Professional Documents

Culture Documents

Loma Abigail Joy C.

Uploaded by

LOMA, ABIGAIL JOY C.0 ratings0% found this document useful (0 votes)

4 views5 pagesThis document contains the solutions to 5 problems regarding financial accounting and reporting. Problem 1 lists 10 true/false statements. Problem 2 contains 4 journal entries. Problems 3-5 each contain journal entries and solutions for accounting for unearned rent, prepaid insurance, and salaries expense.

Original Description:

Original Title

LOMA-ABIGAIL-JOY-C.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains the solutions to 5 problems regarding financial accounting and reporting. Problem 1 lists 10 true/false statements. Problem 2 contains 4 journal entries. Problems 3-5 each contain journal entries and solutions for accounting for unearned rent, prepaid insurance, and salaries expense.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views5 pagesLoma Abigail Joy C.

Uploaded by

LOMA, ABIGAIL JOY C.This document contains the solutions to 5 problems regarding financial accounting and reporting. Problem 1 lists 10 true/false statements. Problem 2 contains 4 journal entries. Problems 3-5 each contain journal entries and solutions for accounting for unearned rent, prepaid insurance, and salaries expense.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

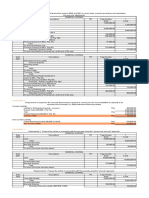

LOMA, ABIGAIL JOY C.

BSACC 1-YA-1

FINANCIAL ACCOUNTING AND REPORTING

PROBLEM 1:

1. FALSE

2. FALSE

3. TRUE

4. TRUE

5. FALSE

6. FALSE

7. TRUE

8. TRUE

9. FALSE

10. TRUE

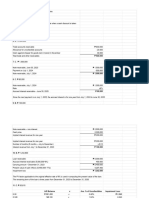

PROBLEM 2:

ACCOUNT TITLE DEBIT CREDIT

1 Advertising Expense ₱ 200,000.00

Advertising payable ₱ 200,000.00

2 Interest receivable (180k x 10% x 2/12) ₱ 3,000.00

Interest income ₱ 3,000.00

3 Depreciation expense ₱ 4,375.00

Accumulated depreciation ₱ 4,375.00

4 Bad debts expense ₱ 45,000.00

Allowance for bad debts ₱ 45,000.00

5. Solutions:

Requirements a:

Liability method Income method

May 1, 20x1 May 1, 20x1

Cash ₱ 480,000 Cash ₱ 480,000

Unearned rent ₱ 480,000 Rent income ₱ 480, 000

To record of 1-year rent in advance. To record the receipt of 1 year rent in

advance.

Requirements b:

Liability method Income method

Dec. 31, 20x1 Dec 31, 20x1

Unearned rent ₱ 320,000 Rent income ₱ 480,000

Rent income ₱ Unearned rent ₱ 480, 000

320,000 To recognized the unearned portion of

To recognized the earned portion of the the 1-year rent in advance.

1-year rent in advance.

(₱ 480,000 X 8/12) = ₱ 320,000

(₱ 480,000 X 4/12) = ₱ 320,000

6. Solutions:

Requirements a:

Asset method Expense method

Aug. 1, 20x1 Aug. 1, 20x1

Prepaid insurance ₱ 360,000 Insurance expense ₱ 360,000

Cash ₱ 360,000 Cash ₱ 360,

To record the prepayment of 1-year 000

insurance. To record the prepayment of 1-year

insurance.

Requirements b:

Asset method Expense method

Dec. 31, 20x1 Dec 31, 20x1

Insurance expense ₱ 150,000 Prepaid insurance ₱ 210,000

Prepaid insurance ₱ Insurance Expense ₱ 210,

150,000 000

To recognized the expired portion of the To recognized the expired portion of the

1-year insurance. 1-year insurance.

