Professional Documents

Culture Documents

Journalizing-3-Laarni-Pascua MAIN

Uploaded by

John DelaPazCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Journalizing-3-Laarni-Pascua MAIN

Uploaded by

John DelaPazCopyright:

Available Formats

JOURNALIZING NO 3

Laarni Pascua, a veteran photographer, opened a studio for the professional practice in July 1.

transaction completed during the month follows:

• Deposited P146,200 in a bank account in the name of the business, Pascua Photo Profiles

• Bought new photography equipment on account from Canon equipment, P71,210

• Invested personal photography equipment into the business P 51,620 ( it is an investment)

• Paid office rent for the month, P5,500

• Bought Photography supplies for cash P7,960

• Paid premium for insurance cover on photography equipment P1,240

• Received P8,960 as professional fees for services rendered

• Paid salary of part time assistant P6,000

• received and paid bill for telephone service P640

• Paid canon Equipment part of the amount owed on the purchased of photography equip.

P4,200

• Received p15, 480 as professional fees for services rendered

• Paid for minor repairs to photography equipment P760

• Pascua withdrew cash for personal use P9,600

CHART OF ACCOUNT

ASSET INCOME

110 Cash 410 Service Revenue

120 Accounts Receivable

130 Supplies

140 Service Vehicle EXPENSES

170 Office Equipment

180 Professional equipment 510 Salaries Expense

530 Rent expense

LIABILITIES 540 Insurance expense

210 Notes Payable 550 Utilities expense

220 Accounts Payable 580 Telecommunication Expense

600 Advertising Expense

OWNERS EQUITY

310 Lopez, Capital

320 Lopez, Withdrawals

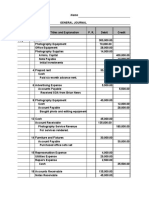

JOURNAL

Date Account Titles and Explanation P. R. Debit Credit

1 July 1 Cash 110 146,200

2 Laarni's Capital 310 146,200

3 Initial Investment

4 July 2 Photography Equipment 180 71,210

5 Accounts Payable 220 71,210

6 Purchased photography equipment on Account

7 July 3 Photography Equipment 180 51,620

8 Laarni's Capital (Photography Equipment) 310 51,620

9 Initial Investment

10 July 4 Rent Expense 530 5,500

11 Cash 110 5,500

12 Rent Payment for Month

13 July 5 Photography Supplies 130 7,960

14 Cash 110 7,960

15 Purchased photography supplies for cash

16 July 6 Insurance Expense 540 1,240

17 Cash 110 1,240

18 Paid Insurance on equipment for cash

19 July 7 Cash 110 8,960

20 Services Revenue 410 8,960

21 Received cash from services rendered

22 July 8 Salaries Expense 510 6,000

23 Cash 110 6,000

24 Paid Salaries of employees

25 July 9 Utilities Expense 550 640

26 Cash 110 640

27 Received a bill and paid for cash

28 July Accounts Payable 220 4,200

10

29 Cash 110 4,200

30 Paid cash for purchased equipment on account

31 July Cash 110 15,480

11

32 Service Revenue 410 15,480

33 Received cash from services

34 July Repair Expense 610 760

12

35 Cash 110 760

36 Paid Cash for repair of equipment

37 July Laarni's Withdrawals 320 9,600

13

38 Cash 110 9,600

39 Owner withdrew cash for personal use

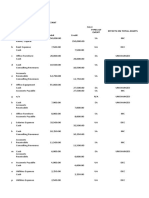

The Ledger

ACCOUNT: CASH ACCOUNT NO: 110

Date Explanation J.R. Debit Credit Balance

1 July 1 Initial Investment 146,200 146,200

2 July 4 Rent Payment for Month 1 5,500 140,700

3 July 5 Purchased photography 1 7,960 132,740

supplies for cash

4 July 6 Paid Insurance on equipment 1 1,240 131,500

for cash

5 July 7 Received cash from services 1 8,960 140,460

rendered

6 July 8 Paid Salaries of employees 1 6,000 134,460

7 July 9 Received a bill and paid for cash 1 640 133,820

8 July 10 Paid cash for purchased 1 4,200 129,620

equipment on account

9 July 11 Received cash from services 1 15,480 145,100

10 July 12 Paid Cash for repair of 1 760 144,340

equipment

11 July 13 Owner withdrew cash for 1 9,600 134,740

personal use

ACCOUnt: Laarni's Capital ACCOUNT NO: 310

Date Explanation J.R. Debit Credit Balance

1 July 1 Initial Investment 1 146,200 146,200

2 July 3 Initial Investment (Photography 1 51,620 197,820

Equipment)

