Professional Documents

Culture Documents

Engineering Economics (BEG495MS)

Engineering Economics (BEG495MS)

Uploaded by

Subas Shrestha0 ratings0% found this document useful (0 votes)

10 views1 pageOriginal Title

Engineering Economics (BEG495MS).doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageEngineering Economics (BEG495MS)

Engineering Economics (BEG495MS)

Uploaded by

Subas ShresthaCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 1

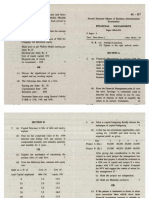

Q.N.3 (a) What is the significance of payback period method?

What are its

KHWOPA ENGINEERING COLLEGE drawbacks? [6]

ASSESSMENT - 2062 (EVEN) b) A man purchased a building 10 years ago for Rs. 25,00,000. Its

maintenance cost is Rs. 50,000 per year. At the end of six years, he

LEVEL:- B. E. (Computer) III/II spent Rs. 150,000 on roof repairs. After the end of 10 years, he sold the

SUBJECT:- BEG495MS, Engineering Economics building for Rs. 30,00,000. During the period of ownership, he put the

FULL MARKS:- 80 building on rent for Rs. 200,000 per year paid at the beginning of each

TIME:- 03:00 hrs. PASS MARKS:- 32 year. Use the FW method to evaluate this investment when his MARR

is 12% per year. [10]

Candidates are requested to give their answers in their own words as far as practicable.

Q.N.4 (a) What do you understand by time value of money? Describe with

Figures in the margin indicate full marks.

suitable examples. [4]

Attempt any FIVE questions. (b) Find the both types of B/C ratio using AW formulation. [12]

First cost= 100000

Q.N.1 (a) How does effective interest rate differ from nominal interest rate? [4]

Project Life= 15 yrs.

(b) The information given below shows the records of a manufacturing

Salvage value= 20000

company comparing the actual data with the data from standard cost

Annual Benefit= 75000

card. [12]

Annual O & M costs= 15000

Standard Actual

i= 15%

Production (units) 2000 7,500

Direct material (Kg) 8,000 72,000 Q.N.5 (a) What do you understand by value added tax (VAT)? [4]

Direct material cost(Rs) 1,60,000 1,29,600 (b) Using the present worth formulation recommend which one is the best

Direct labour hours 4,000 4,800 out of the following two projects. Assume repeatability. MARR = 18%

Direct labour cost (Rs) 1,00,000 1,20,000 [12]

Fixed overheads (Rs) 1,50,000 1,40,000 Project A Project B

Variable overheads (Rs) 50,000 50,000 Initial Investment 400,000 700,000

Salvage value 40,000 50,000

Calculate: (i) total material cost variance (ii) total wage variance

Annual revenues 150,000 160,000

(iii) variable overhead variance and (iv) fixed overhead variance

Annual cost 30,000 40,000

indicating the separate components of each variance.

Useful life (years) 6 8

Also indicate favorable and adverse variances.

Q.N.6 (a) Explain briefly Market Research. [4]

(b) Find the IRR for the following project: [12]

Q.N.2 (a) What do you understand by elements of cost. Explain overhead cost

End of year NET C.F.

and prime cost. [4]

0 -450,000

(b) Compute the ERR for the following project. [12]

1 - 42,500

End of Year Net Cash Flow

2 + 92,800

0 -10 million

3 +386,000

1 +1.8 million

4 +614,600

2 +1.8 million

5 - 202,200

3 +1.8 million

4 +1.8 million Q.N.7 Write short notes on (any FOUR) [4 X 4 = 16]

5 +1.8 million a. Economic system b. NPV

6 +1.8 million c. Decision tree d. Taxes law in Nepal

7 +1.8 million e. Continuous compounding f. Drawbacks of IRR

8 +2.8 million

*****

You might also like

- Tax Certification (W-9)Document1 pageTax Certification (W-9)Enter KenethNo ratings yet

