Professional Documents

Culture Documents

PRJ p856 PDF

Uploaded by

10 unknown facts priyanka suman KeshriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PRJ p856 PDF

Uploaded by

10 unknown facts priyanka suman KeshriCopyright:

Available Formats

Pramana Research Journal ISSN NO: 2249-2976

A STUDY ON DIGITALIZATION OF INSURANCE

INDUSTRY: CUSTOMER’S OPPORTUNITIES AND

CHALLENGES

Mrs.B. Kishori1, R. Kumaran2

1, 2

Department of Management studies

1

Assistant Professor, Anna University, Tiruchirappalli. Tamil Nadu, India

2

PG Students, Anna University, Tiruchirappalli. Tamil Nadu, India

Abstract

In the world people are finding the smell of digitalization in each and every small place

apart insurance. In the insurance sector digitalization facing both merits and demerits. In this

paper, try to understand the customer’s satisfaction, benefits and challenges of digitalization of

insurance faced by customers. This new technology is looking forward and create the bright future

for customers and insurance industry at the time this technology providing problems of insecurity

and data theft and so on. These papers discuss how insurers will use the digitisation chance to

deliver greater value to their customers and gain a competitive advantage. Insurers will have

interaction a lot of intensely with existing customers and attract newer customers with innovative

merchandise, improve each gain and growth.

Keywords: Customer’s satisfaction, Investment, Insecurity, Minimum price, Data theft, Time

saving.

INTRODUCTION

A digitalization is very important technology in the future modern world. In the insurance

industry the customers are classified in three class (upper, middle, lower) so their insurance is also

in several of purpose. That is the upper-class people think insurance is investment, the middle-

class people think insurance is savings but the lower-class people are having insufficient financial

position so they are all not the policy makers only two or three persons only think as savings to

making the insurance policies.

In this digital insurance having several of technology (Digital Billing, Online Payment,

Automated Insurance Claims, High personalised customer data, prevents from loss) is giving more

benefits at the same time have some demerits and challenges in the digital insurance. The insurance

makers are not only the educated people and also uneducated peoples are making policy in the

insurance so the digital insurance is support only the educated people.

But this digitalization is the best and easy way to communicate the customers and the

company in the insurance sector. It is the advanced technology of telecommunication in the

insurance sector and it is used to expand the business level of stage and also improve the customer

level. This is increasing the financial position of the company and customers, it also used to

increase the customer satisfaction about the digital insurance. In the earlier period of insurance

industry only contact by post cards, personal meet but today the insurance sector introducing new

Volume 9, Issue 5, 2019 462 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

technology of digitalization for communication and sending information about policies and

creating awareness of insurance policies by internet, social media, SMS, mobile, mail and so on.

Today both private and public insurance sector improving their technology for engage

more intensely with existing customers and attract the new customers. So, the customer’s overall

perception about the digital transformation of insurance is both in positive and the negative. So,

the digital transformation creates a new environment in the overall world and it’s very important

to develop the knowledge and skills.

OBJECTIVES OF THE STUDY

To study about the aware of customers on new innovative technologies in the digital

insurance in India

To analyse the insurers’ benefits and challenges in digital insurance

To analyse the factors of digital transformation of insurance adoption by the insurers.

DIGITAL TRANSFORMATION

A digital transformation in the insurance industry refers to an outside-in approach in line

with a customer-centric view of the business. Development with new technology helps in bringing

innovation and therefore creating new revenue streams.

A comprehensive digital transformation in the insurance industry includes a

transformation of core insurance applications, customer service as well as claim operations.

Insurance companies hold vast data pertaining to business process management, analytics, mobile

technologies, and business applications.

Insurance companies need to focus on digital methods of garnering, processing and

delivering information. This requires a comprehensive evaluation of existing tools used, process

of managing documents and channels of communication. In totality, the key element is in

transforming analysed behavioural pattern of insurance customers and strategies of business

models to digital readiness.

