Professional Documents

Culture Documents

Momentum Picks

Uploaded by

JJOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Momentum Picks

Uploaded by

JJCopyright:

Available Formats

Momentum Picks

MOMENTUM PICK

New recommendations

Open Recommendations

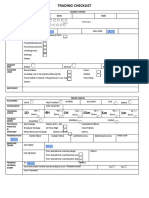

Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration

Gladiator Stocks

15-Oct-20 Nifty Nifty Buy 11940-11962 11998.0/12047.0 11899.00 Intraday

15-Oct-20 Kotak Mahindra Bank KOTMAH Buy 1354.00-1358.00 1367.40/1378.00 1345.40 Intraday

Scrip Action

15-Oct-20 Tata Steel TATSTE Buy 376.00-378.00 380.60/383.50 374.10 Intraday

HDFC Bank Buy

Can Fin Home Buy

Tech Mahindra Buy

Open recommendations Duration: 6 Months

Date Scrip I-Direct Code Action Initiation Range Target Stoploss Duration

Click here to know more…

08-Oct-20 CYIENT CYILIM Buy 393.00-399.00 442.00 373.00 14 Days

ICICI Securities – Retail Equity Research

08-Oct-20 Bajaj Electricals BAJELE Buy 500.00-516.00 565.00 475.00 14 Days

30-Sep-20 Heidelberg Cement HEICEM Buy 178-185 205.00 168.00 14 Days

Intraday recommendations are for current month futures. Positional recommendations are in cash segment

October 15, 2020 For Instant stock ideas:

SUBSCRIBE to mobile notification on

ICICIdirect Mobile app…

Research Analysts

Dharmesh Shah Nitin Kunte, CMT Ninad Tamhanekar, CMT

dharmesh.shah@icicisecurities.com nitin.kunte@icicisecurities.com ninad.tamhanekar@icicisecurities.com

Pabitro Mukherjee Vinayak Parmar

pabitro.mukherjee@icicisecurities.com vinayak.parmar@icicisecurities.com

NSE (Nifty): 11971

Technical Outlook NSE Nifty Daily Candlestick Chart Domestic Indices

Day that was… Indices Close 1 Day Chg % Chg

Open High Low Close

PICK

Equity benchmarks extended gains over 10th consecutive session as

SENSEX Index 40794.74 169.23 0.42

Picks

Nifty gained 37 points or 0.3% to settle Wednesday’s trading session 11917.40 11997.20 11822.15 11971.05

on a positive note at 11971. However, the market breadth remained NIFTY Index 11971.05 36.55 0.31

MOMENTUM

negative with A/D ratio of 1:1.2. Sectorally, financials outshone while Resistance

IT, pharma, auto underperformed. Nifty Futures 11982.25 36.15 0.30

Momentum

@ 12100

Technical Outlook We expect ongoing

momentum to slowdown and BSE500 Index 15508.65 40.18 0.26

• The daily price action formed a bull candle with long lower

shadow, indicating elevated buying demand as supportive efforts index to undergo a temporary Midcap Index 14726.26 73.87 0.50

emerged from 23.6% retracement of past ten sessions sharp up breather around 12100

move (11185-12022), 11824. As a result, index completely

Small cap Index 14859.53 -28.69 -0.19

recouped intraday losses and closed on a positive note. Key SGX Nifty 11992.00 9.75 0.08

• Going ahead, we expect the index to prolong the ongoing Support

consolidation (12100-11700) with a stock specific action amid @ 11500 * SGX Nifty at 7:30 am

progression of Q2FY21 result season. In the process, we expect

Nifty Technical Picture

Bank Nifty to support the benchmark index as it regained upward

momentum and closed above 200 days SMA Intraday Short term

• Key point to highlight since 2009 is that, post sharp up move

Trend

(more than 25%) in the broader market, the intermediate average

correction has been to the tune of 12% to 15%. Meanwhile, time Support 11930-11880 11700

ICICI Securities – Retail Equity Research

wise Nifty midcap and small cap indices undergo secondary

phase for 5-6 weeks. In current scenario, both indices have Resistance 12020-12070 12100

approached maturity of its price wise correction after 10% 20 day EMA 11594

correction. Whereas, time wise they have corrected for past four

weeks and thereby approaching time wise maturity. We believe 200 day EMA 10931

broader market has undergone healthy consolidation and we

expect catch up activity should be seen in broader market since Nifty Future Intraday Reco.

the Nifty has already surpassed August highs. Thus ongoing

consolidation should not be construed as negative as the broader Action Buy

structure remains positive. Instead dips should be capitalised on Price Range 11940-11962

as incremental buying opportunities in quality stocks

• Structurally, the Nifty has seen faster pace of retracement, as it Target 11998.0/12047.0

entirely retraced preceding four week’s corrective phase in just Stoploss 11899.00

Daily stochastic oscillator pointing downward, indicating breather

two weeks, indicating rejuvenation of upward momentum that

makes us confident of believing the Nifty would resolve higher

and retest its lifetime high of 12400 by December 2020. In the

Sectors in focus (Intraday):

process, we maintain key support base at 11500 as it is

confluence of: a) as per change of polarity concept earlier

Positive: Pharma, IT, Consumption,

resistance of 11500 would now act as immediate support b) last

week’s low is placed at 11450 Cement

In the coming session, volatility would remain high owing to weekly

derivative expiry. However, we expect index to hold intraday support Neutral: Power , Oil& Gas

of 11900 and trade with a positive bias. Hence, intraday dip towards

11940-11962 should be used to create long position for 12047 ICICI Securities Ltd. | Retail Equity Research 2

Source: Bloomberg, Spider, ICICI Direct Research

Bank Nifty: 23874

Technical Outlook Bank Nifty Index – Daily Candlestick Chart Nifty Bank daily change

The Bank Nifty snapped a two session decline and closed sharply Open High Low Close Indices Close Change Change%

MOMENTUM PICK

higher by more than 1.5% on Wednesday. The up move was lead

23353.15 23962.70 23149.45 23874.65 Nifty Bank 23874.65 382.45 1.63

by the private banking stocks. The Bank Nifty ended the session

at 23874, up by 382 points or 1.6%

25232

Technical Outlook

• The daily price action formed a bullish engulfing candle

signalling strength and strong buying demand around 23000 Nifty Bank Technical Picture

levels. A follow trough strength above last Monday’s high

(24190) will open fresh upside towards the August high of Intraday Short term

25250 in the coming weeks. Failure to do so will lead to a Trend

healthy base formation in the range of 24200-23000 Support 23680-23500 22200

• Key point to highlight during the ongoing pullback off Support

September low (20405) is that the Bank Nifty has retraced Resistance 24050-24200 25250

@

almost 80% of preceding 19 session’s decline (25232-20405) 22200 20 day EMA 22715

in just 13 sessions, at 24250. The ongoing faster retracement

200 day EMA 23532

signifies robust price structure

• We believe the last three sessions consolidation after a sharp

ICICI Securities – Retail Equity Research

up move (more than 3500 points rally) was seen over the past 20405

11 sessions will help the daily stochastic oscillator to cool off

the overbought condition and make markets healthy. Thus, A follow through strength above last Monday’s

any temporary breather from here on should not be construed 19507 high (24190) will open fresh upside towards the

as negative as the broader structure remains positive. Instead August high of 25250 in the coming weeks

dips should be capitalised on as incremental buying

opportunities in quality banking stocks

• The recent sharp up move and higher high-low in weekly chart

signals elevated buying demand that makes us confident to

revise the short term support base higher towards 22000-

22200 levels being the confluence of the following:

