Professional Documents

Culture Documents

Personal Financial Plan Template

Uploaded by

Bern Balingit-ArnaizCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Personal Financial Plan Template

Uploaded by

Bern Balingit-ArnaizCopyright:

Available Formats

Creating Your

Personal Financial

Plan

Amy White - Daily Successful Living

1

Copyright © 2017 by Amy White. All rights reserved.

No part of this publication may be reproduced, stored, or transmitted in any

form or by any means, electronic, mechanical, photocopying, recording,

scanning, or otherwise, except as permitted under Section 107 or 108 of the

1976 United States Copyright Act, without the prior written permission of the

author. Requests to the author and publisher for permission should be

addressed to the following email: awhite@dailysuccessfulliving.com

Limitation of liability/disclaimer of warranty: While the publisher and author

have used their best efforts in preparing this guide and workbook, they

make no representations or warranties with respect to the accuracy or

completeness of the contents of this document and specifically disclaim any

implied warranties of merchantability or fitness for particular purpose. No

warranty may be created or extended by sales representatives, promoters,

or written sales materials.

The advice and strategies contained herein may not be suitable for your

situation. You should consult with a professional where appropriate. Neither

the publisher nor author shall be liable for any loss of profit or any other

commercial damages, including but not limited to special, incidental,

consequential, or other damages.

Amy White

www.DailySuccessfulLiving.com

awhite@DailySuccessfulLiving.com

Amy White - Daily Successful Living

2

How To Set Up Your

Personal Financial

Plan

I used to do these long-complicated life plans that included every single aspect of my financial life. I

quickly realized that it was overkill. When they are too complicated you lose focus and quite frankly,

they just don’t happen.

Now my personal financial plan is super simple. I focus on these

5 areas:

• Personal Net Worth

• Debt Reduction

• Emergency Savings

• Retirement Savings

• Short-Term Savings goals

Every year, I sit down and calculate my current value in each area and then set goals as to where I want

to be in 1 year, 5 years, 10 years and 30 years. For the emergency fund and short-term savings, I spread-

out my goals over a 12 month time period.

Simple huh!

Here is a sample of what I do for each of the 5 areas mentioned above:

Current Value of Emergency Fund 9,500

Future Goals 15,000

Value of emergency Fund in 3 months 10,874

Value of emergency Fund in 6 months 12,248

Value of emergency Fund in 9 months 13,622

Value of emergency Fund in 12 months 14,966

Value of emergency Fund in 5 years 15,000

Amy White - Daily Successful Living

3

I’m currently underfunded and only have $9,500 in my emergency fund. My goal is to be at $15,000 by

the end of the year. The difference is $5,500 which means I need to save $1,374 per quarter to hit my

end of year goal.

I go through the same process for my net worth goals, debt reduction, retirement and whatever

short-term goals I’m working on.

My personal financial plan template makes it easy for me to quickly visualize the changes I’ll need to

incorporate into my budget to hit my goals.

To make my debt reduction goals, I have to calculate my current debt. Use the “My Current Debt” form

to list all of your debt. You will then use this form to make your debt reduction goals.

My Current Debt

Total Current Debt 197,652

Mortgage On Home 155,555

Car Loan #1 14,547

Car Loan #2 3,200

Credit Card #1 1,556

Credit Card #2 575

Student Loan #1 16,787

Student Loan #2 5,432

Personal Loan 0

Medical Debt 0

Other 0

Other 0

Amy White - Daily Successful Living

4

One of the most important parts to your personal financial plan is working towards a positive and

continually growing Net Worth.

Your Net Worth is your current value in financial terms.

Your personal net worth is calculated by adding up all of your assets and then subtracting your

liabilities. (see the next page for an example)

To calculate your net worth, write down all of your current assets. I include anything that is valued at

over $3,000. I don't stress about the small things in my home. For example, I personally don't include

computers, jewelry, guns, camera's and other medium priced items when I create a personal financial

plan. It isn't worth the time.

The important thing is to make sure that you correctly value your assets. Just because you love your car

doesn’t mean that it is in excellent condition on Kelly Bluebook. Be realistic. Your goal is to get an

accurate value of your net worth, not an inflated valuation based on the original price of an item.

Once you have determined your net worth it is time to set some personal financial goals.

