Professional Documents

Culture Documents

Caps, Floors, and Collars

Caps, Floors, and Collars

Uploaded by

Gessille SalavariaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Caps, Floors, and Collars

Caps, Floors, and Collars

Uploaded by

Gessille SalavariaCopyright:

Available Formats

Debt Instruments and Markets Professor Carpenter

Caps, Floors, and Collars

Concepts

and

Buzzwords

• Caps

• Strike

rate,

• Capped

Floaters

settlement

frequency,

index,

notional

• Floors

amount,

calls

on

• Floaters

with

Floors

yields,

puts

on

yields,

• Collars

portfolio

of

options

• Floaters

with

Collars

Reading

• Veronesi,

pp.387‐392

• Tuckman,

pp.

413

–

416

Caps, Floors, and Collars 1

Debt Instruments and Markets Professor Carpenter

Interest

Rate

Caps

• A

cap

provides

a

guarantee

to

the

issuer

of

a

floating

or

variable

rate

note

or

adjustable

rate

mortgage

that

the

coupon

payment

each

period

will

be

no

higher

than

a

certain

amount.

• In

other

words,

the

coupon

rate

will

be

capped

at

a

certain

ceiling

or

cap

rate

or

strike

rate.

• Caps

are

either

offered

over‐the‐counter

by

dealers

or

embedded

in

a

security.

Payoff

Rule

for

a

Typical

Cap

• Each

payment

date,

the

cap

pays

the

difference,

if

positive,

between

a

floating

index

rate

and

the

cap

rate,

multiplied

by

a

prespecified

notional

amount

of

principle

or

par

value,

divided

by

the

annual

payment

frequency.

• For

example,

a

T‐year,

semi‐annual

cap,

indexed

to

the

6‐month

rate,

with

$100

notional

principle,

and

cap

rate

k

pays

100

max(t‐0.5rt‐k,

0)/2

at

time

t,

t

=

0.5,1,1.5,…,T

Caps, Floors, and Collars 2

Debt Instruments and Markets Professor Carpenter

Capped

Floater

• Consider

the

net

position

of

the

issuer

of

$100

par

of

a

floating

rate

note

who

either

buys

a

matching

cap

from

a

dealer

or

else

embeds

the

cap

in

the

note

at

issue:

• Capped

Floater

=

Floater

minus

Cap

• Time

t

Coupon

Payment

of

Capped

Floater

100

min(t‐0.5rt,k)/2

=

100

t‐0.5rt/2

–

100

max(t‐0.5r

–

k,0)

/

2

Cap

and

Capped

Floater

Coupons

Uncapped

floater

coupons

Cap rate

Caps, Floors, and Collars 3

Debt Instruments and Markets Professor Carpenter

Example:

Cap

Payments

• Consider

a

$100

notional

of

1.5‐year

semi‐annual

cap

with

strike

rate

k

=

5.75%,

indexed

to

the

6‐month

rate.

• At

time

0,

the

6‐month

rate

is

5.54%,

so

the

cap

is

out‐of‐

the‐money,

and

pays

0

at

time

0.5.

• The

later

cap

payments

depend

on

the

path

of

interest

rates.

Suppose

rates

follow

the

up‐up

path

below.

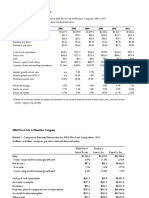

Time 0 Time 0.5 Time 1 Time 1.5

6.915% $0.5825 = (6.915‐5.75)/2

6.004%

$0.127

5.54%

0

5.437%

4.721%

4.275%

Example:

Capped

Floater

Payments

• Consider

a

$100

par

of

1.5‐year

semi‐annual

floater

with

coupon

capped

at

k

=

5.75%.

• Here

are

the

capped

floater

payments

along

the

up‐up

interest

rate

path

below:

Time 0 Time 0.5 Time 1 Time 1.5

6.915% $102.875

6.004%

$2.875

=

5.75/2

5.54%

$2.77

5.437%

4.721%

4.275%

Caps, Floors, and Collars 4

Debt Instruments and Markets Professor Carpenter

Caplet

(Call

on

Yield)

• The

individual

cap

payments

are

called

caplets.