• a) The 50% retracement of the current up move 20405 to 17105

23450 is placed around 22000 levels Daily Stochastic cooling off from the overbought territory

• b) The previous week low is also placed around 22200 levels

• In the coming session, the index is opening on a flat note on

the back of soft global cues. Volatility is expected yo remain

high on account of volatile global cues. We expect the index

to continue with its previous session up move. Hence, use

dips towards 23750-23810 for creating long position for the

target of 24030 with a stoploss of 23640

Source: Bloomberg, Spider, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 3

Stock Picks

Duration: Intraday

Kotak Mahindra Bank (KOTMAH)– Daily candlestick Chart Technical Observations

MOMENTUM PICK

Price sustaining above 50 day EMA & short term trend line breakout signaling further CMP 1358.00

upward momentum in coming sessions

Action Buy

Price sustaining above 50 day

Rationale EMA & short term trend line

50 Days breakout

EMA

Initiation Range 1354.00-1358.00

Stochastic (5,3,S,3) generated bullish crossover suggest positive bias Target 1367.40/1378.00

Stop Loss 1345.40

ICICI Securities – Retail Equity Research

Tata Steel (TATSTE) – Daily candlestick Chart Technical Observations

Price rebound after taking support at 50% Retracement of recent up move suggesting CMP 377.10

further upsides in coming sessions

Action Buy

Price rebound after taking support

Rationale at 50% Retracement of recent up

move

50%

Initiation

Retracement 376.00-378.00

Range

14 period RSI in buy mode suggest bullish bias Target 380.60/383.50

Stop Loss 374.10

Source: Bloomberg, Spider, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 4

Stock Picks

Duration: 14 days

Buy Cyient Limited (CYILIM) in the range of 393.00-399.00 Target: 442,00 Stop Loss: 373.00 Technical Observations

Daily Bar Chart • IT sector is outperforming and

MOMENTUM PICK

513 A potential double bottom signals strength and offers fresh entry opportunity with mid cap IT companies are

a favourable risk reward set up catching up with their large caps

Target exhibiting broad based sector

431 442 @ 442 participation

• The share price of Cyient has

formed a potential double bottom

at the 50 days EMA and 38.2%

367 Support retracement of the previous up

Potential double bottom at @ 373 move (248-431) signalling

the 50 days EMA strength and offers fresh entry

A slower opportunity with a favourable risk

retracement reward set up

248 • The stock has already taken seven

weeks to retrace just 38.2% of the

previous six weeks up move (|

248 to 431). A shallow

184 retracement signals strength and

ICICI Securities – Retail Equity Research

a robust price structure

Strong surge in volume

• The stock has immediate support

at | 373 levels being the

confluence of the rising 50 days

EMA and the lower band of the

The daily stochastic in up trend last nine session consolidation

placed around | 373 levels

• Based on the above observations,

we expect the stock to resume up

move after recent consolidation

and test September high of | 442

Recommendation initiated on i-click to gain at 09:29 on October 08, 2020 levels in the coming sessions

Source: Bloomberg, Spider Software, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 5

Stock Picks

Duration: 14 days

Buy Bajaj Electricals (BAJELE) in the range of 500.00-516.00 Target: 565.00 Stop Loss: 475.00 Technical Observations

Daily Bar Chart • The stock has generated a

MOMENTUM PICK

breakout above the falling

Price rebounding from the lower band of the rising channel and 50 days EMA and has generated a breakout above

trendline joining the recent high of

Target

the falling trendline signalling resumption of up move thus offers fresh entry opportunity Aug’20 (| 545) and Sep’20 (| 520)

545 @ 565

signalling resumption of up move

520 after recent breather thus offers

fresh entry opportunity

460 466

Support • The entire up move since April

442 @ 475 low (| 260) is well channelled

signalling sustained demand at

elevated levels

380

• It has recently rebounded forming

higher base at the rising 50 days

SMA (Currently at | 475) and the

lower band of the rising channel

containing the entire up move

since April 2020 low (| 260)

highlighting a robust price

ICICI Securities – Retail Equity Research

260

structure and strong support base

around | 475 levels

The daily 14 periods RSI is seen sustaining above its nine periods average thus

validates positive bias in the stock • Among the oscillators, the daily

14 periods RSI is seen sustaining

above its nine periods average

thus validates positive bias in the

stock.

• We expect the stock to continue

with its current up move and test

levels of | 565 in the coming

sessions as it is the 123.6%

Recommendation initiated on i-click to gain at 15:24 on October 08, 2020 external retracement of the recent

breather (| 545-442) placed

around | 565 levels

Source: Bloomberg, Spider Software, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 6

Stock Picks

Duration: 14 days

Buy Heidelberg Cement (HEICEM) in the range of 178.00-185.00 Target: 205,00 Stop Loss: 168.00 Technical Observations

Daily Bar Chart • The stock has generated a

MOMENTUM PICK

A falling trendline breakout joining recent highs as the stock rebound from the breakout above the falling

200 days SMA thus offers fresh entry opportunity trendline joining the highs of

205 Target @ 205

August (| 205) and September (|

193) signalling reversal of the last

194 193 six weeks breather and

resumption of up move thus

offers fresh entry opportunity

• The stock during the recent

breather has formed a higher base

174

172 at the rising 200 days SMA

Support (currently placed at 176 levels) as

Higher base at the @ 168 can be seen in the adjacent chart

200 days SMA highlighting a robust price

structure

• The stock has crucial support base

at | 174-170 levels being the

confluence of the lower band of

ICICI Securities – Retail Equity Research

140 the recent consolidation and 50%

retracement of the previous major

The daily 14 periods RSI has generated a bullish crossover above its nine periods up move of May-August (| 140-

average thus supports the positive bias in the stock 205) placed at | 172 levels

• Among the oscillators, the daily

14 periods RSI has generated a

bullish crossover above its nine

periods average thus supports the

positive bias in the stock

• Based on the above observations,

we expect the stock to continue

Recommendation initiated on i-click to gain at 14:10 on September 30, 2020 with its current up move and

retest its August high of | 205 in

the coming sessions

Source: Bloomberg, Spider Software, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 7

Market Activity Report

Global Currency, Commodities and Bond Global Equity Market Performance

Currency/Yield/ 1 Day % 1 Day Change

MOMENTUM PICK

Close Brazil 0.8

Commodities Change

US -0.6

Currency

India 0.4

USD INR 73.28 0.1

Hong Kong -0.7

Dollar Index 93.43 0.0 Japan -0.4

China 0.2

EURO USD 1.17 0.0

Germany 0.1

GBP USD 1.30 0.0 UK -0.6

JPY France -0.1

105.24 0.1

-1.3 -0.8 -0.3 0.2 0.7 1.2

Swiss Franc 0.91 -0.1

% Change

1 Day Change

Commodities ($)

