Professional Documents

Culture Documents

Office of The City Assessor/1101 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2020

Uploaded by

Charles D. FloresOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Office of The City Assessor/1101 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2020

Uploaded by

Charles D. FloresCopyright:

Available Formats

Office/Department : Office of the City Assessor/1101

MANDATE, VISION/MISSION, MAJOR FINAL OUTPUT, PERFORMANCE INDICATORS AND

TARGETS CY 2020

Mandate : The Office of the City Assessor shall take charge of the discovery, classification, appraisal,

assessment and valuation of all real properties within the territorial jurisdiction which shall be used

as the basis for taxation. It includes preparation, installation and maintenance of a system of tax

mapping and records management and the preparation of a Schedule of Fair Market Values of the

different classes of real properties, as provided for in RA 7160.

Vision : The Office of the City Assessor envisions a computerized system of all records including tax maps to

facilitate fast and easy transactions with the real property taxpayers/owners.

Mission : 1. Ensure that all real properties whether taxable or exempt shall be listed in the books of property

assessments and store them in the computer for easy retrieval.

2. To update the taxmaps per barangay

3. Maintain a comprehensive system of real property appraisal and assessment that will ensure a

current and fair market value for taxations purposes.

4. Update records of improvements/buildings/machineries thru frequent field inspection/surveys.

5. To appraise all real property at current Market Values in accordance with the approved Schedule

of Fair Market Values.

6. To issue Tax Declarations covering newly discovered properties and transactions involving

transfer of ownership, subdivisions/segregations of land into two or more parcels and consolidations

of two or more parcels into single ownership and other transactions involving increase and decrease

in the assessment of Real Property for taxation purposes.

7. To prepare and maintain tax mapping showing graphically and property subject to assessment

in the city.

8. To make frequent physical surveys to check and determine that all real properties in the locality

are properly listed in the assessment rolls

I Proposed New Appropriation by Program, Activity and Project

AIP Performance/ Target for Proposed Budget for the Budget Year

Refere Major Final

nce Program/Project/Activity Output Output the budget

Code Description Output Incator Year PS MOOE CO TOTAL

(1) (2) (3) (4) (5) (6) (7) (8) (9)

A. Assessment of Real Property Services 8,495,463.30 955,920.00 - 9,451,383.30

1. Appraisal and Assessment of Real Total Number

Property Units of RPUs

2. Issuance of the following:

- Certificate of landholdings Total Number

- Certificate of no landholdings of RPU's

- Certificate of Improvements per clientille

- Certificate of No Improvements request

- Certified true copies of Tax

Declarations

- Annotations of Mortgages & Bailbonds

3. Prepares final tax map No. of

Barangays

4. Prepares tax map & control roll (TMCR) No. of Maps

5. Updates tax maps & section index maps No. of Maps

6. Encodes Field Appraisal & Assessment No. of RPU's

Sheets (FAAS)

7. Binds FAAS in order No. of RPU's

8. Prepares & Submits to BLGF, Regional No. of Reports

Office, such as:

- Quartely Report 4

- Plans & Programs 1

- Unit Performance Evaluation Report 2

TOTAL 8,495,463.30 955,920.00 - 9,451,383.30

LBP Form No. 2 "Annex C"

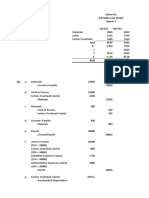

II. Proposed New Appropriation by Object of Expenditures

Current Year (Estimated)

Account

Object of Expenditure Past Year First Semester Second Semester Budget Year

Code Total

(Actual) (Actual) (Estimate) (Proposed)

1 2 3 4 5 6 7

Personal Services

Salaries and Wages - Regular Pay 5-01-01-010 4,950,732.06 2,634,497.24 2,741,610.76 5,376,108.00 5,614,476.00

Personnel Economic Relief Allowance 5-01-02-010 357,169.34 180,000.00 204,000.00 384,000.00 401,025.94

Representation Allowance (RA) 5-01-02-020 139,531.25 71,250.00 71,250.00 142,500.00 148,818.22

Transportation Allowance (TA) 5-01-02-030 134,781.25 71,250.00 71,250.00 142,500.00 148,818.22

Clothing/Uniform Allowance 5-01-02-040 90,000.00 90,000.00 6,000.00 96,000.00 100,256.49

