Professional Documents

Culture Documents

Bagabag National High School: Business Finance

Uploaded by

marissa casareno almuete0 ratings0% found this document useful (0 votes)

219 views1 pageOriginal Title

Practice Set

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

219 views1 pageBagabag National High School: Business Finance

Uploaded by

marissa casareno almueteCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Bagabag National High School

Bagabag, Nueva Vizcaya

Business Finance

PRACTICE SET:

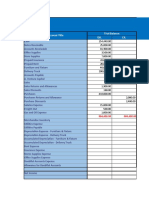

1. Using the following (scrambled) accounts, prepare a balance sheet for

ABC, a retail company, for the year ending in December 31, 2014.

Assume that these are the only Balance Sheet Accounts.

Accounts Payable 39,000

Accrued Expenses 8,000

Accumulated Depreciation 51,000

Additional Paid-In Capital 86,000

Allowance for Doubtful Accounts 2,000

Cash 23,000

Common Stock (PHP0.20 par) 45,000

Current Portion of L.T. Debt 6,000

Gross Accounts Receivable 40,000

Gross Fixed Assets 486,000

Inventories 54,000

Long-Term Debt 210,000

Net Accounts Receivable 38,000

Net Fixed Assets 435,000

Retained Earnings 138,000

Short-Term Bank Loan (Notes 18,000

Payable)

2. Prepare a multi-step income statement for the retail company, ABC, for

the year ending December 31, 2014 given the information below:

Advertising expenditures 68,000

Beginning inventory 256,000

Depreciation 78,000

Ending inventory 248,000

Gross Sales 3,210,000

Interest expense 64,000

Lease payments 52,000

Management salaries 240,000

Materials purchases 2,425,000

R&D expenditures 35,000

Repairs and maintenance costs 22,000

Returns and allowances 48,000

Taxes 51,000

You might also like

- Financial Statement ExamDocument2 pagesFinancial Statement ExamTam TamNo ratings yet

- Factors Affecting Youth Entrepreneurship 1Document51 pagesFactors Affecting Youth Entrepreneurship 1Niraj AryalNo ratings yet

- Adjusting Entries for Uncollectible AccountsDocument6 pagesAdjusting Entries for Uncollectible AccountsKristine IvyNo ratings yet

- Contra AccountsDocument6 pagesContra AccountsRaviSankarNo ratings yet

- Financial Statement of Merchandising BusinessDocument3 pagesFinancial Statement of Merchandising BusinessDina Rose SardumaNo ratings yet

- Acc ActivityDocument6 pagesAcc ActivityJoyce Eguia100% (1)

- ch04.ppt - Income Statement and Related InformationDocument68 pagesch04.ppt - Income Statement and Related InformationAmir ContrerasNo ratings yet

- Jose Calves Realty Year-End Adjustments and Financial StatementsDocument2 pagesJose Calves Realty Year-End Adjustments and Financial StatementsMariecris BatasNo ratings yet

- Adjusting Entries Company A ExercisesDocument19 pagesAdjusting Entries Company A ExercisesRodolfo CorpuzNo ratings yet

- I. Multiple Choice: Read and Analyze Each Item. Circle The Letter of The Best Answer. 1Document3 pagesI. Multiple Choice: Read and Analyze Each Item. Circle The Letter of The Best Answer. 1HLeigh Nietes-GabutanNo ratings yet

- Financial Accounting and Reporting Chapter 4 Problem 3Document1 pageFinancial Accounting and Reporting Chapter 4 Problem 3Paula BautistaNo ratings yet

- Erlinda Company Unadjusted Trial Balance WorksheetDocument12 pagesErlinda Company Unadjusted Trial Balance WorksheetJekoeNo ratings yet

- Certification Lost ReceiptDocument1 pageCertification Lost ReceiptShanghai RollNo ratings yet

- 03 Cash Flow Balance SheetsDocument13 pages03 Cash Flow Balance SheetsDanielle WatsonNo ratings yet

- Answer This To Be Checked On Tuesday, September 21, 2021Document2 pagesAnswer This To Be Checked On Tuesday, September 21, 2021Teresa Mae OrquiaNo ratings yet

- Samplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityDocument6 pagesSamplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityStar RamirezNo ratings yet

- Worksheet - Service - Cotton CompanyDocument7 pagesWorksheet - Service - Cotton CompanyJasmine ActaNo ratings yet

- FOA Final OutputDocument18 pagesFOA Final OutputGwyneth MogolNo ratings yet

- FABM 11 1stQDocument80 pagesFABM 11 1stQNiña Gloria Acuin Zaspa100% (1)

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- OLIVO - Lesson-1-Statistics-Quiz (1)Document2 pagesOLIVO - Lesson-1-Statistics-Quiz (1)Christine Joy DañosNo ratings yet

- ABM 3 Quarterly ExamDocument2 pagesABM 3 Quarterly ExamLenyBarrogaNo ratings yet

