Professional Documents

Culture Documents

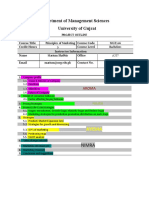

CamScanner 10-19-2020 16.15.33 PDF

CamScanner 10-19-2020 16.15.33 PDF

Uploaded by

ayesha iftikhar0 ratings0% found this document useful (0 votes)

11 views19 pagesOriginal Title

CamScanner 10-19-2020 16.15.33.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views19 pagesCamScanner 10-19-2020 16.15.33 PDF

CamScanner 10-19-2020 16.15.33 PDF

Uploaded by

ayesha iftikharCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 19

Cost accumulation procedures used by manufacturing concerns are clas-

sified as either (1) job order costing or (2) process costing. The preceding

chapter discussed procedures applicable to job order costing. It is important

to understand that, except for some modifications, the accumulation of mate-

rials costs, labor costs, and factory overhead also applies to process costing.

Process costing methods are used for industries producing chemicals, pe-

troleum, textiles, steel, rubber, cement, flour, pharmaceuticals, shoes, plas-

tics, sugar, and coal. This type of costing is also used by firms manufacturing

items such as rivets, screws, bolts, and small electrical parts. A third type of

industry using process costing methods is the assembly-type industry which

manufactures such things as typewriters, automobiles, airplanes, and house-

hold electric appliances (washing machines, refrigerators, toasters, irons,

Tadios, television sets, etc.). Finally, certain service industries, such as gas,

water, and heat, cost their products by using process costing methods. Thus, i

process costing is used when products are manufactured under conditions of _

continuous processing or under mass production methods. In fact, process

costing procedures are often termed ‘‘continuous or mass production” cost

accounting procedures.

116

Scanned with CamScanner

PROCESS COSTING: COST OF PRODUCTION REPORT

The type of manufacturing operations performed determines the cost pro-

_ sedures that must be used. For example, a company manufacturing custom

‘machinery will use job order costing, whereas a chemical company will use

process costing. In the case of the machinery manufacturer, a job order cost

__ sheet is prepated for each order, accumulating the costs of materials, labo

and factory overhead. In contrast, the chemical company cannot identify m:

terials, labor, and factory overhead with each order, since each order is part

‘ofa batch or a continuous process. The individual order identity is lost, and

the cost of a completed unit must be computed by dividing total cost incurred

during a period by total units completed. The summarization of the costs

takes place via the cost of production report, which is an extremely efficient

_ eeondmical, and timesaving device for the collection of large amounts of data

____ The entire process costing discussion is presented in this and the follow-

ing two chapters. This chapter considers the (1) cost of production reports, (2)

alculation of departmental unit costs, (3) costing of work in process, (4) com-

_ potation of costs transferred to other departments or to the finished goods

storeroom, and (5). effect of lost units on unit costs. Chapter 7 deals with (1)

special problems involved in adding materials in departments other than the

first, (2) problems conhected with the beginning work in process, and (3) the

ibility of using cogting methods other than those previously discussed.

CHARACTERISTICS AND PROCEDURES OF PROCESS COSTING

The characteristics of process costing are:

1. A cost of productiog report is used to collect, summarize, and compute

4 total and unit cost:

2. Production is accufnulated and reported by departments.

3. Costs are posted tddepartmental work in process accounts.

|; Production in proce’s at the end of a period is restated in terms of

completed units.

"5. Total cost charged to a department is divided by total computed pro-

~ duction of the department in order to determine a unit cost for a spe-

period.

‘of completed units of a department are transferred to the next

ssing department in order to arrive at the total costs of the fin-

during a period. At the same time, costs are assigned to

labor, and factory overhead costs by depart-

1 department. ‘

to the next and to finished goods.

till in process.

us ‘COST INFORMATION SYSTE@l: ACCUMULATION PROCEDURES Pam

If accurate unit and inventory costs are to be established by process cos,

ing procedures, costs of a period must be identified with units produced in the

same period.

COSTING BY DEPARTMENTS

The nature of manufacturing operations in firms using process or Job

order cost procedures is usually such that work on a product takes place in

Several departments. With either procedure, departmentalization of materials, |

labor, and factory overhead costs facilitates application of responsibility ac. |

counting. Each department performs a specific operation or Process towards |

the completion of the product. For example, after the Blending Department

has completed the starting phase of work on the product, units are transferred

to the Testing Department, after which they may go to the Terminal Depart.

ment for completion and transfer to the finished goods storeroom. Both units

and costs are transferred from one manufacturing department to another. Sep.

arate departmental work in process accounts are used to charge each depart.

