Professional Documents

Culture Documents

Case 7 An Introduction To Debt Policy and Value

Case 7 An Introduction To Debt Policy and Value

Uploaded by

dd0 ratings0% found this document useful (0 votes)

65 views5 pagesOriginal Title

372503263-Case-7-An-Introduction-to-Debt-Policy-and-Value-xlsx.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

65 views5 pagesCase 7 An Introduction To Debt Policy and Value

Case 7 An Introduction To Debt Policy and Value

Uploaded by

ddCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 5

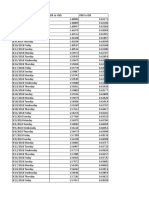

Problem 1: Value of Assets

0% Debt/ 25% Debt/ 50% Debt/

100% Equity 75% Equity 50% Equity

Book Value of Debt 0 $ 2,500.00 $ 5,000.00

Book Value of Equity $ 10,000.00 $ 7,500.00 $ 5,000.00

Market Value of Debt 0 $ 2,500.00 $ 5,000.00

Market Value of Equity $ 10,000.00 $ 8,350.00 $ 6,700.00

Pretax Cost of Debt (rd) 0.05 0.05 0.05

After-Tax Cost of Debt (ri) 0.033 0.033 0.033

Market Value Weights of

Debt 0 0.23 0.43

Equity 1 0.77 0.57

Unlevered Beta 0.80 0.80 0.80

Levered Beta 0.80 0.96 1.19

Risk-Free Rate 0.05 0.05 0.05

Market Premium 0.06 0.06 0.06

Cost of Equity (re) 0.10 0.11 0.12

Cost of Debt 0.033 0.033 0.033

Weighted-Average Cost of Capital 0.10 0.09 0.08

EBIT $ 1,485.00 $ 1,485.00 $ 1,485.00

Taxes (@ 34%) $ 504.90 $ 504.90 $ 504.90

EBIAT $ 980.10 $ 980.10 $ 980.10

+ Depreciation $ 500.00 $ 500.00 $ 500.00

- Capital exp. $ (500.00) $ (500.00) $ (500.00)

+ Change in net working capital 0 0 0

OCF 1,480.10 1,480.10 1,480.10

NFAI $ 500.00 $ 500.00 $ 500.00

NCAI 0 0 0

Free Cash Flow $ 980.10 $ 980.10 $ 980.10

Value of Assets (FCF/WACC) $ 10,001.02 $ 10,851.11 $ 11,701.19

Problem 2: Value of Equity and Debt

0% Debt/ 25% Debt/ 50% Debt/

100% Equity 75% Equity 50% Equity

Cash flow to creditors:

Interest 0 $ 125.00 $ 250.00

Pretax cost of debt (rd) 0.05 0.05 0.05

Value of debt: (CF/rd) 0 $ 2,500.00 $ 5,000.00

Cash flow to shareholders:

EBIT $ 1,485.00 $ 1,485.00 $ 1,485.00

- Interest 0 ($125) ($250)

Pretax profit $ 1,485.00 $ 1,360.00 $ 1,235.00

Taxes (@ 34%) $ 504.90 $ 462.40 $ 419.90

Net income $ 980.10 $ 897.60 $ 815.10

+ Depreciation $ 500.00 $ 500.00 $ 500.00

- Capital exp. $ (500.00) $ (500.00) $ (500.00)

+ Change in net working capital 0 0 0

- Debt amortization 0 0 0

Residual cash flow $ 980.10 $ 897.60 $ 815.10

Cost of equity 0.10 0.11 0.12

Value of equity (CF/re) $ 10,001.02 $ 8,350.93 $ 6,700.82

Value of equity plus value of debt $ 10,001.02 $ 10,850.93 $ 11,700.82

Problem 3: Business Flows and Financing Effects

0% Debt/ 25% Debt/ 50% Debt/

100% Equity 75% Equity 50% Equity

Pure Business Cash Flows:

EBIT $ 1,485 $ 1,485 $ 1,485

Taxes (@ 34%) $ (505) $ (505) $ (505)

