Professional Documents

Culture Documents

Interest Earned: Valuation Sheet For Bank Sample Income Statement

Uploaded by

Bijosh ThomasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest Earned: Valuation Sheet For Bank Sample Income Statement

Uploaded by

Bijosh ThomasCopyright:

Available Formats

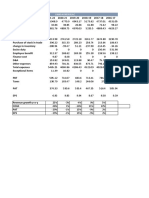

Valuation Sheet for Bank Sample

Income Statement

Interest Earned FY18 FY19 FY20 FY21 FY22

Income from advances 7700.98 9727.0786 12256.119 15442.71 19457.815 8.30% Yield

Income from Investments 2213.92 2462.1068 2732.9385 3033.5618 3367.2536 7.25% Yield

Total 9914.90 12189.185 14989.058 18476.272 22825.068

Interest Expended

Interest on Deposits 5721.90 6438.2808 7404.0229 8514.6264 9791.8203 5.00% Cost

Interest on borrowings 504.52 2080.1715 2853.5134 3870.9493 5203.2938 4.00% cost

Total 6226.42 8518.4523 10257.536 12385.576 14995.114

NII 3670.7331 4731.5212 6090.6961 7829.9541

Other Income 1160.22 1403.8602 1698.6708 2055.3916 2487.0239 21.00% growth rate

Operating Expenses 2504.74 3164.2304 3986.9303 5023.5322 6329.6505 2.70% on Advances

Provisions and Contingencies 950.76 1195.3759 1506.1737 1897.7788 2391.2013 1.02% on Advances

Profit Before Tax 714.98692 937.08804 1224.7768 1596.1261

Taxes 214.49608 281.12641 367.43303 478.83782 30%

Profit After Tax 500.49084 655.96163 857.34373 1117.2883

Dividend

Dividend tax 0 0 0 0 15%

Balance to reserve 500.49084 655.96163 857.34373 1117.2883

Share Capital 394.43 394.43 394.43 394.43 394.43

Reserves 11,879.81 12,878.61 13,534.57 14,391.92 15,509.20

Book Value 12274.24 13273.04 13929.002 14786.345 15903.634

Book Value / Share 61.83 66.86 70.16 74.48 80.11

Multiple 1.66 1.66 1.66

Target 116.46674 123.63539 132.97754

Balance sheet

FY18 FY19 FY20 FY21 FY22

Advances 93010.89 117193.7 147664.1 186056.7 234431.5 26% Growth rate

Investments 30594.68 33960.09 37695.7 41842.23 46444.88 11% Growth rate

Deposits 111970.10 128765.6 148080.5 170292.5 195836.4 15% Growth rate

SLR 5150.625 5923.218 6811.701 7833.456 4%

CRR 24465.47 28135.29 32355.58 37208.92 19%

99149.52 114022 131125.2 150794

Borrowings 12328.84 52004.29 71337.84 96773.73 130082.3

NIIM 2.43% 2.55% 2.67% 2.79%

Face Value 2

No of shares 198.53

Dividend payout 25%

You might also like

- Allahabad Bank Sep 09Document5 pagesAllahabad Bank Sep 09chetandusejaNo ratings yet

- Valuation Task 20 - SUPRITHA.KDocument14 pagesValuation Task 20 - SUPRITHA.KSupritha HegdeNo ratings yet

- AttachmentDocument19 pagesAttachmentSanjay MulviNo ratings yet

- Axis Bank Valuation PDFDocument13 pagesAxis Bank Valuation PDFDaemon7No ratings yet

- FM Assignment 1Document4 pagesFM Assignment 1Akansha BansalNo ratings yet

- Company Vs Industry-1Document3 pagesCompany Vs Industry-1Ajay SutharNo ratings yet

- Income Statement - 2014 - in MillionsDocument2 pagesIncome Statement - 2014 - in MillionsHKS TKSNo ratings yet

- All Numbers Are in INR and in x10MDocument6 pagesAll Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- FM AssDocument15 pagesFM AssKhadija YaqoobNo ratings yet

- Detailed Income Statement Template Landscaping Irrigation Lighting CompanyDocument4 pagesDetailed Income Statement Template Landscaping Irrigation Lighting Companymichael odiemboNo ratings yet

- Particulars 2016 2017 2018: TOTAL Liabilites and Equity 12695701 15985565 18322275Document11 pagesParticulars 2016 2017 2018: TOTAL Liabilites and Equity 12695701 15985565 18322275Muhammad BilalNo ratings yet