- Adjusting Entries QuizDocument2 pagesAdjusting Entries QuizOfelia YanosNo ratings yet

- Business Finance: Mrs. Leah O. RualesDocument28 pagesBusiness Finance: Mrs. Leah O. RualesCleofe Sobiaco100% (1)

- 10-Column Worksheet FormDocument1 page10-Column Worksheet Formobrie diazNo ratings yet

- Question Answer Chapter 2 FInancial ReportingDocument4 pagesQuestion Answer Chapter 2 FInancial ReportingnasirNo ratings yet

- Wright Technological College of Antique Senior High School Sibalom Branch Sibalom, AntiqueDocument6 pagesWright Technological College of Antique Senior High School Sibalom Branch Sibalom, AntiqueLen PenieroNo ratings yet

- Activity - Preparation of Financial StatementsDocument4 pagesActivity - Preparation of Financial StatementsJoy ValenciaNo ratings yet

- Comprehensive Problem: Flashback Activity 4Document1 pageComprehensive Problem: Flashback Activity 4James SyNo ratings yet

- Aveeno Booklet FinalDocument16 pagesAveeno Booklet FinalClaire Hacker0% (1)

- Summary Enhancing Qualitative CharacteristicsDocument3 pagesSummary Enhancing Qualitative CharacteristicsCahyani PrastutiNo ratings yet

- Accounting Cycle Journal Entries Without Chart of Accounts Case IIIDocument3 pagesAccounting Cycle Journal Entries Without Chart of Accounts Case IIIGoogle UserNo ratings yet

- Certified Bookkeeper Program: January 12, 19, 26 and February 2, 2007 ADB Ave. OrtigasDocument63 pagesCertified Bookkeeper Program: January 12, 19, 26 and February 2, 2007 ADB Ave. OrtigasAllen CarlNo ratings yet

- PT-1 Tayler HiroDocument2 pagesPT-1 Tayler HiroAris Jayme Jr.No ratings yet

- Cost AccumulationDocument43 pagesCost AccumulationEmm Jey100% (1)

- BA256 Final Exam Review CH 1 Through 7Document19 pagesBA256 Final Exam Review CH 1 Through 7Joey MannNo ratings yet

- Accounting Cycle for Merchandising BusinessDocument2 pagesAccounting Cycle for Merchandising BusinessAnne Alag100% (1)

- Basic Accounting Equation ExercisesDocument7 pagesBasic Accounting Equation ExerciseshIgh QuaLIty SVT100% (1)

- Chapter 4 - Industry AnalysisDocument37 pagesChapter 4 - Industry AnalysisMichael John OliveriaNo ratings yet

- Akmen CH 12 KelarDocument19 pagesAkmen CH 12 KelarFadhliyaFNo ratings yet

- W7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDocument8 pagesW7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDanica VetuzNo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Accounting ExercisesDocument41 pagesAccounting ExercisesKayla MirandaNo ratings yet

- Lou Bernardo Company October 2021 Trial Balance and AdjustmentsDocument2 pagesLou Bernardo Company October 2021 Trial Balance and AdjustmentsJasfer Niño100% (1)

- Edgar DetoyaDocument16 pagesEdgar DetoyaAngelica EltagonNo ratings yet

- Journalizing Merchandising TransactionsDocument3 pagesJournalizing Merchandising TransactionsMarian Augelio PolancoNo ratings yet

- Accounting ProjectDocument135 pagesAccounting ProjectMylene SalvadorNo ratings yet

- FAR 1st Monthly AssessmentDocument5 pagesFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- Midterm Business Math ReviewDocument4 pagesMidterm Business Math ReviewCJ WATTPADNo ratings yet

- Problems Problem 2-1 Multiple Choice (ACP)Document2 pagesProblems Problem 2-1 Multiple Choice (ACP)Jao FloresNo ratings yet

- Answer Keys - Test Bank - Fabm2Document10 pagesAnswer Keys - Test Bank - Fabm2Kevin Pereña GuinsisanaNo ratings yet

- Om TQM PrelimDocument19 pagesOm TQM PrelimAnthony John BrionesNo ratings yet

- Teresit Buenaflor Company FinancialsDocument12 pagesTeresit Buenaflor Company FinancialsAllecks Juel LuchanaNo ratings yet

- ACTIVITY 1 MabalaDocument5 pagesACTIVITY 1 MabalaJulie mabuyoNo ratings yet

- Accounting Cycle Journal Entries With Chart of AccountsDocument3 pagesAccounting Cycle Journal Entries With Chart of AccountsMay Rojas MortosNo ratings yet

- Job Order CostingDocument8 pagesJob Order CostingAndrea Nicole MASANGKAYNo ratings yet

- Quiz BowlDocument2 pagesQuiz Bowlaccounting probNo ratings yet

- General Journal Entries for Survey CompanyDocument24 pagesGeneral Journal Entries for Survey CompanyMc Clent CervantesNo ratings yet