‘ment for the materials, labor, and factory overhead used to complete its share

of a manufacturing process. |

Process costing involves averaging costs for a particular period in order to

obtain departmental and cumulative unit costs. The cost of a completed unit ia

determined by dividing the total cost of a Period by the total units produced |

during the period. Determining departmental production for a period includes

evaluating units still in process. The breakdown of costs for the computation

of total unit costs and for costing units transferred and departmental work in |

' Process inventories is also desirable for cost control purposes, |

Departmental total and unit costs are determined by the use of the cost of

< Production report, which is described and illustrated in detail in later sections

of this chapter. Most of the activity in Process costing involves the accumula-

tion of data needed for the Preparation of these cost reports,

f PRODUCT FLOW

ke

A product can flow through a factory in numerous ways. Three product

flow formats associated with process costing — sequential, parallel, and se-

lective — are illustrated here to indicate that basically the same costing pro-

‘cedures can be applied to all types of product flow situations.

e '

In a sequential product flow, each item manufactured goes through the

‘Sane sot of operations, as illustrated at the top: af the went page, Matssiale are

placed into production in the Blendit Department, and labor and factory

overhead are added. When the work is finished in the | it

7

Work iw Process —

Testina Depanrwens

Work iw Process —

_Tenmivar Depart

Labor

Factory

overhead

Finssteo Goo0s _

oves to the Testing Department. The second process, and any succeeding

esses, may add more materials or simply work on the partially completed

(from the preceding process, adding only labor and factory overhead, as

inthis example. After the product has been processed by the Terminal De

uriment, it is a completed product and becomes a part of finished goods in-

|

|

_ Ina parallel product flow, certain portions of the work are done simulta- Parallel

ly and then brought together in.a final process or processes for comple- Product

and transfer to finished goods inventory. As in the previous illustration, Flow

fials may be added in subsequent processes. Pictorially, this might be

as:

IN PRocess— Wok In Process —

6 DEPARTMENT. PLANING AND

Sano DEPARTMENT

Work In Process —

Assewaty DerAnTMeNT Wonk In PRocess —

_Panting DEPARTMENT

Materials

Labor

Factory

overhead,

Finise Goons

to different depary

: a

prucetive tna sleive product fw, the WOME predut: For exam

Flow within the plant, depending upon the des! some of the product

Meat processing, after the initial bul in finished goods inven

directly to the Packaging Department er the Packaging Depating’

some goes to the Smoking Department and ie the. Grinding

and finally to finished goods inventory eal ety 10 fi inished goods ine” |

ment, then to the Packaging Department, Pa involves join

tory. Transfer of costs from the Butchering Pe selective Product Roy a

allocation, discussed and illustrated in Chapter ® for

meat processing might be shown as follows: :

Work In Process — i

Same Perea _ Work m Paocess

\aterials PARTMENT

Labor

“ortns a

rhe: aie

Materials

Labor

Factory

ove

Work Process —

—Swoune Derarrwet_

‘Work IN PROCESS —

GRINDING DEPARTMENT

CEDURES FOR MATERIALS,

FACT WERHEAD COSTS

121

(HAPTER 6 PROCESS COSTING: COST OF PRODUCTION REPORT

are usually fewer than those in job order costing, where accumulation of costs

for many orders can become unwieldy

In job order costing, materials requisitions are used to charge jobs for Materials

Costs |

direct materials used. If requisitions are used in process costing, details are

considerably reduced because materials are charged to departments rather

than to jobs, and the number of departments using materials is usually less

than the number of jobs a firm might handle ata given time. Fr equently mate-

fials are issued only to the process-originating department; subsequent depart

ments add labor and factory overhead. If materials are needed in a depart-

ment other than the first, they are charged to that department performing the

specific operation.

For materials control purposes, materials need not always be priced indi-

vidually on requisition forms. The cost of materials used can be determined at

the end of the production period through inventory difference procedures,

ie., adding purchases to beginning inventory and then deducting ending in-

ventory. Or consumption reports which state the cost of materials or quantity

of materials put into process by various departments can be

quantities charged to departments by consumption reports may be based on

formulas or prorations. Formulas specify the type and quantity of materials

required in the various products and are applied to finished production in

trier to calculate the materials consumed. Chemical and pharmaceutical in~

fstries use such procedures, particularly when more than one product is

manufactured by a department. Frequently the cost of materials used bya

department must be prorated to different products on various estimated

bases. This proration is described in Chapter 8 as joint costing

For any of the materials cost computation methods discussed, a typical

journal entry charging direct manufacturing materials used during @ period is: !

used. Costs or

Work in Process — Blending Department 24,500

Materials ..

