Professional Documents

Culture Documents

Indian Bank SO Credit Officer Exam Analysis (March 2020

Uploaded by

hermandeep5Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Bank SO Credit Officer Exam Analysis (March 2020

Uploaded by

hermandeep5Copyright:

Available Formats

Indian Bank SO Credit O cer: Exam Analysis (8

March 2020)

Published on Monday, March 09, 2020 By - Neha Verma

Hi Readers,

Indian Bank SO Credit O cer exam which is held on 8th March 2020 is over now. This exam

was basically cover four topics: English, Reasoning, Quantitative Aptitude & Professional

Knowledge. Here is the overall exam analysis.

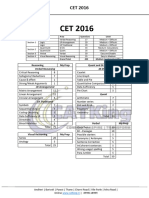

Reasoning Ability

Topic No. of Questions Level

Puzzle 10 Easy to Moderate

Seating Arrangement 10 Moderate

Coding-Decoding

5 Medium

(Chinese)

Syllogism 4 Easy

Inequality 3 Moderate

Machine input-output 5 Moderate

Direction Sense

1 Medium

(Backward)

Statement & Assumption 6 Easy

Statement & Conclusion 1 Easy

Others 5 Medium

Quantitative Aptitude

Topic No. of Questions Level

Data Interpretation 20 Moderate

Simplification &

10 Easy to Moderate

Approximation

Quadratic Equation 5 Moderate

Wrong Series 5 Medium

Problem of ages 1 Easy to Moderate

Mensuration 1 Easy

Compound Interest 1 Easy

Others 7 Moderate

English Language

Topic No. of Questions Level

Reading Comprehensive 20 Easy to Moderate

Rearrangement 5 Medium

Match the following 5 Moderate

Error Spotting 5 Easy

Cloze Test 5 Moderate

Para Jumbles 5 Easy

Phrase 5 Medium

List of Professional Knowledge Questions Asked

Ques.1 Who is issued CIN No.

Answer: Registrar of Companies

Ques.2 One question-Related Debt service coverage ratio

Ques.3 One question also Related to Debt service coverage ratio (Theory)

Ques.4 PARI PASSU question

Ques.5 BCSBI full form (Banking Codes and Standards Board of India)

Ques.6 CERSAI full form

Ques.7 Mudra loan- Tarun limit

Ques.8 One question Related to Current Ratio

Ques.9 Prior Sector Loan Limit (Education Loan)

Answer: 10 Lakh

Ques.10 Debts Recovery Tribunals Minimum Limit

Answer: Rs. 2 lakh

Ques.11 Priority Sector to Weaker Section Limit

Answer: Target is 10% of ANBC

Ques.12 One question related to the classi cation of Priority Sector.

Ques.13 How many pillars of BASEL III

Ques.14 TReds full form

Ques.15 CRAR Ratio 11.5% (2% of Capital Buffer)

Ques.16 Risk-Weighted Assets

Ques.17 Who is authorised to person for Auction

Answer: Authorised O cer of Bank

Ques.18 Digital Signature

Ques.19 Pledge

Ques.20 RERA full form

Ques.21 Exim Bank Established year

Answer: 1982

Ques.22 EGCC works for What purpose

Ques.23 NBFC-MFI Housing Hold limit

Answer: Rs. 125000 (Rural)

Ques.24 P2P NBFC limit

Answer: 50 lakh

Ques.25 CRILC Repassing loan limit

Answer: Rs.5 crore

Ques.26 CGTMSE- Set by GOI & SIDBI

Ques.27 Fund ow statement question (Numerical)

Ques.28 PMEG- Subsidy limit for General Category

Ques.29 Rural help in terms of credit

Answer: NABARD

Ques.30 Law of Limitation period of the decree for Filing suit of case

Ques.31 Minimum shareholders in Public Ltd. Company

Ques.32 NPA % Providing in Sub Standard Asset

Answer: Unsecured Assets

Ques.33 Regulator of Import-Export is

Answer: DGFT

Ques.34 What is Reserved Capital

Ques.35 LIBOR full form

Ques.36 One more question working capital method suitable for the software development

company.

Expected cutoff

As per my analysis, the expected cutoff is 75 for the General category. I am not sure about the

rest of the categories.

Can I help you?

Hey I am Ramandeep Singh. I am determined to help students prepaing for RBI, SEBI,

NABARD and IBPS exams. Do you want me to help you ?