Longetivity Pay 5-01-02-120 5,000.00 10,000.00 10,000.00 10,443.38

Overtime and Night Pay 5-01-02-130 125,913.94 80,000.00 80,000.00 83,547.07

Cash Gift 5-01-02-150 75,000.00 80,000.00 80,000.00 83,547.07

Year End Bonus 5-01-02-140 815,960.00 430,696.00 465,322.00 896,018.00 935,746.00

Retirement and Life Insurance Premiums 5-01-03-010 591,168.66 309,680.13 335,452.83 645,132.96 673,737.12

PAG-IBIG Contributions 5-01-03-020 98,383.71 51,613.35 55,908.81 107,522.16 112,289.52

PHILHEALTH Contributions 5-01-03-030 53,879.21 34,622.52 41,176.56 75,799.08 79,159.89

Employees Compensation Insurance Premiums 5-01-03-040 17,748.55 9,000.00 10,200.00 19,200.00 20,051.30

Other Personnel Benifits - PEI 5-01-04-990 75,000.00 - 80,000.00 80,000.00 83,547.07

Other Personnel Benifits - Anniversary Bonus 5-01-04-990 27,000.00 - - 0.00

TOTAL PERSONAL SERVICES 7,557,267.97 3,882,609.24 4,252,170.96 8,134,780.20 8,495,463.30

Maintenance and other Operating Expenses

Travelling Expenses - Local 5-02-01-010 130,000.00 53,088.00 76,912.00 130,000.00 60,000.00

Training Expenses 5-02-02-010 124,300.00 9,200.00 120,800.00 130,000.00 60,000.00

Office Supplies 5-02-03-010 334,840.00 179,455.40 185,544.60 365,000.00 296,560.00

Fuel, Oil and Lubricants Expenses 5-02-03-090 40,837.80 14,999.97 75,000.03 90,000.00 45,000.00

Other Supplies Expenses 5-02-03-990 83,259.60 46,090.00 48,910.00 95,000.00 40,000.00

Water Expenses 5-02-04-010 5,000.00 17,500.00 17,500.00 35,000.00 30,000.00

Telephone Expenses - Landline 5-02-05-020 2,326.92 - 45,000.00 45,000.00

Telephone Expenses - Mobile 5-02-05-020 95,928.00 48,000.00 48,000.00 96,000.00 96,000.00

Internet Subsciption Expenses - - 30,000.00 30,000.00 22,500.00

Cable, Satellite, Telegraph 5-02-05-040 3,300.00 - 8,000.00 8,000.00

Membership, Dues and Cont. To Org 5-02-99-060 2,500.00 - 12,000.00 12,000.00 10,000.00

Representation Expenses 5-02-99-030 120,714.00 74,300.00 (34,300.00) 40,000.00 92,500.00

Advertising Expenses - - 15,000.00 15,000.00

Printing and Publication Expenses 5-02-99-020 4,500.00 6,996.50 143,003.50 150,000.00 12,000.00

Subsciption Expenses - - 10,000.00 10,000.00

R/M - Building and other Structures 5-02-13-040 8,000.00 - 20,000.00 20,000.00 20,000.00

R/M - Machinery & Equipment (Office Equipt.) 30,287.50 - 15,000.00 15,000.00 10,000.00

R/M - Machinery & Equipment (IT Equipt. & Software) - 11,969.00 38,031.00 50,000.00 30,000.00

R/M - Transportation Expenses 5-02-13-060 11,007.00 - 30,000.00 30,000.00 20,000.00

Taxes, Duties and Licenses 5-02-16-010 - - 6,200.00 6,200.00 5,000.00

Insurance Expenses 5-02-16-030 - - 29,114.00 29,114.00 22,000.00

Other Maint. & Operating Expenses 5-02-99-990 6,279.00 - 15,000.00 15,000.00 72,360.00

Other General Services 5-02-12-990 12,000.00

TOTAL MAINTENANCE AND OTHER OPERATING EXPENSES 1,003,079.82 461,598.87 954,715.13 1,416,314.00 955,920.00

Capital Outlays

Information and Communication Tech. Equipment 1-07-05-030 245,400.00 95,500.00 54,500.00 150,000.00

Furnitures and Fixtures 1-07-07-010 - - - 50,000.00

Office Equipment 1-07-05-020 88,400.00 - 35,000.00 35,000.00

TOTAL CAPITAL OUTLAY 333,800.00 95,500.00 89,500.00 235,000.00

Total Appropriations 8,894,147.79 4,439,708.11 5,296,386.09 9,786,094.20 9,451,383.30

Prepared by: Reviewed by:

HERMELO A. EMBALSADO EnP CARMI ADELE D. ROMERO, JD EnP OJELA MAE M. ENTERO, MBA, DBA

City Assessor Acting-City Budget Officer City Planning & Dev. Coordinator

MONINA A. BERNARDINO, CPA ALAN F. BASAN

City Accountant City Investment Promotion Officer

Acting City Treasurer

Approved by:

JOSEF F. CAGAS, RN, JD

City Mayor

You might also like

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- General Services Office 1061Document2 pagesGeneral Services Office 1061Charles D. FloresNo ratings yet

- International Public Sector Accounting Standards Implementation Road Map for UzbekistanFrom EverandInternational Public Sector Accounting Standards Implementation Road Map for UzbekistanNo ratings yet

- LBP Form No. 4 RecordsDocument2 pagesLBP Form No. 4 RecordsCharles D. FloresNo ratings yet

- Leveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteFrom EverandLeveraging Technology for Property Tax Management in Asia and the Pacific–Guidance NoteNo ratings yet

- Annex 2-REGISTRY OF BUDGET, COMMITMENTS, PAYMENTS AND BALANCESDocument7 pagesAnnex 2-REGISTRY OF BUDGET, COMMITMENTS, PAYMENTS AND BALANCESVermon JayNo ratings yet

- Office of The City Engineer - Construction Services /8752 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2021Document2 pagesOffice of The City Engineer - Construction Services /8752 Mandate, Vision/Mission, Major Final Output, Performance Indicators and Targets Cy 2021Charles D. FloresNo ratings yet

- Socorro Water District Surigao Del Norte Executive Summary 2021Document4 pagesSocorro Water District Surigao Del Norte Executive Summary 2021Miss_AccountantNo ratings yet

- Attachment 6 Leyte Local Revenue Forecast and Resource Mobilization StrategyDocument6 pagesAttachment 6 Leyte Local Revenue Forecast and Resource Mobilization StrategyRiza Angelica Niegos EstraelNo ratings yet

- Annex 4-REGISTRY OF SPECIFIC PURPOSE FUND, COMMITMENTS, PAYMENTS AND BALANCESDocument3 pagesAnnex 4-REGISTRY OF SPECIFIC PURPOSE FUND, COMMITMENTS, PAYMENTS AND BALANCESVermon JayNo ratings yet

- Annex 1REGISTRY OF BUDGET, COMMITMENTS, PAYMENTS AND BALANCES MAINTENANCE AND OTHER OPERATING EXPENSESDocument8 pagesAnnex 1REGISTRY OF BUDGET, COMMITMENTS, PAYMENTS AND BALANCES MAINTENANCE AND OTHER OPERATING EXPENSESVermon JayNo ratings yet

- 09.a-Balasan2022 Part2-Observations and RecommendationsDocument39 pages09.a-Balasan2022 Part2-Observations and RecommendationsEi Mi SanNo ratings yet

- Cenvat Credit Verification and Input Tax ReconciliationDocument7 pagesCenvat Credit Verification and Input Tax ReconciliationSushant Saxena100% (1)

- Esperanza Executive Summary 2018Document5 pagesEsperanza Executive Summary 2018Ma. Danice Angela Balde-BarcomaNo ratings yet

- SBMA2021 Audit Report PDFDocument189 pagesSBMA2021 Audit Report PDFJoshua Andrie GadianoNo ratings yet

- Bidder Certification of Compliance: 1. General Information About The BidderDocument10 pagesBidder Certification of Compliance: 1. General Information About The BidderYoseph AshenafiNo ratings yet

- Executive Summary: A. IntroductionDocument5 pagesExecutive Summary: A. IntroductionChiara Melanie ButawanNo ratings yet

- Carmen-Executive-Summary-2020Document7 pagesCarmen-Executive-Summary-2020Feona TuraldeNo ratings yet

- Sugar Regulatory Administration Executive Summary 2021Document5 pagesSugar Regulatory Administration Executive Summary 2021Jinyoung ParkNo ratings yet

- San Felipe Executive Summary 2019Document4 pagesSan Felipe Executive Summary 2019Jay AnnNo ratings yet

- Marven GOVERNMENT Tax Laws Notes 2023Document20 pagesMarven GOVERNMENT Tax Laws Notes 2023marveen juadiongNo ratings yet

- Public Financial Management Plan 2023Document3 pagesPublic Financial Management Plan 2023banate LGU100% (2)

- LRA2014 Executive SummaryDocument9 pagesLRA2014 Executive SummaryCarmela SalazarNo ratings yet