ACCOUNT: PHOTOGRAPHY EQUIPMENT ACCOUNT NO: 180

Date Explanation J.R. Debit Credit Balance

1 July 2 Purchased photography 1 71,210 71,210

equipment on Account

2 July 3 Initial Investment 1 51,620 122,830

ACCOUNT NAME: PHOTOGRAPHY SUPPLIES ACCOUNT NO: 130

Date Explanation J.R. Debit Credit Balance

1 July 5 Purchased photography 1 7,960 7,960

supplies for cash

2 1

ACCOUNT: ACCOUNTS PAYABLE ACCOUNT NO: 220

Date Explanation J.R. Debit Credit Balance

1 July 2 Purchased photography 1 71,210 71,210

equipment on Account

2 July 10 Paid cash for purchased 1 4,200 67,010

equipment on account

ACCOUNT: UTILITIES EXPENSE ACCOUNT NO: 550

Date Explanation J.R. Debit Credit

1 July 9 Received a bill and paid for 1 640 640

cash

2 J-1

ACCOUNT: RENT EXPENSE ACCOUNT NO: 530

Date Explanation J.R. Debit Credit Balance

1 July 4 Rent Payment for Month 1 5,500 5,500

2 1

ACCOUNT: INSURANCE EXPENSE ACCOUNT NO: 540

Date Explanation J.R. Debit Credit Balance

1 July 6 Paid Insurance on 1 1,240 1,240

equipment for cash

2 J-1

ACCOUNT: SALARIES EXPENSE ACCOUNT NO: 510

Date Explanation J.R. Debit Credit Balance

1 July 8 Paid Salaries of 1 6,000 6,000

employees

2

ACCOUNT: REPAIR EXPENSE ACCOUNT NO: 610

Date Explanation J.R. Debit Credit Balance

1 July 12 Paid Cash for repair 1 760 760

of equipment

2 J-1

ACCOUNT: SERVICE REVENUE ACCOUNT NO: 410

Date Explanation J.R. Debit Credit Balance

1 July 7 Received cash from 1 8,960 8,960

services rendered

2 July 11 Received cash from J-1 15,480 24,440

services

ACCOUNT: Laarni's Withdrawal ACCOUNT NO: 320

Date Explanation J.R. Debit Credit Balance

1 July 13 Owner withdrew 1 9,600 9,600

cash for personal use

2 J-1

TRIAL BALANCE

AS OF JULY , 2015

ACCOUNT TITLE DEBIT CREDIT

ASSET

Cash 134,740

Photography Equipment 122,830

Photography Supplies 7,960

LIABILITIES

Accounts Payable 67,010

OWNERS EQUITY

Laarni's Capital 197,820

Laarni's Withdrawal 9,600

INCOME

Service Revenue 24,440

EXPENSES

Repair Expense 760

Salaries Expense 6,000

Insurance Expense 1,240

Rent Expense 5,500

Utilities Expense 640

TOTAL DEBIT AND CREDIT 289,270 289,270

You might also like

- Date Account Title and Explanation Debit Credit: Ref. NoDocument7 pagesDate Account Title and Explanation Debit Credit: Ref. NoBlesh MacusiNo ratings yet

- Sicat Financial Planning Consultant General Journal December, 2020Document3 pagesSicat Financial Planning Consultant General Journal December, 2020Madelyn SolesNo ratings yet

- 01 Activity 1-Prinma-Converted ARRIVADODocument3 pages01 Activity 1-Prinma-Converted ARRIVADOJannah Mae Arrivado0% (1)

- Week 4 5 ULOb Lets Check Activity 1 SolutionDocument3 pagesWeek 4 5 ULOb Lets Check Activity 1 Solutionemem resuentoNo ratings yet

- Trial Balance Wk17 GeneralizationDocument1 pageTrial Balance Wk17 GeneralizationYenique SalongaNo ratings yet

- Sample Problem For Last MeetingDocument11 pagesSample Problem For Last MeetingLylanie Alcoran AnibNo ratings yet

- Gelua Accounting - PlatoDocument57 pagesGelua Accounting - PlatoJerome NatividadNo ratings yet

- Acctg 1 - PrelimDocument1 pageAcctg 1 - PrelimRalph Christer Maderazo80% (5)

- Completing the Accounting Cycle: Steps and StatementsDocument16 pagesCompleting the Accounting Cycle: Steps and StatementsVeniceNo ratings yet

- Adjusting EntryDocument38 pagesAdjusting EntryNicaela Margareth YusoresNo ratings yet

