Professional Documents

Culture Documents

Form Iv: Details of Tax Paid For The Year 2018-2019

Form Iv: Details of Tax Paid For The Year 2018-2019

Uploaded by

ManjunathOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form Iv: Details of Tax Paid For The Year 2018-2019

Form Iv: Details of Tax Paid For The Year 2018-2019

Uploaded by

ManjunathCopyright:

Available Formats

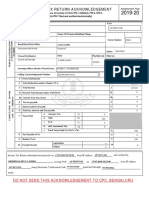

FORM IV

(See rule 8 (cc) (i))

BRUHAT BANGALORE MAHANAGARA PALIKE

SELF ASSESSMENT OF PROPERTY TAX FORM / RETURN

NOTE : IF THERE IS ANY CHANGE IN USAGE OR ADDITIONAL CONSTRUCTION FROM THE PREVIOUS YEAR THEN USE BLUE FORM V

This form can be used for full year payment of tax or payment by installment. [please read the instructions before filing the return]

PART I

1 Year of Assessment 2018-2019 P.I.D No. 66-1-150/1-2

Khata No.

Revenue Survey No.

SAS 2008-09 Application No.

2 13339973 Application No 1500039689

Have you filled a revised return for the previous year ? If yes, date of filling Application No.

Name of the Owner Shri/Smt

3 (If jointly held, mention any one name) HOLDER (M/S. J.R. GRAPHIC ARTS)

Contact Nos. Residential No 0 Office No 0 Mobile No 9845140132

4 BESCOM BWSSB BOREWELL AVAILABILITY Yes

Usage (Tick as

5 Residential Non-Residential Both Others

applicable)

ݱ

Vacant Site Red oxide or

Nature of Property Other Flooring Tiled /Sheet Apt.Complex Hutments Vacant

With Storage Cement flooring

ݱ

6 Address of the Property 150/1-2, DR M.H MARIGOWDA ROAD MADIWALA, Madiwala (66), Bangalore -560068

Ward No. (Old) 66 Name of the Ward(Old) Madiwala

Ward No. (New) 152 Name of the Ward (New) Sudduguntepalya

7 Postal Address 150/1-2, HOSUR ROAD MADIWALA, -, -, 560068

PART-II

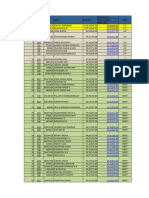

8 Details of tax paid for the year 2018-2019

a Property Tax Paid for the year 2018-2019 Rs. 183825.00

b Cess @ 24% Rs. 44118.00

c Total Property tax (a+b) Rs. 227943.00

d Rebate availed if any, (if filed before 30/04/2018) Rs. 0.00

e Total tax paid for (c-d) Rs. 227943.00

f Amount deducted for tax paid in advance,if any Rs. 0.00

g Rs.

If property tax is paid

h 1st Installment Receipt No. 18192014678 and Date 31/05/2018 Rs. 233702.00

in installments

Rs.

1/31/2020 4:07:17 PM This Document Contains total 2 pages. Page No : 1

9 Computation of property tax for the year 2018-2019

i Property Tax payable for [(as per column 8(a)] Rs. 183825.00

j Cess @ 24% of (i) Rs. 44118.00

k Total Property tax payable (i+j) Rs. 227943.00

l Rebate @ 5% of (k) (if filed before 30/04/2018) Rs. 0.00

m Total tax payable after rebate (k-l) Rs. 227943.00

n Deduct advance tax paid during 2018-2019 if any (i.e. balance amount left after adjusting for 2018-2019) Rs. 0.00

o Interest payable 2% per Month up to the date of payment Rs. 0.00

p Penalty of Rs.100/- if return is filed after 29th November Rs. 0.00

q SWM Cess if applicable Rs. 1200.00

r Arrers (if any during 2018-2019) Rs. 0.00

s Net Property tax payable for the year 2018-2019 Rs. 229143.00

Rounded off to the next higher rupee if more than 0.50 paise or a rupee lower if is less than 0.50 paise

Computation of SWM cess Details

Hotel/Kalyana

Usage of the Property Residential Buildings Commercial Buildings Industrial Buildings Total

Mantapas/Nursing Home

Plinth Area (in Sq ft) 0 0 0 0 0

Rate Per Month 0 0 0 0

SWM Cess Payable 0 0 0 0 0

I/we further certify that the details furnished above are true and correct to the best of my / our knowledge and the particulars furnished in this

form have been duly filled by me / us, and I/we understand that for false declarations there will be penal actions.

