Professional Documents

Culture Documents

Press Release - Oct2020 AUM FINAL

Uploaded by

Kevin ParkerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Press Release - Oct2020 AUM FINAL

Uploaded by

Kevin ParkerCopyright:

Available Formats

NEWS RELEASE

T. ROWE PRICE GROUP REPORTS PRELIMINARY MONTH-END

ASSETS UNDER MANAGEMENT FOR OCTOBER 2020

BALTIMORE (November 11, 2020) - T. Rowe Price Group, Inc. (NASDAQ-GS: TROW) today reported

preliminary month-end assets under management of $1.30 trillion as of October 31, 2020. Client

transf ers from mutual funds to other portfolios, including trusts and separate accounts, were $1.1 billion in

October 2020, and $12.3 billion for the year-to-date period ended October 31, 2020. These client

transf ers include $0.5 billion and $8.2 billion, respectively, transferred to the target-date retirement trusts

during October and the year-to-date period.

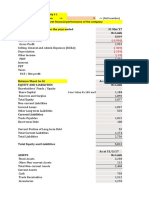

The f irm's assets under management as of October 31, 2020, and for the prior quarter- and year-end, by

investment vehicle, asset class, and in the firm’s target date retirement portfolios are as follows:

As of

Preliminary (a)

(in billions) 10/31/2020 9/30/2020 12/31/2019

U.S. mutual funds

Equity $ 436 $ 442 $ 407

Fixed income, including money market 78 78 74

Multi-asset (b) 193 196 202

707 716 683

Subadvised and separate accounts and other investment

products

Equity 342 344 292

Fixed income, including money market 86 83 74

Multi-asset (b) 165 167 158

593 594 524

Total assets under management $ 1,300 $ 1,310 $ 1,207

Target date retirement products $ 293 $ 297 $ 292

(a) Preliminary - subject to adjustment

(b) The underlying assets under management of the multi-asset portfolios have been aggregated and presented as a separate line and not reported in the equity

and fixed income lines.

Founded in 1937, Baltimore-based T. Rowe Price (troweprice.com) is a global investment management

organization that provides a broad array of mutual funds, subadvisory services, and separate account

management for individual and institutional investors, retirement plans, and financial intermediaries. The

organization also offers a variety of sophisticated investment planning and guidance tools. T. Rowe

Price's disciplined, risk-aware investment approach focuses on diversification, style consistency, and

f undamental research.

###

T. ROWE PRICE CONTACTS:

Public Relations Investor Relations

Brian Lewbart Meghan Azevedo

410-345-2242 410-345-2756

brian.lewbart@troweprice.com meghan.azevedo@troweprice.com

Supplemental Information

The f ollowing table reflects the data with the underlying assets under management of the multi-asset

portfolios included within the equity and fixed income lines.

As of

Preliminary (a)

(in billions) 10/31/2020 9/30/2020 12/31/2019

U.S. mutual funds

Equity and blended assets $ 577 $ 587 $ 553

Fixed income, including money market 130 129 130

707 716 683

Subadvised and separate accounts and other investment

products

Equity and blended assets 469 473 412

Fixed income, including money market 124 121 112

593 594 524

Total assets under management $ 1,300 $ 1,310 $ 1,207

(a) Preliminary - subject to adjustment

You might also like

- 2018 - Aal Chem Supplier Brochures PDFDocument366 pages2018 - Aal Chem Supplier Brochures PDFChris Smith50% (2)

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Toys R Us Bankruptcy CaseDocument2 pagesToys R Us Bankruptcy CaseIan GreyNo ratings yet

- Lecture 1 - Introduction To Management, The Malaysian Construction Industry & Construction OrganisationsDocument21 pagesLecture 1 - Introduction To Management, The Malaysian Construction Industry & Construction Organisationssitti drws0% (1)

- Working With Financial StatementsDocument44 pagesWorking With Financial StatementsLayal KibbiNo ratings yet

- E8-29 Segmented Income Statement: Conceptual ConnectionDocument5 pagesE8-29 Segmented Income Statement: Conceptual ConnectionDhiva Rianitha Manurung100% (1)

