Professional Documents

Culture Documents

Exercise 6-4 ,: Nora Aldawood - By: Alanoud Albarak

Uploaded by

michelleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 6-4 ,: Nora Aldawood - By: Alanoud Albarak

Uploaded by

michelleCopyright:

Available Formats

Chapter 6 1

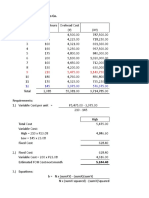

Exercise 6-4 , page 256

Caltec, Inc., Produces and sells recordable CD and DVD packs.

Revenue and cost information relating to the products follows:

Product

CD DVD

Selling price per pack $8 $25

Variable expenses per pack $3,20 $17,50

Traceable fixed expenses per year $138,000 $45,000

Common fixed in the company total $105,000 annually.

Last year the company produced and sold 37,000 CD packs and 18,000

DVD packs.

Required:

prepare a contribution format income statement for the year

segmented by product lines.

Nora Aldawood | By : Alanoud Albarak

Chapter 6 2

Solution:

Table 1

Company CD DVD

Sales 750,000 37,500 * 8 = 300,000 18,000 * 8 = 450,000

(units sold * selling price)

Less: 435,000 37,500 * 3.20 = 120,000 37,500 * 17.50= 315,000

Variable cost

(Units sold* VC per unit)

Equal : 315,000 180,000 135,000

Contribution margin

(Sales - Variable cost)

Less : 183,000 138,000 45,000

Traceable fixed cost

Equal : 132,000 42,000 90,000

Division margin

Less : 105,000

Common fixed cost

Equal : 27,000

Net operating income

Note :

1.The "company box" =CD + DVD , for example = 300,000+ 450,000

2. The traceable fixed cost and common fixed cost "Given in the question"

Nora Aldawood | By : Alanoud Albarak

Chapter 6 3

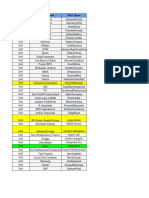

Exercise 6-1 , page 256

Shastri Bicycle of Bombay, India, produces an inexpensive, yet rugged,

bicycle for use the city's crowded streets that sells for 500

rupees.(Indian currency is denominated in rupees, denoted by R.)

Selected data for the company's operations last year follow:

Unit in beginning inventory 0

Unit produced 10,000

Unit sold 8,000

Unit in ending inventory 2,000

Variable costs per unit:

Direct materials R120

Direct labor R140

Variable manufacturing overhead R50

Variable selling and administrative R20

Fixed costs:

Fixed manufacturing overhead R600,000

Fixed selling and administrative R400,000

Required:

1. Assume that the company uses absorption costing.

Compute the unit product cost for one bicycle.

2. Assume that the company uses variable costing.

Compute the unit product cost for one bicycle.

Nora Aldawood | By : Alanoud Albarak

Chapter 6 4

Solution :

1.Absorption costing:

Unit product cost = Direct materials + Direct labor + Variable

manufacturing overhead + Fixed manufacturing overhead "per unit"

= 120 + 140 + 50 + 60*

= 370 units.

*fixed manufacturing overhead per unit = total fixed manufacturing

overhead \ units product

= 600,000 \ 10,000

= 60

2.Variable costing:

Unit product cost = Direct materials + Direct labor + Variable

manufacturing overhead

= 120+140+50

= 310 units.

Nora Aldawood | By : Alanoud Albarak

Chapter 6 5

Exercise 6-2 , page 256

Refer to the data in Exercise 6-1 for Shastri Bicycle.

The absorption costing income statements prepared by the company's

accountant for last year appears below:

Sales R4,000,000

Cost of goods sold R2,960,000

Gross margin R1,040,000

Selling and administrative expense R560,000

Net operating income R480,000

Required:

1. Determine how much of the ending inventory consists of fixed

manufacturing overhead cost deferred in inventory to the next period.

2. Prepare an income statement for the year using variable costing.

Explain the difference in net operating income between the two

costing methods.

Solution:

1.

