Professional Documents

Culture Documents

NeedlesPOA12e - P 15-07

NeedlesPOA12e - P 15-07

Uploaded by

SamerOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NeedlesPOA12e - P 15-07

NeedlesPOA12e - P 15-07

Uploaded by

SamerCopyright:

Available Formats

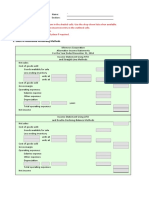

P-15-07 Name:

Section:

Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available.

An asterisk (*) will appear next to an incorrect entry in the outlined cells.

Enter any cash outflows and deductible values with minus sign in Statement of Cash Flows.

1.

Reed Corporation

Statement of Cash Flows

For the Year Ended June 30, 2014

Cash flows from operating activities:

Adjustments to reconcile net income to net

cash flows from operating activities:

Changes in current assets and current liabilities:

Net cash flows from operating activities

Cash flows from investing activities:

Cash flows from financing activities:

Net cash flows from financing activities

Net in cash

Schedule of Noncash Investing and Financing Transactions

2. Enter all amouns as positive values.

The primary reasons for the increase, in addition

to net income of were:

a. accounts receivable between year

b. inventory between years

c. accounts payable between years

d. Depreciation expense (a noncash expense)

e. income taxes payable between years

3.

Cash Flow Yield =

= times

Free Cash Flow =

P-15-07_Sol. Name: Solution

Section:

Enter the appropriate amount or item in the shaded cells. Use the drop-down lists when available.

An asterisk (*) will appear next to an incorrect entry in the outlined cells.

Enter any cash outflows and deductible values with minus sign in Statement of Cash Flows.

1.

Reed Corporation

Statement of Cash Flows

For the Year Ended June 30, 2014

Cash flows from operating activities:

Net income $ 239,200

Adjustments to reconcile net income to net

cash flows from operating activities:

Depreciation $ 120,000

Loss on sale of equipment 8,000

Changes in current assets and current liabilities:

Decrease in accounts receivable 40,000

Decrease in inventory 80,000

Decrease in prepaid expenses 800

Increase in accounts payable 44,000

Increase in income taxes payable 16,000 308,800

Net cash flows from operating activities $ 548,000

Cash flows from investing activities:

Sale of equipment 6,000

Cash flows from financing activities:

Repayment of mortgage $ (40,000)

Repayment of notes payable (160,000)

Issue of notes payable 60,000

Payment of dividends (120,000)

Net cash flows from financing activities (260,000)

Net increase in cash $ 294,000

Cash at beginning of year 40,000

Cash at end of year $ 334,000

Schedule of Noncash Investing and Financing Transactions

Issue of mortgage for land and build. $ 200,000

2. Enter all amouns as positive values.

The primary reasons for the increase, in addition

to net income of $ 239,200 were:

a. Reduction of accounts receivable between year $ 40,000

b. Reduction of inventory between years $ 80,000

c. Increase in accounts payable between years $ 44,000

d. Depreciation expense (a noncash expense) $ 120,000

e. Increase in income taxes payable between years $ 16,000

3.

Cash Flow Yield =

$ 548,000 / $ 239,200 = 2.3 times

Free Cash Flow = $ 434,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Ch12 P11 Build A ModelDocument7 pagesCh12 P11 Build A ModelRayudu RamisettiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Corporate Finance ExamDocument26 pagesCorporate Finance ExamRaman SrinivasanNo ratings yet

- Investor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?Document206 pagesInvestor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?karife3137100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Finance Simulation: M&A in Wine Country Valuation ExerciseDocument7 pagesFinance Simulation: M&A in Wine Country Valuation ExerciseAdemola Adeola0% (2)

- CFA Level I 1 Mock Exam June, 2018 Revision 1Document38 pagesCFA Level I 1 Mock Exam June, 2018 Revision 1Hít'z KhatwaniNo ratings yet

- Anscombe's Data WorkbookDocument5 pagesAnscombe's Data WorkbookSamerNo ratings yet

- Example Selecting Cases in SPSSDocument1 pageExample Selecting Cases in SPSSSamerNo ratings yet

- Example One Sample T TestDocument1 pageExample One Sample T TestSamerNo ratings yet

- Needles POA 12e - P 12-07Document4 pagesNeedles POA 12e - P 12-07SamerNo ratings yet

- NeedlesPOA12e - P 02-05Document9 pagesNeedlesPOA12e - P 02-05SamerNo ratings yet

- NeedlesPOA12e - P 05-06Document4 pagesNeedlesPOA12e - P 05-06SamerNo ratings yet

- NeedlesPOA 12e - P 07-02Document6 pagesNeedlesPOA 12e - P 07-02SamerNo ratings yet

- NeedlesPOA12e - P 05-03Document6 pagesNeedlesPOA12e - P 05-03SamerNo ratings yet

