Professional Documents

Culture Documents

Banking Paper

Uploaded by

aahmed4590 ratings0% found this document useful (0 votes)

10 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views3 pagesBanking Paper

Uploaded by

aahmed459Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Banking

2nd Year Commerce

Section “A” Multiple Choice Questions (MCQs)

Q1. Choose the correct answer for each from the given options.

1. A notice must be served in case of dishonor of:

a) Promissory note

b) Cross cheque

c) Bill of exchange

d) Cheque

2. When an endorser signs his or her name only on the instrument then this is known as:

a) Restricted Endorsement

b) Conditional Endorsement

c) Blank Endorsement

d) Special endorsement

3. When two parallel transverse lines are put across the cheque with or without “& Co”

between them, these parallel lines are called:

a) Special crossing

b) Not negotiable crossing

c) Plain crossing

d) All of these

4. Which of the following is not the principle of employment of bank funds:

a) Liquidity

b) Safety

c) Instability

d) Profitability

5. SBP was established on :

a) 2nd September 1948

b) 1st July 1948

c) 8th November 1947

d) 1st July 1949

6. Bank acts as the custodian of its customers’:

a) Salaries

b) Property

c) Valuables

d) Jewelry

7. Bank overdraft is allowed by bank for:

a) A fixed limit

b) Unlimited time

c) A certain limit

d) All of the above

8. Which of the following is not a credit instrument:

a) Promissory note

b) Cheque

c) Shares

d) Bill of exchange

9. Current account holder can withdraw his money from the bank:

a) After one year

b) During any banking hours

c) After every thirty days

d) All of these

10. The person who writes the cheque is known as:

a) Creditor

b) Drawee

c) Drawer

d) None of these

11. The party to whom the bill is endorsed is known as:

a) Borrower

b) Payee

c) Endorser

d) Endorsee

12. The Letter of credit (L/C) states:

a) The purpose of the bill

b) The amount

c) Period

d) All of the above

13. The foreign Bank Draft is always payable on:

a) The bank’s counter

b) Demand

c) After one week of its issue

d) Specified date

14. The state of having assets or investments that can easily be converted into cash without

incurring substantial cost is called:

a) Profitability

b) Diversity of risk

c) Liquidity

d) Prudence

15. Exchange pegging refers to:

a) Keep up exchange rate

b) Keep up budgetary deficit

c) Keep up budgetary surplus

d) None of the above

16. Open market operation refers to

a) Marketing activities

b) Buying and selling government securities

c) Receiving deposits from markets

d) Selling treasury bills

Section “B” Short Answer Questions

Attempt any seven questions from this section:

Q2.

i. Discuss the primary functions of Commercial Bank.

ii. Name the different types of Bank Accounts. Explain any two of them?

iii. Distinguish between promissory note and a cheque.

iv. Discuss various types of endorsement.

v. Under what circumstances a cheque is dishonored by a bank?

vi. Explain the clearing house function of a central bank.

vii. Explain the advantages of E- Banking.

viii. What is meant by credit creation?

ix. Explain purchasing power parity theory.

x. Distinguish between balance of trade and balance of payment.

Section “C” Detailed Answer Questions

Attempt any three questions from this section:

Q3.

i. Discuss in detail the functions of State Bank of Pakistan.

ii. What is exchange rate and how is it determined? Explain the factors that affect the

rate of exchange?

iii. Explain the profitable and non profitable uses of bank funds.

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Sample 12Document96 pagesSample 12sivakumarNo ratings yet

- CTS C# DumbsDocument23 pagesCTS C# DumbsTuhin Guha RoyNo ratings yet

- Monday 3 June 2019: EconomicsDocument24 pagesMonday 3 June 2019: EconomicsNairit100% (1)

- The Evolution of Philippine Peso Throughout The YearsDocument19 pagesThe Evolution of Philippine Peso Throughout The YearsArjay JacobNo ratings yet

- Ni Act MCQDocument7 pagesNi Act MCQParthNo ratings yet

- 306 FIn Financial System of India Markets & ServicesDocument6 pages306 FIn Financial System of India Markets & ServicesNikhil BhaleraoNo ratings yet

- The Gift of The Magi-Full TextDocument6 pagesThe Gift of The Magi-Full TextJaviNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument62 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSarath KumarNo ratings yet

- Process of RemittanceDocument28 pagesProcess of Remittancethehedonist33% (3)

- JaiibprinciplesbankingmodulesabquestionsDocument59 pagesJaiibprinciplesbankingmodulesabquestionssanjaykv98100% (1)

