Professional Documents

Culture Documents

MCQ Question: 5 Marks (5 X 1 Mark) : Answer Any 5 (Five) Short Questions: 15 Marks (5 x3 Marks)

Uploaded by

Jubaida Alam 203-22-694Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MCQ Question: 5 Marks (5 X 1 Mark) : Answer Any 5 (Five) Short Questions: 15 Marks (5 x3 Marks)

Uploaded by

Jubaida Alam 203-22-694Copyright:

Available Formats

A-F (GB)

MCQ Question: 5 Marks ( 5 x 1 mark)

Ques. 1. For clearing a cheque , bank should put-

a. General Crossing b. Special Crossing

c. Either (a) or (b) d. None of the above

Ques. 2. Who are eligible for opening RFCD account?

a. Foreigners in Bangladesh b. Nonresident Bangladeshis

c. Resident Bangladeshis d. Any Bangladeshi travelling abroad

Ques. 3. Demand draft is :

a. Negotiable instrument b. Quasi negotiable instrument

c. Not negotiable instrument d. None of them

Ques. 4. Cheque is always payable

a. After expiry of the certain b period b. On demand

c. Post dated d. None of them

Ques. 5. Cancellation of crossing of cheque can be done by

a. Holder b. Payee

c. Drawer d. None of them

Ques. 6. Why introduction is necessary for opening an account?

a. For loss of Statutory Protection only b. For risk of issuing fake Cheque only

c. For risk Un-discharged Insolvent only d. For all of the above reasons

Ques. 7. What type of account ‘UCB Saving Plus’ is -

a. Savings Nature A/c b. FDR Scheme

c DPS d Special Scheme

a. Both of them b. None of the above

Ques. 8. Which of the following situation a banking company cannot pay any dividend to its shareholders?

a. Have loans to other banks b. High Defaulted loan rate

c. Paid-up capital is more than 400 crore d. All capitalized expenses have not been written off

What would be the effect on bank account, if a partner die, unless the partnership agreement

Ques. 9.

provides to the contrary-

a. Continue the account b. Close the account

c New account should be opened d Any one of the above with some conditions

Answer any 5 (Five) short questions: 15 Marks ( 5 x3 marks)

1. Define “endorsement”. Who can “Endorse” a cheque? What are the conditions for regular

endorsement?

2. What do you meant by “Authorized alternations? Explain with examples.

3. Compare and contrast between traditional functions and modern functions performed by

commercial banks in Bangladesh.

4. Sate the duties, responsibilities, and liabilities of a paying banker in payment of cheques.

5. Write the situation when a partnership firm will dissolve.

6. Write down short elaboration of the following:

a) MICR b) STR c) BEFT

7. State the functions of cash department. Distinguish between Bill of Exchange & Cheque.

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- NISMDocument9 pagesNISMArunim Mehrotra100% (1)

- Vault Cash ManagementDocument36 pagesVault Cash ManagementJubaida Alam 203-22-694100% (2)

- 500 Question BankDocument48 pages500 Question BankMST. MAHBUBA ATIKA TUNNUR100% (1)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Cape Law: Text and Cases: Contract Law, Tort Law and Real PropertyFrom EverandCape Law: Text and Cases: Contract Law, Tort Law and Real PropertyNo ratings yet

- Cash TheoriesDocument21 pagesCash TheoriesMark Gelo WinchesterNo ratings yet

- General Banking Questions With Answer - MorshedDocument57 pagesGeneral Banking Questions With Answer - MorshedJubaida Alam 203-22-694100% (2)

- PPT#11 Contemporary IssueDocument15 pagesPPT#11 Contemporary Issueshi lapsNo ratings yet

- Case Analysis: Mike's PlanDocument4 pagesCase Analysis: Mike's PlanPooja KumarNo ratings yet

- Multiple Choice and AnswerDocument63 pagesMultiple Choice and AnswerJubaida Alam 203-22-694100% (2)