EBIAT $ 980 $ 980 $ 980

+ Depreciation $ 500 $ 500 $ 500

- Capital exp. $ (500) $ (500) $ (500)

+ Change in net working capital 0 0 0

Cash Flow $ 980 $ 980 $ 980

Unlevered Beta 0.8 0.8 0.8

Risk-Free Rate 0.05 0.05 0.05

Market Premium 0.06 0.06 0.06

Unlevered WACC 9.80% 9.80% 9.80%

Value of Pure Business Flows:

(FCF/Unlevered WACC) $ 10,001.02 $ 10,001.02 $ 10,001.02

Financing Cash Flows

Interest 0 $ (125.00) $ (250.00)

Tax Reduction 0 $ (42.50) $ (85.00)

Pretax Cost of Debt 0.05 0.05 0.05

Value of Financing Effect:

(Tax Reduction/Pretax Cost of Debt) $ - $ (850.00) $ (1,700.00)

Total Value (Sum of Values of

Pure Business Flows and Financing Effects) $ 10,001.02 $ 10,851.02 $ 11,701.02

0% Debt/ 25% Debt/ 50% Debt/

100% Equity 75% Equity 50% Equity

Value of Asset $ 10,001.02 $ 10,851.02 $ 11,701.02

Cash Paid Out $ - $ 2,500.00 $ 5,000.00

Total Market Value of Equity $ 10,001.02 $ 8,351.02 $ 6,701.02

Number of Original Shares 1,000 1,000 1,000

Total Value Per Share $ 10.00 $ 10.85 $ 11.70

Exhibit 1

Koppers Company, Inc.

Before After

Recapitalization Recapitalization

Book Value Balance Sheets

Net working capital $ 212,453.00 $ 1,778,139.00

Fixed assets $ 601,446.00 $ 601,446.00

Total assets $ 813,899.00 $ 2,379,585.00

Additional debt $ 1,565,686.00

Long-term debt $ 172,409.00 $ 1,738,095.00

Deferred taxes, etc. $ 195,616.00 $ 195,616.00

Preferred stock $ 15,000.00 $ 15,000.00

Common equity $ 430,874.00 $ 430,874.00

Total capital $ 813,899.00 $ 2,379,585.00

Market-Value Balance Sheets

Net working capital $ 212,453.00 $ 1,778,139.00

Fixed assets $ 1,618,081.00 $ 1,618,081.00

PV debt tax shield $ 58,619.00 $ 590,952.30

Total assets $ 1,889,153.00 $ 3,987,172.30

Long term debt $ 172,409.00 $ 1,738,095.00

Deferred taxes, etc. $ - $ -

Preferred stock $ 15,000.00 $ 15,000.00

Common equity $ 1,701,744.00 $ 2,234,077.30

Total capital $ 1,889,153.00 $ 3,987,172.30

Number of shares $ 28,128.00 $ 28,128.00

Price per share $ 60.50 $ 79.43

Value to Public Shareholders

Cash received $ - $ 1,565,686.00

Value of shares $ 1,701,744.00 $ 2,234,077.30

Total $ 1,701,744.00 $ 3,799,763.30

Total per share $ 60.50 $ 135.09

You might also like

- Case 9 - Honeywell Inc and Integrated Risk ManagementDocument18 pagesCase 9 - Honeywell Inc and Integrated Risk ManagementAnthony KwoNo ratings yet

- Foreign Exchange Hedging Strategies at General MotorsDocument7 pagesForeign Exchange Hedging Strategies at General MotorsYun Clare Yang0% (1)

- List of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case PreparationDocument4 pagesList of Case Questions: Case #5: Fonderia Di Torino S.P.A Questions For Case Preparationdd100% (2)

- The Investment DetectiveDocument10 pagesThe Investment Detectivewiwoaprilia100% (1)

- The Investment Detective Case StudyDocument3 pagesThe Investment Detective Case StudyItsCj100% (1)

- Aqa Accn3 W SMS 07Document12 pagesAqa Accn3 W SMS 07arsenal992No ratings yet

- The Consistent Traders BlueprintDocument15 pagesThe Consistent Traders BlueprintPaul Vu100% (2)