Join my class here Follow me:

You might also like

- Syllabus PakkaDocument8 pagesSyllabus PakkaSenthilmurugan RNo ratings yet

- Analysis of JMET 2002Document3 pagesAnalysis of JMET 2002api-3835727No ratings yet

- NMATDEC05Document4 pagesNMATDEC05api-3835727No ratings yet

- CET 06 AnalysisDocument5 pagesCET 06 Analysisapi-3835727No ratings yet

- SBI PO Main 2018 Exam Analysis (August 4, 2018)Document3 pagesSBI PO Main 2018 Exam Analysis (August 4, 2018)Sambu AnilNo ratings yet

- Analyzing IRMA 2008 ExamDocument7 pagesAnalyzing IRMA 2008 ExamlionofbtNo ratings yet

- Structure of The Test: Detailed Analysis of NMAT 2008Document4 pagesStructure of The Test: Detailed Analysis of NMAT 2008Mbatutes100% (1)

- Cet 2005Document3 pagesCet 2005Fusion HCM KnowledgebaseNo ratings yet

- MBA CET 2016 Question Paper With Solution PDF MAH MBA MMS DTE PDFDocument42 pagesMBA CET 2016 Question Paper With Solution PDF MAH MBA MMS DTE PDFjyotiangel0% (2)

- MAT May 2009 Analysiswww.e-Papertech - Co.ccDocument5 pagesMAT May 2009 Analysiswww.e-Papertech - Co.ccAshwin RautNo ratings yet

- Bank Job Course Outline 1Document3 pagesBank Job Course Outline 1Mr KarimNo ratings yet

- Ibps Cwe (Po) June2012 AnalysisDocument0 pagesIbps Cwe (Po) June2012 Analysisbhavk20No ratings yet

- 64889908bd0d2Document42 pages64889908bd0d2ushajaisur123No ratings yet

- ATMA 2010 analysis focuses on exam pattern, section-wise breakdownDocument4 pagesATMA 2010 analysis focuses on exam pattern, section-wise breakdownneeraj kumarNo ratings yet

- Snap 2005Document4 pagesSnap 2005virenNo ratings yet

- Analysis: SNAP 2008-09: Overview of The SNAP PaperDocument5 pagesAnalysis: SNAP 2008-09: Overview of The SNAP PaperprincegoyelNo ratings yet

- IARI Toppers App: SubjectsDocument7 pagesIARI Toppers App: SubjectsAvinash KarandeNo ratings yet

- IBPS - Clerical - CWE - Mains - 2015 AnalysisDocument5 pagesIBPS - Clerical - CWE - Mains - 2015 Analysisganeshji loNo ratings yet

- CET (MH) 2009 Analysis: Sectional Breakup of QuestionsDocument5 pagesCET (MH) 2009 Analysis: Sectional Breakup of QuestionsBhaskar MohanNo ratings yet

- Rubrics - Business PlanDocument14 pagesRubrics - Business PlanWAN NUR AYUNI ISNINNo ratings yet

- Final Question Bank With Answers - Treasury Management-Final ExamDocument7 pagesFinal Question Bank With Answers - Treasury Management-Final ExamHarsh MaheshwariNo ratings yet

- CET (MH) 2009 Analysis: Sectional BreakdownDocument5 pagesCET (MH) 2009 Analysis: Sectional BreakdownameyNo ratings yet

- ENT530 RUBRICS (1) Mac 2022Document15 pagesENT530 RUBRICS (1) Mac 2022Nurhaziqah HannahNo ratings yet

- Question Paper With Answers - Treasury Management-Final ExamDocument7 pagesQuestion Paper With Answers - Treasury Management-Final ExamHarsh MaheshwariNo ratings yet

- MH-CET 2011: An Analysis & Cutoffs: Logical ReasoningDocument4 pagesMH-CET 2011: An Analysis & Cutoffs: Logical ReasoningPiyush PandeyNo ratings yet

- Sbi Clerk 2021 56 76Document52 pagesSbi Clerk 2021 56 76Riya LokhandeNo ratings yet

- MAT December 2009 AnalysisDocument5 pagesMAT December 2009 AnalysisRajesh RanjanNo ratings yet

- 17 Jan SBI SO Questions Paper With Answer Key 2016 SBI Specialist Officer Answer SheetDocument9 pages17 Jan SBI SO Questions Paper With Answer Key 2016 SBI Specialist Officer Answer SheetSudhir MaherwalNo ratings yet

- RBI Grade B 6 Step Strategy WorkshopDocument129 pagesRBI Grade B 6 Step Strategy Workshopsj2257617No ratings yet

- LIC AAO 2016 exam syllabus and section-wise preparation tipsDocument18 pagesLIC AAO 2016 exam syllabus and section-wise preparation tipsmahesh_rai44No ratings yet

