Professional Documents

Culture Documents

Ch10 - Basics of Capital Budgeting Evaluating Cash Flows

Uploaded by

radyantamaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ch10 - Basics of Capital Budgeting Evaluating Cash Flows

Uploaded by

radyantamaCopyright:

Available Formats

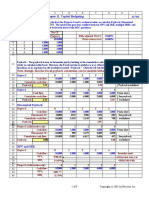

INPUTS:

r = 10%

Initial Cost and Expected Cash Flows

Year 0 1 2 3 4

Project S $ -10,000 $ 5,300 $ 4,300 $ 1,874 $ 1,500

$ 2,061

Present Value $ 5,203 Future Value

of Negative CF $ -10,000 $ 7,054

Terminal Value of Positive CF (TV) = $ 15,819

Calculator: N = 4, PV = -10000, PMT = 0, FV = 15819. Press I/YR to get: MIRRs = 12.15%

Excel RATE function - Easiest: = RATE(G6,0,C10,G11) MIRRs = 12.15%

Excel MIRR function - Easiest: = MIRR(C7:G7;C4;C4) MIRRs = 12.15%

Year 0 1 2 3 4

Project L $ -10,000 $ 1,600 $ 2,364 $ 2,469 $ 8,400

$ 2,716

Present Value $ 2,860

of Negative CF $ -10,000 $ 2,130

$ 16,106

For Project L, using the MIRR function: = MIRR(C20:G20;C4;C4) MIRR L = 12.65%

Project S: PIs = PV of future cash flows ÷ Initial cost

PIs = $ 10,804 ÷ $ 10,000

PIs = 1.08

Project L: PIs = PV of future cash flows ÷ Initial cost

PIs = $ 11,001 ÷ $ 10,000

PIs = 1.10

Project S

Year 0 1 2 3

Cash flow $ -10,000 $ 5,300 $ 4,300 $ 1,874

Cumulative cash flow $ -10,000 $ -4,700 $ -400 $ 1,474

Payback S = 2 + $ 400 ÷ $ 1874 = 2.21

Project Z

Year 0 1 2 3

Cash flow $ -10,000 $ 1,500 $ 2,355 $ 2,500

Cumulative cash flow $ -10,000 $ -8,500 $ -6,145 $ -3,645

Payback Z = 3 + $ 3465 ÷ $ 8000 = 3.46

Project S r = 10%

Year 0 1 2 3

Cash flow $ -10,000 $ 5,300 $ 4,300 $ 1,874

Discounted cash flow $ -10,000 $ 4,818 $ 3,554 $ 1,408

Cumulative discounted CF $ -10,000 $ -5,182 $ -1,628 $ -220

Payback S = 3 + $ 220 ÷ $ 1025 = 3.21 years Perubahan dari aliran kas

negatif ke positif

Project L

Year 0 1 2 3

Cash flow $ -10,000 $ 1,600 $ 2,364 $ 2,469

Discounted cash flow $ -10,000 $ 1,455 $ 1,954 $ 1,855

Cumulative discounted CF $ -10,000 $ -8,545 $ -6,592 $ -4,737

Payback L = 3 + $ 4737 ÷ $ 5737 = 3.83 years Perubahan dari aliran kas

negatif ke positif

4

$ 1,500

$ 2,974

4

$ 8,000

$ 4,355

4

$ 1,500

$ 1,025

$ 804

erubahan dari aliran kas

negatif ke positif

4

$ 8,400

$ 5,737

$ 1,001

erubahan dari aliran kas

negatif ke positif

"Matching Principle Theory"

You might also like

- Fin mgt-st-02 AssignmentDocument6 pagesFin mgt-st-02 AssignmentSyed Sadaf AlamNo ratings yet

- Year Project X Project Y 0 $ (10,000) $ (10,000) 1 $6,500 $3,500 2 $3,000 $3,500 3 $3,000 $3,500 4 $1,000 $3,500Document3 pagesYear Project X Project Y 0 $ (10,000) $ (10,000) 1 $6,500 $3,500 2 $3,000 $3,500 3 $3,000 $3,500 4 $1,000 $3,500Idris100% (1)