If we transfer these experiences of other industries to the insurance industry, we can

identify concrete application areas which should be investigated more thoroughly in terms of

digitization:

Sales and product performance management

Operations and claims management

Planning/ forecasting and reporting

MOBILE TECHNOLOGY FOR THE LIFE INSURANCE

Those who ignore the mobile technology revolution may place their businesses at

disadvantage. Consumer behaviour and expectations, along with pressures to conduct business

more efficiently, are making the shift toward mobile platforms more than just a fad. The challenge

is how to use mobile technology tools and solutions not only to enhance productivity but also to

nurture personal customer interactions and promote customer service.

With the advent of mobile digital technology, the question is whether life insurance

companies can benefit from this new high-tech, high-touch approach to sales. The further

challenge for insurers is how to choose from among the bevy of technologies, and which approach

will be most secure and effective for their business, agents, and brokers.

Volume 9, Issue 5, 2019 463 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

Over the years, the industry has relied on a fairly low-tech, high-touch process of selling

insurance products. Laptop PCs and the Internet initially met with slow acceptance due to a

combination of internal resistance and a lack of external pressure. Today the Web has changed

from frightening challenge to a necessity, and it has changed the relationship between agents and

clients. A recent insurance study found that eight out of every 10 new life insurance clients

obtained insurance quotes or information from a company’s website, and then contacted an agent

to purchase a policy.

Even though today‘s consumer relies on PCs and the Internet, the same is not true for the

agents. Many agents still predominantly rely on paper for presentations, illustrations and

completing applications. Mobile technology has the potential for increasing the use of technology

by agents and making a lasting impression on the consumer as well. In contrast to the years it took

for the Web to catch on in insurance, mobile is relatively quickly becoming an expected platform

in distribution.

Today’s diversity among mobile platforms and hardware devices brings about challenges

in deciding which platform or device to offer to agents. In general, each operating system offers a

variety of smartphones and at least one corresponding tablet from which to choose. As the variety

and number of mobile platforms proliferate, insurers must decide on the capabilities they want to

deliver and then figure out the best way to utilize a platform’s unique features and functionality to

achieve those goals.

Insurers say that their largest concern is security. For many insurers, the BlackBerry is the

only choice because of its security features, but other mobile platforms are stepping up to meet

enterprise security concerns. As insurers explore each platform, they must consider the

effectiveness of a device in preserving or expanding the personal, intimate connection between

agent and customer while mitigating the security implications of their choice. Insurers should

develop a list of capabilities they want and then figure out which devices deliver those capabilities

as they investigate app development. The tablet provides an agent the ability to have an interactive

selling experience, but mobile phones can be successful as well, depending on what functionality

is desired.

Even after choosing a platform or device, insurers might decide that cross-platform

portability is the better approach to mobile app development. Although native apps are built for

one mobile platform and take advantage of the specific features and functions on a specific device,

mobile apps that use Mobile Web technologies are often more cost effective and can be reused

across mobile platforms and websites. Depending on what kind of app is desired, there are

challenges and benefits to both approaches. The cross-platform approach, however, may be very

important if an insurer chooses to adopt a "bring your own technology" approach to asset

management.

Although there are risks, agents can benefit from having certain functions on their mobile

tools. Additionally, mobile apps offer tremendous opportunity to increase market share and

customer value. Some benefits include recruiting and retaining younger salespeople, enhanced

customer service, error reduction due to electronic data submission, direct access to marketing

materials and more interactive comfortable selling.

All insurance companies must address is finding better and faster ways to meet the ever-

increasing demands of the regulatory environment. The impact of digital innovation will drive

Volume 9, Issue 5, 2019 464 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

new regulation, thus additional pressures on insurance organizations to efficiently and effectively

meet these regulatory requirements.

