Professional Documents

Culture Documents

Cost Accounting

Cost Accounting

Uploaded by

group 10 ratings0% found this document useful (0 votes)

6 views4 pagesOriginal Title

cost-accounting.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views4 pagesCost Accounting

Cost Accounting

Uploaded by

group 1Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

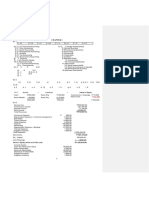

1.

C

2. D

3. C

4. B

5. C

6. C

7. $336

Raw Material, Beginning 75

Raw Materials Purchased (326 + 85 – 75) 336

Raw Materials Available for use 411

Less: Ending Raw Materials inventory ( 85)

Raw Materials used in Production $326

8. C

Direct Material 326 326

Direct Labor x $225

Manufacturing overhead x (.60) 135

Total Manufacturing Cost 686 $686

326 + x + x(.60) = 686 x (.60)

1.60 x = 360 226 x (.60)

1.60 = 1.60 135

x = 225

9. C

Beginning work in process inventor 80

Manufacturing cost 686

Total Work in Process for the Period 766

Less: Ending Work in Process (30)

Cost of Goods Manufactured $736

10. $716

Beginning Finished Goods Inventory 90

Cost of G oods Manufactured

736

Total Goods Available for Sale 826

Ending Finished Goods (110)

Cost of Goods Sold $716

11. C

10,000 – ( x × 5) = 7,400

5 x = 2,700

5 = 5

x = 540

540 + 1,460 =$ 2,000

12. B

Fixed Manufacturing Overhead Cost 90,000 – 84,000 = 6,000

Increase in units in inventory 6,000 / 6 = 1,000

1,000 – 22,000 =$ 21,000

13. D

Unit cost produced 11

Less: Variable unit produced cost (6)

Unit Manufacturing overhead 5 per unit

cost

Divided to: fixed manufacturing overhead (3000)

Change in Inventory 600

Cost of Goods Sold Per Unit 9,000

Change in Inventory (600)

Unit Produced during the year $ 8,400

14. B

(1.75 + 1.25 + 0.50 + 0.60) – 9 = $4.9

Sales 90,000 x 4.9 441,000

Less: Fixed Expense 100,000

Selling and Administrative Expense 70,000

Net Income $271,000

15. B

16. D

17. Sales (100K x 40) 4,000,000

Less: Variable Expense 1,600,000

Contribution Margin (4M x 60%) 2,400,000

Less: Fixed Expense 1,900,000

Net Income 500,000

18. B

Profit = (CM Ratio x Sales) – Fixed Expense

= ( x × 50,000) – 100,000

= 50,000x – 100,000

50,000 x = 100,000 50,000

50,000

x = .20/20%

19. A

20. D

21. D

22. A

23. B

Profit = (Sales – variable expense) – Fixed Expense

10 x = ( x - .30x ) – 50,000

10x - .70 x = - 50,000

.60 x = -50,000

.60 .60

Sales = 83,333 / 2 per unit cost = catfish to be sold

= 41,667

24. A

Total Fixed Cost 150,000

Break-Even Point 1,000

Profit Before tax = 150+500 = 650

25. D

Sales 300,000

Increase in sales (300K x 20%) 60,000

360,000

Sales 360,000

Less: Variable Cost 240,000

Contribution Margin 120,000

Less: Fixed Cost 40,000

Profit 80,000

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 100 Greatest Sales LettersDocument247 pages100 Greatest Sales Letterswannaboo80% (5)

- Boxer CodexDocument13 pagesBoxer Codexgroup 1100% (2)

- GST Chart Book by CA Pranav ChandakDocument54 pagesGST Chart Book by CA Pranav ChandakAman AhujaNo ratings yet

- Cost Accounting Interim ExamDocument5 pagesCost Accounting Interim Examgroup 1No ratings yet

- Golden Minute Film/movie: Date Subject GroupDocument7 pagesGolden Minute Film/movie: Date Subject Groupgroup 1No ratings yet

- Notes PayableDocument2 pagesNotes Payablegroup 1No ratings yet

- Depression RRLDocument15 pagesDepression RRLgroup 1No ratings yet

- Activity: Km. 53 Pan Philippines Highway, Barangay Milagrosa, Calamba City, LagunaDocument2 pagesActivity: Km. 53 Pan Philippines Highway, Barangay Milagrosa, Calamba City, Lagunagroup 1No ratings yet

- DELOS SANTOS - CM3 - NotesACT PDFDocument2 pagesDELOS SANTOS - CM3 - NotesACT PDFgroup 1No ratings yet

- Personality 2. Extrovert 3. Empathetic 4. Impression 5. Realistic 6. GuideDocument1 pagePersonality 2. Extrovert 3. Empathetic 4. Impression 5. Realistic 6. Guidegroup 1No ratings yet