Signature of the property owner / person liable to pay property tax

Name in block letters: HOLDER (M/S. J.R. GRAPHIC ARTS)

1/31/2020 4:07:17 PM This Document Contains total 2 pages. Page No : 2

You might also like

- Biz Cafe Income StatementDocument4 pagesBiz Cafe Income StatementSatnam SinghNo ratings yet

- All India Ranking - TOT, COT & MDRT List: SL - No Zone Division Branch Agency Code Name Premium Commission ClubDocument164 pagesAll India Ranking - TOT, COT & MDRT List: SL - No Zone Division Branch Agency Code Name Premium Commission ClubManjunath100% (5)

- Allen - Agriculture and The Origins of The State in Ancient Egypt PDFDocument20 pagesAllen - Agriculture and The Origins of The State in Ancient Egypt PDFTeSoTras100% (1)

- Reiforcement Rate VARIANCEDocument64 pagesReiforcement Rate VARIANCEreddyrabadaNo ratings yet

- Greater Visakhapatnam Municipal Corporation: OriginalDocument4 pagesGreater Visakhapatnam Municipal Corporation: Originalsai prakash chalumuriNo ratings yet

- 15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.Document3 pages15.09.2023 Reg. Submission GST Difference in RA - 09 - Reg.manohar meenaNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceAshish KumarNo ratings yet

- Usha 1Document4 pagesUsha 1nawaz khanNo ratings yet

- PDF Class NoteDocument1 pagePDF Class NoteSachin KadamNo ratings yet

- 1028020192-Special NoticeDocument4 pages1028020192-Special NoticeSurya PrakashNo ratings yet

- West Mogappair, Chennai RERA Registration No:TN.29/Building/0012/2020Document1 pageWest Mogappair, Chennai RERA Registration No:TN.29/Building/0012/2020BakiarajNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Vimal Kumar PTRCDocument3 pagesVimal Kumar PTRCsapkalniraj2005No ratings yet

- Acfrogajetk9xoevi8pbteko4qjpr7vjs30ejzro Gd96xloz D Quo5vbe35thzxaacfo Qpaon308an4bg6mkm2tz5vo5n9iqh4iii9wwgjylnlfsnfh7ex0jpwbrlzigtwsgy2xvlpg8iuwyzDocument116 pagesAcfrogajetk9xoevi8pbteko4qjpr7vjs30ejzro Gd96xloz D Quo5vbe35thzxaacfo Qpaon308an4bg6mkm2tz5vo5n9iqh4iii9wwgjylnlfsnfh7ex0jpwbrlzigtwsgy2xvlpg8iuwyzAnil UniyalNo ratings yet

- Sale 39 29-03-2024Document1 pageSale 39 29-03-2024Rajat AggarwalNo ratings yet

- MAC Jan-2022 Pending InvDocument1 pageMAC Jan-2022 Pending InvSree ganapathy Facilitation servicesNo ratings yet

- Draft Audit Report XIVDocument11 pagesDraft Audit Report XIVTradingideas2456No ratings yet

- Rajamahendravaram Municipal Corporation: OriginalDocument4 pagesRajamahendravaram Municipal Corporation: OriginalAbhishek saiNo ratings yet

- Appre Atten - Invoice October-22Document15 pagesAppre Atten - Invoice October-22sidhant nayakNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerPramod Kumar GuptaNo ratings yet

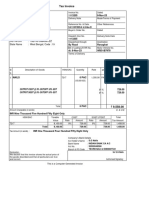

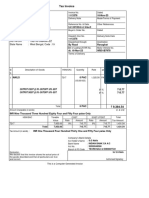

- Tax Invoice: 34 Rath Danga Road Ranaghat Gstin/Uin: 19BYRPS9845M1ZZ State Name: West Bengal, Code: 19Document1 pageTax Invoice: 34 Rath Danga Road Ranaghat Gstin/Uin: 19BYRPS9845M1ZZ State Name: West Bengal, Code: 19Online tally guideNo ratings yet

- Kalyanadurgam Municipality: OriginalDocument4 pagesKalyanadurgam Municipality: OriginalVåññür Swåmy ÂñîNo ratings yet