- MCQ Question: 5 Marks (5 X 1 Mark) : Answer Any 5 (Five) Short Questions: 15 Marks (5 x3 Marks)Document1 pageMCQ Question: 5 Marks (5 X 1 Mark) : Answer Any 5 (Five) Short Questions: 15 Marks (5 x3 Marks)Jubaida Alam 203-22-694No ratings yet

- QuizDocument1 pageQuizAbegail PanangNo ratings yet

- Cash and Cash Equivalent TheoryDocument1 pageCash and Cash Equivalent TheoryExcelsia Grace A. ParreñoNo ratings yet

- Banking PaperDocument3 pagesBanking Paperaahmed459No ratings yet

- JAIIB Genius Week 9 2023Document10 pagesJAIIB Genius Week 9 2023SIBE SNo ratings yet

- Cash & GB MCQ NEW ESKATON FDocument18 pagesCash & GB MCQ NEW ESKATON FJubaida Alam Juthy57% (7)

- 1st SummativeDocument2 pages1st Summativeje-ann montejoNo ratings yet

- Chapter 23Document14 pagesChapter 23muglersaurusNo ratings yet

- JAIIB Genius Week 23 2023Document11 pagesJAIIB Genius Week 23 2023Anand MekalaNo ratings yet

- Seatwork 1Document6 pagesSeatwork 1Danna VargasNo ratings yet

- Principles and Practices of Banking - JAIIBDocument19 pagesPrinciples and Practices of Banking - JAIIBNeeti Vinay SinghNo ratings yet

- Jaiib Questions and Model Question PaperDocument52 pagesJaiib Questions and Model Question Paperவன்னியராஜாNo ratings yet

- Seatwork 1Document6 pagesSeatwork 1Danna VargasNo ratings yet

- First Long Quiz For The Second QuarterDocument7 pagesFirst Long Quiz For The Second QuarterReiah RongavillaNo ratings yet

- Principles and Practices of Banking - JAIIBDocument19 pagesPrinciples and Practices of Banking - JAIIBatul mishraNo ratings yet

- Chapter 23Document29 pagesChapter 23accounting needsNo ratings yet

- Cash Items ReviewerDocument49 pagesCash Items ReviewerlalalalaNo ratings yet

- QCM MCDocument2 pagesQCM MCencgNo ratings yet

- 1 B - Answer - Thories - Asset - Liability - Equity - Mas - MidtermsDocument23 pages1 B - Answer - Thories - Asset - Liability - Equity - Mas - MidtermsAlthea mary kate MorenoNo ratings yet

- 1 A - Thories - Asset - Liability - Equity - Mas - MidtermsDocument23 pages1 A - Thories - Asset - Liability - Equity - Mas - MidtermsAlthea mary kate MorenoNo ratings yet

- Basics of Banking Question BankDocument54 pagesBasics of Banking Question BankRashmi Ranjana100% (1)

- Substantive Test Cash and Cash Equivalents QuizDocument2 pagesSubstantive Test Cash and Cash Equivalents QuizMarieNo ratings yet

- NISM - Series V A - Model Question Bank With Answer KeyDocument13 pagesNISM - Series V A - Model Question Bank With Answer KeyRing RoadNo ratings yet

- Test Your Progress BookDocument14 pagesTest Your Progress BookarunapecNo ratings yet

- BFAR Practice Exercise QuestionnaireDocument3 pagesBFAR Practice Exercise QuestionnairePARBO Alessandra KateNo ratings yet

- Banking Awareness Quiz - Letter of CreditDocument5 pagesBanking Awareness Quiz - Letter of CreditPRIYA RANANo ratings yet

- Xii Mcqs CH - 10 Issue of DebenturesDocument4 pagesXii Mcqs CH - 10 Issue of DebenturesJoanna GarciaNo ratings yet

- Material 2008 BDocument227 pagesMaterial 2008 BshikumamaNo ratings yet

- AUDIT MCQs-Arens, Elder, Beasley - FinalDocument13 pagesAUDIT MCQs-Arens, Elder, Beasley - FinalLeigh PilapilNo ratings yet