• Each

caplet

is

a

kind

of

call

on

the

0.5‐year

rate

set

0.5‐years

before

the

payment

date

• The

payoff

of

the

caplet

on

the

time

t‐0.5‐year

rate,

for

$100

notional

amount

and

strike

rate

k,

is

100

max(t‐0.5rt

–

k,

0)/2

• We

can

value

each

caplet

individually,

and

then

sum

their

values

to

get

the

total

cap

value.

• For

example,

the

1.5‐year

cap

is

the

sum

of

• a

caplet

on

r0.5

‐‐

payoff

known

at

time

0,

paid

at

time

0.5

• a

caplet

on

0.5r1

‐‐

payoff

known

at

time

0.5,

paid

at

time

1

• a

caplet

on

1r1.5

‐‐

payoff

known

at

time

1,

paid

at

time

1.5

Class

Problem:

Caplet

on

0.5r1

• Recall

the

$100

notional

of

1.5‐year

semi‐annual

cap

with

strike

rate

k

=

5.75%.

• Consider

its

time

1

payment,

the

caplet

on

0.5r1

• Fill

in

the

tree

of

values

of

this

caplet

below.

Time 0 Time 0.5 Time 1

6.004%

?

5.54%

?

4.721%

?

Caps, Floors, and Collars 5

Debt Instruments and Markets Professor Carpenter

Class

Problem:

Caplet

on

1r1.5

• Consider

the

time

1.5

payment

of

the

cap,

the

caplet

on

1r1.5.

• Fill

in

the

tree

of

values

of

this

caplet

below.

Time 0 Time 0.5 Time 1 Time 1.5

6.915%

?

6.004%

?

5.54% 5.437%

? ?

4.721%

? 4.275%

?

Class

Problem:

The

Whole

Cap

Fill

in

the

tree

of

values

of

the

whole

cap

below.

At

each

node,

indicate

the

value

excluding

the

currently

scheduled

payment.

Time

0

Time

0.5

Time

1

Time

1.5

6.915%

?

6.004%

?

5.437%

5.54%

?

?

4.721%

4.275%

?

?

2) What is the SR dollar duration of the cap?

3) What is the SR duration of the cap?

Caps, Floors, and Collars 6

Debt Instruments and Markets Professor Carpenter

Class

Problems:

The

Capped

Floater

1) What

is

the

value

of

a

$100

par

of

a

1.5‐year

floater

with

coupon

rate

capped

at

5.75%?

2) What

is

the

SR

dollar

duration

of

$100

par

of

a

plain

vanilla,

uncapped

floater?

3) What is the SR duration of a plain vanilla floater?

4) What is the SR dollar duration of the capped floater?

5) What is the SR duration of the capped floater?

Interest

Rate

Floors

• A

floor

provides

a

guarantee

to

the

owner

of

a

floating

note

that

the

coupon

payment

each

period

will

be

no

less

than

a

certain

floor

rate

or

strike

rate.

• Floors

are

generally

embedded

in

a

floating

rate

note,

but

could

also

be

purchased

separately

from

a

dealer.

Caps, Floors, and Collars 7

Debt Instruments and Markets Professor Carpenter

Payoff

Rule

for

Typical

Floor

• Each

payment

date,

the

floor

pays

the

difference,

if

positive,

between

the

floor

rate

and

the

floating

rate

multiplied

by

the

notional

amount

of

principle

or

par

value,

divided

by

the

annual

payment

frequency.

• For

example,

a

T‐year,

semi‐annual

floor,

indexed

to

the

6‐month

rate,

with

$100

notional

principle,

and

floor

rate

k

pays

100

max(k‐t‐0.5rt,0)/2

at

time

t,

t

=

0.5,1,1.5,…,T

Floater

with

a

Floor

• Consider

the

net

position

of

an

investor

who

holds

$100

par

of

a

floating

rate

note

with

an

embedded

floor

or

else

holds

$100

par

of

a

floater

and

has

purchased

a

floor

separately.

• Floater

with

a

Floor

=

Floater

plus

Floor

• Time

t

Coupon

Payment

of

Floater

with

a

Floor

100

max(t‐0.5rt,

k)/2

=

100

t‐0.5rt/2

+

100

max(k

‐t‐0.5

rt,

0)/2

Caps, Floors, and Collars 8

Debt Instruments and Markets Professor Carpenter

Floor

and

Floater

Coupons

Coupons

of

floater

with

a

floor

Floor rate

Example:

Floor

Payments

• Consider

a

$100

notional

of

1.5‐year

semi‐annual

floor

with

strike

rate

k

=

5%,

indexed

to

the

6‐month

rate.