ICICI Securities – Retail Equity Research

Advance Decline

Gold 1,900.60 -0.4

2000

Brent 43.31 -0.2

1600

Copper 6,716.00 0.4

1200

Silver 24.23 -0.7

800

Yield (bps change)

400

5.90 0.00

India 10 0

US 0.71 -0.43 6-Oct 7-Oct 8-Oct 9-Oct 12-Oct 13-Oct 14-Oct

EURO -0.57 -0.52 Advances Declines

Japan 0.02 -19.35

Source: Bloomberg, Investing, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 8

Market Activity Report

Sectoral Indices Performance Fund Flow activity of the last 5 sessions

1 Day %

Sectoral Indices Close

MOMENTUM PICK

Change FII

Sensex 40,794.7 0.4 1,300

Nifty 11,971.1 0.3 978

832 822

BSE Auto 18,166.6 -0.2

Rs Crore

615

600

Bankex 27,064.4 1.6

Capital Goods 13,796.5 1.0

Consumer

24,187.6 0.0

Durables -100 -39

8-Oct 9-Oct 12-Oct 13-Oct 14-Oct

FMCG 11,087.0 0.1

Date

ICICI Securities – Retail Equity Research

Healthcare 19,996.8 -0.7

DII

IT 22,312.6 -1.5 400

127

100 20

Metal 7,975.5 0.0

-200

Oil & Gas 11,890.6 -1.1 Rs Crore

-500

-800

Power 1,607.3 -1.6

-1,100 -1,029

Realty 1,692.4 1.0 -1,400 -1,276

-1,700

BSE 500 15,508.7 0.3 -1,674

-2,000

BSE Midcap Index 14,726.3 0.5 8-Oct 9-Oct 12-Oct 13-Oct 14-Oct

Date

BSE Small Cap 14,859.5 -0.2

Source: Bloomberg, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 9

Trend Scanner

Heat Map Positive Trend Universe: NSE 500 52 Weeks High

Bajaj 6,100 811 Bajaj 3,372 ICICI 407 Indusind 623 Change 20-Day Delivery Scrip Name LTP

MOMENTUM PICK

Finserv

SBI Life

Finance Bank Bank Scrip Name Close

4.0% 3.1% 3.0% 2.7% 2.4% % SMA ( %) HCL Tech 887

SBI

200

Axis Bank

471

L&T

915

T ata Steel

376 Grasim 764 Kotak Mahindra Bank 1353.35 0.62 1299.00 39 JK Cement 1730

Ind

2.2% 2.2% 2.1% 2.0% 1.9%

Info Edge 3740.55 4.50 3504.00 20 Mphasis 1425

1,980 2,254 4,443 3,790 HDFC 1,212

HDFC Ltd Eicher Ultratech Britannia

Bank Tata Chemical 318.05 3.45 298.00 19

1.9% 1.5% 1.4% 1.2% 1.1%

Ultratech 4442.85 1.37 4076.00 16

HDFC 572 2,158 511 3,311 3,054 52 Weeks Low

HUL UPL Hero Moto Bajaj Auto

Life

1.0% 0.9% 0.9% 0.7% 0.6% Quick Heal 177.95 5.92 160.00 14 Scrip Name LTP

Kotak 1,353

Hindalco

174 Asian 2,071 Reliance 2,288

JSW Steel

291 Ingersoll rand 560

Bank Paints Ind.

0.6% 0.5% 0.3% 0.3% 0.2% Coal India 110

15,673 2,810 Sun 502 Shree 21,040 Adani 349

Nestle T CS

0.0% -0.2%

Pharma

-0.2%

Cement

-0.2%

Ports

-0.3%

Negative Trend Universe: NSE 500

3,130 7,002 1,223 Bharti 413 83 Change 20-day Delivery Overbought Stocks

Divis Lab Maruti T itan GAIL Scrip Name Close

Airtel % SMA ( %)

-0.3% -0.4% -0.4% -0.5% -0.6% Scrip Name LTP Stochastic

Coal India 110.55 -2.90 118.00 38 Adani transmission 295 93

ICICI Securities – Retail Equity Research

624 782 5,123 890 168

M&M Cipla Dr Reddy HCl T ech IT C

-0.6% -0.7% -0.9% -1.1% -1.4%

1,137 333 75 Power 157 849

Infosys BPCL IOC T echM

Grid

-1.8% -1.8% -1.9% -2.1% -2.2%

T ata 131

Coal India

111

ONGC

67

NT PC

79

Wipro

350 Oversold Stocks

Motors

-2.5% -2.9% -3.0% -4.3% -6.8% Scrip Name LTP Stochastic

Akzo India 2010 7

Candlestick Pattern Balkrishna Industries 1380 11

Bullish Candlestick Formations Bearish Candlestick Formations Godrej Industries 379 12

Scrip Name Pattern name LTP Scrip Name Pattern name LTP

Axis Bank Engulfing 471.0 LTI Shooting star 3330.0

Bajaj Finance Engulfing 3372.0 Natco pharma Belt Hold line 901.0

Blue Star Piercing line 624.0 Lupin Engulfing 1036.0

Gujarat Gas Engulfing 296.0 Chola Holding Belt Hold line 394.0

Source: Bloomberg, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 10

Intraday Supports and Resistance (Cash)

