Professional Documents

Culture Documents

Balance Sheet - Report Form:: Definition and Explanation

Balance Sheet - Report Form:: Definition and Explanation

Uploaded by

Bryent GawOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet - Report Form:: Definition and Explanation

Balance Sheet - Report Form:: Definition and Explanation

Uploaded by

Bryent GawCopyright:

Available Formats

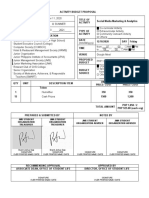

Balance Sheet - Report Form:

Definition and Explanation:

Balance sheet shows the financial position or condition of an organization at a particular

point in time. In fact, it is sometimes referred to as a position statement or statement of

condition.

It shows the economic resources (properties, possessions) of an organization, referred to as

assets, and the claims that creditors and owners have against the assets. Economic

obligations of an organization (amount owed to creditors) are called liabilities, and owners,

claims are referred to as owner's equity, or capital.

A common arrangement of the balance sheet is to list assets on the left side and liabilities

and owner's equity on the right. This balance arrangement, with assets and equities

(liabilities) side by side, is sometimes referred to as the account form of balance sheet,

because it resembles the traditional T-form of an account.

An alternative arrangement, sometimes called the report form of balance sheet, centers

the asset section under the heading, with the equity claims shown below the asset. The

report form frequently fits on a standard sheet of paper better than the account form.

Assets are normally reported on balance sheet in the order of their relative nearness to

cash. For example, the account receivable (sundry debtors) account usually follows the cash

account because the accounts receivable are likely to turn into cash very soon. On the other

hand, assets like land and buildings are normally listed towards the end, because they are

expected to be around a long time. So, the balance sheet that divides its accounts into

subgroups within the major sections of the statement is called a classified balance sheet.

Generally assets are divided into two groups, current and non-current assets are cash and

other assets that are relatively close to being cash. In practice, an asset is classified as

current if it can meet any of the following conditions within the year:

1. If it can reasonably be expected to turn into cash.

2. If it can easily be converted to cash by the managers of the entity.

3. If it can take the place of cash (as with prepaid expenses).

When assets are divided into current and non-current groups, It is common practice to

classify liabilities in a similar way. Current liabilities are liabilities that cash reasonably be

expected to be paid within one year. Naturally, the liabilities that are not expected to be

paid within one year are transferred to as non-current liabilities:

You might also like

- Deed of Substituted Security - BOS - HalifaxDocument2 pagesDeed of Substituted Security - BOS - HalifaxDamian MikaNo ratings yet

- Assignment 2Document14 pagesAssignment 2Bryent GawNo ratings yet

- Balance Sheet AccountsDocument7 pagesBalance Sheet AccountsroldanNo ratings yet

- Financial Management Time Value of Money Lecture 2,3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2,3 and 4Rameez Ramzan Ali67% (3)

- Business and Consumer LoanDocument18 pagesBusiness and Consumer LoanMhavie Calamno VallenteNo ratings yet

- Sap Fico Balance SheetDocument28 pagesSap Fico Balance Sheetvenkat pulluriNo ratings yet

- Assets, Liabilities & EquityDocument2 pagesAssets, Liabilities & EquityDeepaVanuNo ratings yet

- Chapter Two: Accounting Cycle For Service-Giving BusinessDocument35 pagesChapter Two: Accounting Cycle For Service-Giving BusinessMathewos Woldemariam Birru100% (2)

- Sections of The Balance Sheet: Assets SectionDocument4 pagesSections of The Balance Sheet: Assets Sectionchand1234567893No ratings yet

- In Financial AccountingDocument1 pageIn Financial AccountingKia PottsNo ratings yet

- Assets Liabilities and Net-WorthDocument6 pagesAssets Liabilities and Net-WorthNegress1No ratings yet

- Preparation of Balance SheetDocument5 pagesPreparation of Balance SheetPrakashMhatre100% (1)

- MBA AssignmentDocument2 pagesMBA Assignmentg_d_dubeyciaNo ratings yet

- Accounting Chap.2Document35 pagesAccounting Chap.2Tasebe GetachewNo ratings yet

- Handout No. 1 in Fundamentals of Accounting, Business, and Management 2Document8 pagesHandout No. 1 in Fundamentals of Accounting, Business, and Management 2Stephanie DecidaNo ratings yet