- News Release: T. Rowe Price Group Reports Preliminary Month-End Assets Under Management For September 2020Document4 pagesNews Release: T. Rowe Price Group Reports Preliminary Month-End Assets Under Management For September 2020Kevin ParkerNo ratings yet

- News Release: T. Rowe Price Group Reports Preliminary Month-End Assets Under Management For July 2019Document1 pageNews Release: T. Rowe Price Group Reports Preliminary Month-End Assets Under Management For July 2019Anonymous axQBY0KT7tNo ratings yet

- 100 - NHK 2020 Q1 FS - Sedar FinalDocument16 pages100 - NHK 2020 Q1 FS - Sedar FinalHoward QinNo ratings yet

- Veta Q1 2022 FinancialsDocument14 pagesVeta Q1 2022 FinancialsOleksandr StorcheusNo ratings yet

- News Release: T. Rowe Price Group Reports Preliminary Month-End Assets Under Management For March 2020Document1 pageNews Release: T. Rowe Price Group Reports Preliminary Month-End Assets Under Management For March 2020Kevin ParkerNo ratings yet

- Chapter Review and Self-Test Problems: 3.1 Sources and Uses of CashDocument11 pagesChapter Review and Self-Test Problems: 3.1 Sources and Uses of CashVincentDenhereNo ratings yet

- Test Sheet 194: 2021 - 2022: Term: I: F/m&m/ep/4.9Document3 pagesTest Sheet 194: 2021 - 2022: Term: I: F/m&m/ep/4.9Lavanya SharmaNo ratings yet

- Five Below 2018 Financial StatementsDocument4 pagesFive Below 2018 Financial StatementsElie GergesNo ratings yet

- Chapter 3 108-117Document10 pagesChapter 3 108-117Leony SantikaNo ratings yet

- Assets: PAYNET, Inc. Consolidated Balance SheetsDocument3 pagesAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303No ratings yet

- Hong Fok Corporation Limited: Revenue (Note 1)Document10 pagesHong Fok Corporation Limited: Revenue (Note 1)Theng RogerNo ratings yet

- 2021 Con Quarter01 SceDocument4 pages2021 Con Quarter01 SceMohammadNo ratings yet

- Norco Annual Report 2017Document107 pagesNorco Annual Report 2017Jigar Rameshbhai PatelNo ratings yet

- Cash Flow From Assets - Solution PDFDocument3 pagesCash Flow From Assets - Solution PDFSeptian Sugestyo PutroNo ratings yet

- HomeDepot F22 SolutionDocument4 pagesHomeDepot F22 SolutionFalguni ShomeNo ratings yet

- XFINMAN - Cash Flow AnalysisDocument17 pagesXFINMAN - Cash Flow AnalysisMae Justine Joy TajoneraNo ratings yet

- Reconciliation q4 Fy23Document5 pagesReconciliation q4 Fy23Shady FathyNo ratings yet

- 631aebc63e54dc674c550f7f 2208181457278539Document18 pages631aebc63e54dc674c550f7f 2208181457278539ojas khuranaNo ratings yet

- Sellfa 2Document21 pagesSellfa 2ashokawijesingheNo ratings yet

- Press Release June19 AUM FINALDocument1 pagePress Release June19 AUM FINALAnonymous GnrU1SxINo ratings yet

- Financial Statements, Cash Flow AnalysisDocument41 pagesFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- HKICPA QP Exam (Module A) Sep2008 Question PaperDocument9 pagesHKICPA QP Exam (Module A) Sep2008 Question Papercynthia tsui67% (3)

- Institute of Rural Management Anand: 1. Non-Current AssetsDocument5 pagesInstitute of Rural Management Anand: 1. Non-Current AssetsDharampreet SinghNo ratings yet

- Handout 1 (B) Ratio Analysis Practice QuestionsDocument5 pagesHandout 1 (B) Ratio Analysis Practice QuestionsMuhammad Asad AliNo ratings yet

