSITY LAHORE

ROLL NO. ____________________________ NAME: _______________________________

GC UNIVERSITY LAHORE

ROLL NO. ____________________________ NAME: _______________________________

Sales Tax ,Custom and Excise Duty

Q. No. Questions Marks

Compute the sales tax liability of a registered manufacturer who has the

following transactions during the tax period.

Amount

Particulars

(Rs.)

Supplies to Registered 7,000,000

1 Person---------------------------------------------------------- 12,80,000

Supplies to Un-registered 4,00,000

Person------------------------------------------------------ 6,00,000

14

Exempted 40,00,000

Sales-------------------------------------------------------------------------- 5,00,000

------ 1,00,000

Zero-rated

Supply------------------------------------------------------------------------

----

Purchases from Registered

Person---------------------------------------------------

Purchases from non-registered person

----------------------------------------------

Imported

Goods(taxable)--------------------------------------------------------------

-----

Required:

i. Input Tax ii. Output Tax iii. Sales Tax Liability

2 Briefly Explain the requirement of Registration as per Sales Tax Act 1990 06

You might also like

- Assignment T&DDocument2 pagesAssignment T&DMahnoor ShahbazNo ratings yet

- Assignment Sales TaxDocument2 pagesAssignment Sales TaxMahnoor ShahbazNo ratings yet

- Article Competency Based Selection and InterviewDocument3 pagesArticle Competency Based Selection and InterviewMahnoor ShahbazNo ratings yet

- CHAPTER 8 AppealDocument4 pagesCHAPTER 8 AppealMahnoor ShahbazNo ratings yet

- Assingnment: Ch#4 (Options Market and Contracts)Document10 pagesAssingnment: Ch#4 (Options Market and Contracts)Mahnoor ShahbazNo ratings yet

- Advance AccountingDocument12 pagesAdvance AccountingMahnoor ShahbazNo ratings yet

- Questionnaire: Psychological Safety Climate Effect Employee PerformanceDocument2 pagesQuestionnaire: Psychological Safety Climate Effect Employee PerformanceMahnoor ShahbazNo ratings yet

- Cover LetterDocument2 pagesCover LetterMahnoor ShahbazNo ratings yet

- What Is Your Car Loan Services?: 1. What Is Difference Between Commercial and Islamic Bank?Document4 pagesWhat Is Your Car Loan Services?: 1. What Is Difference Between Commercial and Islamic Bank?Mahnoor ShahbazNo ratings yet

- Assignment No 1 PapDocument11 pagesAssignment No 1 PapMahnoor ShahbazNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Pp. 419-427 - Joseph Dainow - Civil Law V Common Law SystemsDocument10 pagesPp. 419-427 - Joseph Dainow - Civil Law V Common Law SystemsSiddharth ShahiNo ratings yet

- FLOREZA V EVANGELISTADocument2 pagesFLOREZA V EVANGELISTAtinsky16100% (2)

- Three Faces of Party OrganizationDocument1 pageThree Faces of Party OrganizationCarolinaVizcarraNo ratings yet

- Anak Dan Kejahatan (Faktor Penyebab Dan Perlindungan Hukum) : Jurnal SelatDocument10 pagesAnak Dan Kejahatan (Faktor Penyebab Dan Perlindungan Hukum) : Jurnal SelatIva AsfianiiNo ratings yet

- Labor Law (Case II)Document7 pagesLabor Law (Case II)Rian Niño TrinidadNo ratings yet

- Ong YongDocument9 pagesOng YongInnah Agito-RamosNo ratings yet

- Digest Oca V GutierrezDocument2 pagesDigest Oca V GutierrezJamiah HulipasNo ratings yet

- Model Law ExtraditionDocument66 pagesModel Law Extraditionmansi gabaNo ratings yet

- In The Court of District & Session Judge, AmritsarDocument12 pagesIn The Court of District & Session Judge, Amritsarvidit mongaNo ratings yet

- Criminal Lawyer New YorkDocument2 pagesCriminal Lawyer New Yorkstospo07No ratings yet

- Italian Embassy - Colombo Tourist Visa: Yes No N/aDocument1 pageItalian Embassy - Colombo Tourist Visa: Yes No N/aAsitha RathnayakeNo ratings yet

- Menifee Transcript 1Document32 pagesMenifee Transcript 1Dan LehrNo ratings yet

- Jo Chung vs. Pacific Commercial Co.Document16 pagesJo Chung vs. Pacific Commercial Co.anonNo ratings yet

- The Ombudsman in Latin America Author(s) : Fredrik Uggla Source: Journal of Latin American Studies, Vol. 36, No. 3 (Aug., 2004), Pp. 423-450 Published By: Stable URL: Accessed: 24/02/2015 15:06Document29 pagesThe Ombudsman in Latin America Author(s) : Fredrik Uggla Source: Journal of Latin American Studies, Vol. 36, No. 3 (Aug., 2004), Pp. 423-450 Published By: Stable URL: Accessed: 24/02/2015 15:06Amegalir ZamjtulNo ratings yet

- 2009OpinionNo09 17Document4 pages2009OpinionNo09 17Paolo Ervin PerezNo ratings yet

- Trisha College of Education Hamirpur To CM.Document2 pagesTrisha College of Education Hamirpur To CM.VIJAY KUMAR HEERNo ratings yet

- Checklist For A Business License Application PDFDocument3 pagesChecklist For A Business License Application PDFflorian francesNo ratings yet

- Peñaranda v. Baganga Plywood Corporation (G.R. No. 159577. May 3, 2006)Document4 pagesPeñaranda v. Baganga Plywood Corporation (G.R. No. 159577. May 3, 2006)yanaNo ratings yet

- Motion For Reconsideration: Rule 52Document1 pageMotion For Reconsideration: Rule 52Manny DerainNo ratings yet

- 14 La Vista Association v. CADocument14 pages14 La Vista Association v. CAEarlNo ratings yet

- List of Cases and Headnotes For Conspiracy To InjureDocument75 pagesList of Cases and Headnotes For Conspiracy To InjureMalini SubramaniamNo ratings yet

- Lozada v. MendozaDocument1 pageLozada v. MendozaGemma F. TiamaNo ratings yet

- Consti Bernas and SuarezDocument21 pagesConsti Bernas and Suarezchristie joi100% (2)

- Diallo Complaint Filed Nov. 9, 2018 in Denver Federal District CourtDocument19 pagesDiallo Complaint Filed Nov. 9, 2018 in Denver Federal District CourtJeanLotusNo ratings yet

- $ Upreme Qeourt: 3aepublit of TbeDocument9 pages$ Upreme Qeourt: 3aepublit of TbeAnonymous KgPX1oCfrNo ratings yet

- Montemayor Vs Araneta University FoundationDocument2 pagesMontemayor Vs Araneta University FoundationMac Burdeos CamposueloNo ratings yet

- Obli - Philippine Reclamation Vs RomagoDocument2 pagesObli - Philippine Reclamation Vs RomagoFlorienne MelendrezNo ratings yet

- Digest of Impaired Driving LawsDocument579 pagesDigest of Impaired Driving LawsQuinton BoltinNo ratings yet

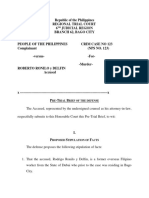

- Case 2 Pre Trial Brief Defense PartDocument5 pagesCase 2 Pre Trial Brief Defense PartDarkSlumberNo ratings yet