Professional Documents

Culture Documents

Feasibility Evaluation

Uploaded by

Ruby De GranoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Feasibility Evaluation

Uploaded by

Ruby De GranoCopyright:

Available Formats

CAVITE STATE UNIVERSITY

Imus Campus

Cavite Civic CenterPalico IV, Imus, Cavite

(046) 471-66-07 / (046) 471-67-70 / (046) 686-23-4

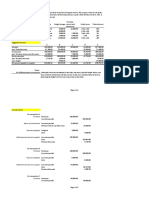

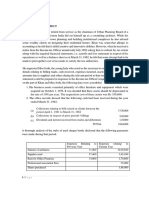

MIDTERM EXAMINATION INCOME AND BUSINESS TAXATION

2nd SEMESTER SY 2017-2018

NAME: __________________________ DATE: _______________

YEAR & SECTION: _______________ SCORE: ______________

I. CHOOSE THE CORRECT LETTERS FOR THE STATEMENTS BELOW. STRICTLY NO

ERASURES! (10pts)

1. Which of the following is a form of business?

a. Trading

b. Manufacturing

c. Service business

d. All of the above

2. Which of the following is not a merchandising business?

a. Grocery store

b. Department store

c. Distributor

d. Accounting firm

3. Which of the following is considered as engaged in servicing business

a. EGV accounting firm

b. GFROX manufacturing

c. EDVAL supermarket

d. VALROX CAR dealer

4. Which of the following are BIR compliance requirements for those are engaged in business?

a. Registration with Revenue District Office

b. Keeping of accounting records

c. Issuance of invoices and receipts

d. All of the above

5. Which of the following is not correct regarding the Taxpayer’s Identification Number?

a. Only one TIN is allowed for each taxpayer

b. The TIN is issued every year every time the taxpayer is renewing his registration

c. The TIN is required to be indicated in every taxpayers tax return

d. Failure to indicate correct TIN on documents specified to be indicated with TIN shall be subject to applicable criminal sanctions

6. Which of the following taxes describes a value-added tax?

a. Income tax

b. Sales tax

c. Indirect tax

d. Personal tax

7. The annual registration fee for a VAT-registered business is

a. P 50

b. P 500

c. P 1,500

d. P 5,000

8. A business tax is generally

a. Direct tax

b. Indirect tax

c. Property tax

d. None of the above

9. The books of accounts must be kept in

a. Any language depending on the preference of the taxpayer

b. English language only

c. Native language or English only

d. Native language, English or Spanish

10. Implementation date of the TRAIN law

a. December 19, 2017

b. January 1, 2018

c. December 11, 2017

d. December 31, 2018

II. TRUE OR FALSE (10pts)

1. Sale of drugs for diabetes, high cholesterol, and hypertension will be VAT- free starting 2019.TRUE

2. Socialized and mass housing projects P2million an d below will be VAT-free starting 2020. FALSE

3. Increase of non-hybrid cars over 600,000 to 1million is 5%. FALSE

4. A 5% tax will be imposed on cosmetics surgery or medical procedures for purely aesthetic purposes.TRUE

5. A single tax rate of 5% based on the net value of the estate with a standard deduction of P5million will be imposed.FALSE

6. TRAIN aims to make the current tax system simpler, fairer, and more efficient.TRUE

7. Starting January 1, 2018 compensation earners, self-employed and professional taxpayers whose annual taxable incomes are P250,000 and

below or less than P21,000 a months is exempted from the personal income tax. TRUE

8. Agricultural products are exempted from VAT.TRUE

9. Cooperatives are also exempted from VAT. TRUE

10. Senior citizens are exempted from VAT. TRUE

III. ENUMERATE THE FOLLOWING

1.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Test 1 SolutionsDocument20 pagesTest 1 SolutionssamanialenaNo ratings yet

- First Preboard TAX ReviewDocument17 pagesFirst Preboard TAX Reviewlois martinNo ratings yet

- Prelim Examination. AY 2nd SEM 2023 2024Document5 pagesPrelim Examination. AY 2nd SEM 2023 2024amseservices18No ratings yet