- Goodwill HandoutDocument14 pagesGoodwill HandoutCharudatta MundeNo ratings yet

- T RoweDocument1 pageT RoweKevin ParkerNo ratings yet

- DTCC Annual Financial Statements 2020 and 2019Document51 pagesDTCC Annual Financial Statements 2020 and 2019EvgeniyNo ratings yet

- Intellipharmaceutics International Inc. q2 2021Document31 pagesIntellipharmaceutics International Inc. q2 2021Sandesh PatilNo ratings yet

- Keown10 PPT 04Document49 pagesKeown10 PPT 04aseelNo ratings yet

- 10Q1Q2012Document131 pages10Q1Q2012Biswa Mohan PatiNo ratings yet

- RoweDocument1 pageRoweAnonymous nYp0Y7QNo ratings yet

- UntitledDocument69 pagesUntitledJonathan OngNo ratings yet

- Held by Promoter/promoter Group Held by Public: Page 1 of 5Document5 pagesHeld by Promoter/promoter Group Held by Public: Page 1 of 5ratnadalNo ratings yet

- Хариу HW2 ACC732Document6 pagesХариу HW2 ACC732ZayaNo ratings yet

- Charging All Costs To Expense When IncurredDocument27 pagesCharging All Costs To Expense When IncurredAnonymous N9dx4ATEghNo ratings yet

- Cashflow Statements IAS 7 - P4Document10 pagesCashflow Statements IAS 7 - P4Vardhan Chulani100% (1)

- Health Master: Balance SheetDocument1 pageHealth Master: Balance SheetAminur Rahman KhanNo ratings yet

- Laforge Systems, Inc. Balance Sheet (In Millions) Years Ended December 31 2007 2008Document6 pagesLaforge Systems, Inc. Balance Sheet (In Millions) Years Ended December 31 2007 2008Dina WongNo ratings yet

- Financial Statements and Cash Flow: Mcgraw-Hill/IrwinDocument38 pagesFinancial Statements and Cash Flow: Mcgraw-Hill/IrwinBennyKurniawanNo ratings yet

- F22 BorgWarner SolutionDocument3 pagesF22 BorgWarner SolutionFalguni ShomeNo ratings yet

- Chapter 5 - Financial StatementDocument31 pagesChapter 5 - Financial StatementQUYÊN VŨ THỊ THUNo ratings yet

- PwC-IFRS-FS-2020-IFRS - VN - Part 8Document6 pagesPwC-IFRS-FS-2020-IFRS - VN - Part 8Hung LeNo ratings yet

- Harte Gold EEFF 2019Document29 pagesHarte Gold EEFF 2019Nestor CordovaNo ratings yet

- Itlog Ni JanDocument10 pagesItlog Ni JanAlejandro Javellana Paras IVNo ratings yet

- Fy 2020 ReportDocument225 pagesFy 2020 ReportMohamed ANo ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- Class Day Test BSC Finance Year 2Document5 pagesClass Day Test BSC Finance Year 2Revatee HurilNo ratings yet

- Consolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Document1 pageConsolidated Balance Sheet: in Millions, Except Per Share Amounts, at December 31Juan Jeronimo Marin ArevaloNo ratings yet

- Netflix, Inc. Consolidated Balance Sheets (In Thousands, Except Share and Per Share Data)Document9 pagesNetflix, Inc. Consolidated Balance Sheets (In Thousands, Except Share and Per Share Data)John AngNo ratings yet

- Chap 003Document80 pagesChap 003Châu Anh ĐàoNo ratings yet

- TZero 2018 10-KDocument20 pagesTZero 2018 10-KgaryrweissNo ratings yet

- MR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Document15 pagesMR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Mzm Zahir MzmNo ratings yet

- APM Assignment 2 - by SameeraDocument18 pagesAPM Assignment 2 - by SameeraRahull GurnaniNo ratings yet

- Financial Statement Analysis: Jeddah International College Answer PaperDocument4 pagesFinancial Statement Analysis: Jeddah International College Answer PaperBushraYousafNo ratings yet

- (A) Shareholding of Promoter and Promoter GroupDocument6 pages(A) Shareholding of Promoter and Promoter GroupVimal AgrawalNo ratings yet