Ending inventory = Units produced - Units sold

= 10,000 - 8000

= 2000

Fixed manufacturing overhead cost "per unit" = Total fixed

manufacturing overhead \ Units produced

= 600,000 \10.000 = 60

= 2000*60= 120,000

Nora Aldawood | By : Alanoud Albarak

Chapter 6 6

2. The variable costing income statement :

Sales 4,000,000

Variable expenses :

Variable cost of goods sold )8,000* 310)

(Units sold * Variable manufacturing cost only "per unit"( 2,480,000

Variable selling and administrative (8,000* 20)

(Units sold* cost of Variable selling & Adm. "per unit") 160,000

Total variable expenses 2,640,000

Contribution margin 1,360,000

Fixed expenses :

Fixed manufacturing overhead 600,000

Fixed selling and administrative 400,000

Total fixed expenses 1,000,000

Net operating income 360,000

Nora Aldawood | By : Alanoud Albarak

You might also like

- EXercise VC1Document6 pagesEXercise VC1Abdulmajed Unda Mimbantas100% (1)

- Cost - Concepts and ClassificationsDocument23 pagesCost - Concepts and ClassificationsYehetNo ratings yet

- A. Trend Percentages: RequiredDocument5 pagesA. Trend Percentages: RequiredAngel NuevoNo ratings yet

- Chap13 Exercise 56Document4 pagesChap13 Exercise 56John Lester C Alag0% (1)

- Strategic Cost Management Exercises 12369Document2 pagesStrategic Cost Management Exercises 12369Arlene Diane OrozcoNo ratings yet

- DT 2Document8 pagesDT 2Janesene SolNo ratings yet

- Amazing Aluminum 2020 Financial StatementsDocument4 pagesAmazing Aluminum 2020 Financial Statementsjennie kyutiNo ratings yet

- Chapter 4 Review Question.Document6 pagesChapter 4 Review Question.Rhea May BaluteNo ratings yet

- Tugas AKMENBIS TM 10 Kel. 5Document4 pagesTugas AKMENBIS TM 10 Kel. 5Dimas Iqbal100% (1)

- Garcia, Phoebe Stephane C. Cost Accounting BS Accountancy 1-A CHAPTER 10: Process Costing True or FalseDocument26 pagesGarcia, Phoebe Stephane C. Cost Accounting BS Accountancy 1-A CHAPTER 10: Process Costing True or FalsePeabeeNo ratings yet

- 8 Standard CostingDocument22 pages8 Standard CostingNeha KhalidNo ratings yet

- Fman April 3,2020 - Operating and Financial LeverageDocument2 pagesFman April 3,2020 - Operating and Financial LeverageAngela Dela PeñaNo ratings yet

- Chapter 10 - AnswerDocument15 pagesChapter 10 - AnswerAgentSkySkyNo ratings yet

- Gbermic 11-12Document13 pagesGbermic 11-12Paolo Niel ArenasNo ratings yet

- Short-Term Sources For Financing Current AssetsDocument11 pagesShort-Term Sources For Financing Current AssetsAlexandra TagleNo ratings yet

- CVP AnalysisDocument24 pagesCVP AnalysisKim Cherry BulanNo ratings yet

- CVP Analysis in One ProductDocument6 pagesCVP Analysis in One ProductShaira GampongNo ratings yet

- ACCGT7 CHP13 PPTDocument7 pagesACCGT7 CHP13 PPTJohn Lester C AlagNo ratings yet

- Solutions To ProblemsDocument42 pagesSolutions To ProblemsJane TuazonNo ratings yet

- Strategic Cost ManagementDocument5 pagesStrategic Cost ManagementMiafe B. AlmendralejoNo ratings yet

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNo ratings yet

- Strategic Cost Management ExercisesDocument30 pagesStrategic Cost Management ExercisesChin FiguraNo ratings yet

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- Standard CostingDocument11 pagesStandard CostingAbigail Dela Cruz Manggas100% (1)

- Chapter 16 - AnswerDocument14 pagesChapter 16 - AnswerMarlon A. RodriguezNo ratings yet

- Bond Issuance and AmortizationDocument1 pageBond Issuance and AmortizationRhitzelynn Ann BarredoNo ratings yet

- Management Accountants. Classify Each of The End-Of-Year Games (A-G) As (I) AcceptableDocument3 pagesManagement Accountants. Classify Each of The End-Of-Year Games (A-G) As (I) AcceptableRhea OraaNo ratings yet

- Diana May Company IssuedDocument1 pageDiana May Company IssuedQueen ValleNo ratings yet

- Problem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Document2 pagesProblem 3: Carr Company Reported The Following Shareholders' Equity On January 1, 2021Katrina Dela Cruz100% (1)

- Assignment - Joint Products and by Products Costing - Without AnswersDocument5 pagesAssignment - Joint Products and by Products Costing - Without AnswersRoselyn LumbaoNo ratings yet

