Professional Documents

Culture Documents

Pak Oasis Educational System: Multiple Choice Questions

Uploaded by

Umar Mughal0 ratings0% found this document useful (0 votes)

13 views2 pagesmy presentation

Original Title

2nd year paper 1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmy presentation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesPak Oasis Educational System: Multiple Choice Questions

Uploaded by

Umar Mughalmy presentation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Pak Oasis Educational System

Multiple Choice Questions

Class: 2nd Year Paper: Banking Date: 19/06/2021

Q: Attempt All Questions

1. Open market operation is a method of:

a. Exchange rate b. Balance or trade c. Issuing note d. Credit control

2. Always payable on demand is:

a. Note payable b. Rent payable c. Bill payable d. Cheque

3. State Bank of Pakistan was established on:

a. 1st Aug 1948 b. 1st July 1948 c. 14th Aug 1947 d. 25th Dec 1947

4. Central bank is lender of last resort to:

a. Public its employees b. State Bank c. Commercial Bank d. None

5. Schedule banks are registered with:

a. State Bank b. National Bank c. Commercial Bank d. None

6. The credit instruments which are transferable from one person to another are:

a. Semi negotiable b. Non-negotiable c. negotiable instruments d. None

7. Commercials bank grant overdraft facility to:

a. Fixed account holders b. Saving account holders c. Current account holders d. None

8. No interest is given by the bank on:

a. Term deposit account b. PLS account c. Current account d. None

9. The purchasing power parity theory was presented by:

a. Gustar Cassel b. J.S Mill c. David Ricardo d. Alfred Marshal

10. The letter of credit is a/an:

a. Request b. Order c. Promise d. Agreement

11. Call rate are charged on these kinds of loans:

a. Term loans b. Loans of demand c. Short term loan d. Long term loan

12. This is not a credit instrument:

a. Cheque b. Bill of Exchange c. Postal order d. Promissory note

13. Bank can pay this cheque to anyone:

a. Cross cheque b. Bearer Cheque c. Stale Cheque d. Order cheque

14. A bill of exchange is:

a. Unconditional order b. Unconditional promise c. Conditional order d. Conditional promise

15. Balance trade includes:

a. Invisible import and export items b. Visible import and export items

c. Bothe visible and invisible import and export d. None of these

16. The objective of clearing house is to:

a. Clear transactions of members bank b. Control Money c. Clear market rate d. None

17. These are not ancestors of early bank:

a. Gold Smith b. Industrialists c. Money lenders d. Merchants

18. Monopoly of currency note issuance is a characteristic of the:

a. Federal Government b. Central Bank c. Commercial Bank d. Provincial Government

19. Bank does not pay interest on this account:

a. Saving b. Current c. Profit and loss d. Demand

20. The bank which comes into existence under the legislative assembly is called:

a. Statutory Bank b. Private bank c. Public Bank d. Partnership Bank

21. The difference of total import and total exports of country is:

a. Import trade b. Export trade c. Balance trade d. Balance of payment

22. Overdraft facility is provided in this account only:

a. Saving b. Fixed deposit c. current d. Profit and loss

23. This is not include in credit instruments:

a. Bill of exchange b. Promissory Note c. Cheque d. Prize Bond

24. A notice must be served in case of dishonoring of:

a. Bill of exchange b. Cheque c. Promissory Note d. Prize Bond

25. Crossing a cheque which contains the name of particular bank:

a. Regular crossing b. Irregular crossing c. General Crossing d. Special Crossing

26. The central bank advances loan to commercial banks:

a. By clearing house b. By Re-discounting Bill of exchange c. By Credit control d. Against cash

27. This is not a quantitative method in the credit control:

a. Open market b. Legislation c. Reserve Ratio d. Rationing of credit

28. Bank deals in:

a. Money b. Money and Credit c. Gold and silver d. Credit

29. All commercial bank keeps their minimum required cash reserve with the:

a. Stock exchange b. Any other bank c. Mortgage bank d. Central bank

30. Bank acts as the custodian of its customer’s:

a. Valuables b. Business c. Cash d. None

31. Exchange bank deals in:

a. Gold and Bullion b. Foreign exchange c. Negotiable instruments d. None

32. E- Banking refers to:

a. Local Banking b. Banking through electronic means c. local banks d. None

33. Central bank rediscounts bill of commercial banks at:

a. Commission b. Bank rate c. Profit rate d. Exchange rate

34. The first central bank of the world is:

a. Bank of Scotland b. Bank of America c. Bank of Venice d. Bank of England

35. The price at which currency of one country is sent to another is:

a. Demand draft b. Transfer money c. Rate of exchange d. Foreign exchange

36. Bank rate determination is the function of:

a. Commercial Bank b. The Federal Government c. Provincial Government d. Central Bank

