Professional Documents

Culture Documents

Afo Edited 7

Uploaded by

Rajem Lexi PolicarpioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Afo Edited 7

Uploaded by

Rajem Lexi PolicarpioCopyright:

Available Formats

MISSION

To create value

for our THE BANK FOR

stakeholders by EVERYJUAN

delivering

innovative and

cost-effective

financial services.

Contact Us

VISSION (123) 456-7890

# Holy Angel Avenue , Sto. Rosario

Angles City It's for

To be the leading allforjuan@gmail.com

allforjuanbank.com

Everyjuan to

financial services bank with

SUBMITTED TO: MS. LORIES PINGUL

provider in our

chosen markets,

helping customers, ALL FOR

staff, shareholders Pineda, Eunice JUAN BANK

Policarpio, Rajem Lexi

and communities Rivera, Mark Andrew

prosper.

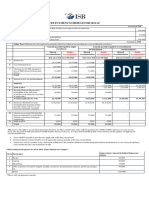

OFFER 2 OFFER 3

OFFER 1

Compoun

d Simple

Simple INTEREST

ANNUITY

Offers 2.5% interest rate,

INTEREST Offers a principal amount of ₱ 2,000,500

compounded annually, and a future

and 4% interest rate, compounded semi-

value of ₱ 2,553,621.54

Offers a principal amount of ₱ 2,000,500 annually, for 4 years.

(P ^ Q) - Offer 3 has an interest

and 7% interest rate for 3 years.

(P ^ Q) - Offer 2 has an interest rate of

rate of 2.5 % and interest of

(P ^ Q) - Offer 1 has an interest rate of 7%

₱ ₱ 2,513,621.54

∨ ∨

4% and interest of 343,318.76.

₱

∨

and an interest of 420,105.

(P Q) - Offer 2 leads to an interest of (P Q) - Offer 3 leads to an

₱ 2,513,621.54 or a

(P Q) – Offer 1 leads to an interest of

₱ 420,105 or a maturity value of

₱ 343,318.76 or a maturity value of interest of

₱ maturity value of ₱ 2,553,621.54

(P →

₱ 2,420,605.

Q) – If you borrow an amount of (P →

2,343,318.76.

Q) - If you borrow an amount of

(P → Q) – If you borrow an amount

₱ 1,900,000, then you will have to invest it ₱ 1,900.00, then you will invest it for

of ₱ 1,900,000, then you will have

to invest it for 5 years compounded

↔

for 3 years. 4 years compounded semi-annually.

monthly.

(P Q) – The maturity value will be ₱

₱ 40,000

P = 2,000,000

₱ 2,420,605, if and only if, you invested

R = 4%

P =

₱ 2,000,500.

R = 2.5%

T = 4 years

p = ₱ 2,000,500

T = 5 years

Compounded Semi-Annually Compounded Monthly

r = 7%

Compound Amount

t = 3 years

Maturity Value Ordinary Annuity

A = P (1+rt)

A = ₱ 2,000,500 (1+(0.07)(3)

A = ₱ 2,420,605

Interest

I = PRT FVoa = ₱ 40,000

I = ( ₱ 2,000,500)(0.07)(3) FVoa = 2,553,621.54

I = ₱ 420,105

You might also like

- Engineering Economy I PDFDocument2 pagesEngineering Economy I PDFrenzon272No ratings yet

- Impairment of LoanDocument4 pagesImpairment of LoanaleywaleyNo ratings yet

- Simple Interest Versus Compound Interest (LO1) First City Bank Pays 8 Percent Simple InterestDocument4 pagesSimple Interest Versus Compound Interest (LO1) First City Bank Pays 8 Percent Simple InterestMary VenturaNo ratings yet

- This Is FreedomDocument31 pagesThis Is FreedomNurhussein RaopanNo ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- Final Draft - 15 November 2019 PDFDocument32 pagesFinal Draft - 15 November 2019 PDFAnonymous ndN94kNo ratings yet

- Week 2 - TVM, NPV IRR - SDocument63 pagesWeek 2 - TVM, NPV IRR - SVaishnavi HallikarNo ratings yet

