Professional Documents

Culture Documents

Assignment MAC 404 2020

Assignment MAC 404 2020

Uploaded by

Munashe Muzambi0 ratings0% found this document useful (0 votes)

9 views3 pagesOriginal Title

Assignment MAC 404 2020.doc

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesAssignment MAC 404 2020

Assignment MAC 404 2020

Uploaded by

Munashe MuzambiCopyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 3

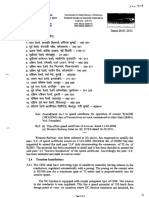

ASSIGNMENT QUESTION

The following information represents the consolidated statement of

Komborerai Ltd Group for the year ended 31 December 2017.

KOMBORE LTD GROUP

CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER

2017.

$

Revenue 297600

Cost of sales (153400)

Gross profit 144200

Other income 19000

Other expenses (45300)

Finance costs (18100)

Profit before tax 99800

Income tax expense (27944)

Profit for the year 71856

Total comprehensive income for the year 71856

Profit and total comprehensive income attributable to:

Owners of the parent 54856

Non-controlling interest 17000

71856

KOMBORE LTD GROUP

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31

DECEMBER 2017

2017 2016

$ $

ASSETS

Non-current assets 400000 380000

Property, plant and equipment 390000 370000

Investment in equity instruments 10000 10000

Current assets 207600 133140

Inventories 56300 36500

Trade receivables 67400 42040

Cash and cash equivalents 83900 54600

Total assets 607600 513140

EQUITY AND LIABILITY

Total equity 369256 264400

Equity attributable to the owners of the parent 341256 224400

Share capital 165000 100000

Retained earnings 149256 124400

Non-controlling interests 55000 40000

Non-current liabilities 195000 185000

Long term borrowings 195000 185000

Current liabilities 43344 63740

Trade and other payables 13344 43740

Short term portion of long-term borrowing 30000 20000

Total liabilities 238344 248740

Total equity and liabilities 607600 513140

KOMBORE LTD GROUP

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE

YEAR ENDED 31 DECEMBER 2017

Share Retained Total NCI Total

Capital earnings equity

$ $ $ $ $

Balance at 1Jan 2017 100000 124400 224400 40000 264400

Changes eqty for 2017

Shares issued 45000 --- 45000 -- 45000

Capitalised issue 20000 (20000) -- -- --

Dividend paid -- (10000) (10000) (2000) (12000)

Profit for the year -- 54856 54856 17000 71856

Balance at 31 Dec 2017 165000 149256 314256 55000 369256

Additional information

1. Property, plant and equipment consists of the following items:

2017 2016

$ $

Machinery 390 000 370 000

Cost 620 000 590 000

Accumulated depreciation (230 000) (220 000)

2. During the current year, Komborerai Limited replaced an existing

machine with a new machine to meet the current production

demands. The machine which was replaced had a carrying amount of

$75 000 and was sold for $93 000.

3. Included in other income for the current year is a gain on the sale

of machinery and investment income of $1 000.

4. Other expenses include depreciation of $40 000. The depreciation

for the machinery that was replaced per additional information 2 is

included in this amount.

5. Included in trade and other payables is $4 400 due to the

Zimbabwe Revenue Authority for the year ended 31 December 2017

(2016: $5 200).

6. Except for the given information, no other non-cash flow items

existed which could influence the statement of cash flows.

Required:

Prepare the statement of cash flow using the direct method according

IAS 7.