(₱ 360,000 X 5/12) = ₱ 150,000

(₱ 360,000 X 7/12) = ₱ 210,000

PROBLEM 3:

ACCOUNT TITLE DEBIT CREDIT

1 Interest Expense ₱ 31,500.00

Interest payable ₱ 31,500.00

2 Utilities expense ₱ 32,000.00

Utilities payable ₱ 32,000.00

3 Rent expense ₱ 22,000.00

Rent payable ₱ 22,000.00

4 Rent receivable (400k x 2months) ₱ 8,000.00

Rent Income ₱ 8,000.00

5 Bad debts expense (400k x 5%) ₱ 20,000.00

Allowance for bad debts ₱ 20,000.00

6 Depreciation expense ₱ 500,000.00

Accumulated depreciation ₱ 500,000.00

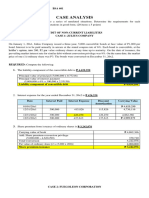

7. Solutions:

Requirements a:

Liability method Income method

Nov 1, 20x1 Nov 1, 20x1

Cash ₱ 720,000 Cash ₱ 720,000

Unearned income ₱ Rent income ₱ 720,000

720,000 To record of receipts of advanced royalty

To record of receipts of advanced income.

royalty income.

Requirements b:

Liability method Income method

Dec. 31, 20x1 Dec 31, 20x1

Unearned income ₱ 560,000 Royalty income ₱ 160,000

Royalty income ₱ Unearned income ₱ 160, 000

560,000 To recognized the unearned portion of

To recognized the earned portion of the the 1 advanced royalty.

advanced royalty.

₱ 560,000 earned portion

(₱ 720,000 – 560,000) = ₱ 160,000 unread portion

8. Solutions:

Requirements a:

Asset method Expense method

Oct. 31, 20x1 Oct. 31, 20x1

Prepaid insurance ₱ 360,000 Insurance expense ₱ 360,000

Cash ₱ 360,000 Cash ₱ 360,

To record the prepayment of 1-year 000

insurance. To record the prepayment of 1-year

insurance.

Requirements b:

Asset method Expense method

Dec. 31, 20x1 Dec 31, 20x1

Insurance expense ₱ 60,000 Prepaid insurance ₱ 300,000

Prepaid insurance ₱ Insurance Expense ₱ 300,

60,000 000

To recognized the expired portion of the To recognized the expired portion of the

1-year insurance. 1-year insurance.

(₱ 360,000 X 2/12) = ₱ 60,000

(₱ 360,000 X 10/12) = ₱ 300,000

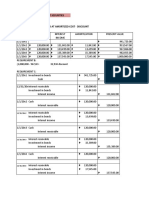

PROBLEM 4:

ACCOUNT TITLE DEBIT CREDIT

1 Interest Expense (400kx14%x7/12) ₱ 32,666.67

Interest Income ₱ 32,666.67

2 Salaries expense ₱ 46,000.00

Salaries payable ₱ 46,000.00

3 Utilities expense ₱ 16,000.00

Utilities payable ₱ 16,000.00

4 Rent expense ₱ 240,000.00

Rent payable ₱ 240,000.00

5 Depreciation expense ₱ 110,000.00

Accumulated Depreciation ₱ 110,000.00

6 Bad debts expense ₱ 30,000.00

Allowance for bad debts ₱ 30,000.00

7. Solutions:

Requirements a:

Liability method Income method

June 1, 20x1 Nov 1, 20x1

Cash ₱ 360,000 Cash ₱ 360,000

Unearned rent ₱ 360,000 Rent income ₱ 360,000

To record of receipts of 1-year rent in To record of receipts of 1-year rent in

advance. advance.

Requirements b:

Liability method Income method

Dec. 31, 20x1 Dec 31, 20x1

Unearned income ₱ 210,000 Royalty income ₱ 150,000

Royalty income ₱ Unearned income ₱ 150, 000

210,000 To recognized the unearned portion of

To recognized the earned portion of the the 1-year rent in advance.

