Professional Documents

Culture Documents

Pension Trust Contributions 8. Research and Development 7. Charitable Contributions 6. Depletion

Uploaded by

Gabriellen QuijadaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pension Trust Contributions 8. Research and Development 7. Charitable Contributions 6. Depletion

Uploaded by

Gabriellen QuijadaCopyright:

Available Formats

6. DEPLETION 7. CHARITABLE 8. RESEARCH AND 9. PENSION TRUST 10.

OPTIONAL STANDARD

CONTRIBUTIONS DEVELOPMENT CONTRIBUTIONS DEDUCTION

Part Costs of the property Deductible in Full Ordinary & necessary expense Funding of current service cost In lieu of the itemized deductions,

in the year incurred or paid is deductible in full an individual taxpayer except non-

resident alien may elect a standard

Allowable Deductions *Donations to NEDA

deduction in an amount not

*Donations to certain Deferred expenses charged to a Funding of past service cost is exceeding forty percent (40%) of

Not to exceed 25% of foreign institutions capital account but not to amortized over 10 years the gross sales/receipts

net income from based on treaties property subject to

mining operations *Donations to depreciation or development

accredited NGOs and amortized over 60 months Overfunding is prepaid pension

from the month first benefits expense deductible in the

Excess shall be carried were realized from such future as funding of future

Deductible with limitation

over the succeeding expenditures current service cost

years until fully

deducted *Individual- not more

than 10% of T.I

*Corporation- not

more than 5% of T.I

You might also like

- Deductions From Gross IncomeDocument2 pagesDeductions From Gross IncomeNoroNo ratings yet

- Deductions From Gross IncomeDocument3 pagesDeductions From Gross IncomeKezNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Tax Implications of Various Types of IncomeDocument23 pagesTax Implications of Various Types of IncomeButch MaatNo ratings yet

- Taxation of Dividend: Change in Dividend Taxation Regime Under Finance Act, 2020Document4 pagesTaxation of Dividend: Change in Dividend Taxation Regime Under Finance Act, 2020Swapnil SudhanshuNo ratings yet

- Chapter 14 Auto FinanceDocument4 pagesChapter 14 Auto FinanceMuhammad AamirNo ratings yet

- Special Allowable Itemized Deduction and OSDDocument19 pagesSpecial Allowable Itemized Deduction and OSDdelacruzrojohn600No ratings yet

- Prudential Regulations For Consumer Financing: Important DefinitionsDocument4 pagesPrudential Regulations For Consumer Financing: Important DefinitionsKhalil ShaikhNo ratings yet

- 515 Bluebird Senior Syndication Term Sheet PDFDocument23 pages515 Bluebird Senior Syndication Term Sheet PDFzoure samyrNo ratings yet

- If Deductions Are Claimed:, The Burden of Proving The Legality of The Deductions Rests Upon The TaxpayerDocument7 pagesIf Deductions Are Claimed:, The Burden of Proving The Legality of The Deductions Rests Upon The TaxpayerEmma Mariz GarciaNo ratings yet

- TAX 702 - Income Tax Rates CorporationsDocument6 pagesTAX 702 - Income Tax Rates CorporationsJuan Miguel UngsodNo ratings yet

- Theory For Cma Final CFRDocument59 pagesTheory For Cma Final CFRDharshini AravamudhanNo ratings yet

- Notes of Consumer FinanceDocument8 pagesNotes of Consumer Financemuneebmateen01No ratings yet

- Fees & Profit Sharing: 3 Things To Know About Avg FeesDocument3 pagesFees & Profit Sharing: 3 Things To Know About Avg Feesjohn smithNo ratings yet

- Icici Mortgage Pacustomer Raj Mandal 7727040114 150923Document6 pagesIcici Mortgage Pacustomer Raj Mandal 7727040114 150923Live lifeNo ratings yet

- Deductions From Gross IncomeDocument6 pagesDeductions From Gross Incomeacuman.irishNo ratings yet

- Fidelity Funds - Iberia Fund: Key Investor InformationDocument2 pagesFidelity Funds - Iberia Fund: Key Investor InformationMNo ratings yet

- 6 - Deductions From Gross IncomeDocument9 pages6 - Deductions From Gross IncomeSamantha Nicole Hoy100% (2)

- FRS 123 Borrowing Costs PDFDocument4 pagesFRS 123 Borrowing Costs PDFRandy AsnorNo ratings yet

- Income Payment Subject To Creditable Withholding TaxDocument2 pagesIncome Payment Subject To Creditable Withholding TaxChelsea Anne VidalloNo ratings yet