If you have a negative net worth, I would focus on debt reduction to get the most bang for your buck.

If you have a positive net worth, then review your assets to see where you have holes. For example, if

you have a lean emergency fund, you may want to prioritize your emergency fund this year and then

next year focus on retirement planning and short-term saving goals.

Creating a Personal Financial Plan doesn’t need to be hard!

I go through this process every year and it really helps me stay on track with my budget, spending and

saving.

If you have any questions on these forms please reach out to me via my website. I’d love to hear from

you.

Love,

Amy

www.DailySuccessfulLiving.com

Amy White - Daily Successful Living

5

Current Estimated Net Worth

Assets

Personal Residence (Estimated Full Value) 210,000

Vehicles 21,000

Savings Accounts 6,000

Stocks/Bonds/Mutual Funds/ETF’s 12,000

Retirement Accounts 125,000

Other Assets 15,000

Other Assets

Other Assets

Total Assets 389,000

Liabilities

Mortgage Loan Balance 155,555

Vehicle Loan Balance 17,747

Student Loans 22,219

Credit Card Balance 2,131

Personal Loans 0

Medical Debt 0

Other Liabilities 0

Other Liabilities 0

Other Liabilities 0

Total Liabilities 197,652

Net Worth (Assets - Liabilities) 191,348

Amy White - Daily Successful Living

6

Personal Financial Plan

Date: ________

Current Net Worth

Future Goals

Net Worth In 1 year

Net Worth in 5 years

Net Worth in 10 years

Net Worth in 10 Years

Current Value of Emergency Fund

Future Goals

Value of emergency Fund in 3 months

Value of emergency Fund in 6 months

Value of emergency Fund in 9 months

Value of emergency Fund in 12 months

Value of emergency Fund in 5 years

Current Total Debt

Future Goals

Total Debt in 1 year

Total Debt in 5 years

Total Debt in 10 years

Total Debt in 30 years

Amy White - Daily Successful Living

8

My Current Debt

Total Current Debt

Mortgage On Home

Car Loan #1

Car Loan #2

Credit Card #1

Credit Card #2

Student Loan #1

Student Loan #2

Personal Loan

Medical Debt

Other

Other

Current Retirement Savings

Future Goals

Total Retirement Savings in 1 year

Total Retirement Savings in 5 years

Total Retirement Savings in 10 years

Total Retirement Savings in 30 years

Amy White - Daily Successful Living

9

Current Retirement Savings - Spouse

Future Goals

Total Retirement Savings in 1 year

Total Retirement Savings in 5 years

Total Retirement Savings in 10 years

Total Retirement Savings in 30 years

Current Short Term Savings

Saving For:

Future Goals

Total Short Term Savings in 3 months

Total Short Term Savings in 6 months

Total Short Term Savings in 9 months

Total Short Term Savings in 12 months

Total Short Term Savings in 24 months

Current Short Term Savings

Saving For:

Future Goals

Total Short Term Savings in 3 months

Total Short Term Savings in 6 months

Total Short Term Savings in 9 months

Total Short Term Savings in 12 months

Total Short Term Savings in 24 months

Amy White - Daily Successful Living

10

Current Estimated Net Worth

Assets

Personal Residence (Estimated Full Value)

Vehicles

Savings Accounts

Stocks/Bonds/Mutual Funds/ETF’s

Total Short Term Savings in 24 months

Other Assets

Other Assets

Other Assets

Total Assets

Liabilities

Mortgage Loan Balance

Vehicle Loan Balance

Student Loans

Credit Card Balance

Personal Loans

Medical Debt

Other Liabilities

Other Liabilities

Other Liabilities

Total Liabilities

Net Worth (Assets - Liabilities)

www.DailySuccessfulLiving.com

Amy White - Daily Successful Living

11

You might also like

- Master Your Money: The Comprehensive Guide to Personal Finance, Budgeting and Money Management to Build WealthFrom EverandMaster Your Money: The Comprehensive Guide to Personal Finance, Budgeting and Money Management to Build WealthNo ratings yet

- Understanding Business Failure Causes and SolutionsDocument12 pagesUnderstanding Business Failure Causes and Solutionsgoneatlast1985No ratings yet

- Business Planners Corporate ProfileDocument8 pagesBusiness Planners Corporate ProfileOliver JuanirNo ratings yet

