Professional Documents

Culture Documents

Cost of Goods Sold Calculations and Scrap Material Entries

Uploaded by

justine reine cornicoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Goods Sold Calculations and Scrap Material Entries

Uploaded by

justine reine cornicoCopyright:

Available Formats

E2 – 14

1. 40,000/10,000= 4 days

2. 40,000-(40,000x.75) – 10,000

10,000/10,000= 1 day

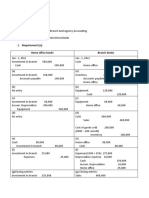

E2 – 15

a. Raw and In – Process 80,000

Accounts Payable 80,000

b. No Entry

c. Conversion Costs 10,000

Payroll 10,000

d. Conversion Costs 60,000

Various Credits 60,000

e. Finished Goods 150,000

Raw and In – Process 80,000

Conversion Costs 70,000

f. Accounts Receivable 225,000

Sales 225,000

Cost of Goods Sold 150,000

Finished Goods 150,000

E-16

e. No Entry

f. Cost of Goods Sold 150,000

Raw and In – Process 80,000

Conversion Costs 70,000

E-17

a. Raw and In – Process 70,000

Accounts Payable 70,000

b. No Entry

c. Conversion Costs 15,000

Payroll 15,000

d. Conversion Costs 45,000

Various Credits 45,000

e. Finished Goods 130,000

Raw and In – Process 70,000

Conversion Costs 60,000

f. Accounts Receivable 195,000

Sales 195,000

Cost of Goods Sold 130,000

Finished Goods 130,000

E2 – 18

e. No entry

f. Cost of Goods Sold 130,000

Raw and In – Process 70,000

Conversion Costs 60,000

E2 – 19

a. Scrap Materials 125

Factory Overhead(Scrap) 125

Cash 125

Scrap Materials 125

b. No entry at the time scrap is identified

At the time of Sale

Cash 75

Factory Overhead(Scrap) 75

c. No entry at the time scrap is identified

At the time of Sale

Accounts Receivable 85

Work – In Process 85

d. No entry at the time scrap is identified

At the time of Sale

Cash 40

Scrap Revenue 40

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Process CostingDocument6 pagesProcess Costingaju p vNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Chapter 01 - Answers - Job Order CostingDocument15 pagesChapter 01 - Answers - Job Order CostingEmmanuelle MazaNo ratings yet

- Practical Auditing by Empleo 2022 Chapter 4 Receivables Related RevenuesDocument55 pagesPractical Auditing by Empleo 2022 Chapter 4 Receivables Related RevenuesDarence IndayaNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingenzoNo ratings yet

- Latihan Soal - 261121-DPKDocument6 pagesLatihan Soal - 261121-DPKsitepu1223No ratings yet

- Journal Entries (COST)Document2 pagesJournal Entries (COST)CarlNo ratings yet

- audit-sm-ch-4-2022Document13 pagesaudit-sm-ch-4-2022andzie09876No ratings yet

- Practical Accounting 2 1Document24 pagesPractical Accounting 2 1NCTNo ratings yet

- WB Job OrderDocument30 pagesWB Job OrderSaleh AlizadeNo ratings yet

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- Chapter 10 Answer Key True or FalseDocument8 pagesChapter 10 Answer Key True or FalseArn KylaNo ratings yet

- Acco 3520 Tarea 2.2 Conjunto ADocument3 pagesAcco 3520 Tarea 2.2 Conjunto ANEISHA CASTELLANOSNo ratings yet

- 1 637681001255067638 767649Document5 pages1 637681001255067638 767649MUHAMMAD KASHIF RAHEEMNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingTrixie DacanayNo ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

- Assignment 8Document13 pagesAssignment 8Jerickho JNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Case Study Comparison of Financial Data for 3 CompaniesDocument2 pagesCase Study Comparison of Financial Data for 3 Companieskhiladi883No ratings yet

- Excel Practise Questions and SolutionsDocument18 pagesExcel Practise Questions and SolutionsFahad NadeemNo ratings yet

- Solution To Assignment 1Document3 pagesSolution To Assignment 1Khyla DivinagraciaNo ratings yet

- Maria2 103130Document4 pagesMaria2 103130Clay MaaliwNo ratings yet

- P 5 - Assigned Tasks Afar302aDocument7 pagesP 5 - Assigned Tasks Afar302aLyn CosNo ratings yet