- Problem 23-7 and 23-8Document2 pagesProblem 23-7 and 23-8Maria LicuananNo ratings yet

- 5Document11 pages5shayn delapenaNo ratings yet

- 3 - Discussion - Standard Costing and Variance AnalysisDocument1 page3 - Discussion - Standard Costing and Variance AnalysisCharles Tuazon0% (1)

- DFDocument1 pageDFJanesene Sol0% (1)

- Chapter 7-The Balanced Scorecard: A Tool To Implement StrategyDocument3 pagesChapter 7-The Balanced Scorecard: A Tool To Implement StrategyitsmenatoyNo ratings yet

- Factors That Are Causing Changes in The Contemporary Business Environment How The Changes Affect The Way Those Firms and Organizations Use Cost Management InformationDocument2 pagesFactors That Are Causing Changes in The Contemporary Business Environment How The Changes Affect The Way Those Firms and Organizations Use Cost Management InformationJin HandsomeNo ratings yet

- Problem 20 share capital entriesDocument13 pagesProblem 20 share capital entriesBella RonahNo ratings yet

- Chapter 1 PDFDocument6 pagesChapter 1 PDFsneha mallikaNo ratings yet

- 6 Organizational Innovations: Total Quality Management Just-In-Time Production System PDFDocument5 pages6 Organizational Innovations: Total Quality Management Just-In-Time Production System PDFAryan LeeNo ratings yet

- Cost Accounting Exam QuestionsDocument9 pagesCost Accounting Exam QuestionsTyrsonNo ratings yet

- TQM and JIT Production Systems at Batangas State UniversityDocument22 pagesTQM and JIT Production Systems at Batangas State Universityitsdaloveshot naNANAnanaNo ratings yet

- Chapter 24 Answer KeyDocument3 pagesChapter 24 Answer KeyShane TabunggaoNo ratings yet

- Problem 5-31 (Verna Company)Document7 pagesProblem 5-31 (Verna Company)Jannefah Irish SaglayanNo ratings yet

- Limited Partnership RightsDocument6 pagesLimited Partnership RightsJovelyn OrdoniaNo ratings yet

- Sol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1BDocument10 pagesSol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1BMahasia MANDIGAN100% (1)

- Answer KeyDocument19 pagesAnswer KeyRenNo ratings yet

- Chap16 ProblemsDocument20 pagesChap16 ProblemsYen YenNo ratings yet

- Chapter 5 (Exercise 1-7) CabreraDocument17 pagesChapter 5 (Exercise 1-7) CabreraBaby MushroomNo ratings yet

- Quick Guide On AISDocument209 pagesQuick Guide On AISGioNo ratings yet

- Mid Term Quiz 2 On Cost Accounting and Control - Manufacturing Overhead - DepartmentalizationDocument3 pagesMid Term Quiz 2 On Cost Accounting and Control - Manufacturing Overhead - DepartmentalizationGabriel Adrian ObungenNo ratings yet

- CHAPTER 3 Dissolution and Winding Up CODALDocument5 pagesCHAPTER 3 Dissolution and Winding Up CODALfermo ii ramosNo ratings yet

- Chapter 10Document11 pagesChapter 10clarice razonNo ratings yet

- 4Document3 pages4Carlo ParasNo ratings yet

- M8 CHP 12 4 Allocation of Joint CostsDocument2 pagesM8 CHP 12 4 Allocation of Joint CostsQueennie EllamNo ratings yet

- Mixed CostDocument4 pagesMixed CostPeter WagdyNo ratings yet

- Chapter22 BuenaventuraDocument4 pagesChapter22 BuenaventuraAnonnNo ratings yet

- Law Article 1485-1488Document1 pageLaw Article 1485-1488John Lexter MacalberNo ratings yet

- Bca 423-Marginal Vs Absoption Costing.Document8 pagesBca 423-Marginal Vs Absoption Costing.James GathaiyaNo ratings yet

- Chapter 4Document8 pagesChapter 4Châu Ánh ViNo ratings yet

- Exercise of VariableDocument10 pagesExercise of VariableAqoon Kaab ChannelNo ratings yet

- T-TEST GUIDE: WHEN & HOW TO APPLY POPULATION MEAN HYPOTHESIS TESTSDocument30 pagesT-TEST GUIDE: WHEN & HOW TO APPLY POPULATION MEAN HYPOTHESIS TESTSmichelleNo ratings yet

