Professional Documents

Culture Documents

Long Term Construction Contract Discussion Guide

Uploaded by

Laren KayeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Long Term Construction Contract Discussion Guide

Uploaded by

Laren KayeCopyright:

Available Formats

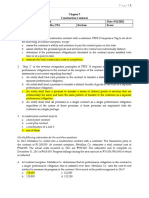

Long Term Construction Contracts

Construction Contract

- A contract specifically negotiated for the construction of an asset or a combination of

assets that are closely interrelated or interdependent in terms of their design, technology

and function of their ultimate purpose or use

Types:

1. Fixed Price Contract: the contractor agrees to a fixed contract price or a fixed rate per

unit of output which in some cases are subject to cost escalation methods

2. Cost Plus Contract: the contractor is reimbursed for allowable or otherwise defined

costs, plus a percentage of these costs

Contract Revenue

1. The initial amount of revenue agreed in the contract

2. Variations in contract work, claims and incentive payments

Contract Costs

1. Costs specifically related to the contract

2. Costs that are attributable to contract activity and can be allocated to the contract

3. Other costs that are specifically chargeable to the customer under the terms of the contract

Accounting Methods/Procedures for Long Term Construction

1. Percentage of Completion Method

o Used when the outcome of construction could be estimated reliably

o Revenue and costs are recognized based on the percentage of completion

o Types:

Input Measures/Cost to Cost Method

Output Measure

2. Cost Recovery Method/Zero Profit Method

o Used when the outcome of the construction cannot be estimated reliably

o Revenue recognized to the extent of the contract costs

Recognition of Expected Losses

- If total contract costs exceed the total contract revenue, the expected loss should be

recognized immediately

- Requires the recognition of loss on onerous contract

Changes in Estimate

- Change in the contract costs and contract revenue shall be treated as a change in

accounting estimate (prospectively)

Financial Statement Presentation

- Contract asset: Total Revenue exceeds Total Billings

- Contract liability: Total Billings exceeds Total Revenue

Problems

1. Champ Incorporated accepted a contract to construct an expressway from Brgy. Quiling

Sur to Brgy Tabug in the City of Batac for 50 million. Construction began on 2018 and was

completed in 2020. Data with respect to this contract were as follows:

2018 2019 2020

Costs incurred 9 million 19 million 2 million

Estimated costs to complete 21 million 7 million ---

Determine the amount of revenue and the realized gross profit for the year 2018, 2019

and 2020 under the Percentage of Completion Method and the Cost Recovery Method

2. Cee Construction Company enters into a contract to build a 20-story building in 2018 for

100 million. Construction was completed on 2020. Information with respect to this contract

were as follows:

2018 2019 2020

Costs incurred 20 million 43 million 32 million

Estimated costs at completion 80 million 105 million ---

Determine the amount of revenue and the realized gross profit for the year 2018, 2019

and 2020 using the percentage of completion method and the Cost Recovery Method.

3. Neo Construction Incorporated agreed to construct a building costing 100 million on 2018.

On 2019, it was agreed to add one more floor to the contract initially entered thus

increasing the contract price to 110 million. The project was completed in 2020. Data with

respect to this construction were as follows:

2018 2019 2020

Costs incurred to date 28 million 66.3 million 92 million

Estimated costs to complete 52 million 18.7 million ---

Determine the Realized Gross Profit for the year 2018, 2019 and 2020 using the

Percentage of Completion Method and the Cost Recovery Method

4. Clay Inc. entered into an agreement to construct a bridge connecting the Island of

Bacucang and the City of Batac at a contract price for 80 million the construction was

started on 2018 and would be completed in 2020. Data with respect to this contract were

as follows:

2018 2019 2020

Costs incurred each year 13 million 18.5 million 33 million

Estimated costs to complete 52 million 38.5 million ---

Billings per year 15 million 25 million 40 million

Determine the amount of contract asset or contract liability to be presented in the

statement of financial position with respect to this construction for the year 2018, 2019

and 2020 under the Percentage of Completion and Cost Recovery Method.