- Bitcoin Alternative InvestmentDocument29 pagesBitcoin Alternative InvestmentForkLogNo ratings yet

- Presentation Usdinr - FinalDocument45 pagesPresentation Usdinr - FinalBhavin Karia100% (1)

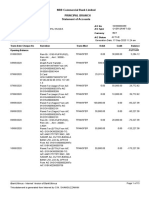

- NRB Commercial Bank Limited Principal Branch Statement of AccountsDocument15 pagesNRB Commercial Bank Limited Principal Branch Statement of AccountsS.M. Shamsuzzaman SalimNo ratings yet

- NFT Marketplace Potential and Its Expected GrowthDocument5 pagesNFT Marketplace Potential and Its Expected GrowthXANALIA100% (1)

- Certification Course in Foreign ExchangeDocument16 pagesCertification Course in Foreign ExchangeVishav Mahajan100% (6)

- International Trade Multiple Choice QuestionsDocument24 pagesInternational Trade Multiple Choice QuestionsMarvin DevannyNo ratings yet

- MCQ - 2022Document58 pagesMCQ - 2022Master Mind100% (1)

- Banking_question_bank(NME)Document11 pagesBanking_question_bank(NME)aswinsai615No ratings yet

- Banking Theory Law and PracticeDocument4 pagesBanking Theory Law and Practicejesimayasminj131No ratings yet

- Jaiib I 50q-PrinciplesDocument33 pagesJaiib I 50q-PrinciplessharmilaNo ratings yet

- Mid Term Examination for Banking StudiesDocument2 pagesMid Term Examination for Banking StudiesAamir KhanNo ratings yet

- New Syllabus - Examiners ReportDocument70 pagesNew Syllabus - Examiners ReportPrecious Onyeka OkoyeNo ratings yet

- 1) A Bank Accepts A Deposit From A Corporate House.: B) Mortgage of The TractorDocument17 pages1) A Bank Accepts A Deposit From A Corporate House.: B) Mortgage of The TractoramitatforeNo ratings yet

- Basics of Banking Question BankDocument54 pagesBasics of Banking Question BankRashmi Ranjana100% (1)

- Commercial Banking MCQsDocument8 pagesCommercial Banking MCQsaahmed459No ratings yet

- Dra New QuestionDocument8 pagesDra New QuestionHarsh PatelNo ratings yet

- Institute For Technology & Management: Banking Services & Operations Question PaperDocument5 pagesInstitute For Technology & Management: Banking Services & Operations Question PaperKunal ChaudhryNo ratings yet

- BFS QuestionsDocument4 pagesBFS QuestionstprithiruNo ratings yet

- Notes Mcq's-Jaiib BankingDocument7 pagesNotes Mcq's-Jaiib BankingNikhil MalhotraNo ratings yet

- Financial Awareness Questions Fro oNgCDocument6 pagesFinancial Awareness Questions Fro oNgCFreudestein UditNo ratings yet

- BANKING LAW AND PRACTICE MCQsDocument38 pagesBANKING LAW AND PRACTICE MCQsChris Shean100% (1)

- Jaiib mcq2 Nov08Document51 pagesJaiib mcq2 Nov08Dipti Jain100% (2)

- Banking and Insurance Part2Document3 pagesBanking and Insurance Part2Souvik JEE 2024No ratings yet

- GB MaterialsDocument21 pagesGB Materialsuttamdas79No ratings yet

- Part I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)Document5 pagesPart I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)solomonaauNo ratings yet

- Banking exam multiple choice questionsDocument5 pagesBanking exam multiple choice questionssolomonaauNo ratings yet

- Pak Oasis 2nd Year Banking Multiple Choice QuestionsDocument2 pagesPak Oasis 2nd Year Banking Multiple Choice QuestionsUmar MughalNo ratings yet

- General Banking (Summarized)Document15 pagesGeneral Banking (Summarized)uttamdas79100% (1)

- Digital Banking Exam QuestionsDocument2 pagesDigital Banking Exam QuestionsDr. R. SankarganeshNo ratings yet

- Material For PracticeDocument8 pagesMaterial For PracticeJayaKhemani100% (1)

- Part I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)Document5 pagesPart I: Multiple Choices: Choose The Best Answer From The Given Alternatives. (1.5 26 39 PTS.)solomonaauNo ratings yet

- BFM-C Treasury Management NotesDocument10 pagesBFM-C Treasury Management NotesMuralidhar Goli100% (1)

- Quick Revision (M&B PDFDocument4 pagesQuick Revision (M&B PDFTrijal SehgalNo ratings yet