- EXERCISES AND PROBLEMSDocument5 pagesEXERCISES AND PROBLEMSSally Ubando Delos ReyesNo ratings yet

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- Chapter 1 Assignment Cost AccountingDocument3 pagesChapter 1 Assignment Cost AccountingSydnei HaywoodNo ratings yet

- Job Order CostingDocument4 pagesJob Order CostingTrina Mae BarrogaNo ratings yet

- Problem 1:: Job Order CostingDocument4 pagesProblem 1:: Job Order CostingTrina Mae BarrogaNo ratings yet

- Inventories and Related Expenses: Multiple Choice - TheoryDocument14 pagesInventories and Related Expenses: Multiple Choice - TheoryMadielyn Santarin MirandaNo ratings yet

- Toaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRDocument12 pagesToaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRMeg Lorenz DayonNo ratings yet

- Practice Problem 1 1. Journal EntriesDocument6 pagesPractice Problem 1 1. Journal Entriesjohn carlo tolentinoNo ratings yet

- Quizzes - Chapter 6 - Accounting Books - Journal and LedgerDocument5 pagesQuizzes - Chapter 6 - Accounting Books - Journal and LedgerAmie Jane MirandaNo ratings yet

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- Latihan Soal - 231121-CBTDocument6 pagesLatihan Soal - 231121-CBTsitepu1223No ratings yet

- Acccob3 HW3Document20 pagesAcccob3 HW3Reshawn Kimi SantosNo ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- 07 - Briggita Rapunzel Citra Respati - Tugas 2Document5 pages07 - Briggita Rapunzel Citra Respati - Tugas 207Briggita Rapunzel Citra RespatiNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- This Study Resource Was: ScoreDocument9 pagesThis Study Resource Was: ScoreReal Estate Golden TownNo ratings yet

- ASsignemts SCIDocument25 pagesASsignemts SCIPedro PelaezNo ratings yet

- CPA Review School Pre-Board ExamsDocument20 pagesCPA Review School Pre-Board ExamsCiatto SpotifyNo ratings yet

- Date Description DR CRDocument1 pageDate Description DR CRUrooj KhanNo ratings yet

- Advance 1Document7 pagesAdvance 1Diana Faye CaduadaNo ratings yet

- Alonzo Company manufacturing inventory and expense accounts problemDocument11 pagesAlonzo Company manufacturing inventory and expense accounts problemJOSCEL SYJONGTIANNo ratings yet

- Answer No. 1: A. MaterialDocument4 pagesAnswer No. 1: A. MaterialFaroo wazirNo ratings yet

- Chapter 4 Receivables and Related RevenuesDocument12 pagesChapter 4 Receivables and Related Revenuesjohn condesNo ratings yet

- Assignment #1 SolutionDocument18 pagesAssignment #1 SolutionJesse DanielsNo ratings yet

- Activity 4 Job Order CostingDocument4 pagesActivity 4 Job Order CostingJOSCEL SYJONGTIANNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- Cost Accounting Problems Solved Step-by-StepDocument13 pagesCost Accounting Problems Solved Step-by-StepImthe OneNo ratings yet

- Latihan CH 19Document12 pagesLatihan CH 19laurentinus fikaNo ratings yet

- Salce Prelim Act102 E2Document8 pagesSalce Prelim Act102 E2Joshua P. SalceNo ratings yet

- Backflush costing and JIT problemsDocument2 pagesBackflush costing and JIT problemsdoora keysNo ratings yet

- Case 1. Landers CompanyDocument3 pagesCase 1. Landers CompanyMavel DesamparadoNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- Assignment 4Document2 pagesAssignment 4Mohammed Al ArmaliNo ratings yet

- Remson Mark C. Macawile MCP Quiz Part 2: Transaction Account Title Debit CreditDocument2 pagesRemson Mark C. Macawile MCP Quiz Part 2: Transaction Account Title Debit CreditMarcus McWile MorningstarNo ratings yet

- Maam Jasmin 1Document6 pagesMaam Jasmin 1justine reine cornicoNo ratings yet

- Quiz - MonDocument11 pagesQuiz - Monjustine reine cornicoNo ratings yet

- Valuation Apr 05Document10 pagesValuation Apr 05justine reine cornicoNo ratings yet