- 02 Concept, Nature and Characteristics of Taxation and TaxesDocument4 pages02 Concept, Nature and Characteristics of Taxation and TaxesRonn Robby Rosales100% (2)

- Tax1 4compiDocument49 pagesTax1 4compiAnne Marieline Buenaventura100% (1)

- 4EC1 02 Que 20200305Document24 pages4EC1 02 Que 20200305Adeeba iqbalNo ratings yet

- Verification ReportDocument2 pagesVerification ReportMarvin GamboaNo ratings yet

- Answer All The Questions:: Discuss Briefly Explain The Steps of Value EngineeringDocument2 pagesAnswer All The Questions:: Discuss Briefly Explain The Steps of Value EngineeringSanjivee SachinNo ratings yet

- Cap BudDocument4 pagesCap Budyashikasoni8722No ratings yet

- December 2019Document20 pagesDecember 2019Kunal GargNo ratings yet

- Engineering EconomicsDocument32 pagesEngineering EconomicsbibekNo ratings yet

- This Test Is Only For Students of MS Consultancy ManagementDocument2 pagesThis Test Is Only For Students of MS Consultancy ManagementrudypatilNo ratings yet

- Units Or: 1 Which IsDocument5 pagesUnits Or: 1 Which IsTanvi PriyaNo ratings yet

- MG2451 ModelDocument2 pagesMG2451 ModelchandrasekarcncetNo ratings yet

- Capital Budgeting PDocument14 pagesCapital Budgeting PAjayNo ratings yet

- BMS College of Engineering, Bangalore-560019: I I I I I I I Iii IDocument3 pagesBMS College of Engineering, Bangalore-560019: I I I I I I I Iii Ihemavathi jayNo ratings yet

- Candidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarksDocument2 pagesCandidates Are Required To Give Their Answers in Their Own Words As Far As Practicable. The Figures in The Margin Indicate Full MarkssushilNo ratings yet

- Paper8 SolutionDocument15 pagesPaper8 SolutionSandeep BadinehalNo ratings yet

- BMS College of Engineering, Bangalore-560019: January 2015 Semester End Make Up ExaminationsDocument2 pagesBMS College of Engineering, Bangalore-560019: January 2015 Semester End Make Up Examinationshemavathi jayNo ratings yet

- Management AccountingDocument8 pagesManagement AccountingVinu VaviNo ratings yet

- BM-228 - FINAL Bca 3d Semm Model PapperDocument2 pagesBM-228 - FINAL Bca 3d Semm Model Papperfajal ansariNo ratings yet

- 4th Semester (Previous YEar Question Paper)Document88 pages4th Semester (Previous YEar Question Paper)HassanNo ratings yet

- Adobe Scan 12-Jan-2024 Accounts 3 SemDocument10 pagesAdobe Scan 12-Jan-2024 Accounts 3 SemRiya KumariNo ratings yet

- Ce 22 MWX HW4Document1 pageCe 22 MWX HW4Jonas Lemuel DatuNo ratings yet

- Faculty of Commerce and LawDocument4 pagesFaculty of Commerce and LawFaith MpofuNo ratings yet

- Answer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2Document16 pagesAnswer To PTP - Intermediate - Syllabus 2012 - Jun2014 - Set 2HustleSquadNo ratings yet

- BBB 2203 - Intermediate Micro Economics 2018 Year II Semester 1Document2 pagesBBB 2203 - Intermediate Micro Economics 2018 Year II Semester 1prittycarol8No ratings yet

- Solution 8Document16 pagesSolution 8zhafsafathimaNo ratings yet

- Bba FM 21Document3 pagesBba FM 21Kundan JhaNo ratings yet

- 57 International Financial Reporting Standards May 2022Document8 pages57 International Financial Reporting Standards May 2022premium info2222No ratings yet