- Balance SheetDocument6 pagesBalance Sheetddoc.mimiNo ratings yet

- A Balance Sheet Is A Financial StatementDocument6 pagesA Balance Sheet Is A Financial StatementNatsu DragneelNo ratings yet

- Introduction of A Financial Performance ProjectDocument15 pagesIntroduction of A Financial Performance ProjectNazir HussainNo ratings yet

- Name: Giovanni Oliveria. Opog 12-VenusDocument7 pagesName: Giovanni Oliveria. Opog 12-VenusbannieopogNo ratings yet

- Breaking Down The Balance SheetDocument2 pagesBreaking Down The Balance SheetJesse WeeningNo ratings yet

- Fabm2 PPTG1Document65 pagesFabm2 PPTG1chrisraymund.bermudoNo ratings yet

- Fofm Word File Roll No 381 To 390Document26 pagesFofm Word File Roll No 381 To 390Spandan ThakkarNo ratings yet

- The Balance SheetDocument7 pagesThe Balance Sheetsevirous valeriaNo ratings yet

- 21 Process Financial Transactions and Extract Interim ReportDocument22 pages21 Process Financial Transactions and Extract Interim Reportembaendo27uNo ratings yet

- Accounting Elements in The Statement of Financial PositionDocument4 pagesAccounting Elements in The Statement of Financial PositionBianca Jane GaayonNo ratings yet

- How The Balance Sheet WorksDocument5 pagesHow The Balance Sheet Worksrimpyagarwal100% (1)

- The Different and Interrelated Stages of The Accounting Cycle Will Be PresentedDocument15 pagesThe Different and Interrelated Stages of The Accounting Cycle Will Be PresentedHussen AbdulkadirNo ratings yet

- A Balance SheetDocument3 pagesA Balance SheetKarthik ThotaNo ratings yet

- Chapter2 0Document56 pagesChapter2 0Eaindray OoNo ratings yet

- Faculty of Businee and EconomicsDocument9 pagesFaculty of Businee and EconomicsEfrem WondaleNo ratings yet

- 1.fundamentals of ABM 2Document27 pages1.fundamentals of ABM 2MaraNo ratings yet

- Unit .2 The Accounting Cycle For Service Giving BusinessDocument21 pagesUnit .2 The Accounting Cycle For Service Giving BusinessNikki100% (1)

- Accounting TerminologiesDocument10 pagesAccounting Terminologiesshakaday ShokshokNo ratings yet

- Resumen: Capitulo 2 Ross Financial Statements and Flow of CashDocument2 pagesResumen: Capitulo 2 Ross Financial Statements and Flow of CashEric CarreraNo ratings yet

- Introduction to Balance Sheet: Fulfilled: student of the AБ-71-8a group V.V. Radko Checked: Z. A. OleksichDocument14 pagesIntroduction to Balance Sheet: Fulfilled: student of the AБ-71-8a group V.V. Radko Checked: Z. A. OleksichРадько Вікторія ВікторівнаNo ratings yet

- Balance Sheet PreparationDocument34 pagesBalance Sheet PreparationShafi Marwat KhanNo ratings yet

- The Statement of Financial Position or (SFP)Document4 pagesThe Statement of Financial Position or (SFP)UnkownamousNo ratings yet

- Balance SheetDocument11 pagesBalance SheetVilexy NuñezNo ratings yet

- Introduction To Balance SheetDocument10 pagesIntroduction To Balance SheetJodie Ann PajacNo ratings yet

- How The Balance Sheet Is Structured?Document4 pagesHow The Balance Sheet Is Structured?Abhimanyu MalhotraNo ratings yet

- CH 2 FAcc1@2013-1Document19 pagesCH 2 FAcc1@2013-1tamebirhanu696No ratings yet

- Fundamentals Ofabm2: Gerlie D. BorneaDocument53 pagesFundamentals Ofabm2: Gerlie D. BorneaGerlie BorneaNo ratings yet

- Reading and Interpreting Banks Balance SheetDocument8 pagesReading and Interpreting Banks Balance SheetRavalika PathipatiNo ratings yet

- IBF Short Notes Chapter 3Document4 pagesIBF Short Notes Chapter 3Minhaj TariqNo ratings yet

- FABM 2 - Lesson1 5Document78 pagesFABM 2 - Lesson1 5Sis HopNo ratings yet

- 4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Document15 pages4 Common Types of Financial Statements To Know: 1. What Is A Statmemt of Financial Position (Balance Sheets) ?Ray Allen Uy100% (1)