- HSBC Holdings PLC: Data Pack 2Q 2020Document131 pagesHSBC Holdings PLC: Data Pack 2Q 2020Сона СергейNo ratings yet

- CAP-III SA Group-I Dec2021 FinalDocument79 pagesCAP-III SA Group-I Dec2021 FinalSanjay AryalNo ratings yet

- 2023 Healthy Harbor Report CardDocument9 pages2023 Healthy Harbor Report CardKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Retail Market ReportDocument1 pageRoanoke 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Due Madri MenuDocument1 pageDue Madri MenuKevin ParkerNo ratings yet

- P2024 SBB 20240506 ENG_0Document2 pagesP2024 SBB 20240506 ENG_0Kevin ParkerNo ratings yet

- Consumer Products Update - April 2024Document31 pagesConsumer Products Update - April 2024Kevin ParkerNo ratings yet

- Due Madri - Catering MenuDocument1 pageDue Madri - Catering MenuKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 RichmondDocument1 pageFive Fast Facts Q1 2024 RichmondKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Industrial Market ReportDocument3 pagesFredericksburg 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Office Market ReportDocument1 pageRoanoke 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Industrial Market ReportDocument1 pageRoanoke 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Hampton Roads 2024 Q1 Office Market ReportDocument3 pagesHampton Roads 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Retail Q1 2024Kevin ParkerNo ratings yet

- 2024 Q1 Industrial Houston Report ColliersDocument7 pages2024 Q1 Industrial Houston Report ColliersKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 FredericksburgDocument1 pageFive Fast Facts Q1 2024 FredericksburgKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Retail Market ReportDocument1 pageCharlottesville 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Office Market ReportDocument3 pagesFredericksburg 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Canals 2024 UpdateDocument57 pagesCanals 2024 UpdateKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 CharlottesvilleDocument1 pageFive Fast Facts Q1 2024 CharlottesvilleKevin ParkerNo ratings yet

- LeadershipDocument4 pagesLeadershipKevin ParkerNo ratings yet

- 2024 Real Estate Event InvitationDocument1 page2024 Real Estate Event InvitationKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Office Market ReportDocument1 pageCharlottesville 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- HO Waterways WV 231108Document2 pagesHO Waterways WV 231108Kevin ParkerNo ratings yet

- Linesight Construction Market Insights Americas - March 2024 1Document36 pagesLinesight Construction Market Insights Americas - March 2024 1Kevin ParkerNo ratings yet

- BestConstructionPracticesBUDMWorkshop Midwest FlyerDocument2 pagesBestConstructionPracticesBUDMWorkshop Midwest FlyerKevin ParkerNo ratings yet

- Manufacturing Update - March 2024Document31 pagesManufacturing Update - March 2024Kevin ParkerNo ratings yet

- GLDT Webinar Agenda APRIL 3 - 2024Document1 pageGLDT Webinar Agenda APRIL 3 - 2024Kevin ParkerNo ratings yet

- FY2023 Results - Transcript WebcastDocument20 pagesFY2023 Results - Transcript WebcastKevin ParkerNo ratings yet

- 2023 H2 Healthcare Houston Report ColliersDocument2 pages2023 H2 Healthcare Houston Report ColliersKevin ParkerNo ratings yet

- 2024 02 21 Item F2 Surfers-Beach-Staff-ReportDocument5 pages2024 02 21 Item F2 Surfers-Beach-Staff-ReportKevin ParkerNo ratings yet

- Kdoe.1 - 2021 - 15.10 - Tran Thi Ha Vi - 1915530542Document19 pagesKdoe.1 - 2021 - 15.10 - Tran Thi Ha Vi - 1915530542Vi TrầnNo ratings yet

- Inc42's 100 Unicorn Report 2022Document253 pagesInc42's 100 Unicorn Report 2022imrahulpasiNo ratings yet

- SCM Chapter 5Document4 pagesSCM Chapter 5mini moniNo ratings yet

- 08 Project Performance DomainsDocument9 pages08 Project Performance DomainsShivansh TulsyanNo ratings yet