The source of the cost figures for thi

labor and factory overhead is the cost of

beginning on page 123.

Labor costs are identified by

thus eliminating the detailed ¢!

Daily time tickets or weekly ti

‘tickets. Summary labor charge’

24,500

1e above entry as well as the entries for

production report which is discussed

‘and charged to departments in process cost- Labor Costs

Jerical work of accumulating labor costs by

ime clock cards are used instead of job

5 are made to departments through an

29,140

37,310

32,400

me Pere ee Te ee a

2 RES PART 2

he 822 ‘AgCUMULATION

4 COST INFORMATION SYSTEM:

in job order cost-

F II as in job or

EF ing as WE" © for pro-

f ven, a Factory overhead incurred in process oe subsidiary aed ie

Betosts ing should be accumulated in the factory OVER” onsistent wil

Be ducing and service departments. This prey reporting. "

ments for responsibility accounting and respon"! smmend the use of pre-

i The factory overhead-chapters emphasize a to jobs and products. How.

determined overhead rates for charging overheat

tual overhead rather

ever, in various process and job order cost procedures, 3c This practice is

than applied overhead is sometimes used for product e from period to period,

feasible when production remains comparatively stabl ee adimonth to the

Since factory overhead will then remain about the ad Bey overhead

next. The use of actual overhead can also be justified when Tet Ot

is not an important part of total cost. However, predetermine

for producing departments should be used if:

E

t

k

f

i

e 1. Production is not stable. jen ost.

be 2. Factory overhead, especially fixed overhead, is a significant cost.

Fluctuations in production can lead to the unequal incurrence of actual

factory overhead from month to month. In such cases, factory overhead

: should be applied to production using predetermined rates, so that units pro-

duced receive proper charges for factory overhead. Similarly, if factory over-

5. head — especially fixed factory overhead — is significant, it is desirable to

allocate factory overhead on the basis of normal or uniform production using

Predetermined rates. Indeed, the use of predetermined rates is highly recom-

mended for improving cost control and facilitating cost analysis.

Prior to charging factory overhead to departments via their respective

‘ work in process accounts, expenses must be accumulated in a factory over-

¥ head control account. As expenses are incurred, the entry is:

Factory Overhead Control

Accounts Payable...

XXXXX,

XXXXX

. Accumulated Depreciation — Machinery AXXXX

Prepaid Insurance. XXXXX

Materials XXXX

Payroll XXXXX

The use of a factory overhead control account Tequires a subsidiary ledger

for factory overhead, with departmental expense analysis sheets to which all

enses are posted (see Chapter 10). Service department expenses are kept

in like manner and buted later to producing departments. At the end of

period, departmental expense analysis sheets are totaled. These totals,

also include distributed service department costs, represent factory

overhead for each department. By debiting the actual cost incurred or by

the predetermined rates multiplied by the respective actual activity base

hours) for each producing department, the entry charging

o work in process is as follows:

eee ss 5%

jin Process — Blending Department ......

in Process — Vesting Department

in Process — Terminal Department

28,200

32,800

19,800

80,800

THE COST OF PRODUCTION REPORT

A departmental cost of production report shows all costs chargeable to a

gartment. It is not only the source for summary journal entries at the end of

but also a most convenient vehicle for presenting and disposing of

accumulated during the month.

“Accost of production report shows (1) total and unit costs transferred to it

a preceding department; (2) materials, labor, and factory overhead

by the department; (3) unit costs added by the department; (4) total and

ts accumulated to the end of operations in the department; (5) the cost

beginning and ending work in process inventories; and (6) cost trans-

ed toa succeeding department \. toa finished goods storeroom.

Itis customary to divide the cost section of the report into two parts: one

costs for which the department is accountable, including departmen-

and cumulative total and unit costs, the other showing the disposition of

costs. A quantity schedule showing the total number of units for which

gpartment is accountable and the disposition made of these units is also

of each department's cost of production report. Information in this

, adjusted for equivalent production, is used to determine the unit

dded by a department, the costing of the ending work in process inven-

the cost to be transferred out of the department.

A cost of production report determines periodic total and unit costs.

er, a report that would merely summarize the total costs of materials,

and factory overhead and show only the unit cost for the period would

satisfactory for controlling costs. Total figures mean very little; cost

equires detailed data. Therefore, in most instances, the total cost is

Furthermore, detailed departmental figures are needed be-

e various completion stages of the work in process inventories.

