Professional Documents

Culture Documents

ULO3 Let'sCheck Torrejos

ULO3 Let'sCheck Torrejos

Uploaded by

Jerah TorrejosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ULO3 Let'sCheck Torrejos

ULO3 Let'sCheck Torrejos

Uploaded by

Jerah TorrejosCopyright:

Available Formats

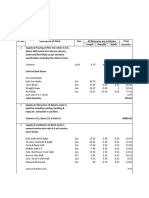

Jerah Y.

Torrejos

ACP311 (2960)

EX.1

A B

Net Income 180,000

Salary 120,000 80,000 (200,000)

(20,000)

Share on Profit (10,000) (10,000)

110,000 70,000 180,000

Entry: Income Summary 180,000

A, Capital 110,000

B, Capital 70,000

EX.2

F G H

Net Loss (33,000)

Interest 12,000 6,000 4,000 (22,000)

Salaries 30,000 20,000 (50,000)

(105,000)

Share on Profit (35,000) (35,000) (35,000)

7,000 (29,000) (11,000) (33,000)

The capital of F will have an additional of 7,000

EX. 3

J 60% P 40%

Net Income ?

Salary 100,000 50,000 (150,000)

Interest 50,000 20,000 (70,000)

325,000

Share on Profit 195,000 130,000

345,000 200,000 545,000

Total Partnership Income is 545,000

J, Capital 345,000

P, Capital 200,000

545,000

EX. 4 Net Income: 19,500

Depreciation (2,100)

Inventory (11,400)

Adjusted Net Income 6,000

P- 3 R-2

Net Income 6,000

Salary 14,400 13,200 (27,600)

(21,600)

Equal Distribution (10,800) (10,800)

PNL Distribution 3,600 2,400 6,000

The Capital is increased by 3,600 for P and 2,400 for R.

EX. 5 Income from Fees 90,000

Expenses (48,000)

Net Income 42,000

CC-5 DD-3 EE-2

Net Income 42,000

Salary 14,000 (14,000)

28,000

Share on Profit 14,000 8,400 5,600 (28,000)

0

Additional Profit to DD (1,500) 2,100 (600)

PnL Distribution 12,500 10,500 19,000

The amounts to be credited in each capital account are:

CC, Capital 12,500

DD, Capital 10,500

EE, Capital 19,000

EX. 6

LL- 5 MM-3 PP-2 38,550

Net Income ?

Interest 2,000 1,250 750 (4,000)

Salary 8,500 (8,500)

Additional to MM 7,050 (7,050)

19,000

Share on Profit 9,500 5,700 3,800

20,000 14,000 4,550 38,550

The amount that must be earned by the partnership is 38,550.

EX. 7 A-60% B-30% C-10% D

Capital Balances 80,000 40,000 20,000

For D (20,000) (10,000) (5,000) 35,000

60,000 30,000 15,000

Capital BONUS

A, Capital 60,000 69,000 9,000

B, Capital 30,000 34,500 4,500

C, Capital 15,000 16,500 1,500

D, Capital 35,000 20,000 (15,000)

140,000 140,000

Cash 40,000

BV 35,000 Capital Balances:

5,000 A, Capital 69,000

Divide 1/4 B, Capital 34,500

20,000 C,Capital 16,500

Multiply .60 D, Capital 20,000

12,000 140,000

80,000

92,000

Multiply .75

54,000

EX. 8 A-60% B-30% C-10% D

Capital Balances 252,000 126,000 42,000

For D (50,400) (25,200) (8,400) 84,000

201,600 100,800 33,600

Capital Balances of the Partners:

A, Capital 201,600 201,600

B, Capital 100,800 100,800

C, Capital 33,600 33,600

D, Capital 84,000 84,000

420,000 420,000

Agreed Capital Bonus

EX. 9 A, Capital 35,000 31,500 (3,500)

B, Capital 30,000 28,500 (1,500)

C, Capital 25,000 30,000 5,000

90,000 90,000

The Capital Balances

A, Capital 31,500

B, Capital 28,500

C, Capital 30,000

90,000

5 3 2

EX. 10 A B C

100,000 150,000 200,000

Inventory 20,000 10,000 6,000 4,000

Net Income 140,000 70,000 42,000 28,000

180,000 198,000 232,000

C, Capital 232,000

Cash 195,000 Remaining Capital Balances:

A, Capital 23,125 A B

B, Capital 13,875 180,000 198,000

23,125 13,875

203,125 211,875

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Prac II Partneship Formation PDFDocument26 pagesPrac II Partneship Formation PDFJerah TorrejosNo ratings yet

- Ce Mark - Application FormDocument3 pagesCe Mark - Application Formrajivsinghal90No ratings yet

- Ratings and EvaluationDocument1 pageRatings and EvaluationJerah TorrejosNo ratings yet

- Health and Wellness, Financial Stability, Career Advancement, Personal Satisfaction, Community Engagement, and Added SkillsDocument4 pagesHealth and Wellness, Financial Stability, Career Advancement, Personal Satisfaction, Community Engagement, and Added SkillsJerah TorrejosNo ratings yet

- Audit OpinionDocument39 pagesAudit OpinionJerah TorrejosNo ratings yet

- College of Business Administration EducationDocument2 pagesCollege of Business Administration EducationJerah TorrejosNo ratings yet