INVESTMENT DECISION OF POLICY MAKER

Mostly the investors are making investment is based on the Gender, Age, Income and the

Education but before their decision they should be in aware of the investment. At the time the

digitalization should do the major work of explaining the insurance policies in the detailed manner.

This information is helped to evaluating the policies and also providing the several of decisions

about the insurance policies. This decision is helped to preserving from the big level of loss and

risk. On the basis of decision making they will face both benefits and challenges of the investment.

They are like saving time for payment of insurance policy, minimum price of the internet while

compare to the travelling charges and some disadvantages is insecurity of the data and easy to theft

the personal details through digitalisation.

FACTORS AFFECTING DIGITAL INSURANCE ADOPTION

Digital Insurance is affected by a many of factors. Customers will adopt digital

insurance based on various reasons. Some of the reasons due to convenience, investment, security

and savings associated with the various modes of digital insurance. The various factors discussed

in details below.

Influence of Awareness

In insurance the digital transformation is very important but the insurers do not have

any awareness to adopt the digitalization of insurance. This is the main factor in insurance and in

India has very low awareness of the new innovative technologies when compare to the other

countries then only the India has very poor in finance and the developments.

Trust and Security

The customer trust is very important factor that affects the success of digital insurance

services uptake. So, the trust is only finalising the security of digital services, but the more

customers should want to adapt the digital transformation of services for their convenience at the

same time trust and security is not fare to the customers and it is the main drawbacks in the

digitalisation.

Trialability

The innovation is more complex and not user friendly, so the customers needs lot of effort

and it discourage the adoption of innovative technologies. So, the innovation is must create

comfortable to the customers they will try to use the digital technologies in long time and then

they want the updated version in the digitalization.

CONCLUSION

The digitalization of insurance industry have many of benefits and challenges, where

change must happen without interrupting, the flow of daily business. The digital transformation

of the insurance industry is one of the key challenges ahead – and certainly a big opportunity for

Volume 9, Issue 5, 2019 465 https://pramanaresearch.org/

Pramana Research Journal ISSN NO: 2249-2976

the industry to renew. Digitization will fundamentally change the business model and the value

chain of insurers. Insurance companies should develop their own individual strategy for

digitization. The digital insurance is vary from one company to another company.

REVIEW OF LITERATURE

• Meenakshi Acharya and Dr.C.K. Hebbar, (2016), “Digitalization of Insurance sector: Issues and

challenges to an Insurance advisor. In this study explains the earlier model of the insurance

industry (personal contact and post cards) and present model of insurance (internet, social media,

telephone and SMS)

• Anshu Arora, (may 2003), “E-insurance: analysis of the impact and implications of E-commerce

on the insurance industry,” by this study found current trends within the internet.

• Dr. Fredrick S. Odoyo, (nov 2011), “E- insurance: An empirical study of perceived benefits. In

this study found and analyze the information and communication technology of private and public

insurance sectors.

• International Association of Insurance Supervisors, (nov 2018), “Increasing digitalization in

insurance and its potential impact on consumer outcomes.” In this study explained the various of

digitalization in various countries.

• Martin Eling and Martin Lehmann, (2018), “The impact of digitalization on the insurance value

chain and the insurability of risks.” In this study found the list of digital technologies and its impact

on the insurer’s value chain.

• Rajesh R. Gawali, Dr. Shivaji, D. Mundhe (nov 2016), “Digital transformation in insurance

sector.” This study motives the innovation of new technologies for engage more intensely with

existing customers and attract the new customers.

• Dr. S. Yuvaraj, Sheila Eveline.N (july 2018), “Consumers’ perception towards cashless

transactions and information security in the digital economy.” In this study says money is said to

be blood with the advent of internet and world should develop and follow digital technology.

• Dr. R. Gokilavani, Mr. D. Venkatesh Kumar, Dr. M. Durgarani, Dr.R.Mahalakshmi (2018), “A

study on perception of consumers towards digital payment.” This paper finding the result is most

of the customers have moderate level of perception towards digital payment and they satisfy by

the user friendly, time savings, convenient, easiness and protection of privacy policy.