- RateDocument3 pagesRatemikamiiNo ratings yet

- PERCENTAGE TAX RATES TABLEDocument2 pagesPERCENTAGE TAX RATES TABLERenelyn FiloteoNo ratings yet

- Understanding Liabilities in Under 40Document2 pagesUnderstanding Liabilities in Under 40Catherine Joy MoralesNo ratings yet

- Bajaj Allianz CenturyPlusDocument2 pagesBajaj Allianz CenturyPlusHarish ChandNo ratings yet

- Notes in Percentage TaxDocument8 pagesNotes in Percentage TaxESTRADA, Angelica T.No ratings yet

- Dividend DistributionDocument24 pagesDividend DistributionSai PhaniNo ratings yet

- Last Minute Notes DeductionDocument2 pagesLast Minute Notes DeductionPrincess Helen Grace BeberoNo ratings yet

- TSU-CBA Tax Deductions GuideDocument6 pagesTSU-CBA Tax Deductions GuideJamaica DavidNo ratings yet

- Direct Tax Code 2010Document4 pagesDirect Tax Code 2010manojjain29No ratings yet

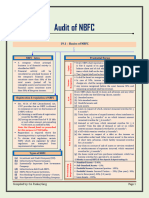

- Ca Final NBFCDocument5 pagesCa Final NBFCDeepak DhondiyalNo ratings yet

- Taxation of Different Fixed Income Instruments W e F April 01 2023Document4 pagesTaxation of Different Fixed Income Instruments W e F April 01 2023ArpNo ratings yet

- Taxation of Non-Bank Financial Intermediaries PhilippinesDocument12 pagesTaxation of Non-Bank Financial Intermediaries Philippinesjosiah9_5No ratings yet

- Ie KPMG Research Development Tax Credit DetailedDocument4 pagesIe KPMG Research Development Tax Credit Detailedgrahambatchelor83No ratings yet

- Unit 2 Income From SalariesDocument21 pagesUnit 2 Income From SalariesShreya SilNo ratings yet

- Percentage Tax ItemsDocument3 pagesPercentage Tax ItemsKristine CamposNo ratings yet

- Gross Income: Definition Means All Gains, Profits, and IncomeDocument19 pagesGross Income: Definition Means All Gains, Profits, and IncomeKathNo ratings yet

- Chapter 5Document6 pagesChapter 5Azi LheyNo ratings yet

- Final TDS and Tax ExemptionsDocument4 pagesFinal TDS and Tax Exemptionsdpak bhusalNo ratings yet

- Docrep O00000908 00000039 0001 2022 02 18 Ki en 0000Document2 pagesDocrep O00000908 00000039 0001 2022 02 18 Ki en 0000Geeta RawatNo ratings yet

- Valuation Cheat SheetDocument1 pageValuation Cheat SheetRISHAV BAIDNo ratings yet

- De Minimis BenefitsDocument4 pagesDe Minimis BenefitsFrancesca Roshelle GonzalesNo ratings yet

- E-Portfolio: PAS 36 - Impairment of AssetsDocument3 pagesE-Portfolio: PAS 36 - Impairment of AssetsKaye NaranjoNo ratings yet

- CHAPTER 5 - Percentage TaxDocument2 pagesCHAPTER 5 - Percentage Taxnewlymade641No ratings yet

- Threshold-Limits-under-the-Income-Tax-Act-Income-Tax-DepartmentDocument5 pagesThreshold-Limits-under-the-Income-Tax-Act-Income-Tax-Departmentavinashsonawane20No ratings yet

- Lecture 2b - Fringe BenefitsDocument2 pagesLecture 2b - Fringe BenefitsRhezel Baroro PusingNo ratings yet

- Gross Income: Part 1: Module No. 5Document8 pagesGross Income: Part 1: Module No. 5Jay Lord FlorescaNo ratings yet

- Kinds of DeductionsDocument3 pagesKinds of DeductionsMeghan Kaye LiwenNo ratings yet

- Chapter 5 - Final Income Taxation PDFDocument39 pagesChapter 5 - Final Income Taxation PDFgeraldine biasong100% (1)

- What Is Percentage TaxDocument4 pagesWhat Is Percentage Taxmy miNo ratings yet

- Tax Rate For EntityDocument5 pagesTax Rate For EntitySantosh ChhetriNo ratings yet

- Taxation of Residual Income: Cma K.R. RamprakashDocument25 pagesTaxation of Residual Income: Cma K.R. RamprakashShriya JoseincheckalNo ratings yet

- Deductions From Gross IncomeDocument5 pagesDeductions From Gross IncomeShena Gladdys BaylonNo ratings yet