- Final Exam Practice Papers SolutionsDocument31 pagesFinal Exam Practice Papers Solutionssamuel ngNo ratings yet

- Ch10 Tool KitDocument9 pagesCh10 Tool KitNino NatradzeNo ratings yet

- FIN Home Assigment AnswersDocument5 pagesFIN Home Assigment AnswersIkra MemonNo ratings yet

- GSLC Session 16 NPV AnalysisDocument6 pagesGSLC Session 16 NPV AnalysisJavier Noel ClaudioNo ratings yet

- Tugas GSLC Corp Finance Session 16Document6 pagesTugas GSLC Corp Finance Session 16Javier Noel ClaudioNo ratings yet

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Document6 pagesGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90salsabilla rpNo ratings yet

- Project A: Question 1 AnswerDocument6 pagesProject A: Question 1 AnswerShafiqUr RehmanNo ratings yet

- Capital Budgeting Techniques WorkshopDocument3 pagesCapital Budgeting Techniques WorkshopValentina Barreto Puerta0% (1)

- Benito Juhantyo Wibbowo 1714422056 NPVDocument6 pagesBenito Juhantyo Wibbowo 1714422056 NPVBenito JuhantyoNo ratings yet

- Final ExamDocument3 pagesFinal ExamBervie RondonuwuNo ratings yet

- Chapter 9 Check Figures and Complete SolutionsDocument6 pagesChapter 9 Check Figures and Complete SolutionsAmrita AroraNo ratings yet

- Managerial Project (Akanksha Shahi) FINALDocument5 pagesManagerial Project (Akanksha Shahi) FINALakankshashahi1986No ratings yet

- FM II Assignment 2 Solution W22Document5 pagesFM II Assignment 2 Solution W22Farah ImamiNo ratings yet

- Capital Budgeting SeatworkDocument5 pagesCapital Budgeting SeatworkJOHN RYAN JINGCONo ratings yet

- Evaluating Business and Engineering Assets - Part II: Professor C. S. ParkDocument8 pagesEvaluating Business and Engineering Assets - Part II: Professor C. S. ParkAlishaNo ratings yet

- Ejercicio Ded VPN g1Document6 pagesEjercicio Ded VPN g1Eliasid Abimael Franco MorrobelNo ratings yet

- Part 1. Worksheet For Chapter 11, Capital BudgetingDocument9 pagesPart 1. Worksheet For Chapter 11, Capital BudgetingIndrama PurbaNo ratings yet

- Ise 307 - Chapter 7Document51 pagesIse 307 - Chapter 7Ali MakkiNo ratings yet

- Fin322 Week2 2018Document12 pagesFin322 Week2 2018chi_nguyen_100No ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- CH 9 ClsDocument2 pagesCH 9 Clsrupok100% (1)

- WBS T C S Description Budget StartDocument14 pagesWBS T C S Description Budget StartJohn NoriegaNo ratings yet

- Alifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcDocument9 pagesAlifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcFaldo DaffaNo ratings yet

- Payback Period Year Cash Flows Cumulative Cash FlowsDocument8 pagesPayback Period Year Cash Flows Cumulative Cash Flowsfarhann JattNo ratings yet

- CaseStudy2-Dataset2 v2Document49 pagesCaseStudy2-Dataset2 v2Chip choiNo ratings yet

- Bab 10 Teknik Anggaran & Cost of CapitalDocument50 pagesBab 10 Teknik Anggaran & Cost of CapitalRandrey SihombingNo ratings yet

- Engineering Economics: Ali SalmanDocument16 pagesEngineering Economics: Ali SalmanMuhammad atif latif0% (1)

- Practice Questions 1 and 2 ReviewDocument8 pagesPractice Questions 1 and 2 ReviewHashani KumarasingheNo ratings yet

- PaybackDocument3 pagesPaybackMd. Masudur Rahman MasumNo ratings yet

- Proposal A Proposal B Proposal CDocument6 pagesProposal A Proposal B Proposal CMaha HamdyNo ratings yet

- Wey-Acctg Princ 9e-26p-4b-SolDocument6 pagesWey-Acctg Princ 9e-26p-4b-SolTSGohNo ratings yet