- JAIIB Principles of Banking MCQ MOD BDocument4 pagesJAIIB Principles of Banking MCQ MOD BChandru Mba100% (1)

- 9 MCQ On Third Party Products With Ans.Document4 pages9 MCQ On Third Party Products With Ans.Nitin MalikNo ratings yet

- Banking Awareness Quiz - Letter of CreditDocument5 pagesBanking Awareness Quiz - Letter of CreditPRIYA RANANo ratings yet

- PPB 200 Most Important MCQsDocument46 pagesPPB 200 Most Important MCQs20uch207No ratings yet

- Model Questions - Jaiib Principles of Banking - Module A & BDocument10 pagesModel Questions - Jaiib Principles of Banking - Module A & Bapi-3808761No ratings yet

- Exam Code 1 ObDocument4 pagesExam Code 1 ObHuỳnh Lê Yến VyNo ratings yet

- NotesDocument1,164 pagesNotesV HariNo ratings yet

- MCQ Review 2022 AnswerDocument14 pagesMCQ Review 2022 AnswerNhư Ý NguyễnNo ratings yet

- Finance 18UCF102-FINANCIAL-SERVICESDocument24 pagesFinance 18UCF102-FINANCIAL-SERVICESAvinash GurjarNo ratings yet

- Mock MCQ Test on Financial Markets and Institutions (FMIDocument15 pagesMock MCQ Test on Financial Markets and Institutions (FMIDragon BankNo ratings yet

- Corporate Banking MCQs and True FalseDocument5 pagesCorporate Banking MCQs and True FalseShreya KaushalNo ratings yet

- JaiibDocument19 pagesJaiibiswarya_nNo ratings yet

- Banking and Finance 3 (Chapter - Negotiable Instrument Act 1881) Solved MCQs (Set-1)Document6 pagesBanking and Finance 3 (Chapter - Negotiable Instrument Act 1881) Solved MCQs (Set-1)Mahendra SinghNo ratings yet

- Banking 1 21 McqsDocument8 pagesBanking 1 21 McqslakshminrshNo ratings yet

- BalagangaDocument71 pagesBalagangaSrinath BhattacherjeeNo ratings yet

- Principles and Practices of Banking - JAIIBDocument19 pagesPrinciples and Practices of Banking - JAIIBNeeti Vinay SinghNo ratings yet

- MCQ Question: 5 Marks (5 X 1 Mark) : Answer Any 5 (Five) Short Questions: 15 Marks (5 x3 Marks)Document1 pageMCQ Question: 5 Marks (5 X 1 Mark) : Answer Any 5 (Five) Short Questions: 15 Marks (5 x3 Marks)Jubaida Alam 203-22-694No ratings yet

- Midterm Exam PDFDocument4 pagesMidterm Exam PDFAleandro NierreNo ratings yet

- IFS End Term 2015Document6 pagesIFS End Term 2015SharmaNo ratings yet

- Jaiib Questions and Model Question PaperDocument52 pagesJaiib Questions and Model Question Paperவன்னியராஜாNo ratings yet

- POC PaperDocument3 pagesPOC Paperaahmed459No ratings yet

- CHP 11 Worksheet VIIIDocument2 pagesCHP 11 Worksheet VIIIaahmed459No ratings yet

- CHP 9 Worksheet VIIIDocument2 pagesCHP 9 Worksheet VIIIaahmed459No ratings yet

- Use of Have and Have GotDocument6 pagesUse of Have and Have Gotaahmed459No ratings yet

- DE 1, 2 & 3 (Introduction, History and Income and Growth)Document42 pagesDE 1, 2 & 3 (Introduction, History and Income and Growth)aahmed459No ratings yet

- Time Table Day 1 PDFDocument1 pageTime Table Day 1 PDFaahmed459No ratings yet

- Brann Robinson Crusoe V1N1 PDFDocument22 pagesBrann Robinson Crusoe V1N1 PDFaahmed459No ratings yet

- Notification Credit Bureaus Act 2015Document1 pageNotification Credit Bureaus Act 2015aahmed459No ratings yet

- Finish The Story - The Birthday PartyDocument1 pageFinish The Story - The Birthday Partymadeinengland2No ratings yet

- Figurativelanguageassessment 2-5Document4 pagesFigurativelanguageassessment 2-5Kooking JubiloNo ratings yet

- Subject Verb AgreementDocument4 pagesSubject Verb Agreementaahmed459No ratings yet

