Professional Documents

Culture Documents

Strictly Personal and Confidential

Uploaded by

Mohd ZiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strictly Personal and Confidential

Uploaded by

Mohd ZiaCopyright:

Available Formats

Strictly Personal and Confidential

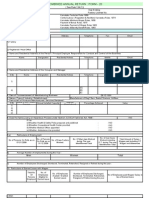

CorpHRO/REVN/15/00025388/1

January 09, 2015

Ms. Deeba Nikhat

SBS

SALES

NORTH REGION

Dear Ms. Deeba Nikhat,

Your Role & Designation and Compensation structure for the year 2014-15 are as follows.

Benefit Plan P

Role COUNSELOR

Designation OFFICER - SALES

Effective Date January 01, 2015

Amount ( )

A. Monthly Salary Basic : 3,600

Flexibasket : 11,400

Gross Monthly : 15,000

B. Annual Benefits

PF (as per Act) : 3,584

Bonus (as per Act) : 12,400

ESI (as per act) : 5,680

Annual Benefits Total : 21,664

C. Variable Compensation (on achievement of 100% goals)

Sales Incentive : 34,683

D. Retention Bonus : 34,683

E. Total Annual On Target Compensation : 271,030

With best wishes,

Sincerely,

For NIIT Yuva Jyoti Ltd.

Authorized signatory

1. Flexibasket :The flexibasket consists of Medical/LTA (Upto Rs. 2,500/- pm. HRA/CLA (Up to 50% of Basic Salary); Internet usage

at residence (Up to Rs. 1500/- pm); Mobile phone usage charges (upto Rs.3,000/- pm). Towards self-owned car usage, vehicle

expenses reimbursement up to a maximum of Rs. 1,800/- pm (for vehicles upto 1600 cc), Rs. 2,400/-pm (for vehicles above

1600cc) can be claimed. The limits towards the above components (except HRA/CLA, for which you need to contact HRO) needs to

be defined using the Personalized Compensation Structure (PCS) on iNIITian based on the estimated usage. For eligible cases, on

availment of the Leased Vehicle, the Monthly Lease Rentals will be reduced from the Flexi basket. The reimbursement limits

already defined under the Flexibasket can be modified at any time depending on your need and estimated usage using the online

PCS.

2. Corporate National Pension Scheme (NPS) : NPS is a voluntary retirement savings scheme introduced by the Government of India.

NIITians after enrollment into the scheme, can contribute an amount upto 10% of the Basic Salary earned effective date of joining

or April 1, 2014, whichever is later. The amount of contribution is exempt from Income Tax under Section 80CCD(2) of the Income

Tax Act, 1968.

3. Sales Incentive will be paid on the Sales Incentive policy applicable for the year 2014-15 which is available on iNIITian-

>Knowledge Bank->Benefits and Policies.

4. Benefits & Policies : Modifications or revisions, if any to the existing Benefits & Policies applicable to you, shall be made available

and communicated through the “Benefits & Policies” link available on iNIITian.

You might also like

- Compensation LetterDocument6 pagesCompensation LetterRashmikant RautNo ratings yet

- Shreenath LNU PDFDocument3 pagesShreenath LNU PDFshrinathNo ratings yet

- Manish Soni - Offer LetterDocument2 pagesManish Soni - Offer LetterMd SharidNo ratings yet

- Annexure A 7.2Document1 pageAnnexure A 7.2panduram tiyuNo ratings yet

- Annexure ADocument1 pageAnnexure Apanduram tiyuNo ratings yet

- 1Document3 pages1manojNo ratings yet

- Letter of Intent: Atul Verma MIET, MeerutDocument2 pagesLetter of Intent: Atul Verma MIET, MeerutRahul GilgilanNo ratings yet

- Dear Niharika,: Bebo Technologies Private LimitedDocument11 pagesDear Niharika,: Bebo Technologies Private LimitedEr Niharika KhuranaNo ratings yet

- Offshore Increment Letter2014Document2 pagesOffshore Increment Letter2014Ashok Taneja0% (2)