- DCF Trident 2Document20 pagesDCF Trident 2Jayant JainNo ratings yet

- GK LboDocument2 pagesGK LboShubhangi JainNo ratings yet

- Hindustan Petrolium Corporation LTD: ProsDocument9 pagesHindustan Petrolium Corporation LTD: ProsChandan KokaneNo ratings yet

- Punjab National BankDocument7 pagesPunjab National BankSandeep PareekNo ratings yet

- Bharat Hotels Valuation Case StudyDocument3 pagesBharat Hotels Valuation Case StudyRohitNo ratings yet

- Performance at A GlanceDocument7 pagesPerformance at A GlanceLima MustaryNo ratings yet

- ProjectDocument3 pagesProjectTouseef RizviNo ratings yet

- Tata SteelDocument66 pagesTata SteelSuraj DasNo ratings yet

- V MartDocument44 pagesV MartPankaj SankholiaNo ratings yet

- Analysis RatiosDocument6 pagesAnalysis RatiosKrishnamoorthy SubramaniamNo ratings yet

- FM 2 AssignmentDocument337 pagesFM 2 AssignmentAvradeep DasNo ratings yet

- JSW SteelDocument34 pagesJSW SteelShashank PatelNo ratings yet

- SUNDARAM CLAYTONDocument19 pagesSUNDARAM CLAYTONELIF KOTADIYANo ratings yet

- Income Statement-2014Quarterly - in MillionsDocument6 pagesIncome Statement-2014Quarterly - in MillionsHKS TKSNo ratings yet

- AVIVADocument5 pagesAVIVAHAFIS JAVEDNo ratings yet

- Fsa Colgate - AssignmentDocument8 pagesFsa Colgate - AssignmentTeena ChandwaniNo ratings yet

- NMDC AnalysisDocument59 pagesNMDC Analysisshivani guptaNo ratings yet

- PNB ValuationDocument6 pagesPNB Valuationmpsingh2200No ratings yet

- Group 5Document28 pagesGroup 5Kapil JainNo ratings yet

- Sr. Name: Registration #: Hassan Abid Ilyas 36230 Muhammad Saad 36229 Kamran Shah 23662 Noman Ahmed 37554Document19 pagesSr. Name: Registration #: Hassan Abid Ilyas 36230 Muhammad Saad 36229 Kamran Shah 23662 Noman Ahmed 37554hasan abidNo ratings yet

- AFDMDocument6 pagesAFDMAhsan IqbalNo ratings yet

- Super 8 MotelDocument8 pagesSuper 8 MotelNarinderNo ratings yet

- Motherson Sumi Systems LTD Excel FinalDocument30 pagesMotherson Sumi Systems LTD Excel Finalwritik sahaNo ratings yet

- DCF TVSDocument17 pagesDCF TVSSunilNo ratings yet

- Fin3320 Excelproject sp16 TravuobrileDocument9 pagesFin3320 Excelproject sp16 Travuobrileapi-363907405No ratings yet

- Company Name Last Historical Year CurrencyDocument55 pagesCompany Name Last Historical Year Currencyshivam vermaNo ratings yet

- BV Gorup 5Document39 pagesBV Gorup 5Kapil JainNo ratings yet

- Eidul Hussain 12Document103 pagesEidul Hussain 12Rizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Ultratech Cement LTD.: Total IncomeDocument36 pagesUltratech Cement LTD.: Total IncomeRezwan KhanNo ratings yet

- MIRTADocument18 pagesMIRTAleylaNo ratings yet

- V MartDocument47 pagesV MartHarshit JainNo ratings yet

- Income Statement of Arrow Electronics: ItemsDocument78 pagesIncome Statement of Arrow Electronics: Itemsasifabdullah khanNo ratings yet

- Common Size Income Statement - TATA MOTORS LTDDocument6 pagesCommon Size Income Statement - TATA MOTORS LTDSubrat BiswalNo ratings yet

- Indian Oil 17Document2 pagesIndian Oil 17Ramesh AnkithaNo ratings yet

- Mahindra Ratio Sesha SirDocument9 pagesMahindra Ratio Sesha SirAscharya DebasishNo ratings yet

- Marico Financial Model (Final) (Final-1Document22 pagesMarico Financial Model (Final) (Final-1Jayant JainNo ratings yet

- Tech MahindraDocument17 pagesTech Mahindrapiyushpatil749No ratings yet

- Apple V SamsungDocument4 pagesApple V SamsungCarla Mae MartinezNo ratings yet

- Book 1Document2 pagesBook 1justingordanNo ratings yet

- 199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Document2 pages199.44 - 12.86462 Excluding Finance Cost 653.92 615.11Nivedita YadavNo ratings yet

- Hotel Sector AnalysisDocument39 pagesHotel Sector AnalysisNishant DhakalNo ratings yet