You might also like

- UCC Security AgreementDocument4 pagesUCC Security AgreementRDL100% (1)

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument17 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Cash FlowDocument6 pagesCash FlowKailaNo ratings yet

- Income StatementDocument3 pagesIncome StatementBiswajit SarmaNo ratings yet

- 288 - Federal Reserve Act RemedyDocument4 pages288 - Federal Reserve Act RemedyDavid E Robinson100% (5)

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Cash FlowDocument22 pagesCash FlowXaad ZebNo ratings yet

- Practice - Cash Flows Statement - Hale CompanyDocument1 pagePractice - Cash Flows Statement - Hale CompanyRaaj Nishanth SNo ratings yet

- 2017 Bcom ExaminationsDocument55 pages2017 Bcom ExaminationsB CHIBWANANo ratings yet

- Financial Reporting and Analysis 101Document7 pagesFinancial Reporting and Analysis 101Samrat KanitkarNo ratings yet

- STATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Document5 pagesSTATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Fatima Ansari d/o Muhammad AshrafNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Hale Co - in ClassDocument3 pagesHale Co - in ClassRaaj Nishanth SNo ratings yet

- Chapter 1 - Introduction To Published AccountsDocument20 pagesChapter 1 - Introduction To Published AccountsParas VohraNo ratings yet

- IAS (7) Cashflow-6-3-2020Document32 pagesIAS (7) Cashflow-6-3-2020Dana HasanNo ratings yet

- FINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)Document2 pagesFINANCIAL RATIOS: (Compute For Year 2020 Only, Answers Must Be Rounded Off in Two Decimal Places) (5 Points)ISABELA QUITCONo ratings yet

- CAPE U1 Ratio QuestionDocument12 pagesCAPE U1 Ratio QuestionNadine DavidsonNo ratings yet

- Bus 5110 Discussion Forum Unit 5 SubmissionDocument3 pagesBus 5110 Discussion Forum Unit 5 SubmissionAhmad Hafez100% (1)

- Wip C.Document9 pagesWip C.Never GonondoNo ratings yet

- Tutorial QuestionsDocument5 pagesTutorial QuestionsRavinesh PrasadNo ratings yet

- Malik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F RDocument1 pageMalik Group of Companies (Disposal + Acquisition) : Cfap 1: A A F R.No ratings yet

- Indian Institute of Management Rohtak: End Term ExaminationDocument14 pagesIndian Institute of Management Rohtak: End Term ExaminationaaNo ratings yet

- Case Study FinalDocument47 pagesCase Study FinalVan Errl Nicolai SantosNo ratings yet

- EPCRDocument71 pagesEPCRYinka JosephNo ratings yet

- Inflation Accounting CPPDocument3 pagesInflation Accounting CPPPradeepNo ratings yet

- Chapter 7Document4 pagesChapter 7Aisha AlarimiNo ratings yet

- ASSIGNMENT NO.2 (Entrepreneurship)Document9 pagesASSIGNMENT NO.2 (Entrepreneurship)Malik Mughees AwanNo ratings yet

- Valuation of BusinessDocument2 pagesValuation of BusinessLAKHAN TRIVEDINo ratings yet

- VIII. Financial Plan: A. Current Funding RequirementsDocument15 pagesVIII. Financial Plan: A. Current Funding RequirementsSaad AkramNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Financial StatmentDocument2 pagesFinancial StatmentMohammed ademNo ratings yet

- CaterpillarDocument37 pagesCaterpillarMaria guadalupe Sandoval picoNo ratings yet

- Microsoft Corporation Financial StatementDocument6 pagesMicrosoft Corporation Financial StatementMega Pop LockerNo ratings yet

- Latif Khan, Architect Income Statement For The Period Ended March 31, 2012Document4 pagesLatif Khan, Architect Income Statement For The Period Ended March 31, 2012Harshdeep BhatiaNo ratings yet

- Cashflow Statement-Class Practice 1Document2 pagesCashflow Statement-Class Practice 1AnikaNo ratings yet

- Mas12 FS AnalysisDocument10 pagesMas12 FS Analysishatdognamaycheese123No ratings yet

- Financial Ratio QuizDocument1 pageFinancial Ratio QuizMylene SantiagoNo ratings yet

- 362 End Term FRA SecDDocument5 pages362 End Term FRA SecDkhushali goharNo ratings yet

- Quiz 1Document2 pagesQuiz 1jevieconsultaaquino2003No ratings yet

- Just Balance Sheet FinalDocument7 pagesJust Balance Sheet Finalsantosh hugarNo ratings yet

