Professional Documents

Culture Documents

Corporate Income Tax Rate

Uploaded by

Juliana Cheng0 ratings0% found this document useful (0 votes)

209 views3 pagesThe document summarizes corporate income tax rates, capital gains tax rates, and other income tax rates that apply to different types of corporations and common carriers in the Philippines. It outlines the regular corporate income tax rate of 30% for domestic, resident foreign, and non-resident foreign corporations. It also discusses minimum corporate income tax of 2%, passive income tax rates, capital gains tax rates, special tax rates for proprietary educational institutions, non-profit organizations, and common carriers.

Original Description:

Original Title

CORPORATE-INCOME-TAX-RATE

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes corporate income tax rates, capital gains tax rates, and other income tax rates that apply to different types of corporations and common carriers in the Philippines. It outlines the regular corporate income tax rate of 30% for domestic, resident foreign, and non-resident foreign corporations. It also discusses minimum corporate income tax of 2%, passive income tax rates, capital gains tax rates, special tax rates for proprietary educational institutions, non-profit organizations, and common carriers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

209 views3 pagesCorporate Income Tax Rate

Uploaded by

Juliana ChengThe document summarizes corporate income tax rates, capital gains tax rates, and other income tax rates that apply to different types of corporations and common carriers in the Philippines. It outlines the regular corporate income tax rate of 30% for domestic, resident foreign, and non-resident foreign corporations. It also discusses minimum corporate income tax of 2%, passive income tax rates, capital gains tax rates, special tax rates for proprietary educational institutions, non-profit organizations, and common carriers.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

CORPORATE INCOME TAX RATE

Domestic Resident Foreign Non-resident

Corporation Corporation Foreign Corporation

1. Regular Corporate

Income Tax (RCIT) 30% 30% 30%

RATE:

Net income Net income Gross Income

Tax base:

(within and without) (within only) (within only)

2. Minimum Corporate

Income Tax MCIT 2% 2% Not applicable

RATE:

Gross Income Gross Income

Tax base: Not applicable

(within and without) (within only)

3. Gross Income Tax

(GIT) OPTIONAL 15% 15% Not applicable

RATE:

Gross Income Gross Income

Tax base: Not applicable

(within and without) (within only)

Note: if there’s a loss in last year’s operation – deduct such loss from the current taxable income.

PASSIVE INCOME SUBJECT TO FINAL TAXES

DC RFC NRFC

1. Interest in any currency bank deposit 20 20 30

2. Yield/monetary benefit from deposit

20 20 30

substitute

3. Yield/monetary benefit from trust fund and

20 20 30

other similar arrangement

4. Royalties 20 20 30

5. Interest Income derived from depository bank

15 7.5 Exempt

under FOREIGN CURRENCY DEPOSIT SYSTEM

6. Inter-corporate dividends received from

exempt exempt 15/30

domestic corporation

CAPITAL GAINS SUBJECT TO CAPITAL GAINS TAX

DC Foreign Corporation: RFC NRFC

1. Sale of share of stock not traded in

First 100,000 5 5

the local stock exchange

15

Amount in excess of

10 10

TAX BASE: NET CAPITAL GAIN 100,000

3. Sale or exchange or disposition of

Land or buildings.

6 NOT APPLICABLE

TAX BASE: SELLING PRICE OR FAIR

VALUE WHICHEVER IS HIGHER

TAX TREATMENT OF CO-VENTURER’S SHARE IN THE NET INCOME OF A JOINT VENTURE

Joint Venture By a Corporate Co-Venturer By an Individual Co-Venturer

Net Income: dividend income

(Inter-corporate Dividend)

1. Taxable Joint Venture TAX EXEMPT FWT

Note: income is not distributed Note: Income is NOT

distributed to individual

The respective share in the The respective share in the

joint venture profit shall be joint venture profit shall be

included in the computation of subject to basic tax (graduated

2. Tax-exempt Joint the corporate co-venturer’s tax).

Venture taxable income of 30%

Note: income is distributed to Note: income is distributed to

co-venturer co-venturer

INCOME TAX RATES OF SPECIAL CORPORATIONS

1. DOMESTIC CORPORATIONS: (BASIS: NET INCOME) Rate

Proprietary educational institutions (PEI)

10

Note: GI<UNRELATED INCOME = 30%

Non-profit hospitals 10

2. RESIDENT FOREIGN CORPORATION (BASIS: NET INCOME)

International Carrier 2.5

Regional Operating headquarters (ROHQ) of

10

multinational corporation

3. NON-RESIDENT FOREGN CORPORATION

(BASIS: GROSS INCOME)

Non-resident owner or lessor of vessel 4.5

Non-resident cinematography film owner, lessor

25

or distribution

Non-resident lessor of aircraft, machinery 7.5

APPLICABLE INCOME TAX OF EDUC ATION INSTTUTIONS IN THE PHILIPPINES

Passive

Educational Institution Ordinary Income Capital Gains

Income

Proprietary Educational Generally, 10% of net income

FWT CWT

Institution (PEI) 30% - unrelated income>related income

Philippine Constitution, Art. XIV, Sec.