- Group 6Document6 pagesGroup 6Love KarenNo ratings yet

- Crispin Rosales JournalizingDocument5 pagesCrispin Rosales JournalizingNightmare WolfNo ratings yet

- General Journal Entries Photography BusinessDocument18 pagesGeneral Journal Entries Photography BusinessMc Clent CervantesNo ratings yet

- Agatha Trading Financial Statement 2019Document1 pageAgatha Trading Financial Statement 2019Jasmine Acta0% (1)

- Resuento - Ulob ActivitiesDocument16 pagesResuento - Ulob Activitiesemem resuentoNo ratings yet

- Data ShortDocument5 pagesData Shortgk concepcion0% (1)

- Fundamentals of ABM 1 Accounting CycleDocument47 pagesFundamentals of ABM 1 Accounting CycleHarrold HarryNo ratings yet

- Name of Examinee: - : Prepare The FollowingDocument15 pagesName of Examinee: - : Prepare The FollowingNoel CarpioNo ratings yet

- Bella Employment Agency Chart of Accounts and General LedgerDocument17 pagesBella Employment Agency Chart of Accounts and General LedgerDeimos DeezNo ratings yet

- Journalizing and posting laundry business transactionsDocument1 pageJournalizing and posting laundry business transactionsSteve Duty50% (4)

- L2: The Accounting Cycle (AJPUAFCPR) : Accounting For Service and Merchandising Entities ACC11Document12 pagesL2: The Accounting Cycle (AJPUAFCPR) : Accounting For Service and Merchandising Entities ACC11Rose LaureanoNo ratings yet

- General Journal April 1-30 EntriesDocument17 pagesGeneral Journal April 1-30 EntriesgegegeeNo ratings yet

- Q4 ABM Fundamentals of ABM1 11 Week 4Document4 pagesQ4 ABM Fundamentals of ABM1 11 Week 4Celine Angela AbreaNo ratings yet

- City Laundry Chart of AccountsDocument6 pagesCity Laundry Chart of AccountsGina Calling DanaoNo ratings yet

- Eternal Images Journal Entries and Financial StatementsDocument11 pagesEternal Images Journal Entries and Financial StatementsMarielle Ebin100% (3)

- Legacy of Wisdom Academy of Dasmariñas, IncDocument4 pagesLegacy of Wisdom Academy of Dasmariñas, InczavriaNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- Integrated Accounting Learning Module Attachment (Do Not Copy)Document15 pagesIntegrated Accounting Learning Module Attachment (Do Not Copy)Jasper PelicanoNo ratings yet

- FABM ProblemsDocument1 pageFABM ProblemsNeil Gumban40% (5)

- Acc and BMDocument8 pagesAcc and BMShawn Mendez100% (1)

- Or, Deposit Slip and Withdrawl SlipDocument4 pagesOr, Deposit Slip and Withdrawl SlipJessica Rose AlbaracinNo ratings yet

- Merchandising Business Chart of AccountsDocument10 pagesMerchandising Business Chart of AccountsMary Jane PalermoNo ratings yet

- Davao Commercial Center Chart of AccountsDocument2 pagesDavao Commercial Center Chart of AccountsFrancis Raagas67% (3)

- General Journal: Date Account Titles and Explanation Ref Debit CreditDocument17 pagesGeneral Journal: Date Account Titles and Explanation Ref Debit CreditPrecious NosaNo ratings yet

- Landing On You Travel Services Company, A Company: Page 1 of 22Document22 pagesLanding On You Travel Services Company, A Company: Page 1 of 22LETS STUDY100% (1)

- 2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsDocument25 pages2016 Jan 1 Cash Computer Equipment Lok, Capital: General Journal Date ParticularsMoon Binn100% (2)

- Merchandising BusinessDocument11 pagesMerchandising BusinessABM-AKRISTINE DELA CRUZNo ratings yet

- S. Roces Answer To Journal EntryDocument4 pagesS. Roces Answer To Journal EntryChoco LebbyNo ratings yet

- Hourly Employee Earnings Rate M T W TH F Reg. OT GrossDocument6 pagesHourly Employee Earnings Rate M T W TH F Reg. OT GrossAislin Joy SabusapNo ratings yet

- Fabm Sample Exercises With Answer KeyDocument7 pagesFabm Sample Exercises With Answer KeySg DimzNo ratings yet

- PT .1 in AccountingDocument8 pagesPT .1 in AccountingMerdwindelle Allagones100% (1)