- Minicases 2 AnswerDocument9 pagesMinicases 2 Answerdini sofiaNo ratings yet

- Statement of Cash Flow Set-2Document9 pagesStatement of Cash Flow Set-2vdj kumarNo ratings yet

- Q7 Mguni LimitedDocument2 pagesQ7 Mguni Limitedamosmalusi5No ratings yet

- Sunshine Income Statement For The Year Ending September 30, 2014 NoteDocument4 pagesSunshine Income Statement For The Year Ending September 30, 2014 Notesanjay blakeNo ratings yet

- Chapt 17-18 Suyanto - DDocument8 pagesChapt 17-18 Suyanto - DZephyrNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Common Size and Comparative StatementsDocument6 pagesCommon Size and Comparative StatementsRichu BijuNo ratings yet

- 2023 Hacc421 Hspac427 Wip BDocument7 pages2023 Hacc421 Hspac427 Wip Bagrippa [OrleanNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Cash Flow Statement Illustration (IAS 7)Document2 pagesCash Flow Statement Illustration (IAS 7)amahaktNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Model Question PaperDocument3 pagesModel Question Paperi.am.dheeraj8463No ratings yet

- Taj Power TechDocument12 pagesTaj Power TechNujhat SharminNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- Cfas Ias 1 Presentation of FS For StudentsDocument15 pagesCfas Ias 1 Presentation of FS For StudentsFreja del CastilloNo ratings yet

- Wajiha's ProjectDocument3 pagesWajiha's ProjectSidra MumtazNo ratings yet

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- Group Presentation SHB&BIDVDocument15 pagesGroup Presentation SHB&BIDVdiep nhyNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Business Plan - Sasha TuwachaDocument23 pagesBusiness Plan - Sasha TuwachaMunashe MuzambiNo ratings yet

- Sale XXX Add Closing Inventory XXX XXX Less Opening Inventory XXX Purchases XXX XXX XXX Less Running Expenses XXX Net Profit XXXDocument2 pagesSale XXX Add Closing Inventory XXX XXX Less Opening Inventory XXX Purchases XXX XXX XXX Less Running Expenses XXX Net Profit XXXMunashe MuzambiNo ratings yet

- Diluted Earnings Per ShareDocument13 pagesDiluted Earnings Per ShareMunashe MuzambiNo ratings yet

- Convertible InstrumentsDocument8 pagesConvertible InstrumentsMunashe MuzambiNo ratings yet

- MMS401 Assignment 4 - Preparation of A Business PlanDocument4 pagesMMS401 Assignment 4 - Preparation of A Business PlanMunashe MuzambiNo ratings yet

- Faculty of Business Peace Leadership and Governance: Industrial Attachment Report Prepared byDocument22 pagesFaculty of Business Peace Leadership and Governance: Industrial Attachment Report Prepared byMunashe MuzambiNo ratings yet

- Design An Overall Audit Strategy For The EngagementDocument4 pagesDesign An Overall Audit Strategy For The EngagementMunashe MuzambiNo ratings yet

- MAC 404 Course Outline UpdatedDocument6 pagesMAC 404 Course Outline UpdatedMunashe MuzambiNo ratings yet

- Earnings Per Share New Issues With Changes in Resources 2. Mandatory ConvertibleDocument2 pagesEarnings Per Share New Issues With Changes in Resources 2. Mandatory ConvertibleMunashe MuzambiNo ratings yet

- MMS401 Assignment 4 - Preparation of A Business PlanDocument4 pagesMMS401 Assignment 4 - Preparation of A Business PlanMunashe MuzambiNo ratings yet

- The Monetary Policy Provides A Statement of The Principles That The Bank Proposes To Follow in The Implementation of The Monetary Policy and Evaluation of The Monetary Policy and Its ImplementatiDocument5 pagesThe Monetary Policy Provides A Statement of The Principles That The Bank Proposes To Follow in The Implementation of The Monetary Policy and Evaluation of The Monetary Policy and Its ImplementatiMunashe MuzambiNo ratings yet