- NeedlesPOA12e - P 16-11Document2 pagesNeedlesPOA12e - P 16-11SamerNo ratings yet

- NeedlesPOA12e - P 16-01Document3 pagesNeedlesPOA12e - P 16-01SamerNo ratings yet

- NeedlesPOA12e - P 02-08Document8 pagesNeedlesPOA12e - P 02-08SamerNo ratings yet

- Needles POA 12e - P 12-03Document2 pagesNeedles POA 12e - P 12-03SamerNo ratings yet

- NeedlesPOA12e - P 08-04Document2 pagesNeedlesPOA12e - P 08-04SamerNo ratings yet

- NeedlesPOA12e - P 02-03Document8 pagesNeedlesPOA12e - P 02-03SamerNo ratings yet

- NeedlesPOA 12e - P 06-04Document3 pagesNeedlesPOA 12e - P 06-04SamerNo ratings yet

- Balaji TelefilmsDocument23 pagesBalaji TelefilmsShraddha TiwariNo ratings yet

- Chapter 18 Capital Budgeting and Valuation With Leverage: Corporate Finance, 2E, Global Edition (Berk/Demarzo)Document46 pagesChapter 18 Capital Budgeting and Valuation With Leverage: Corporate Finance, 2E, Global Edition (Berk/Demarzo)WesNo ratings yet

- Tablet-Case-SpreadsheetDocument138 pagesTablet-Case-SpreadsheetdynaNo ratings yet

- UVA-S-F-1211 (Rosario)Document8 pagesUVA-S-F-1211 (Rosario)Fahima_lmNo ratings yet

- Smaliraza - 3622 - 18945 - 1 - Lecture 10 - Investement Ana & Portfolio ManagementDocument17 pagesSmaliraza - 3622 - 18945 - 1 - Lecture 10 - Investement Ana & Portfolio ManagementSadia AbidNo ratings yet

- BMW Investor Presentation May 2016 PDFDocument39 pagesBMW Investor Presentation May 2016 PDFnunobNo ratings yet

- Carrefour FY 2020 18 02 2021 Complete 1Document58 pagesCarrefour FY 2020 18 02 2021 Complete 1AyaNo ratings yet

- Final Exam 2023 Corporate ValuationDocument5 pagesFinal Exam 2023 Corporate ValuationShivam SharmaNo ratings yet

- CH09 PPT MLDocument127 pagesCH09 PPT MLXianFa WongNo ratings yet

- Caledonia Products Integrative ProblemsDocument5 pagesCaledonia Products Integrative Problemstwalkthis069No ratings yet

- Literature Review Cash Flow ManagementDocument6 pagesLiterature Review Cash Flow Managementafmzitaaoxahvp100% (2)

- CTP EPP Formula FlashcardsDocument22 pagesCTP EPP Formula Flashcardsrivaldi000No ratings yet

- CVCXVCXV DDF DFDGFDG FGFG FGFG FGFD SGFGFG GDSDG DGGD FLGKFL GHomeDocument12 pagesCVCXVCXV DDF DFDGFDG FGFG FGFG FGFD SGFGFG GDSDG DGGD FLGKFL GHomeKrishnaPavanNo ratings yet

- Advanced Investment AppraisalDocument64 pagesAdvanced Investment AppraisalAayaz Turi100% (2)

- Sulzer Annual Results Presentation 2012Document29 pagesSulzer Annual Results Presentation 2012Diana PoltlNo ratings yet

- Page IndustriesDocument74 pagesPage IndustriesKiranNo ratings yet

- Fundamentals of Corporate Finance Canadian 2nd Edition Berk Solutions ManualDocument16 pagesFundamentals of Corporate Finance Canadian 2nd Edition Berk Solutions Manualomicronelegiac8k6st100% (23)

- Individual Assignment On Vedanta Resources by Divya PrakashDocument20 pagesIndividual Assignment On Vedanta Resources by Divya PrakashDivya Prakash MishraNo ratings yet

- Forecasting and Valuing Cash FlowDocument31 pagesForecasting and Valuing Cash FlowIshitta SardaNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisdavewagNo ratings yet

- Ejercicio 7.23Document1 pageEjercicio 7.23Enrique M.No ratings yet

- Case: Calpine Corporation: The Evolution From Project To Corporate FinanceDocument7 pagesCase: Calpine Corporation: The Evolution From Project To Corporate FinanceKshitishNo ratings yet

- Business Valuations: Net Asset Value (Nav)Document9 pagesBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNo ratings yet

- Atlantic Computer Case Study: A Bundle of Pricing OptionsDocument7 pagesAtlantic Computer Case Study: A Bundle of Pricing OptionsRaihan MuflihhamimNo ratings yet

- JK Tyres - 20020141022 - 20020141004Document80 pagesJK Tyres - 20020141022 - 20020141004AKANSH ARORANo ratings yet