- T-TEST GUIDE: WHEN & HOW TO APPLY POPULATION MEAN HYPOTHESIS TESTSDocument30 pagesT-TEST GUIDE: WHEN & HOW TO APPLY POPULATION MEAN HYPOTHESIS TESTSmichelleNo ratings yet

- Value Added TaxDocument26 pagesValue Added TaxAimee100% (1)

- Government Accounting Manual AcknowledgementDocument493 pagesGovernment Accounting Manual Acknowledgementnicah100% (1)

- GPPB Resolution No. 09-2020 With SGD PDFDocument17 pagesGPPB Resolution No. 09-2020 With SGD PDFmichelleNo ratings yet

- Top of Form: Basic Segmented Income Statement (LO1)Document1 pageTop of Form: Basic Segmented Income Statement (LO1)michelleNo ratings yet

- IMRAD1Document12 pagesIMRAD1Carrie Joy DecalanNo ratings yet

- Top of Form: Basic Segmented Income Statement (LO1)Document1 pageTop of Form: Basic Segmented Income Statement (LO1)michelleNo ratings yet

- Audit of Cash and Cash EquivalentsDocument38 pagesAudit of Cash and Cash Equivalentsxxxxxxxxx86% (81)

- PHIL ARTS - Contemporary Arts and CriticismsDocument19 pagesPHIL ARTS - Contemporary Arts and CriticismsmichelleNo ratings yet

- 2020visuals - Briefer On KAPA As of 07242020Document22 pages2020visuals - Briefer On KAPA As of 07242020michelleNo ratings yet

- Chapter 3 - Effect of Omitting Adjusting Journal Entries: Examples: Type Effect of Not Making The Adjustment DEDocument3 pagesChapter 3 - Effect of Omitting Adjusting Journal Entries: Examples: Type Effect of Not Making The Adjustment DEGelle PascualNo ratings yet

- Perpetuation of Life - Animal ReproductionDocument14 pagesPerpetuation of Life - Animal ReproductionmichelleNo ratings yet

- Chapter 3 - Effect of Omitting Adjusting Journal Entries: Examples: Type Effect of Not Making The Adjustment DEDocument3 pagesChapter 3 - Effect of Omitting Adjusting Journal Entries: Examples: Type Effect of Not Making The Adjustment DEGelle PascualNo ratings yet

- PHIL ARTS - PaintingDocument68 pagesPHIL ARTS - PaintingmichelleNo ratings yet

- PHIL ARTS Elements Principles GuideDocument25 pagesPHIL ARTS Elements Principles GuidemichelleNo ratings yet

- Introduction To Applied EconomicsDocument62 pagesIntroduction To Applied EconomicsmichelleNo ratings yet

- Lesson 8 - The Material Economic SelfDocument2 pagesLesson 8 - The Material Economic SelfmichelleNo ratings yet

- Natural Processes and Hazards Hazards and Mitigation: GeologicDocument5 pagesNatural Processes and Hazards Hazards and Mitigation: GeologicmichelleNo ratings yet

- Lesson 7 - Sexual Self PDFDocument11 pagesLesson 7 - Sexual Self PDFmichelleNo ratings yet

- Endogenic Processes: Continental Drift TDocument6 pagesEndogenic Processes: Continental Drift TmichelleNo ratings yet

- Understanding the Physical SelfDocument2 pagesUnderstanding the Physical SelfmichelleNo ratings yet

- PHIL ARTS - Definition, Importance and PurposeDocument17 pagesPHIL ARTS - Definition, Importance and PurposemichelleNo ratings yet

- Dance:: The Power of MovementDocument24 pagesDance:: The Power of MovementMich MiradaNo ratings yet

- Lesson 5 - The Self in Western and Eastern OrientalsDocument2 pagesLesson 5 - The Self in Western and Eastern OrientalsLatenci Fercis100% (1)

- Lesson 11 - The Digital SelfDocument2 pagesLesson 11 - The Digital SelfmichelleNo ratings yet

- Top Filipino Artists & Music GenresDocument36 pagesTop Filipino Artists & Music GenresMich MiradaNo ratings yet

- Lesson 4 - PsychologyDocument7 pagesLesson 4 - PsychologymichelleNo ratings yet

- Lesson 1 - The Self From Various PerspectiveDocument6 pagesLesson 1 - The Self From Various PerspectivePaige PHNo ratings yet