- 6rev AOM No. 2020-006 (19) DPPF - CIPpDocument3 pages6rev AOM No. 2020-006 (19) DPPF - CIPpLa AlvarezNo ratings yet

- Revised RAE 27aug19Document13 pagesRevised RAE 27aug19DorthyNo ratings yet

- Masantol Executive Summary 2019Document5 pagesMasantol Executive Summary 2019Juan Miguel NavarroNo ratings yet

- Casiguran Executive Summary 2020Document5 pagesCasiguran Executive Summary 2020recx.jyke06No ratings yet

- Executive Summary of Baao Municipality AuditDocument4 pagesExecutive Summary of Baao Municipality Auditsandra bolokNo ratings yet

- La Paz Executive Summary 2021Document5 pagesLa Paz Executive Summary 2021kmarkcramosNo ratings yet

- Executive Summary A. IntroductionDocument6 pagesExecutive Summary A. IntroductionCatherine JoyceNo ratings yet

- Government AccountsDocument36 pagesGovernment AccountskunalNo ratings yet

- ST ND: AC 41 - 1 Sem, A.Y. 2019-2020Document13 pagesST ND: AC 41 - 1 Sem, A.Y. 2019-2020kenn anoberNo ratings yet

- Budget Forms and Relevant Rules 2003Document88 pagesBudget Forms and Relevant Rules 2003syed.jerjees.haiderNo ratings yet

- PASSO OS RevisedDocument14 pagesPASSO OS RevisedJosephus DaguploNo ratings yet

- Bamban Executive Summary 2017Document6 pagesBamban Executive Summary 2017Reyna YlenaNo ratings yet

- Loreto Executive Summary 2014Document5 pagesLoreto Executive Summary 2014Justine CastilloNo ratings yet

- AOM 2023-001 - MaljoDocument17 pagesAOM 2023-001 - MaljoKen BocsNo ratings yet

- Bislig City Executive Summary 2017Document8 pagesBislig City Executive Summary 2017liezeloragaNo ratings yet

- Alegria Executive Summary 2019Document6 pagesAlegria Executive Summary 2019Ronel CadelinoNo ratings yet

- Assessment Report On Tax Mapping Capabilities of Lgus: A. IntroductionDocument19 pagesAssessment Report On Tax Mapping Capabilities of Lgus: A. Introductionjunayrah galmanNo ratings yet

- Executive Summary: in Thousands of PesosDocument6 pagesExecutive Summary: in Thousands of PesosDAS MAGNo ratings yet

- Budget AccountabilityDocument33 pagesBudget AccountabilityNonielyn SabornidoNo ratings yet

- Olongapo City Executive Summary 2022Document9 pagesOlongapo City Executive Summary 2022Mary Patricia Irma MoralesNo ratings yet

- Rus Form 7Document8 pagesRus Form 7joneeazucenaNo ratings yet

- Efficient Water Service for San Pablo CityDocument8 pagesEfficient Water Service for San Pablo CityJohn Archie SerranoNo ratings yet

- Inbound 2597438685297588432Document6 pagesInbound 2597438685297588432RA MonillaNo ratings yet

- Government Accounting PunzalanDocument5 pagesGovernment Accounting PunzalanN Jo88% (17)

- 02-Loboc2012 Executive SummaryDocument9 pages02-Loboc2012 Executive SummaryMiss_AccountantNo ratings yet

- Subic Executive Summary 2022Document7 pagesSubic Executive Summary 2022Jezreel GironNo ratings yet

- San Antonio Executive Summary 2019Document6 pagesSan Antonio Executive Summary 2019Jay AnnNo ratings yet

- Agusan Del Sur Executive Summary 2018Document8 pagesAgusan Del Sur Executive Summary 2018Sittie Fatma ReporsNo ratings yet

- Chap 002Document7 pagesChap 002ericle8767% (3)

- Alegria Executive Summary 2015Document8 pagesAlegria Executive Summary 2015Reyna YlenaNo ratings yet

- Reconcile Inventory and Financial ReportsDocument8 pagesReconcile Inventory and Financial ReportsGuiller MagsumbolNo ratings yet

- Tubod Executive SummaryDocument4 pagesTubod Executive SummaryPatrick Lenard Villaluz JaynarioNo ratings yet

- Manaoag 07112023Document5 pagesManaoag 07112023Sarah WilliamsNo ratings yet

- Development of Fisheries and Aquaculture in Khyber PakhtunkhwaDocument98 pagesDevelopment of Fisheries and Aquaculture in Khyber PakhtunkhwaAmar WadoodNo ratings yet