- SG 4 - Answer Form For Case Mannx - OTCDocument2 pagesSG 4 - Answer Form For Case Mannx - OTCFadhila Hanif100% (1)

- PAS 33-Earnings Per ShareDocument26 pagesPAS 33-Earnings Per ShareGeoff MacarateNo ratings yet

- Accounting EquationDocument6 pagesAccounting EquationShiny NatividadNo ratings yet

- I. Case BackgroundDocument7 pagesI. Case BackgroundHiya BhandariBD21070No ratings yet

- SG 4 - Answer Form For Assignments of Film Tragedy of Commons and Beautiful MindDocument3 pagesSG 4 - Answer Form For Assignments of Film Tragedy of Commons and Beautiful MindFadhila HanifNo ratings yet

- Fonderia Di Torino Case Study GroupDocument15 pagesFonderia Di Torino Case Study GroupFarhan SoepraptoNo ratings yet

- London Pop Concert TreePlanDocument2 pagesLondon Pop Concert TreePlanTri Septia Rahmawati KaharNo ratings yet

- Investment DetectiveDocument5 pagesInvestment DetectiveNadya Rizkita100% (1)

- Nike CaseDocument7 pagesNike CaseNindy Darista100% (1)

- Nike Inc Cost of Capital - Syndicate 1 (Financial Management)Document26 pagesNike Inc Cost of Capital - Syndicate 1 (Financial Management)natya lakshitaNo ratings yet

- 29116520Document6 pages29116520Rendy Setiadi MangunsongNo ratings yet

- Fonderia TorinoDocument3 pagesFonderia TorinoMatilda Sodji100% (1)

- The Demand For Sweet Potatoes in The United States: Business EconomicsDocument8 pagesThe Demand For Sweet Potatoes in The United States: Business EconomicsAlhabu GamingNo ratings yet

- Final Exam - Manfin - EMBA61 - 2020Document12 pagesFinal Exam - Manfin - EMBA61 - 2020NurIndah100% (1)

- Syndicate 7 - Nike Inc. Cost of CapitalDocument8 pagesSyndicate 7 - Nike Inc. Cost of CapitalAnthony Kwo100% (1)

- Arcadia - Syndicate 9Document6 pagesArcadia - Syndicate 9Uus FirdausNo ratings yet

- Case 26 An Introduction To Debt Policy ADocument5 pagesCase 26 An Introduction To Debt Policy Amy VinayNo ratings yet

- Managerial Finance AssignmentDocument5 pagesManagerial Finance AssignmentvinneNo ratings yet

- Syndicate 7 - Nike Inc. Cost of CapitalDocument8 pagesSyndicate 7 - Nike Inc. Cost of CapitalAnthony Kwo100% (1)

- AN INTRODUCTION TO DEBT POLICY AND VALUE Case Syndicate 1 Cliff, Uri, Ary, KevinDocument7 pagesAN INTRODUCTION TO DEBT POLICY AND VALUE Case Syndicate 1 Cliff, Uri, Ary, KevinAntonius CliffSetiawanNo ratings yet

- Syndicate 1 An Introduction To Debt Policy and ValueDocument9 pagesSyndicate 1 An Introduction To Debt Policy and ValueBernadeta PramudyaWardhaniNo ratings yet

- Investment DetectiveDocument16 pagesInvestment Detectiveabhilasha_yadav_1100% (2)

- Investment Detective CaseDocument3 pagesInvestment Detective CaseWidyawan Widarto 闘志50% (2)

- An Introduction To Debt Policy and Value - Syndicate 4Document9 pagesAn Introduction To Debt Policy and Value - Syndicate 4Henni RahmanNo ratings yet

- Fonderia Di Torino SDocument15 pagesFonderia Di Torino SYrnob RokieNo ratings yet

- Yeat Valves and Control Inc For ScribdDocument9 pagesYeat Valves and Control Inc For ScribdRizky Yoga Pratama100% (1)