- PGP Class of 2022 - Fee StructureDocument1 pagePGP Class of 2022 - Fee StructureGAURAV GUPTANo ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- Ruiz Family Budget: Projected Monthly Income SourceDocument15 pagesRuiz Family Budget: Projected Monthly Income SourceLucio Jr RuizNo ratings yet

- Interest ExercisesDocument9 pagesInterest ExercisesArvie Angeles AlferezNo ratings yet

- Loma Abigail Joy C.Document5 pagesLoma Abigail Joy C.LOMA, ABIGAIL JOY C.No ratings yet

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageDocument6 pagesInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaNo ratings yet

- CHPT 4Document41 pagesCHPT 4ferahNo ratings yet

- A.R. and N.R. Additional TopicsDocument10 pagesA.R. and N.R. Additional TopicsaleywaleyNo ratings yet

- Financial Feasibility SampleDocument66 pagesFinancial Feasibility SampleKimmyNo ratings yet

- City of Welland Notice of Planning Fee IncreaseDocument1 pageCity of Welland Notice of Planning Fee IncreaseDave JohnsonNo ratings yet

- Ch10 - Basics of Capital Budgeting Evaluating Cash FlowsDocument6 pagesCh10 - Basics of Capital Budgeting Evaluating Cash FlowsradyantamaNo ratings yet

- Myka Eleonor Estole Quiz 5Document8 pagesMyka Eleonor Estole Quiz 5Julienne UntalascoNo ratings yet

- Studio Accommodation Studio Accommodation Studio AccommodationDocument4 pagesStudio Accommodation Studio Accommodation Studio AccommodationNISHA BANSALNo ratings yet

- Pag-Ibig Mp2 SavingsDocument37 pagesPag-Ibig Mp2 SavingsVanessa GestaNo ratings yet

- Week 2 Assignment FNCE UCWDocument14 pagesWeek 2 Assignment FNCE UCWamyna abhavaniNo ratings yet

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- Financial Accounting and Reporting: Exercise 1Document6 pagesFinancial Accounting and Reporting: Exercise 1Lenneth MonesNo ratings yet

- Downtown Dallas LandDocument18 pagesDowntown Dallas LandKeya VaidyaNo ratings yet

- Chapter 9 Part 2-Notes Receivables: Don Honorio Ventura State University College of Business StudiesDocument13 pagesChapter 9 Part 2-Notes Receivables: Don Honorio Ventura State University College of Business StudiesKyleRhayneDiazCaliwagNo ratings yet

- 05 Activity 1Document1 page05 Activity 1Charise Oliva0% (1)

- Five YearsDocument1 pageFive YearsRamesh KumarNo ratings yet

- Time Value of Money NotesDocument16 pagesTime Value of Money NotesAssassin Panda14No ratings yet

- Case Analysis 1 Write Up RevisedDocument8 pagesCase Analysis 1 Write Up RevisedAbda Alif PrasidyaNo ratings yet

- Quiz 1Document1 pageQuiz 1geraldabubopaduaNo ratings yet

- The 4F: Revised Plan: "Form Follows Finance" FourplexDocument1 pageThe 4F: Revised Plan: "Form Follows Finance" FourplexNoah TangNo ratings yet

- Corporate Finance - Lecture 3Document40 pagesCorporate Finance - Lecture 3Faraz BodaghiNo ratings yet

- Ae211 Finals QuizDocument20 pagesAe211 Finals QuizDJAN IHIAZEL DELA CUADRANo ratings yet

- Chap 2 Part 3Document28 pagesChap 2 Part 3ENGLAND DE ASIS ESCLAMADONo ratings yet

- Problem Set 5Document8 pagesProblem Set 5Jade BilisNo ratings yet

- BIP-Week-13-14-with NotesDocument8 pagesBIP-Week-13-14-with NotesgelNo ratings yet

- CT Fair MarketDocument3 pagesCT Fair MarketHelen BennettNo ratings yet

- Lyons Document Storage Corporation: Bond Accounting: Lake PushkarDocument9 pagesLyons Document Storage Corporation: Bond Accounting: Lake PushkarantonioNo ratings yet