- EB 10-11 General Services - StampedDocument29 pagesEB 10-11 General Services - StampedMatt HampelNo ratings yet

- Work & Financial Plan SLP 2021Document4 pagesWork & Financial Plan SLP 2021Fonzy RoneNo ratings yet

- Binmaley Executive Summary 2014Document5 pagesBinmaley Executive Summary 2014Jolina FabiaNo ratings yet

- Obligations & ContractsDocument4 pagesObligations & ContractsCharles D. FloresNo ratings yet

- RFBT 5-PDIC, Bank Secrecy, and AMLA Pre-TestDocument6 pagesRFBT 5-PDIC, Bank Secrecy, and AMLA Pre-TestCharles D. FloresNo ratings yet

- Negotiable Instruments Pre-test ReviewDocument4 pagesNegotiable Instruments Pre-test ReviewCharles D. FloresNo ratings yet

- RFBT 5-Cooperatives Pre-TestDocument3 pagesRFBT 5-Cooperatives Pre-TestCharles D. FloresNo ratings yet

- H08 Pre TestDocument6 pagesH08 Pre TestJason Saberon QuiñoNo ratings yet

- RFBT 3- Law on Credit Transactions Pre-testDocument5 pagesRFBT 3- Law on Credit Transactions Pre-testCharles D. FloresNo ratings yet

- H02 Post TestDocument7 pagesH02 Post TestCharles100% (1)

- H04 Pre TestDocument8 pagesH04 Pre TestCharles D. FloresNo ratings yet

- RFBT 4-Partnership Post-TestDocument5 pagesRFBT 4-Partnership Post-TestCharles D. FloresNo ratings yet

- RFBT 4-Partnership Pre-TestDocument4 pagesRFBT 4-Partnership Pre-TestCharles D. Flores0% (1)

- RFBT 4-Partnership Post-TestDocument5 pagesRFBT 4-Partnership Post-TestCharles D. FloresNo ratings yet

- Negotiable Instruments Pre-test ReviewDocument4 pagesNegotiable Instruments Pre-test ReviewCharles D. FloresNo ratings yet

- RFBT Law on Sales Pre-testDocument8 pagesRFBT Law on Sales Pre-testCharles100% (1)

- RFBT 3- Law on Credit Transactions Post-Test ReviewDocument5 pagesRFBT 3- Law on Credit Transactions Post-Test ReviewCharles D. FloresNo ratings yet

- RFBT 4-Partnership Pre-TestDocument4 pagesRFBT 4-Partnership Pre-TestCharles D. Flores0% (1)

- H04 Pre TestDocument8 pagesH04 Pre TestCharles D. FloresNo ratings yet

- RFBT 5-Corporation Pre-TestDocument4 pagesRFBT 5-Corporation Pre-TestCharles D. FloresNo ratings yet

- RFBT 5-Corporation Pre-TestDocument4 pagesRFBT 5-Corporation Pre-TestCharles D. FloresNo ratings yet

- Course Outline: ACP 313-Accounting For Government and Not-For - Profit OrganizationsDocument7 pagesCourse Outline: ACP 313-Accounting For Government and Not-For - Profit OrganizationsCharles D. FloresNo ratings yet

- Negotiable Instruments Pre-test ReviewDocument4 pagesNegotiable Instruments Pre-test ReviewCharles D. FloresNo ratings yet

- Certificate of Participation: Charles D. FloresDocument1 pageCertificate of Participation: Charles D. FloresCharles D. FloresNo ratings yet

- Reply Letter 012020Document1 pageReply Letter 012020Charles D. FloresNo ratings yet

- Course Outline: ACP 313-Accounting For Government and Not-For - Profit OrganizationsDocument6 pagesCourse Outline: ACP 313-Accounting For Government and Not-For - Profit OrganizationsPritz Marc Bautista MorataNo ratings yet

- SUC Retiree Benefits ListDocument3 pagesSUC Retiree Benefits ListCharles D. FloresNo ratings yet

- DSSC - Cost To OperateDocument4 pagesDSSC - Cost To OperateCharles D. FloresNo ratings yet

- BP Form 204 2021Document2 pagesBP Form 204 2021Charles D. FloresNo ratings yet

- Reply LetterDocument1 pageReply LetterCharles D. FloresNo ratings yet

- FAR 4 - FebruaryDocument10 pagesFAR 4 - FebruaryCharles D. FloresNo ratings yet