1-year rent in advance

(₱ 360,000 x 7/12) = ₱ 210,000

(₱ 360,000 x 5/12) = ₱ 150,000

8. Solutions:

Requirements a:

Asset method Expense method

Sept. 1, 20x1 Sept. 1, 20x1

Prepaid insurance ₱ 360,000 Insurance expense ₱ 360,000

Cash ₱ 360,000 Cash ₱ 360,

To record the prepayment of 1-year 000

insurance. To record the prepayment of 1-year

insurance.

Requirements b:

Asset method Expense method

Dec. 31, 20x1 Dec 31, 20x1

Insurance expense ₱ 120,000 Prepaid insurance ₱ 240,000

Prepaid insurance ₱ Insurance Expense ₱ 240,

120,000 000

To recognized the expired portion of the To recognized the expired portion of the

1-year insurance. 1-year insurance.

(₱ 360,000 X 4/12) = ₱ 120,000

(₱ 360,000 X 8/12) = ₱ 240,000

PROBLEM 5:

ACCOUNT TITLE DEBIT CREDIT

1 Salaries Expense [25employees x ₱ 90,000.00

(600x2)x3days] ₱ 90,000.00

Salaries payable

2 Interest expense (1Mx10%x5/12) ₱ 41,666.67

Interest income ₱ 41,666.67

3 Interest expense (350kx12%x8/12) ₱ 28,000.00

Interest payable ₱ 28,000.00

4 Utilities expense ₱ 13,000.00

Utilities payable ₱ 13,000.00

5 Depreciation expense [(1.6M/5yrs)x9/12] ₱ 240,000.00

Accumulated depreciation ₱ 240,000.00

6 Prepaid supplies (34k-8k) ₱ 26,000.00

Prepaid Supplies ₱ 26,000.00

7 Prepaid supplies ₱ 8,000.00

Supplies expense ₱ 8,000.00

8 Bad debts expense (340k x 3%) ₱ 10,200.00

Allowance for bad debts ₱ 10,200.00

You might also like

- PricewaterhouseCoopers' Guide to the New Tax RulesFrom EverandPricewaterhouseCoopers' Guide to the New Tax RulesNo ratings yet

- Sol. Man. - Chapter 8 - Adjusting Entries PDFDocument11 pagesSol. Man. - Chapter 8 - Adjusting Entries PDFPerdito John VinNo ratings yet

- Sol. Man. - Chapter 8 - Adjusting EntriesDocument11 pagesSol. Man. - Chapter 8 - Adjusting EntriesPerdito John Vin100% (3)

- Camante James G Bsac 1 2 Assignment Acctng1100Document4 pagesCamante James G Bsac 1 2 Assignment Acctng1100James Gliponio CamanteNo ratings yet

- Chap8 SWDocument3 pagesChap8 SWGracey DoyuganNo ratings yet

- Chap8 QuizDocument5 pagesChap8 QuizGracey DoyuganNo ratings yet

- Jackson Kervin Rey G. Intacc 189 Activity 4 Unit 2 1Document4 pagesJackson Kervin Rey G. Intacc 189 Activity 4 Unit 2 1Kervin Rey JacksonNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesDocument6 pagesNUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesKyla Artuz Dela CruzNo ratings yet

- Acctg Lab 2.Document110 pagesAcctg Lab 2.AngieNo ratings yet

- Leases (Part 2) : Problem 1: True or FalseDocument23 pagesLeases (Part 2) : Problem 1: True or FalseKim Hanbin100% (1)

- FAR - MIDTERM - SEATWORK - Accruals, Depreciation and Bad DebtsDocument4 pagesFAR - MIDTERM - SEATWORK - Accruals, Depreciation and Bad Debtsshe kioraNo ratings yet

- ORQUIA AssignmentDocument4 pagesORQUIA AssignmentClint RoblesNo ratings yet

- Chapter 11Document7 pagesChapter 11Xynith Nicole RamosNo ratings yet

- FDNACCT Quiz 3 Solutions To PS Set ADocument2 pagesFDNACCT Quiz 3 Solutions To PS Set APia DigaNo ratings yet

