Professional Documents

Culture Documents

Entries For Reconciliation

Uploaded by

Mae MarinoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Entries For Reconciliation

Uploaded by

Mae MarinoCopyright:

Available Formats

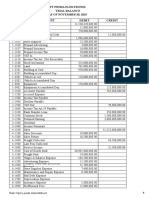

Preparation of Entries for Reconciliation

Debit Credit

a. Operating - Decrease in Accounts Receivable 10,000

Accounts Payable 10,000

b. Inventory 5,000

Operating - Increase inInventory 5,000

c. Prepaid Expenses 4,000

Operating - Increase in Prepaid Expenses 4,000

110,00

d. Land 0

110,00

Bonds Payable 0

120,00

e. Building 0

120,00

Investing - Purchase in Equipment 0

f. Equipment 25,000

Investing - Purchase in Equipment 25,000

g. Investing - Sale of Equipment 4,000

Operating - Loss on Disposal of Plant Assets 3,000

Accumulated Depreciation - Equipment 1,000

Equipment 8,000

h. Operating - Increase in Accounts Payable 16,000

Accounts Payable 16,000

i. Income Taxes Payable 2,000

Operating - Decrease in Income Taxes Payable 2,000

j. Financing - Increase in Common Stock 20,000

Common Stock 20,000

k. Operating - Depreciation Expense - Building 6,000

Accumulated Depreciation - Building 6,000

l. Operating - Depreciation Expense - Equipment 3,000

Accumulated Depreciation - Equipment 3,000

m 145,00

. Operating - Net Income 0

145,00

Retained Earnings 0

n. Retained Earnings 29,000

Financing - Payment of Dividends 29,000

o. Cash 22,000

Increase in Cash 22,000

You might also like

- Entries For ReconciliationDocument1 pageEntries For ReconciliationMae MarinoNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Solution Cash FlowDocument7 pagesSolution Cash FlowritamNo ratings yet

- Cada IntmgtAcctg3Exer1Document7 pagesCada IntmgtAcctg3Exer1KrishNo ratings yet

- AKL 2 - Tugas 3 Marselinus A H T (A31113316)Document3 pagesAKL 2 - Tugas 3 Marselinus A H T (A31113316)Marselinus Aditya Hartanto TjungadiNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- FABM 2 HANDOUTS 1st QRTRDocument17 pagesFABM 2 HANDOUTS 1st QRTRDanise PorrasNo ratings yet

- 1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Document14 pages1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Shien Angel Delos ReyesNo ratings yet

- Far CH7.P7 CH8.P5&7Document4 pagesFar CH7.P7 CH8.P5&7she kioraNo ratings yet

- Baysa ParcorChapter 1-5 Answer KeyDocument52 pagesBaysa ParcorChapter 1-5 Answer KeymoonjianneNo ratings yet

- APC Ch1solDocument7 pagesAPC Ch1solAnonymous LusWvyNo ratings yet

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2BDocument4 pagesAssignment in Financial Accounting: Jane B. Evangelista Bsba-2BJane Barcelona Evangelista0% (1)

- Seat Foodie Financial StatementsDocument6 pagesSeat Foodie Financial Statementsapi-542433757No ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Fa3 PDF LongDocument1 pageFa3 PDF LongAmir LMNo ratings yet

- Problem No 1Document5 pagesProblem No 1shabNo ratings yet

- Answer To Sample Question 2Document3 pagesAnswer To Sample Question 2Farid AbbasovNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Cost Accounting System: TopicDocument2 pagesCost Accounting System: Topicsamartha umbareNo ratings yet

- Midterm Problem - DocmDocument2 pagesMidterm Problem - Docmpippen venegasNo ratings yet

- Statement of Profit or Loss For The Year Ended 31 December 2016Document2 pagesStatement of Profit or Loss For The Year Ended 31 December 2016Plawan GhimireNo ratings yet

- Chapter 1 - Multiple Choice Problem Answers AfarDocument13 pagesChapter 1 - Multiple Choice Problem Answers AfarChincel G. ANINo ratings yet

- ANS - 1 (A, B, C)Document5 pagesANS - 1 (A, B, C)Nazir AhmadNo ratings yet

- Goodah Products Company FSADocument1 pageGoodah Products Company FSAFood EyeNo ratings yet

- A. The Following Account Balances Were Presented On December 31, 2017Document3 pagesA. The Following Account Balances Were Presented On December 31, 2017Shiela Mae Pon AnNo ratings yet

- Accouncting ProblemDocument3 pagesAccouncting ProblemShaneNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Quiz 3 Acctg For Business Combination - EntriesDocument6 pagesQuiz 3 Acctg For Business Combination - EntriesNhicoleChoiNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- Multiple Choice ProblemsDocument5 pagesMultiple Choice ProblemsHannahbea LindoNo ratings yet