- RMC No. 65-2016 PDFDocument3 pagesRMC No. 65-2016 PDFlavyne56No ratings yet

- Intro Prework Workbook and Reflection QP Jun 2022 SessionDocument69 pagesIntro Prework Workbook and Reflection QP Jun 2022 Sessiondevil1angelNo ratings yet

- Food Committee DutiesDocument2 pagesFood Committee DutiesAnanthapadmanabhan JayachandranNo ratings yet

- Personal Strategic PlanDocument9 pagesPersonal Strategic PlanDanielle BlairNo ratings yet

- Financial Planning: Presented byDocument28 pagesFinancial Planning: Presented byamansidhu88100% (2)

- Financial Planning Students CornerDocument22 pagesFinancial Planning Students CornerBella RamadhantiNo ratings yet

- 7 Steps To A Perfectly Written Business PlanDocument54 pages7 Steps To A Perfectly Written Business PlanJohn Rhimon Abaga Gelacio100% (1)

- Personal Financial Plan SampleDocument8 pagesPersonal Financial Plan SampleKim Del Agua100% (2)

- PIP Part A New File PDFDocument18 pagesPIP Part A New File PDFFarwa HashmiNo ratings yet

- BGPMS DCF 2016Document29 pagesBGPMS DCF 2016Poleng MalimutinNo ratings yet

- Personal Financial SpecialistDocument5 pagesPersonal Financial SpecialistNiño Rey LopezNo ratings yet

- Group 1 Crowd Fin InclusionDocument48 pagesGroup 1 Crowd Fin InclusionSusu AlmondNo ratings yet

- Jane Smith: Written and Presented byDocument16 pagesJane Smith: Written and Presented byerudite_0206No ratings yet

- FDI in Real Estate and Investment in Property - FEMA ProvisionsDocument25 pagesFDI in Real Estate and Investment in Property - FEMA Provisionsharibhuj1983No ratings yet

- Bs AccountancyDocument4 pagesBs Accountancy123455690210No ratings yet

- Final Activity 1Document10 pagesFinal Activity 1Skermberlo Sprekitik BombomNo ratings yet

- Lecture 8 - Life InsuranceDocument33 pagesLecture 8 - Life InsurancePhí Thị Hoàng HàNo ratings yet

- Lecture 4 Personal Financial PlanningDocument48 pagesLecture 4 Personal Financial Planningsknatey221No ratings yet

- Mod 1 Fundamentals of Personal FinanceDocument15 pagesMod 1 Fundamentals of Personal FinanceShruti b ahujaNo ratings yet

- How to create an emergency fund to prepare for life's uncertaintiesDocument2 pagesHow to create an emergency fund to prepare for life's uncertaintiesRahul JainNo ratings yet

- 4 Managing Debts Effectively PDFDocument48 pages4 Managing Debts Effectively PDFLawrence CezarNo ratings yet

- Pfin5 5th Edition Billingsley Solutions ManualDocument22 pagesPfin5 5th Edition Billingsley Solutions Manualthoabangt69100% (30)

- Freshen up your finances with a complete guideDocument25 pagesFreshen up your finances with a complete guidesgirishri4044No ratings yet

- Do Not Use Cut, Copy Paste Anywhere.: Need Based Financial Planning MR Anil GhaiDocument27 pagesDo Not Use Cut, Copy Paste Anywhere.: Need Based Financial Planning MR Anil GhaiAmit SheoranNo ratings yet

- Consumer credit advantages and disadvantagesDocument23 pagesConsumer credit advantages and disadvantagesDina SboulNo ratings yet

- Saving 101Document18 pagesSaving 101devinebugNo ratings yet

- EDUC 108 - Financial LiteracyDocument30 pagesEDUC 108 - Financial LiteracyLee DuquiatanNo ratings yet

- Steps To Rebuilding CreditDocument2 pagesSteps To Rebuilding CreditKri RunNo ratings yet

- Sione and Andrea (Rework)Document10 pagesSione and Andrea (Rework)Ammer Yaser MehetanNo ratings yet

- Wealth ManagementDocument67 pagesWealth ManagementShera BhaiNo ratings yet

- How To Create A Personal Balance Sheet and Determine Your Net WorthDocument2 pagesHow To Create A Personal Balance Sheet and Determine Your Net WorthCalvin YeohNo ratings yet