- Intermediate Accounting 2 Chapter 4Document2 pagesIntermediate Accounting 2 Chapter 4Miel TaggaoaNo ratings yet

- Accounting Special TransactionDocument25 pagesAccounting Special TransactionMarinel Mae ChicaNo ratings yet

- Chapter 10 - Cash To Accrual Basis of AccountingDocument3 pagesChapter 10 - Cash To Accrual Basis of AccountingXienaNo ratings yet

- Chapter 10 - Cash To Accrual Basis of AccountingDocument3 pagesChapter 10 - Cash To Accrual Basis of AccountingJEFFERSON CUTENo ratings yet

- Bonds PayableDocument4 pagesBonds PayableyelzNo ratings yet

- IA3 Chapter 14 Problem 31Document3 pagesIA3 Chapter 14 Problem 31Bea TumulakNo ratings yet

- Chapter 13 (Incomplete)Document22 pagesChapter 13 (Incomplete)Dan ChuaNo ratings yet

- Worksheet Page 176-177Document8 pagesWorksheet Page 176-177rainellagmendozaNo ratings yet

- ADJUSTING ENTRIES With Answers by AlagangWencyDocument3 pagesADJUSTING ENTRIES With Answers by AlagangWencyHello KittyNo ratings yet

- FINACCREDocument187 pagesFINACCREKendall JennerNo ratings yet

- Quiz 4 With SolutionDocument5 pagesQuiz 4 With SolutionKarl Lincoln TemporosaNo ratings yet

- Adjusting Entries AssignmentDocument4 pagesAdjusting Entries AssignmentJynilou PinoteNo ratings yet

- Sol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionDocument13 pagesSol. Man. - Chapter 6 - Receivables - Addtl Concepts - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Abbie Merry VecinaBSA 6011Document7 pagesAbbie Merry VecinaBSA 6011elleeeewoodssssNo ratings yet

- Notes ReceivableDocument12 pagesNotes ReceivableSimon D. San GabrielNo ratings yet

- Module 5: Assignment: 2. Bond Discount (P6,000,000 X .04)Document3 pagesModule 5: Assignment: 2. Bond Discount (P6,000,000 X .04)Camille BonaguaNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- Exercise 2Document6 pagesExercise 2Drey JanNo ratings yet

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- FinAct ARDocument12 pagesFinAct ARNMCartNo ratings yet

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- Group Activities in Receivable FinancingDocument2 pagesGroup Activities in Receivable FinancingTrisha VillegasNo ratings yet

- Chap 10Document5 pagesChap 10Shiela DimaculanganNo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Untitled SpreadsheetDocument7 pagesUntitled SpreadsheetJames Gliponio CamanteNo ratings yet

- Receivables Practice SolvingDocument15 pagesReceivables Practice SolvingddalgisznNo ratings yet

- Solution Manual INTACC3 SUMMERDocument25 pagesSolution Manual INTACC3 SUMMERRaven SiaNo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- Tugas KB Aklan TM 13-Kelompok 1Document10 pagesTugas KB Aklan TM 13-Kelompok 1AdnanNo ratings yet

- (TEST BANK and SOL) Bonds PayableDocument6 pages(TEST BANK and SOL) Bonds PayableJhazz DoNo ratings yet

- (TEST BANK and SOL) Bonds PayableDocument6 pages(TEST BANK and SOL) Bonds PayableJhazz DoNo ratings yet

- Module 1 - Seatwork Answer KeyDocument3 pagesModule 1 - Seatwork Answer KeyKATHRYN CLAUDETTE RESENTENo ratings yet

- Nudjpia Far and Afar Solutions - Government GrantsDocument3 pagesNudjpia Far and Afar Solutions - Government GrantsKyla Artuz Dela CruzNo ratings yet

