Professional Documents

Culture Documents

11 4 Indu Is in Business Buying and Selling Goods On Credit

Uploaded by

parwez_0505Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

11 4 Indu Is in Business Buying and Selling Goods On Credit

Uploaded by

parwez_0505Copyright:

Available Formats

11

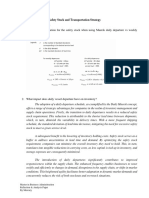

4 Indu is in business buying and selling goods on credit.

The following information is available.

$

At 1 October 2018

Inventory 35 000

For the year ended 30 September 2019

Revenue 400 000

Expenses 52 000

At 30 September 2019

Inventory 68 000

Owner’s capital 150 000

5% bank loan – repayable 2025 50 000

Mark‑up was 25%.

REQUIRED

(a) Calculate the following for the year ended 30 September 2019.

Comparative figures for the year ended 30 September 2018 are shown in the last column.

Workings Answer Year ended

30 September

2018

Cost of sales

$270 000

Purchases

$260 000

Percentage of gross

profit to revenue 25%

(gross profit margin)

Percentage of

profit for the year 10%

to revenue (profit

margin)

Return on capital

employed (ROCE) 18%

[10]

© UCLES 2019 7110/21/O/N/19 [Turn over

12

(b) Suggest four possible reasons for the change in the profitability ratios of the business over

the two years.

1 ................................................................................................................................................

...................................................................................................................................................

...................................................................................................................................................

2 ................................................................................................................................................

...................................................................................................................................................

...................................................................................................................................................

3 ................................................................................................................................................

...................................................................................................................................................

...................................................................................................................................................

4 ................................................................................................................................................

...................................................................................................................................................

...................................................................................................................................................

[4]

Indu wishes to increase her profit for the year and has made some proposals. A friend has advised

that each proposal may not comply with an accounting principle or concept.

REQUIRED

(c) Complete the table by placing a tick (3) to indicate the effect on the profit for the year of each

proposal. Name the accounting principle or concept not being applied.

The first one has been completed as an example.

Proposal Effect on profit for the year Accounting principle or

concept not applied

Increase Decrease No effect

Value closing inventory at cost 3 Historic cost

price plus mark‑up.

Remove provision for doubtful

debts from financial statements.

Place a value on the satisfaction

and loyalty of customers.

Make no adjustment for expenses

prepaid at year end.

[6]

[Total: 20]

© UCLES 2019 7110/21/O/N/19

You might also like

- CH 09Document19 pagesCH 09Shayne0% (3)

- Optimize SAP APO PPDS Production Planning and Detailed SchedulingDocument77 pagesOptimize SAP APO PPDS Production Planning and Detailed Schedulingmanish161286% (7)

- Assessment 1 - Accounting For Decision Makers - UWL ID 21432210Document48 pagesAssessment 1 - Accounting For Decision Makers - UWL ID 21432210Natasha de Silva100% (1)

- The Big Picture: Brief ExercisesDocument13 pagesThe Big Picture: Brief ExercisesRacel Agonia0% (1)

- Assignment DFA6127Document3 pagesAssignment DFA6127parwez_0505No ratings yet

- Mother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Document3 pagesMother - Please Speak Out: Income Statement For The Year Ended March 31, 2019 ($000s) Net Sales 100,000Jayash Kaushal0% (2)

- p2 With TheoryDocument40 pagesp2 With TheoryGrace Corpo0% (1)

- Financial Accounting And The Financial StatementsDocument10 pagesFinancial Accounting And The Financial StatementsRajiv RankawatNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument20 pagesCambridge International Advanced Subsidiary and Advanced LevelAimen AhmedNo ratings yet

- Appendix 4E and Annual Report FY20Document79 pagesAppendix 4E and Annual Report FY20Gursheen KaurNo ratings yet

- Far670 Solution Jul 2020Document4 pagesFar670 Solution Jul 2020siti hazwaniNo ratings yet

- FSA Tutorial 1Document2 pagesFSA Tutorial 1KHOO TAT SHERN DEXTONNo ratings yet

- Paper 2.2 QQ NDocument20 pagesPaper 2.2 QQ NKAINo ratings yet

- Liquidity, activity, profitability ratios analysisDocument7 pagesLiquidity, activity, profitability ratios analysisZaref IslamNo ratings yet