4(3) – all REVENUES and ASSETS of

non-s tock, non-profit educational

Non-stock non-profit institutes used actually, directly,

educational institutions exclusively for educational purposes.

(NSEIs) = TAX EXEMPT

Section 30, NIRC = TAX EXEMPT

(h) = A non-stock non-profit FWT CGT

educational institution

Government Educational Section 30, NIRC – the following shall not be

Institutions (GEIs) taxes:

(i) Government educational institution FWT CGT

and

As provided in the law or charter

creating the GEI

APPLICABLE INCOME TAX OF COMMON CARRIERS (SUMMARY)

Common Carrier Ordinary Passive Income Capital Gains

Domestic Common Carriers (Higher): 30%

FWT CGT

(Local companies) RCIT or 2% MCIT

GR: 2.5% GPB; or

Preferential % or

International Carriers (RFCs) FWT CGT

exempt on the

basis of a treaty

of reciprocity

You might also like

- Taxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Document12 pagesTaxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Ramainne Ronquillo100% (1)

- Lecture 3 - Income Taxation (Corporate)Document5 pagesLecture 3 - Income Taxation (Corporate)Paula MerrilesNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- Answers - Business Taxation - Exempt Sales (Chapter 4)Document3 pagesAnswers - Business Taxation - Exempt Sales (Chapter 4)Gino CajoloNo ratings yet

- Local Government Tax PDFDocument9 pagesLocal Government Tax PDFNikko ParNo ratings yet

- Module 1. Transfer TaxesDocument4 pagesModule 1. Transfer TaxesYolly DiazNo ratings yet

- Deductions From Gross Estate (Presentation Slides)Document24 pagesDeductions From Gross Estate (Presentation Slides)KezNo ratings yet

- MSC-Audited FS With Notes - 2014 - CaseDocument12 pagesMSC-Audited FS With Notes - 2014 - CaseMikaela SalvadorNo ratings yet

- Introduction To Donor's Tax (Presentation Slides)Document22 pagesIntroduction To Donor's Tax (Presentation Slides)KezNo ratings yet

- Quiz 1Document11 pagesQuiz 1VIRGIL KIT AUGUSTIN ABANILLANo ratings yet

- TX02 Individual Income Taxpayer and Fringe BenefitDocument15 pagesTX02 Individual Income Taxpayer and Fringe BenefitAce DesabilleNo ratings yet

- Allowable Deductions Part 1Document3 pagesAllowable Deductions Part 1John Rich GamasNo ratings yet

- CPAR Deductions (Batch 89) HandoutDocument26 pagesCPAR Deductions (Batch 89) HandoutlllllNo ratings yet

- Input:Output Tax ReviewerDocument2 pagesInput:Output Tax ReviewerHiedi SugamotoNo ratings yet

- How Much Is The Distributable Income of The GPP?Document2 pagesHow Much Is The Distributable Income of The GPP?Katrina Dela CruzNo ratings yet

- BFINMAX Handout - Gross Profit Variance AnalysisDocument6 pagesBFINMAX Handout - Gross Profit Variance AnalysisDeo CoronaNo ratings yet

- Mas Solutions To Problems Solutions 2018Document14 pagesMas Solutions To Problems Solutions 2018Jahanna Martorillas0% (1)

- Reo Notes - TaxDocument20 pagesReo Notes - TaxgeexellNo ratings yet

- Solution To Donors Vat Other Perecetnages Taxes ExerciseDocument6 pagesSolution To Donors Vat Other Perecetnages Taxes ExerciseMarco Alejandro IbayNo ratings yet

- Final Examination - Income TaxationDocument28 pagesFinal Examination - Income TaxationAisah ReemNo ratings yet

- 2 General Principles of Income TaxationDocument9 pages2 General Principles of Income TaxationDenise ZurbanoNo ratings yet