• At

time

0,

the

6‐month

rate

is

5.54%,

so

the

floor

is

out‐of‐

the‐money,

and

pays

0

at

time

0.5.

• The

later

floor

payments

depend

on

the

path

of

interest

rates.

Suppose

rates

follow

the

down‐down

path

below.

Time 0 Time 0.5 Time 1 Time 1.5

6.915%

6.004%

0

5.437%

5.54%

4.721%

$0.1395

4.275%

$0.3625=

(5‐4.275)/2

Caps, Floors, and Collars 9

Debt Instruments and Markets Professor Carpenter

Example:

Floater

with

a

Floor

• Consider

a

$100

par

of

1.5‐year

semi‐annual

floater

with

a

5%

floor.

• Here

are

the

capped

floater

payments

along

the

down‐

down

interest

rate

path

below:

Time 0 Time 0.5 Time 1 Time 1.5

6.915%

6.004%

$2.77

5.437%

5.54%

4.721%

$2.5

4.275%

$102.5

Floorlet

(Put

on

Yield)

• The

individual

floor

payments

are

called

floorlets.

• Each

floorlet

is

a

kind

of

put

on

the

0.5‐year

rate

set

0.5‐

years

before

the

payment

date

• The

payoff

of

the

floorlet

on

the

time

t‐0.5‐year

rate,

for

$100

notional

amount

and

strike

rate

k,

is

100

max(k‐t‐0.5rt,

0)/2

• We

can

value

each

floorlet

individually,

and

then

sum

their

values

to

get

the

total

floor

value.

• For

example,

the

1.5‐year

floor

is

the

sum

of

• a

floorlet

on

r0.5

‐‐

payoff

known

at

time

0,

paid

at

time

0.5

• a

floorlet

on

0.5r1

‐‐

payoff

known

at

time

0.5,

paid

at

time

1

• a

floorlet

on

1r1.5

‐‐

payoff

known

at

time

1,

paid

at

time

1.5

Caps, Floors, and Collars 10

Debt Instruments and Markets Professor Carpenter

Example:

Floorlet

on

0.5r1

• Recall

the

$100

notional

of

the

1.5‐year

5%

semi‐annual

floor.

• Consider

its

time

1

payment,

the

floorlet

on

0.5r1.

• Fill

in

the

tree

of

values

of

this

floorlet

below.

Time 0 Time 0.5 Time 1

6.004%

0

5.54%

0.0663 =

0.5 x 0.1363/ 4.721%

(1+0.0554/2) 0.1363 = 0.1395/(1+0.04721/2)

Example:

Floorlet

on

1r1.5

• Consider

its

time

1.5

payment

of

the

floor,

the

floorlet

on

1r1.5.

• Fill

in

the

tree

of

values

of

this

floorlet

below.

Time 0 Time 0.5 Time 1 Time 1.5

6.915%

0

6.004%

0

5.54% 5.437%

0.0843 = 0.5 0

x 0.1734/ 4.721%

(1+0.0554/2) 0.1734 = 0.5 x 4.275%

0.3549/ 0.3549 = 0.3625/

(1+0.04721/2) (1+0.04275/2)

Caps, Floors, and Collars 11

Debt Instruments and Markets Professor Carpenter

Example:

The

Whole

Floor

Fill

in

the

tree

of

values

of

the

whole

floor.

At

each

node,

indicate

the

value

excluding

the

currently

scheduled

payment.

Time

0

Time

0.5

Time

1

Time

1.5

6.915%

6.004%

0

0

5.437%

5.54%

0

0.1506

=

4.721%

0.0663+0.0843

0.3097

=

4.275%

0.1363+0.1734

0.3549

The

SR

dollar

duration

of

the

floor

is

–(0‐0.3097)/(6.004%‐4.721%)

=

24.14.

The

SR

duration

of

the

floor

is

24.14/0.1506

=

160.3.

The

Floater

with

a

Floor

1) What

is

the

value

of

a

$100

par

of

a

1.5‐year

floater

with

5%

floor?

2) What

is

the

SR

dollar

duration

of

this

floater

with

a

floor?