- Return On EquityDocument5 pagesReturn On EquityLakshit MittalNo ratings yet

- Acc ReportDocument24 pagesAcc ReportchavindiNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementhyp siinNo ratings yet

- Paper 2.1 QQ N PDFDocument20 pagesPaper 2.1 QQ N PDFKAINo ratings yet

- Financial Analysis of Pakistan State Oil For The Period July 2017-June 2020Document9 pagesFinancial Analysis of Pakistan State Oil For The Period July 2017-June 2020Adil IqbalNo ratings yet

- Sohar Power Company's Financial Analysis and Ratio TrendsDocument11 pagesSohar Power Company's Financial Analysis and Ratio TrendsShaista MajeedNo ratings yet

- 9706 - m19 - QP - 22 AdjustedDocument20 pages9706 - m19 - QP - 22 Adjustedhusse fokNo ratings yet

- ACC 404 RatiosDocument11 pagesACC 404 RatiosMahmud TuhinNo ratings yet

- Snisbury's Ratio AnalysisDocument8 pagesSnisbury's Ratio Analysis99 Nazmul AlamNo ratings yet

- Steps: Answers To Week 3 Seminar ActivityDocument10 pagesSteps: Answers To Week 3 Seminar ActivityZubair Afzal KhanNo ratings yet

- BBA 8338 Financial Statement Analysis Assignment SolutionsDocument11 pagesBBA 8338 Financial Statement Analysis Assignment Solutionsmonir mahmudNo ratings yet

- Appendix 4D and Condensed Consolidated Interim Financial Statements 9 Spokes International Limited 30 September 2020Document33 pagesAppendix 4D and Condensed Consolidated Interim Financial Statements 9 Spokes International Limited 30 September 2020jenny smithNo ratings yet

- Alliance Aviation 2020Document80 pagesAlliance Aviation 2020Hoàng Minh ChuNo ratings yet

- Authentic Assessment 1Document10 pagesAuthentic Assessment 1entc.fdp.zaranaNo ratings yet

- Audit of Expenditure and Disbursements Cycle BA 123 ProblemsDocument4 pagesAudit of Expenditure and Disbursements Cycle BA 123 ProblemsBecky GonzagaNo ratings yet

- Assignment FinalDocument10 pagesAssignment FinalJamal AbbasNo ratings yet

- Asset Management RatiosDocument5 pagesAsset Management RatiosJhon Ray RabaraNo ratings yet

- 11 Financial Statements - Thalanga Copper MinesDocument23 pages11 Financial Statements - Thalanga Copper MinesalanNo ratings yet

- Ratio and Interpretaion With GraphsDocument12 pagesRatio and Interpretaion With GraphsShilpiNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- AP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document5 pagesAP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Fella GultianoNo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyNo ratings yet

- Directors ReportDocument51 pagesDirectors ReportEllis ElliseusNo ratings yet

- Tugas Personal Ke - (1) Minggu 2Document10 pagesTugas Personal Ke - (1) Minggu 2sallyNo ratings yet

- Statement of Clhanges in EquityDocument21 pagesStatement of Clhanges in EquityBon juric Jr.No ratings yet

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- Sig Plc ReportDocument13 pagesSig Plc ReportrashiNo ratings yet

- KMAMC Annual Report FY 18-19Document88 pagesKMAMC Annual Report FY 18-19World EntertainmentNo ratings yet

- 1652623621ratio AnalysisDocument5 pages1652623621ratio Analysismg21138No ratings yet

- November 2020 Insert Paper 31Document12 pagesNovember 2020 Insert Paper 31Shahmeer HasanNo ratings yet

- Building The Marketplace of The: Interim Report 2023Document76 pagesBuilding The Marketplace of The: Interim Report 2023Rhoda LawNo ratings yet

- Financial Statement AnalysisDocument11 pagesFinancial Statement AnalysisAbdul RehmanNo ratings yet