- Export Financing GuideDocument82 pagesExport Financing GuideRamesh ReddyNo ratings yet

- BP B1P Tests AKDocument9 pagesBP B1P Tests AKĐức TínNo ratings yet

- Request For ProposalDocument40 pagesRequest For ProposalTender infoNo ratings yet

- FH3 - Learner Guide - Module 1Document249 pagesFH3 - Learner Guide - Module 1ZwelizweleereevereNo ratings yet

- LedgerDocument3 pagesLedgerAnonnNo ratings yet

- Codes of Ethics and Business ConductDocument6 pagesCodes of Ethics and Business Conductjaycebelle ugat100% (1)

- How Much Do Professionals Earn InfographicDocument4 pagesHow Much Do Professionals Earn InfographicAneeqahNo ratings yet

- Topic 4 Extra QuestionsDocument2 pagesTopic 4 Extra QuestionsThirusha balamuraliNo ratings yet

- Scaler ResumeDocument1 pageScaler ResumeRitik VermaNo ratings yet

- African Nations Cup ProjectDocument15 pagesAfrican Nations Cup ProjectAgbor AyukNo ratings yet

- Table Definitions For Audit Analysis - BKPF Field Data Element Data Typelength DecimalDocument71 pagesTable Definitions For Audit Analysis - BKPF Field Data Element Data Typelength DecimalJason Dan MooreNo ratings yet

- Ifric - 13 - Example AccountingDocument16 pagesIfric - 13 - Example AccountingNarayanPrajapatiNo ratings yet

- VC, PE, Angel investors and startup ecosystem parties in IndonesiaDocument82 pagesVC, PE, Angel investors and startup ecosystem parties in IndonesiaGita SwastiNo ratings yet

- Risk Assessment Checklist: Insert Company Logo HereDocument17 pagesRisk Assessment Checklist: Insert Company Logo HereRaffique HazimNo ratings yet

- A Study On Customer SatisfactionDocument14 pagesA Study On Customer Satisfactionakash ManwarNo ratings yet

- Baring Brothers Short Version April 2009Document4 pagesBaring Brothers Short Version April 2009Daniel IsacNo ratings yet

- Database AdminDocument118 pagesDatabase Adminvivekpandey99No ratings yet

- Customer Relationship Management Impact On Performance of Food and Beverages Industries A Case Study of Rite Food Limited, Lagos, NigeriaDocument5 pagesCustomer Relationship Management Impact On Performance of Food and Beverages Industries A Case Study of Rite Food Limited, Lagos, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 1570-1635319411751-Unit 02 Marketing Processes and PlanningDocument17 pages1570-1635319411751-Unit 02 Marketing Processes and Planningsathsaraniranathunga6No ratings yet

- A Study On Customer Satisfaction With After Sales Services at BLUE STAR Air ConditionerDocument99 pagesA Study On Customer Satisfaction With After Sales Services at BLUE STAR Air ConditionerVinay KashyapNo ratings yet

- Bankruptcy Removal Procedure KitDocument7 pagesBankruptcy Removal Procedure Kitduvard purdue100% (1)

- Analysis of Indonesian Consumer Online Shopping Behavior During The Covid-19 Pandemic: A Shopee Case StudyDocument11 pagesAnalysis of Indonesian Consumer Online Shopping Behavior During The Covid-19 Pandemic: A Shopee Case StudySiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Finding faults in cables through predictive testingDocument8 pagesFinding faults in cables through predictive testingMiguel AngelNo ratings yet

- 02C) Financial Ratios - ExamplesDocument21 pages02C) Financial Ratios - ExamplesMuhammad AtherNo ratings yet

- Billing and CollectionDocument3 pagesBilling and CollectionMary Therese Anne DequiadoNo ratings yet

- Credit Cards ChargesDocument3 pagesCredit Cards Chargesislamasraful4411No ratings yet

- LAW ON BUSINESS ORGANIZATIONS: PARTNERSHIPDocument53 pagesLAW ON BUSINESS ORGANIZATIONS: PARTNERSHIPJanelle Joyce Maranan DipasupilNo ratings yet

- External Forces of Organizational ChangeDocument6 pagesExternal Forces of Organizational ChangeyousufNo ratings yet

- Strategic Planning - BMW Strategic PlanningDocument26 pagesStrategic Planning - BMW Strategic Planningyasir_irshad100% (4)

- LR Format 1.2Document1 pageLR Format 1.2Ch.Suresh SuryaNo ratings yet