- SNAP 2009 Analysis PDFDocument5 pagesSNAP 2009 Analysis PDFAekanshNo ratings yet

- Syllabus SSC CGL 2014Document4 pagesSyllabus SSC CGL 2014Sikander Singh KhurlNo ratings yet

- Ent530 Oct22 RubricsDocument14 pagesEnt530 Oct22 RubricsNur FikriyahNo ratings yet

- How To Prepare For The Kearney Aptitude TestDocument20 pagesHow To Prepare For The Kearney Aptitude TestRohit PaiNo ratings yet

- Main ExamDocument3 pagesMain ExamZion RamngaihawmaNo ratings yet

- Complete SBI PO Syllabus and Guide For Prelims 2018 - Download As PDF!Document13 pagesComplete SBI PO Syllabus and Guide For Prelims 2018 - Download As PDF!YashWant DonGe ThaKurNo ratings yet

- Complete SBI PO Syllabus and Guide For Prelims 2018 Download As PDFDocument13 pagesComplete SBI PO Syllabus and Guide For Prelims 2018 Download As PDFRohan NakasheNo ratings yet

- IBPS PO Mains Syllabus & Study MaterialDocument10 pagesIBPS PO Mains Syllabus & Study MaterialEyaminNo ratings yet

- Simcat 4: The Experts' Take: Test Overview Section Cut OffDocument6 pagesSimcat 4: The Experts' Take: Test Overview Section Cut OffShNo ratings yet

- 2009 Paper 1 AnalysisDocument4 pages2009 Paper 1 AnalysisNishant RaiNo ratings yet

- Analysis XAT 2012Document3 pagesAnalysis XAT 2012himanshuNo ratings yet

- Detailed IBPS PO Syllabus 2018: Quant, LR & English SectionsDocument12 pagesDetailed IBPS PO Syllabus 2018: Quant, LR & English SectionsEyaminNo ratings yet

- Detailed SBI PO Syllabus GuideDocument12 pagesDetailed SBI PO Syllabus GuideSindeesh DineshNo ratings yet

- Analysis-XAT 2010Document4 pagesAnalysis-XAT 2010himanshuNo ratings yet

- IBPS RRB 2020 BhotDocument4 pagesIBPS RRB 2020 BhotVirendra Singh RajpurohitNo ratings yet

- Mgt201 Collection of Old PapersDocument133 pagesMgt201 Collection of Old Paperscs619finalproject.com100% (1)

- Collegedekho 230826 214207Document3 pagesCollegedekho 230826 214207Bhumi GuptaNo ratings yet

- Joint Management Entrance Test 2010-13 Dec-2009Document3 pagesJoint Management Entrance Test 2010-13 Dec-2009Varinder DuaNo ratings yet

- AGRICULTURE INSURANCE CO. OF INDIA LTD. ONLINE RECRUITMENT EXAM INFORMATIONDocument10 pagesAGRICULTURE INSURANCE CO. OF INDIA LTD. ONLINE RECRUITMENT EXAM INFORMATIONHimanshu RaghuwanshiNo ratings yet

- IBPS PO CWE Mains 2015 AnalysisDocument2 pagesIBPS PO CWE Mains 2015 AnalysisAditya MishraNo ratings yet

- Analysis of IRMA 2004Document3 pagesAnalysis of IRMA 2004api-3835727No ratings yet

- Suitability ScoreDocument2 pagesSuitability ScoreTanaka MakweraNo ratings yet

- RRB NTPC CBT Exam Analysis 05 January 2020Document5 pagesRRB NTPC CBT Exam Analysis 05 January 2020shubham jaiswalNo ratings yet

- Sbi Po Detailed Syllabus 2020: Useful LinksDocument13 pagesSbi Po Detailed Syllabus 2020: Useful Linksutkarsh bhargavaNo ratings yet

- Sbi Associate Bank Po SyllabusDocument6 pagesSbi Associate Bank Po SyllabusAbhishek JoshiNo ratings yet

- Ibps Po MT Xii Ih Eng 2022Document11 pagesIbps Po MT Xii Ih Eng 2022Tanmay ModakNo ratings yet

- How to Prepare for DILRDocument19 pagesHow to Prepare for DILRmovie downloadNo ratings yet

- Rajasthan Cooperative Recruitment Board: On-Line Examination - Recruitment of Manager & Sr. ManagerDocument7 pagesRajasthan Cooperative Recruitment Board: On-Line Examination - Recruitment of Manager & Sr. ManagerHardik MehraNo ratings yet