- Nestle AnanlysisDocument18 pagesNestle AnanlysisSLUG GAMINGNo ratings yet

- Bec524 and Bec524e Test 2 October 2022Document5 pagesBec524 and Bec524e Test 2 October 2022Walter tawanda MusosaNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- 6 201506Q3Document19 pages6 201506Q3Hannah GohNo ratings yet

- CH 13Document28 pagesCH 13chengezen0414No ratings yet

- Cost and Management Accounting Topic-Ratio Analysis and Cash Flow Statement of Reliance Industries Ltd. 2019 - 2020Document8 pagesCost and Management Accounting Topic-Ratio Analysis and Cash Flow Statement of Reliance Industries Ltd. 2019 - 2020sarans goelNo ratings yet

- Financial Management Problem SolvingDocument5 pagesFinancial Management Problem Solvingpaul sagudaNo ratings yet

- Strategic planning and financial analysis in the construction industryDocument10 pagesStrategic planning and financial analysis in the construction industrySanghamithra raviNo ratings yet

- Module 3 Problems On Income StatementDocument8 pagesModule 3 Problems On Income StatementShruthi PNo ratings yet

- Corporate CFRA ASSIGNMENTDocument11 pagesCorporate CFRA ASSIGNMENTHimanshu NagvaniNo ratings yet

- Final Statement Assessment 1Document7 pagesFinal Statement Assessment 1AssignemntNo ratings yet

- K-One AR2020 - Part 2Document85 pagesK-One AR2020 - Part 2apeachsugaNo ratings yet

- G12 Fabm2 Week 8Document11 pagesG12 Fabm2 Week 8Whyljyne GlasanayNo ratings yet

- Skills MARCH... JULY 2020 #IfrsiseasyDocument138 pagesSkills MARCH... JULY 2020 #IfrsiseasyEniola OlakunleNo ratings yet

- Adobe Reports Record Revenue: Digital Experience Subscription Revenue Grows 25 Percent Year-Over-Year in Q3Document7 pagesAdobe Reports Record Revenue: Digital Experience Subscription Revenue Grows 25 Percent Year-Over-Year in Q3Dhruba laskarNo ratings yet

- CGI Financial Analysis-AmmendmentsDocument13 pagesCGI Financial Analysis-AmmendmentsmosesNo ratings yet

- Major 1 Finance Project - 20461Document12 pagesMajor 1 Finance Project - 20461Augum DuaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- 15 5 Eli and Sumit Are in Partnership.: DebitDocument3 pages15 5 Eli and Sumit Are in Partnership.: Debitparwez_0505No ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- CompanyDocument4 pagesCompanyparwez_0505No ratings yet

- Company AnswerDocument3 pagesCompany Answerparwez_0505No ratings yet

- Chapter 1 Accounting Concepts Question 1 Donald (A) (I)Document1 pageChapter 1 Accounting Concepts Question 1 Donald (A) (I)parwez_0505No ratings yet

- Incomplete RecordsDocument4 pagesIncomplete Recordsparwez_0505100% (1)

- Marking SchemeDocument6 pagesMarking Schemeparwez_0505No ratings yet

- TR F''L Poster ! .-:: T-Lsaaii) (EttriedllDocument1 pageTR F''L Poster ! .-:: T-Lsaaii) (Ettriedllparwez_0505No ratings yet

- Accounting Basics TutorialDocument15 pagesAccounting Basics TutorialsasyedaNo ratings yet

- Bringing Public Debt to 60% of GDP by 2020-21Document1 pageBringing Public Debt to 60% of GDP by 2020-21parwez_0505No ratings yet

- Anex II PampleDocument1 pageAnex II Pampleparwez_0505No ratings yet

- Entrepreneurship Course For Lower VI 2Document18 pagesEntrepreneurship Course For Lower VI 2parwez_0505No ratings yet

- 24 Statement of Cash FlowsDocument2 pages24 Statement of Cash Flowsparwez_0505No ratings yet

- Entrepreneurship Course For Lower VI 2Document18 pagesEntrepreneurship Course For Lower VI 2parwez_0505No ratings yet

- Sa AaDocument6 pagesSa Aaparwez_0505No ratings yet

- Cost of CapitalDocument21 pagesCost of Capitalparwez_0505No ratings yet

- Correction of ErrorsDocument6 pagesCorrection of Errorsparwez_0505No ratings yet