- 2013MBA Sem II Financial Management - pdf2013Document3 pages2013MBA Sem II Financial Management - pdf2013Riya AgrawalNo ratings yet

- Ac5011 Ma Tca QuestionsDocument14 pagesAc5011 Ma Tca QuestionsyinlengNo ratings yet

- Unit IiDocument5 pagesUnit IiRohit SinghNo ratings yet

- Central College of Business Management: Mid Term Examination: February 2020Document2 pagesCentral College of Business Management: Mid Term Examination: February 2020UNik ROnz OFFICIALNo ratings yet

- CE 22 - Engineering Economy: General InstructionsDocument1 pageCE 22 - Engineering Economy: General InstructionsMarco ConopioNo ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- Facacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityDocument4 pagesFacacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityAbhayNo ratings yet

- Engineering Economics (BEG495MS) - 1Document2 pagesEngineering Economics (BEG495MS) - 1Subas ShresthaNo ratings yet

- Answer Any TWO Questions. All Questions Carry Equal MarksDocument3 pagesAnswer Any TWO Questions. All Questions Carry Equal MarksdinobalaNo ratings yet

- Befa Regular 22019Document2 pagesBefa Regular 22019reddy reddyNo ratings yet

- Engineering Economics (BEG495MS)Document1 pageEngineering Economics (BEG495MS)Subas ShresthaNo ratings yet

- Ce 8 Sem Construction Economics and Finance Jun 2017Document4 pagesCe 8 Sem Construction Economics and Finance Jun 2017Panna KurmiNo ratings yet

- Answer To PTP - Intermediate - Syllabus 2008 - Jun2014 - Set 1: Paper - 8: Cost & Management AccountingDocument16 pagesAnswer To PTP - Intermediate - Syllabus 2008 - Jun2014 - Set 1: Paper - 8: Cost & Management AccountingHarshit AggarwalNo ratings yet

- Management Information May-Jun 2016Document2 pagesManagement Information May-Jun 2016SomeoneNo ratings yet

- Capital Budgeting AnswerDocument18 pagesCapital Budgeting AnswerPiyush ChughNo ratings yet

- Capital Budgeting - Select ExercisesDocument12 pagesCapital Budgeting - Select ExercisesNitin MauryaNo ratings yet

- HSS01 ETE Autumn20Document4 pagesHSS01 ETE Autumn20NIKHIL KUMARNo ratings yet

- Sri Sairam Institute of Management Studies Chennai - 44Document4 pagesSri Sairam Institute of Management Studies Chennai - 44Anbarasu KrishnanNo ratings yet

- Sec-B2 2022Document3 pagesSec-B2 2022Sanchari DasNo ratings yet

- Alpa Bravo 123Document16 pagesAlpa Bravo 123adnan khanNo ratings yet

- Question PaperDocument36 pagesQuestion PaperSenthil Kumar Ganesan0% (1)

- Cost and Management Accounting - Ii - HonoursDocument4 pagesCost and Management Accounting - Ii - HonoursAnit LuckyNo ratings yet

- Capital BudgetingDocument8 pagesCapital BudgetingArun AntonyNo ratings yet

- Paper10 Set1 AnswerDocument17 pagesPaper10 Set1 Answerjunejajiya12No ratings yet

- Paper10 Set1 SolutionDocument17 pagesPaper10 Set1 SolutioninvincibleNo ratings yet

- Chapter 9 - Lecture Notes - Co HDDocument41 pagesChapter 9 - Lecture Notes - Co HDminhndn21405No ratings yet

- Ac PaperDocument6 pagesAc PaperAshwini SakpalNo ratings yet

- BMP6015 FRM - Exam PaperDocument7 pagesBMP6015 FRM - Exam PaperIulian RaduNo ratings yet

- Part-A - Strategic Management Accounting: Multiple Choice Questions (MCQS)Document33 pagesPart-A - Strategic Management Accounting: Multiple Choice Questions (MCQS)ARIF HUSSAIN AN ENGLISH LECTURER FOR ALL CLASSESNo ratings yet