3) What is the SR duration of the capped floater?

Caps, Floors, and Collars 12

Debt Instruments and Markets Professor Carpenter

Interest

Rate

Collars

• A

collar

is

a

long

position

in

a

cap

and

a

short

position

in

a

floor.

• The

issuer

of

a

floating

rate

note

might

use

this

to

cap

the

upside

of

his

debt

service,

and

pay

for

the

cap

with

a

floor.

• Collars

are

generally

embedded

in

a

floating

rate

note,

but

could

also

be

purchased

separately

from

a

dealer.

Class

Problems:

Collared

Floater

1) What

is

the

value

of

$100

par

of

a

1.5‐year

floater

with

a

5%‐5.75%

collar?

2) What

is

the

SR

dollar

duration

of

this

collared

floater?

3) What is its SR duration?

Caps, Floors, and Collars 13

You might also like

- Bond ValuationDocument57 pagesBond ValuationRajib BurmanNo ratings yet

- FF Presentation 20150520 001 PDFDocument27 pagesFF Presentation 20150520 001 PDFGessille SalavariaNo ratings yet

- Cap FloorDocument13 pagesCap FloorYousra RahmaniNo ratings yet

- Investment Basics I: ObjectivesDocument14 pagesInvestment Basics I: Objectivesno nameNo ratings yet

- Internal Models For Regulatory Capital Session 2: - November 2016Document24 pagesInternal Models For Regulatory Capital Session 2: - November 2016Daniel RodriguezNo ratings yet

- Chapter 3 - Inflation and Escalation 10102016Document11 pagesChapter 3 - Inflation and Escalation 10102016Muhammad NursalamNo ratings yet

- FM 6Document19 pagesFM 6Taaran ReddyNo ratings yet

- Transaction ExposureDocument13 pagesTransaction ExposureNeneng WulandariNo ratings yet

- 4 FI Derivatives - Forward, FRA, IRSDocument25 pages4 FI Derivatives - Forward, FRA, IRSyveziviNo ratings yet

- Chapter 6 - Bond ValuationDocument46 pagesChapter 6 - Bond ValuationHarith DaniealNo ratings yet

- Debt, NPV, Interest Rate, Loans, Bonds, ArbitrageDocument68 pagesDebt, NPV, Interest Rate, Loans, Bonds, ArbitrageGagAnasNo ratings yet

- Security Valuation: DCF Approach To Stock and Bond ValuationDocument44 pagesSecurity Valuation: DCF Approach To Stock and Bond ValuationarchonVNo ratings yet

- 07 BondsDocument85 pages07 Bondsmelekkbass10No ratings yet

- Ch. 20 - Hybrid FinancingDocument31 pagesCh. 20 - Hybrid FinancingLara FloresNo ratings yet

- Key Concepts and Skills: Discounted Cash Flow ValuationDocument4 pagesKey Concepts and Skills: Discounted Cash Flow Valuationnida younasNo ratings yet

- Valuation of Securities-3Document54 pagesValuation of Securities-3anupan92No ratings yet

- Prepared By: Deveshree Raut Debjani Singha Jagruti ChauhanDocument22 pagesPrepared By: Deveshree Raut Debjani Singha Jagruti Chauhanarunj49No ratings yet

- Market RiskDocument72 pagesMarket RiskSudhansuSekharNo ratings yet

- UntitledDocument29 pagesUntitledDEEPIKA S R BUSINESS AND MANAGEMENT (BGR)No ratings yet

- Chapter 5Document25 pagesChapter 5aman7300No ratings yet

- FINA2010 Financial Management: Lecture 3: Time Value of MoneyDocument62 pagesFINA2010 Financial Management: Lecture 3: Time Value of MoneymoonNo ratings yet

- Chapter 24 - Warrants and ConvertiblesDocument25 pagesChapter 24 - Warrants and ConvertiblesAMALLIA WULANDARI 2251030002No ratings yet

- Corporate BondsDocument36 pagesCorporate BondsCharlene LeynesNo ratings yet

- Valuation of Financial AssetDocument55 pagesValuation of Financial Assetkate trishaNo ratings yet

- How To Value Bonds?: Application of Time Value of MoneyDocument36 pagesHow To Value Bonds?: Application of Time Value of Moneyabhishek dharNo ratings yet

