Professional Documents

Culture Documents

The Institute of Actuaries of Australia Life Insurance 2002 Examinations Paper One Answer All 6 Questions. (15 Marks)

Uploaded by

Jeff GundyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Institute of Actuaries of Australia Life Insurance 2002 Examinations Paper One Answer All 6 Questions. (15 Marks)

Uploaded by

Jeff GundyCopyright:

Available Formats

THE INSTITUTE OF ACTUARIES OF AUSTRALIA

LIFE INSURANCE 2002 EXAMINATIONS

PAPER ONE

Answer all 6 questions.

QUESTION 1 (15 marks)

You are the Appointed Actuary for a medium-sized Australian life office writing a range of

risk and investment products typical for a modern day Australian Life Insurance Company.

A new Director, who has never before been a Director of a Life Insurance Company, has

approached you. He would like you to explain to him how product profitability is

measured for life insurance business. He is familiar with the concept of an internal rate of

return and knows that the company has a hurdle rate of 15% per annum.

Draft a response to the Director outlining the possible ways to evaluate and then analyse

the profitability of a life office. In your reply, provide an example of how profitability can

be measured and analysed for a term insurance product. (There is no need to provide

numerical examples).

(15 marks)

© 2002 The Institute of Actuaries of Australia Page 1 of 6

THE INSTITUTE OF ACTUARIES OF AUSTRALIA

LIFE INSURANCE 2002 EXAMINATIONS

PAPER ONE

QUESTION 2 (23 marks)

A medium-sized Bancassurer employs you. The marketing department is planning a series

of direct marketing campaigns to the bank’s client base. The planned campaigns include:

1. Mortgage Protection Cover for new loans.

2. Accidental Death Cover with no underwriting.

3. Term Life Cover with a simple application form with five YES/NO

underwriting questions.

(a) For each of these products, provide suggestions for product features and eligibility

criteria that you consider to be appropriate to manage the risk to the Bancassurer

associated with these products. (15 marks)

(b) You have also been asked to approve the specifications for the client base extract that

will be used to generate the names and addresses for those clients being sent the

various offers. List any principles you would use to determine the actuarial criteria

for selecting which lives should be included or excluded; and then list the various

criteria you would recommend for each of the three products, given that the database

contains at least the following data fields:

• Name

• Address

• Postcode

• Sex

• Date of birth

• Marital status

• Occupation (5 digit Australian Standard Industry Classification Code)

• Income bracket

• Current products with the group

You can request additional data fields if sufficient reason is given to justify the

complexity and cost of requesting the data.

(8 marks)

© 2002 The Institute of Actuaries of Australia Page 2 of 6

THE INSTITUTE OF ACTUARIES OF AUSTRALIA

LIFE INSURANCE 2002 EXAMINATIONS

PAPER ONE

QUESTION 3 (23 marks)

You are the Appointed Actuary of a company with a number of statutory funds, including a

full range of policies sold over a number of years. The company was originally a mutual

entity but demutualised a number of years ago. The statutory funds include participating

policies although these products are now closed to new business.

In the most recent year, the company has made significant investments in new systems to

allow more efficient operations going forward. The expenses involved are significant and

hence there is some concern that an appropriate allocation basis is applied.

(a) Explain the role of the Appointed Actuary, the Directors and External Auditors in

respect of expense allocation. (5 marks)

(b) Comment on the main issues that need to be considered by the Appointed Actuary in

respect of the situation referred to above. (8 marks)

(c) Following receipt of your initial recommendation, the Chief Executive has stated

that, in her view, more expenses should be allocated to the participating

policyholders, as they will benefit from expense savings achieved through use of the

system for administering their policies. Outline what comments you would make in

addition to those outlined in part (b) or which points you would reinforce in response

to these comments. (5 marks)

(d) What actions would be appropriate for you to take as the Appointed Actuary in this

situation? (5 marks)

© 2002 The Institute of Actuaries of Australia Page 3 of 6

THE INSTITUTE OF ACTUARIES OF AUSTRALIA

LIFE INSURANCE 2002 EXAMINATIONS

PAPER ONE

QUESTION 4 (10 marks)

You are the Investment Actuary of a company which has mainly investment business, both

investment linked and investment account business. You work with the Investment Team

and Product Managers to determine the declared interest rate for the investment account

business. An Investment Equalisation Reserve (“IER”) is held by the company (as part of

the policy liabilities) for smoothing of returns over time on investment account business.