37. Alternation in cheque must be signed by the:

a. Drawer b. Endorser c. Payee d. Bank Manager

38. For deferred payments it is used:

a. Cash b. Simple agreement c. Credit instrument d. None

You might also like

- Mastering Credit - The Ultimate DIY Credit Repair GuideFrom EverandMastering Credit - The Ultimate DIY Credit Repair GuideRating: 1 out of 5 stars1/5 (1)

- Banking 1 21 McqsDocument8 pagesBanking 1 21 McqslakshminrshNo ratings yet

- 3Document8 pages3ABDUL RAHMANNo ratings yet

- 500 Question BankDocument48 pages500 Question BankMST. MAHBUBA ATIKA TUNNUR100% (1)

- Financial Awareness Questions Fro oNgCDocument6 pagesFinancial Awareness Questions Fro oNgCFreudestein UditNo ratings yet

- More Than 5% But Not More Than 15%Document16 pagesMore Than 5% But Not More Than 15%Mubashir RanaNo ratings yet

- Multiple Choice and AnswerDocument63 pagesMultiple Choice and AnswerJubaida Alam 203-22-694100% (2)

- Commercial Banking MCQsDocument8 pagesCommercial Banking MCQsaahmed459No ratings yet

- Banking PaperDocument3 pagesBanking Paperaahmed459No ratings yet

- 2020 Appraiser's Exam Mock Exam Set GDocument5 pages2020 Appraiser's Exam Mock Exam Set GMarkein Dael VirtudazoNo ratings yet

- Acctg 201a Final Exam Questions 1st Sem 20-21Document7 pagesAcctg 201a Final Exam Questions 1st Sem 20-21YameteKudasaiNo ratings yet

- Cash and Cash Equivalent TheoryDocument1 pageCash and Cash Equivalent TheoryExcelsia Grace A. ParreñoNo ratings yet

- Wise Practice TestDocument9 pagesWise Practice TestJosh SimonNo ratings yet

- XII Banking Mid Term Paper 2021-2022 (MID TERM)Document2 pagesXII Banking Mid Term Paper 2021-2022 (MID TERM)Aamir KhanNo ratings yet

- Principles and Practices of Banking - JAIIBDocument19 pagesPrinciples and Practices of Banking - JAIIBatul mishraNo ratings yet

- Exam Code 1 ObDocument4 pagesExam Code 1 ObHuỳnh Lê Yến VyNo ratings yet

- 1st SummativeDocument2 pages1st Summativeje-ann montejoNo ratings yet

- Test BankDocument8 pagesTest BankĐào Quỳnh AnhNo ratings yet

- Finance 18UCF102-FINANCIAL-SERVICESDocument24 pagesFinance 18UCF102-FINANCIAL-SERVICESAvinash GurjarNo ratings yet

- Basics of Banking Question BankDocument54 pagesBasics of Banking Question BankRashmi Ranjana100% (1)

- GB MaterialsDocument21 pagesGB Materialsuttamdas79No ratings yet

- General Banking (Summarized)Document15 pagesGeneral Banking (Summarized)uttamdas79100% (1)

- Exam Questions (91%)Document13 pagesExam Questions (91%)Stuti SinghalNo ratings yet

- Real Estate Finance and Economics - Quiz - 10feb2023 - PrintedDocument8 pagesReal Estate Finance and Economics - Quiz - 10feb2023 - Printedivy jane estrella100% (2)

- Test Bank FMT-84-97Document14 pagesTest Bank FMT-84-97Đỗ Minh HuyềnNo ratings yet

- Banking and Financial InstitutionsDocument6 pagesBanking and Financial InstitutionsAriel ManaloNo ratings yet

- Level Three Theory (Knowledge) ChoiceDocument17 pagesLevel Three Theory (Knowledge) ChoiceYaa Rabbii100% (1)