- Online 2.3 - Yield To MaturityDocument7 pagesOnline 2.3 - Yield To MaturityPhilippNo ratings yet

- CH 8Document57 pagesCH 8quynhlthhs180552No ratings yet

- Floating Rate Notes: Concepts and BuzzwordsDocument6 pagesFloating Rate Notes: Concepts and BuzzwordsMyagmarsuren SanaakhorolNo ratings yet

- Bonds Overview Pricing YieldDocument40 pagesBonds Overview Pricing YieldRajesh Chowdary Chintamaneni100% (1)

- Exam 1 - Session 1 & 2 Intro - Risk & InsuranceDocument64 pagesExam 1 - Session 1 & 2 Intro - Risk & InsurancePratibha ChaurasiaNo ratings yet

- Asset Liability Management & Model Building: Heshy SummerDocument21 pagesAsset Liability Management & Model Building: Heshy SummerIbnu Nugroho100% (1)

- Session 26 - 27 - IRR - DGAP Analysis PDFDocument26 pagesSession 26 - 27 - IRR - DGAP Analysis PDFrizzzNo ratings yet

- Bifs Session 20 ReviewDocument23 pagesBifs Session 20 Reviewrajan tiwariNo ratings yet

- Duration: Measuring Interest Rate SensitivityDocument19 pagesDuration: Measuring Interest Rate SensitivityALNo ratings yet

- Interest Rate Models and Derivatives 2019Document69 pagesInterest Rate Models and Derivatives 2019Elisha MakoniNo ratings yet

- Bifs Session 18 Ay 2022-23 First Round - Swap PricingDocument21 pagesBifs Session 18 Ay 2022-23 First Round - Swap Pricingrajan tiwariNo ratings yet

- 財管Ch3Document41 pages財管Ch3Alexjohn56No ratings yet

- Chapter 1 Overview of Debt SecuritiesDocument64 pagesChapter 1 Overview of Debt SecuritiesHồng Nhung PhạmNo ratings yet

- FIN2004 - 2704 Week 3Document84 pagesFIN2004 - 2704 Week 3ZenyuiNo ratings yet

- Time Value of MoneyDocument47 pagesTime Value of MoneyPrashant JhakarwarNo ratings yet

- Chapter 4 - Interest RatesDocument16 pagesChapter 4 - Interest Ratesuyenbp.a2.1720No ratings yet

- Bonds CallableDocument52 pagesBonds CallablekalyanshreeNo ratings yet

- Lecture 2 - Derivative Market: Futures Forwards OptionsDocument39 pagesLecture 2 - Derivative Market: Futures Forwards OptionsasifNo ratings yet

- Chapter 3 Bond RisksDocument60 pagesChapter 3 Bond RisksHồng Nhung PhạmNo ratings yet

- Mechanics of Forwads & FuturesDocument44 pagesMechanics of Forwads & FuturesLuvnica VermaNo ratings yet

- Corporate Finance - CH 6, 7 8Document156 pagesCorporate Finance - CH 6, 7 8JoanWang100% (1)

- Investment Analysis and Portfolio Management: Lecture 6 Part 2Document35 pagesInvestment Analysis and Portfolio Management: Lecture 6 Part 2jovvy24No ratings yet

- Financial Statement AnalysisDocument46 pagesFinancial Statement AnalysisAnkanNo ratings yet

- 2.1 - Swaps, Bridge To SwapsDocument56 pages2.1 - Swaps, Bridge To SwapscutehibouxNo ratings yet

- Convertible BondDocument52 pagesConvertible BondAtif SaeedNo ratings yet

- Determination of Forward & Future Prices: R. SrinivasanDocument18 pagesDetermination of Forward & Future Prices: R. SrinivasanorazikmaNo ratings yet

- Portfolio Management: Dr. Himanshu Joshi FORE School of Management New DelhiDocument25 pagesPortfolio Management: Dr. Himanshu Joshi FORE School of Management New Delhiashishbansal85No ratings yet

- Bond DurationDocument7 pagesBond DurationmonikatatteNo ratings yet

- Presentation Week 1: Han Xu Huang Jingyao Wang Yuqing Wen SiyuDocument15 pagesPresentation Week 1: Han Xu Huang Jingyao Wang Yuqing Wen Siyu王宇晴No ratings yet