- NAME Chapter7Document10 pagesNAME Chapter7Shawn VerzalesNo ratings yet

- Business TaxationDocument7 pagesBusiness TaxationMystic LoverNo ratings yet

- Allowed Deductions From Gross IncomeDocument8 pagesAllowed Deductions From Gross Incomealliahbilities currentNo ratings yet

- Short Quiz 7 Set A With AnswerDocument3 pagesShort Quiz 7 Set A With AnswerJean Pierre Isip100% (1)

- Transfer and Business Taxation: Module WritersDocument129 pagesTransfer and Business Taxation: Module WritersPaulita GomezNo ratings yet

- HOMEWORK 2 Tax AdministrationDocument4 pagesHOMEWORK 2 Tax Administrationfitz garlitos100% (1)

- Tax RevDocument4 pagesTax RevCanapi AmerahNo ratings yet

- Chapter 9 Tax 2 (9-5) ND 9-6Document2 pagesChapter 9 Tax 2 (9-5) ND 9-6Elai grace FernandezNo ratings yet

- Income-Tax-Banggawan 2019-cr7 Compress Income-Tax-Banggawan 2019-cr7 CompressDocument11 pagesIncome-Tax-Banggawan 2019-cr7 Compress Income-Tax-Banggawan 2019-cr7 CompressEarth PirapatNo ratings yet

- Income-Tax Banggawan2019 CR7Document10 pagesIncome-Tax Banggawan2019 CR7Noreen Ledda11% (9)

- RIT Inclusions and ExclusionsDocument46 pagesRIT Inclusions and ExclusionsBisag AsaNo ratings yet

- The Use of OSD For Corporations Excludes Cost of Goods Sold From Gross Sales/Gross ReceiptsDocument8 pagesThe Use of OSD For Corporations Excludes Cost of Goods Sold From Gross Sales/Gross ReceiptsJohn Carlo Aquino100% (1)

- Qualifying Exam Taxation SET ADocument11 pagesQualifying Exam Taxation SET AChina ReyesNo ratings yet

- Exercises Corporate Income Taxation LatestDocument7 pagesExercises Corporate Income Taxation LatestTru Colors100% (1)

- The Professional CPA Review School: Main: 3F C. Villaroman Bldg. 873 P. Campa St. Cor Espana, Sampaloc, ManilaDocument10 pagesThe Professional CPA Review School: Main: 3F C. Villaroman Bldg. 873 P. Campa St. Cor Espana, Sampaloc, ManilaKriztleKateMontealtoGelogoNo ratings yet

- Before Course Exam SBSDocument17 pagesBefore Course Exam SBSGia LâmNo ratings yet

- East African CollegeDocument2 pagesEast African CollegedesalejofeNo ratings yet

- .Arch94-03 - Corporate Income TaxationDocument18 pages.Arch94-03 - Corporate Income TaxationShintaro KisaragiNo ratings yet

- Final Exam in Taxation AccountingDocument5 pagesFinal Exam in Taxation AccountingMarvin CeledioNo ratings yet

- Final ExamDocument8 pagesFinal ExamJunior ArgieNo ratings yet

- Tax At6Document11 pagesTax At6Nerie Joy Mestiola AverillaNo ratings yet

- Introduction To Accounting With Answers by AlagangwencyDocument5 pagesIntroduction To Accounting With Answers by AlagangwencyHello KittyNo ratings yet

- Session 1 Exercise DrillDocument5 pagesSession 1 Exercise DrillABBIE GRACE DELA CRUZNo ratings yet

- Exercise Tax AdministrationDocument5 pagesExercise Tax AdministrationJacqueline SyNo ratings yet

- Handout 7.2.INCOME TAX QUIZZER Lecturer'sDocument15 pagesHandout 7.2.INCOME TAX QUIZZER Lecturer'sApolinar Alvarez Jr.100% (4)

- CRC FAR Oct 2022 (1st PB)Document11 pagesCRC FAR Oct 2022 (1st PB)Rodmae VersonNo ratings yet

- HANDOUT-business TaxesDocument29 pagesHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- Multiple Choice Questions: Analyzing Operating ActivitiesDocument22 pagesMultiple Choice Questions: Analyzing Operating ActivitiesAnh LýNo ratings yet