- Book KeepingDocument174 pagesBook KeepingaroralokeshNo ratings yet

- FABM 2 - Lesson1Document19 pagesFABM 2 - Lesson1---100% (1)

- Accounting BasicDocument61 pagesAccounting BasicSwapna Zacharia CheripurathuNo ratings yet

- Balance Sheet Assets Liabilities Income StatementDocument4 pagesBalance Sheet Assets Liabilities Income Statementmadhav5544100% (1)

- Accounting Manual On Double Entry System of AccountingDocument12 pagesAccounting Manual On Double Entry System of AccountingGaurav TrivediNo ratings yet

- Statement of Financial Position: Business StudiesDocument8 pagesStatement of Financial Position: Business StudiesUpasana ChaubeNo ratings yet

- Chapter Summary Chapter #2: Accounting Decision ToolsDocument1 pageChapter Summary Chapter #2: Accounting Decision ToolsKerri McGinleyNo ratings yet

- OF Financial Statement: Dr. Quang NguyenDocument56 pagesOF Financial Statement: Dr. Quang NguyenQuang NguyễnNo ratings yet

- Balance SheetDocument4 pagesBalance SheetPFENo ratings yet

- In Business and AccountingDocument6 pagesIn Business and AccountingHarish AroraNo ratings yet

- 02 Handout 1Document6 pages02 Handout 1Stacy Anne LucidoNo ratings yet

- FABM2 STATEMENT OF FINANCIAL POSITION AbstractionDocument5 pagesFABM2 STATEMENT OF FINANCIAL POSITION AbstractionIrish Shyne IINo ratings yet

- Balance Sheet - A.K.A. Statement of Financial PositionDocument8 pagesBalance Sheet - A.K.A. Statement of Financial PositionLovely Mae LacasteNo ratings yet

- Balance Sheet - A.K.A. Statement of Financial PositionDocument8 pagesBalance Sheet - A.K.A. Statement of Financial PositionLovely Mae Manuel LacasteNo ratings yet

- Fin BuzDocument2 pagesFin BuzSiva Nageswara Rao ChebroluNo ratings yet

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersFrom EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersNo ratings yet

- Bookbind HRMDocument132 pagesBookbind HRMBryent GawNo ratings yet

- Chiang Kai Shek College Assessment No. 3Document6 pagesChiang Kai Shek College Assessment No. 3Bryent GawNo ratings yet

- MT Act 2-GEGRBK: Types of Literature Direction: Based On The Local Tradition and Culture of The Philippines, Supply The FollowingDocument1 pageMT Act 2-GEGRBK: Types of Literature Direction: Based On The Local Tradition and Culture of The Philippines, Supply The FollowingBryent GawNo ratings yet

- Chiang Kai Shek College: A Documentary Requirement For Work-Integrated Learning at Ollopa CompanyDocument3 pagesChiang Kai Shek College: A Documentary Requirement For Work-Integrated Learning at Ollopa CompanyBryent GawNo ratings yet

- Jms Student Organization Treasurer Jma Student Organization Treasurer Jms Student Organization Adviser Jma Student Organization AdviserDocument2 pagesJms Student Organization Treasurer Jma Student Organization Treasurer Jms Student Organization Adviser Jma Student Organization AdviserBryent GawNo ratings yet

- Umayyad Caliphate 661 To 750 Abu Sufyan Ibn HarbDocument4 pagesUmayyad Caliphate 661 To 750 Abu Sufyan Ibn HarbBryent GawNo ratings yet

- Working CapsDocument2 pagesWorking CapsBryent GawNo ratings yet

- Human Resource Management AssignmentDocument2 pagesHuman Resource Management AssignmentBryent GawNo ratings yet

- 2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxDocument7 pages2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxBryent GawNo ratings yet

- Scrap 5Document14 pagesScrap 5Bryent GawNo ratings yet

- Titi Ni Manoy SauceDocument6 pagesTiti Ni Manoy SauceBryent GawNo ratings yet

- De La Salle Araneta UniversityDocument7 pagesDe La Salle Araneta UniversityBryent GawNo ratings yet

- Donkey's Dick For DinnerDocument3 pagesDonkey's Dick For DinnerBryent GawNo ratings yet

- Gelato: Not Quite The SameDocument1 pageGelato: Not Quite The SameBryent GawNo ratings yet