• Shamsher Singh, (dec 2017), “Study of consumer perception of digital payment mode.” This

journal study explains the wallets of using digital payment and transaction mostly say its benefits

like wallets, offers and discounts and the OTP.

• Ruth Kwamboka Momanyi, “Factors influencing the adoption of digital banking by customers

among commercial banks in Kenya.” This project says the problems in digitalisation adoption by

the customers and explains the several of thinking of customers about the digital banking.

Volume 9, Issue 5, 2019 466 https://pramanaresearch.org/

You might also like

- Impact of Information Technology in The Service Delivery of Indian Insurance SectorDocument3 pagesImpact of Information Technology in The Service Delivery of Indian Insurance SectorTanvir KhanNo ratings yet

- Insuretech 2Document8 pagesInsuretech 2Anusha.RNo ratings yet

- Digitalization of Insurance Sector: Issues and Challenges To An Insurance Advisor Meenakshi Acharya & Dr. C. K. HebbarDocument5 pagesDigitalization of Insurance Sector: Issues and Challenges To An Insurance Advisor Meenakshi Acharya & Dr. C. K. HebbarSelvi MoorthyNo ratings yet

- DXC Digital InsuranceDocument16 pagesDXC Digital Insurancemohanp716515No ratings yet

- Fintech's Impact on the Insurance IndustryDocument7 pagesFintech's Impact on the Insurance IndustryHarshil MehtaNo ratings yet

- InsurtechDocument25 pagesInsurtechrahul bhutraNo ratings yet

- The Future of Insurance - KPMG CanadaDocument7 pagesThe Future of Insurance - KPMG CanadaZaid KamalNo ratings yet

- Digital Transformation in The Insurance IndustryDocument16 pagesDigital Transformation in The Insurance IndustryChafî Red100% (1)

- Insurance Research ForecastDocument8 pagesInsurance Research ForecastShaarveen Raj KogularajaNo ratings yet

- Insurance Innovation Report 2016Document21 pagesInsurance Innovation Report 2016Rishita GuptaNo ratings yet

- Digital Transformation in Insurance SectorDocument9 pagesDigital Transformation in Insurance SectorEditor IJRITCC100% (1)

- InsuranceDocument82 pagesInsuranceNikesh KothariNo ratings yet

- InsuranceDocument82 pagesInsuranceNikesh KothariNo ratings yet

- Digital Transformation of Insurance by Prathibha KielDocument18 pagesDigital Transformation of Insurance by Prathibha Kielarc chanukaNo ratings yet

- The Impact of Technolgy On Insurance IndustryDocument12 pagesThe Impact of Technolgy On Insurance Industryzoey thakuriiNo ratings yet

- World Insurance Report - 2018Document64 pagesWorld Insurance Report - 2018Broken BatsNo ratings yet

- How Can A Traditional Insurance Company Make Scope and Ecosystem Transformation?Document2 pagesHow Can A Traditional Insurance Company Make Scope and Ecosystem Transformation?Raichel SuseelNo ratings yet

- EY Future of Insurance A Digital World Design CommentsDocument16 pagesEY Future of Insurance A Digital World Design CommentsVivekCSNo ratings yet

- Project in Insurance SectorDocument51 pagesProject in Insurance Sectoryaminipawar509100% (1)

- Article - 5 Trends in Insurance Broking - Jan - 2020Document6 pagesArticle - 5 Trends in Insurance Broking - Jan - 2020sahapdeen haiderNo ratings yet

- Use of IT in insurance industryDocument1 pageUse of IT in insurance industrySharmila MurugavelNo ratings yet

- Insurance TechnologyDocument14 pagesInsurance TechnologyYadunath SadasivaNo ratings yet