- Case Study - Daily MaeskDocument5 pagesCase Study - Daily MaeskgiemansitNo ratings yet

- Inventory SystemsDocument3 pagesInventory SystemsDevi OctafiaNo ratings yet

- Cyberdragon Cash Flow AnalysisDocument3 pagesCyberdragon Cash Flow AnalysisBablu EscobarNo ratings yet

- Inventory Planning Strategies for Asian Paints to Maintain High Service LevelsDocument6 pagesInventory Planning Strategies for Asian Paints to Maintain High Service LevelsAniket ChavanNo ratings yet

- Customer Service and Logistics Elements in Planning TriangleDocument14 pagesCustomer Service and Logistics Elements in Planning TriangleGhani RizkyNo ratings yet

- Credit MonitoringDocument97 pagesCredit MonitoringManish AroraNo ratings yet

- "The Conversion Cycle": Two Subsystems: - Ends With Completed Product Sent To The Finished Goods WarehouseDocument2 pages"The Conversion Cycle": Two Subsystems: - Ends With Completed Product Sent To The Finished Goods WarehouseKaren CaelNo ratings yet

- Financial Accounting IFRS 3rd Edition Weygandt Solutions Manual DownloadDocument107 pagesFinancial Accounting IFRS 3rd Edition Weygandt Solutions Manual DownloadLigia Jackson100% (25)

- List of All SAP Standard Reports (Well Most of Them) 4.7Document14 pagesList of All SAP Standard Reports (Well Most of Them) 4.7vfrmark83% (6)

- Invent Invest PpeDocument9 pagesInvent Invest PpeRaca DesuNo ratings yet

- Strategic Supply-Chain For S4HANA - Jan - 2020Document54 pagesStrategic Supply-Chain For S4HANA - Jan - 2020venkay1123100% (1)

- CMA PlanDocument113 pagesCMA PlanYash Gandhi- 370No ratings yet

- One Warehouse Multiretailer System With Centralized Stock InformationDocument13 pagesOne Warehouse Multiretailer System With Centralized Stock InformationdeevaNo ratings yet

- 3 Persed BRG-Lat2Document2 pages3 Persed BRG-Lat2hasnaglowNo ratings yet

- 2 Week Activity Predetermined OH Rates and Separating Mixed CostsDocument6 pages2 Week Activity Predetermined OH Rates and Separating Mixed CostsAlrac GarciaNo ratings yet

- FIFO, LIFO inventory accounting methods impactDocument2 pagesFIFO, LIFO inventory accounting methods impactKanika Bothra 1820441No ratings yet

- Deloitte POV:: Future of Route-to-Market in SEADocument38 pagesDeloitte POV:: Future of Route-to-Market in SEAnguyen minhanhNo ratings yet

- Mapping The Value StreamDocument8 pagesMapping The Value StreamMahipal Singh RatnuNo ratings yet

- Most Useful 50 Textile Merchandising Terms and DefinitionsDocument7 pagesMost Useful 50 Textile Merchandising Terms and DefinitionsOnnoSaikat100% (1)

- 06-04-07 Creating Competitive Advantage Through Mass CustomizationDocument18 pages06-04-07 Creating Competitive Advantage Through Mass CustomizationSomia KhanNo ratings yet

- Customer Sample Report BSR For S4hanaDocument79 pagesCustomer Sample Report BSR For S4hanaHarpy AhmedNo ratings yet

- 2628 LamsonDocument5 pages2628 LamsonRehan Memon0% (1)

- Cost Concepts 05032023 095733pmDocument51 pagesCost Concepts 05032023 095733pmnida amanNo ratings yet

- AIB Food Safety Eng Man WebDocument118 pagesAIB Food Safety Eng Man WebAchmad IrwantoNo ratings yet

- Organisational Study at Rubco Co-operativeDocument87 pagesOrganisational Study at Rubco Co-operativeJason William George100% (2)

- Supply Chain ManagementDocument39 pagesSupply Chain Managementshweta_46664100% (2)

- Operations Management: William J. StevensonDocument40 pagesOperations Management: William J. StevensonsohaibjamilNo ratings yet