- Tax RatesDocument37 pagesTax RatesMelanie OngNo ratings yet

- Everything you need to know about the National Pension System (NPSDocument16 pagesEverything you need to know about the National Pension System (NPSRafikul IslamNo ratings yet

- Cash Flow StatementDocument12 pagesCash Flow StatementRIONAN CUADRASALNo ratings yet

- Bab 2Document6 pagesBab 2Elsha Cahya Inggri MaharaniNo ratings yet

- Acquisition of Foreign Owned CompanyDocument2 pagesAcquisition of Foreign Owned CompanySyakira HarithNo ratings yet

- Summary Notes On Regular Allowable Itemized Deductions - CompressDocument4 pagesSummary Notes On Regular Allowable Itemized Deductions - CompressRochel Ada-olNo ratings yet

- Affidavit of Loss - CanenciaDocument1 pageAffidavit of Loss - CanenciaGabriellen QuijadaNo ratings yet

- Affidavit of Loss - CanenciaDocument1 pageAffidavit of Loss - CanenciaGabriellen QuijadaNo ratings yet

- AppoinmentDocument1 pageAppoinmentGabriellen QuijadaNo ratings yet

- Affidavit One and The Same PersonDocument1 pageAffidavit One and The Same PersonGabriellen QuijadaNo ratings yet

- Sublease AgreementDocument3 pagesSublease AgreementGabriellen QuijadaNo ratings yet

- In Chlorine DisinfectionDocument1 pageIn Chlorine DisinfectionGabriellen QuijadaNo ratings yet

- 2 Euro Linea Vs NLRCDocument3 pages2 Euro Linea Vs NLRCGabriellen QuijadaNo ratings yet

- Sosisto Vs Aguinaldo DevelopmentDocument3 pagesSosisto Vs Aguinaldo DevelopmentJacquelyn AlegriaNo ratings yet

- CIR Vs de La SalleDocument59 pagesCIR Vs de La SalleGabriellen QuijadaNo ratings yet

- 1 Abella Vs NLRCDocument4 pages1 Abella Vs NLRCGabriellen QuijadaNo ratings yet

- Colgate Palmolive Phil Vs OpleDocument5 pagesColgate Palmolive Phil Vs OpleJacquelyn AlegriaNo ratings yet

- Business Registration FlowchartDocument3 pagesBusiness Registration FlowchartGabriellen Quijada100% (1)

- Strengths Weaknesses: MarketingDocument3 pagesStrengths Weaknesses: MarketingGabriellen QuijadaNo ratings yet

- Alita V CADocument3 pagesAlita V CABoyet CariagaNo ratings yet

- 5 Gelmart Vs NLRCDocument5 pages5 Gelmart Vs NLRCGabriellen QuijadaNo ratings yet

- 6 China Banking Vs BorromeoDocument2 pages6 China Banking Vs BorromeoGabriellen QuijadaNo ratings yet

- Colgate Palmolive vs Ople: Minister Erred in Certifying UnionDocument2 pagesColgate Palmolive vs Ople: Minister Erred in Certifying UnionGabriellen QuijadaNo ratings yet

- APPENDICESDocument9 pagesAPPENDICESGabriellen QuijadaNo ratings yet

- CIR Vs de La SalleDocument59 pagesCIR Vs de La SalleGabriellen QuijadaNo ratings yet

- CIR Vs de La SalleDocument59 pagesCIR Vs de La SalleGabriellen QuijadaNo ratings yet

- TRANSPORT CORPORATION Vs EJANDRA DigestDocument3 pagesTRANSPORT CORPORATION Vs EJANDRA DigestGabriellen Quijada100% (1)

- Letter To Deped Division For EndorsementDocument1 pageLetter To Deped Division For EndorsementGabriellen QuijadaNo ratings yet

- Labor Prelim PointersDocument12 pagesLabor Prelim PointersGabriellen QuijadaNo ratings yet

- Board Resolution SampleDocument2 pagesBoard Resolution SampleGabriellen QuijadaNo ratings yet

- Free 1185324411Document8 pagesFree 1185324411Tariq Hussain KhanNo ratings yet

- Board Resolution SampleDocument1 pageBoard Resolution SampleGabriellen Quijada100% (1)

- Board ResoDocument2 pagesBoard ResoGabriellen QuijadaNo ratings yet

- Board Resolution SampleDocument1 pageBoard Resolution SampleGabriellen Quijada100% (1)

- AFFIDAVIT OF LOSS PassportDocument1 pageAFFIDAVIT OF LOSS PassportGabriellen QuijadaNo ratings yet