- Annexure A 3.80Document1 pageAnnexure A 3.80panduram tiyuNo ratings yet

- Offer Letter - Naga Mythili JuturDocument3 pagesOffer Letter - Naga Mythili JuturAnu RadhaNo ratings yet

- Alphonse Irudayaraj Offer LetterDocument4 pagesAlphonse Irudayaraj Offer Letteralphonse INo ratings yet

- LetterDocument5 pagesLetterJyotirmay SahuNo ratings yet

- Mr. Vitlesh PanditaDocument5 pagesMr. Vitlesh PanditaVitlesh PanditaNo ratings yet

- Annexure A 4.2Document1 pageAnnexure A 4.2panduram tiyuNo ratings yet

- Jain Irrragation SytemDocument3 pagesJain Irrragation SytemMorya Zerox BuldanaNo ratings yet

- Offer Letter-Siddharth KukrejaDocument5 pagesOffer Letter-Siddharth KukrejaSiddharth100% (1)

- CandidateDocument4 pagesCandidateabbai rNo ratings yet

- Anusha Yenishetty PDFDocument2 pagesAnusha Yenishetty PDFSrinivasa Rao JagarapuNo ratings yet

- Letter of Intent: Deepak Agarwal JECRC UniversityDocument2 pagesLetter of Intent: Deepak Agarwal JECRC UniversityRavi KumawatNo ratings yet

- ADOBE - Compensation Breakup - Member of Technical StaffDocument2 pagesADOBE - Compensation Breakup - Member of Technical Staffdehejar970No ratings yet

- Compensation 1682945 2020-2021Document9 pagesCompensation 1682945 2020-2021Alisha riya FrancisNo ratings yet

- Naac Data c5-2-1 1661850316893Document4 pagesNaac Data c5-2-1 1661850316893vibhapanchal7470No ratings yet

- How To Save Income Tax On Income From Salary For IndividualsDocument12 pagesHow To Save Income Tax On Income From Salary For IndividualsIndiranNo ratings yet

- Compensation and Benefits: (Bob) Bouquet Flexibility Compensation ComponentsDocument3 pagesCompensation and Benefits: (Bob) Bouquet Flexibility Compensation ComponentsdasdNo ratings yet

- Offer Letter - Liza Marie LoboDocument5 pagesOffer Letter - Liza Marie LoboLisa LoboNo ratings yet

- Salary StructureDocument1 pageSalary Structureomer farooqNo ratings yet

- Mr. Aditya Vardhan PatniDocument9 pagesMr. Aditya Vardhan PatniAdityaPatniNo ratings yet

- Dhruv Rajput NewDocument13 pagesDhruv Rajput NewAbhay SharmaNo ratings yet

- ACFrOgA8B1 AXdvFTvs9j3EM24DahDYIcJzmeVabGUoqlt8xCvhCtozvckYFaqz3P4WJYXOuEu DVmJqZeUF HFF KuUpHKzSp2Ff c9FeMgmMQstd 2g0oW6kOjXdcDocument3 pagesACFrOgA8B1 AXdvFTvs9j3EM24DahDYIcJzmeVabGUoqlt8xCvhCtozvckYFaqz3P4WJYXOuEu DVmJqZeUF HFF KuUpHKzSp2Ff c9FeMgmMQstd 2g0oW6kOjXdcFrancis MFANo ratings yet

- Sanjay G Cognizant OfferDocument9 pagesSanjay G Cognizant Offersoupboysanjay12No ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFAdarsh RaoNo ratings yet

- 1Document9 pages1ThoomuNo ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFPurushothaman ANo ratings yet

- User FileDocument12 pagesUser FileShaik TabrashNo ratings yet

- Dinesh Babu NatarajanDocument9 pagesDinesh Babu NatarajanTeja 17bf1a04h1No ratings yet

- Adarsh Rao PDFDocument3 pagesAdarsh Rao PDFPurushothaman ANo ratings yet

- 161 - Updated - Combined Offer LettersDocument9 pages161 - Updated - Combined Offer LettersAnkit ChoudharyNo ratings yet