Scrip Name Trend Close S1 S2 S3 R1 R2 R3

NIFTY 50 Neutral 11971.05 11863 11755 11688 12038 12105 12213

MOMENTUM PICK

S&P BSE SENSEX INDEX Neutral 40794.74 40424 40051 39823 41024 41253 41625

NIFTY BANK Neutral 23874.65 23361 22849 22548 24175 24475 24988

NIFTY 50 FUTURES Neutral 11973 11859 11745 11673 12045 12117 12231

NIFTY BANK FUTURES Neutral 23944.5 23431 22916 22620 24242 24538 25053

ACC LTD Negative 1549.5 1518 1489 1470 1567 1585 1615

AMBUJA CEMENTS Neutral 246.6 242 237 234 250 253 258

ADANI POWER LTD Neutral 36.4 35 35 35 36 37 37

ADANI ENTERPRISE Neutral 313.4 310 307 305 316 319 322

ADANI PORTS AND Negative 348.95 345 342 338 351 355 358

ASHOK LEYLAND Negative 73.2 72 71 70 74 75 76

AMARA RAJA BATT Positive 729.55 723 715 705 741 751 759

APOLLO HOSPITALS Negative 2227.7 2200 2173 2136 2264 2301 2328

ASIAN PAINTS LTD Neutral 2071.35 2057 2041 2026 2087 2102 2118

APOLLO TYRES LTD Negative 128.65 126 124 121 131 134 136

ICICI Securities – Retail Equity Research

AUROBINDO PHARMA Negative 810.4 798 784 775 821 830 844

AXIS BANK LTD Neutral 471.3 459 446 439 480 488 501

BAJAJ FINANCE LT Neutral 3372.05 3276 3179 3126 3425 3479 3575

BATA INDIA LTD Negative 1364.75 1345 1326 1310 1380 1396 1415

BHARTI AIRTEL Negative 413.25 411 407 402 419 423 427

BHARAT ELECTRON Neutral 91.55 90 89 88 93 95 95

BHARAT HEAVY ELE Negative 27.95 28 28 27 28 29 29

BHARAT FORGE CO Negative 443.5 437 430 420 455 464 472

BALKRISHNA INDS Negative 1379.6 1359 1337 1312 1405 1429 1451

BIOCON LTD Negative 446.7 443 439 434 451 457 460

BAJAJ AUTO LTD Positive 3054.15 3025 2995 2970 3080 3105 3135

BAJAJ FINSERV LT Positive 6100.05 5921 5743 5631 6211 6323 6501

BANK OF BARODA Neutral 42.05 42 40 40 44 44 46

BANK OF INDIA Negative 40.3 39 39 38 40 41 42

BOSCH LTD Negative 12075.45 11924 11771 11537 12310 12545 12697

BHARAT PETROL Negative 332.9 327 323 317 338 343 348

Source: Bloomberg, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 11

Intraday Supports and Resistance (Cash)

Scrip Name Trend Close S1 S2 S3 R1 R2 R3

BERGER PAINTS Negative 605.85 602 598 593 611 616 620

MOMENTUM PICK

BRITANNIA INDS Positive 3789.8 3752 3715 3690 3814 3839 3876

CANARA BANK Negative 88.55 88 87 87 90 91 92

CONTAINER CORP Negative 364.85 359 354 350 368 372 377

CADILA HEALTHCAR Negative 430.55 424 418 413 436 440 447

CENTURY TEXTILE Negative 315.95 308 301 295 320 325 332

CESC LTD Negative 582.6 580 576 571 588 592 596

CHOLAMANDALAM IN Neutral 249.55 242 235 230 255 259 267

CIPLA LTD Negative 781.5 767 753 740 795 809 823

COFORGE LTD Negative 2606.7 2545 2484 2373 2717 2828 2889

COLGATE PALMOLIV Neutral 1446.85 1434 1420 1408 1461 1474 1487

COAL INDIA LTD Negative 110.55 108 107 104 112 115 117

DABUR INDIA LTD Negative 516.95 510 502 497 522 526 534

DEWAN HOUSING Negative 12.3 11 11 11 12 13 13

DIVI LABS LTD Negative 3130.45 3102 3073 3043 3161 3191 3220

ICICI Securities – Retail Equity Research

DLF LTD Neutral 159.1 154 150 148 161 164 167

DR REDDY'S LABS Negative 5123 5070 5016 4941 5199 5274 5328

EICHER MOTORS Positive 2253.9 2207 2160 2130 2284 2314 2361

EQUITAS HOLDINGS Negative 51.7 51 50 49 53 54 56

ESCORTS LTD Negative 1232.35 1218 1204 1186 1250 1268 1282

EXIDE INDUS LTD Neutral 160.8 158 157 156 161 163 164

FED BANK LTD Neutral 52.9 53 51 51 55 55 56

GAIL INDIA LTD Negative 82.65 81 80 79 83 84 85

GODREJ CONSUMER Negative 699.8 692 683 669 715 729 738

GMR INFRASTRUCTU Negative 23.7 24 23 23 25 25 25

GLENMARK PHARMA Negative 486.4 473 460 448 498 510 524

GRASIM INDS LTD Neutral 763.6 742 720 707 777 790 811

HAVELLS INDIA Negative 697.45 692 687 681 704 711 716

HCL TECH LTD Positive 890.45 877 865 849 906 923 935

HOUSING DEV FIN Neutral 1979.85 1937 1893 1867 2007 2033 2077

HDFC BANK LTD Negative 1211.5 1186 1161 1147 1225 1239 1263

Source: Bloomberg, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 12

Intraday Supports and Resistance (Cash)

Scrip Name Trend Close S1 S2 S3 R1 R2 R3

HERO MOTOCORP LT Positive 3310.8 3277 3242 3214 3340 3368 3403

MOMENTUM PICK

HINDALCO INDS Positive 174.2 171 169 167 175 177 179

HINDUSTAN PETRO Negative 168.6 166 163 160 171 173 176

HINDUSTAN UNILEV Positive 2158.15 2137 2117 2103 2171 2185 2205

VODAFONE IDEA LT Negative 8.4 7 8 7 8 8 8

IDFC FIRST BANK Negative 31.25 31 30 30 32 32 33

INDRAPRASTHA GAS Positive 373.1 366 360 356 376 380 385

INDIABULLS HOUSI Neutral 155.3 147 140 135 160 164 172

INDUSIND BANK Neutral 622.65 606 587 577 635 645 663

INTERGLOBE AVIAT Negative 1342.6 1318 1292 1262 1374 1404 1430

INFOSYS LTD Negative 1137 1123 1110 1089 1157 1178 1191

INDIAN OIL CORP Negative 74.65 74 73 72 76 77 78

ICICI PRUDENTIAL Neutral 425.15 412 397 389 434 441 456

ITC LTD Negative 167.8 167 165 163 171 173 175

JINDAL STEEL & P Negative 190.15 188 186 184 192 194 195

ICICI Securities – Retail Equity Research

JSW STEEL LTD Positive 290.65 286 283 280 293 296 299

JSW ENERGY LTD Neutral 60.2 57 55 53 61 63 66

JUBILANT FOODWOR Positive 2315.05 2279 2243 2220 2337 2361 2396

JUST DIAL LTD Negative 408.9 405 400 397 414 418 423

CUMMINS INDIA Neutral 437.8 434 430 425 444 450 454

KOTAK MAHINDRA Positive 1353.35 1332 1311 1298 1366 1379 1400

LIC HOUSING FIN Negative 286.45 282 277 274 290 293 298

LUPIN LTD Negative 1036.2 1019 1001 980 1057 1079 1096

LARSEN & TOUBRO Neutral 915.2 895 876 865 925 936 955

L&T FINANCE HOLD Neutral 62.8 61 59 58 64 65 67

MAHANAGAR GAS LT Negative 792.7 783 772 765 800 808 818

MAX FINANCIAL SE Neutral 595.9 586 576 570 602 608 619

MANAPPURAM FINAN Neutral 166.5 163 159 157 169 171 175

Source: Bloomberg, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 13

Intraday Supports and Resistance (Cash)