- Short Answer Study Guide Questions - HamletDocument1 pageShort Answer Study Guide Questions - Hamletaahmed459No ratings yet

- Subject Verb AgreementDocument4 pagesSubject Verb Agreementaahmed459No ratings yet

- IRS FAQs GuideDocument15 pagesIRS FAQs GuideNabeel SarfarazNo ratings yet

- Gross Domestic Product of Pakistan (At Constant Basic Prices of 2005-06)Document2 pagesGross Domestic Product of Pakistan (At Constant Basic Prices of 2005-06)M Jahanzaib KhaliqNo ratings yet

- Intensive Paragraphs PDFDocument18 pagesIntensive Paragraphs PDFaahmed459No ratings yet

- Subject Verb Agreement PhrasesDocument2 pagesSubject Verb Agreement Phrasesaahmed4590% (1)

- Methods of Waste Management: A Concise ComparisonDocument4 pagesMethods of Waste Management: A Concise ComparisonfranciscogarridoNo ratings yet

- Other Side of Truth Teaching Sequence Carnegie Greenaway EditionDocument8 pagesOther Side of Truth Teaching Sequence Carnegie Greenaway Editionaahmed459No ratings yet

- Teaching Guide 6 PDFDocument95 pagesTeaching Guide 6 PDFaahmed459No ratings yet

- Accounting For Business CombinationsDocument32 pagesAccounting For Business CombinationsAmie Jane MirandaNo ratings yet

- New Scholorship AnchoringDocument17 pagesNew Scholorship AnchoringSANYAM VATSNo ratings yet

- RMK Maths Lesson Plan for Class 3Document10 pagesRMK Maths Lesson Plan for Class 3SaravananNo ratings yet

- Math 3: Odd and Even NumbersDocument16 pagesMath 3: Odd and Even NumbersZL TenorioNo ratings yet

- April 9-15 2020 PDFDocument24 pagesApril 9-15 2020 PDFBlessing DickmoreNo ratings yet

- LiquidityDocument9 pagesLiquiditynewalbertblkyanNo ratings yet

- Country, Capital and Currency: Part - 1Document3 pagesCountry, Capital and Currency: Part - 1ADWAIT SHINDENo ratings yet

- Major Stock Exchanges in India - NSE, BSEDocument2 pagesMajor Stock Exchanges in India - NSE, BSESaurabh YadavNo ratings yet

- UntitledDocument9 pagesUntitledRexi Chynna Maning - AlcalaNo ratings yet

- Reports BIP ENG 002 ACRREVAL 00133988Document21 pagesReports BIP ENG 002 ACRREVAL 00133988kalkidan kassahunNo ratings yet

- Foreign Currency Transactions and Hedging RiskDocument53 pagesForeign Currency Transactions and Hedging RiskTam29100% (10)

- 85 Filipino Pipe v. NAWASADocument1 page85 Filipino Pipe v. NAWASAFrancesca Isabel MontenegroNo ratings yet

- IMF: International Monetary Fund ExplainedDocument25 pagesIMF: International Monetary Fund ExplainedSantosh SharmaNo ratings yet

- Why XRP's Institutional Value and Use Cases Matter More than PriceDocument2 pagesWhy XRP's Institutional Value and Use Cases Matter More than PriceAlex HedarNo ratings yet

- Master Directions For ReportingDocument145 pagesMaster Directions For ReportingIshani MukherjeeNo ratings yet

- NFT 1Document12 pagesNFT 1Samridhi GuptaNo ratings yet

- Foreign Currency Transactions2021 3Document6 pagesForeign Currency Transactions2021 3Sheira Mae GuzmanNo ratings yet

- LBC Express - SEL, Inc. Payslip For The Month of June 2019 Period 16 Jun 2019 - 30 Jun 2019Document1 pageLBC Express - SEL, Inc. Payslip For The Month of June 2019 Period 16 Jun 2019 - 30 Jun 2019Kris marcoNo ratings yet

- Banking, Economics & Finance Awareness Notes 1 - GKmojoDocument18 pagesBanking, Economics & Finance Awareness Notes 1 - GKmojoMOHAMMAD NADEEMNo ratings yet

- (Frederic - S. - Mishkin) - Economics - of - Moneyy, - Banking - and - Financial MarketsDocument22 pages(Frederic - S. - Mishkin) - Economics - of - Moneyy, - Banking - and - Financial MarketsNouran MohamedNo ratings yet

- U1 Week 4 The Monster in The Mountain: Exchange MoneyDocument3 pagesU1 Week 4 The Monster in The Mountain: Exchange MoneyStella YINNo ratings yet