- Suggested Answer - Syl16 - June2019 - Paper - 15 Final Examination: Suggested Answers To QuestionsDocument26 pagesSuggested Answer - Syl16 - June2019 - Paper - 15 Final Examination: Suggested Answers To QuestionsPola PolzNo ratings yet

- Bazg521 Nov25 AnDocument2 pagesBazg521 Nov25 AnDheeraj RaiNo ratings yet

- Assignment 1Document2 pagesAssignment 1ilyas muhammadNo ratings yet

- 4 Management Information Questions Nov Dec 2019 CLDocument2 pages4 Management Information Questions Nov Dec 2019 CLToahaNo ratings yet

- CE 22 - Engineering Economics: Problem SetDocument1 pageCE 22 - Engineering Economics: Problem SetNathan TanNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Efficiency of Investment in a Socialist EconomyFrom EverandEfficiency of Investment in a Socialist EconomyMieczyslaw RakowskiNo ratings yet

- FDG FoundationDocument1 pageFDG FoundationSubas ShresthaNo ratings yet

- System: Items Default Require D Setting DescriptionDocument7 pagesSystem: Items Default Require D Setting DescriptionSubas Shrestha100% (2)

- POE16S-1AFG User Manual Power Over Ethernet and Data ExtenderDocument3 pagesPOE16S-1AFG User Manual Power Over Ethernet and Data ExtenderSubas ShresthaNo ratings yet

- 138ADocument21 pages138ASubas ShresthaNo ratings yet

- Engineering Mathematics I: Course DescriptionDocument3 pagesEngineering Mathematics I: Course DescriptionSubas ShresthaNo ratings yet

- Electronic Devices and Circuits: Course DescriptionDocument4 pagesElectronic Devices and Circuits: Course DescriptionSubas ShresthaNo ratings yet

- Jan138 SowDocument2 pagesJan138 SowSubas ShresthaNo ratings yet

- Specifi Ed Skilled WorkerDocument4 pagesSpecifi Ed Skilled WorkerSubas ShresthaNo ratings yet

- Object Oriented Programming in C++Document4 pagesObject Oriented Programming in C++Subas ShresthaNo ratings yet

- Digital Logic SyllabusDocument5 pagesDigital Logic SyllabusSubas ShresthaNo ratings yet

- Web Technology and Programming IDocument5 pagesWeb Technology and Programming ISubas ShresthaNo ratings yet

- Engineering Mathematics II: Course DescriptionDocument3 pagesEngineering Mathematics II: Course DescriptionSubas ShresthaNo ratings yet

- Engineering Mathematics III: EG 2104 SHDocument2 pagesEngineering Mathematics III: EG 2104 SHSubas ShresthaNo ratings yet

- Probability & Statistics (BEG203HS) - 1Document2 pagesProbability & Statistics (BEG203HS) - 1Subas ShresthaNo ratings yet

- Engineering Chemistry II: Course DescriptionDocument4 pagesEngineering Chemistry II: Course DescriptionSubas ShresthaNo ratings yet

- Computer Graphics (BEG375CO)Document1 pageComputer Graphics (BEG375CO)Subas ShresthaNo ratings yet

- Microprocessor Based Instrumentation (BEG332EC)Document1 pageMicroprocessor Based Instrumentation (BEG332EC)Subas ShresthaNo ratings yet

- Probability & Statistics (BEG203HS)Document1 pageProbability & Statistics (BEG203HS)Subas ShresthaNo ratings yet

- Engineering Economics (BEG495MS) - 1Document2 pagesEngineering Economics (BEG495MS) - 1Subas ShresthaNo ratings yet

- Database Management System (DBMS) (BEG376CO)Document2 pagesDatabase Management System (DBMS) (BEG376CO)Subas ShresthaNo ratings yet