Scrip Name Trend Close S1 S2 S3 R1 R2 R3

MAHINDRA & MAHIN Negative 623.85 618 612 607 630 635 641

MOMENTUM PICK

M&M FIN SERVICES Negative 129.55 126 122 120 132 134 139

MARICO LTD Negative 361.6 359 355 350 367 373 376

MRF LTD Negative 59132.6 58373 57612 57224 59522 59910 60671

MARUTI SUZUKI IN Negative 7002.35 6929 6854 6781 7077 7150 7224

MOTHERSON SUMI Negative 110.55 110 108 107 113 114 116

MINDTREE LTD Neutral 1551.9 1526 1501 1461 1591 1631 1656

MUTHOOT FINANCE Neutral 1156.05 1129 1100 1084 1174 1190 1219

NATIONAL ALUMIN Negative 29.8 30 29 29 31 31 32

NBCC INDIA LTD Negative 22.5 23 22 22 24 24 24

NESTLE INDIA LTD Negative 15673.05 15542 15411 15272 15812 15951 16082

NCC LTD Negative 31.7 31 30 30 33 34 35

NMDC LTD Neutral 79.95 78 76 75 82 84 86

NTPC LTD Negative 79.1 77 75 72 82 85 87

OIL INDIA LTD Negative 84.35 83 82 80 86 88 89

ICICI Securities – Retail Equity Research

OIL & NATURAL GA Negative 67 65 65 63 67 69 70

PAGE INDUSTRIES Negative 20677.35 20190 19701 19365 21014 21350 21839

PIDILITE INDS Neutral 1486.7 1478 1467 1459 1497 1505 1515

PIRAMAL ENTERPRI Negative 1299.65 1266 1233 1213 1320 1341 1373

PETRONET LNG LTD Negative 210.2 206 203 198 215 219 223

PUNJAB NATL BANK Negative 28.15 28 27 27 29 29 29

POWER FINANCE Neutral 86.2 84 82 81 87 88 90

PVR LTD Neutral 1245.6 1222 1199 1174 1271 1297 1320

POWER GRID CORP Negative 157.05 155 154 151 160 163 164

RBL BANK LTD Negative 172.9 168 163 160 176 179 184

REC LTD Neutral 95.45 92 90 88 96 98 100

RELIANCE INDS Positive 2287.5 2270 2252 2235 2306 2323 2341

STEEL AUTHORITY Negative 32.95 33 32 32 33 34 34

STATE BANK IND Neutral 200.05 195 190 187 203 206 211

SHRIRAM TRANSPRT Neutral 665.2 646 627 614 678 691 710

Source: Bloomberg, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 14

Intraday Supports and Resistance (Cash)

Scrip Name Trend Close S1 S2 S3 R1 R2 R3

SHREE CEMENT Negative 21040 20688 20335 20019 21357 21673 22025

MOMENTUM PICK

SRF LTD Negative 4371.75 4305 4238 4186 4424 4476 4544

SUN PHARMA INDU Negative 502.2 495 487 480 509 515 523

SUN TV NETWORK Negative 439.75 432 426 419 445 452 459

TATA STEEL LTD Positive 375.55 371 366 363 378 382 386

TATA CONSULTANCY Negative 2809.6 2784 2759 2730 2838 2867 2893

TECH MAHINDRA LT Negative 848.85 838 828 810 866 884 895

TATA CONSUMER PR Neutral 489.8 473 454 445 500 510 528

TORRENT POWER LT Negative 297.85 295 291 289 301 303 307

TATA POWER CO Negative 52.95 52 51 50 54 55 56

RAMCO CEMENT/THE Negative 769.5 755 741 731 779 789 804

TORRENT PHARMA Negative 2758.45 2726 2696 2645 2808 2859 2889

TITAN CO LTD Negative 1223.45 1211 1200 1181 1241 1260 1272

TATA CHEMICALS Positive 318.05 311 305 300 321 325 331

TATA MOTORS LTD Negative 130.7 127 125 122 133 137 139

ICICI Securities – Retail Equity Research

TVS MOTOR CO LTD Negative 461.55 455 449 444 466 471 477

UNITED BREWERIES Positive 971.1 960 949 940 980 989 1000

UJJIVAN FINANCIA Negative 208 205 201 198 212 215 220

UNITED SPIRITS Negative 524.05 518 514 509 528 532 537

UPL LTD Negative 510.9 499 488 481 517 524 534

ULTRATECH CEMENT Negative 4442.85 4353 4262 4209 4497 4550 4641

VEDANTA LTD Negative 98.45 94 89 86 101 105 109

VOLTAS LTD Negative 673.8 661 649 642 680 687 698

WIPRO LTD Negative 350.45 345 338 328 362 372 378

YES BANK LTD Neutral 12.9 13 13 13 13 13 13

ZEE ENTERTAINMEN Negative 186.2 180 174 170 189 194 199

Source: Bloomberg, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 15

Forthcoming Economic Event Calendar

Date Event Date Event

MOMENTUM PICK

US China

16-Oct Industrial Production MoM 15-Oct Industrial Production YTD YoY

21-Oct MBA Mortgage Applications 15-Oct Retail Sales YTD YoY

28-Oct Retail Inventories MoM 17-Oct Swift Global Payments CNY

29-Oct GDP Annualised QoQ 21-Oct FX Net Settlement - Clients CNY

30-Oct PCE Core deflator MoM 29-Oct Industrial Profits YoY

30-Oct Manufacturing PMI

30-Oct Non-manufacturing PMI

India UK

15-Oct Expot/Import 17-Oct Bank of England Bank Rate

29-Oct Fiscal Deficit INR Crore 18-Oct Retail Sales Ex Auto Fuel MoM

30-Oct Eight Infrastructure Industries 23-Oct CBI Retailing Reported Sales

28-Oct Nationwide House PX MoM

ICICI Securities – Retail Equity Research

Source: Bloomberg, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 16

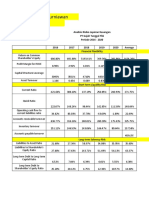

Momentum Picks: Strategy Follow up

Duration: Intraday

MOMENTUM PICK

Date Scrip Idirect Code Strategy Recommended Price Targets SL Gain/Loss % Comment

14-Oct-20 Nifty Nifty Sell 11955.0-11978.0 11916.0/11868.0 12017.00 - No trade

14-Oct-20 Britannia Industries BRIIND Buy 3746.00-3752.00 3779.80/3809.00 3718.30 1.60 target 2 almost achieved

14-Oct-20 Power Finance Corporation POWFIN Sell 84.20-84.80 83.60/82.60 85.50 1.20 target 1 achieved

Duration: Cash Positional

Date Scrip Idirect Code Strategy Recommended Price Targets SL Gain/Loss % Comment

06-Oct-20 Bandhan Bank BANBAN Buy 304 334.00 283.00 7.00 Book 50% profit at 325.00

06-Oct-20 Nocil NOCIL Buy 148 169.00 138.00 -4.00 Exit at 141.35

ICICI Securities – Retail Equity Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 17

Gladiator Stocks: Open Recommendations

Date Scrip Name Strategy Recommendations Price Target Stoploss Time Frame

9-Oct-20 Canfin home Buy 450-460 528.00 417.00 6 Months

MOMENTUM PICK

9-Oct-20 HDFC Bank Buy 1200-1230 1378.00 1135.00 6 Months

5-Oct-20 Tech Mahindra Buy 830-850 950.00 780.00 6 Months

29-Sep-20 Blue Dart Buy 3100-3220 3710.00 2850.00 6 Months

18-Sep-20 Caplin point Buy 585-602 710.00 527.00 6 Months

18-Sep-20 Godrej Properties Buy 900-922 1065.00 840.00 6 Months

3-Sep-20 Sun pharma Buy 510-525 605.00 467.00 6 Months

18-Aug-20 Britannia Industries Buy 3870-3920 4510.00 3560.00 6 Months

1-Jun-20 Pidilite Ind Buy 1450-1490 1670.00 1320.00 6 Months

All the recomedations are in Cash segment

ICICI Securities – Retail Equity Research

Back to Top

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 18

Price history of last three years

Bajaj Electricals CYIENT

MOMENTUM PICK

ICICI Securities – Retail Equity Research

Heidelberg Cement

Source: Spider Software, ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 19

Product Guidelines......

