Professional Documents

Culture Documents

C2A LAQ October 2012 Questions PDF

Uploaded by

Jeff GundyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C2A LAQ October 2012 Questions PDF

Uploaded by

Jeff GundyCopyright:

Available Formats

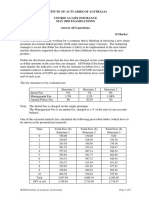

2012 PART III EXAMINATIONS

C2A Life Insurance

Subject Title:

(longer answer component)

Date: Friday, 19 October 2012

Time: 1:00 pm – 4:00 pm

Time allowed: Three (3) hours including reading time

Instructions: Type your answers to the longer answer

component in a Word document and

ensure that there is no data linked to

spreadsheets.

For Q1 BOTH your Word document and

your Excel Spreadsheet will be marked.

For Q2 ONLY your Word document will be

marked. Your Excel file should also be

saved as a backup.

.

Number of Questions: Two (2)

Question Marks

1 30

2 30

Total 60

Candidates are required to answer ALL questions.

This paper has three (3) pages (excluding this page).

COURSE 2A LIFE INSURANCE OCTOBER 2012 EXAMINATIONS

Answer both questions.

QUESTION 1 (30 Marks)

This question is set in a mythical country which is like Australia in every way except that risk

insurances are sold mainly with a 5-year term and level premiums, and reserving and

capital requirements are simplified as below.

The following averages have been derived from your company’s existing large portfolio of

death-only 5 year Level Premium Term insurances for the year to 30 June 2012.

Average sum insured $250,000

Smoothed mortality rates, from company’s own 50% of attached Standard Table

experience for non-smoker males aged 30 to 50

Mortality rates used 2 years ago for pricing this 60% of Standard Table

product

Reinsurer current recommended mortality rates 59% of Standard table

Reinsurer mortality rates included in existing treaty 59% of Standard Table

Per-policy annual expenses $60.00

Initial expenses not related to commission 50% of new annual premium

Initial commission and commission overheads 100% of new annual premium

Renewal commission and commission overheads 10% of renewal annual premiums

Overhead expenses 10% of all premium income

Investment return (near-cash asset backing) 3% p.a.

Lapse rate year 1 20%

Lapse rate years 2+ 10% pa

Policy liability to be reserved from start of each Present value of future expected claims

year plus expenses less premiums, discounting

at the expected earning rate

Capital to be allocated at start of each year 10% of the present value of future

expected claims

The company’s required minimum pre-tax return on capital is 12% pa, but most risk

products have been priced to include a pre-tax profit margin of 10% of gross premiums.

Your company has asked you to suggest a premium rate for a new 5-year level premium

product to be used for nil-commission sales made by advisors charging a fee-for-service to

the client. The Marketing Division is keen to have a very competitive rate for this new sales

initiative. Using the data above and/or other assumptions that you specify, derive and

justify a premium rate for non-smoker males aged 35 at entry. The Chief Actuary has

2012 Institute of Actuaries of Australia Page 1 of 3

COURSE 2A LIFE INSURANCE OCTOBER 2012 EXAMINATIONS

suggested you consider allowance for mortality selection, even though the company has

not done that in the past.

Your answer should be in the form of a note to the Chief Actuary, as a basis for your

discussions with him. It can be informal, but must be clear and complete so that his formal

advice can be based on it. Different assumptions and premium rates can be discussed,

but a single recommendation must be given in each case. A clearly labelled spreadsheet

calculating the premium rate must be included and will be marked in addition to your

note.

Attachments

1. 2A_LAQ1_October_2012_Data - Standard_Mortality_Table.xlsx

2012 Institute of Actuaries of Australia Page 2 of 3

COURSE 2A LIFE INSURANCE OCTOBER 2012 EXAMINATIONS

QUESTION 2 (30 Marks)

You have managerial responsibility for the unit pricing backing the $10 billion of retail

investment products at your large, diversified financial institution. As part of month-end

reconciliation, you have discovered an error in the daily Australian Equities unit prices.

These prices have also been used in setting prices for the Growth, Balanced and Stable

units. It appears the Australian Equity prices have been overstated by approximately 1% for

the past 2 to 3 weeks. The error affects unit trusts, plus Ordinary and Superannuation

policies within the life insurance company.

Your Line Manager has convened a meeting 1 hour from now to discuss the problem.