- VAT - MCQ Test Questions by Mahbub SirDocument16 pagesVAT - MCQ Test Questions by Mahbub SirAysha Alam100% (1)

- Santa Isabel College Manila: A. B. C. DDocument9 pagesSanta Isabel College Manila: A. B. C. DJen Ner100% (1)

- MCQ and TRUE FALSE QUESTION - Chapter 1-4Document11 pagesMCQ and TRUE FALSE QUESTION - Chapter 1-4IrdinaNo ratings yet

- Tax Pre TestDocument5 pagesTax Pre TestKryzzel Anne JonNo ratings yet

- Module 8.2Document28 pagesModule 8.2Yen AllejeNo ratings yet

- Quiz 7 - Tax On CorporationsDocument14 pagesQuiz 7 - Tax On CorporationsJoyce Anne GarduqueNo ratings yet

- Abm Fabm2 Module 8 Lesson 2 Income and Business TaxationDocument24 pagesAbm Fabm2 Module 8 Lesson 2 Income and Business TaxationMelody Fabreag76% (25)

- Survey QuestionnaireDocument5 pagesSurvey QuestionnairePrince GueseNo ratings yet

- TAX MQ1 Special Quiz Answer KeyDocument4 pagesTAX MQ1 Special Quiz Answer KeyCJAY SOTELONo ratings yet

- MASDocument4 pagesMASJoyce PajarilloNo ratings yet

- Quarter Examination-FABM 1 SY 2018-2019Document4 pagesQuarter Examination-FABM 1 SY 2018-2019Raul Soriano Cabanting100% (2)

- Calculate Taxes Fees & Charges ASSIGNMENT NewDocument2 pagesCalculate Taxes Fees & Charges ASSIGNMENT NewJarra AbdurahmanNo ratings yet

- TAX 2021 - Theories and Independent ProblemsDocument28 pagesTAX 2021 - Theories and Independent ProblemsMingcheng JeeNo ratings yet

- Tax Quiz2 Answer KeyDocument5 pagesTax Quiz2 Answer Keycloy aubreyNo ratings yet

- True False False True True True False True True True True True True True True True True False False True True True False True TrueDocument5 pagesTrue False False True True True False True True True True True True True True True True False False True True True False True TrueDong RoselloNo ratings yet

- Final Examintation - TaxationDocument5 pagesFinal Examintation - TaxationMPCINo ratings yet

- CorporationDocument18 pagesCorporationkalai.mae19No ratings yet

- Financial Statement Analysis 10th Edition Subramanyam Test BankDocument36 pagesFinancial Statement Analysis 10th Edition Subramanyam Test Bankcleopatramabelrnnuqf100% (29)

- Financial Statement Analysis 10Th Edition Subramanyam Test Bank Full Chapter PDFDocument57 pagesFinancial Statement Analysis 10Th Edition Subramanyam Test Bank Full Chapter PDFvanbernie75nn6100% (12)

- Manual Registration Application Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD) / SEZ Developer/ SEZ UnitDocument29 pagesManual Registration Application Normal Taxpayer/ Composition/ Casual Taxable Person/ Input Service Distributor (ISD) / SEZ Developer/ SEZ UnitshaouluNo ratings yet

- Basic Principles of TaxationDocument19 pagesBasic Principles of TaxationAngela Nicole Nobleta0% (1)

- Income & Business Taxation QB3Document8 pagesIncome & Business Taxation QB3Keahlyn Boticario0% (1)

- Business Transfer Tax MidcmuDocument13 pagesBusiness Transfer Tax MidcmuEricaNo ratings yet

- Statement 2: Associations and Mutual Fund Companies, For Income Tax Purposes, Are Excluded in TheDocument7 pagesStatement 2: Associations and Mutual Fund Companies, For Income Tax Purposes, Are Excluded in TheEdward Glenn Bagui0% (1)

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- RR Filing, Penalties, RemediesDocument7 pagesRR Filing, Penalties, RemediesLisa ManobanNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Strama 2Document26 pagesStrama 2Ruby De GranoNo ratings yet

- The Marketing Channel: Ruby-Lyn T. de GranoDocument14 pagesThe Marketing Channel: Ruby-Lyn T. de GranoRuby De GranoNo ratings yet