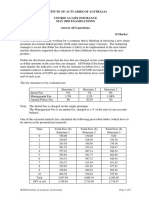

In the most recent year, the following results were observed for the investment account

business.

$m

Premium 100

Investment Income 200

Claims 100

Expenses 50

Increase in Reserves 100

MoS Profit 50

Interest Credited to Accounts 75

IER at Beginning 400

IER at End 525

MoS Reserve at Beginning 3,000

MoS Reserve at End 3,100

(a) Explain the relationship between surplus, MoS profits, Investment Equalisation

Reserve, investment return and interest credited to accounts in these results.

(4 marks)

(b) Discuss the issues that you will have considered in determining the crediting rate

policy. (4 marks)

(c) Some policies have an additional payment to be paid on termination that reflects the

performance of the policy in the most recent years. Comment briefly on the potential

reasons for this approach. (2 marks)

© 2002 The Institute of Actuaries of Australia Page 4 of 6

THE INSTITUTE OF ACTUARIES OF AUSTRALIA

LIFE INSURANCE 2002 EXAMINATIONS

PAPER ONE

QUESTION 5 (15 marks)

You have recently become the Appointed Actuary for a relatively new Australian Life

Insurance Company. The Company has been writing Term Life and Disability Income

Insurance business for four years.

On your first day at work, during the course of discussions with the Managing Director, he

comments that the previous actuary was very conservative when he set the discontinuance

rate assumptions, particularly for Disability Income Insurance. In the Managing Director’s

view, the experience to date was volatile, and that given time, the experience for Disability

Income and Term Insurance will move closer together.

When you return to your office, you review the most recent Financial Condition Report,

which contains high-level details of experience investigations showing lapse rates of 6%

for Term Insurance and 23% for Disability Income Insurance.

(a) What factors might contribute to the discontinuance experience varying so widely

between these products. List five factors and explain your reasoning for each factor.

(10 marks)

(b) What additional investigations should be conducted to more fully understand the

experience? List five additional investigations and outline what you are looking for

in each investigation. (5 marks)

© 2002 The Institute of Actuaries of Australia Page 5 of 6

THE INSTITUTE OF ACTUARIES OF AUSTRALIA

LIFE INSURANCE 2002 EXAMINATIONS

PAPER ONE

QUESTION 6 (14 marks)

You are the Product Development Actuary for a medium-sized life office that writes a

variety of individual risk and investment products. Your company’s Distribution Manager

has approached you regarding his suggestion that the company introduce a Group Salary

Continuance Product.

His initial comments to you are that as the individual product features are very similar to

the group product, he expects that the development effort required by the actuarial team to

introduce the new group product should be relatively small, as the company has been

writing income protection business for a number of years.

Draft your response to the Distribution Manager commenting on his proposed approach to

the product development for the Group Salary Continuance Product.

(14 marks)

END OF PAPER ONE

© 2002 The Institute of Actuaries of Australia Page 6 of 6

You might also like

- C2A April 2012 Questions PDFDocument6 pagesC2A April 2012 Questions PDFJeff GundyNo ratings yet

- The Institute of Actuaries of Australia Life Insurance 1998 Examinations Specialist Level Paper One Answer All 7 Questions Question 1 8 MarksDocument8 pagesThe Institute of Actuaries of Australia Life Insurance 1998 Examinations Specialist Level Paper One Answer All 7 Questions Question 1 8 MarksJeff GundyNo ratings yet

- S2 Paper1 2000 Exam PDFDocument6 pagesS2 Paper1 2000 Exam PDFJeff GundyNo ratings yet

- C2A May 2013 Questions PDFDocument5 pagesC2A May 2013 Questions PDFJeff GundyNo ratings yet

- C2A October 2011 Exam PDFDocument8 pagesC2A October 2011 Exam PDFJeff GundyNo ratings yet

- Subject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsDocument8 pagesSubject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsJeff GundyNo ratings yet

- The Institute of Actuaries of Australia Life Insurance 1997 Examinations Specialist Level Paper One Answer All 6 Questions Question 1 22 MarksDocument7 pagesThe Institute of Actuaries of Australia Life Insurance 1997 Examinations Specialist Level Paper One Answer All 6 Questions Question 1 22 MarksJeff GundyNo ratings yet