“in the cost of production report itself or in the supporting sched-

material used by a department is listed; every labor opera-

rately; factory overhead components are noted individu-

the illustrated cost

rts, only total materials, labor, and factory overhead

ents are considered; and unit costs are computed only for

for each item.

, Which manufactures one product

, Testing, and Terminal), are used to

cost IFoRMATION SYSTEM; ACCUMULATION PROCEDURES PART 2

Blending Department, the originating

is shown below. It illustrates the de.

cost of production report.

Blending ‘The cost of production report of the

Department department of The Clonex Corporation,

i tailed computations needed to complete a C

| ‘The Clonex Corporation

E Blending Department

Cost of Production Report

For the Month of January, 19-~

Quantity Schedule

Units started in process. 000 =

Units transferred to next department .......cc.ssreser ser 5S 4000

Units stl in process (ll materials — labor and factory overhead). 41

Units lost in process. 5

Cost Charged to the Department Tora = UN

Cost added by department oor

Materials. $24,500

Labor 29,140

Factory overh« . -

Total cost to be accounted for

Cost Accounted for as Follows

Transferred to next department (45,000 x $1.72) .nninnaninnrnne $77,400

Work in process — ending inventory

Materials (4,000 * $.50) 1.0.

Labor (4,000 x ¥ x $62)...

Factory overhead (4,000 x ¥2 x §.60).....

Total cost accounted for.

E

‘ADpITionAL, COMPUTATIONS:

Equivalent production: Materials = 45,000 + 4,000 = 49,000 units

4,00

Labor and factory overhead = 45,000 + = 47,000 units

* $24,500

Unit costs: Materials = “==

iad $29,140

: Labor = Ss

Factory overhead =

= $.50 per unit

= $.62 per unit

$28,200

47,000

= $.60 per unit

‘The quantity schedule of the cost report shows jing Depart-

ment put 50,000 units in process, sik aa oral aia na finished

Z ae Could be stated in pounds, feet, gallons, barrels, etc.

1 dto a department are stated in pounds and the finished prod-

units in the quantity schedule will be in terms of the

Product conversion table would be used to deter-

SE ee ae eee

PROCESS COSTING: COST OF PRODUCTION REPORT ba

the next department (Testing), 4,000 units are still in process, and 1,000

were lost in processing.

ent Production. Costs charged to a department come from an analysis

‘materials used, payroll distribution sheets, and departmental expense analy

is sheets. The Blending Department's unit cost amounts to $1.72: $.50 for

_gaterials, $.62 for labor, and $.60 for factory overhead

Computation of individual unit costs requires an analysis of the ending

| work in process to determine its stage of completion. This analysis is usually

_ made by a supervisor or is the result of using predetermined formulas. Materi

as, labor, and factory overhead have been used on the 4,000 units in process

"jut not in an amount sufficient for completion. To assign costs equitably to

jnprocess inventory and transferred units, units still in process must be re-

"gated in terms of completed units, which is 4,000 units for materials cost but

| fess than 4,000 for labor and overhead costs. The figure for partially com-

pleted units in process is added to units actually completed in order to arrive

} at cae equivalent production figure for the period. This equivalent production

figure represents the number of units for which sufficient materials, labor, and

“overhead were issued or used during a period. Materials, labor, and overhead

costs are divided by the appropriate equivalent production figure to compute

nit costs by elements. Should a cost element be at a different stage of com-

pletion with respect to units in process, then a separate equivalent production |

figure must be computed. |

In many manufacturing processes, all materials are issued at the start of

production. Unless stated otherwise, the illustrations in this discussion as-

‘aime such a procedure. Therefore, the 4,000 units still in process have all the

erials needed for their completion but not all labor and factory overhead.

| Only 50 percent of the labor and factory overhead needed to complete the

nits has been used. In terms of equivalent production, labor and factory

head in process are sufficient to complete 2,000 units. The illustrations in

is chapter do not include the beginning work in process, a consideration é

ed to the next chapter.