- Solutions For A Changing WorldDocument16 pagesSolutions For A Changing WorldAl BruceNo ratings yet

- Financial Literacy Project 660 760 763 443 867 907 PDFDocument33 pagesFinancial Literacy Project 660 760 763 443 867 907 PDFSanchit Gupta 660No ratings yet

- Decoded Money: The Secrets Of How To Get Rid Off Financial Worries/insecurities and Peace Of Mind With MoneyFrom EverandDecoded Money: The Secrets Of How To Get Rid Off Financial Worries/insecurities and Peace Of Mind With MoneyNo ratings yet

- Credit Score SecretsDocument73 pagesCredit Score SecretsVijaya Bhasker100% (1)

- MMPE08Document21 pagesMMPE08Joshua CornitoNo ratings yet

- 6 PILLARS TO FINANCIAL SUCCESSDocument22 pages6 PILLARS TO FINANCIAL SUCCESSsonalNo ratings yet

- No Debt Zone: Your 9 Step Guide To a Debt Free LifeFrom EverandNo Debt Zone: Your 9 Step Guide To a Debt Free LifeRating: 5 out of 5 stars5/5 (1)

- Sample - Monetary Current Assets and LiabilitiesDocument2 pagesSample - Monetary Current Assets and LiabilitiesAdmin - At Least Know ThisNo ratings yet

- Financial Literacy and Preparedness: Key Concepts for Achieving GoalsDocument37 pagesFinancial Literacy and Preparedness: Key Concepts for Achieving GoalsMichael Data Paitan100% (4)

- Financial PlanningDocument6 pagesFinancial PlanningSheikh NadeemNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial Planningsabarais100% (3)

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial PlanningsabaraisNo ratings yet

- Personal Financial Planning Personal Financial PlanningDocument35 pagesPersonal Financial Planning Personal Financial PlanningsabaraisNo ratings yet

- The Debt Master Detox. A Comprehensive Guide to Getting out of Debt and Building Wealth.: 1, #1From EverandThe Debt Master Detox. A Comprehensive Guide to Getting out of Debt and Building Wealth.: 1, #1No ratings yet

- FinancialPlanningGuide May2013Document40 pagesFinancialPlanningGuide May2013Pranitkumar pathadeNo ratings yet

- Roadmap To Financial PlanningDocument7 pagesRoadmap To Financial PlanningMuskan SadhwaniNo ratings yet

- Creating A Personal Financial PlanDocument10 pagesCreating A Personal Financial Plangrisell de los angeles velasquez polancoNo ratings yet

- Act 3 - Personal Budget Plan - 09-10-22Document5 pagesAct 3 - Personal Budget Plan - 09-10-22riri mNo ratings yet

- Get Your Financial Life On Track PDFDocument35 pagesGet Your Financial Life On Track PDFkapoor_mukesh4uNo ratings yet

- Financial Literacy PortfolioDocument15 pagesFinancial Literacy PortfolioIt-is EmogieNo ratings yet

- Tutorial PFPDocument20 pagesTutorial PFPGAW KAH YAN KITTYNo ratings yet

- FABM 2 Wk9 ReportDocument10 pagesFABM 2 Wk9 ReportBern Balingit-ArnaizNo ratings yet

- Businesses According To SizeDocument1 pageBusinesses According To SizeBern Balingit-ArnaizNo ratings yet

- Reflective Essay in PehDocument1 pageReflective Essay in PehBern Balingit-ArnaizNo ratings yet

- Sole Proprietorship: Co-Branding Campaign: The Art of TravelDocument3 pagesSole Proprietorship: Co-Branding Campaign: The Art of TravelBern Balingit-ArnaizNo ratings yet

- Filipino Values: Loyalty, Resignation to Fate, and DelicadezaDocument9 pagesFilipino Values: Loyalty, Resignation to Fate, and DelicadezaBern Balingit-ArnaizNo ratings yet

- Watercolor Teacher's Newsletter by SlidesgoDocument47 pagesWatercolor Teacher's Newsletter by SlidesgoLiseth GómezNo ratings yet

- Sketchnotes Lesson by SlidesgoDocument41 pagesSketchnotes Lesson by SlidesgoCarlos Manuel HernándezNo ratings yet