You might also like

- MODULE 5 - Construction AccountingDocument8 pagesMODULE 5 - Construction AccountingEdison Salgado CastigadorNo ratings yet

- Afar Construction Contracts PDFDocument10 pagesAfar Construction Contracts PDFArah Opalec0% (1)

- Long-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Document5 pagesLong-Term Construction Contracts (Special Revenue Recognition) JLM Illustrative Problems Problem 1Divine Cuasay100% (1)

- Long Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeDocument5 pagesLong Term Construction Contracts Special Revenue Recognition JLM Illustrative Problems Problem 1 PDF FreeMichael Brian TorresNo ratings yet

- FT Specialized IndustryDocument4 pagesFT Specialized IndustryJamie RamosNo ratings yet

- THEORY26PROBLEMSDocument10 pagesTHEORY26PROBLEMSIryne Kim PalatanNo ratings yet

- Finals 3Document8 pagesFinals 3Patricia Jane CabangNo ratings yet

- LTCC Short QuizDocument3 pagesLTCC Short QuizMecha Tresha MoninNo ratings yet

- Longterm Conat QuizDocument3 pagesLongterm Conat QuizKurtNo ratings yet

- Problems - Construction ContractDocument2 pagesProblems - Construction ContractAbby Gail TiongsonNo ratings yet

- General de Jesus CollegeDocument12 pagesGeneral de Jesus CollegeErwin Labayog MedinaNo ratings yet

- 13 Long Term Construction ContractsDocument2 pages13 Long Term Construction ContractsJem ValmonteNo ratings yet

- Construction Contracts Prac 2 2020 PDFDocument27 pagesConstruction Contracts Prac 2 2020 PDFSharmaineMiranda100% (1)

- Long-Term Construction Contracts and FranchisingDocument7 pagesLong-Term Construction Contracts and FranchisingEpal AkoNo ratings yet

- 9006 - LTCC SolutionsDocument9 pages9006 - LTCC SolutionsFrancis Vonn Tapang100% (1)

- AFAR 1.5 - Construction ContractsDocument3 pagesAFAR 1.5 - Construction ContractsKile Rien MonsadaNo ratings yet

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocument3 pagesLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaNo ratings yet

- LTCCDocument16 pagesLTCCandzie09876No ratings yet

- RR Construction Accounting QuestionsDocument18 pagesRR Construction Accounting QuestionsSharmaineMirandaNo ratings yet

- P2 Construction Contract - GuerreroDocument22 pagesP2 Construction Contract - GuerreroCelen OchocoNo ratings yet

- Afar302 A - ConstructionDocument8 pagesAfar302 A - ConstructionNicole TeruelNo ratings yet

- Long Term Construction ContractsDocument4 pagesLong Term Construction ContractsAnalynNo ratings yet

- Accounting For Long Term Construction ContractsDocument25 pagesAccounting For Long Term Construction Contractspearl100% (1)

- Special Revenue Recognition Special Revenue RecognitionDocument4 pagesSpecial Revenue Recognition Special Revenue RecognitionCee Gee BeeNo ratings yet

- Yes Yes No Yes No NoDocument16 pagesYes Yes No Yes No No수지No ratings yet

- 4 Material 4 LTCC For Students 2Document3 pages4 Material 4 LTCC For Students 2Joyce Anne GarduqueNo ratings yet

- Practice Set # 7B: Long-Term Construction ContractsDocument2 pagesPractice Set # 7B: Long-Term Construction ContractsRey Joyce AbuelNo ratings yet

- Mid-Term Revision Exercises (ch4-5)Document3 pagesMid-Term Revision Exercises (ch4-5)Cheuk Ying NicoleNo ratings yet

- Long Term Construction Quiz PDF FreeDocument4 pagesLong Term Construction Quiz PDF FreeMichael Brian TorresNo ratings yet

- Long-Term Construction QuizDocument4 pagesLong-Term Construction QuizCattleyaNo ratings yet

- Construction ContractDocument17 pagesConstruction ContractYvonne Gam-oyNo ratings yet