- C2A October 2005 Exam PDFDocument7 pagesC2A October 2005 Exam PDFJeff GundyNo ratings yet

- Subject Title: C2A: Life InsuranceDocument8 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- Course 2A Life Insurance May 2013 Examinations Answer Two Questions. (30 MARKS)Document9 pagesCourse 2A Life Insurance May 2013 Examinations Answer Two Questions. (30 MARKS)Jeff GundyNo ratings yet

- LI&R Valuation 2020 S1 Tutorial 6 - ExerciseDocument7 pagesLI&R Valuation 2020 S1 Tutorial 6 - ExerciseJeff GundyNo ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- 2011 DP-IU Fall (PAK LPM)Document39 pages2011 DP-IU Fall (PAK LPM)Noura ShamseddineNo ratings yet

- AuditingDocument8 pagesAuditingShahadath HossenNo ratings yet

- Business Management and Strategy: Certified Finance and Accounting Professional Stage ExaminationsDocument3 pagesBusiness Management and Strategy: Certified Finance and Accounting Professional Stage ExaminationsRamzan AliNo ratings yet

- CP11 221 EXAM Final CleanDocument5 pagesCP11 221 EXAM Final CleanElroy PereiraNo ratings yet

- AGSO J07 Question Paper Final DraftDocument4 pagesAGSO J07 Question Paper Final Draftatish7No ratings yet

- Subjectst32005 2009Document191 pagesSubjectst32005 2009chan chadoNo ratings yet

- Auditing Question Bank 1Document6 pagesAuditing Question Bank 1Shahadath HossenNo ratings yet

- Examination: Subject SA6 Investment Specialist ApplicationsDocument148 pagesExamination: Subject SA6 Investment Specialist Applicationschan chadoNo ratings yet

- FandI Subj401!1!199904 ExampaperDocument5 pagesFandI Subj401!1!199904 ExampaperrishiNo ratings yet

- Sem 5 QuesDocument5 pagesSem 5 QuesHumayra RahmanNo ratings yet

- CP11 September22 EXAMDocument5 pagesCP11 September22 EXAMElroy PereiraNo ratings yet

- The Institute of Actuaries of Australia Life Insurance 1999 Examinations Paper One Answer All 7 Questions QUESTION 1 (10 Marks)Document6 pagesThe Institute of Actuaries of Australia Life Insurance 1999 Examinations Paper One Answer All 7 Questions QUESTION 1 (10 Marks)Jeff GundyNo ratings yet

- Working CapitalDocument31 pagesWorking CapitalHiya SanganiNo ratings yet

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- Examination: Subject SA1 Health and Care Specialist ApplicationsDocument168 pagesExamination: Subject SA1 Health and Care Specialist Applicationschan chadoNo ratings yet

- 5BUSS001W.Business Decision Making - sem3.finalOTA2020Document10 pages5BUSS001W.Business Decision Making - sem3.finalOTA2020Raza AliNo ratings yet

- Ocean Manufacturing Inc. Case Study: Before Accepting A New Client, An Auditor Should Establish ReasonableDocument7 pagesOcean Manufacturing Inc. Case Study: Before Accepting A New Client, An Auditor Should Establish ReasonableAssignemntNo ratings yet

- Examination: Subject ST5 Finance and Investment Specialist Technical ADocument151 pagesExamination: Subject ST5 Finance and Investment Specialist Technical Achan chadoNo ratings yet

- Pakistan: Time Allowed: 03 Hours Maximum Marks: 100 Roll No.Document3 pagesPakistan: Time Allowed: 03 Hours Maximum Marks: 100 Roll No.Muhammad Zahid FaridNo ratings yet

- ACCA P2 Revision Mock June 2013 ANSWERS Version 6 FINAL at 24 Feb PDFDocument19 pagesACCA P2 Revision Mock June 2013 ANSWERS Version 6 FINAL at 24 Feb PDFPiyal HossainNo ratings yet

- November 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument22 pagesNovember 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- Cp1a 0-2Document4 pagesCp1a 0-2Rahul IyerNo ratings yet

- LI&R Valuation 2020 S1 Tutorial 8Document6 pagesLI&R Valuation 2020 S1 Tutorial 8Jeff GundyNo ratings yet

- C2A May 2006 Exam PDFDocument8 pagesC2A May 2006 Exam PDFJeff GundyNo ratings yet