- Sketchnotes Lesson by SlidesgoDocument41 pagesSketchnotes Lesson by SlidesgoCarlos Manuel HernándezNo ratings yet

- School Assignments by SlidesgoDocument53 pagesSchool Assignments by SlidesgoBà Bà HàNo ratings yet

- Job Title Estimated Monthly Salary Income Tax (Single, No Dependent, Private Company)Document1 pageJob Title Estimated Monthly Salary Income Tax (Single, No Dependent, Private Company)Bern Balingit-ArnaizNo ratings yet

- Social Studies Class by SlidesgoDocument47 pagesSocial Studies Class by SlidesgoBern Balingit-ArnaizNo ratings yet

- Ursula SlidesCarnivalDocument31 pagesUrsula SlidesCarnivalAndrés Suárez CarrilloNo ratings yet

- Media & Information Literacy Weeks 4 & 5 Flexible Task 2: Colegio San AgustinDocument1 pageMedia & Information Literacy Weeks 4 & 5 Flexible Task 2: Colegio San AgustinBern Balingit-ArnaizNo ratings yet

- Simple Google Slide Templates: Click The Template You Want To Use BelowDocument3 pagesSimple Google Slide Templates: Click The Template You Want To Use BelowBern Balingit-ArnaizNo ratings yet

- Role of Media and InformationDocument1 pageRole of Media and InformationBern Balingit-ArnaizNo ratings yet

- PhotographyDocument34 pagesPhotographyBern Balingit-ArnaizNo ratings yet

- Simple Google Slide Templates: Click The Template You Want To Use BelowDocument3 pagesSimple Google Slide Templates: Click The Template You Want To Use BelowBern Balingit-ArnaizNo ratings yet

- LSCP Aug. Oct.5 16Document1 pageLSCP Aug. Oct.5 16Bern Balingit-ArnaizNo ratings yet

- Business Finance Vital Task 1 Week 5Document1 pageBusiness Finance Vital Task 1 Week 5Bern Balingit-ArnaizNo ratings yet

- Arts Week 5 Vital Task 1Document2 pagesArts Week 5 Vital Task 1Bern Balingit-ArnaizNo ratings yet

- Business Finance Vital Task 2 Week 5Document1 pageBusiness Finance Vital Task 2 Week 5Bern Balingit-ArnaizNo ratings yet

- 170-331 Business Math ManualDocument145 pages170-331 Business Math ManualBern Balingit-ArnaizNo ratings yet

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- From Here and Beyond PDFDocument1 pageFrom Here and Beyond PDFBern Balingit-ArnaizNo ratings yet

- Section35 Permutations, Combinations, and ProbabilityDocument9 pagesSection35 Permutations, Combinations, and Probabilitymarchelo_cheloNo ratings yet

- 5 Year Financial PlanDocument29 pages5 Year Financial PlanFrankieNo ratings yet

- BusinessmanDocument17 pagesBusinessmanBern Balingit-ArnaizNo ratings yet

- Math10 TG U3 PDFDocument91 pagesMath10 TG U3 PDFaoakk76% (25)

- Reviewer in Professional Education Focus: Curriculum Development and Educational TechnologyDocument36 pagesReviewer in Professional Education Focus: Curriculum Development and Educational TechnologyBern Balingit-ArnaizNo ratings yet

- Cost Management For Just-in-Time Environments: Financial and Managerial Accounting 8th Edition Warren Reeve FessDocument57 pagesCost Management For Just-in-Time Environments: Financial and Managerial Accounting 8th Edition Warren Reeve FessRETNO KURNIAWANNo ratings yet

- Who Was Charlie ChaplinDocument4 pagesWho Was Charlie ChaplinHugo Alonso Llanos CamposNo ratings yet

- So Ping Bun's Warehouse Occupancy DisputeDocument4 pagesSo Ping Bun's Warehouse Occupancy DisputeVincent BernardoNo ratings yet

- Shakespeare's Language InnovationsDocument5 pagesShakespeare's Language InnovationsThương ThảoNo ratings yet

- Yongqiang - Dealing With Non-Market Stakeholders in The International MarketDocument15 pagesYongqiang - Dealing With Non-Market Stakeholders in The International Marketisabelle100% (1)