- Ged 109 Reviewer General Concepts and Historical Events in Science, Technology and Society Scientific RevolutionDocument25 pagesGed 109 Reviewer General Concepts and Historical Events in Science, Technology and Society Scientific Revolutionjustine reine cornicoNo ratings yet

- 04 CorporationsDocument76 pages04 Corporationsjustine reine cornicoNo ratings yet

- Understanding The Self Ged 101 Pointers To Review Understanding The SelfDocument1 pageUnderstanding The Self Ged 101 Pointers To Review Understanding The Selfjustine reine cornicoNo ratings yet

- Types of Hotels and Accommodation Facilities Hotel: RomsDocument10 pagesTypes of Hotels and Accommodation Facilities Hotel: Romsjustine reine cornicoNo ratings yet

- Partnership Distributive ShareDocument20 pagesPartnership Distributive Sharejustine reine cornicoNo ratings yet

- Responsibility Accounting and Transfer PricingDocument25 pagesResponsibility Accounting and Transfer Pricingjustine reine cornicoNo ratings yet

- Hme 207Document1 pageHme 207justine reine cornicoNo ratings yet

- Pe 101Document1 pagePe 101justine reine cornicoNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Chapter 1 The Acco Untancy Profession Question 1-1 Multiple Choice (Acp)Document55 pagesChapter 1 The Acco Untancy Profession Question 1-1 Multiple Choice (Acp)justine reine cornicoNo ratings yet

- History: Ancient Sumeria / Sumer 4000 BCDocument18 pagesHistory: Ancient Sumeria / Sumer 4000 BCjustine reine cornicoNo ratings yet

- 1 Far Answer KeyDocument25 pages1 Far Answer KeyAngelie0% (1)

- FINANCIAL ACCOUNTING THEORY: KEY CONCEPTSDocument14 pagesFINANCIAL ACCOUNTING THEORY: KEY CONCEPTSjustine reine cornicoNo ratings yet

- Practical Accounting Problems SolvedDocument11 pagesPractical Accounting Problems SolvedStela Marie CarandangNo ratings yet

- This Study Resource Was: Succession and Transfer TaxesDocument6 pagesThis Study Resource Was: Succession and Transfer Taxesjustine reine cornicoNo ratings yet

- Answer The Following in Not More Than Five (5) Brief Sentences Each. (5pts. Each)Document1 pageAnswer The Following in Not More Than Five (5) Brief Sentences Each. (5pts. Each)justine reine cornicoNo ratings yet

- Quiz 1Document4 pagesQuiz 1justine reine cornicoNo ratings yet

- I Used To Think That - Now I ThinkDocument1 pageI Used To Think That - Now I Thinkjustine reine cornicoNo ratings yet

- MARVELSDocument2 pagesMARVELSjustine reine cornicoNo ratings yet

- Chapter 12 TAX Answer KEY ExplainedDocument5 pagesChapter 12 TAX Answer KEY Explainedjustine reine cornico100% (1)

- Give at Least 3 Ways To Promote Environmental Stewardship in A Specific IndustryDocument1 pageGive at Least 3 Ways To Promote Environmental Stewardship in A Specific Industryjustine reine cornicoNo ratings yet

- Bustax Answer KeyDocument18 pagesBustax Answer KeyMarchelle CaelNo ratings yet

- To Be Posted 10Document1 pageTo Be Posted 10justine reine cornicoNo ratings yet

- To Be Posted 7,8,9Document6 pagesTo Be Posted 7,8,9justine reine cornicoNo ratings yet

- Module 9: Safety and Health at Work Videos To Watch!!!Document1 pageModule 9: Safety and Health at Work Videos To Watch!!!justine reine cornicoNo ratings yet

- Module 5 - Retention and MotivationDocument4 pagesModule 5 - Retention and Motivationjustine reine cornicoNo ratings yet

- Module 9: Safety and Health at Work Videos To Watch!!!Document1 pageModule 9: Safety and Health at Work Videos To Watch!!!justine reine cornicoNo ratings yet

- Business Plan Sample Format Entrep 9Document24 pagesBusiness Plan Sample Format Entrep 9Hazel MierNo ratings yet