- Quotation Mrs. Afifa FINAL - Mei 2023 - Sales Afifa FinalDocument2 pagesQuotation Mrs. Afifa FINAL - Mei 2023 - Sales Afifa FinalrahmandikaNo ratings yet

- Outline: MFIN6003 Derivative SecuritiesDocument14 pagesOutline: MFIN6003 Derivative SecuritiesMavisNo ratings yet

- TNP Q4 2018Document11 pagesTNP Q4 2018SANDESH GHANDATNo ratings yet

- ANTHONY MOSCOSA - Financial Accounting-Activity Sheet 06Document1 pageANTHONY MOSCOSA - Financial Accounting-Activity Sheet 06RICARDO JOSE VALENCIANo ratings yet

- Problem Set 2Document7 pagesProblem Set 2Jade BilisNo ratings yet

- Short Sale InventoryDocument4 pagesShort Sale InventoryLarry BrownNo ratings yet

- Macalalag, John Lloyd H. - Activity No.1 (09-18-2020)Document3 pagesMacalalag, John Lloyd H. - Activity No.1 (09-18-2020)Jaloyd MacalalagNo ratings yet

- 4 & 5 Rooms: Luxurious ApartmentsDocument14 pages4 & 5 Rooms: Luxurious ApartmentsAdnanNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Loss Contingency, Debt Restructuring, Asset SwapDocument2 pagesLoss Contingency, Debt Restructuring, Asset SwapBuenaventura, Elijah B.No ratings yet

- Discussion Problems: FAR.2928-Notes Payable OCTOBER 2020Document3 pagesDiscussion Problems: FAR.2928-Notes Payable OCTOBER 2020John Nathan KinglyNo ratings yet

- Tutorial-3 - KEYDocument8 pagesTutorial-3 - KEYFeroskhan Hibathul CareemNo ratings yet

- BRRRR v2Document5 pagesBRRRR v2SujitKGoudarNo ratings yet

- QBE Fijis Key Disclosure Statement For The Financial Year Ended 2022Document2 pagesQBE Fijis Key Disclosure Statement For The Financial Year Ended 2022Navinesh NandNo ratings yet

- Example Prob, NPV, IRR&PIDocument10 pagesExample Prob, NPV, IRR&PITin Bernadette DominicoNo ratings yet

- I Pin F P + I F P (1 + In) : Engineering EconomyDocument3 pagesI Pin F P + I F P (1 + In) : Engineering EconomyJeanelyn TomNo ratings yet

- Job Loss Income Planner For 2 YearsDocument5 pagesJob Loss Income Planner For 2 YearsKv kNo ratings yet

- Discussion Problems: FAR.2828-Notes Payable MAY 2020Document3 pagesDiscussion Problems: FAR.2828-Notes Payable MAY 2020stephen poncianoNo ratings yet

- Rental Housing: Lessons from International Experience and Policies for Emerging MarketsFrom EverandRental Housing: Lessons from International Experience and Policies for Emerging MarketsRating: 5 out of 5 stars5/5 (1)

- SacramentalsDocument7 pagesSacramentalsRajem Lexi PolicarpioNo ratings yet

- Family Metaphor and Simile PoemDocument1 pageFamily Metaphor and Simile PoemRajem Lexi PolicarpioNo ratings yet

- Recreational Game:: "Build Up The Can! If You Can!"Document3 pagesRecreational Game:: "Build Up The Can! If You Can!"Rajem Lexi PolicarpioNo ratings yet

- Philo Lecture Oct 21 PDFDocument1 pagePhilo Lecture Oct 21 PDFRajem Lexi PolicarpioNo ratings yet

- Chalkboard Style Venn Diagram PDFDocument1 pageChalkboard Style Venn Diagram PDFRajem Lexi PolicarpioNo ratings yet

- Sustainability 12 04912 PDFDocument10 pagesSustainability 12 04912 PDFRajem Lexi PolicarpioNo ratings yet

- MODEC, Inc. 2019 Half-Year Financial Results Analysts PresentationDocument16 pagesMODEC, Inc. 2019 Half-Year Financial Results Analysts Presentationfle92No ratings yet