- Chapter 2 MARKETING RESEARCH PROCESS AND PROPOSALSDocument10 pagesChapter 2 MARKETING RESEARCH PROCESS AND PROPOSALSRuby De GranoNo ratings yet

- CHAPTER 3 From Exposure To ComprehensionDocument15 pagesCHAPTER 3 From Exposure To ComprehensionRuby De GranoNo ratings yet

- Strama 3Document20 pagesStrama 3Ruby De GranoNo ratings yet

- Strama 1Document30 pagesStrama 1Ruby De GranoNo ratings yet

- Chapter 1 Market ResearchDocument11 pagesChapter 1 Market ResearchRuby De GranoNo ratings yet

- Basic Parts of Research PaperDocument11 pagesBasic Parts of Research PaperRuby De Grano100% (1)

- ALTERNATIVE-TEACHING-PLAN - Business Comm PDFDocument2 pagesALTERNATIVE-TEACHING-PLAN - Business Comm PDFRuby De GranoNo ratings yet

- Business LetterDocument4 pagesBusiness LetterRuby De GranoNo ratings yet

- Chapter 2 Motivation Ability and OpportunityDocument10 pagesChapter 2 Motivation Ability and OpportunityRuby De GranoNo ratings yet

- Meeting MinutesDocument1 pageMeeting MinutesRuby De GranoNo ratings yet

- Teaching Plan For Alternative Mode of Teaching and Learning: Cavite State University (Cvsu)Document2 pagesTeaching Plan For Alternative Mode of Teaching and Learning: Cavite State University (Cvsu)Ruby De GranoNo ratings yet

- Questionnaire For StudentsDocument5 pagesQuestionnaire For StudentsRuby De GranoNo ratings yet

- DEVELOPING INFORMATION ABOUT CONSUMER BEHAVIOR Appendix Chap 1Document6 pagesDEVELOPING INFORMATION ABOUT CONSUMER BEHAVIOR Appendix Chap 1Ruby De GranoNo ratings yet

- Organizational Differences and PerformanceDocument61 pagesOrganizational Differences and PerformanceRuby De GranoNo ratings yet

- Feasibility Study Format: o Packaging Figure 2. Product Logo o Pricing StructureDocument2 pagesFeasibility Study Format: o Packaging Figure 2. Product Logo o Pricing StructureRuby De GranoNo ratings yet

- Questionnaire For Faculties Organizational CultureDocument3 pagesQuestionnaire For Faculties Organizational CultureRuby De GranoNo ratings yet

- Chapter 1 Marketing ManagementDocument9 pagesChapter 1 Marketing ManagementRuby De GranoNo ratings yet

- BRT Word Format1 Chapter1 To 4 With Bibliography and Appendix A RevisedDocument35 pagesBRT Word Format1 Chapter1 To 4 With Bibliography and Appendix A RevisedRuby De GranoNo ratings yet

- De La Salle University - Dasmariñas: Graduate ProgramDocument23 pagesDe La Salle University - Dasmariñas: Graduate ProgramRuby De GranoNo ratings yet

- Chapter 1 Understanding Consumer Behavior PDFDocument21 pagesChapter 1 Understanding Consumer Behavior PDFRuby De GranoNo ratings yet

- DEVELOPING INFORMATION ABOUT CONSUMER BEHAVIOR Appendix Chap 1Document6 pagesDEVELOPING INFORMATION ABOUT CONSUMER BEHAVIOR Appendix Chap 1Ruby De GranoNo ratings yet

- An Overview of Organizational BehaviorDocument5 pagesAn Overview of Organizational BehaviorRuby De GranoNo ratings yet

- Chapter 3 Marketing ManagementDocument5 pagesChapter 3 Marketing ManagementRuby De GranoNo ratings yet

- CHAPTER 2 Marketing ManagementDocument8 pagesCHAPTER 2 Marketing ManagementRuby De GranoNo ratings yet

- Chapter 4 Marketing ManagementDocument11 pagesChapter 4 Marketing ManagementRuby De GranoNo ratings yet

- Chapter5 Marketing SegmentationDocument5 pagesChapter5 Marketing SegmentationRuby De GranoNo ratings yet

- Chapter 1 Marketing ManagementDocument9 pagesChapter 1 Marketing ManagementRuby De GranoNo ratings yet