- Nelson Daganta CashDocument10 pagesNelson Daganta CashDan RioNo ratings yet

- B.1 Directions: Prepare Journal Entries For The Following Transactions Using A Periodic Inventory SystemDocument4 pagesB.1 Directions: Prepare Journal Entries For The Following Transactions Using A Periodic Inventory SystemJestine AlcantaraNo ratings yet

- Larry Jones Laundry Shop New FormatDocument18 pagesLarry Jones Laundry Shop New FormatVincent Madrid100% (1)

- Reynaldo Adjusment EntryDocument5 pagesReynaldo Adjusment EntryAra HasanNo ratings yet

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- Fabm - Q2 - Las-For LearnersDocument113 pagesFabm - Q2 - Las-For LearnersABM-AKRISTINE DELA CRUZNo ratings yet

- Dr. Who Clinic Journal EntriesDocument18 pagesDr. Who Clinic Journal EntriesJasmine P. Manlungat - EMERALDNo ratings yet

- Dellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditDocument6 pagesDellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditJaira AsuncionNo ratings yet

- Group Activity 1Document10 pagesGroup Activity 1Winshei Cagulada0% (1)

- Module 7Document8 pagesModule 7Charissa Jamis ChingwaNo ratings yet

- Cindy Lota - Activity No. 4 - SFP Antonio TradingDocument5 pagesCindy Lota - Activity No. 4 - SFP Antonio TradingCindy Lota100% (2)

- (Transaction # 1Document3 pages(Transaction # 1Caryl May Esparrago MiraNo ratings yet

- Book 1Document6 pagesBook 1ItsRenz YTNo ratings yet

- Topic: Accounting Cycle of A Service BusinessDocument5 pagesTopic: Accounting Cycle of A Service BusinessJohn Rey BusimeNo ratings yet

- Answer Key To Fundamentals of Financial Accounting and Reporting CDCDocument3 pagesAnswer Key To Fundamentals of Financial Accounting and Reporting CDCAprile Margareth HidalgoNo ratings yet

- Everr Greene CorrectDocument12 pagesEverr Greene CorrectRonNo ratings yet

- Fundamentals of Accountancy, Business and Management 1Document19 pagesFundamentals of Accountancy, Business and Management 1Shiellai Mae Polintang0% (1)

- Comprehensive Problem Activity 3-2 ReportDocument19 pagesComprehensive Problem Activity 3-2 ReportJhyvril GulacNo ratings yet

- AccountingDocument21 pagesAccountingReana ReyesNo ratings yet

- INTERNAL. This Information Is Accessible To ADB Management and Staff. It May Be Shared Outside ADB With Appropriate PermissionDocument1 pageINTERNAL. This Information Is Accessible To ADB Management and Staff. It May Be Shared Outside ADB With Appropriate PermissionJohn DelaPazNo ratings yet

- Asynchronous Activity No.2 ORG. AND MNGT.Document2 pagesAsynchronous Activity No.2 ORG. AND MNGT.John DelaPazNo ratings yet

- Name: SectionDocument1 pageName: SectionJohn DelaPazNo ratings yet

- UntitledDocument2 pagesUntitledJohn DelaPazNo ratings yet

- MCA partners authorize OMB applicationDocument1 pageMCA partners authorize OMB applicationJohn DelaPazNo ratings yet

- Opening Prayer 3/30/23 Let Us Put Ourselves in The Presence of The Lord in The Name of The Father, and of The Son, and of The Holy Spirit, AmenDocument1 pageOpening Prayer 3/30/23 Let Us Put Ourselves in The Presence of The Lord in The Name of The Father, and of The Son, and of The Holy Spirit, AmenJohn DelaPazNo ratings yet

- TEAM STRUCTURE Group 1Document1 pageTEAM STRUCTURE Group 1John DelaPazNo ratings yet

- Analysis Paper Chapter 3&4 DelapazDocument3 pagesAnalysis Paper Chapter 3&4 DelapazJohn DelaPazNo ratings yet

- Journalizing Exercises 10Document11 pagesJournalizing Exercises 10John DelaPaz0% (1)

- Grade 11: Oral Assessment 3Document4 pagesGrade 11: Oral Assessment 3John DelaPazNo ratings yet

- Ecommerce For Entreprneurs: Boon or BaneDocument8 pagesEcommerce For Entreprneurs: Boon or BaneJohn DelaPazNo ratings yet

- UntitledDocument44 pagesUntitledJohn DelaPazNo ratings yet

- Name: John Benedict R. Delapaz Section: 11 FUENTESDocument3 pagesName: John Benedict R. Delapaz Section: 11 FUENTESJohn DelaPazNo ratings yet