‘osts. Departmental cost of production reports indicate the cost of units 4

eave each department. These individual departmental unit costs are

ited into a completed unit cost for the period. The report for the

‘Department shows a materials cost of $24,500, labor cost of $29,140,

ry overhead of $28,200. The materials cost of $24,500 is sufficient to

49,000 units (the 45,000 units transferred out of the department as

work in process for which enough materials are in process to

units). The unit materials cost is, therefore, $.50 ($24,500 =

‘computation determines the number of units actually and

eted with the labor cost of $29,140 and the factory overhead

) ec n units ‘in process are added to the 45,000 units

n & total equivalent production figure of

te

126

COST INFORMATION SYSTEM; ACCUMULATION PROCEDURES PART 2

47,000 units for both labor and factory overhead. When the equivalent pr,

duction figure of 47,000 units is divided into the monthly labor cost of $29,149,

Plt cost for labor of $.62 ($29,140 = 47,000) is computed. The unit cost for

factory overhead is §.60 ($28,200 + 47,000). The unit cost added by the de.

Partment is $1.72, which is the sum of the materials, labor, and overhead unit

Costs — §.50, §. 62, and $.60. This departmental unit cost figure cannot be

dletermined by dividing the total departmental cost of $81,840 by a singie

©duivalent production figure, because no such figure exists; units in process

FTE at different stages of completion as to materials, labor, and factory over.

head Ss

Disposition of Departmental Costs. In the departmental cost report, the section

titled “Cost Charged to the Department’’ shows a total departmental cost of

$81,840. The section titled “Cost Accounted for as Follows” shows the dispo-

sition of this cost. The 45,000 units transferred to the next department hav

Cost of $77,400 (45,000 units x $1.72). The balance of the cost to be

Counted for, $4,440 ($81,840 — $77,400), is the cost of work in process.

The inventory figure must be broken down into its component parts: ma-

als, labor, and factory overhead. These individual costs are easily deter.

mined. The cost of materials in process is obtained by multiplying total units

in process by the materials unit cost (4,000 x $.50 = $2,000). The costs of

labor and factory overhead in process are similarly calculated, The amount of

labor and overhead in process is sufficient to complete only 50 percent, or

2,000, of the units in process. ‘Therefore, the cost of labor in Process is $1,240

(2,000 x $.62) and factory overhead in Process is $1,200 (2,000 x $.60).

Lost Units. Continuous processing leads to the possibility of waste, seepage,

shrinkage, and other factors which cause loss or spoilage of production units.

Management is interested not only in the quantities reported as completed

production, units in process, and lost units but also in a comparison of

planned and actual results. In verifying reported figures, the accountant must

reconcile quantities put into process with quantities reported as completed

and lost. One method of making such reconciliations is to establish the pro-

cess yield, i.c., the finished production that should result from processing

various materials. This yield is computed as follows:

teri

x Weight of finished set

Percent yield “We ofameras Gases x 100

The yield figure is useful to management for controlling materials consump-

tion and ties in closely with a firm’s quality control procedures. Various yields

are established as normal. Yields below normal are measures of inefficiencies

and are sometimes used to compute lost units. Frequently quality control dat

are used to since the use of incorrect quantities

Scanned with CamScanner

PROCESS COSTING: COST OF PRODUCTION REPORT

"its lost in the Blending Department increase the unit costs of materials,

"labor, and factory overhead. Had these units not been lost, the equivalent

production figure would be 50,000 units for materials and 48,000 for labor and

"factory overhead. The unit cost for materials would be 8.49 instead of $.50;

labor, $.607 instead of $.62; and factory overh , $.588 instead of $.60. In

the first department, the only effect of losing units is an increase in the unit

cost of the remaining good units. In this situation, the loss is assumed to apply

to all good units and to be within normal tolerance limits. The treatment of

excess or abnormal loss i8 discussed on pages 131-132

The Blending Department transferred 45,000 units to the Testing Depart-

ment, where labor and factory overhead were added before the units were

transferred to the Terminal Department. Costs incurred by the Testing De-

partment resulted in additional departmental as well as cumulative unit costs,

| The cost of production report of the Testing Department, shown on page

108, differs from that of the Blending Department in several respects. Several

additional calculations are made, for which space has been provided on the

report. The additional information deals with (1) cost received from the pre-

ceding department, (2) an adjustment of the preceding department's unit cost

ecause of lost units, and (3) cost received from the preceding department to

be included in the cost of the ending work in process inventory. .