- UPSC Exam Comprehensive News Analysis. August 14th, 2020 CNA Download PDFDocument19 pagesUPSC Exam Comprehensive News Analysis. August 14th, 2020 CNA Download PDFhermandeep5No ratings yet

- Ba7202 Financial ManagementDocument193 pagesBa7202 Financial ManagementBasanta K SahuNo ratings yet

- Economic Survey 2020 Quiz: Ramandeep SinghDocument24 pagesEconomic Survey 2020 Quiz: Ramandeep Singhhermandeep5No ratings yet

- Prachi Kansal - Risk Manager - Canara Bank - LinkedIn PDFDocument4 pagesPrachi Kansal - Risk Manager - Canara Bank - LinkedIn PDFhermandeep5No ratings yet

- Accounting Ratios: Inancial Statements Aim at Providing FDocument47 pagesAccounting Ratios: Inancial Statements Aim at Providing Fabc100% (1)

- Banking and Financia L Aware Ne Ss Fe Bruary 2020: We Ek IDocument3 pagesBanking and Financia L Aware Ne Ss Fe Bruary 2020: We Ek Ihermandeep5No ratings yet

- Indian Bank Previous Paper 2020Document78 pagesIndian Bank Previous Paper 2020Preetham MNo ratings yet

- BOI Previous Paper PDFDocument40 pagesBOI Previous Paper PDFhermandeep5No ratings yet

- Latest Question Papers For Bank Exams - PDF - BankExamsTodayDocument9 pagesLatest Question Papers For Bank Exams - PDF - BankExamsTodayhermandeep5No ratings yet

- Syllabus Bank of India Credit Officer Course 2018 - BankExamsTodayDocument10 pagesSyllabus Bank of India Credit Officer Course 2018 - BankExamsTodayhermandeep5No ratings yet

- Operating and Financial LeverageDocument4 pagesOperating and Financial Leveragehermandeep5No ratings yet

- Professional Knowledge Questions For Indian Bank So (Credit)Document28 pagesProfessional Knowledge Questions For Indian Bank So (Credit)hermandeep5No ratings yet

- CAIIB PAPER 2 MODULE D Bank Financial Management BalanceSheet PDFDocument38 pagesCAIIB PAPER 2 MODULE D Bank Financial Management BalanceSheet PDFhermandeep5No ratings yet

- Bank of India Banking Officer Paper – 2017 (Practice SetDocument29 pagesBank of India Banking Officer Paper – 2017 (Practice Sethermandeep5No ratings yet

- Indian Bank Annual Report 2008 2009 PDFDocument206 pagesIndian Bank Annual Report 2008 2009 PDFhermandeep5No ratings yet

- Abm CaiibDocument70 pagesAbm Caiibsubhasis123bbsrNo ratings yet

- HDB Enterprise Business Loans - HDBDocument4 pagesHDB Enterprise Business Loans - HDBhermandeep5No ratings yet

- HDB CREDIT APPRAISAL PROCESS OF HDB FINANCIAL SERVICES PptsDocument20 pagesHDB CREDIT APPRAISAL PROCESS OF HDB FINANCIAL SERVICES Pptshermandeep5No ratings yet

- SplAdvt 51 2020 Engl - 0Document46 pagesSplAdvt 51 2020 Engl - 0Sadasivam RNo ratings yet

- HDB Interest Rates & Charges - HDBFSDocument5 pagesHDB Interest Rates & Charges - HDBFShermandeep5No ratings yet

- Google Search Use Google Dork Like INURL and Specific Timeline Based SearchDocument1 pageGoogle Search Use Google Dork Like INURL and Specific Timeline Based Searchhermandeep5No ratings yet

- Current Affairs PDF PlansDocument20 pagesCurrent Affairs PDF PlansAshish AgarwalNo ratings yet

- Vision Ias Labour Reforms PDFDocument5 pagesVision Ias Labour Reforms PDFhermandeep5No ratings yet

- Strategic Financial Management - CA Nikhil JobanputraDocument2 pagesStrategic Financial Management - CA Nikhil Jobanputrahermandeep5No ratings yet

- Syllabus For Bank of India Credit Officer 2020Document6 pagesSyllabus For Bank of India Credit Officer 2020hermandeep5No ratings yet

- Strategic Financial Management by Pavan SirDocument4 pagesStrategic Financial Management by Pavan Sirhermandeep5No ratings yet

- Social SecurityDocument10 pagesSocial SecurityParth DevNo ratings yet

- FM - Financial ManagementDocument1 pageFM - Financial Managementhermandeep5No ratings yet