- Tax Invoice: 34 Rath Danga Road Ranaghat Gstin/Uin: 19BYRPS9845M1ZZ State Name: West Bengal, Code: 19Document1 pageTax Invoice: 34 Rath Danga Road Ranaghat Gstin/Uin: 19BYRPS9845M1ZZ State Name: West Bengal, Code: 19Online tally guideNo ratings yet

- 5th RA BILL FinalDocument7 pages5th RA BILL Finalalmamunmolla96No ratings yet

- GL-57 Provisional Cost SheetDocument2 pagesGL-57 Provisional Cost Sheetorangeideas7No ratings yet

- 1014017423-Special NoticeDocument4 pages1014017423-Special NoticeMohammadNo ratings yet

- Sumia To Kagua Claim O3Document2 pagesSumia To Kagua Claim O3Justin KubulNo ratings yet

- Guntur Municipal Corporation: OriginalDocument4 pagesGuntur Municipal Corporation: OriginalSubbu BudduNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- DJBBill 817764956128 PDFDocument2 pagesDJBBill 817764956128 PDFStory SEONo ratings yet

- PriceList - Shriram Liberty Square - 99acresDocument3 pagesPriceList - Shriram Liberty Square - 99acresKayjay2050No ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesshrishNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax InvoiceDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax InvoicevirendramehraNo ratings yet

- Special NoticeDocument4 pagesSpecial Noticeraghu raghuNo ratings yet

- GST Tax Invoice 2Document1 pageGST Tax Invoice 2yogende kumarNo ratings yet

- Final Bill & Its EnclosuresDocument17 pagesFinal Bill & Its EnclosuresmanikandanNo ratings yet

- GST 12 To 18Document34 pagesGST 12 To 18Rajesh ChandelNo ratings yet

- EntityDocument1 pageEntityom shanker soniNo ratings yet

- BM2308I002689002Document2 pagesBM2308I002689002Dharmendra KumarNo ratings yet

- Electricity Bill FrescoDocument1 pageElectricity Bill FrescoMohit AggarwalNo ratings yet

- Bill of Supply For Electricity: Due Date: 23-10-2018Document1 pageBill of Supply For Electricity: Due Date: 23-10-2018raj sahilNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToRomendro ThokchomNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMaheshNo ratings yet

- 2019 08 08 14 49 18 168 - 1565255958168 - XXXPD2712X - Acknowledgement PDFDocument1 page2019 08 08 14 49 18 168 - 1565255958168 - XXXPD2712X - Acknowledgement PDFMaheshNo ratings yet

- InvoicePDF C2C090823099260Document2 pagesInvoicePDF C2C090823099260Bishnu KumarNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument3 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesPiyushNo ratings yet

- Cetp ChargesDocument1 pageCetp ChargesBharat SharmaNo ratings yet

- Ra-09 Abstract SheetDocument23 pagesRa-09 Abstract SheetYash DeoreNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesAvinash GollaNo ratings yet

- RA - 23rd SMN USSHAR - R0Document91 pagesRA - 23rd SMN USSHAR - R0smn.ussharNo ratings yet

- Yadadri Bhuvanagiri - Pochampally - MPPS Danthur - 36200901402 - P200901402 - 20231109 - 000006 - Green Chalk BoardsDocument2 pagesYadadri Bhuvanagiri - Pochampally - MPPS Danthur - 36200901402 - P200901402 - 20231109 - 000006 - Green Chalk BoardsdurgaprasadNo ratings yet

- Harpreet Raikhy: Invoic EDocument1 pageHarpreet Raikhy: Invoic Edalip kumarNo ratings yet

- Congratulations! You Are On One Airtel 1349 PlanDocument11 pagesCongratulations! You Are On One Airtel 1349 PlanPrakash RajNo ratings yet

- Summary of The Bill: Disconnection Notice and Bill ForDocument2 pagesSummary of The Bill: Disconnection Notice and Bill ForPopi BhowmikNo ratings yet

- Bharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The CustomerDocument1 pageBharat Sanchar Nigam Limited: Telephone Bill/Tax Invoice Name and Address of The Customermohammed sahadNo ratings yet

- Urvisha MB SMNDocument15 pagesUrvisha MB SMNalmamunmolla96No ratings yet

- Tax Invoice: Nehatarika NehatarikaDocument1 pageTax Invoice: Nehatarika NehatarikaRuchi RaoraneNo ratings yet