- LTCC SampeDocument1 pageLTCC SampeShaina GarciaNo ratings yet

- Long Term Construction ContractsDocument4 pagesLong Term Construction ContractsJustine CruzNo ratings yet

- Quiz No. 2Document3 pagesQuiz No. 2abbyNo ratings yet

- Accounting Standard 7Document5 pagesAccounting Standard 7abinash2830No ratings yet

- Long Term Construction Contract AssignmentDocument2 pagesLong Term Construction Contract Assignmentcali cdNo ratings yet

- Long-Term Construction - Type ContractsDocument14 pagesLong-Term Construction - Type ContractsMarco UyNo ratings yet

- Construction FranchiseDocument7 pagesConstruction FranchisetheresaazuresNo ratings yet

- Topic 3 Long-Term Construction Contracts PresentationDocument65 pagesTopic 3 Long-Term Construction Contracts PresentationAllira OrcajadaNo ratings yet

- CMPC 131 7-Construction ContractDocument7 pagesCMPC 131 7-Construction ContractGab IgnacioNo ratings yet

- Quiz 3 QuestionsDocument7 pagesQuiz 3 QuestionsVernnNo ratings yet

- LO3 ProblemsDocument11 pagesLO3 ProblemsKayla SheltonNo ratings yet

- Long Term Construction Contract Quiz2020Document10 pagesLong Term Construction Contract Quiz2020Riza Mae AlceNo ratings yet

- LongDocument18 pagesLongGem Kristel ManayNo ratings yet

- Construction Contracts ProblemsDocument14 pagesConstruction Contracts ProblemsAngela A. MunsayacNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErwin Labayog MedinaNo ratings yet

- Quiz 3 Construction ContractsDocument7 pagesQuiz 3 Construction ContractsMarinel Mae Chica100% (2)

- Notes IntaccDocument15 pagesNotes Intaccimsana minatozakiNo ratings yet

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynNo ratings yet

- Long Term Construction Contracts Theory On The Date and Particular ColumnDocument6 pagesLong Term Construction Contracts Theory On The Date and Particular ColumnAgatha de CastroNo ratings yet

- Long Term Construction Contracts - 0Document15 pagesLong Term Construction Contracts - 0Daryl Hanna RecileNo ratings yet

- LTCC ConsultationDocument2 pagesLTCC ConsultationMark Gelo WinchesterNo ratings yet

- Quiz-Construction ContractsDocument7 pagesQuiz-Construction ContractsRojin TingabngabNo ratings yet

- LTCC 1Document3 pagesLTCC 1Jamie RamosNo ratings yet

- Assumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceDocument4 pagesAssumption College of Nabunturan: Nabunturan, Compostela Valley ProvinceAireyNo ratings yet

- Midterm 138 - BDocument6 pagesMidterm 138 - BJoyce Anne IgotNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- Policies and Investments to Address Climate Change and Air Quality in the Beijing–Tianjin–Hebei RegionFrom EverandPolicies and Investments to Address Climate Change and Air Quality in the Beijing–Tianjin–Hebei RegionNo ratings yet

- Technical Rockwell Automation FactoryTalk HistorianDocument6 pagesTechnical Rockwell Automation FactoryTalk HistorianAmit MishraNo ratings yet

- Elasticsearch, Logstash, and Kibana - CERTDocument35 pagesElasticsearch, Logstash, and Kibana - CERTManuel VegaNo ratings yet

- Charles Zastrow, Karen K. Kirst-Ashman-Understanding Human Behavior and The Social Environment-Thomson Brooks - Cole (2007)Document441 pagesCharles Zastrow, Karen K. Kirst-Ashman-Understanding Human Behavior and The Social Environment-Thomson Brooks - Cole (2007)joan82% (17)

- Prometric Questions-1 AnswersDocument45 pagesPrometric Questions-1 AnswersNina Grace Joy Marayag-Alvarez100% (1)

- Unit 1 Building A Professional Relationship Across CulturesDocument16 pagesUnit 1 Building A Professional Relationship Across CulturesAlex0% (1)