- Outsourcing Trends in Insurance IndustryDocument15 pagesOutsourcing Trends in Insurance IndustryRaviNo ratings yet

- Digitalization of Insurance by Ushara KarunarathneDocument17 pagesDigitalization of Insurance by Ushara Karunarathnearc chanukaNo ratings yet

- Recent Trends in The Insurance BusinessDocument4 pagesRecent Trends in The Insurance Businessanna merlin sunnyNo ratings yet

- Assignment 1A Final Draft Research ProposalDocument11 pagesAssignment 1A Final Draft Research ProposalAnil KumarNo ratings yet

- Swot Analysis For Online Insurance IndiaDocument11 pagesSwot Analysis For Online Insurance IndiaRamasamy Velmurugan100% (1)

- Digital InsuranceDocument72 pagesDigital InsuranceSiddharth Gupta50% (2)

- Information Technology in Insurance SectorDocument4 pagesInformation Technology in Insurance SectorRicky LouisNo ratings yet

- The Customer-Centric Insurer in The Digital EraDocument34 pagesThe Customer-Centric Insurer in The Digital ErawilsonNo ratings yet

- LMS 9Document11 pagesLMS 9prabakar1No ratings yet

- Cloudera Industry Brief Digital InsuranceDocument2 pagesCloudera Industry Brief Digital InsurancehidayatNo ratings yet

- Expert Insights - Digital Readiness of The Insurance Industry - First Draftv1.0Document3 pagesExpert Insights - Digital Readiness of The Insurance Industry - First Draftv1.0Dipak SahooNo ratings yet

- Block ChainDocument16 pagesBlock ChainLuisNo ratings yet

- Redesigning The Future of Business Through Artificial Intelligence (AI) v1.1Document3 pagesRedesigning The Future of Business Through Artificial Intelligence (AI) v1.1nazlihasriNo ratings yet

- Farid Atmimou Groupe 1 Master 2 Finance InsuranceDocument1 pageFarid Atmimou Groupe 1 Master 2 Finance InsuranceFarid AtmimouNo ratings yet

- Insurance Innovation Report 2021Document12 pagesInsurance Innovation Report 2021Rajiv MalhanNo ratings yet

- Sigma6 2015 enDocument43 pagesSigma6 2015 enHarry CerqueiraNo ratings yet

- Deloitte Uk Insurance Trends 2019 PDFDocument16 pagesDeloitte Uk Insurance Trends 2019 PDFRaghav RawatNo ratings yet

- HBR - The Big Easy Button For Customer Experience in InsuranceDocument11 pagesHBR - The Big Easy Button For Customer Experience in InsuranceJonathan Martin LimbongNo ratings yet

- CoverheroDocument5 pagesCoverherohamon.hyacintheNo ratings yet

- IRDA Dec 2010 Online Edition RDocument100 pagesIRDA Dec 2010 Online Edition RSatyen ShrivastavaNo ratings yet

- Data-Driven Insurance: Ready For The Next Frontier?Document52 pagesData-Driven Insurance: Ready For The Next Frontier?Harry CerqueiraNo ratings yet

- Digital Adoption in The Insurance Sector: From Ambition To Reality?Document12 pagesDigital Adoption in The Insurance Sector: From Ambition To Reality?Ivan GrgićNo ratings yet

- Chapter Two Review of LiteratureDocument28 pagesChapter Two Review of LiteratureOwolabi PetersNo ratings yet

- 2020 DXC Insurance Survey Report - The Voice of The U.S. ConsumerDocument23 pages2020 DXC Insurance Survey Report - The Voice of The U.S. Consumerprasanthbanala51No ratings yet

- A Study On Evolving Impact of Ai On The Insurance IndustryDocument14 pagesA Study On Evolving Impact of Ai On The Insurance IndustrynavadurgavaishnaviNo ratings yet

- Modern Tech Impacts Insurance IndustryDocument75 pagesModern Tech Impacts Insurance IndustryNikhil patilNo ratings yet