- Business Strategy: Page 1 of 8Document8 pagesBusiness Strategy: Page 1 of 8vikkyNo ratings yet

- CP3 Exam PaperDocument4 pagesCP3 Exam Paperaa4e11No ratings yet

- Sub RM 502Document77 pagesSub RM 502sohail merchantNo ratings yet

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocument174 pagesExamination: Subject SA3 General Insurance Specialist Applicationschan chadoNo ratings yet

- CA1 - Paper I - IAI - QP - 0512Document4 pagesCA1 - Paper I - IAI - QP - 0512charmingsheenaNo ratings yet

- Examination: Subject CA1 Core Applications Concepts Paper 2 (Liabilities and Asset Liability Management)Document178 pagesExamination: Subject CA1 Core Applications Concepts Paper 2 (Liabilities and Asset Liability Management)chan chadoNo ratings yet

- SINU ACC 704 Assignment 1Document2 pagesSINU ACC 704 Assignment 1Jake LukmistNo ratings yet

- 2019 AIC22A2 Test 1Document10 pages2019 AIC22A2 Test 1kdmd.wwNo ratings yet

- Sub Rma 503Document10 pagesSub Rma 503Areeb BaqaiNo ratings yet

- Information Transparency: Can You Value What You Cannot See?Document24 pagesInformation Transparency: Can You Value What You Cannot See?Taranga SenNo ratings yet

- SPM Test-3 Q. Paper (CH 8 To 10) FinalDocument2 pagesSPM Test-3 Q. Paper (CH 8 To 10) FinalMuhammad Abid QaziNo ratings yet

- School of Business and Law: AssignmentDocument8 pagesSchool of Business and Law: AssignmentMHANo ratings yet

- Institute of Actuaries of Australia Course 2A Life Insurance May 2005 Examinations Answer All 6 Questions. (9 Marks)Document9 pagesInstitute of Actuaries of Australia Course 2A Life Insurance May 2005 Examinations Answer All 6 Questions. (9 Marks)Jeff GundyNo ratings yet

- Assignment - Corporate FinanceDocument9 pagesAssignment - Corporate FinanceShivam GoelNo ratings yet

- Nism 5 A - Mutual Fund Exam - Practice Test 6 - Copy - PDF (Secured) - Adobe ReaderDocument24 pagesNism 5 A - Mutual Fund Exam - Practice Test 6 - Copy - PDF (Secured) - Adobe ReaderNithin VarghzzNo ratings yet

- FandI ST2 200509 ExampaperDocument3 pagesFandI ST2 200509 ExampaperHafiz IqbalNo ratings yet

- 2002 8I Fall (PAK LPM)Document20 pages2002 8I Fall (PAK LPM)Noura ShamseddineNo ratings yet

- MAA363 - T1 2020 - Assessment 1 PDFDocument4 pagesMAA363 - T1 2020 - Assessment 1 PDF與終人.No ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- IandF CA11 201409 ExamDocument4 pagesIandF CA11 201409 ExamSaad MalikNo ratings yet

- Cge101 Exam Paper 2022 02Document7 pagesCge101 Exam Paper 2022 02Kurt BrockerhoffNo ratings yet

- Institute and Faculty of Actuaries: Subject SA2 - Life Insurance Specialist ApplicationsDocument5 pagesInstitute and Faculty of Actuaries: Subject SA2 - Life Insurance Specialist Applicationsdickson phiriNo ratings yet

- LI&R Val S1 2020 M08 Exercise 8.5Document2 pagesLI&R Val S1 2020 M08 Exercise 8.5Jeff GundyNo ratings yet

- Institute of Actuaries of Australia Course 2A Life Insurance October 2011 Examinations Marking GuideDocument31 pagesInstitute of Actuaries of Australia Course 2A Life Insurance October 2011 Examinations Marking GuideJeff GundyNo ratings yet

- Subject Title: C2A: Life InsuranceDocument8 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- C2A October 2009 Questions & Solutions PDFDocument23 pagesC2A October 2009 Questions & Solutions PDFJeff GundyNo ratings yet

- C2A October 2010 Questions and Solutions PDFDocument35 pagesC2A October 2010 Questions and Solutions PDFJeff GundyNo ratings yet

- The Institute of Actuaries of Australia Life Insurance Marking Guide & Solutions Paper 1 2000 ExaminationsDocument23 pagesThe Institute of Actuaries of Australia Life Insurance Marking Guide & Solutions Paper 1 2000 ExaminationsJeff GundyNo ratings yet