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsClasherNo ratings yet

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsYugant NNo ratings yet

- Balance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MDocument16 pagesBalance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MGirish RamachandraNo ratings yet

- CocaCola - Financial Statement - FactSet - 2019Document66 pagesCocaCola - Financial Statement - FactSet - 2019Zhichang ZhangNo ratings yet

- SBI AbridgedProfitnLossDocument1 pageSBI AbridgedProfitnLossRohitt MutthooNo ratings yet

- Balance Sheet ACC LTDDocument5 pagesBalance Sheet ACC LTDVandita KhudiaNo ratings yet

- Ratio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of PakistanDocument17 pagesRatio Analysis of Kohinoor Textile Mill and Compare With Textile Industry of Pakistanshurahbeel75% (4)

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- HRMDocument1 pageHRMBijosh ThomasNo ratings yet

- MARKET DYNAMICS - Sara James - 24.06.2020Document1 pageMARKET DYNAMICS - Sara James - 24.06.2020Bijosh ThomasNo ratings yet

- Feasibility AnalysisDocument1 pageFeasibility AnalysisBijosh ThomasNo ratings yet

- However The Mean of Equity Per ShareDocument1 pageHowever The Mean of Equity Per ShareBijosh ThomasNo ratings yet

- Mahindra and MahindraDocument1 pageMahindra and MahindraBijosh ThomasNo ratings yet

- Comparative Analysis Report For Iip (Template)Document2 pagesComparative Analysis Report For Iip (Template)Bijosh ThomasNo ratings yet

- Week 4: Practice Challenge 1 - FormattingDocument6 pagesWeek 4: Practice Challenge 1 - FormattingBijosh ThomasNo ratings yet

- IAPM 5th ModuleDocument9 pagesIAPM 5th ModuleBijosh ThomasNo ratings yet

- Investment Analysis and Portfolio Management: Prof Rajiv U KDocument27 pagesInvestment Analysis and Portfolio Management: Prof Rajiv U Kakanksha raghavNo ratings yet

- IAPM 3th ModuleDocument20 pagesIAPM 3th ModuleBijosh ThomasNo ratings yet

- IAPM 4th ModuleDocument22 pagesIAPM 4th ModuleBijosh ThomasNo ratings yet

- Investment Analysis and Portfolio Management: Prof - Rajiv@cms - Ac.inDocument41 pagesInvestment Analysis and Portfolio Management: Prof - Rajiv@cms - Ac.inBijosh ThomasNo ratings yet

- Business Communication: in Person, in Print, OnlineDocument21 pagesBusiness Communication: in Person, in Print, OnlineBijosh ThomasNo ratings yet

- Advanced Financial Reporting: Module 4: Final Accounts of Insurance CompaniesDocument23 pagesAdvanced Financial Reporting: Module 4: Final Accounts of Insurance CompaniesBijosh ThomasNo ratings yet

- qpiLwnXjEei8FQ6TnIKJEA - C2 W2 Assessment WorkbookDocument5 pagesqpiLwnXjEei8FQ6TnIKJEA - C2 W2 Assessment WorkbookBijosh ThomasNo ratings yet

- Modulezerodha FuturesTradingDocument131 pagesModulezerodha FuturesTradingrajeshksm100% (4)

- TASK - 13 Qualitative AnalysisDocument4 pagesTASK - 13 Qualitative AnalysisBijosh ThomasNo ratings yet

- Management Skills and Effectiveness Self Assignment: Name Bijosh P ThomasDocument2 pagesManagement Skills and Effectiveness Self Assignment: Name Bijosh P ThomasBijosh ThomasNo ratings yet

- Technological AnalysisDocument1 pageTechnological AnalysisBijosh ThomasNo ratings yet

- FADocument7 pagesFABijosh ThomasNo ratings yet

- Project FinanceDocument22 pagesProject FinanceagbakushaNo ratings yet

- Goods and Service Tax (GST) : Task 8Document20 pagesGoods and Service Tax (GST) : Task 8Bijosh ThomasNo ratings yet

- TASK-3: Economic Reforms-The First PhaseDocument12 pagesTASK-3: Economic Reforms-The First PhaseBijosh ThomasNo ratings yet

- Task 18: Ratios Peer Comparison of SBI and PNB With Other PSB Interest Income / Total AssetDocument6 pagesTask 18: Ratios Peer Comparison of SBI and PNB With Other PSB Interest Income / Total AssetBijosh ThomasNo ratings yet

- TASK-3: Economic Reforms-The First PhaseDocument12 pagesTASK-3: Economic Reforms-The First PhaseBijosh ThomasNo ratings yet