- Major Components of An IPS: Risk & Return On The IPSDocument2 pagesMajor Components of An IPS: Risk & Return On The IPSRosa Estefany EspinozaNo ratings yet

- (Baldomar, Bernabe, Carpiso, Dy, Fuentes, Quiben) : Final ExamDocument4 pages(Baldomar, Bernabe, Carpiso, Dy, Fuentes, Quiben) : Final ExamJohn Christian Emmanuelle FuentesNo ratings yet

- Use CONTEXT CLUES To Determine The Correct DICTIONARY ENTRYDocument3 pagesUse CONTEXT CLUES To Determine The Correct DICTIONARY ENTRYAriane Zgheia May Castueras0% (1)

- 7 Commissioner of Internal Revenue v. John Gotamco & Sons, Inc.Document6 pages7 Commissioner of Internal Revenue v. John Gotamco & Sons, Inc.Vianice BaroroNo ratings yet

- Project Report On TAXATION LAW-II: Abatement of Duty On Damaged or Deteriorated GoodsDocument15 pagesProject Report On TAXATION LAW-II: Abatement of Duty On Damaged or Deteriorated GoodsShreya100% (1)

- Chapter 3 - Page 6 Financial Statement Analysis Answer: D Diff: M NDocument2 pagesChapter 3 - Page 6 Financial Statement Analysis Answer: D Diff: M NpompomNo ratings yet

- 7Document2 pages7Jen Bernadette CiegoNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementVampire LadyNo ratings yet

- PDF International Taxation in A Nutshell Mindy Herzfeld Ebook Full ChapterDocument53 pagesPDF International Taxation in A Nutshell Mindy Herzfeld Ebook Full Chapterkenneth.gillard346100% (2)

- Appeals and RevisionDocument44 pagesAppeals and RevisionabcNo ratings yet

- Reviewer Mga BoplaxDocument10 pagesReviewer Mga BoplaxJay-R Delos SantosNo ratings yet

- Kolkata Municipal Corporation: A Case Study On Finance: Bhoomika U 2067608Document8 pagesKolkata Municipal Corporation: A Case Study On Finance: Bhoomika U 2067608bhoomika shanakarNo ratings yet

- Lutz v. Araneta, 98 Phil 148Document5 pagesLutz v. Araneta, 98 Phil 148Dom ValdezNo ratings yet

- 2 Topic2 Residence StatusDocument19 pages2 Topic2 Residence StatusIskandar Zulkarnain KamalluddinNo ratings yet

- ct-1 Income TaxDocument2 pagesct-1 Income TaxKartik LuthraNo ratings yet

- Soal K12 21.02.2024Document9 pagesSoal K12 21.02.2024Sugandi AldiNo ratings yet

- Joshua de Jesus Bsba 3B: Tax Sales TaxDocument7 pagesJoshua de Jesus Bsba 3B: Tax Sales TaxJoshua de JesusNo ratings yet

- Summary Rules of Prizes and Winnings For Individual TaxpayersDocument2 pagesSummary Rules of Prizes and Winnings For Individual TaxpayersAllia AntalanNo ratings yet

- Bonam PartemDocument2 pagesBonam PartemAarti100% (3)

- Principle of Unjust EnrichmentDocument3 pagesPrinciple of Unjust EnrichmentAanchal KashyapNo ratings yet

- UntitledDocument8 pagesUntitledgraceNo ratings yet

- Amended Tax Credit Certificate 2022: 9371000KA Pps NoDocument2 pagesAmended Tax Credit Certificate 2022: 9371000KA Pps NoJose ArevaloNo ratings yet

- 2022 Certified Statement of IncomeDocument2 pages2022 Certified Statement of IncomeAnne Socorro AbellanosaNo ratings yet

- Paystub TjmaxxDocument1 pagePaystub Tjmaxxyishii258000No ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)perfora7orNo ratings yet