- Application 1 (Basic Steps in Accounting)Document2 pagesApplication 1 (Basic Steps in Accounting)Maria Nezka Advincula86% (7)

- Q4-W1-CommissionsDocument23 pagesQ4-W1-Commissionsmarissa casareno almueteNo ratings yet

- Group-1-Real-life-problems-on-Mark-uo-Markdown-Mark-onDocument15 pagesGroup-1-Real-life-problems-on-Mark-uo-Markdown-Mark-onmarissa casareno almueteNo ratings yet

- Characteristics Social StratificationDocument14 pagesCharacteristics Social Stratificationmarissa casareno almueteNo ratings yet

- Business-Math-Q3-W1Document2 pagesBusiness-Math-Q3-W1marissa casareno almueteNo ratings yet

- Group-5-The-Marketing-Research-of-Budgeting-Skills-of-Business-Owners_03.04.2024Document12 pagesGroup-5-The-Marketing-Research-of-Budgeting-Skills-of-Business-Owners_03.04.2024marissa casareno almueteNo ratings yet

- Socialization and Career DevelopmentDocument24 pagesSocialization and Career Developmentmarissa casareno almueteNo ratings yet

- Course Outline in FABM 1Document5 pagesCourse Outline in FABM 1marissa casareno almueteNo ratings yet

- Q1 W2 Users of Accounting InformationDocument16 pagesQ1 W2 Users of Accounting Informationmarissa casareno almueteNo ratings yet

- Meaning and Nature of Social StratificationDocument11 pagesMeaning and Nature of Social Stratificationmarissa casareno almueteNo ratings yet

- Principles of Marketing QuizDocument1 pagePrinciples of Marketing Quizmarissa casareno almueteNo ratings yet

- Group1 The Impact of Mass Media On SOCIALIZATION Loreyn CairoDocument12 pagesGroup1 The Impact of Mass Media On SOCIALIZATION Loreyn Cairomarissa casareno almueteNo ratings yet

- Child Misbehaviour and Socialization IssuesDocument13 pagesChild Misbehaviour and Socialization Issuesmarissa casareno almueteNo ratings yet

- Socialization ReviewDocument8 pagesSocialization Reviewmarissa casareno almueteNo ratings yet

- Q1 W1 Intro To AccountingDocument20 pagesQ1 W1 Intro To Accountingmarissa casareno almueteNo ratings yet

- Ucsp Q1 W1Document17 pagesUcsp Q1 W1marissa casareno almueteNo ratings yet

- Ucsp Q1 W2 3Document18 pagesUcsp Q1 W2 3marissa casareno almueteNo ratings yet

- InnopreneurshipDocument9 pagesInnopreneurshipmarissa casareno almuete100% (1)

- Forms and Functions of Social Organizations Group ActivityDocument26 pagesForms and Functions of Social Organizations Group Activitymarissa casareno almueteNo ratings yet

- UCSP Q2 W8 New Challenges To Human Adaptation and Social ChangeDocument45 pagesUCSP Q2 W8 New Challenges To Human Adaptation and Social Changemarissa casareno almueteNo ratings yet

- Understanding Culture, Society and PoliticsDocument5 pagesUnderstanding Culture, Society and Politicsmarissa casareno almueteNo ratings yet

- QUIZ 2 UCSP Case StudiesDocument2 pagesQUIZ 2 UCSP Case Studiesmarissa casareno almueteNo ratings yet

- Work Immersion: (Quarter 4, Week 7)Document3 pagesWork Immersion: (Quarter 4, Week 7)marissa casareno almuete100% (1)

- Group 2 Project Jerwhyn Aquino ExplorerDocument8 pagesGroup 2 Project Jerwhyn Aquino Explorermarissa casareno almueteNo ratings yet

- Work Immersion (Quarter 3, Week 1 and 2) Learning Activity Sheet Work Ethics and Safety in The WorkplaceDocument6 pagesWork Immersion (Quarter 3, Week 1 and 2) Learning Activity Sheet Work Ethics and Safety in The Workplacemarissa casareno almueteNo ratings yet

- Q2 W3 Kinship and FamilyDocument20 pagesQ2 W3 Kinship and Familymarissa casareno almueteNo ratings yet

- Common Practices in Business OrganizationsDocument30 pagesCommon Practices in Business Organizationsmarissa casareno almueteNo ratings yet

- Work Immersion - 12 Q4-W6Document4 pagesWork Immersion - 12 Q4-W6marissa casareno almueteNo ratings yet

- Work Immersion - 12 Q4-W5: Learning Activity SheetDocument2 pagesWork Immersion - 12 Q4-W5: Learning Activity Sheetmarissa casareno almuete100% (1)

- Business Ethics and Social Responsibility (1 Quarter: Week 5)Document6 pagesBusiness Ethics and Social Responsibility (1 Quarter: Week 5)marissa casareno almueteNo ratings yet