Document the full extent of the problem and your recommended solutions. Your

document does not need to be formal, but it should be suitable to be used as a handout

at the meeting, which will include some non-technical Managers. It should include a list,

with explanations and justifications, of actions you suggest should be performed. It should

cover the who, what, why and when for your proposals in respect of all affected business

lines and all affected transaction types. It should illustrate the problems with some

numerical examples.

In addition to correcting the problem, describe the further investigations and other actions

you would take to reduce the risk of recurrence, as you will bring this up at the end of the

meeting.

END OF PAPER

2012 Institute of Actuaries of Australia Page 3 of 3

You might also like

- Becoming Resilient – The Definitive Guide to ISO 22301 Implementation: The Plain English, Step-by-Step Handbook for Business Continuity PractitionersFrom EverandBecoming Resilient – The Definitive Guide to ISO 22301 Implementation: The Plain English, Step-by-Step Handbook for Business Continuity PractitionersRating: 5 out of 5 stars5/5 (3)

- Course 2A Life Insurance October 2012 Examinations Answer All Two Questions. (30 Marks)Document7 pagesCourse 2A Life Insurance October 2012 Examinations Answer All Two Questions. (30 Marks)Jeff GundyNo ratings yet

- C2A May 2013 Questions PDFDocument5 pagesC2A May 2013 Questions PDFJeff GundyNo ratings yet

- C2A April 2012 Questions PDFDocument6 pagesC2A April 2012 Questions PDFJeff GundyNo ratings yet

- Course 2A Life Insurance May 2013 Examinations Answer Two Questions. (30 MARKS)Document9 pagesCourse 2A Life Insurance May 2013 Examinations Answer Two Questions. (30 MARKS)Jeff GundyNo ratings yet

- UEHT3 2021 - 200921 Security Analysis and Business Valuation - Midterm ExamDocument4 pagesUEHT3 2021 - 200921 Security Analysis and Business Valuation - Midterm ExamLinh TrầnNo ratings yet

- 1 Business Case Studies 2Document5 pages1 Business Case Studies 2David RiveraNo ratings yet

- Business Statistics and Decision Science 2Document7 pagesBusiness Statistics and Decision Science 2Aayu GargNo ratings yet

- School of Business and Law: AssignmentDocument8 pagesSchool of Business and Law: AssignmentMHANo ratings yet

- Assignment # 1 Spring-2021: Teacher's MessageDocument3 pagesAssignment # 1 Spring-2021: Teacher's MessageSayed AssadullahNo ratings yet

- CF - Structure and Content of Mid-Term and Final Exams - F1 2021Document3 pagesCF - Structure and Content of Mid-Term and Final Exams - F1 2021MaggieNo ratings yet

- The Institute of Actuaries of Australia Life Insurance 2002 Examinations Paper One Answer All 6 Questions. (15 Marks)Document6 pagesThe Institute of Actuaries of Australia Life Insurance 2002 Examinations Paper One Answer All 6 Questions. (15 Marks)Jeff GundyNo ratings yet

- Subject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsDocument8 pagesSubject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsJeff GundyNo ratings yet

- Exam Duration: Two Hours: Instructions For The ExamDocument5 pagesExam Duration: Two Hours: Instructions For The ExamSanJana NahataNo ratings yet

- FNCE623 Solution To Final Exam 2021 WinterDocument4 pagesFNCE623 Solution To Final Exam 2021 Winteralka murarkaNo ratings yet

- ACCT101 Project Instructions (Final 21jun21)Document12 pagesACCT101 Project Instructions (Final 21jun21)Vedanshi BihaniNo ratings yet

- Exam - 2015 5 Proposed SolutionDocument9 pagesExam - 2015 5 Proposed SolutionmrdirriminNo ratings yet

- Practice Final Exam Questions399Document17 pagesPractice Final Exam Questions399MrDorakonNo ratings yet

- AB1201 Exam - Sem1 AY 2021-22 - QDocument9 pagesAB1201 Exam - Sem1 AY 2021-22 - QShuHao ShiNo ratings yet

- Assignment #2Document3 pagesAssignment #2Chad OngNo ratings yet

- Solutions: Part 5 Practice Exam 2Document23 pagesSolutions: Part 5 Practice Exam 2Lee AlvarezNo ratings yet

- Compre BAV Sol 2019-20 1Document9 pagesCompre BAV Sol 2019-20 1f20211062No ratings yet