- Jack Guttman Vs Warren Diamond John Delmonaco, Jacob FrydmanDocument129 pagesJack Guttman Vs Warren Diamond John Delmonaco, Jacob FrydmanJayNo ratings yet

- Handout No. 03 - Purchase TransactionsDocument4 pagesHandout No. 03 - Purchase TransactionsApril SasamNo ratings yet

- Dr. Reddy CaseDocument1 pageDr. Reddy Caseyogesh jangaliNo ratings yet

- Universiti Teknologi Mara Final Examination: CourseDocument7 pagesUniversiti Teknologi Mara Final Examination: Coursemuhammad ali imranNo ratings yet

- US Economic Indicators: Corporate Profits in GDP: Yardeni Research, IncDocument16 pagesUS Economic Indicators: Corporate Profits in GDP: Yardeni Research, IncJames HeartfieldNo ratings yet

- Temporary Employment ContractDocument2 pagesTemporary Employment ContractLancemachang Eugenio100% (2)

- Impact of Dividend PolicyDocument12 pagesImpact of Dividend PolicyGarimaNo ratings yet

- Summer Internship Report: Submitted byDocument53 pagesSummer Internship Report: Submitted byruchi mishraNo ratings yet

- 9-28-21 Mexico Market UpdateDocument14 pages9-28-21 Mexico Market UpdateSchneiderNo ratings yet

- Journalizing TransactionsDocument38 pagesJournalizing TransactionsPratyush mishraNo ratings yet

- Ch.09 Solution Manual - Funadmentals of Financial ManagementDocument18 pagesCh.09 Solution Manual - Funadmentals of Financial Managementsarahvillalon100% (2)

- Resilience of Hyderabad Residential Market During COVID-19Document5 pagesResilience of Hyderabad Residential Market During COVID-19Celestine DcruzNo ratings yet

- BCG Matrix Analysis 1Document9 pagesBCG Matrix Analysis 1MichaylaNo ratings yet

- Arguments Against Corporate Social ResponsibilityDocument6 pagesArguments Against Corporate Social ResponsibilityScorus OvidiuNo ratings yet

- Costingg Work BookDocument170 pagesCostingg Work BookDharshini AravamudhanNo ratings yet

- KudumbashreeDocument12 pagesKudumbashreeamarsxcran100% (1)

- Chapter 4 - Retail Market Strategy SVDocument29 pagesChapter 4 - Retail Market Strategy SVBẢO ĐẶNG QUỐCNo ratings yet

- Measure Progress Using Working HoursDocument3 pagesMeasure Progress Using Working HoursLaiqueShahNo ratings yet

- Practice UncertainDocument1 pagePractice UncertainMaisongpol PolruthNo ratings yet

- Fast Retailing Sustainability Report 2019Document20 pagesFast Retailing Sustainability Report 2019Mahmudul HaqueNo ratings yet

- Sukhwinder Kaur - Office ManagerDocument4 pagesSukhwinder Kaur - Office ManagerAbhishek aby5No ratings yet

- Thesis Topics in Finance PakistanDocument6 pagesThesis Topics in Finance Pakistanaflnqhceeoirqy100% (1)

- By Laws-SheDocument25 pagesBy Laws-SheSherilyn CastilloNo ratings yet

- Latif Khan PDFDocument2 pagesLatif Khan PDFGaurav AroraNo ratings yet

- Toyota Shaw Vs CA DigestDocument2 pagesToyota Shaw Vs CA Digestda_sein32No ratings yet

- Chapter OneDocument13 pagesChapter OneSofonias MenberuNo ratings yet

- Bond, Undertaking & Indemnity (CCE)Document4 pagesBond, Undertaking & Indemnity (CCE)Rahul Kumar100% (1)

- Peo Scsp0508Document318 pagesPeo Scsp0508rajrudrapaa100% (1)

- Motorcycle To Car Ownership The Role of Road Mobility Accessibility and Income InequalityDocument8 pagesMotorcycle To Car Ownership The Role of Road Mobility Accessibility and Income Inequalitymèo blinksNo ratings yet

- Case Study - DaburDocument1 pageCase Study - DaburMonica PandeyNo ratings yet