0% found this document useful (0 votes)

323 views7 pagesACC101 Chapter 2 Problem Solved

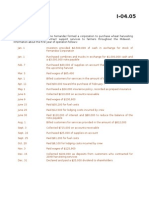

This document records various financial transactions of an engineering firm owned by S. Shelton. It shows Shelton's initial capital investment of $105,000 in cash. It also records the purchase of various assets like land, buildings, equipment using cash and financing. Revenue and expenses are recorded, including wages, equipment rental, advertising. Debits and credits are provided to record each transaction and update account balances.

Uploaded by

Nhi NguyễnCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

323 views7 pagesACC101 Chapter 2 Problem Solved

This document records various financial transactions of an engineering firm owned by S. Shelton. It shows Shelton's initial capital investment of $105,000 in cash. It also records the purchase of various assets like land, buildings, equipment using cash and financing. Revenue and expenses are recorded, including wages, equipment rental, advertising. Debits and credits are provided to record each transaction and update account balances.

Uploaded by

Nhi NguyễnCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

- General Journal: Contains entries detailing financial transactions involving cash, equipment, and other accounts, with debit and credit balances.

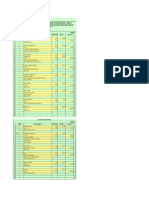

- Balance Column Account: Presents detailed balances for various accounts including initial investment, purchases, and expenses across different accounts.

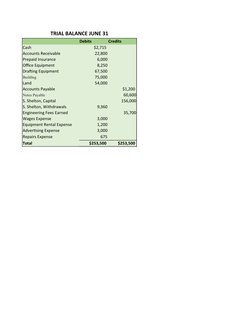

- Trial Balance: Summarizes all debits and credits as of June 31, ensuring the balanced accounting equation.