- Marking Guide: Institute of Actuaries of Australia Course 2A Life Insurance October 2008 ExaminationsDocument28 pagesMarking Guide: Institute of Actuaries of Australia Course 2A Life Insurance October 2008 ExaminationsJeff GundyNo ratings yet

- C2A October 2007 Solution PDFDocument48 pagesC2A October 2007 Solution PDFJeff GundyNo ratings yet

- C2A October 2005 Solution PDFDocument35 pagesC2A October 2005 Solution PDFJeff GundyNo ratings yet

- C2A April 2012 Questions and Solutions PDFDocument25 pagesC2A April 2012 Questions and Solutions PDFJeff GundyNo ratings yet

- Subject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsDocument8 pagesSubject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsJeff GundyNo ratings yet

- C2A October 2005 Exam PDFDocument7 pagesC2A October 2005 Exam PDFJeff GundyNo ratings yet

- C2A October 2006 Solution PDFDocument33 pagesC2A October 2006 Solution PDFJeff GundyNo ratings yet

- Course 2A Life Insurance May 2013 Examinations Answer Two Questions. (30 MARKS)Document9 pagesCourse 2A Life Insurance May 2013 Examinations Answer Two Questions. (30 MARKS)Jeff GundyNo ratings yet

- C2A May 2006 Exam PDFDocument8 pagesC2A May 2006 Exam PDFJeff GundyNo ratings yet

- C2A May 2006 Solution PDFDocument31 pagesC2A May 2006 Solution PDFJeff GundyNo ratings yet

- C2A May 2005 Solution PDFDocument29 pagesC2A May 2005 Solution PDFJeff GundyNo ratings yet

- C2A LAQ October 2012 Questions PDFDocument4 pagesC2A LAQ October 2012 Questions PDFJeff GundyNo ratings yet

- C2A - May - LAQ - 1 - Australian Investment DataDocument7 pagesC2A - May - LAQ - 1 - Australian Investment DataJeff GundyNo ratings yet

- C2A - May - LAQ - 1 - Examlife Product LiabilitiesDocument1 pageC2A - May - LAQ - 1 - Examlife Product LiabilitiesJeff GundyNo ratings yet

- Subject Title: C2A: Life InsuranceDocument9 pagesSubject Title: C2A: Life InsuranceJeff GundyNo ratings yet

- Course 2A Life Insurance October 2012 Examinations Answer All Two Questions. (30 Marks)Document7 pagesCourse 2A Life Insurance October 2012 Examinations Answer All Two Questions. (30 Marks)Jeff GundyNo ratings yet

- The Institute of Actuaries of Australia Life Insurance 1999 Examinations Paper One Answer All 7 Questions QUESTION 1 (10 Marks)Document6 pagesThe Institute of Actuaries of Australia Life Insurance 1999 Examinations Paper One Answer All 7 Questions QUESTION 1 (10 Marks)Jeff GundyNo ratings yet

- Institute of Actuaries of Australia Course 2A Life Insurance May 2005 Examinations Answer All 6 Questions. (9 Marks)Document9 pagesInstitute of Actuaries of Australia Course 2A Life Insurance May 2005 Examinations Answer All 6 Questions. (9 Marks)Jeff GundyNo ratings yet

- S2 Paper1 2001 Solutions PDFDocument10 pagesS2 Paper1 2001 Solutions PDFJeff GundyNo ratings yet

- Uyanage Heshan Ruwantha de Silva (21478284)Document6 pagesUyanage Heshan Ruwantha de Silva (21478284)Natasha de SilvaNo ratings yet

- What Is Cybersecurity Insurance and Why Is It ImportantDocument3 pagesWhat Is Cybersecurity Insurance and Why Is It ImportantJaveed A. KhanNo ratings yet

- Pengendalian Keselamatan Dan Kesehatan Kerja Pada Proyek Pembangunan HotelDocument21 pagesPengendalian Keselamatan Dan Kesehatan Kerja Pada Proyek Pembangunan HotelIren DamimaNo ratings yet

- Marketing Analsyis For Fish Farming BusinessDocument12 pagesMarketing Analsyis For Fish Farming BusinessNabeel AhmadNo ratings yet

- Household Hazardous Waste ManagementDocument15 pagesHousehold Hazardous Waste ManagementAWADHI NGELANo ratings yet