- AMO Main 2020Document16 pagesAMO Main 2020TanyaNo ratings yet

- A3 BSBFIM501 Manage Budgets and Financial PlansDocument5 pagesA3 BSBFIM501 Manage Budgets and Financial PlansMaya Roton0% (1)

- ModelOff Round 1 - Case Study InfomationDocument3 pagesModelOff Round 1 - Case Study InfomationGabriel Jiabei GaoNo ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- I601F23 - Assignment 1 SolutionsDocument5 pagesI601F23 - Assignment 1 SolutionschitraliNo ratings yet

- BUS1AFB - Assignment 1 - Semester 1 2020 - FINALDocument3 pagesBUS1AFB - Assignment 1 - Semester 1 2020 - FINALHiep ThieuNo ratings yet

- C2A October 2011 Exam PDFDocument8 pagesC2A October 2011 Exam PDFJeff GundyNo ratings yet

- BUS1AFB - Assignment 2 - Semester 1 2021 - FINALDocument4 pagesBUS1AFB - Assignment 2 - Semester 1 2021 - FINALChi NguyenNo ratings yet

- EnronDocument5 pagesEnronSabina GartaulaNo ratings yet

- Final-Term Exam (Take-Home) Fall - 2020 Department of Business AdministrationDocument4 pagesFinal-Term Exam (Take-Home) Fall - 2020 Department of Business Administrationsyed aliNo ratings yet

- Corporate Finance, Term-II, 2021-23Document2 pagesCorporate Finance, Term-II, 2021-23keshav kumarNo ratings yet

- 212ECN Normal Coursework March 2017Document5 pages212ECN Normal Coursework March 2017phuongfeoNo ratings yet

- Nanyang Technological UniversityDocument9 pagesNanyang Technological UniversityShuHao ShiNo ratings yet

- Accounting Feb 2021Document11 pagesAccounting Feb 2021TAQQI JAFFARINo ratings yet

- Case Study Before UTS LD21-20221028051637Document5 pagesCase Study Before UTS LD21-20221028051637Abbas MayhessaNo ratings yet

- 2324 BM Formative Assignment Brief FinalDocument10 pages2324 BM Formative Assignment Brief Finalprplayz55No ratings yet

- Bafi3184 - Businee Finance: Case StudyDocument22 pagesBafi3184 - Businee Finance: Case Studytuan lyNo ratings yet

- Actuarial CT5 General Insurance, Life and Health Contingencies Sample Paper 2011Document11 pagesActuarial CT5 General Insurance, Life and Health Contingencies Sample Paper 2011ActuarialAnswers50% (2)

- ACC220 Course SyllabusDocument8 pagesACC220 Course Syllabuskayd08No ratings yet

- TACC102 Individual Assignmentdocx 9527Document4 pagesTACC102 Individual Assignmentdocx 9527ashibhallau0% (1)

- Example Exam MoF Corporate Finance Instructor 12042016Document4 pagesExample Exam MoF Corporate Finance Instructor 12042016ciaoNo ratings yet

- RETIREMENT PLANNING - Background InformationDocument3 pagesRETIREMENT PLANNING - Background InformationAngelo OdalNo ratings yet

- S2 Paper1 2000 Exam PDFDocument6 pagesS2 Paper1 2000 Exam PDFJeff GundyNo ratings yet

- Practice of Ratio Analysis, InterpretationDocument4 pagesPractice of Ratio Analysis, InterpretationZarish AzharNo ratings yet

- IBF Assesment SP 20Document2 pagesIBF Assesment SP 20anonymous dcNo ratings yet

- ACC701 Mid Exam - Question PaperDocument5 pagesACC701 Mid Exam - Question PaperSALESHNI LALNo ratings yet

- Sample Online MidtermDocument11 pagesSample Online MidtermXue ChenNo ratings yet

- Korteweg FBE 432: Corporate Financial Strategy Spring 2017Document6 pagesKorteweg FBE 432: Corporate Financial Strategy Spring 2017PeterNo ratings yet

- MAA363 - T1 2020 - Assessment 1 PDFDocument4 pagesMAA363 - T1 2020 - Assessment 1 PDF與終人.No ratings yet

- BFA312 Case Study S1 22Document7 pagesBFA312 Case Study S1 22Farooq HaiderNo ratings yet

- P1 Sept 2013Document20 pagesP1 Sept 2013Anu MauryaNo ratings yet

- Finance Exam Jan - 2017Document9 pagesFinance Exam Jan - 2017mrdirriminNo ratings yet