- Blackbook Project On IT in Insurance - 163417596Document75 pagesBlackbook Project On IT in Insurance - 163417596Dipak Chauhan57% (7)

- Blockchain Innovation Within The Insurance Industry - SettleMintDocument68 pagesBlockchain Innovation Within The Insurance Industry - SettleMintHarsh ChoudharyNo ratings yet

- Claims 2030 Dream or Reality April 2022Document9 pagesClaims 2030 Dream or Reality April 2022Shaily VyasNo ratings yet

- South African Insurance Survey 2020Document148 pagesSouth African Insurance Survey 2020wNo ratings yet

- A1 Sulabh Soral and James Rakow - 0Document9 pagesA1 Sulabh Soral and James Rakow - 0Teja KrishnaNo ratings yet

- Artikel - 2019 - 3 - Insurtech - Micro-Trends - To - WatchDocument4 pagesArtikel - 2019 - 3 - Insurtech - Micro-Trends - To - WatchMario Vittoria FilhoNo ratings yet

- 4 XI November 2016Document6 pages4 XI November 2016Vardhan SinghNo ratings yet

- BCG ZA Tech Omni Channel in Insurance 1703568596Document18 pagesBCG ZA Tech Omni Channel in Insurance 1703568596waqar.asgharNo ratings yet

- Rangkuman Kebutuhan SDM Asuransi Di Era 4Document3 pagesRangkuman Kebutuhan SDM Asuransi Di Era 4sofiaNo ratings yet

- Predicting Travel Insurance Purchases in An InsuraDocument16 pagesPredicting Travel Insurance Purchases in An Insuradiansyah dwiNo ratings yet

- Insurance 4.0: Benefits and Challenges of Digital TransformationFrom EverandInsurance 4.0: Benefits and Challenges of Digital TransformationNo ratings yet

- The INSURTECH Book: The Insurance Technology Handbook for Investors, Entrepreneurs and FinTech VisionariesFrom EverandThe INSURTECH Book: The Insurance Technology Handbook for Investors, Entrepreneurs and FinTech VisionariesNo ratings yet

- PRJ p856 PDFDocument5 pagesPRJ p856 PDF10 unknown facts priyanka suman KeshriNo ratings yet

- Digital Disruption in InsuranceDocument59 pagesDigital Disruption in Insurancekrishima100% (1)

- Frount Page of ChemDocument1 pageFrount Page of Chem10 unknown facts priyanka suman KeshriNo ratings yet

- Frount Page of ChemDocument1 pageFrount Page of Chem10 unknown facts priyanka suman KeshriNo ratings yet

- Manual XG5000IEC V2.7 PDFDocument742 pagesManual XG5000IEC V2.7 PDFEkanit ChuaykoedNo ratings yet

- MPLab Tutorial v1Document45 pagesMPLab Tutorial v1ASIM RIAZNo ratings yet

- IT and Software Companies - GujaratDocument31 pagesIT and Software Companies - GujaratDishank100% (1)

- "How Do I Convince Investors To Invest in My Start Up - "Document4 pages"How Do I Convince Investors To Invest in My Start Up - "VohahNo ratings yet

- NPN Epitaxial Silicon Power Transistors MJE13002 MJE13003 TO-126 Plastic PackageDocument4 pagesNPN Epitaxial Silicon Power Transistors MJE13002 MJE13003 TO-126 Plastic PackageJavier Mendoza CastroNo ratings yet

- Functional Requirements:: Control of The ProcessorsDocument6 pagesFunctional Requirements:: Control of The Processorsusama jabbarNo ratings yet

- I&M Marketing&StrategyDocument16 pagesI&M Marketing&StrategynevilleNo ratings yet

- ZXSDR BS8900A Quick Installation Guide R2.0 - CH - ENDocument37 pagesZXSDR BS8900A Quick Installation Guide R2.0 - CH - ENMuhammad AliNo ratings yet