- VAT Exempt Exercise TBPDocument3 pagesVAT Exempt Exercise TBPBryent GawNo ratings yet

- 91 Aloo Gobi: Northern India, IndiaDocument5 pages91 Aloo Gobi: Northern India, IndiaBryent GawNo ratings yet

- Donkey's Dick For DinnerDocument3 pagesDonkey's Dick For DinnerBryent GawNo ratings yet

- What Is A Balance SheetDocument26 pagesWhat Is A Balance SheetAbhirup SenguptaNo ratings yet

- Keeping-Current-2007-09-Realmiamibeach ComDocument28 pagesKeeping-Current-2007-09-Realmiamibeach Comrealmiamibeach100% (1)

- Credit Transactions (Palmares v. CA)Document2 pagesCredit Transactions (Palmares v. CA)Maestro Lazaro100% (1)

- Fin 4303 Chapter 8 ContentDocument10 pagesFin 4303 Chapter 8 Contentsxsy8124100% (1)

- Transunion Cibil ReportDocument39 pagesTransunion Cibil ReportSHREYAS KHANOLKARNo ratings yet

- Topic 11-Loan DebentureDocument57 pagesTopic 11-Loan DebentureSofia ArissaNo ratings yet

- Act No. 2655 - An Act Fixing Rates of Interest Upon Loans and Declaring The Effect of Receiving or Taking Usurious Rates and For Other PurposesDocument3 pagesAct No. 2655 - An Act Fixing Rates of Interest Upon Loans and Declaring The Effect of Receiving or Taking Usurious Rates and For Other PurposesGabe BedanaNo ratings yet

- LKAS 37 - StudentsDocument7 pagesLKAS 37 - StudentskawindraNo ratings yet

- Engineoring Jaime: Question Bank TiongDocument1 pageEngineoring Jaime: Question Bank TiongJimuel Sanchez CayabasNo ratings yet

- Credit Policy 2018Document10 pagesCredit Policy 2018Alan Lule100% (1)

- Difference Between Shareholders Loan and Increase in Share CapitalDocument2 pagesDifference Between Shareholders Loan and Increase in Share CapitalTeebaSolaimalai100% (1)

- Compound Interest QuizDocument16 pagesCompound Interest Quizvijeta diwanNo ratings yet

- Debt ManagementDocument9 pagesDebt ManagementAngelie AnilloNo ratings yet

- Fria LawDocument40 pagesFria LawSK San Isidro BombonNo ratings yet

- Fairway Mortgage DocumentsDocument6 pagesFairway Mortgage DocumentsFairway Independent MortgageNo ratings yet

- Bad Debts Structured 2019 PDFDocument16 pagesBad Debts Structured 2019 PDFArshad ChaudharyNo ratings yet

- Larrobis, Jr. v. Philippine Veterans Bank: RulingDocument3 pagesLarrobis, Jr. v. Philippine Veterans Bank: RulingJulie Anne GarciaNo ratings yet

- Balance Sheet Presentation of Liabilities: Problem 10.2ADocument4 pagesBalance Sheet Presentation of Liabilities: Problem 10.2AMuhammad Haris100% (1)

- Chapter 9 Simple Interest PDFDocument7 pagesChapter 9 Simple Interest PDFAhmed AymanNo ratings yet

- LLAWJDOC6002 - Credit and Security Law SyllabusDocument3 pagesLLAWJDOC6002 - Credit and Security Law SyllabusWing Laam Tam (Bobo)No ratings yet

- Munar8257 - Welcome LetterDocument3 pagesMunar8257 - Welcome LetterYash DaymaNo ratings yet

- Loans and AdvancesDocument6 pagesLoans and AdvancesAnusuya Chela100% (1)

- Section 53 of IBCDocument46 pagesSection 53 of IBCajay khandelwalNo ratings yet

- Current Liabilities - ProvisionsDocument9 pagesCurrent Liabilities - ProvisionsJerome_JadeNo ratings yet

- IAS 32, 39, IFRS 7, 9 - Long-Term LiabilitiesDocument48 pagesIAS 32, 39, IFRS 7, 9 - Long-Term Liabilitiesdzenita5beciragic5kaNo ratings yet

- What Is A Treasury BondDocument12 pagesWhat Is A Treasury Bondmorris yenenehNo ratings yet

- Bpi Investment Corporation Vs CADocument2 pagesBpi Investment Corporation Vs CAJulianNo ratings yet