- Financial Management (Scattered Lectures, Do Only Selected by CA Raj K AggarwalDocument14 pagesFinancial Management (Scattered Lectures, Do Only Selected by CA Raj K Aggarwalhermandeep5No ratings yet

- Sources For Writing An NSF CAREER ProposalDocument2 pagesSources For Writing An NSF CAREER ProposalBitao LaiNo ratings yet

- Being A Successful Interpreter - Adding Value and Delivering ExcellenceDocument124 pagesBeing A Successful Interpreter - Adding Value and Delivering ExcellenceGodo Yawovi100% (4)

- Curriculum Vitae: A.Puthiyavan, S/O S.AnbarasanDocument3 pagesCurriculum Vitae: A.Puthiyavan, S/O S.AnbarasanJayaprabhu PrabhuNo ratings yet

- Bài tập mệnh đề quan hệDocument121 pagesBài tập mệnh đề quan hệNguyễn Xuân HoàngNo ratings yet

- Pamantasan NG Lungsod NG Valenzuela Poblacion II, Malinta, Valenzuela CityDocument55 pagesPamantasan NG Lungsod NG Valenzuela Poblacion II, Malinta, Valenzuela CityAbegail A. AraojoNo ratings yet

- ACIO Grade II exam questions and answersDocument34 pagesACIO Grade II exam questions and answersrahulNo ratings yet

- Woman and LawDocument9 pagesWoman and LawMariNo ratings yet

- Quality Improvement vs Research - Do I Need IRBDocument4 pagesQuality Improvement vs Research - Do I Need IRBDavid WheelerNo ratings yet

- QA/QC Engineer-Inspector ResumeDocument2 pagesQA/QC Engineer-Inspector Resumejulius j. madularaNo ratings yet

- Lose Yourself QuestionsDocument2 pagesLose Yourself QuestionscloudzblueNo ratings yet

- Concept Note On Community ParticipationDocument7 pagesConcept Note On Community ParticipationLikassa LemessaNo ratings yet

- Personnel management: Hiring & developing employeesDocument5 pagesPersonnel management: Hiring & developing employeesАлина УсялитеNo ratings yet

- Capitulo 1 Ritchie-Crouch 2003Document15 pagesCapitulo 1 Ritchie-Crouch 2003hiendiversNo ratings yet

- Marvelous Images Kendall L. Walton PDFDocument265 pagesMarvelous Images Kendall L. Walton PDFMadalina Maier100% (5)

- Stephanie B. Balaga (My Report Lite001)Document15 pagesStephanie B. Balaga (My Report Lite001)Teph BalagaNo ratings yet

- Unit 1 Curriculum: The Concept: StructureDocument24 pagesUnit 1 Curriculum: The Concept: StructureMiyNo ratings yet

- Nursing 403 EfolioDocument4 pagesNursing 403 Efolioapi-403368398No ratings yet

- UNMAC - Mine ActionDocument284 pagesUNMAC - Mine ActionFrancesco100% (1)

- The Dissertation JourneyDocument249 pagesThe Dissertation Journeyaperfectcircle7978100% (6)

- Raven's Progressive MatricesDocument4 pagesRaven's Progressive MatricesAnonymous ImPC4e33% (3)

- 12th Maths Vol1 EM WWW - Tntextbooks.inDocument304 pages12th Maths Vol1 EM WWW - Tntextbooks.inkarthikNo ratings yet

- Seven Habits of Highly Effective PeopleDocument4 pagesSeven Habits of Highly Effective PeopleJayesh JainNo ratings yet

- Peak Performance Success in College and Beyond 9th Edition Ferrett Solutions ManualDocument39 pagesPeak Performance Success in College and Beyond 9th Edition Ferrett Solutions Manualriaozgas3023100% (11)

- Teacher's Interview QuestionsDocument13 pagesTeacher's Interview QuestionsGirlie Harical GangawanNo ratings yet

- Par Statements - Updated 2016Document2 pagesPar Statements - Updated 2016K DNo ratings yet

- Republic of The Philippines Position Description Form DBM-CSC Form No. 1Document2 pagesRepublic of The Philippines Position Description Form DBM-CSC Form No. 1Maria ClaraNo ratings yet

- BSBLDR523 - Assessment Task 2Document39 pagesBSBLDR523 - Assessment Task 2dsharlie94No ratings yet

- Division Memorandum No. 100, S. 2017Document6 pagesDivision Memorandum No. 100, S. 2017Dee HeiNo ratings yet

- BBA Curriculum Guide 2022-23Document10 pagesBBA Curriculum Guide 2022-23Geeta UnivNo ratings yet