- IA2Document14 pagesIA2ALEA MAE THERESE BERMEJONo ratings yet

- Chapter 8 Leases Part 2Document9 pagesChapter 8 Leases Part 2Thalia Rhine AberteNo ratings yet

- 1T Siñel ACTIVITY7Document10 pages1T Siñel ACTIVITY7Von Jaurdan SinelNo ratings yet

- MILLAN CHAPTER 6 Receivables - Additional ConceptsDocument16 pagesMILLAN CHAPTER 6 Receivables - Additional Concepts밀크milkeuNo ratings yet

- ACT1106 - Midterm Quiz No. 2 With AnswerDocument8 pagesACT1106 - Midterm Quiz No. 2 With AnswerPj Dela VegaNo ratings yet

- Sol HW FranchiseDocument4 pagesSol HW FranchiseMarjorie Kate PagaoaNo ratings yet

- Problem 2-1: Current LiabilityDocument3 pagesProblem 2-1: Current LiabilityDanica RamosNo ratings yet

- Intermediate Accounting 1 (Chap 17)Document10 pagesIntermediate Accounting 1 (Chap 17)Natalie Anne Bambico MercadoNo ratings yet

- Bonds Payable-Between Interest Dates and SerialDocument4 pagesBonds Payable-Between Interest Dates and SerialJohn Williever GonzalezNo ratings yet

- The Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeFrom EverandThe Tax-Free Exchange Loophole: How Real Estate Investors Can Profit from the 1031 ExchangeNo ratings yet

- Question 4.1Document2 pagesQuestion 4.1LOMA, ABIGAIL JOY C.No ratings yet

- Theories in Ia Midterms ExamDocument12 pagesTheories in Ia Midterms ExamLOMA, ABIGAIL JOY C.No ratings yet

- Genetics Final Examination ReviewerDocument14 pagesGenetics Final Examination ReviewerLOMA, ABIGAIL JOY C.No ratings yet

- QUESTION 1.3cDocument1 pageQUESTION 1.3cLOMA, ABIGAIL JOY C.No ratings yet

- QUESTION 2.5bDocument1 pageQUESTION 2.5bLOMA, ABIGAIL JOY C.No ratings yet

- Proj BDocument3 pagesProj BLOMA, ABIGAIL JOY C.No ratings yet

- College English Finals ReviewerDocument8 pagesCollege English Finals ReviewerLOMA, ABIGAIL JOY C.No ratings yet

- Matm Midterm TransesDocument4 pagesMatm Midterm TransesLOMA, ABIGAIL JOY C.No ratings yet

- NCMA - 217A - Journal Reading - APGAR SCORING - : Name of Student: Neme Ñ O, Esther Cohlinne L. Level: BSN 2y 1-7Document2 pagesNCMA - 217A - Journal Reading - APGAR SCORING - : Name of Student: Neme Ñ O, Esther Cohlinne L. Level: BSN 2y 1-7LOMA, ABIGAIL JOY C.No ratings yet

- A Descriptive Study On The Readiness of CCBHS' Grade 11 Students in Terms of Materials For Synchronous and Asynchronous Classes, S.Y. 2020-2021Document40 pagesA Descriptive Study On The Readiness of CCBHS' Grade 11 Students in Terms of Materials For Synchronous and Asynchronous Classes, S.Y. 2020-2021LOMA, ABIGAIL JOY C.No ratings yet

- Analyzation and Interpretation and Summary of FindingsDocument9 pagesAnalyzation and Interpretation and Summary of FindingsLOMA, ABIGAIL JOY C.No ratings yet

- Group 4 Audio and Motion Dimensions of Information and MediaDocument18 pagesGroup 4 Audio and Motion Dimensions of Information and MediaLOMA, ABIGAIL JOY C.No ratings yet

- Quiz On Inventory - TheoriesDocument4 pagesQuiz On Inventory - TheoriesEms TeopeNo ratings yet