- O Grady Apparel CompanyDocument4 pagesO Grady Apparel CompanySoniaKasellaNo ratings yet

- Module 15 UPDATEDDocument11 pagesModule 15 UPDATEDelise tanNo ratings yet

- Types of Entrepreneurship: Survival, Lifestyle, Dynamic Growth and SpeculativeDocument2 pagesTypes of Entrepreneurship: Survival, Lifestyle, Dynamic Growth and SpeculativeDenise ReidNo ratings yet

- Dividends For RetirementDocument2 pagesDividends For RetirementThad MalleyNo ratings yet

- Mohd Azzarain Bin Abdul Aziz: Injection WithdrawalDocument2 pagesMohd Azzarain Bin Abdul Aziz: Injection WithdrawalAffeif AzzarainNo ratings yet

- S 18 - Dividends and Dividend PolicyDocument53 pagesS 18 - Dividends and Dividend PolicySibasishNo ratings yet

- Manual of Ideas Part.1Document50 pagesManual of Ideas Part.1yp0No ratings yet

- The Canada Pension Plan Investment Board: HistoryDocument8 pagesThe Canada Pension Plan Investment Board: Historyvedant badayaNo ratings yet

- 5-Financial Markets and Surplus Deficit Spending UnitDocument34 pages5-Financial Markets and Surplus Deficit Spending UnitMoud KhalfaniNo ratings yet

- Balancing ROIC and Growth To Build ValueDocument8 pagesBalancing ROIC and Growth To Build ValueLuis Daniel Napa TorresNo ratings yet

- Synopsis: A Study On Cash Flow Statement Atamararaja Batteries LTD., at KarakambadiDocument3 pagesSynopsis: A Study On Cash Flow Statement Atamararaja Batteries LTD., at Karakambadisree anugraphicsNo ratings yet

- Project Annual Report Colgate-2013-14Document76 pagesProject Annual Report Colgate-2013-14Mikant FernandoNo ratings yet

- Local Media6473773012995304781Document2 pagesLocal Media6473773012995304781Milcah De GuzmanNo ratings yet

- Tim Bourquin InterviewDocument8 pagesTim Bourquin Interviewartus14No ratings yet

- Personal Cash Flow Statement: GoalsDocument3 pagesPersonal Cash Flow Statement: GoalsWilliam ReeceNo ratings yet

- BFC 3379 Investment Analysis and Portfolio Management PDFDocument3 pagesBFC 3379 Investment Analysis and Portfolio Management PDFdouglas kimaniNo ratings yet

- Lecture 2 BCG MatrixDocument26 pagesLecture 2 BCG MatrixAnant MishraNo ratings yet

- Difference Between Joint Venture and ConsignmentDocument1 pageDifference Between Joint Venture and ConsignmentAbhiRishi100% (1)

- Financing DecisionsDocument5 pagesFinancing DecisionsMr. Pravar Mathur Student, Jaipuria LucknowNo ratings yet

- This Study Resource Was: Problem 5Document3 pagesThis Study Resource Was: Problem 5Hasan SikderNo ratings yet

- Session 5Document17 pagesSession 5maha khanNo ratings yet

- Ujala Co ProjctDocument36 pagesUjala Co ProjctShamseer Ummalil0% (2)

- Exchange Traded Funds: There Are Safer Ways To Invest in Stocks Rebounding Up From LowsDocument1 pageExchange Traded Funds: There Are Safer Ways To Invest in Stocks Rebounding Up From LowsRajeshbhai vaghaniNo ratings yet

- India Infrastructure Report PDFDocument159 pagesIndia Infrastructure Report PDFSirsanath Banerjee50% (2)

- Demat Account: Guntur P. Guru Prasad Faculty MemberDocument20 pagesDemat Account: Guntur P. Guru Prasad Faculty MemberPUTTU GURU PRASAD SENGUNTHA MUDALIAR100% (1)

- Management of Bank AL Habib LimitedDocument74 pagesManagement of Bank AL Habib LimitedKhalil ShakirNo ratings yet

- Case Study On Investment Analysis Case StudyDocument8 pagesCase Study On Investment Analysis Case StudyramakrishnanNo ratings yet

- On July 1 2018 Truman Company Acquired A 70 PercentDocument1 pageOn July 1 2018 Truman Company Acquired A 70 PercentAmit PandeyNo ratings yet

- Valuation: Quiz 1 Review: Aswath Damodaran Updated: March 2013Document20 pagesValuation: Quiz 1 Review: Aswath Damodaran Updated: March 2013erpsindhuNo ratings yet

- Financial AnalysisDocument12 pagesFinancial AnalysisTrisha Lane AtienzaNo ratings yet