- ASSIGNMENT 411 - Audit of FS PresentationDocument4 pagesASSIGNMENT 411 - Audit of FS PresentationWam OwnNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- PDF Sol Man Chapter 10 Cash To Accrual Basis of Acctg - CompressDocument9 pagesPDF Sol Man Chapter 10 Cash To Accrual Basis of Acctg - CompressFrost GarisonNo ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- Assignment - J&RDocument6 pagesAssignment - J&RJie SapornaNo ratings yet

- ACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KDocument2 pagesACFrOgCXlqyBubUO 0k2 oqedP7h-nBYz6kyTwIOUtsM8YzGP85yKUDWiFtg8sxBlV4Hw82Zrv8Ha9zgsOOJOU6tLz838EivSxvzOqilLjimAlle6rnKpoa8Bur97ErTWtcl mZnrslLoC3IU KStefanie Jane Royo PabalinasNo ratings yet

- Acc Concepts PP QnsDocument9 pagesAcc Concepts PP Qnsmoots altNo ratings yet

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Chap 13 - 1 To 5Document5 pagesChap 13 - 1 To 5Buenaventura, Lara Jane T.No ratings yet

- Adjusted Entries:: Dr. CRDocument2 pagesAdjusted Entries:: Dr. CRemem resuentoNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- Anteneh Assignment 1Document17 pagesAnteneh Assignment 1Abatneh mengistNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- PDF Far Quiz 2 Final W Answers - CompressDocument3 pagesPDF Far Quiz 2 Final W Answers - CompressdasdsadsadasdasdNo ratings yet

- Model Paper AnswersDocument12 pagesModel Paper AnswersShenali NupehewaNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Cost Accounting WorksheetDocument2 pagesCost Accounting WorksheetLEON JOAQUIN VALDEZNo ratings yet

- Financial Statement Analysis ExerciseDocument5 pagesFinancial Statement Analysis ExerciseMelanie SamsonaNo ratings yet

- Chapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyDocument4 pagesChapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyCertified Public AccountantNo ratings yet

- Solution - Chapter 31, 32, 33, 34 and 41Document10 pagesSolution - Chapter 31, 32, 33, 34 and 41Aeron Arroyo IINo ratings yet

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Economic Order QuantityDocument1 pageEconomic Order QuantityMae MarinoNo ratings yet

- Case Digests in Credit TransactionsDocument6 pagesCase Digests in Credit TransactionsMae MarinoNo ratings yet

- StatisticsDocument1 pageStatisticsMae MarinoNo ratings yet

- Financial WorksheetDocument2 pagesFinancial WorksheetMae MarinoNo ratings yet

- Corporate CultureDocument2 pagesCorporate CultureMae MarinoNo ratings yet

- Financial WorksheetDocument2 pagesFinancial WorksheetMae MarinoNo ratings yet

- Earnings Per ShareDocument1 pageEarnings Per ShareMae MarinoNo ratings yet

- Allowance For ImpairmentDocument1 pageAllowance For ImpairmentMae MarinoNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsMae MarinoNo ratings yet

- JFCDocument1 pageJFCMae MarinoNo ratings yet

- Net Income / No. of Outstanding Shares 5,000,000 / 100,000Document2 pagesNet Income / No. of Outstanding Shares 5,000,000 / 100,000Mae MarinoNo ratings yet

- Statistical AnalysisDocument1 pageStatistical AnalysisMae MarinoNo ratings yet

- Dimaculangan CorpDocument1 pageDimaculangan CorpMae MarinoNo ratings yet

- ABC CompanyDocument1 pageABC CompanyMae MarinoNo ratings yet

- Loan Impairment (Bad Debt Expense) 201CDocument1 pageLoan Impairment (Bad Debt Expense) 201CMae MarinoNo ratings yet

- GHI CompanyDocument2 pagesGHI CompanyMae MarinoNo ratings yet

- DEF CompanyDocument1 pageDEF CompanyMae MarinoNo ratings yet

- Petty Cash Shortage or Overage: DEF CompanyDocument1 pagePetty Cash Shortage or Overage: DEF CompanyMae MarinoNo ratings yet

- Net Income / No. of Outstanding Shares 5,000,000 / 100,000Document2 pagesNet Income / No. of Outstanding Shares 5,000,000 / 100,000Mae MarinoNo ratings yet

- Net Income / No. of Outstanding Shares 5,000,000 / 100,000Document2 pagesNet Income / No. of Outstanding Shares 5,000,000 / 100,000Mae MarinoNo ratings yet

- Allowance For ImpairmentDocument1 pageAllowance For ImpairmentMae MarinoNo ratings yet