The quantity schedule for the Testing Department shows that the 45,000

its received from the Blending Department were accounted for as follows:

‘40,000 units sent to the Terminal Department, 3,000 units still in process, and

,000 units lost. An analysis of the work in process indicates that units in

s are but one-third complete as to labor and factory overhead. Unit

, $.91 for labor and $.80 for factory overhead, were calculated as fol-

equivalent production of the Testing Department is 41,000 units [40,000

,000)], the labor unit cost is $.91 ($37,310 = 41,000), and the factory

ad unit cost $.80 ($32,800 = 41,000). There is no materials unit cost,

‘no materials were added by the department. The departmental unit cost

of the labor unit cost of $.91 and the factory overhead unit

S Testing Department is responsible for labor and factory overhead

vell as for the cost of units received from the Blending Department.

cost charged to the department under the title

ding department,"” which is immediately above the section

1g with cost added by the department. The cost transferred

¥y shown in the cost report of the Blending Depart-

‘out of that department by this entry:

Testing

Department

COST INFORMATION SYSTEM; ACCUMULATION PROC Be

The Clonex (las

cona1 Production Report

For the Month of January, 19-~

Quantity Schedule

Units received from preceding department

Units transferred to next department

Units still in process (Ys labor and factory ovement)

Units fost in process

Cost Charged to the Department

Cost from preceding department

Transtorred in during the month (45,000 units)

Cost added by department.

Labor

Factory overhead

Total cost added

Adjustment for lost units.

Total cost to be accounted for

Cost Accounted for as Follows

Transferred to next department (40,000 x $3.51)

Work in process — ending Inventory:

Adjusted cost from piscang spots {3,000 x ($1.72 +

$.08)).

Labor (3,000 * ¥4 x $91)...

Factory overhead (3,000 *

Total cost accounted for.

210

$147,510

‘Appirionat. COMPUTATIONS:

3.

Equivalent production: Labor and factory overhead = 40,000 +

7.310

Unit costs: Labor = $2732. 5.91 per unit

47,000

$92,800

‘e Factory overhead = “555

‘Adjustment for lost units: nt

S7eBy ~ $100; $1.80- $1.72 = $8.08 perunit

| Matiod No, 2— 2000 units» $1.72 = $3440; S249 $08 por unit

= $.80 per unit

Scanned with CamScanner

PROCES i

‘SS COSTING: COST OF PRODUCTION REPORT

be adjusted. The total cost of the units transfe

43,000 Units must now absorb this total coe nny :

per unit due to the loss of 2,000 units in che Testing Depart ieee

The lost unit cost can be computed by one of eed ie

ermines a new unit cost for work done in the read oe Mee a

Gets tiference betwee tne vwo figures ig ueruddiional cox

to the lost units. The $1.80 new adjusted unit cost for aie ione in the

ceding department is obtained by dividing the remaining good units, 43,000

( Beni ied into the cost transferred in, $77,400, The od unit cost figure

.72 is subtracted from the revised unit cost to arrive at the adjustment of

nains at $77,400,

artment

Method No. 2 determines the lost units’ share of total cost and allocates

cost to the remaining good units. Total cost previously absorbed by the

“units lost is $3,440, which is the result of multiplying the 2,000 lost units by

their unit cost of $1.72. The $3,440 cost must now be absorbed by the remain,

good units. The additional cost to be picked up by each remaining good

nit is $.08 ($3,440 + 43,000 units).

~The lost unit cost adjustment must be entered in the cost of production

_ The $.08 is entered on the “Adjustment for lost units” line. The de=

ntal unit cost of $1.71 does not have to be adjusted for units lost. In the

Testing Department, the cost of any work done on lost units has automatically

absorbed in the departmental unit cost by g the equivalent produc-

figure of 41,000 instead of 43,000 units, The $1.72 unadjusted unit cost for

done in the preceding department, the $1.71 departmental unit cost, and

$.08 adjustment for lost units are totaled in order to obtain the $3.51 cu-

ative unit cost for work done up to the end of operations in the Testing

iment.

of Lost Units. Lost units may occur at the begin , during, or at the

id of a process. For purposes of practicality and simplicity, it is ordinarily

fai ‘ur st at the beginning or during a process were never putin

nits lost is spread over the units completed and units

“units are lost or are identified as lost at the end of a process, the

Jost units is charged to completed units only. No part of the loss is

units still in process. Assume that the 2,000 units lost by the Test-

in were the result of spoilage found at final inspection by the

| Department; their cost would be charged only to the 40,000

‘illust ‘on page 130 in the cost of production report for

129

Quantity Schedule

Units received {rom preceding department

Units transferred to next de partment ead)...

Units stil in process (¥4 labor and factory ov

Units lost in process {at end of process)

Cost cI 'ged to the Department

Cost from preceding department:

Transferred in during the month (45,000 units)

Cost added by department:

Labor.