- Syndicate 1 - Investment DetectiveDocument3 pagesSyndicate 1 - Investment DetectiveAntonius CliffSetiawanNo ratings yet

- Investment DetectiveDocument1 pageInvestment Detectiveforeverktm100% (4)

- Kota Fibres IncDocument20 pagesKota Fibres IncMuhamad FudolahNo ratings yet

- Bethesda & GoodweekDocument8 pagesBethesda & GoodweekDian Pratiwi RusdyNo ratings yet

- Syndicate 3 - Analisa Ratio IndustriDocument5 pagesSyndicate 3 - Analisa Ratio IndustriMarkus100% (1)

- The Investment Detective (Answer)Document2 pagesThe Investment Detective (Answer)Eddy ErmanNo ratings yet

- Fonderia Di Torino (Final)Document4 pagesFonderia Di Torino (Final)Tracye Taylor100% (2)

- Faris Dzikrur Rahman - 29317008 - Decision Tree AssignmentDocument2 pagesFaris Dzikrur Rahman - 29317008 - Decision Tree AssignmentFaris Dzikrur Rahman100% (1)

- Integrative Approach Blemba 62Document26 pagesIntegrative Approach Blemba 62sofia harwanaNo ratings yet

- Mm0057 Financial Management Midterm Exam: No. 1 - Track Software, IncDocument15 pagesMm0057 Financial Management Midterm Exam: No. 1 - Track Software, Incnavier funtabulousNo ratings yet

- Developing Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018Document5 pagesDeveloping Financial Insight - Tugas MBA ITB Syndicate 2 CCE58 2018DenssNo ratings yet

- Tugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDocument10 pagesTugas Finance Management Individu - MBA ITB - CCE58 2018 ExcelDenssNo ratings yet

- Syndicate 5 - Krakatau Steel ADocument19 pagesSyndicate 5 - Krakatau Steel AEdlyn Valmai Devina SNo ratings yet

- Case Krakatau Steel (A) Financial Performance Syndicate 8Document8 pagesCase Krakatau Steel (A) Financial Performance Syndicate 8Tegar BabarunggulNo ratings yet

- Arcadian Microarray TechnologiesDocument20 pagesArcadian Microarray Technologies0407199050% (2)

- The Investment DetectiveDocument9 pagesThe Investment DetectiveFadhila Nurfida HanifNo ratings yet

- Finance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BDocument4 pagesFinance Detective - Rizqi Ghani Faturrahman - 29120382 - YP-64BrizqighaniNo ratings yet

- Nike Case Solution PDFDocument9 pagesNike Case Solution PDFKunal KumarNo ratings yet

- Krakatau Steel A ReportDocument6 pagesKrakatau Steel A ReportSoniaKasellaNo ratings yet

- This Spreadsheet Supports Analysis of The Case, "The Investment Detective" (Case 18)Document5 pagesThis Spreadsheet Supports Analysis of The Case, "The Investment Detective" (Case 18)Chittisa Charoenpanich100% (1)

- UTS / Mid Semester Test Finance Management (M5007) - MBA ITB CCE 58 2018Document28 pagesUTS / Mid Semester Test Finance Management (M5007) - MBA ITB CCE 58 2018DenssNo ratings yet

- Syndicate 3 ExxonValdez Week2Document5 pagesSyndicate 3 ExxonValdez Week2Riza MaulidaNo ratings yet

- Nike, IncDocument19 pagesNike, IncRavi PrakashNo ratings yet

- Syndicate 1 - Yeats Valve and Control IncDocument11 pagesSyndicate 1 - Yeats Valve and Control IncrizqighaniNo ratings yet

- Fonderia DI TorinoDocument19 pagesFonderia DI TorinoA100% (3)

- KT 1@syndicate4Document12 pagesKT 1@syndicate4Reynaldo Dimas FachriNo ratings yet

- Negotiation Agreement (Hollyville) - SellerDocument3 pagesNegotiation Agreement (Hollyville) - SellerDimas FathurNo ratings yet