- CSPMODocument18 pagesCSPMOCharles D. FloresNo ratings yet

- FAR 4 - JanuaryDocument12 pagesFAR 4 - JanuaryCharles D. FloresNo ratings yet

- Prasarana Group KPIs 2011 (Print)Document15 pagesPrasarana Group KPIs 2011 (Print)anon_216090584No ratings yet

- NRB Commercial Bank LTD.: Valuation Survey Report OF Land & BuildingDocument10 pagesNRB Commercial Bank LTD.: Valuation Survey Report OF Land & BuildingAnamul IslamNo ratings yet

- AJAY HRM ProjectDocument14 pagesAJAY HRM ProjectPankaj GhevariyaNo ratings yet

- Guidance Note On Audit of BanksDocument808 pagesGuidance Note On Audit of BanksGanesh PhadatareNo ratings yet

- List of Companies (Partial)Document6 pagesList of Companies (Partial)Mikaella SarmientoNo ratings yet

- Audit of Property, Plant and Equipment (PPE) : Auditing Problems AP.0102Document8 pagesAudit of Property, Plant and Equipment (PPE) : Auditing Problems AP.0102Mae0% (1)

- Accounting principles overviewDocument17 pagesAccounting principles overviewPatrick John AvilaNo ratings yet

- Chapter 02Document34 pagesChapter 02Amit ShuklaNo ratings yet

- Jao Company's Comprehensive Income StatementDocument9 pagesJao Company's Comprehensive Income StatementJesiah PascualNo ratings yet

- Classification of The CostDocument23 pagesClassification of The Costnalani1No ratings yet

- Critical Success Factors in Public-Private Partnerships (PPPS) On A Ffordable Housing Schemes Delivery in TanzaniaDocument20 pagesCritical Success Factors in Public-Private Partnerships (PPPS) On A Ffordable Housing Schemes Delivery in TanzaniaAhmad Fariski0% (1)

- FA 2020 Practice Question TESCO (2015) Quiz Part B (QUESTION)Document10 pagesFA 2020 Practice Question TESCO (2015) Quiz Part B (QUESTION)Samir IsmailNo ratings yet

- Analysis of Factors Influencing Fraudulent Financial ReportingDocument12 pagesAnalysis of Factors Influencing Fraudulent Financial ReportingTifanny LaurenzaNo ratings yet

- 2021T1 ACC309 Final Exam (Online)Document5 pages2021T1 ACC309 Final Exam (Online)Shamha NaseerNo ratings yet

- BDM Corp audit risk analysisDocument10 pagesBDM Corp audit risk analysisPrancesNo ratings yet

- Foreword: Financial Auditing 1 - 9 Edition - 1Document37 pagesForeword: Financial Auditing 1 - 9 Edition - 1meyyNo ratings yet

- Audit Evidence & ProceduresDocument3 pagesAudit Evidence & ProceduresRose Medina BarondaNo ratings yet

- SBI Offshore Annual Report 2012 - Assembling A Solid FoundationDocument118 pagesSBI Offshore Annual Report 2012 - Assembling A Solid FoundationWeR1 Consultants Pte LtdNo ratings yet

- Classification and Types of Engineering ServicesDocument55 pagesClassification and Types of Engineering ServicesAngelica Lirio Gorom100% (1)

- Cia Review: Part 2 Study Unit 5: Engagement Procedures and SupervisionDocument8 pagesCia Review: Part 2 Study Unit 5: Engagement Procedures and SupervisionjorgeNo ratings yet

- 87efe75eb3 9308202d90Document101 pages87efe75eb3 9308202d90Azzirwand SufrieNo ratings yet

- Asian MicroDocument103 pagesAsian MicroJames WarrenNo ratings yet

- Guidance Notes For CfabDocument13 pagesGuidance Notes For CfabWeb Browser100% (1)

- DBP v. COA, GR No. 88435Document23 pagesDBP v. COA, GR No. 88435Jay Mark EscondeNo ratings yet

- Audit SolutionsDocument82 pagesAudit SolutionsFlow RiyaNo ratings yet

- PR - Roll Up - Getinge SWPDocument14 pagesPR - Roll Up - Getinge SWPAllyssa BuenaventuraNo ratings yet

- 122208Document17 pages122208lieselenaNo ratings yet

- Juarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622Document3 pagesJuarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622ramaNo ratings yet

- Rebuttal 2Document15 pagesRebuttal 2diannedawnNo ratings yet

- Application New Form - NKD - Page 3Document1 pageApplication New Form - NKD - Page 3Hemil GandhiNo ratings yet