- Beatrice Peabody CaseDocument14 pagesBeatrice Peabody CaseSindhura Mahendran100% (9)

- 2019 AIC22A2 Test 1Document10 pages2019 AIC22A2 Test 1kdmd.wwNo ratings yet

- Problem Set 4Document2 pagesProblem Set 4rtchuidjangnanaNo ratings yet

- Principles of Accounting (AAF001-1) Referral or Deferral AssignmentDocument3 pagesPrinciples of Accounting (AAF001-1) Referral or Deferral Assignmentmohammedakbar88No ratings yet

- LI&R Val S1 2020 M08 Exercise 8.5Document2 pagesLI&R Val S1 2020 M08 Exercise 8.5Jeff GundyNo ratings yet

- The Institute of Actuaries of Australia Life Insurance Marking Guide & Solutions Paper 1 2000 ExaminationsDocument23 pagesThe Institute of Actuaries of Australia Life Insurance Marking Guide & Solutions Paper 1 2000 ExaminationsJeff GundyNo ratings yet

- C2A October 2007 Solution PDFDocument48 pagesC2A October 2007 Solution PDFJeff GundyNo ratings yet

- C2A October 2011 Exam PDFDocument8 pagesC2A October 2011 Exam PDFJeff GundyNo ratings yet

- Marking Guide: Institute of Actuaries of Australia Course 2A Life Insurance October 2008 ExaminationsDocument28 pagesMarking Guide: Institute of Actuaries of Australia Course 2A Life Insurance October 2008 ExaminationsJeff GundyNo ratings yet

- Institute of Actuaries of Australia Course 2A Life Insurance October 2011 Examinations Marking GuideDocument31 pagesInstitute of Actuaries of Australia Course 2A Life Insurance October 2011 Examinations Marking GuideJeff GundyNo ratings yet

- The Institute of Actuaries of Australia Life Insurance 2002 Examinations Paper One Answer All 6 Questions. (15 Marks)Document6 pagesThe Institute of Actuaries of Australia Life Insurance 2002 Examinations Paper One Answer All 6 Questions. (15 Marks)Jeff GundyNo ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- C2A October 2010 Questions and Solutions PDFDocument35 pagesC2A October 2010 Questions and Solutions PDFJeff GundyNo ratings yet

- C2A October 2009 Questions & Solutions PDFDocument23 pagesC2A October 2009 Questions & Solutions PDFJeff GundyNo ratings yet

- Subject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsDocument8 pagesSubject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsJeff GundyNo ratings yet

- C2A October 2005 Exam PDFDocument7 pagesC2A October 2005 Exam PDFJeff GundyNo ratings yet

- C2A October 2006 Solution PDFDocument33 pagesC2A October 2006 Solution PDFJeff GundyNo ratings yet

- C2A October 2005 Solution PDFDocument35 pagesC2A October 2005 Solution PDFJeff GundyNo ratings yet

- Subject Title: C2A: Life InsuranceDocument8 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- C2A April 2012 Questions and Solutions PDFDocument25 pagesC2A April 2012 Questions and Solutions PDFJeff GundyNo ratings yet

- C2A May 2006 Exam PDFDocument8 pagesC2A May 2006 Exam PDFJeff GundyNo ratings yet

- C2A May 2005 Solution PDFDocument29 pagesC2A May 2005 Solution PDFJeff GundyNo ratings yet

- C2A May 2006 Solution PDFDocument31 pagesC2A May 2006 Solution PDFJeff GundyNo ratings yet

- C2A - May - LAQ - 1 - Australian Investment DataDocument7 pagesC2A - May - LAQ - 1 - Australian Investment DataJeff GundyNo ratings yet

- C2A - May - LAQ - 1 - Examlife Product LiabilitiesDocument1 pageC2A - May - LAQ - 1 - Examlife Product LiabilitiesJeff GundyNo ratings yet

- S2 Paper1 2000 Exam PDFDocument6 pagesS2 Paper1 2000 Exam PDFJeff GundyNo ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- The Institute of Actuaries of Australia Life Insurance 1999 Examinations Paper One Answer All 7 Questions QUESTION 1 (10 Marks)Document6 pagesThe Institute of Actuaries of Australia Life Insurance 1999 Examinations Paper One Answer All 7 Questions QUESTION 1 (10 Marks)Jeff GundyNo ratings yet