- PWC Appendix ADocument3 pagesPWC Appendix AAbhishekRanjanNo ratings yet

- 1Document9 pages1Dev ChouhanNo ratings yet

- Mr. Balaji Manoharan: TCS Confidential Ref: TCS/2019-20/BPS-BPO2/882137Document3 pagesMr. Balaji Manoharan: TCS Confidential Ref: TCS/2019-20/BPS-BPO2/882137BalajiNo ratings yet

- Anupuji RajuDocument9 pagesAnupuji RajuRohit VNo ratings yet

- CandidateDocument2 pagesCandidateleelamrs48No ratings yet

- Anusha AervaDocument2 pagesAnusha Aervamrcopy xeroxNo ratings yet

- Confirmation LetterDocument2 pagesConfirmation LetterdineshgenopharmaNo ratings yet

- Ashwinisudhakarrao EmekarDocument2 pagesAshwinisudhakarrao EmekarswatiNo ratings yet

- TCS Anniversary2Document4 pagesTCS Anniversary2Vitlesh PanditaNo ratings yet

- Offer Letter: D-278, Near Hanuman MandirDocument3 pagesOffer Letter: D-278, Near Hanuman MandirGhanshyam SinghNo ratings yet

- Level+11+&+10 Non+Flexi Ops+Tfo+Atci+Ops v1Document5 pagesLevel+11+&+10 Non+Flexi Ops+Tfo+Atci+Ops v1bskapoor68No ratings yet

- Suresh Bethavandu: Global Head-Talent AcquisitionDocument3 pagesSuresh Bethavandu: Global Head-Talent AcquisitionThejeshReddyNo ratings yet

- KFD New20012024140359061 E35Document17 pagesKFD New20012024140359061 E35msaurabh9142No ratings yet

- Deepank Sharma PDFDocument9 pagesDeepank Sharma PDFgourav sharmaNo ratings yet

- Quantum GravityDocument2 pagesQuantum GravitySubhodeep BanerjeeNo ratings yet

- 1194 Sneha Babu-Teleperformance (CSE) 2019-2020Document3 pages1194 Sneha Babu-Teleperformance (CSE) 2019-2020Popi BhowmikNo ratings yet

- Offer LetterDocument5 pagesOffer Letterzig zack3999No ratings yet

- FICO Compensation Details - FTE ConversionDocument1 pageFICO Compensation Details - FTE ConversionNiteshNo ratings yet

- Offer Letter JyotiDocument3 pagesOffer Letter Jyotitushar.phalswalNo ratings yet

- 1Document9 pages1Kiran KulkarniNo ratings yet

- Ramya M 16-479Document4 pagesRamya M 16-479Nagaraja RaoNo ratings yet

- Letter Head PizzabiteDocument1 pageLetter Head PizzabiteMohd ZiaNo ratings yet

- Employee ListDocument2 pagesEmployee ListMohd ZiaNo ratings yet

- Hindi Lan WS 1Document1 pageHindi Lan WS 1Mohd ZiaNo ratings yet

- Delhi Public School, Unnao Worksheet 01 (2020-21) Subject: English Language Class: II Name: Roll No.: DateDocument1 pageDelhi Public School, Unnao Worksheet 01 (2020-21) Subject: English Language Class: II Name: Roll No.: DateMohd ZiaNo ratings yet

- Our Wonderful Body Pages 6-7Document2 pagesOur Wonderful Body Pages 6-7Mohd ZiaNo ratings yet

- Delhi Public School, Unnao Worksheet 02 (2020-21) Subject: English Literature Class: II Name: Roll No.: DateDocument2 pagesDelhi Public School, Unnao Worksheet 02 (2020-21) Subject: English Literature Class: II Name: Roll No.: DateMohd ZiaNo ratings yet

- Class 2 Hindi Lang Ch.भाषाDocument2 pagesClass 2 Hindi Lang Ch.भाषाMohd ZiaNo ratings yet

- Annual Report - 0910Document44 pagesAnnual Report - 0910bdmNo ratings yet

- List of First Class Municipalities in The Philippines: Revised VersionDocument8 pagesList of First Class Municipalities in The Philippines: Revised Versionjade123_129No ratings yet