- 1 Which of The Following Statements About Debt Is IncorrectDocument2 pages1 Which of The Following Statements About Debt Is IncorrectAmit PandeyNo ratings yet

- Jpia QuizbowlDocument9 pagesJpia Quizbowljenylyn acostaNo ratings yet

- Reviewer1 PDFDocument4 pagesReviewer1 PDFspur iousNo ratings yet

- Notes Mcq's-Jaiib BankingDocument7 pagesNotes Mcq's-Jaiib BankingNikhil MalhotraNo ratings yet

- 14 Mar 7 PMDocument17 pages14 Mar 7 PMJeeshmas BuffetNo ratings yet

- O Paper: EconomicsDocument6 pagesO Paper: EconomicsShivam RastogiNo ratings yet

- Problem 1-8 Multiple Choice (IAA)Document2 pagesProblem 1-8 Multiple Choice (IAA)jayNo ratings yet

- Quizlet 1Document38 pagesQuizlet 1calliemozartNo ratings yet

- Which of The Following Should Not Be Considered CashDocument5 pagesWhich of The Following Should Not Be Considered CashErica FlorentinoNo ratings yet

- Financial Accounting Review Pre-Board ExaminationDocument7 pagesFinancial Accounting Review Pre-Board ExaminationAnonymous 2Qp0oYNNo ratings yet

- JAIIB Principles of Banking MCQ MOD BDocument4 pagesJAIIB Principles of Banking MCQ MOD BChandru Mba100% (1)

- Question Paper - Laob - 2021Document5 pagesQuestion Paper - Laob - 2021Raj HansNo ratings yet

- ACC106 P2 Q2 Set A KDocument2 pagesACC106 P2 Q2 Set A KShane QuintoNo ratings yet

- Quiz Chapter 4 - Chapter 8Document11 pagesQuiz Chapter 4 - Chapter 8Fäb RiceNo ratings yet

- MCQ - 2022Document58 pagesMCQ - 2022Master Mind100% (1)

- Quiz in Intacc 1 & 2 (Finals)Document1 pageQuiz in Intacc 1 & 2 (Finals)Sandra100% (1)

- Substantive Tests 1 Copy - CompressDocument11 pagesSubstantive Tests 1 Copy - Compressmariakate LeeNo ratings yet

- XII Banking Mid Term Paper 2021-2022 (MID TERM)Document2 pagesXII Banking Mid Term Paper 2021-2022 (MID TERM)Aamir KhanNo ratings yet

- FARDocument7 pagesFARRosemarie MoinaNo ratings yet

- Banking Law and Practice - McqsDocument38 pagesBanking Law and Practice - McqsChris Shean100% (1)

- BFS QuestionsDocument4 pagesBFS QuestionstprithiruNo ratings yet

- 1) A Bank Accepts A Deposit From A Corporate House.: B) Mortgage of The TractorDocument17 pages1) A Bank Accepts A Deposit From A Corporate House.: B) Mortgage of The TractoramitatforeNo ratings yet

- Make Money with Condominiums and TownhousesFrom EverandMake Money with Condominiums and TownhousesRating: 4 out of 5 stars4/5 (1)

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- UCBL Credit Products FTC 2018Document32 pagesUCBL Credit Products FTC 2018Jubaida Alam 203-22-694No ratings yet

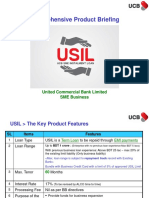

- Comprehensive Product Briefing: United Commercial Bank Limited SME BusinessDocument35 pagesComprehensive Product Briefing: United Commercial Bank Limited SME BusinessJubaida Alam 203-22-694No ratings yet

- Updated SOC - 19 Jan 2020Document13 pagesUpdated SOC - 19 Jan 2020Jubaida Alam 203-22-694No ratings yet

- TD RD EncashmentDocument14 pagesTD RD EncashmentJubaida Alam 203-22-694No ratings yet