- Institute of Actuaries of Australia Course 2A Life Insurance May 2005 Examinations Answer All 6 Questions. (9 Marks)Document9 pagesInstitute of Actuaries of Australia Course 2A Life Insurance May 2005 Examinations Answer All 6 Questions. (9 Marks)Jeff GundyNo ratings yet

- S2 Paper1 2001 Solutions PDFDocument10 pagesS2 Paper1 2001 Solutions PDFJeff GundyNo ratings yet

- Recovery Hospital Cash FactsheetDocument4 pagesRecovery Hospital Cash FactsheetMuhammad ArifinNo ratings yet

- Marine InsuranceDocument15 pagesMarine InsuranceRanadeep PoddarNo ratings yet

- INSURANCE Double Insurance-ReinsuranceDocument5 pagesINSURANCE Double Insurance-ReinsuranceHonnely Palen-Garzon Aponar-MahilumNo ratings yet

- Reliance Life Insurance CompanyDocument65 pagesReliance Life Insurance Companygunpriya100% (1)

- CODE - 00491630201020000022: Declaration of Insurance PolicyDocument2 pagesCODE - 00491630201020000022: Declaration of Insurance PolicyKeller Brown Jnr100% (1)

- SurveyorDocument2 pagesSurveyordtr170% (2)

- Pride Microfinance RFPDocument53 pagesPride Microfinance RFPGodfrey BukomekoNo ratings yet

- Upr Long Term 1Document16 pagesUpr Long Term 1Arra ValerieNo ratings yet

- FINN 326 - Financial Risk Management-Bushra NaqviDocument5 pagesFINN 326 - Financial Risk Management-Bushra NaqviMuhammad Idrees0% (1)

- Actuarial Valuation LifeDocument22 pagesActuarial Valuation Lifenitin_007100% (1)

- 2009 Condo InsuranceCertificateDocument3 pages2009 Condo InsuranceCertificateEliot HoumanNo ratings yet

- MD Abdullah InsuDocument2 pagesMD Abdullah Insug8x5sxkfjnNo ratings yet

- Liability Insurance Certificate 2020Document2 pagesLiability Insurance Certificate 2020Majdi BelguithNo ratings yet

- IFM Class 10 CH 7 NotesDocument4 pagesIFM Class 10 CH 7 NotesVidhit VermaNo ratings yet

- OmniOMS Output GenerationDocument1 pageOmniOMS Output GenerationRanjith SriNo ratings yet

- Insurance Law CasesDocument15 pagesInsurance Law CasesPrincess Rosshien HortalNo ratings yet

- Turner's Contractor Controlled Insurance ProgramDocument26 pagesTurner's Contractor Controlled Insurance ProgramdanielschumanNo ratings yet

- NISM-Series-XXII: Fixed Income Securities Certification ExaminationDocument5 pagesNISM-Series-XXII: Fixed Income Securities Certification ExaminationVinay ChhedaNo ratings yet

- Updated COIDocument1 pageUpdated COIDragoş RîciuNo ratings yet

- Accident & Sickness Study ChecklistDocument3 pagesAccident & Sickness Study ChecklistYuhui ShiNo ratings yet

- 2021 SBU Red Book Volume 2 - Commercial LawDocument123 pages2021 SBU Red Book Volume 2 - Commercial LawJong CjaNo ratings yet

- Types of Construction InsuranceDocument3 pagesTypes of Construction InsuranceThe UntamedNo ratings yet

- INTL 303 Syllabus - 2019 WinterDocument8 pagesINTL 303 Syllabus - 2019 WinterWilliam LattaoNo ratings yet

- P&C InsuranceDocument145 pagesP&C Insuranceshanmuga89100% (7)

- Stat 475 Life ContingenciesDocument42 pagesStat 475 Life ContingenciesTama AmpkNo ratings yet

- PGDBFI Project Format 2023-24 (1) RAVI 123Document38 pagesPGDBFI Project Format 2023-24 (1) RAVI 123bhagyashrikand0524No ratings yet

- InsuranceDocument16 pagesInsuranceJustynaNo ratings yet

- PT Kmdi QQ PT Roz Voz Auta Palembang-Pekanbaru 24 November 2022Document1 pagePT Kmdi QQ PT Roz Voz Auta Palembang-Pekanbaru 24 November 2022337Corp -HardCORENo ratings yet

- Unit 2 Objectives VipulDocument7 pagesUnit 2 Objectives Vipulamrutapillai06No ratings yet