- MCQ - 2022Document58 pagesMCQ - 2022Master Mind100% (1)

- Chapter 01 - Test Bank: Multiple Choice QuestionsDocument48 pagesChapter 01 - Test Bank: Multiple Choice QuestionsW11No ratings yet

- Chapter 02 - Commercial BanksDocument45 pagesChapter 02 - Commercial BanksKhang Tran DuyNo ratings yet

- Chapter 10: Banking and The Management of Financial InstitutionsDocument25 pagesChapter 10: Banking and The Management of Financial InstitutionsThi MinhNo ratings yet

- DocDocument16 pagesDocNorman Delirio100% (1)

- DocxDocument48 pagesDocxLorraine Mae Robrido100% (1)

- Bank L0 DumpDocument503 pagesBank L0 Dumpdhootankur60% (5)

- CAIIB-BFM Practice Que Set-1Document5 pagesCAIIB-BFM Practice Que Set-1Surya PillaNo ratings yet

- Summative Test in Fabm 2 Name: - Grade/Section: - ScoreDocument5 pagesSummative Test in Fabm 2 Name: - Grade/Section: - ScorebethNo ratings yet

- Dra New QuestionDocument8 pagesDra New QuestionHarsh PatelNo ratings yet

- Financial Market1Document21 pagesFinancial Market1pvervint0121No ratings yet

- Sample 12Document96 pagesSample 12sivakumarNo ratings yet

- Principles and Practices of Banking - JAIIBDocument19 pagesPrinciples and Practices of Banking - JAIIBNeeti Vinay SinghNo ratings yet

- Mock Test Papers On Financial Awareness Including Economic and Monetary ScenarioDocument4 pagesMock Test Papers On Financial Awareness Including Economic and Monetary ScenarioSuvasish DasguptaNo ratings yet

- Multinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsDocument31 pagesMultinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsPiyush ChaturvediNo ratings yet

- Multinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsDocument31 pagesMultinational Financial Management: Alan Shapiro 7 Edition J.Wiley & SonsSanjay DomdiyaNo ratings yet

- MCQs Chapter 10 Banking and The Management of Financial InstitutionsDocument25 pagesMCQs Chapter 10 Banking and The Management of Financial Institutionsphamhongphat2014No ratings yet

- Level III Theory AssessmentDocument4 pagesLevel III Theory AssessmentElias TesfayeNo ratings yet

- CH 18Document31 pagesCH 18Shifat SardarNo ratings yet

- MF0007 Treasury Management MQPDocument11 pagesMF0007 Treasury Management MQPNikhil Rana0% (1)

- 4Document24 pages4Kevin HaoNo ratings yet

- Class XI AccountancyDocument6 pagesClass XI AccountancyPRASHANT RANJANNo ratings yet

- Multiple Choices PracticeDocument42 pagesMultiple Choices PracticetrucNo ratings yet

- Level Three Theory (Knowledge) Choice: C. Journalizing - Posting - Trial Balance - Financial StatementsDocument17 pagesLevel Three Theory (Knowledge) Choice: C. Journalizing - Posting - Trial Balance - Financial Statementseferem0% (1)

- Vac Exam QPDocument2 pagesVac Exam QPDr. R. SankarganeshNo ratings yet

- CITF Specimen 1Document46 pagesCITF Specimen 1nguyentumkhanhNo ratings yet

- Test Finance and EconDocument4 pagesTest Finance and EconJay ElizanNo ratings yet

- Choice 1-1Document17 pagesChoice 1-1Dagnachew WeldegebrielNo ratings yet

- Theory (1) 1Document18 pagesTheory (1) 1Debela RegasaNo ratings yet

- Docs in International TradeDocument30 pagesDocs in International TradeYash MittalNo ratings yet

- Cash and Cash Equi Theories and ProblemsDocument29 pagesCash and Cash Equi Theories and ProblemsIris Mnemosyne100% (5)

- Chapter 09 - Short-Term DebtDocument15 pagesChapter 09 - Short-Term DebtKhang Tran DuyNo ratings yet

- Financial Services QBDocument89 pagesFinancial Services QBVimal RajNo ratings yet

- Amityfees Pay in SlipDocument1 pageAmityfees Pay in SlipPranav JainNo ratings yet