- Local Government Taxation CasesDocument1 pageLocal Government Taxation CasesRichard Rhamil Carganillo Garcia Jr.No ratings yet

- Mock Deparmentals MASQDocument6 pagesMock Deparmentals MASQHannah Joyce MirandaNo ratings yet

- Dealings in PropertiesDocument9 pagesDealings in PropertiesJoyce Leeann ManansalaNo ratings yet

- VAT Exempt Transactions (TRAIN Law)Document2 pagesVAT Exempt Transactions (TRAIN Law)Pau SantosNo ratings yet

- 05 Input TaxesDocument4 pages05 Input TaxesJaneLayugCabacunganNo ratings yet

- The Regular Corporate Income TaxDocument4 pagesThe Regular Corporate Income TaxReniel Renz AterradoNo ratings yet

- Financial Management RiskDocument11 pagesFinancial Management RisknevadNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- A. Four-Variance MethodDocument3 pagesA. Four-Variance MethodMeghan Kaye LiwenNo ratings yet

- (CPAR2016) TAX-8002 (+llamado Notes - INTRODUCTION TO INCOME TAX & TAXATION OF INDIVIDUALS)Document21 pages(CPAR2016) TAX-8002 (+llamado Notes - INTRODUCTION TO INCOME TAX & TAXATION OF INDIVIDUALS)Ralph SantosNo ratings yet

- VAT Exempt TransactionsDocument4 pagesVAT Exempt TransactionsAndehl AguinaldoNo ratings yet

- Construction ContractDocument17 pagesConstruction ContractYvonne Gam-oyNo ratings yet

- Corporate Income TaxDocument6 pagesCorporate Income TaxMark Domingo MendozaNo ratings yet

- Lemon LawDocument5 pagesLemon LawApril VillanuevaNo ratings yet

- Deductions From Gi (Part 2)Document4 pagesDeductions From Gi (Part 2)Koibitz WarrenNo ratings yet

- General Principles of Taxation ReviewerDocument24 pagesGeneral Principles of Taxation ReviewerDaphneNo ratings yet

- CPA Exam Room Assignment May 2019Document22 pagesCPA Exam Room Assignment May 2019Shei La MhaeNo ratings yet

- Activity 5 Gross IncomeDocument6 pagesActivity 5 Gross IncomeRussel Jay CardeñoNo ratings yet

- When, What and How of Insurance Contract (Perfection) When Is It Perfected?Document9 pagesWhen, What and How of Insurance Contract (Perfection) When Is It Perfected?Jexelle Marteen Tumibay PestañoNo ratings yet

- Discuss The Components and Characteristics of Maximization and Minimization ModelDocument5 pagesDiscuss The Components and Characteristics of Maximization and Minimization ModelNicole AutrizNo ratings yet

- Items of Gross Income Subject To RegularDocument2 pagesItems of Gross Income Subject To Regularace zeroNo ratings yet

- Fria QuizDocument2 pagesFria QuizdavidgollaNo ratings yet

- A-Basic Share Capital Transactions2Document4 pagesA-Basic Share Capital Transactions2Sophia Santos0% (1)

- CPAR Estate Tax (Batch 89) HandoutDocument18 pagesCPAR Estate Tax (Batch 89) HandoutlllllNo ratings yet

- Deductions On Gross Estate Part 1Document19 pagesDeductions On Gross Estate Part 1Angel Clarisse JariolNo ratings yet

- CPA Dreams Test BankDocument6 pagesCPA Dreams Test BankMayla MasxcxlNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Week 1 Principles of Taxation True or FalseDocument4 pagesWeek 1 Principles of Taxation True or FalsekemeeNo ratings yet

- Chapter 01 Introduction To Internal Revenue TaxesDocument12 pagesChapter 01 Introduction To Internal Revenue TaxesNikki BucatcatNo ratings yet

- Tax RemediesDocument13 pagesTax RemediesYan MoretzNo ratings yet

- TAX-401 (Other Percentage Taxes - Part 1)Document5 pagesTAX-401 (Other Percentage Taxes - Part 1)Princess ManaloNo ratings yet

- 3.2 Exercise - RCIT v. MCITDocument1 page3.2 Exercise - RCIT v. MCITGiselle MartinezNo ratings yet

- At Last Minute by HerculesDocument19 pagesAt Last Minute by HerculesFranklin ValdezNo ratings yet