- Tax Invoice: 34 Rath Danga Road Ranaghat Gstin/Uin: 19BYRPS9845M1ZZ State Name: West Bengal, Code: 19Document1 pageTax Invoice: 34 Rath Danga Road Ranaghat Gstin/Uin: 19BYRPS9845M1ZZ State Name: West Bengal, Code: 19Online tally guideNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument3 pagesMobile Services: Your Account Summary This Month'S ChargesArunNo ratings yet

- 1183000002-Special NoticeDocument4 pages1183000002-Special Noticegandiias468No ratings yet

- Emergency Amount After Due Date: 18002669944 (Tollfree) (022) - 68759400, (022) - 24012400Document2 pagesEmergency Amount After Due Date: 18002669944 (Tollfree) (022) - 68759400, (022) - 24012400sonaalimuke1680No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Electronic Cash LedgerDocument4 pagesElectronic Cash LedgerManjunathNo ratings yet

- PRMKARERA1251310AG170824000071Document1 pagePRMKARERA1251310AG170824000071ManjunathNo ratings yet

- Stanch Urban Village WebDocument6 pagesStanch Urban Village WebManjunathNo ratings yet

- G o 16Document20 pagesG o 16ManjunathNo ratings yet

- Animal Husbandry and Veterinary Services, Mandya DistrictDocument15 pagesAnimal Husbandry and Veterinary Services, Mandya DistrictManjunathNo ratings yet

- Codename Evolve BrochureDocument50 pagesCodename Evolve BrochureManjunathNo ratings yet

- BrochureDocument109 pagesBrochureManjunathNo ratings yet

- Codename Destination 4 PagerDocument4 pagesCodename Destination 4 PagerManjunathNo ratings yet

- MysoreDocument6 pagesMysoreManjunathNo ratings yet

- KM4 G1 YDGAdditional ReportDocument153 pagesKM4 G1 YDGAdditional ReportManjunathNo ratings yet

- Timetable Dec - 19Document2 pagesTimetable Dec - 19ManjunathNo ratings yet

- The OND Bonanza Contest - APC AP (Direct Code)Document18 pagesThe OND Bonanza Contest - APC AP (Direct Code)ManjunathNo ratings yet

- Only For InformationDocument8 pagesOnly For InformationManjunathNo ratings yet

- Animal Husbandry and Veterinary Services, TUMKUR DistrictDocument8 pagesAnimal Husbandry and Veterinary Services, TUMKUR DistrictManjunathNo ratings yet

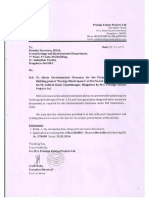

- Signature Not Verified: Digitally Signed by Sunilkumar Date: 2018.08.04 17:34:56 IST Location: BengaluruDocument1 pageSignature Not Verified: Digitally Signed by Sunilkumar Date: 2018.08.04 17:34:56 IST Location: BengaluruManjunathNo ratings yet

- October Bonanza APE Contest - APC LA & AP (Self Code)Document11 pagesOctober Bonanza APE Contest - APC LA & AP (Self Code)ManjunathNo ratings yet

- Only For InformationDocument18 pagesOnly For InformationManjunathNo ratings yet

- Only For InformationDocument20 pagesOnly For InformationManjunathNo ratings yet

- Only For InformationDocument11 pagesOnly For InformationManjunathNo ratings yet

- In The High Court of Karnataka at BengaluruDocument9 pagesIn The High Court of Karnataka at BengaluruManjunathNo ratings yet

- Resume SushmithaDocument2 pagesResume SushmithaManjunathNo ratings yet

- Commission Paid+Payable+ Bonus Paid Club SL - No Branch Agency Code Name PremiumDocument3 pagesCommission Paid+Payable+ Bonus Paid Club SL - No Branch Agency Code Name PremiumManjunathNo ratings yet

- Devarabidanahalli 28Document1 pageDevarabidanahalli 28ManjunathNo ratings yet

- Proforma Zone: Bangalore Customs: (Rs. in Lakhs)Document8 pagesProforma Zone: Bangalore Customs: (Rs. in Lakhs)ManjunathNo ratings yet

- Abstract of DRC Issued in BBMPDocument2 pagesAbstract of DRC Issued in BBMPManjunathNo ratings yet