• In case of intraday stock recommendations, execute the trade within +/- 0.25% of the recommended range provided in

the report. The stock recommendation has to be execute after the first 5 minutes of trade and only up to 11:00 am. In

MOMENTUM PICK

case of Nifty future execute after the first 5 minutes of trade and up to 03:00 pm

• In case of positional recommendations, execute the recommendations in the range provided in the report

• Once the recommendation is executed, it is advisable to maintain strict stop loss as provided in the report. For positional

recommendation maintain stop loss on daily closing basis

• We adapt a trading strategy of booking 50% profit when the position is in profit by 4-5% and trail stop loss on remaining

position to the entry point (In case of positional stock recommendations)

• In case of intra day Nifty futures recommendation, once recommendation is activated, consider booking 50% profit near

1st Target (tolerance of 3 points) and trail stop loss to cost for remaining positions

• If the recommended intra day stock hits the target price before getting activated, then it is considered not initiated

• The Intra day recommendations are valid only for the day and should be squared off by 15:10 hrs. The positional

recommendations are valid only for the prescribed period and are to be squared off at the end of mentioned period

ICICI Securities – Retail Equity Research

unless communicated otherwise through separate mail or on i-click to gain page

• Only stocks in derivatives segment have been considered for intra day recommendations

• Medium to long-term prospects of a stock does not have any bearing on the intra day view

Trading portfolio allocation

• It is recommended to spread out the trading corpus in a proportionate manner between the various technical research

products

• Please avoid allocating the entire trading corpus to a single stock or a single product segment

• Within each product segment it is advisable to allocate equal amount to each recommendation

• For example: The ‘Momentum Pick’ product carries 2 to 4 intraday recommendations. It is advisable to allocate equal

amount to each recommendation

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 20

Recommended product wise trading portfolio allocation

Allocations

Product Product wise Max allocation

Number of Calls Return Objective Duration

MOMENTUM PICK

allocation In 1 Stock

Momentum Picks- 10% 30-50% 2 Stocks 1-2% Intraday

Intraday

Momentum Picks- 25% 8-10% 8-10 Per Month 5-8% 14 Days

Positional

Gladiator Stocks 35% 10-13% Opportunity Based 15-20% 6 Months

Yearly Technical 25% 12-15% 7-9 Per Year 20-30% 1 Year

Cash 5%

ICICI Securities – Retail Equity Research

100%

Source: ICICI Direct Research

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 21

Candlesticks Glossary

Candlestick patterns describe the market sentiment for the specified period. Some of the formations suggest reversal of sentiment (trend) and, therefore, are important

for a chart reader. By themselves, the patterns do not carry any price target but only an indication of change in market behaviour. More importance needs to be given

MOMENTUM PICK

to the placement of the pattern within larger trend

Morning Star: Potential bottom reversal pattern made of three candle lines. The first sizeable black candle reflects a market in which the bears are in complete charge.

The next candle line--the small real body--shows a slight diminution of the bearish force. The white candle that makes up the last part of the morning star visually

displays the bulls are gaining the upper hand. Lowest low amongst three candles becomes technical support

Bullish Engulfing Line: A potential bottom reversal pattern. This pattern typically appears at the culmination of a decline or downtrend. The market falls, and a black

candle forms (ideally a small black candle). Next, a white real body wraps around the prior session’s black body. Low of the pattern becomes short term support for

prices

Piercing Line: Potential bottom reversal pattern. A black body forms in the downtrend. The market continues moving south on the next session’s open but that session

culminates in a white real body that closes (e.g. pierces) than half way or more into the prior black body. Lowest low between two candles is referred to as technical

support for prices

Hammer: A candlestick line which, during a downtrend, has a very long lower shadow and small real body (black or white) at the top end of the session’s range. There

should be no, or a very small, upper shadow. Pattern suggests buying support during declines and needs confirmation in terms of sustainability of prices above head of

the Hammer in following session

ICICI Securities – Retail Equity Research

Evening Star: Potential Top reversal pattern made of three candle lines. Comparable with a traffic signal. First white candle reflects a market in bullish trend. The next

candle line--the small real body—warns waning momentum. The black candle that completes the evening star visually exhibits that prior up trend has stopped or

reversed

Bearish Engulfing Line: Potential top reversal signal. This two candlestick pattern emerges during a rally. A black candle real body wraps around a white real body

(classically a small white candle) Highest high between two candles becomes resistance level for prices for future reference

Dark Cloud cover: A dark cloud cover forms a top reversal pattern. The first session should be a strong, white real body. The second session’s price opens over the

prior session’s high (or above the prior session’s close). By the end of the second session, it closes near the low of the session and should fall well into the prior

session’s white body. Pattern suggests that market has a poor chance of rising immediately

Shooting Star: A single candlestick line during a rally in which there is a small real body (white or black) at the bottom end of the session's range and a very long

upper shadow. The candle line should also have little or no lower shadow. Pattern suggest the trouble for prices overhead

Continuation Patterns: Other than widely known Candlestick reversal patterns discussed above, there are numerous patterns mentioned in literature on Candlestick

which describe the continuation of existing sentiments i.e. bullish or bearish. We have refrained from mentioning names of these patterns to avoid confusion. However,

the remark Continuation Pattern refers to bullish or bearish candlestick patterns which suggest continuation of existing trend

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 22

MOMENTUM PICK

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICI Securities – Retail Equity Research

ICICI Direct Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 23

Disclaimer

We /I, Dharmesh Shah, Nitin Kunte, Ninad Tamhanekar, Pabitro Mukherjee, Vinayak Parmar Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the

subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. Analysts are not registered as research analysts by FINRA and are not associated

persons of the ICICI Securities Inc. It is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and do not serve as an officer, director or employee

of the companies mentioned in the report.

MOMENTUM PICK

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities Limited is a SEBI registered Research Analyst with SEBI

Registration Number – INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock broker. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged in businesses of

housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on www.icicibank.com

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking and other business relationship with a significant percentage of

companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, outstanding positions, trading volume etc as opposed to focusing on a company's fundamentals and, as such, may not match with the

recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions expressed in this document may or may not match or may be contrary

with the views, estimates, rating, target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in

any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis,

ICICI Securities is under no obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been

suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational

purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the

ICICI Securities – Retail Equity Research

same time. ICICI Securities will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your

specific circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient.

This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange

rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure

Document to understand the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings,

corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law,

regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in

whose possession this document may come are required to inform themselves of and to observe such restriction.