- Third Examination Review (ACP 312/8B)Document20 pagesThird Examination Review (ACP 312/8B)Jerah TorrejosNo ratings yet

- Third Examination Review (ACP 312/8B)Document20 pagesThird Examination Review (ACP 312/8B)Jerah TorrejosNo ratings yet

- Assignment For 25 PDFDocument1 pageAssignment For 25 PDFJerah TorrejosNo ratings yet

- In A Nutshell - TorrejosDocument1 pageIn A Nutshell - TorrejosJerah TorrejosNo ratings yet

- ACP 314 Auditing and Assurance Principle Rev. 0 1st Sem SY 2020-2021Document12 pagesACP 314 Auditing and Assurance Principle Rev. 0 1st Sem SY 2020-2021Jerah TorrejosNo ratings yet

- Iggy and SwaggyDocument3 pagesIggy and SwaggyJerah TorrejosNo ratings yet

- Let's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)Document2 pagesLet's Analyze: Name: Jerah Y. Torrejos Subject: ACP312 (4965)Jerah TorrejosNo ratings yet

- Let's Check For 26-1Document1 pageLet's Check For 26-1Jerah TorrejosNo ratings yet

- Liebherr Hs 8300 HD Data Sheet Englisch 11244650 Email 13877-0Document16 pagesLiebherr Hs 8300 HD Data Sheet Englisch 11244650 Email 13877-0Angel ArocaNo ratings yet

- Tia PortalDocument15 pagesTia PortalEdison MalacaraNo ratings yet

- 60-Day Limited Period For Changes To Existing Elections Under The Federal Flexible Spending Account Program FSAFEDSDocument4 pages60-Day Limited Period For Changes To Existing Elections Under The Federal Flexible Spending Account Program FSAFEDSFedSmith Inc.100% (1)

- Term Paper SurveyDocument6 pagesTerm Paper Surveyea4c954q100% (1)

- Company and Marketing StrategyDocument10 pagesCompany and Marketing StrategyHannah Martin100% (1)

- Kalaw vs. RelovaDocument2 pagesKalaw vs. RelovaYvon BaguioNo ratings yet

- Usa V Fitzsimons Memo Re Status of DiscoveryDocument17 pagesUsa V Fitzsimons Memo Re Status of DiscoveryFile 411No ratings yet

- Aiwa AM-F70Document10 pagesAiwa AM-F70Valerio IncertoNo ratings yet

- Jinko 535WDocument2 pagesJinko 535Wheinz de la cruzNo ratings yet

- Conformal Cooling 140217011257 Phpapp01 PDFDocument50 pagesConformal Cooling 140217011257 Phpapp01 PDFcute7707No ratings yet

- Introduction To Aviation IndustryDocument10 pagesIntroduction To Aviation IndustryMohd MohsinNo ratings yet

- Thang Máy Gia Đình CIBES S300 - Cibeslift - Com.vnDocument4 pagesThang Máy Gia Đình CIBES S300 - Cibeslift - Com.vnThang máy gia đình Cibes Thụy ĐiểnNo ratings yet

- Composite Wrapping - A Challenging Solution For Deep-Water Repair ApplicationsDocument9 pagesComposite Wrapping - A Challenging Solution For Deep-Water Repair ApplicationsMubeenNo ratings yet

- BK 2022 NoteDocument18 pagesBK 2022 NoteKiran C MasutiNo ratings yet

- Case StudyDocument21 pagesCase StudyVinu Thomas0% (1)

- Termination and DiscriminationDocument17 pagesTermination and DiscriminationLisa N100% (1)

- Bill of MaterialsDocument7 pagesBill of MaterialsTerancen RajuNo ratings yet

- Python: A Industrial Training and Project PresentationDocument11 pagesPython: A Industrial Training and Project PresentationMukul PurohitNo ratings yet

- International Arbitrage and Interest Rate ParityDocument13 pagesInternational Arbitrage and Interest Rate ParityAbdullah S.No ratings yet

- Varkombi 18 PC TFT Register TableDocument44 pagesVarkombi 18 PC TFT Register TableIbrahim AL-SORAIHINo ratings yet

- LOA Renewal and ExtensionDocument31 pagesLOA Renewal and ExtensionsrinivasNo ratings yet

- Documentare ElectroeroziuneDocument7 pagesDocumentare Electroeroziuneprofanu1No ratings yet

- Case Study of A Secondary School Model For Special Needs StudentsDocument343 pagesCase Study of A Secondary School Model For Special Needs StudentsAntonette Zamora- NuevaNo ratings yet

- BG06 For Die Cutting - Cartoon Box PackagingDocument9 pagesBG06 For Die Cutting - Cartoon Box PackagingDeniMestiWidiantoNo ratings yet

- Easy JavaScript Notes ?Document32 pagesEasy JavaScript Notes ?VIS SHINo ratings yet

- Astm b858 1995Document6 pagesAstm b858 1995rensieoviNo ratings yet

- Global Timesheet GuidanceDocument3 pagesGlobal Timesheet GuidanceprakashNo ratings yet

- C# Tutorial - Create PDFDocument11 pagesC# Tutorial - Create PDFtamer845100% (1)

- 9 Solar Charger Design For Electric VehiclesDocument11 pages9 Solar Charger Design For Electric VehiclesGál Károly-IstvánNo ratings yet