Factory overhead

Total cost added

Total cost to be accounted for.

$147,510 $335

Cost Accounted for as Follows:

Transferred to next department (40,000 units x ($3.95 +

$.1675))" “

Work in prox ing inventor

» From preceding department (3,000 x $1.72)

Labor (3,000 x 1% x $.67)..

‘actory overhead (3,000 x ¥5 x $.76).

Total cost accounted for...

$ 5,160

ADDITIONAL COMPUTATIONS:

Equivalent production: Labor and factory overhead = 40,000 + 50 o

2,000 lost units = 43,000 units

Unit costs: Labor = 7210 _ 67, ‘

nit costs: Labor = $87.310 _ er unit

40,000 units x $3.5175 = $140,709

2 computed: 187 10 gy

PRODUCTION REPORT 131

‘

PROCESS COSTING: COS

on checks prior to the e1

nd of the pr 5,

Bers not complete when eF en Such a procedure uncovers

eye the loss may pert loss is incurred or the spoilage dis-

Effin: such a case cs only to units completed and not to units

of complet ¢ lost units should be adjusted for their ;

gir conversion would ae ance 2,000 units lost at the 90 percent

as aia

and factory overhead costs, 800 equivalent units with regard to

: en onthe Lest of Units. Units are lost through evapora

oe in at s, spoiled work, poor workmanship, Of ineffici

jpment. instances the nature of operations makes cert losses

unavoida 2

or unavoidable, because they are considered within normal tolerance

The cost of these normally lost units

he remaining

tion, shrink-

ient

its for human and machine errors.

not appear as a separate item of cost but is spread over #

od units.

: A different situation is created by abnormal or avoidable spoilage OF

ipses that are not expected to arise under normal, efficient operating condi-

"The cost of such abnormal spoilage or losses is charged either to Fac

as an additional unfavor-

ory Overhead, as shown below, thereby appearing

or directly to @ current period expense

le factory overhead variance,

‘account and reported as a separate item in the cost of goods sold statement.

‘SuBSIDIARY

Record | DR rs

6,700

6,700

6,700

5 Testing Departmen

oilage or loss

Work in Proces

st of production repo!

. The co’

transferred to next departmer (40,000 units * $3.39). $134,020"

ferred to factory overhead {140,000 units * $1675) oF

. 6,700

ypanicy +

$6,700 = $134,020.

(2,000 lost unil

its x $3.35 = $134,000

aes uimtmputed: $147,510 — '$6,790 ending inventory ~ *®

vt would show the abnormal SP

its x $3.35)] «-

“To avoid decimal diserepancy (he cost trans

mplete, equivalent production cal-

Jletion when lost or spoiled, and

be weighted accordingly. If one part

abnormal, each portion must be treated

|. The critical factor in distinguishing

Joss is the degree of controllability.

ii ed by the process under

ntrollable. Abnormal or

, because the conditions

thin the limits set by

Scanned with CamScanner

Ie

COST INFORMATION SYSTEM; ACCUMULATION PROCEDURES Parr 9

(Re State of the ait of production, the difference is a short-run condition; iq

ihc Tong ran, management should adjust and control all £4ctors of prextucton

86d eliminate all abnormal conditions,

Disposition

128 shows

ment

@f Testing Department Costs, The cast of production POrt ON page

& (otal cost of $147,510 to be accounted for by the Testing Depart

The department completed and transferred 40,000 units to the Terminay

Rent at a cost of $140,400 (40,000 X $3.51). The remaining cost is

‘ed to the work in process inventory, This b is t

© Various costs in process, When computing the cost of the

“SS taventory of any department subsequent {0 the first, costs received

YOM preceding departments must be included

The 3,000 units still in proc “ompleted by the Blending De

ANE SOSCOF $1.72, were later adjusted by $.08 (to $1.80) because of the loss

of some of the units transferred, Therefore, the Blending Department's cost of

the 3.000 units still in process is $5,400, the result of multiplying the 3,000

‘Units by the $1.80 adjusted unit cost, The $5,400 figure is not broken. down

further, since such information is not pertinent to the Testing Department's

pesritions, However, the amount is listed separately in the cost of production

jcPort, Because it is part of the Testing Department's ending work in process

to the Terminal Department, $140,400, a

charged to the Testing Department.