October 15, 2020 ICICI Securities Ltd. | Retail Equity Research 24

You might also like

- Trading Journal SheetsDocument2 pagesTrading Journal SheetsDiana LondonNo ratings yet

- How To Trade Using The Shooting Star CandlestickDocument3 pagesHow To Trade Using The Shooting Star CandlestickDian SuryadinNo ratings yet

- Pay Attention To What The Market Is SayingDocument11 pagesPay Attention To What The Market Is SayingEmmy ChenNo ratings yet

- Stock Screeners: What Is A Stock Screener?Document9 pagesStock Screeners: What Is A Stock Screener?Evergreen StoriesNo ratings yet

- Intraday Option Trading StrategiesDocument6 pagesIntraday Option Trading StrategiesMarkandaiya Acharya0% (1)

- Trading Plan TemplateDocument12 pagesTrading Plan TemplateKasiviswanathan MuthiahNo ratings yet

- Developing Profitable Trading Strategies - A Beginner’s Guide to Backtesting using Microsoft ExcelFrom EverandDeveloping Profitable Trading Strategies - A Beginner’s Guide to Backtesting using Microsoft ExcelNo ratings yet

- BMW Group Investor Presentation October 2020Document51 pagesBMW Group Investor Presentation October 2020JJNo ratings yet

- Basics of Derivatives MarketsDocument4 pagesBasics of Derivatives MarketsMonica SainiNo ratings yet

- Technical Analysis by Leavitt BrothersDocument441 pagesTechnical Analysis by Leavitt Brothersvinodtp100% (2)

- Swing Trading Guide by Tanmay BhavsarDocument71 pagesSwing Trading Guide by Tanmay BhavsarTanmayNo ratings yet

- Richard Rhodes' Trading Rules: Chart SchoolDocument3 pagesRichard Rhodes' Trading Rules: Chart SchoolSonu KumarNo ratings yet

- BSP Organizational StructureDocument1 pageBSP Organizational StructureJason MablesNo ratings yet

- MCX Silver: 31 July, 2012Document2 pagesMCX Silver: 31 July, 2012arjbakNo ratings yet

- 1 - Introduction To Capital MarketDocument31 pages1 - Introduction To Capital MarketSuresh AsangiNo ratings yet

- Tech AnalysisDocument19 pagesTech AnalysisjatingediaNo ratings yet

- Technical Analysis Guide for TradersDocument7 pagesTechnical Analysis Guide for TradersKaty CoulthaneNo ratings yet

- Initial Balance Perspective: The OpenDocument2 pagesInitial Balance Perspective: The OpenwilwilwelNo ratings yet

- 50 Trading Rule Tips and Mistakes Hindi + EnglishDocument5 pages50 Trading Rule Tips and Mistakes Hindi + EnglishSushant DhembreNo ratings yet

- Ebook Basic TradesmartfxDocument47 pagesEbook Basic TradesmartfxDanny P100% (1)

- How To Create Your Own Option Buying SystemDocument20 pagesHow To Create Your Own Option Buying SystemSashwat ShresthNo ratings yet

- Guerrero v. YñigoDocument3 pagesGuerrero v. YñigoAmber AncaNo ratings yet

- Breakout Trading PDF Guide Content UpgradeDocument9 pagesBreakout Trading PDF Guide Content UpgradeHendra GunawanNo ratings yet

- Trading Checklist BH v2Document2 pagesTrading Checklist BH v2Tong SepamNo ratings yet

- Day Trading Grain Futures A Practical Guide To Trading For A Living by Bennett David B003zshuhkDocument5 pagesDay Trading Grain Futures A Practical Guide To Trading For A Living by Bennett David B003zshuhkEstevan JantskNo ratings yet

- SWING TRADING: 4 KEY STEPS TO PROFIT USING 44 MADocument3 pagesSWING TRADING: 4 KEY STEPS TO PROFIT USING 44 MAAsim Saeed0% (1)

- Date Open High Low Close PP Gain/ (Loss)Document6 pagesDate Open High Low Close PP Gain/ (Loss)Mrdilipa DilipaNo ratings yet

- 1649497527678investing Strategies To Create Wealth 61445e8aDocument31 pages1649497527678investing Strategies To Create Wealth 61445e8aVimalahar rajagopalNo ratings yet

- What The MACD Indicator Is and How It WorksDocument6 pagesWhat The MACD Indicator Is and How It WorksAkingbemi MorakinyoNo ratings yet

- ThePerfectTrade PDFDocument9 pagesThePerfectTrade PDFLatari100% (1)

- Citrix Gateway 12.1Document708 pagesCitrix Gateway 12.1JJ100% (1)

- Stock Selection For Trading - UnencryptedDocument2 pagesStock Selection For Trading - UnencryptedRamesh KutadiNo ratings yet

- Bank Trading: Specialising With Order FlowDocument29 pagesBank Trading: Specialising With Order Flowmd asifNo ratings yet

- The Camarilla Equation Explained: How to Anticipate Market Behavior Using This Powerful Price-Based IndicatorDocument9 pagesThe Camarilla Equation Explained: How to Anticipate Market Behavior Using This Powerful Price-Based IndicatorSAM SMITHNo ratings yet

- Daytrade Master Indicator: Entry SetupDocument7 pagesDaytrade Master Indicator: Entry SetupyaxaNo ratings yet

- Appendix A - Trading Plan Template: Financial GoalDocument3 pagesAppendix A - Trading Plan Template: Financial GoalBrian KohlerNo ratings yet

- Mastering Expiry Day Trading PDFDocument126 pagesMastering Expiry Day Trading PDFpr9cdfrz7pNo ratings yet

- Trading Journal BeginnersDocument48 pagesTrading Journal BeginnersadelinNo ratings yet

- Secretary of Finance V IllardeDocument2 pagesSecretary of Finance V IllardeJanPalmaNo ratings yet

- Trading Nifty Futures For A Living by Chartless Trader Vol Book 1Document3 pagesTrading Nifty Futures For A Living by Chartless Trader Vol Book 1Anantha TheerthanNo ratings yet

- @PAVLeader Useful Trading BooksDocument1 page@PAVLeader Useful Trading BooksRajendraSingh ChhabraNo ratings yet

- Conclave 2 CandleDocument15 pagesConclave 2 CandleNaveen KumarNo ratings yet

- Rule 57 Cases (Originals)Document76 pagesRule 57 Cases (Originals)Anonymous Ig5kBjDmwQNo ratings yet

- 6 Best Books On Intraday Trading - Financial Analyst Insider PDFDocument8 pages6 Best Books On Intraday Trading - Financial Analyst Insider PDFAbhishek MusaddiNo ratings yet

- Three Ways To Trade The Opening Range: Open Range de NitionDocument8 pagesThree Ways To Trade The Opening Range: Open Range de NitionIrene LyeNo ratings yet

- Profitable Forex Trading Using High and Low Risk Strategies: Book 1, #4From EverandProfitable Forex Trading Using High and Low Risk Strategies: Book 1, #4No ratings yet

- NGANIEANGDER KÝ THUONG VI£T NAM Chihanb Braneh bEOTCB LAC LONG QUANDocument1 pageNGANIEANGDER KÝ THUONG VI£T NAM Chihanb Braneh bEOTCB LAC LONG QUANĐào Văn CườngNo ratings yet

- 208 - Jardine v. Aliposa - de LunaDocument1 page208 - Jardine v. Aliposa - de LunaVon Lee De LunaNo ratings yet