- Briefing The Yemen Conflict and CrisisDocument36 pagesBriefing The Yemen Conflict and CrisisFinlay AsherNo ratings yet

- Share Curriculum Vitae Ahmed SaadDocument7 pagesShare Curriculum Vitae Ahmed SaadDR ABO HAMZANo ratings yet

- School Governing Council Guide (SGCDocument17 pagesSchool Governing Council Guide (SGCMayMay Serpajuan-Sablan71% (7)

- The Impact of COVID-19 On Toyota Group Automotive Division and CountermeasuresDocument8 pagesThe Impact of COVID-19 On Toyota Group Automotive Division and CountermeasuresDâu TâyNo ratings yet

- Irb Ar 2012-13Document148 pagesIrb Ar 2012-13Shikhin GargNo ratings yet

- Financial Management in The Sport Industry 2nd Brown Solution Manual DownloadDocument12 pagesFinancial Management in The Sport Industry 2nd Brown Solution Manual DownloadElizabethLewisixmt100% (41)

- Central Excise Vizag08022021Document35 pagesCentral Excise Vizag08022021do or dieNo ratings yet

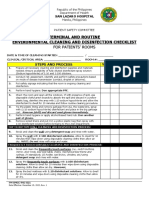

- Fm-Omcc-Psc-021 Terminal and Routine Environmental Cleaning and Disinfection Checklist.Document2 pagesFm-Omcc-Psc-021 Terminal and Routine Environmental Cleaning and Disinfection Checklist.Sheick MunkNo ratings yet

- Chapter 1Document5 pagesChapter 1patricia gunioNo ratings yet

- 283 - Phrasal Verbs Test 1Document11 pages283 - Phrasal Verbs Test 1LyzerOP GamingNo ratings yet

- General TermsDocument8 pagesGeneral TermsSyahmi GhazaliNo ratings yet

- SY 2020-2021 Region IV-A (Visually Impairment)Document67 pagesSY 2020-2021 Region IV-A (Visually Impairment)Kristian Erick BautistaNo ratings yet

- Carta de Porte Ferroviario: Modelos de Contratos InternacionalesDocument5 pagesCarta de Porte Ferroviario: Modelos de Contratos InternacionalesJonathan RccNo ratings yet

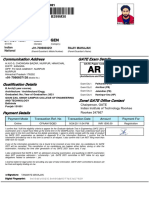

- 24 Nov 1997 Male GEN: Communication Address GATE Exam DetailsDocument1 page24 Nov 1997 Male GEN: Communication Address GATE Exam DetailsAr Tanmaye MahajanNo ratings yet

- Peoria County Booking Sheet 11/02/13Document8 pagesPeoria County Booking Sheet 11/02/13Journal Star police documentsNo ratings yet

- Employer Branding: A Case For Robi Axiata LimitedDocument108 pagesEmployer Branding: A Case For Robi Axiata LimitedJeremiah Knight100% (1)

- Calpers Public Employees' Retirement FundDocument30 pagesCalpers Public Employees' Retirement FundEpicDoctor0% (1)

- Laws Affecting Nursing PracticeDocument65 pagesLaws Affecting Nursing PracticeDave MismanNo ratings yet

- Islamiat AssignmentDocument2 pagesIslamiat AssignmentAreej HaiderNo ratings yet

- East Pakistan 1971 - Distortions and Lies - Revised Edition PDFDocument372 pagesEast Pakistan 1971 - Distortions and Lies - Revised Edition PDFHalqa e Yaran100% (2)

- Kentucky Gun Co Black Friday Page 1 2022Document1 pageKentucky Gun Co Black Friday Page 1 2022AmmoLand Shooting Sports NewsNo ratings yet

- MBA Waitlist PDFDocument5 pagesMBA Waitlist PDFhemant_mahajan_1No ratings yet

- Flaws in India's Coal Allocation ProcessDocument12 pagesFlaws in India's Coal Allocation ProcessBhaveen JoshiNo ratings yet

- All Hands Naval Bulletin - Nov 1942Document56 pagesAll Hands Naval Bulletin - Nov 1942CAP History Library0% (1)

- Immanuel Kant's Categorical Imperative and Kantian EthicsDocument4 pagesImmanuel Kant's Categorical Imperative and Kantian EthicsSylpauline EboraNo ratings yet