- Brief Introduction On Salary Components and Their Income Tax ApplicabilityDocument21 pagesBrief Introduction On Salary Components and Their Income Tax ApplicabilityAkshay ChauhanNo ratings yet

- Syllabus of Principle of Taxation Law For BALLB V SemesterDocument3 pagesSyllabus of Principle of Taxation Law For BALLB V SemesterYashNo ratings yet

- HRDocument15 pagesHRIndulekha Thattamparambil KrishnamaniNo ratings yet

- Legal Framework of CompensationDocument18 pagesLegal Framework of CompensationSujataNo ratings yet

- Sasm by RupokDocument54 pagesSasm by Rupokশাইখ উদ্দীনNo ratings yet

- Baker Bros Feasibility StudyDocument126 pagesBaker Bros Feasibility StudyJeysi Lucero100% (1)

- 8 - PNB vs. PNB Employees AssociationDocument24 pages8 - PNB vs. PNB Employees AssociationKatNo ratings yet

- I. Concept Notes IAS19: Employee BenefitsDocument5 pagesI. Concept Notes IAS19: Employee Benefitsem cortezNo ratings yet

- PNL November 2021Document19 pagesPNL November 2021putripandeanNo ratings yet

- Payslip 2018 2019 1 100000000421201 IGSLDocument1 pagePayslip 2018 2019 1 100000000421201 IGSLArivu AkilNo ratings yet

- Form - 20Document3 pagesForm - 20uptvNo ratings yet

- Business Math Midterm Reviewer Session 8 Introduction To Salaries and WagesDocument8 pagesBusiness Math Midterm Reviewer Session 8 Introduction To Salaries and WagesJwyneth Royce DenolanNo ratings yet

- Cost Accounting Notes For StudentsDocument41 pagesCost Accounting Notes For StudentsDipak K. SahNo ratings yet

- The Kenyan Worker and The Law: An Information Booklet On Labour LawDocument32 pagesThe Kenyan Worker and The Law: An Information Booklet On Labour LawsashalwNo ratings yet

- Labor 0901417Document13 pagesLabor 0901417DanyNo ratings yet

- National Federation of Sugar Workers vs. Ovejera, Et. AlDocument39 pagesNational Federation of Sugar Workers vs. Ovejera, Et. AlRustom IbañezNo ratings yet

- VACANCY ANNOUNCEMENT - Post of Systems AdministratorDocument3 pagesVACANCY ANNOUNCEMENT - Post of Systems AdministratorRashid BumarwaNo ratings yet

- Supreme Court Uganda 2017 63 - 2 PDFDocument8 pagesSupreme Court Uganda 2017 63 - 2 PDFMusiime Katumbire HillaryNo ratings yet

- Labor Velasco CasesDocument49 pagesLabor Velasco Caseskath mags100% (9)

- Pastor Search Committee WorkbookDocument45 pagesPastor Search Committee WorkbookTad TraylorNo ratings yet

- About The Charts: CA Pooja Kamdar DateDocument8 pagesAbout The Charts: CA Pooja Kamdar DatekbalakarthikaNo ratings yet

- Jaravata vs. SandiganbayanDocument3 pagesJaravata vs. SandiganbayanRocky Diente SenupeNo ratings yet

- Payroll Introduction in Tally ERP9Document14 pagesPayroll Introduction in Tally ERP9Attitude Tally Academy50% (2)

- Retaining Women in The Workforce: Australian Institute of Management - Victoria and TasmaniaDocument18 pagesRetaining Women in The Workforce: Australian Institute of Management - Victoria and Tasmania@12No ratings yet

- Commission Agreement: 1. EmploymentDocument5 pagesCommission Agreement: 1. EmploymentJudah SsekyanziNo ratings yet

- Letter of Offer For Employment DAV Zohaib MehmoodDocument2 pagesLetter of Offer For Employment DAV Zohaib MehmoodZohaib MehmoodNo ratings yet

- Contract of EmploymentDocument4 pagesContract of EmploymentKassahun Adelo100% (1)

- Chapter 3Document39 pagesChapter 3Ashwin vk100% (1)