- Currently Circulating Notes Value Dimensions Thread Description Date of Remarks Main ColorsDocument1 pageCurrently Circulating Notes Value Dimensions Thread Description Date of Remarks Main ColorsJubaida Alam 203-22-694No ratings yet

- Qus 02 PDFDocument4 pagesQus 02 PDFJubaida Alam 203-22-694No ratings yet

- OVERVIEWDocument2 pagesOVERVIEWnganNo ratings yet

- Healthymagination at Ge Healthcare Systems PDF FreeDocument5 pagesHealthymagination at Ge Healthcare Systems PDF FreeDimas PurbowoNo ratings yet

- Brand Study & Marketing Plan Preparation: AdidasDocument41 pagesBrand Study & Marketing Plan Preparation: AdidasSachin Attri100% (1)

- Glory Mpcs LTDDocument1 pageGlory Mpcs LTDkartik DebnathNo ratings yet

- Cad, Cam, Virtual Reality TechnologyDocument1 pageCad, Cam, Virtual Reality TechnologyIrmawatiNo ratings yet

- Unit 9 - Small BusinessDocument5 pagesUnit 9 - Small BusinessRosemary PaulNo ratings yet

- Clara Lorenza SaraswatiDocument192 pagesClara Lorenza SaraswatiSeptian Jefry Cahyo NugrohoNo ratings yet

- Invoice Payment RecordDocument155 pagesInvoice Payment RecordEvo HarmoniNo ratings yet

- 5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedDocument5 pages5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedKiara Marie P. LAGUDANo ratings yet

- Internship Report Chap 2Document11 pagesInternship Report Chap 2Faizan MalikNo ratings yet

- Accountant Services - Oceanx-CompressedDocument20 pagesAccountant Services - Oceanx-Compressedطراد الفنديNo ratings yet

- Writing Skills CBSE and ICSEDocument35 pagesWriting Skills CBSE and ICSEAbhishek100% (1)

- Chapter 3Document17 pagesChapter 3akash GoswamiNo ratings yet

- Accounting ConceptsDocument16 pagesAccounting Conceptsumerceo100% (1)

- Analysing Sample Production Processes in The Apparel Industry and A Model ProposalDocument7 pagesAnalysing Sample Production Processes in The Apparel Industry and A Model ProposalFahim 500No ratings yet

- HR TasksDocument34 pagesHR TasksSowjanya ReddyNo ratings yet

- Sap Ase Hadr Users Guide enDocument546 pagesSap Ase Hadr Users Guide enManjunathNo ratings yet

- 9 - Joint Products and by Products - By-ProductDocument3 pages9 - Joint Products and by Products - By-ProductChris Aruh BorsalinaNo ratings yet

- STC Packet Generator-Analyzer Base Package DatasheetDocument4 pagesSTC Packet Generator-Analyzer Base Package Datasheet김운영No ratings yet

- Zimbabwe Tax SystemDocument396 pagesZimbabwe Tax SystemEugenie KupembonaNo ratings yet

- T04 Overheads - STDDocument18 pagesT04 Overheads - STDkhairul sbrNo ratings yet

- Call Center LearnerDocument156 pagesCall Center LearnerMauricio SolorzanoNo ratings yet

- Assessment Paper and Instructions To CandidatesDocument3 pagesAssessment Paper and Instructions To CandidatesJohn DoeNo ratings yet

- RWJ Chapter 5 NPV and Other Investment RulesDocument55 pagesRWJ Chapter 5 NPV and Other Investment RulesMinh Châu Tạ ThịNo ratings yet

- Cooperativism As A Way of LifeDocument48 pagesCooperativism As A Way of LifeZebulun DocallasNo ratings yet

- Placementdata OthersDocument48 pagesPlacementdata OthersmegaspiceNo ratings yet

- Product and Service MarketingDocument4 pagesProduct and Service MarketingShoaib SharifNo ratings yet

- A Desi Multinational A Case Study of HinDocument12 pagesA Desi Multinational A Case Study of HinSaradha NatarajanNo ratings yet