- HW 1 SolutionsDocument7 pagesHW 1 Solutionsjinny6061No ratings yet

- Real Property Gain TaxDocument4 pagesReal Property Gain Taxlcs1234678100% (1)

- Kotak PMS Pharma Strategy May 2018Document50 pagesKotak PMS Pharma Strategy May 2018rchawdhry123No ratings yet

- Chapter 4 Organization and Functioning of Securities MarketsDocument79 pagesChapter 4 Organization and Functioning of Securities MarketsIntanNo ratings yet

- Financialhubindia NotesDocument25 pagesFinancialhubindia NotesAnonymous ZcaMXDNo ratings yet

- How To Define Your Brand and Determine Its Value.: by David Haigh and Jonathan KnowlesDocument7 pagesHow To Define Your Brand and Determine Its Value.: by David Haigh and Jonathan KnowlesMahesh SavanthNo ratings yet

- Ministry of Corporate Affairs - MCA ServicesDocument1 pageMinistry of Corporate Affairs - MCA ServicesPranay ChauguleNo ratings yet

- Nutmeg Securities LTD Business Continuity PlanningDocument71 pagesNutmeg Securities LTD Business Continuity Planningapi-3801982No ratings yet

- T NG Ôn FIMDocument84 pagesT NG Ôn FIMTrần Thiện Ngọc ĐàiNo ratings yet

- Ku vs. RCBC SecuritiesDocument16 pagesKu vs. RCBC SecuritiesEmir Mendoza0% (1)

- Convertibles, Exchangeables, - and WarrantsDocument26 pagesConvertibles, Exchangeables, - and WarrantsPankaj ShahNo ratings yet

- CA FINAL SFM DERIVATIVES Futures SUMMARYDocument9 pagesCA FINAL SFM DERIVATIVES Futures SUMMARYsujeet mauryaNo ratings yet

- Mit Cheatsheet Prep For Finals IDocument2 pagesMit Cheatsheet Prep For Finals IDapo TaiwoNo ratings yet

- HW FINS3635 2018 1 1Document9 pagesHW FINS3635 2018 1 1Roger GuoNo ratings yet

- Struktur OrganisasiDocument1 pageStruktur OrganisasiRoudaNo ratings yet

- International Corporate FinanceDocument8 pagesInternational Corporate FinanceAnirudh DewadaNo ratings yet

- m339d Lecture Fourteen Binomial Option Pricing One Period PDFDocument9 pagesm339d Lecture Fourteen Binomial Option Pricing One Period PDFPriyanka ChampatiNo ratings yet

- Department of Labor: 96 22717Document11 pagesDepartment of Labor: 96 22717USA_DepartmentOfLaborNo ratings yet

- Commodity AssignmentDocument7 pagesCommodity Assignment05550No ratings yet

- Voluntary Disclosure of Black MoneyDocument6 pagesVoluntary Disclosure of Black Money777priyankaNo ratings yet

- SmartPay HDFCDocument2 pagesSmartPay HDFCpriyaNo ratings yet

- CMR ReportDocument2 pagesCMR ReportRajesh KUMAR JHANo ratings yet

- Futures and Options Trading: Pradiptarathi Panda Assistant Professor, NismDocument43 pagesFutures and Options Trading: Pradiptarathi Panda Assistant Professor, NismMaunil OzaNo ratings yet

- Booking ConfirmationDocument2 pagesBooking ConfirmationVitalia BaltagNo ratings yet

- Insurance ExamDocument3 pagesInsurance ExamLeo EstanielNo ratings yet

- Formation of Reinsurance AgreementsDocument2 pagesFormation of Reinsurance AgreementsDean RodriguezNo ratings yet

- IandF SP6 201904 ExamPaperDocument7 pagesIandF SP6 201904 ExamPaperVedant BangNo ratings yet

- PS 1Document4 pagesPS 1BlackRoseNo ratings yet

- Quantitative Trading Strategies Using Python Technical Analysis, Statistical Testing, and Machine Learning (Peng Liu) (Z-Library)Document341 pagesQuantitative Trading Strategies Using Python Technical Analysis, Statistical Testing, and Machine Learning (Peng Liu) (Z-Library)alex seow100% (1)