- This Study Resource Was: Integrative Case 7: Casa de DisenoDocument5 pagesThis Study Resource Was: Integrative Case 7: Casa de DisenoFikri N SetyawanNo ratings yet

- Ayustinagiusti - Developing Financial Insights - Using A Future Value (FV) and A Present Value (PV) ApproachDocument10 pagesAyustinagiusti - Developing Financial Insights - Using A Future Value (FV) and A Present Value (PV) ApproachAyustina GiustiNo ratings yet

- (DMN GM 10) Mid-Term Exam - Bianda Puspita SariDocument6 pages(DMN GM 10) Mid-Term Exam - Bianda Puspita SariBianda Puspita SariNo ratings yet

- Case Nike Cost of Capital - FinalDocument7 pagesCase Nike Cost of Capital - FinalNick ChongsanguanNo ratings yet

- Krakatau Steel A Study Cases Financial M PDFDocument8 pagesKrakatau Steel A Study Cases Financial M PDFZulkifli SaidNo ratings yet

- Debt Policy and ValueDocument7 pagesDebt Policy and ValueMuhammad Nabil EzraNo ratings yet

- Debt and Policy Value CaseDocument6 pagesDebt and Policy Value CaseUche Mba100% (2)

- Syndicate 4 - Value at RiskDocument8 pagesSyndicate 4 - Value at RiskAnthony KwoNo ratings yet

- Covariance CorrelationDocument14 pagesCovariance CorrelationAnthony KwoNo ratings yet

- Ethical Climate: By: Syndicate 7Document12 pagesEthical Climate: By: Syndicate 7Anthony KwoNo ratings yet

- Analytic Hierarchy ProcessDocument2 pagesAnalytic Hierarchy ProcessAnthony KwoNo ratings yet

- History Exchange ReportDocument14 pagesHistory Exchange ReportAnthony KwoNo ratings yet

- Ethcis in FinanceDocument23 pagesEthcis in FinanceAnthony KwoNo ratings yet

- Topic Hedging BRVCDocument34 pagesTopic Hedging BRVCAnthony KwoNo ratings yet

- HEDGINGDocument57 pagesHEDGINGAnthony Kwo0% (2)

- Swaps and Interest Rate Options: OutlineDocument57 pagesSwaps and Interest Rate Options: OutlineAnthony KwoNo ratings yet

- Republic of Indonesia: An Emerging Economic Powerhouse in AsiaDocument35 pagesRepublic of Indonesia: An Emerging Economic Powerhouse in AsiaAnthony KwoNo ratings yet

- Nike Inc - Cost of Capital - Syndicate 10Document16 pagesNike Inc - Cost of Capital - Syndicate 10Anthony KwoNo ratings yet

- Capital Market Analysis - Warren BuffettDocument10 pagesCapital Market Analysis - Warren BuffettAnthony KwoNo ratings yet

- Forward, Futures&OptionsDocument43 pagesForward, Futures&OptionsAnthony KwoNo ratings yet

- Case 8 - Dell's Working Capital - Syndicate 10Document13 pagesCase 8 - Dell's Working Capital - Syndicate 10Anthony KwoNo ratings yet

- Financial Futures MarketsDocument48 pagesFinancial Futures MarketsAnthony KwoNo ratings yet

- Business Ethics - GOJEK CaseDocument5 pagesBusiness Ethics - GOJEK CaseAnthony KwoNo ratings yet

- The Asian Financial Crisis - Syndicate 10Document12 pagesThe Asian Financial Crisis - Syndicate 10Anthony KwoNo ratings yet

- Syndicate 10 - GOJEKDocument10 pagesSyndicate 10 - GOJEKAnthony KwoNo ratings yet

- Bank Central Asia: 3Q17 Review: Quality Above EverythingDocument6 pagesBank Central Asia: 3Q17 Review: Quality Above EverythingAnthony KwoNo ratings yet

- Kristen's Cookies Co - Mind MapDocument1 pageKristen's Cookies Co - Mind MapAnthony KwoNo ratings yet

- Syndicate 10 - Chipotle Business Strategy ReviewDocument18 pagesSyndicate 10 - Chipotle Business Strategy ReviewAnthony Kwo100% (1)