- Behavioral Finance MAC410 PDFDocument18 pagesBehavioral Finance MAC410 PDFMunashe MuzambiNo ratings yet

- Lesson No. I Fundamental Counting PrincipleDocument14 pagesLesson No. I Fundamental Counting PrincipleQueenie Joyce JamisolaNo ratings yet

- HSCC Advt 28.03.2024Document13 pagesHSCC Advt 28.03.2024anshikammmutNo ratings yet

- AIBE 16 Set A Question Paper QuestionpaperdriveDocument8 pagesAIBE 16 Set A Question Paper Questionpaperdrivekevin12345555No ratings yet

- 3 - WAG5H - (3WAG5H) Amendment No.-1, Dated - 20.01.2012Document2 pages3 - WAG5H - (3WAG5H) Amendment No.-1, Dated - 20.01.2012deepak_gupta_pritiNo ratings yet

- JETIR1811B48Document8 pagesJETIR1811B48shraddhar534No ratings yet

- Pre Employment ChecklistDocument1 pagePre Employment ChecklistJeric Art GumacalNo ratings yet

- Income Tax Sem 5Document12 pagesIncome Tax Sem 5vricaNo ratings yet

- RA-030046 - CIVIL ENGINEER - Manila - 5-2022 FinalDocument340 pagesRA-030046 - CIVIL ENGINEER - Manila - 5-2022 FinalEiron UnoNo ratings yet

- Ambush MarketingDocument22 pagesAmbush MarketingraisehellNo ratings yet

- DayTrip AgreementDocument2 pagesDayTrip AgreementVaidNo ratings yet

- Expert Talk On Intellectual Property Rights With Specific Focus On NIPAMDocument2 pagesExpert Talk On Intellectual Property Rights With Specific Focus On NIPAMCHINTAN RESHAMWALANo ratings yet

- Pentagon Papers Part IV A 4 PDFDocument115 pagesPentagon Papers Part IV A 4 PDFCarl RadleNo ratings yet

- GI Tags Complete ListDocument17 pagesGI Tags Complete Listrameshb87No ratings yet

- FuskerDocument3 pagesFuskerlinda976No ratings yet

- Set RSA PIN For VDI Users PDFDocument13 pagesSet RSA PIN For VDI Users PDFK.M.K.HassanNo ratings yet

- INSIDE11 IssuuDocument22 pagesINSIDE11 IssuuBedis Hafiane100% (1)

- Ratio Analysis: - Investment RatiosDocument9 pagesRatio Analysis: - Investment RatiosSayantan KhamruiNo ratings yet

- IFEAT Bali 2019 Call For PapersDocument3 pagesIFEAT Bali 2019 Call For PapersCTCINo ratings yet

- M103 BioethicsDocument37 pagesM103 BioethicsQuerubin DandoyNo ratings yet

- People V RapezaDocument2 pagesPeople V RapezaJoyce Sumagang ReyesNo ratings yet

- The Church " Ekklesia"Document2 pagesThe Church " Ekklesia"Errol SmytheNo ratings yet

- Client Counselling BasicsDocument8 pagesClient Counselling BasicsEkansh AroraNo ratings yet

- Banks Ranking ReportDocument9 pagesBanks Ranking ReportParikshit Vilas LokeNo ratings yet

- The Malaysian ConstitutionDocument138 pagesThe Malaysian ConstitutionWilliam Anthony100% (1)

- Political Science II ProjectDocument20 pagesPolitical Science II Projectkazan kazanNo ratings yet

- MYTV Vendor Registration FormDocument11 pagesMYTV Vendor Registration FormShida Yunus100% (1)

- The Village Reporter - February 26th, 2014Document20 pagesThe Village Reporter - February 26th, 2014thevillagereporterNo ratings yet

- Maharishi Mahesh YogiDocument16 pagesMaharishi Mahesh YogiHugh GriffithsNo ratings yet