- Example Prob, NPV, IRR&PIDocument10 pagesExample Prob, NPV, IRR&PITin Bernadette DominicoNo ratings yet

- FM II Assignment 3 Solution W22Document3 pagesFM II Assignment 3 Solution W22Farah ImamiNo ratings yet

- Huỳnh Hiếu Hậu 2000002356 Accounting PrinciplesDocument4 pagesHuỳnh Hiếu Hậu 2000002356 Accounting PrinciplesTuấn DươngNo ratings yet

- Financial Management Assignment NotesDocument3 pagesFinancial Management Assignment NotesDaniyal AliNo ratings yet

- Chapter 5 Interest Formulas For Single Cash FlowsDocument10 pagesChapter 5 Interest Formulas For Single Cash FlowsORK BUNSOKRAKMUNYNo ratings yet

- Chapter 4 - Concept Questions and Exercises StudentDocument9 pagesChapter 4 - Concept Questions and Exercises StudentVõ Lê Khánh HuyềnNo ratings yet

- Financial Management - Exercise 2 (NPV & IRR)Document7 pagesFinancial Management - Exercise 2 (NPV & IRR)Tanatip VijjupraphaNo ratings yet

- Quiz 3Document14 pagesQuiz 3K L YEONo ratings yet

- Laura Leticia López Aguilar Activiti 1 Capital BudgetingDocument2 pagesLaura Leticia López Aguilar Activiti 1 Capital BudgetingLets A LopezNo ratings yet

- 3815capital Budgeting TechniqueDocument51 pages3815capital Budgeting TechniqueMUHMMAD ARSALAN 13728No ratings yet

- 3 - Capital Budgeting ImplementationDocument9 pages3 - Capital Budgeting ImplementationoryzanoviaNo ratings yet

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- Other Investment Criteria and Free Cash Flows in Finance: Capital Budgeting DecisionsDocument48 pagesOther Investment Criteria and Free Cash Flows in Finance: Capital Budgeting DecisionsAbdullah MujahidNo ratings yet

- Lecture 27 Rate of Return AnalysisDocument32 pagesLecture 27 Rate of Return AnalysisDevyansh GuptaNo ratings yet

- TUGAS CHAPTER 9 DAN 10Document8 pagesTUGAS CHAPTER 9 DAN 10Shavia KusumaNo ratings yet

- FM II Assignment 5 Solution 19Document6 pagesFM II Assignment 5 Solution 19Sheryar NaeemNo ratings yet

- IB Bm2tr 3 Resources Answers8Document6 pagesIB Bm2tr 3 Resources Answers8Gabriel FungNo ratings yet

- Akmen Chapter 13 KadishaDocument5 pagesAkmen Chapter 13 Kadishakidus.gaming52No ratings yet

- Chapter 7Document39 pagesChapter 7Indriati ArisaNo ratings yet

- Week 13and14 Assignment FINALSDocument10 pagesWeek 13and14 Assignment FINALSkristelle0marisseNo ratings yet

- The NPV Is Positively Related To The The Value of Foreign CurrencyDocument10 pagesThe NPV Is Positively Related To The The Value of Foreign CurrencyYulia Tri CahyaniNo ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- lpv13 6 RDocument18 pageslpv13 6 RPhan Hải YếnNo ratings yet

- Accounting ExamDocument6 pagesAccounting Examgenn katherine gadunNo ratings yet

- Exercise 2 Solutions (Chapter 4-5 FinanceDocument5 pagesExercise 2 Solutions (Chapter 4-5 FinanceeyNo ratings yet

- What Project Will You Sugggest To The Management and Why?Document8 pagesWhat Project Will You Sugggest To The Management and Why?Tin Bernadette DominicoNo ratings yet

- Introduction To MATLAB With Image ProcessingDocument25 pagesIntroduction To MATLAB With Image Processingجمال سينغNo ratings yet

- AC800F F2K Connect B1 6.2 CONFIGURATIONDocument43 pagesAC800F F2K Connect B1 6.2 CONFIGURATIONassessorNo ratings yet

- Drainage DesignDocument21 pagesDrainage Designronaldnyirenda2230100% (1)