- SH CO. NOTES-konti Na LangDocument15 pagesSH CO. NOTES-konti Na LangDare QuimadaNo ratings yet

- Solution Manual For Introduction To Accounting An Integrated Approach 6th Edition by AinsworthDocument6 pagesSolution Manual For Introduction To Accounting An Integrated Approach 6th Edition by Ainswortha755883752No ratings yet

- TECHNO Act.3 - Opportunity, Risk Taking & EfficiencyDocument4 pagesTECHNO Act.3 - Opportunity, Risk Taking & EfficiencyEarl averzosaNo ratings yet

- Bulgari Group Reports 23.1% Revenue Decline in Q1 2009Document38 pagesBulgari Group Reports 23.1% Revenue Decline in Q1 2009sl7789No ratings yet

- CH 5 - Intercompany Transaction - InventoriesDocument14 pagesCH 5 - Intercompany Transaction - InventoriesMutia WardaniNo ratings yet

- Malcolm Baldrige National Quality Award-Manufacturing: Presented byDocument13 pagesMalcolm Baldrige National Quality Award-Manufacturing: Presented byAditya KumarNo ratings yet

- Fa Msu PDFDocument254 pagesFa Msu PDFSelvakumar Thangaraj100% (1)

- ExercisesDocument3 pagesExercisesNgọc TràNo ratings yet

- Dimalupig & Gabrielle: Marketing PlanDocument24 pagesDimalupig & Gabrielle: Marketing PlanErika May RamirezNo ratings yet

- Entrep12 Q1 Mod3 Recognize-and-Understand-the-Market v2Document13 pagesEntrep12 Q1 Mod3 Recognize-and-Understand-the-Market v2MrBigbozz21No ratings yet

- SCM PPT CH 1-4Document64 pagesSCM PPT CH 1-4ashu tkNo ratings yet

- 01 Leverages FTDocument7 pages01 Leverages FT1038 Kareena SoodNo ratings yet

- CV With Photo 02Document1 pageCV With Photo 02afriyiepeterowusuNo ratings yet

- 07 - Capital - Structure ProblemsDocument5 pages07 - Capital - Structure ProblemsRohit KumarNo ratings yet

- Business Proposal For Navarro'S Food International, IncDocument53 pagesBusiness Proposal For Navarro'S Food International, Incjane dillanNo ratings yet

- Gul Ahmed Final PresentationDocument37 pagesGul Ahmed Final PresentationDanyal Ansari50% (4)

- Marketing Căn B N - PhilipkotlerDocument384 pagesMarketing Căn B N - Philipkotlerngochan00595No ratings yet

- Anna Avdeeva Project 3 Facebook AdsDocument24 pagesAnna Avdeeva Project 3 Facebook Adsapi-514677250No ratings yet

- Cambridge O Level: 7115/11 Business StudiesDocument12 pagesCambridge O Level: 7115/11 Business StudiesBACKYARD BOYNo ratings yet

- Entrepreneurship TheoryDocument119 pagesEntrepreneurship TheoryAkinwunmi OpeyemiNo ratings yet

- Droom InternationalDocument2 pagesDroom Internationalyash sharmaNo ratings yet

- Google Ads Measurement Certification AnswersDocument34 pagesGoogle Ads Measurement Certification AnswersE Kaynaklar60% (5)

- Board Question Paper: September 2021: Book Keeping & AccountancyDocument5 pagesBoard Question Paper: September 2021: Book Keeping & AccountancyPriyansh ShahNo ratings yet

- Sierra Furniture Is An Elite Desk Manufacturer It Manufactures TwoDocument2 pagesSierra Furniture Is An Elite Desk Manufacturer It Manufactures TwoAmit Pandey67% (3)

- Case 7Document3 pagesCase 7Shaarang BeganiNo ratings yet

- All SubjectsDocument13 pagesAll SubjectsManuNo ratings yet

- Marketing MyopiaDocument2 pagesMarketing MyopiaSreelakshmiNo ratings yet

- MSQ-01 - Activity Cost & CVP Analysis (Final)Document11 pagesMSQ-01 - Activity Cost & CVP Analysis (Final)Mary Alcaflor40% (5)

- REINSURANCE: Spreading Risk for InsurersDocument69 pagesREINSURANCE: Spreading Risk for InsurersAbhi ChavanNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)