- Shishir Hari Rajbhandari Nepal Case Analysis of Sears Changes Again and Again SynopsisDocument3 pagesShishir Hari Rajbhandari Nepal Case Analysis of Sears Changes Again and Again SynopsisrajbhandarishishirNo ratings yet

- Memorandum - Quarter 1 Declaration 2023Document3 pagesMemorandum - Quarter 1 Declaration 2023rovenNo ratings yet

- LJV Company Introduction 2019 - HADocument36 pagesLJV Company Introduction 2019 - HAlawrence tungNo ratings yet

- Chap004, Process CostingDocument17 pagesChap004, Process Costingrief1010No ratings yet

- 21-09 Janitorial Services NFLDocument19 pages21-09 Janitorial Services NFLEmeka EzeonyilimbaNo ratings yet

- Lot 4 - Lamu Sub-Centre - Bill of Quantities, Specifications & Drawings-Tender Reference No-kefri-Ont-011-2022-2023Document297 pagesLot 4 - Lamu Sub-Centre - Bill of Quantities, Specifications & Drawings-Tender Reference No-kefri-Ont-011-2022-2023gonyango561No ratings yet

- Quiz in Entrepreneurship LESSON 4: Entrepreneurial Ventures in The PhilippinesDocument3 pagesQuiz in Entrepreneurship LESSON 4: Entrepreneurial Ventures in The PhilippinesJustine Elissa Arellano MarceloNo ratings yet

- CVP NumericalsDocument12 pagesCVP NumericalsManmeet SinghNo ratings yet

- Afar Costing 2Document16 pagesAfar Costing 2JANUARY ANN C. BETENo ratings yet

- Swot Analysis Edited2Document8 pagesSwot Analysis Edited2Ronnel CompayanNo ratings yet

- Construction Manager's Job DescriptionDocument27 pagesConstruction Manager's Job Descriptionrojan ansulaNo ratings yet

- DUPA Aggregate Sub Base Course Item 200Document1 pageDUPA Aggregate Sub Base Course Item 200Richard FallegaNo ratings yet

- 7external Training Procurement Policy and Procedures TemplateDocument3 pages7external Training Procurement Policy and Procedures Templatepragatiaryal1998No ratings yet

- By Subhodip Pal A Detail Analysis of Indian Life Insurance SectorDocument21 pagesBy Subhodip Pal A Detail Analysis of Indian Life Insurance Sectorutkarsh tripathiNo ratings yet

- MAS - First Pre-Board 2014-15 With SolutionsDocument6 pagesMAS - First Pre-Board 2014-15 With SolutionsAj de CastroNo ratings yet

- How To Get and Write A Testimonial Letter That Will Increase Your Business!Document10 pagesHow To Get and Write A Testimonial Letter That Will Increase Your Business!Mobile MentorNo ratings yet

- Project Management A Managerial Approach 10th Edition Meredith Test BankDocument36 pagesProject Management A Managerial Approach 10th Edition Meredith Test Bankincubousbrocard.u8eo02100% (12)

- Creating Corporate Code of EthicsDocument8 pagesCreating Corporate Code of EthicsReywen KuderaNo ratings yet

- Reporting On Audited Financial Statements: Proposed New and Revised International Standards On Auditing (Isas)Document16 pagesReporting On Audited Financial Statements: Proposed New and Revised International Standards On Auditing (Isas)Andrecarvalho97No ratings yet

- Impact of Service Quality Corporate Image and Perceived Value On Brand Loyalty With Presence and Absence of Customer SatisfactionDocument24 pagesImpact of Service Quality Corporate Image and Perceived Value On Brand Loyalty With Presence and Absence of Customer SatisfactionNurulfitrahhafidNo ratings yet

- CPD Tokenomics 3108Document5 pagesCPD Tokenomics 3108VitaliyNo ratings yet

- Quality Management For The Medical Laboratory: Michael Noble MD FRCPCDocument26 pagesQuality Management For The Medical Laboratory: Michael Noble MD FRCPCRobinson KetarenNo ratings yet

- Professional SalesmanshipDocument12 pagesProfessional SalesmanshipMarianne Bag-aoNo ratings yet