- StatisticsDocument1 pageStatisticsMae MarinoNo ratings yet

- GHI CompanyDocument2 pagesGHI CompanyMae MarinoNo ratings yet

- Relevant RatiosDocument1 pageRelevant RatiosMae MarinoNo ratings yet

- Corporate CultureDocument2 pagesCorporate CultureMae MarinoNo ratings yet

- What Are The Good and Bad Culture That Mitsubishi Have?Document2 pagesWhat Are The Good and Bad Culture That Mitsubishi Have?Mae MarinoNo ratings yet

- FIFO and Weighted AveDocument2 pagesFIFO and Weighted AveMae MarinoNo ratings yet

- The Different Formulas For Recovery From COVID - FinalDocument29 pagesThe Different Formulas For Recovery From COVID - FinalKrishNo ratings yet

- BataanDocument2 pagesBataanMae MarinoNo ratings yet

- Content Problem Sets 4. Review Test Submission: Problem Set 08Document8 pagesContent Problem Sets 4. Review Test Submission: Problem Set 08gggNo ratings yet

- Essentials of Budgetary ControlDocument13 pagesEssentials of Budgetary ControlShashiprakash SainiNo ratings yet

- Application For Bank FacilitiesDocument4 pagesApplication For Bank FacilitiesChetan DigarseNo ratings yet

- Tutorial Istisna (Soalan)Document2 pagesTutorial Istisna (Soalan)Nurul Farah Mohd FauziNo ratings yet

- Research Papers On Bank Loans in IndiaDocument7 pagesResearch Papers On Bank Loans in Indiaofahxdcnd100% (1)

- MBA711 - Chapter11 - Answers To All Homework ProblemsDocument17 pagesMBA711 - Chapter11 - Answers To All Homework ProblemsGENIUS1507No ratings yet

- UAE MacroeconomicsDocument31 pagesUAE Macroeconomicsapi-372042367% (3)

- IRS Publication Form Instructions 2106Document8 pagesIRS Publication Form Instructions 2106Francis Wolfgang UrbanNo ratings yet

- Cash Flow statement-AFMDocument27 pagesCash Flow statement-AFMRishad kNo ratings yet

- 19696ipcc Acc Vol2 Chapter14Document41 pages19696ipcc Acc Vol2 Chapter14Shivam TripathiNo ratings yet

- Chap 011 SolutionsDocument8 pagesChap 011 Solutionsarie_spp100% (1)

- Institutional Support For SSIDocument11 pagesInstitutional Support For SSIRideRNo ratings yet

- First Data Annual Report 2008Document417 pagesFirst Data Annual Report 2008SteveMastersNo ratings yet

- SolutionsChpt 08Document12 pagesSolutionsChpt 08Brenda LeonNo ratings yet

- Obligations and Contracts Case Digests Chapter IIDocument5 pagesObligations and Contracts Case Digests Chapter IIVenice Jamaila DagcutanNo ratings yet

- Transfield Vs LHCDocument3 pagesTransfield Vs LHCKarla BeeNo ratings yet

- Tds - Tax Deducted at Source: FCA Vishal PoddarDocument22 pagesTds - Tax Deducted at Source: FCA Vishal PoddarPalak PunjabiNo ratings yet

- Jurnal Tentang RibaDocument15 pagesJurnal Tentang RibaMuhammad AlfarabiNo ratings yet

- BP2313 Audit With Answers)Document44 pagesBP2313 Audit With Answers)hodgl1976100% (4)

- Pasig Revenue Code PDFDocument295 pagesPasig Revenue Code PDFJela Oasin33% (9)

- Chapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinDocument21 pagesChapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinmaheraldamatiNo ratings yet

- FINA3080 Assignment 1 Q&ADocument4 pagesFINA3080 Assignment 1 Q&AJason LeungNo ratings yet

- TRAVELERS INDEMNITY COMPANY OF ILLINOIS Et Al v. CLARENDON AMERICAN INSURANCE COMPANY Et Al ComplaintDocument41 pagesTRAVELERS INDEMNITY COMPANY OF ILLINOIS Et Al v. CLARENDON AMERICAN INSURANCE COMPANY Et Al ComplaintACELitigationWatchNo ratings yet

- UkccDocument10 pagesUkccFaiz Pecinta Reb0% (1)

- Chapter 5 - Fund Flow Statement (FFS)Document36 pagesChapter 5 - Fund Flow Statement (FFS)T- SeriesNo ratings yet

- Econ & Ss 2011Document187 pagesEcon & Ss 2011Amal ChinthakaNo ratings yet

- 6018 p2p3 SPK PD Subur AverageDocument21 pages6018 p2p3 SPK PD Subur AverageNadyaNo ratings yet

- MLFA Form 990 - 2016Document25 pagesMLFA Form 990 - 2016MLFANo ratings yet

- A. Balance Sheet: Hytek Income Statement Year 2012Document3 pagesA. Balance Sheet: Hytek Income Statement Year 2012marc chucuenNo ratings yet

- Ledger - Problems and SolutionsDocument1 pageLedger - Problems and SolutionsDjamal SalimNo ratings yet