- KM 53 Pan-Philippine Hwy, Calamba, Laguna 4027 Philippines: UAEB-100Document1 pageKM 53 Pan-Philippine Hwy, Calamba, Laguna 4027 Philippines: UAEB-100group 1No ratings yet

- IA3 ACTIVITY Sept 18 PDFDocument7 pagesIA3 ACTIVITY Sept 18 PDFgroup 1No ratings yet

- Foreign Studies About Inventory SystemDocument2 pagesForeign Studies About Inventory SystemAnonymous 1ze6UmWM571% (49)

- 165207019767Document281 pages165207019767warehouseNo ratings yet

- Diamond FinalDocument13 pagesDiamond FinalGohar AbidNo ratings yet

- Amm MCQDocument18 pagesAmm MCQnabil sayed100% (1)

- Venkat MM WM Ariba ResumeDocument3 pagesVenkat MM WM Ariba ResumeGopi KrishnanNo ratings yet

- Yatra: Dhruv Shringi Ceo & Founder Started in 2006 With 3 Member Rose To 700+ in 2008Document4 pagesYatra: Dhruv Shringi Ceo & Founder Started in 2006 With 3 Member Rose To 700+ in 2008Vikram PandyaNo ratings yet

- Boss Naik Accounti NG Series: ReceivablesDocument8 pagesBoss Naik Accounti NG Series: ReceivablesKian BarredoNo ratings yet

- Post Graduate Diploma in Business Management (PGDBM) I Term Assignment (2017) Dbm-416: Quantitative and Research MethodsDocument4 pagesPost Graduate Diploma in Business Management (PGDBM) I Term Assignment (2017) Dbm-416: Quantitative and Research Methodssiva prakashNo ratings yet

- Retail Market Strategy: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedDocument32 pagesRetail Market Strategy: Retailing Management 8E © The Mcgraw-Hill Companies, All Rights ReservedSangen RaiNo ratings yet

- Chapter 4 Short and Medium Term Decision MakingDocument43 pagesChapter 4 Short and Medium Term Decision MakingNurina NabilahNo ratings yet

- Case VF CorpDocument2 pagesCase VF Corpalven liuNo ratings yet

- Direct Costing and Absorption Costing QuestionsDocument2 pagesDirect Costing and Absorption Costing QuestionsAbigailGraceCascoNo ratings yet

- Financial Accounting Bbaw2103 Final 2Document18 pagesFinancial Accounting Bbaw2103 Final 2mel100% (1)

- Business Requirements Document Template: Tech Comm TemplatesDocument3 pagesBusiness Requirements Document Template: Tech Comm TemplatesShaily GandhiNo ratings yet

- (In Thousands) : 2-35 Computing Cost of Goods Purchased and Cost of Goods SoldDocument2 pages(In Thousands) : 2-35 Computing Cost of Goods Purchased and Cost of Goods SoldKarthikeyan GopalNo ratings yet

- Expanding Into Europe - A Guide For US EntrepreneursDocument70 pagesExpanding Into Europe - A Guide For US EntrepreneursIndex Ventures100% (18)

- CHAPTER 5 COST ALLOCATION RevisedDocument12 pagesCHAPTER 5 COST ALLOCATION RevisedyebegashetNo ratings yet

- Part 1 MathematicsDocument7 pagesPart 1 MathematicsRonald A. CarniceNo ratings yet

- Analyzing Business Markets: Prepared By, Mr. Nishant AgrawalDocument20 pagesAnalyzing Business Markets: Prepared By, Mr. Nishant AgrawalAisha NadeemNo ratings yet

- The Right Attitude Towards The "Selling" FunctionDocument14 pagesThe Right Attitude Towards The "Selling" FunctioneeNo ratings yet

- Visual Merchandising in PepperfryDocument2 pagesVisual Merchandising in PepperfryDHARAM GANERIWALNo ratings yet

- Solution of Chapter 9 Books ProblemsDocument30 pagesSolution of Chapter 9 Books ProblemssaraNo ratings yet

- Negotiation Styles Script ExampleDocument6 pagesNegotiation Styles Script ExamplePierre Anthony100% (1)

- CMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionDocument4 pagesCMPC 131 Finals Quiz 1 Short Term AY 2018 2019 SolutionAlinah AquinoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)sanketNo ratings yet

- Module 2 Tax On IndividualsDocument12 pagesModule 2 Tax On Individualscha11No ratings yet

- Evaluation and Feedback MechanismsDocument3 pagesEvaluation and Feedback MechanismsNikita TamrakarNo ratings yet

- Partnership and Corporation Accounting Chapter 1 SolManDocument11 pagesPartnership and Corporation Accounting Chapter 1 SolManDavid BarletaNo ratings yet