- RFBT - CPAR Pre-Boards in RFBT Batch 87 RFBT - CPAR Pre-Boards in RFBT Batch 87Document11 pagesRFBT - CPAR Pre-Boards in RFBT Batch 87 RFBT - CPAR Pre-Boards in RFBT Batch 87Adelio BalmezNo ratings yet

- ReSA CPA Review Batch 45 Pre-Recorded Lecture VideosDocument2 pagesReSA CPA Review Batch 45 Pre-Recorded Lecture VideosMarielle GonzalvoNo ratings yet

- San Beda College of Law: 2005 C B O Annex B T R CDocument3 pagesSan Beda College of Law: 2005 C B O Annex B T R CRachel LeachonNo ratings yet

- Ch04 Taxation of Corp. TRAIN With Answers 1Document15 pagesCh04 Taxation of Corp. TRAIN With Answers 1Nicole100% (1)

- Ch04 Taxation of CorporationsDocument13 pagesCh04 Taxation of CorporationsKyla ArcillaNo ratings yet

- Acco 20133 - Unit Iii & Iv - CreateDocument35 pagesAcco 20133 - Unit Iii & Iv - CreateHarvey AguilarNo ratings yet

- REO CPA Review: Amendments To The Anti-Money Laundering ActDocument2 pagesREO CPA Review: Amendments To The Anti-Money Laundering ActJuliana ChengNo ratings yet

- 17Q June 2018Document96 pages17Q June 2018Juliana ChengNo ratings yet

- 17Q March 2015Document74 pages17Q March 2015Juliana ChengNo ratings yet

- Bank Secrecy Law and Truth in Lending ActDocument23 pagesBank Secrecy Law and Truth in Lending ActJuliana ChengNo ratings yet

- Anti - Bouncing Checks Law: Batas Pambansa Blg. 22Document36 pagesAnti - Bouncing Checks Law: Batas Pambansa Blg. 22Juliana ChengNo ratings yet

- 17Q June 2016Document95 pages17Q June 2016Juliana ChengNo ratings yet

- 17Q June 2015Document82 pages17Q June 2015Juliana ChengNo ratings yet

- The Greedy and Egoistic LeaderDocument5 pagesThe Greedy and Egoistic LeaderJuliana ChengNo ratings yet

- 17Q June 2017Document104 pages17Q June 2017Juliana ChengNo ratings yet

- 17Q June 2014Document81 pages17Q June 2014Juliana ChengNo ratings yet

- Luxembourg Education SystemDocument6 pagesLuxembourg Education SystemJuliana ChengNo ratings yet

- Audit PlanningDocument15 pagesAudit PlanningJuliana ChengNo ratings yet

- June 26 - Assignemnt 3 CISDocument2 pagesJune 26 - Assignemnt 3 CISJuliana ChengNo ratings yet

- Introduction To AuditingDocument20 pagesIntroduction To AuditingJuliana ChengNo ratings yet

- Completing The AuditDocument26 pagesCompleting The AuditJuliana ChengNo ratings yet

- Module 2 - Relevant CostingDocument7 pagesModule 2 - Relevant CostingJuliana ChengNo ratings yet

- Chapter 8 Discussion QuestionsDocument3 pagesChapter 8 Discussion QuestionsJuliana ChengNo ratings yet

- Module 4 BASIC CONSOLIDATION PROCEDURESDocument21 pagesModule 4 BASIC CONSOLIDATION PROCEDURESJuliana ChengNo ratings yet

- Preliminary Enga Gement ActivitiesDocument7 pagesPreliminary Enga Gement ActivitiesJuliana ChengNo ratings yet

- Over Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Document2 pagesOver Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Juliana ChengNo ratings yet

- UST Golden Notes - Intellectual Property LawDocument32 pagesUST Golden Notes - Intellectual Property LawRay Macote96% (26)

- Admission of A New Partner: Total AssetsDocument10 pagesAdmission of A New Partner: Total AssetsJuliana Cheng100% (5)

- De MinimisDocument5 pagesDe MinimisJuliana ChengNo ratings yet

- IA3 Chapter 2Document7 pagesIA3 Chapter 2Juliana ChengNo ratings yet

- A Joint Project of The Government Accountancy Sector and Corporate Government SectorDocument55 pagesA Joint Project of The Government Accountancy Sector and Corporate Government SectorJuliana ChengNo ratings yet

- IA3 Chapter 1Document4 pagesIA3 Chapter 1Juliana ChengNo ratings yet

- PSA 210 RedraftedDocument40 pagesPSA 210 RedraftedVal Benedict MedinaNo ratings yet