- Ammar Abbasi Assignment 5Document8 pagesAmmar Abbasi Assignment 5Usman SiddiquiNo ratings yet

- Working Capital Management Exercise 2Document2 pagesWorking Capital Management Exercise 2Nikki San GabrielNo ratings yet

- DocScanner 18-Sep-2022 14-06Document205 pagesDocScanner 18-Sep-2022 14-06hp NETWORKNo ratings yet

- Accounting For Non AccountantsDocument66 pagesAccounting For Non AccountantsPrinceAndre100% (2)

- Abm01 - Module 5-6.1 (Bus. Transaction)Document19 pagesAbm01 - Module 5-6.1 (Bus. Transaction)Love JcwNo ratings yet

- Quick StudyDocument8 pagesQuick StudyTrang Nguyễn thị minhNo ratings yet

- Financial Modeling - Module I - Workbook 09.28.09Document38 pagesFinancial Modeling - Module I - Workbook 09.28.09rabiaasimNo ratings yet

- Introduction of Working CapitalDocument2 pagesIntroduction of Working Capitalpurna3195592100% (6)

- Ratio (1) FDocument4 pagesRatio (1) FKathryn Bianca Acance100% (1)

- ENTREP. CHAPTER 12 and 13. Leaflet (GROUP 4)Document5 pagesENTREP. CHAPTER 12 and 13. Leaflet (GROUP 4)JCNo ratings yet

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- Financial AccountingDocument5 pagesFinancial AccountingMelissa Kayla ManiulitNo ratings yet

- HKABE 2014-15 Paper2A QuestionDocument11 pagesHKABE 2014-15 Paper2A QuestionChan Wai KuenNo ratings yet

- Asistensi Pertemuan 9Document2 pagesAsistensi Pertemuan 9kerang ajaibNo ratings yet

- Q3 Oikonomikes Katastaseis enDocument91 pagesQ3 Oikonomikes Katastaseis enVenture ConsultancyNo ratings yet

- MasDocument36 pagesMasClareng Anne57% (7)

- Financial Management 3B LAO FinalDocument7 pagesFinancial Management 3B LAO Final221103909No ratings yet

- Managerial Accounting Decision Making and Motivating Performance 1st Edition Datar Rajan Test BankDocument46 pagesManagerial Accounting Decision Making and Motivating Performance 1st Edition Datar Rajan Test Bankmable100% (19)

- Preparation and Presentation of Financial Statements of IAS 1Document7 pagesPreparation and Presentation of Financial Statements of IAS 1Md AladinNo ratings yet

- Chapter 31 Practical Acctg 1 ValixDocument10 pagesChapter 31 Practical Acctg 1 ValixloiseNo ratings yet

- 326 Chapter 9 - Fundamentals of Capital BudgetingDocument20 pages326 Chapter 9 - Fundamentals of Capital BudgetingAbira Bilal HanifNo ratings yet

- Managerial Accounting Creating Value in A Dynamic Business Environment Hilton 10th Edition Solutions ManualDocument6 pagesManagerial Accounting Creating Value in A Dynamic Business Environment Hilton 10th Edition Solutions ManualDominic Allen100% (30)

- Week 2 Lecture Notes (1 Slide)Document71 pagesWeek 2 Lecture Notes (1 Slide)Sarthak GargNo ratings yet

- Corporate Reporting July 2014Document20 pagesCorporate Reporting July 2014rajeshaisdu009100% (1)

- Income TaxationDocument15 pagesIncome TaxationTrixie mae MagdayongNo ratings yet

- HW 4Document14 pagesHW 4Racaz EwingNo ratings yet

- Deathwithdrawalretirement of A PartnersDocument12 pagesDeathwithdrawalretirement of A PartnersALYZA ANGELA ORNEDONo ratings yet

- Pre-Board 22-23 PDFDocument13 pagesPre-Board 22-23 PDFAdrian D'souzaNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik PolymersDocument17 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Kubik Polymersamit22505No ratings yet