- Name: John Benedict R. Delapaz Section: 11 FUENTES Asynchronous Activity No. 1 (ORG. AND MNGT.) - 30 PtsDocument2 pagesName: John Benedict R. Delapaz Section: 11 FUENTES Asynchronous Activity No. 1 (ORG. AND MNGT.) - 30 PtsJohn DelaPazNo ratings yet

- Plate No: EM8635: Official ReceiptDocument1 pagePlate No: EM8635: Official ReceiptRomie Opeda67% (3)

- This Study Resource WasDocument3 pagesThis Study Resource WasCHAU Nguyen Ngoc BaoNo ratings yet

- Contract Costing Sem IVDocument17 pagesContract Costing Sem IVHarshit DaveNo ratings yet

- Route 10 Public Bus Timetable Casuarina To DarwinDocument2 pagesRoute 10 Public Bus Timetable Casuarina To DarwinAsjsjsjsNo ratings yet

- DVC Company ProfileDocument10 pagesDVC Company ProfileDv AccountingNo ratings yet

- 05 Budgeting QuestionsDocument5 pages05 Budgeting QuestionsWynie AreolaNo ratings yet

- Sri Mahila Griha Udyog Lijjat Papad: Strategic Management CourseDocument23 pagesSri Mahila Griha Udyog Lijjat Papad: Strategic Management CoursePrachit ChaturvediNo ratings yet

- Value Stream Mapping: Array Architects January 16, 2014Document30 pagesValue Stream Mapping: Array Architects January 16, 2014puphNo ratings yet

- Guilin Hualun Diamond Tools Co LTDDocument44 pagesGuilin Hualun Diamond Tools Co LTDFranklin Suarez GomezNo ratings yet

- Global Free Trade Has Done More Harm Than GoodDocument1 pageGlobal Free Trade Has Done More Harm Than GoodZea SantosNo ratings yet

- Applied Statistics and Probability For Engineers Chapter - 7Document8 pagesApplied Statistics and Probability For Engineers Chapter - 7MustafaNo ratings yet

- Catalog Duct Low Static PanasonicDocument2 pagesCatalog Duct Low Static PanasonicGhiban ConstantinNo ratings yet

- Brochure 3F Linda LED enDocument30 pagesBrochure 3F Linda LED enHarris SouglerisNo ratings yet

- Form Po-001Document2 pagesForm Po-001Marnhy SNo ratings yet

- Rosenthal CoverLetter2 BlackRock Feb2021Document1 pageRosenthal CoverLetter2 BlackRock Feb2021Mitchell RosenthalNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceKanyaka PriyadarsiniNo ratings yet

- Objective: Standard Operating ProcedureDocument1 pageObjective: Standard Operating Proceduremanan mohanNo ratings yet

- REVIEW OF CLRMsDocument53 pagesREVIEW OF CLRMswebeshet bekeleNo ratings yet

- KSRTC Financial PerformanceDocument55 pagesKSRTC Financial Performancearunraj03No ratings yet

- Pfaff Performance 2054 Service ManualDocument110 pagesPfaff Performance 2054 Service ManualiliiexpugnansNo ratings yet

- GBD1006 5033 ASM2 Presentation UniqueTeamDocument49 pagesGBD1006 5033 ASM2 Presentation UniqueTeamPhương DungNo ratings yet

- Certifion de Mme Silvie Doc enDocument1 pageCertifion de Mme Silvie Doc enMarcelNo ratings yet

- Chapter 5: Factor Endowments & The Heckscher-Ohlin Theory: Dr. Adel Zagha International Trade 736 1Document45 pagesChapter 5: Factor Endowments & The Heckscher-Ohlin Theory: Dr. Adel Zagha International Trade 736 1سعيد نمرNo ratings yet

- Saving: Robertson KeynesDocument10 pagesSaving: Robertson KeynesDipen DhakalNo ratings yet

- Database Calon PegawaiDocument12 pagesDatabase Calon PegawainadyaNo ratings yet

- Form MGT 7 01032021 SignedDocument14 pagesForm MGT 7 01032021 SignedMohak GuptaNo ratings yet

- Musanada SorDocument311 pagesMusanada SorismaeelNo ratings yet

- Linear Regression Model to Calculate Economic Value of an EcosystemDocument5 pagesLinear Regression Model to Calculate Economic Value of an Ecosystemwayan tabahNo ratings yet

- Society and Economy of the Mauryan EmpireDocument2 pagesSociety and Economy of the Mauryan EmpireEkansh DwivediNo ratings yet

- LaxmanDocument2 pagesLaxmanBhimrao PhalkeNo ratings yet