- Shoppers Stop - Company Profile: Also ReadDocument4 pagesShoppers Stop - Company Profile: Also ReadSuman KumarNo ratings yet

- Marketing Plan: Prepared & Submitted By: Boys & Girls Clubs of Greater Any Town Area Marketing CommitteeDocument18 pagesMarketing Plan: Prepared & Submitted By: Boys & Girls Clubs of Greater Any Town Area Marketing CommitteeDaniel Hutapea100% (1)

- Runwal Commerz Kanjurmarg BrochureDocument25 pagesRunwal Commerz Kanjurmarg BrochureInfo SaifNo ratings yet

- Strunal CZ, A.s.: Strunal Schönbach S.R.O. Is A String Instrument Manufacturer BasedDocument4 pagesStrunal CZ, A.s.: Strunal Schönbach S.R.O. Is A String Instrument Manufacturer BasedXAREG VARNo ratings yet

- Mini Importation Business Masterclass - Make Money in Nigeria With Mini ImportationDocument26 pagesMini Importation Business Masterclass - Make Money in Nigeria With Mini ImportationAzubuike Henry OziomaNo ratings yet

- DeepSeas MDR Managed Detection Response OverviewDocument2 pagesDeepSeas MDR Managed Detection Response OverviewZach MaynardNo ratings yet

- An Empirical Analysis of Growth of Msme in India and Role of SidbiDocument14 pagesAn Empirical Analysis of Growth of Msme in India and Role of SidbiShubhi SinghNo ratings yet

- Csc-Roii-Acic and Lddap of Payment For Online TrainingDocument4 pagesCsc-Roii-Acic and Lddap of Payment For Online TrainingJale Ann A. EspañolNo ratings yet

- Dream Construction Profile 9.9Document8 pagesDream Construction Profile 9.9virNo ratings yet

- Cadweld Multi: An Evolution in Exothermic WeldingDocument2 pagesCadweld Multi: An Evolution in Exothermic Weldingakshaf10No ratings yet

- Question Bank Consumer's Equilibrium and Demand Multiple Choice Questions: Choose The Correct AnswerDocument37 pagesQuestion Bank Consumer's Equilibrium and Demand Multiple Choice Questions: Choose The Correct AnswerJayant VijanNo ratings yet

- Deed of Sale of Motor VehicleDocument1 pageDeed of Sale of Motor VehicleJoemar CalunaNo ratings yet

- Profood International CorporationDocument26 pagesProfood International CorporationYew MercadoNo ratings yet

- Employment Agencies in BangladeshDocument23 pagesEmployment Agencies in BangladeshMd Abdur Rahman Bhuiyan0% (1)

- The Lost Chapters of Overdeliver PDFDocument174 pagesThe Lost Chapters of Overdeliver PDFDouglas MarquesNo ratings yet

- Michael Howlett The Criteria For Effective Policy Design Character and Context in Policy Instrument Choices.Document36 pagesMichael Howlett The Criteria For Effective Policy Design Character and Context in Policy Instrument Choices.Antonin DolohovNo ratings yet

- DTC95B GTSGMBH 12 23Document19 pagesDTC95B GTSGMBH 12 23Esteban Enrique Posan BalcazarNo ratings yet

- Ogdcl Internship Program 2021Document1 pageOgdcl Internship Program 2021masroor umairNo ratings yet

- Intermediate Accounting 2 (Notes Payable) - Problem 2Document3 pagesIntermediate Accounting 2 (Notes Payable) - Problem 2DM MontefalcoNo ratings yet

- News Release INDY Result 6M22Document7 pagesNews Release INDY Result 6M22Rama Usaha MandiriNo ratings yet

- Bharti Airtel LTD.: Your Account Summary This Month'S ChargesDocument5 pagesBharti Airtel LTD.: Your Account Summary This Month'S ChargesMadhukar Reddy KukunoorNo ratings yet

- CFA一级百题预测 财务Document90 pagesCFA一级百题预测 财务Evelyn YangNo ratings yet

- Module 10 PAS 33Document4 pagesModule 10 PAS 33Jan JanNo ratings yet

- Understanding FIDICDocument329 pagesUnderstanding FIDICmekkawi6650100% (4)

- MBA - Hand BookDocument17 pagesMBA - Hand Bookt_syamprasadNo ratings yet