- TRAINING ON POWER GENERATION PROCESSESDocument19 pagesTRAINING ON POWER GENERATION PROCESSESPriyank Gaba100% (1)

- 5520 Access Management System, Release 9.7Document19 pages5520 Access Management System, Release 9.7Fernando Martins de OliveiraNo ratings yet

- MisMissile Systems Lethality Enhancement Through The Use of A Conducting Aerosol Plasma Warheadsile Systems Lethality Enhancement Through The Use of A Conducting Aerosol Plasma Warhead PDFDocument24 pagesMisMissile Systems Lethality Enhancement Through The Use of A Conducting Aerosol Plasma Warheadsile Systems Lethality Enhancement Through The Use of A Conducting Aerosol Plasma Warhead PDFvig1ilNo ratings yet

- Reduce Concrete Waste with Bubble Deck SlabsDocument11 pagesReduce Concrete Waste with Bubble Deck Slabsgpt krtlNo ratings yet

- DLP Week 2 MILDocument10 pagesDLP Week 2 MILReniel VillaverdeNo ratings yet

- Voip Ceiling SpeakerDocument42 pagesVoip Ceiling SpeakerMaría dieciochoNo ratings yet

- Cheet SheetDocument2 pagesCheet SheetJack Murphy100% (1)

- ILM # 1 History of Science and TechnologyDocument25 pagesILM # 1 History of Science and TechnologyRajiv DomingoNo ratings yet

- Underwater Warfare: Making A DifferenceDocument7 pagesUnderwater Warfare: Making A DifferencehocineNo ratings yet

- Seal Kit Catalog 08Document368 pagesSeal Kit Catalog 08Sarl Gaf PmtpcNo ratings yet

- Company Website Telephone: Tams@agriculture - Gov.ieDocument5 pagesCompany Website Telephone: Tams@agriculture - Gov.ieAishwarya LogidasanNo ratings yet

- MATLAB Basics for Communication SystemsDocument19 pagesMATLAB Basics for Communication SystemsSyed F. JNo ratings yet

- Epson Robots Product Specifications CatalogDocument64 pagesEpson Robots Product Specifications CatalogProduccion TAMNo ratings yet

- Saxxon Pro Sax0416mnDocument2 pagesSaxxon Pro Sax0416mnapm11426No ratings yet

- User Manual: Control Process Controller D500Document32 pagesUser Manual: Control Process Controller D500boyerNo ratings yet

- LPI Passguaranteed 701-100 v2018-12-16 by Hector 39qDocument20 pagesLPI Passguaranteed 701-100 v2018-12-16 by Hector 39qRafik AidoudiNo ratings yet

- IJSRD - International Journal for Scientific Research & Development| Vol. 5, Issue 10, 2017 | ISSN (online): 2321-0613Document2 pagesIJSRD - International Journal for Scientific Research & Development| Vol. 5, Issue 10, 2017 | ISSN (online): 2321-0613venturamercia_472121No ratings yet

- CEN Department IITBombayDocument80 pagesCEN Department IITBombayNirleshSinghNo ratings yet

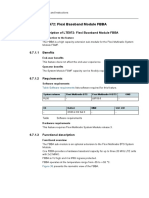

- 6.7.1 Description of LTE972: Flexi Baseband Module FBBADocument6 pages6.7.1 Description of LTE972: Flexi Baseband Module FBBAАндрей МоисеевNo ratings yet

- Top Risk 2021Document18 pagesTop Risk 2021NelsonNo ratings yet

- PressReleasePoint - eTOM - A Business Process Framework Implementer's Guide - 2009-04-29Document2 pagesPressReleasePoint - eTOM - A Business Process Framework Implementer's Guide - 2009-04-29jbdecorzent0% (1)

- Work Study 1Document47 pagesWork Study 1Anonymous phDoExVlNo ratings yet