- Convertible Bonds CourseDocument34 pagesConvertible Bonds CourseAsmae KhamlichiNo ratings yet

- Topic 7-ValuationDocument36 pagesTopic 7-ValuationK60 Nguyễn Ngọc Quế AnhNo ratings yet

- FINA2010 Financial Management: Lecture 6: Bond ValuationDocument43 pagesFINA2010 Financial Management: Lecture 6: Bond ValuationDerek DerekNo ratings yet

- Session 11 BondsDocument24 pagesSession 11 Bondspgdmib23ritwikaNo ratings yet

- Topic 5 Valuation of Bonds and Shares PDFDocument32 pagesTopic 5 Valuation of Bonds and Shares PDFMoud KhalfaniNo ratings yet

- FINA2010 Financial Management: Lecture 6: Bond and Stock ValuationDocument61 pagesFINA2010 Financial Management: Lecture 6: Bond and Stock ValuationmoonNo ratings yet

- I NST Ruct I On:i NT Erpreteachquadrant ST Hecashfl Owusi Ngthewayst Oproducei Ncome. Q1-E (Youhaveaj Ob)Document3 pagesI NST Ruct I On:i NT Erpreteachquadrant ST Hecashfl Owusi Ngthewayst Oproducei Ncome. Q1-E (Youhaveaj Ob)Gessille SalavariaNo ratings yet

- Receipt 05oct2022 132707Document1 pageReceipt 05oct2022 132707Gessille SalavariaNo ratings yet

- ASSESSMENT 7vvjmfxdukncxzzhjDocument3 pagesASSESSMENT 7vvjmfxdukncxzzhjGessille SalavariaNo ratings yet

- Assessment - 12Document2 pagesAssessment - 12Gessille SalavariaNo ratings yet

- Amla 90: American Language Accelerated Developmental WritingDocument7 pagesAmla 90: American Language Accelerated Developmental WritingGessille SalavariaNo ratings yet

- Instruction: Compare and Contrast The Four Types of Market Structure Base On Features and CharacteristicsDocument2 pagesInstruction: Compare and Contrast The Four Types of Market Structure Base On Features and CharacteristicsGessille SalavariaNo ratings yet

- Proposed ProductServicefhjjvxdyDocument1 pageProposed ProductServicefhjjvxdyGessille SalavariaNo ratings yet

- Asset Valuation Problem Solving - CMDocument3 pagesAsset Valuation Problem Solving - CMGessille SalavariaNo ratings yet

- Terms Meaning EXAMPLE Discussion (With Calculation)Document2 pagesTerms Meaning EXAMPLE Discussion (With Calculation)Gessille SalavariaNo ratings yet

- Mountain View College: Name: Date SubmittedDocument2 pagesMountain View College: Name: Date SubmittedGessille SalavariaNo ratings yet

- Terms Meaning EXAMPLE Discussion (With Calculation)Document1 pageTerms Meaning EXAMPLE Discussion (With Calculation)Gessille SalavariaNo ratings yet

- Senior High School Voucher Program Application Parent Consent FormDocument1 pageSenior High School Voucher Program Application Parent Consent FormGessille SalavariaNo ratings yet

- Lessons From Daniel 6 (1-16) - 0 PDFDocument3 pagesLessons From Daniel 6 (1-16) - 0 PDFGessille SalavariaNo ratings yet

- Money: Gessille May S. SalavariaDocument6 pagesMoney: Gessille May S. SalavariaGessille SalavariaNo ratings yet

- Name: Date Submitted:: Mountain View CollegeDocument2 pagesName: Date Submitted:: Mountain View CollegeGessille SalavariaNo ratings yet

- Emilyn S. Cabaluna: Grade 8 - St. FrancisDocument1 pageEmilyn S. Cabaluna: Grade 8 - St. FrancisGessille SalavariaNo ratings yet

- Jollibee FinalDocument32 pagesJollibee FinalGessille SalavariaNo ratings yet

- BMAK Lectures IIDocument46 pagesBMAK Lectures IItheodoreNo ratings yet

- International Labor Migration: Changing Families, Communities, and SocietiesDocument29 pagesInternational Labor Migration: Changing Families, Communities, and SocietiesJohn Kevin NocheNo ratings yet