- List of DRC Issued in Head OfficeDocument65 pagesList of DRC Issued in Head OfficeManjunathNo ratings yet

- DRC Issued List: DRC Issued in Head Office For The Year 2006-07Document28 pagesDRC Issued List: DRC Issued in Head Office For The Year 2006-07ManjunathNo ratings yet

- Understanding The Machinery Breakdown Policy & MLOP PolicyDocument20 pagesUnderstanding The Machinery Breakdown Policy & MLOP Policylamdientran0% (1)

- Payroll SOPDocument8 pagesPayroll SOPicahimanshumehtaNo ratings yet

- WebDocument313 pagesWebYemi FajingbesiNo ratings yet

- 11th Five Year Plan 2007-12, India, Inclusive GrowthDocument306 pages11th Five Year Plan 2007-12, India, Inclusive GrowthDeepak PareekNo ratings yet

- Paper Industries Corporation of The Philippines (PICOP) v. CA, G.R. No. 106949, December 1, 1995Document27 pagesPaper Industries Corporation of The Philippines (PICOP) v. CA, G.R. No. 106949, December 1, 1995Newbie KyoNo ratings yet

- Minutes of The Board of Education March 9, 2021 Flag Salute: GeneralDocument13 pagesMinutes of The Board of Education March 9, 2021 Flag Salute: GeneralS SNo ratings yet

- S. No Miti Particulars Bill No. Gross Total Taxable VatDocument1 pageS. No Miti Particulars Bill No. Gross Total Taxable VatRam Krishna PandeyNo ratings yet

- Citiizen's Charter of The Provincial Government of South CotabatoDocument111 pagesCitiizen's Charter of The Provincial Government of South CotabatoXyrilloid Mercado LandichoNo ratings yet

- Maita Gomez Value Chain Luzon ConferenceDocument29 pagesMaita Gomez Value Chain Luzon ConferenceBlogWatchNo ratings yet

- BIR Form 1603QDocument2 pagesBIR Form 1603QAngelique MasupilNo ratings yet

- Assets and Liabilities FormDocument8 pagesAssets and Liabilities Formrathnakar sarmaNo ratings yet

- ERA2010 Journal Ranking LawDocument21 pagesERA2010 Journal Ranking LawkzontanosNo ratings yet

- Pakistan Economic Survey 2010-11Document392 pagesPakistan Economic Survey 2010-11raza9871No ratings yet

- Avenue E-Commerce Limited: 00009595951005759154 Crate IdDocument1 pageAvenue E-Commerce Limited: 00009595951005759154 Crate IdApoorva PareekNo ratings yet

- Income and Business TaxationDocument138 pagesIncome and Business Taxationjustine reine cornico100% (1)

- DSJ LicenseDocument7 pagesDSJ LicenseFernando Fernandes NeriNo ratings yet

- Representative OfficeDocument4 pagesRepresentative OfficeAbee TiponesNo ratings yet

- Desco BrochureDocument4 pagesDesco Brochureapi-357702320No ratings yet

- Literature Review On Indian Accounting StandardsDocument11 pagesLiterature Review On Indian Accounting Standardsfve140vbNo ratings yet

- Flash FillDocument2 pagesFlash FillMuhammad AfridiNo ratings yet

- Toppic List Summer TrainingDocument9 pagesToppic List Summer TrainingDinesh SinghNo ratings yet

- F 1040 SeDocument2 pagesF 1040 SeseihnNo ratings yet

- Write Your Name and The Name of Your Partners: Business Mathematics Performance Task-Building Your Own BusinessDocument4 pagesWrite Your Name and The Name of Your Partners: Business Mathematics Performance Task-Building Your Own BusinessArlene CalataNo ratings yet

- VRT Tor PDFDocument7 pagesVRT Tor PDFnirav16No ratings yet

- Economics of FreebiesDocument21 pagesEconomics of FreebiesRaveena RanaNo ratings yet

- LN01 Smart3075419 13 FI C01 FinalDocument37 pagesLN01 Smart3075419 13 FI C01 FinalMarwa Deria.No ratings yet

- Pambansang Koalisyon NG Mga Samahang Magsasaka v. Executive SecretaryDocument5 pagesPambansang Koalisyon NG Mga Samahang Magsasaka v. Executive SecretaryHappy Dreams PhilippinesNo ratings yet