- Furniture AnnexDocument6 pagesFurniture AnnexAlaa HusseinNo ratings yet

- Do Now:: What Is Motion? Describe The Motion of An ObjectDocument18 pagesDo Now:: What Is Motion? Describe The Motion of An ObjectJO ANTHONY ALIGORANo ratings yet

- P6 - TT2 - Revision Test 2021-2022 Page 1 of 11Document11 pagesP6 - TT2 - Revision Test 2021-2022 Page 1 of 11Nilkanth DesaiNo ratings yet

- Gold Loan Application FormDocument7 pagesGold Loan Application FormMahesh PittalaNo ratings yet

- Wiska Varitain - 0912Document18 pagesWiska Varitain - 0912Anonymous hHWOMl4FvNo ratings yet

- NCERT Solutions For Class 10 Maths Chapter 5 Arithmetic Progression (Ex 5.1) Exercise 5.1Document8 pagesNCERT Solutions For Class 10 Maths Chapter 5 Arithmetic Progression (Ex 5.1) Exercise 5.1Akash DasNo ratings yet

- Swift As A MisanthropeDocument4 pagesSwift As A MisanthropeindrajitNo ratings yet

- Oral Communication in ContextDocument19 pagesOral Communication in ContextAzory ZelleNo ratings yet

- Gigabyte Ga b85m Ds3h A r10 PDFDocument30 pagesGigabyte Ga b85m Ds3h A r10 PDFMartha Lorena TijerinoNo ratings yet

- 8 Adam AmuraroDocument28 pages8 Adam Amurarokmeena73No ratings yet

- Storage-Tanks Titik Berat PDFDocument72 pagesStorage-Tanks Titik Berat PDF'viki Art100% (1)

- Unit 3: Theories and Principles in The Use and Design of Technology Driven Learning LessonsDocument5 pagesUnit 3: Theories and Principles in The Use and Design of Technology Driven Learning Lessons서재배No ratings yet

- Banin Cawu 1: Panitia Ujian Perguruan Islam Mathali'Ul FalahDocument4 pagesBanin Cawu 1: Panitia Ujian Perguruan Islam Mathali'Ul FalahKajen PatiNo ratings yet

- Coating Resins Technical Data SYNOCURE 867S - 60Document1 pageCoating Resins Technical Data SYNOCURE 867S - 60Heramb TrifaleyNo ratings yet

- Teaching PowerPoint Slides - Chapter 5Document19 pagesTeaching PowerPoint Slides - Chapter 5Azril ShazwanNo ratings yet

- VERGARA - RPH Reflection PaperDocument2 pagesVERGARA - RPH Reflection PaperNezer Byl P. VergaraNo ratings yet

- Construction Drawing: Legend Notes For Sanitary Piping Installation General Notes NotesDocument1 pageConstruction Drawing: Legend Notes For Sanitary Piping Installation General Notes NotesrajavelNo ratings yet

- The Determinants of Corporate Dividend PolicyDocument16 pagesThe Determinants of Corporate Dividend PolicyRutvikNo ratings yet

- Present Perfect Simp ContDocument14 pagesPresent Perfect Simp ContLauGalindo100% (1)

- Aircraft Flight Control SystemDocument25 pagesAircraft Flight Control Systemthilina jayasooriyaNo ratings yet

- Lesson Plan 1Document3 pagesLesson Plan 1api-311983208No ratings yet

- A Structural Modelo of Limital Experienci Un TourismDocument15 pagesA Structural Modelo of Limital Experienci Un TourismcecorredorNo ratings yet

- Week 1 Familiarize The VmgoDocument10 pagesWeek 1 Familiarize The VmgoHizzel De CastroNo ratings yet

- Introduction To Microelectronic Fabrication PDFDocument332 pagesIntroduction To Microelectronic Fabrication PDFChristy Moore92% (13)

- SANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabDocument2 pagesSANDWICH Elisa (Procedure) - Immunology Virtual Lab I - Biotechnology and Biomedical Engineering - Amrita Vishwa Vidyapeetham Virtual LabsantonuNo ratings yet