- No Nama Posisi/Jabatan CPDocument3 pagesNo Nama Posisi/Jabatan CPHARTHON EntertainmentNo ratings yet

- Roshaane Gul RegionDocument4 pagesRoshaane Gul RegionRoshaane GulNo ratings yet

- Global 04 Political & Legal Environment-1Document35 pagesGlobal 04 Political & Legal Environment-1pritesh1983No ratings yet

- Test Bank For Survey of Economics 6th Edition OsullivanDocument59 pagesTest Bank For Survey of Economics 6th Edition OsullivanLindaEvansizgo100% (29)

- ECV 204 - 3.1 - Structural Forms - 2021.06.06Document43 pagesECV 204 - 3.1 - Structural Forms - 2021.06.06Collins KipronoNo ratings yet

- Monsoon 2023 Registration NoticeDocument2 pagesMonsoon 2023 Registration NoticeAbhinav AbhiNo ratings yet

- Saln 2023Document2 pagesSaln 2023Ngirp Alliv TreborNo ratings yet

- APTs 1st Set of 20 of 240 Printable MCQs For AQA As Econ Sect 1Document15 pagesAPTs 1st Set of 20 of 240 Printable MCQs For AQA As Econ Sect 1simran rughooNo ratings yet

- Question 1 (14 Points)Document18 pagesQuestion 1 (14 Points)Spam SpamNo ratings yet

- Wild Wood Case StudyDocument6 pagesWild Wood Case Studyaudrey gadayNo ratings yet

- Term Paper On Poverty in The PhilippinesDocument5 pagesTerm Paper On Poverty in The Philippinesdoawpfcnd100% (1)

- OnlyIas Important Committee Their Recommendations Marks BoosterDocument42 pagesOnlyIas Important Committee Their Recommendations Marks Boosterprakash patelNo ratings yet

- Industrial Attachment Log BookDocument20 pagesIndustrial Attachment Log BookMartha ChambakataNo ratings yet

- Literature Review On Financial Management PDFDocument5 pagesLiterature Review On Financial Management PDFeyewhyvkg100% (2)

- Slum Settlement Regeneration in Lagos Mega-City: An Overview of A Waterfront Makoko CommunityDocument17 pagesSlum Settlement Regeneration in Lagos Mega-City: An Overview of A Waterfront Makoko Communityvarshini sharmaNo ratings yet

- Green at Heart by Catherine TanDocument5 pagesGreen at Heart by Catherine TanKl HumiwatNo ratings yet

- NO No Kwit No Container Size Tanggal Nopol Jumh Harga Keterangan IN OUT IN OUT HariDocument2 pagesNO No Kwit No Container Size Tanggal Nopol Jumh Harga Keterangan IN OUT IN OUT Hariapul sianturiNo ratings yet

- What Are The Economic Functions of GovernmentDocument2 pagesWhat Are The Economic Functions of GovernmentSakib RonyNo ratings yet

- Tourism Impacts On The EconomyDocument4 pagesTourism Impacts On The Economyqueenie esguerraNo ratings yet

- Case Study Gas Compression ProjectDocument5 pagesCase Study Gas Compression Projectegy pureNo ratings yet

- Lovely Professional University Academic Task No. Iii Mittal School of BusinessDocument9 pagesLovely Professional University Academic Task No. Iii Mittal School of BusinessShubham SinghNo ratings yet

- Business Structuring Merger LLPDocument94 pagesBusiness Structuring Merger LLPRaghuraman PillaiNo ratings yet

- Summative Test (Fabm2)Document2 pagesSummative Test (Fabm2)Zybel RosalesNo ratings yet

- ECON 1000 Exam Review Worksheet - Sample Final: Use The Table Below To Answer The Following QuestionsDocument5 pagesECON 1000 Exam Review Worksheet - Sample Final: Use The Table Below To Answer The Following QuestionsSlock TruNo ratings yet

- DcmentDocument77 pagesDcmentNawaz ImtaizNo ratings yet

- My Contact 1704338207105Document62 pagesMy Contact 1704338207105supremecourtriteshkumarNo ratings yet

- Kelompok 7. Customs UnionDocument23 pagesKelompok 7. Customs Unionsri yuliaNo ratings yet

- Job Sheet - 3-ArcDocument3 pagesJob Sheet - 3-ArcSamerNo ratings yet