- How To Day Trade Stocks With A Trend Strategy - Entries, Exits, and Risk ManagementDocument14 pagesHow To Day Trade Stocks With A Trend Strategy - Entries, Exits, and Risk ManagementTrader CatNo ratings yet

- E-Book GaryDocument19 pagesE-Book GaryRenganathan VenkatavaradhanNo ratings yet

- The Logical Trader Applying A Method To The Madness PDFDocument137 pagesThe Logical Trader Applying A Method To The Madness PDFJose GuzmanNo ratings yet

- Standard Deviation (Volatility) : AverageDocument7 pagesStandard Deviation (Volatility) : AverageSachin SahooNo ratings yet

- BP Matsuri Suites - FinalDocument229 pagesBP Matsuri Suites - FinalAldi WirawanNo ratings yet

- Intra-Day Trading Plan 20071224 ADocument10 pagesIntra-Day Trading Plan 20071224 ADesain AppsNo ratings yet

- FX Trading Course CurriculumDocument8 pagesFX Trading Course CurriculumSanthoshNo ratings yet

- Tweezer TopDocument5 pagesTweezer Topkarthick sudharsanNo ratings yet

- Lesson 1 - Supply and Demand With The TrendDocument1 pageLesson 1 - Supply and Demand With The TrendAlexis Edax100% (1)

- Your Trading Coach 4,5,6 ImportantDocument861 pagesYour Trading Coach 4,5,6 Importantbuccas130% (1)

- Market Mantra: Prime IndicatorsDocument3 pagesMarket Mantra: Prime IndicatorsvivekNo ratings yet

- Laththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty TrendDocument1 pageLaththur Arasu Trading Company: Nifty Option Day Trading Plan Nifty Trend9952090083No ratings yet

- Secrets For Profiting in Bull and Bear Markets - enDocument11 pagesSecrets For Profiting in Bull and Bear Markets - enKelvin KwanNo ratings yet

- Moving Average Indicator Checklist: Tradingwithrayner PresentsDocument8 pagesMoving Average Indicator Checklist: Tradingwithrayner PresentsHimanshu Singh RajputNo ratings yet

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierDocument5 pagesUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888No ratings yet

- Q: A Brief Background and Your Tryst With Markets: Manu Bhatia'sDocument3 pagesQ: A Brief Background and Your Tryst With Markets: Manu Bhatia'sSavan JaviaNo ratings yet

- Chart Patterns Double Tops BottomsDocument9 pagesChart Patterns Double Tops BottomsJeremy NealNo ratings yet

- Metastock RSC Exploration PDFDocument5 pagesMetastock RSC Exploration PDFRaam Mk100% (1)

- RSI MOMENTUM TRADING STRATEGY Learn How To Trade RSI Momentum Trading Strategy in Banknifty Futures (STOCK TRADER)Document9 pagesRSI MOMENTUM TRADING STRATEGY Learn How To Trade RSI Momentum Trading Strategy in Banknifty Futures (STOCK TRADER)Shah NirajNo ratings yet

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Document23 pagesThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNo ratings yet

- Candlestick Charting and Technical Analysis (PDFDrive)Document39 pagesCandlestick Charting and Technical Analysis (PDFDrive)Rathod arvinNo ratings yet

- Coronavirus (COVID-19) Tax DevelopmentsDocument51 pagesCoronavirus (COVID-19) Tax DevelopmentsJJNo ratings yet

- Higher Education Support Amdt (Job-Ready Graduates - Remote Students) Bill 2020 - Amendments - PDF Filetype Application - PDFDocument13 pagesHigher Education Support Amdt (Job-Ready Graduates - Remote Students) Bill 2020 - Amendments - PDF Filetype Application - PDFJJNo ratings yet

- 001 01 PDFDocument3 pages001 01 PDFJJNo ratings yet

- 01Document3 pages01JJNo ratings yet

- Chapter 5 Peter RoseDocument13 pagesChapter 5 Peter RoseRafiur Rahman100% (1)

- Ecorea 2 Invoice Copy 06-09-2023Document1 pageEcorea 2 Invoice Copy 06-09-2023Jai Narayan TemhurkarNo ratings yet

- HubcoDocument6 pagesHubcolaiba mujahidNo ratings yet

- IFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportDocument34 pagesIFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportWubneh AlemuNo ratings yet

- Finance 18UCF102-FINANCIAL-SERVICESDocument24 pagesFinance 18UCF102-FINANCIAL-SERVICESAvinash GurjarNo ratings yet

- Fin Power BSNL CivilDocument10 pagesFin Power BSNL CivilagmlmbsnlNo ratings yet

- Collection of Short Stories and Poems From The African WritersDocument46 pagesCollection of Short Stories and Poems From The African WritersLauraSantosNo ratings yet

- Fabm 2: Quarter 3 - Module 1 The Statement of Financial Position (Elements, Forms and Its Classifications)Document23 pagesFabm 2: Quarter 3 - Module 1 The Statement of Financial Position (Elements, Forms and Its Classifications)Maria Nikka GarciaNo ratings yet

- Summary of Key Aspects of IFRS 3Document3 pagesSummary of Key Aspects of IFRS 3Ericha MutiaNo ratings yet

- Drugstores Association of The Philippines, Inc. v. National Council On Disability Affairs FactsDocument16 pagesDrugstores Association of The Philippines, Inc. v. National Council On Disability Affairs FactsJayson Lloyd P. MaquilanNo ratings yet

- Ratio Tell A StoryDocument6 pagesRatio Tell A StoryHeru MuskitaNo ratings yet

- PT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Document26 pagesPT Gajah Tunggal Tbk Financial Risk Analysis 2016-2020Ananda LukmanNo ratings yet

- Question bank-BBA 208-Income Tax by Dr. Preeti JindalDocument2 pagesQuestion bank-BBA 208-Income Tax by Dr. Preeti JindalDrPreeti JindalNo ratings yet

- Api 2201Document13 pagesApi 2201Cesar Kv RangelNo ratings yet

- EVA Financial Management at Godrej Consumer Products LTDDocument28 pagesEVA Financial Management at Godrej Consumer Products LTDRahul SaraogiNo ratings yet

- MCQ 3Document6 pagesMCQ 3Senthil Kumar Ganesan100% (1)

- Strategic Capacity ManagementDocument50 pagesStrategic Capacity ManagementHarsh JaswalNo ratings yet

- Bcsbi Pictorial BookDocument24 pagesBcsbi Pictorial BookMALAYADRI DUARINo ratings yet

- FcffsimpleginzuDocument62 pagesFcffsimpleginzuJosé Manuel EstebanNo ratings yet

- AEDP Phase I and IIDocument32 pagesAEDP Phase I and IIDrPramod HanamgondNo ratings yet

- Housing DeterminantsDocument77 pagesHousing Determinantsperumak3949No ratings yet

- 21 Republic Vs de GUzman PDFDocument22 pages21 Republic Vs de GUzman PDFShivaNo ratings yet

- Ankitastic Exams SolutionsDocument30 pagesAnkitastic Exams SolutionsAnkitastic tutoring ServicesNo ratings yet