The cost of production report of the

trated on page 133. Total and unit cost figu

third or Terminal Department is illus-

res were derived by using pro-

shed goods storeroom;

}oods storeroom'’ is used in place of

lent.”

thus, the title “Transferred to finished g

the title “Transferred to next departm

Scanned with CamScanner

133

PROCESS COSTING: COST OF PRODUCTION REPORT

The Clonex Corporation

Terminal Department

Cost of Production Report

For the Month of January, 19—

received from preceding department sme

transferred to finished goods storeroom, 35,000

is stil in process ("4 labor and factory overhead), 4,000

fost in process 1000 __ 40,000

ged to the Department

Torn. Unit

{rom preceding department Cost Cost

erred In during the month (40,000 units) $140,400 __ $3.51

aaded by department

POF rn . - so2400 $90

Factory overhead . 19,800 Ey

Total cost added $52,200 $1.45

justment for lost units, : : 09

Total cost to be accounted for 92,600 $5.05

; , 0

\ecounted for as Follows

fansterred to finished goods storeroom (35,000 » $6.05) $176,750

in process — ending inventory

justed cost trom preceding department (4,000 » ($3.51 +

$.09)). 2 $ 14,400

(4,000 ~ % « §.90) : 900

tory overhead (4,000 » Vs » §.55) samen 880

Total cost accounted for.

aL COMPUTATIONS:

= 32400 5 90 per unit

_ $19,800

pe siete = 736,000

= $.55 per unit

‘= $3.60; $3.60 ~ $3.51 = $.09 per unit

3,51

= $.09 per unit

Scanned with CamScanner

a

pcoumuisrion PROCEDURES Pee

Clonex Corporation »

for iM

Combined The three cost of prosuetion EAT, meas reposts WOU! mos likgy

‘ost of goes computed separated manufacturing Operations o¢

Production _¢° discussed and c rt summarize ated below, shoulg

Reports Consolidated in a single rep’ report, as ill various depan, =

i od. Such @ FePOTL O° Or the Partneng,

sours el ooo :

reports.

134

CcosT INFORMATION SYSTE

tion

‘The Glonex Corporat

Cost of Production Reeart

All Producing Departments

For the Month of January,

Terma

Units received from preceding 40,000

department. ern —

Units transferred to next

department... 1» 45,000

Units transferred to finished goods

34 storeroo1

Units still in process

Units lost in process

Tora. Use

Cost Charged to the Department Cost ‘Cost

Cost from preceding department:

Transferred in during the month... $a5t

Cost added by department:

Materials... é

arg $0

Factory overhead, 28,200 5

Total cost added .. $81,840 $1 $145

Adjustment for lost units. 4

Total cost to be accounted for,

Gost Accounted for as Follows

‘Gost Accounted for as Follows

_ Transferred to next department...

Transferred to finished goods

‘storeroom...

Bess

scanned with CamScanner

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MGT206 Projct OutlineDocument1 pageMGT206 Projct Outlineayesha iftikharNo ratings yet

- Research PaperDocument14 pagesResearch Paperayesha iftikharNo ratings yet

- 19010920-074, SOC-101, MidtermDocument7 pages19010920-074, SOC-101, Midtermayesha iftikharNo ratings yet

- What Is ColonialismDocument11 pagesWhat Is Colonialismayesha iftikharNo ratings yet

- Questions: Basic Macroeconomic RelationshipsDocument7 pagesQuestions: Basic Macroeconomic Relationshipsayesha iftikharNo ratings yet

- BiDocument453 pagesBiRaveen Arun73% (11)

- Analyzing The Marketing EnvironmentDocument8 pagesAnalyzing The Marketing Environmentayesha iftikharNo ratings yet

- Social Organization / Institutions: Assignment # 2 Semester Fall-2020Document8 pagesSocial Organization / Institutions: Assignment # 2 Semester Fall-2020ayesha iftikharNo ratings yet

- Assignment 2Document13 pagesAssignment 2ayesha iftikharNo ratings yet

- The Marketing Environment PDFDocument32 pagesThe Marketing Environment PDFayesha iftikharNo ratings yet

- Classification of Sentences: Assignment # 2 Semester Fall-2019Document5 pagesClassification of Sentences: Assignment # 2 Semester Fall-2019ayesha iftikharNo ratings yet

- Spreadsheets (Ms-Excel) : Assignment # 3 Semester Fall-2019Document4 pagesSpreadsheets (Ms-Excel) : Assignment # 3 Semester Fall-2019ayesha iftikharNo ratings yet

- Software and Viruses: Assignment # 2 Semester Fall-2019Document7 pagesSoftware and Viruses: Assignment # 2 Semester Fall-2019ayesha iftikharNo ratings yet