- MQ 1 Inventories Ak PDFDocument4 pagesMQ 1 Inventories Ak PDFJuliana ChengNo ratings yet

- Auditing ProcessDocument11 pagesAuditing ProcessJuliana ChengNo ratings yet

- RR 11 2018 - Annex C - Withholding Agent Sworn DeclarationDocument2 pagesRR 11 2018 - Annex C - Withholding Agent Sworn DeclarationGlaze LlagasNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- LIM2019PROBLEMEXERCISESININCOMETAXATIONandTRAINLAW BDocument11 pagesLIM2019PROBLEMEXERCISESININCOMETAXATIONandTRAINLAW BMark MagnoNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BArun SasidharanNo ratings yet

- Ebook Concepts in Federal Taxation 2018 25Th Edition Murphy Test Bank Full Chapter PDFDocument67 pagesEbook Concepts in Federal Taxation 2018 25Th Edition Murphy Test Bank Full Chapter PDFbeckhamquangi9avb100% (9)

- Final Exam Practice - Comprehensive (With Answers)Document22 pagesFinal Exam Practice - Comprehensive (With Answers)Brandon ErbNo ratings yet

- DTP Full NotesDocument114 pagesDTP Full NotesCHAITHRANo ratings yet

- RR No. 25-2020Document2 pagesRR No. 25-2020Kram Ynothna BulahanNo ratings yet

- Pro Forma Balance Sheet Template: Company NameDocument5 pagesPro Forma Balance Sheet Template: Company NamePhương ĐinhNo ratings yet

- PPE - Part - 1. CHAPTER 15Document22 pagesPPE - Part - 1. CHAPTER 15Ms VampireNo ratings yet

- Release NotesDocument10 pagesRelease NotesSirc ElocinNo ratings yet

- Limited Liabilities Partnership FirmDocument14 pagesLimited Liabilities Partnership FirmPraveen JoeNo ratings yet

- The County Collector of Sun Coast County Is Responsible ForDocument1 pageThe County Collector of Sun Coast County Is Responsible ForMuhammad ShahidNo ratings yet

- 01-18-2020 Payslip PDFDocument1 page01-18-2020 Payslip PDFCarla ZanteNo ratings yet

- Final CTPM Chapter 1-ProblemDocument14 pagesFinal CTPM Chapter 1-Problembalaji RNo ratings yet

- Aakansha Sethi - A15 (Direct Tax Assignment)Document19 pagesAakansha Sethi - A15 (Direct Tax Assignment)Aakansha SethiNo ratings yet

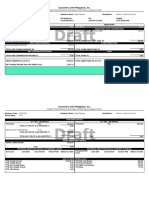

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionszayn malikNo ratings yet

- TDS & VDS Percentage With Section or Service Code - BMCDocument7 pagesTDS & VDS Percentage With Section or Service Code - BMCSyedur RahmanNo ratings yet

- Purchase Order Goods Vat or Non Vat With 2306 and 2307Document17 pagesPurchase Order Goods Vat or Non Vat With 2306 and 2307marivic dyNo ratings yet

- RUB Payment Instructions: Effective As of 1 May 2016Document3 pagesRUB Payment Instructions: Effective As of 1 May 2016Alex10505No ratings yet

- Contemporaray Taxation Acc: 300: PerquisitesDocument5 pagesContemporaray Taxation Acc: 300: PerquisitesALEEM MANSOORNo ratings yet

- Form - 6251Document2 pagesForm - 6251Anonymous JqimV1ENo ratings yet

- Kuis AkuntansiDocument3 pagesKuis AkuntansiNurul Khalishah AzzahraNo ratings yet

- Cost - Vi SemDocument18 pagesCost - Vi SemAR Ananth Rohith BhatNo ratings yet

- Capital Versus Revenue: Some Guidance: Pyott V CIRDocument7 pagesCapital Versus Revenue: Some Guidance: Pyott V CIRAbigail Ruth NawashaNo ratings yet

- Assessment and Returns of IncomeDocument13 pagesAssessment and Returns of IncomeMaster KihimbwaNo ratings yet

- BackgroundDocument6 pagesBackgroundSyed Ali Hussain BokhariNo ratings yet

- SS and SSS Chap 1 To 10 (2020)Document215 pagesSS and SSS Chap 1 To 10 (2020)Dinh TranNo ratings yet

- VE Banking Tests PrTest03Document4 pagesVE Banking Tests PrTest03trivanthNo ratings yet

- SW06Document6 pagesSW06Nadi HoodNo ratings yet