- Chapter 3 Design of Products and ServicesDocument1 pageChapter 3 Design of Products and ServicesAnthony KwoNo ratings yet

- Google's Project Oxygen: Do Managers Matter?Document6 pagesGoogle's Project Oxygen: Do Managers Matter?Anthony KwoNo ratings yet

- Group-6 Presentation On FIIDocument42 pagesGroup-6 Presentation On FIIPankaj Kumar Bothra100% (1)

- Pakistan Tobacco Company LimitedDocument10 pagesPakistan Tobacco Company LimitedMinhas KhanNo ratings yet

- Jurnal 2 - Alaeto Henry Emeka (2020) - Determinants - of - Dividend - Polic - NigeriaDocument31 pagesJurnal 2 - Alaeto Henry Emeka (2020) - Determinants - of - Dividend - Polic - NigeriaGilang KotawaNo ratings yet

- Acc 112 - Partnership LiquidationDocument19 pagesAcc 112 - Partnership LiquidationJIYAN BERACISNo ratings yet

- Quiz#3 - SCFDocument3 pagesQuiz#3 - SCF11 ABM 2A -TORREMOCHANo ratings yet

- American Options: An Undergraduate Introduction To Financial MathematicsDocument60 pagesAmerican Options: An Undergraduate Introduction To Financial MathematicsAmsalu WalelignNo ratings yet

- Adjusting Journal EntriesDocument2 pagesAdjusting Journal EntriesMicah Danielle S. TORMONNo ratings yet

- Chapter 1 - TutorialDocument13 pagesChapter 1 - TutorialPro TenNo ratings yet

- Mba 3 Sem Corporate Financial Management Group B Financial Management Paper 1 Summer 2018Document3 pagesMba 3 Sem Corporate Financial Management Group B Financial Management Paper 1 Summer 2018pranali nagleNo ratings yet

- Alternative FinanceDocument43 pagesAlternative FinancePragathi SundarNo ratings yet

- CPChap 2Document79 pagesCPChap 2K59 Hoang Gia HuyNo ratings yet

- Final Exam FA36013 Principles of Accounting Answer SheetDocument4 pagesFinal Exam FA36013 Principles of Accounting Answer Sheetjos huaNo ratings yet

- 07 Quiz 13Document3 pages07 Quiz 134mpspxd5msNo ratings yet

- Market Capitalization Versus Market ValueDocument3 pagesMarket Capitalization Versus Market ValueIdrisNo ratings yet

- Lecture No. 7 Parties Interested in Financial StatementsDocument3 pagesLecture No. 7 Parties Interested in Financial StatementssajjadNo ratings yet

- Chapter 10Document16 pagesChapter 10Kurt dela Torre0% (2)

- C6T2 - Basel III - Risk Management PDFDocument10 pagesC6T2 - Basel III - Risk Management PDFTanmoy IimcNo ratings yet

- Chapter 2 Financial AnalysisDocument76 pagesChapter 2 Financial AnalysisAhmad Ridhuwan Abdullah100% (1)

- Introduction To IFRSDocument42 pagesIntroduction To IFRSstiftriteNo ratings yet

- Open Interest & VolumeDocument3 pagesOpen Interest & VolumeSingh SudipNo ratings yet

- Far DrillDocument5 pagesFar DrillJung Hwan SoNo ratings yet

- Meketa Small Cap Search Presentation PDFDocument38 pagesMeketa Small Cap Search Presentation PDFLucienMDNo ratings yet

- AFO+ +Mock+TestDocument12 pagesAFO+ +Mock+TestArrow NagNo ratings yet

- F2 QuestionsDocument92 pagesF2 QuestionsKeotshepile Esrom MputleNo ratings yet

- FM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Document4 pagesFM Unit 2 Tutorial - Finanacial Statement Analysis Revised 2019Tanice WhyteNo ratings yet

- Assumption Under Markowitz TheoryDocument3 pagesAssumption Under Markowitz TheoryHania SaeedNo ratings yet