- Hedgeye Financials FSP Slides For Nov 10 2020Document38 pagesHedgeye Financials FSP Slides For Nov 10 2020Grady SandersNo ratings yet

- Part I Debby Kauffman and Her Two Colleagues Jamie HiattDocument2 pagesPart I Debby Kauffman and Her Two Colleagues Jamie HiattAmit PandeyNo ratings yet

- Daily Trading Stance - 2010-01-11Document3 pagesDaily Trading Stance - 2010-01-11Trading FloorNo ratings yet

- Eco Project Rbi 2Document19 pagesEco Project Rbi 2tusharNo ratings yet

- 17-Banking Services ProceduresDocument37 pages17-Banking Services ProceduresjayNo ratings yet

- Ov QPR GIVBp at 5 Q8 MDocument15 pagesOv QPR GIVBp at 5 Q8 ManuranjankumarNo ratings yet

- Fiscal Policy Vs Monetary PolicyDocument2 pagesFiscal Policy Vs Monetary PolicyAkash Ray100% (1)

- Mining Valuation Financial ModelingDocument3 pagesMining Valuation Financial Modelingkanabaramit100% (1)

- Política Monetaria en Un Entorno de Dos Monedas: Banco Central de Reserva Del PerúDocument39 pagesPolítica Monetaria en Un Entorno de Dos Monedas: Banco Central de Reserva Del PerúCristian Fernando Sanabria BautistaNo ratings yet

- Accounts Assign After Plegarism With SSDocument4 pagesAccounts Assign After Plegarism With SSIt's reechaNo ratings yet

- Q1 2023 RICS UK Commercial Propety MonitorDocument14 pagesQ1 2023 RICS UK Commercial Propety Monitor344clothingNo ratings yet

- Current AccountsDocument8 pagesCurrent AccountsAnonymous fcqc0EsXHNo ratings yet

- Case Study - So What Is It WorthDocument7 pagesCase Study - So What Is It WorthJohn Aldridge Chew100% (1)

- Fin Acc Valix PDFDocument58 pagesFin Acc Valix PDFKyla Renz de LeonNo ratings yet

- Agreement On The Use of Swap Free Accounts: 1. Payments and InterestDocument2 pagesAgreement On The Use of Swap Free Accounts: 1. Payments and InterestAndar SihombingNo ratings yet

- Final Exam Engineering EconomyDocument2 pagesFinal Exam Engineering EconomyGelvie Lagos100% (2)

- World Bank General Conditions For LoansDocument32 pagesWorld Bank General Conditions For LoansMax AzulNo ratings yet

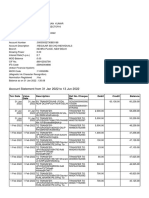

- OpTransactionHistoryUX522 02 2024Document7 pagesOpTransactionHistoryUX522 02 2024piyush882676No ratings yet

- Secretary's Certificate For Account Opening (Domestic Corporation)Document3 pagesSecretary's Certificate For Account Opening (Domestic Corporation)JACQUE ARCENALNo ratings yet

- VipszDocument1 pageVipszkumaran08112000No ratings yet

- MathDocument3 pagesMathMaRia CaroLina PollarcaNo ratings yet

- Tender Documnet ICTDocument54 pagesTender Documnet ICTMusharaf Habib100% (1)

- 349191compund Intrest Sheet-3 - CrwillDocument9 pages349191compund Intrest Sheet-3 - Crwillmadhuknl8674No ratings yet

- List of Swift MessagesDocument50 pagesList of Swift MessageslarefisoftNo ratings yet

- RBI Master CircularDocument42 pagesRBI Master CircularDeep Singh PariharNo ratings yet

- The Effect of Income and Earnings Management On Firm Value - Empirical Evidence From Indonesia PDFDocument8 pagesThe Effect of Income and Earnings Management On Firm Value - Empirical Evidence From Indonesia PDFHafiz MamailaoNo ratings yet

- Personal Finance - Simulation 2Document11 pagesPersonal Finance - Simulation 2api-256424425No ratings yet

- Working Capital Project by HILAL AHMADDocument74 pagesWorking Capital Project by HILAL AHMADLeo SaimNo ratings yet

- Short Questions FMDocument21 pagesShort Questions FMsultanrana100% (1)