- Silvaco Models SytnaxDocument14 pagesSilvaco Models SytnaxAhmed M. NageebNo ratings yet

- Fe-C Phase Transformations and Hardening of SteelDocument21 pagesFe-C Phase Transformations and Hardening of SteelchenshicatherineNo ratings yet

- Bagi Yang Masih Awam Memakai Google Sheet, File Ini Bisa Didownload Dengan Klik File Download MS. ExcelDocument67 pagesBagi Yang Masih Awam Memakai Google Sheet, File Ini Bisa Didownload Dengan Klik File Download MS. Excelwisnu pranata adhiNo ratings yet

- Exocytosis and Endocytosis: © 2012 Pearson Education, IncDocument49 pagesExocytosis and Endocytosis: © 2012 Pearson Education, IncGlein CenizaNo ratings yet

- Panasonic TH-42PX6U and 50Document106 pagesPanasonic TH-42PX6U and 50corbin12No ratings yet

- WOCD-0306-02 Rotary Drilling With Casing - A Field Proven Method of Reducing Wellbore Construction CostDocument7 pagesWOCD-0306-02 Rotary Drilling With Casing - A Field Proven Method of Reducing Wellbore Construction CostMile SikiricaNo ratings yet

- OSY Practical No.1Document18 pagesOSY Practical No.1aniket bhoirNo ratings yet

- Chap2 (B) Fits and TolerancesDocument20 pagesChap2 (B) Fits and TolerancesjojoNo ratings yet

- Phylogenetic studies of Mammillaria provide new insightsDocument13 pagesPhylogenetic studies of Mammillaria provide new insightsA Man ZedNo ratings yet

- Spring Boot ServicesDocument27 pagesSpring Boot ServicesMarcosNo ratings yet

- Circuit Center ValvulaDocument4 pagesCircuit Center ValvulaLuis Carlos PardoNo ratings yet

- Introduction To Operations ResearchDocument37 pagesIntroduction To Operations ResearchSiegfred Laborte100% (1)

- Curtain Wall Conn2Document11 pagesCurtain Wall Conn2Raveendra Babu CherukuriNo ratings yet

- Apex Series 5000 7000 Bill Acceptor Manual PDFDocument17 pagesApex Series 5000 7000 Bill Acceptor Manual PDFFidelRomasantaNo ratings yet

- Pelatihan Kader: Lampiran Uji StatistikDocument2 pagesPelatihan Kader: Lampiran Uji StatistikSiti Hidayatul FitriNo ratings yet

- MCGB - Data Sheet For Suppliers Old MAT Nos.: Weldox 700 EDocument3 pagesMCGB - Data Sheet For Suppliers Old MAT Nos.: Weldox 700 Ebaskaran ayyapparajNo ratings yet

- Readings: Decision AnalysisDocument44 pagesReadings: Decision AnalysisPierre Moreno SotoNo ratings yet

- SAIVEERA ACADEMY’S GUIDE TO 12TH CHEMISTRY UNIT 1 METALLURGYDocument26 pagesSAIVEERA ACADEMY’S GUIDE TO 12TH CHEMISTRY UNIT 1 METALLURGYKrish Krishn100% (1)

- Mouna HezbriDocument106 pagesMouna HezbriMuhammedNo ratings yet

- Book 22Document11 pagesBook 22bernardo garciaNo ratings yet

- Cable 4 PDFDocument46 pagesCable 4 PDFmuhammadshafiq69No ratings yet

- Lecture-SULAMAN SADIQ - TSE-SDH and SONETDocument51 pagesLecture-SULAMAN SADIQ - TSE-SDH and SONETSulaman SadiqNo ratings yet

- GCB HVR BrochureDocument8 pagesGCB HVR BrochureHan HuangNo ratings yet

- Peter-Linz-Automata BUET Download PDFDocument2 pagesPeter-Linz-Automata BUET Download PDFmalang0% (2)

- AOCS Annual Meeting 2020 Surfactants Detergents AbstractsDocument47 pagesAOCS Annual Meeting 2020 Surfactants Detergents AbstractsJonathan DiamondNo ratings yet

- Ashpasol SupremeDocument2 pagesAshpasol SupremeAlex K.No ratings yet