Professional Documents

Culture Documents

Let's Analyze - UNIT IV

Let's Analyze - UNIT IV

Uploaded by

regineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Let's Analyze - UNIT IV

Let's Analyze - UNIT IV

Uploaded by

regineCopyright:

Available Formats

Let’s Analyze – UNIT IV

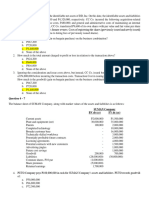

1. At year-end, an entity purchased for P30 per share all 200,000 of an acquiree’s

outstanding ordinary share. On this date, the carrying amount of net assets of the

acquiree was P5,000,000. The fair value of identifiable asset on this date was

P400,000 in excess of their carrying amount.

Required: the amount to be reported as goodwill.

Purchase price (200,000 x 30) P 6 000 000

Net assets @ FV 5 400 000

Goodwill 600 000

Carrying amount of net assets P 5 000 000

Excess fair value of identifiable asset 400 000

Fair value of net asset 5 400 000

2. 2. An entity was granted a patent on January 1, 2013 and capitalized P450,000.

The entity was amortizing the patent over the useful life of 15 years. During 2016,

the entity paid P150,000 in successfully defending an attempted infringement of

the patent. After the legal action was completed, the entity sold the patent to the

plaintiff for P750,000. The policy is to take no amortization in the year of disposal.

Required: (a) schedule for gain on sale; and (b) journal entries from 2013 to

2016.

(a)

Acquisition cost P 450 000

Amortization (450 000/ 15 x 3) (90 000)

Carrying amount 2016 360 000

Carrying Amount 360 000

Sale price 750 000

Gain on sale of patent 390 000

(b)

2013

Patent 450 000

Cash 450 000

Amortization of patent 30 000

Patent (450 000/15) 30 000

2014

Amortization of patent 30 000

Patent (450 000/15) 30 000

2015

Amortization of patent 30 000

Patent (450 000/15) 30 000

2016

Legal expense 150 000

Cash 150 000

Cash 750 000

Patent 360 000

Gain on sale of patent 390 000

3. An entity bought a franchise at the beginning of the current year for P2, 040,000.

An independent consultant estimated that the remaining useful life of the

franchise was 50 years. The unamortized cost of the franchise was P680, 000.

The entity decided to amortize the franchise over the maximum period allowed.

Required: journal entry for the current year related to the acquisition and

amortization of the franchise.

Franchise 2 040 000

Cash 2 040 000

Amortization of franchise 40 800

Franchise (2 040 000/50) 40 800

You might also like

- BSA2BQuiz 3Document19 pagesBSA2BQuiz 3Monica Enrico0% (1)

- Quizzes Chapter 3 Acccounting EquationDocument6 pagesQuizzes Chapter 3 Acccounting Equationez lang100% (1)

- Aguilan: Question No. 1 Answer BDocument82 pagesAguilan: Question No. 1 Answer BAnn Margarette Boco75% (4)

- Buscommmmmmmm 1Document7 pagesBuscommmmmmmm 1Erico PaderesNo ratings yet

- Module 003 - Substantive Tests of Receivables and SalesDocument17 pagesModule 003 - Substantive Tests of Receivables and SalesKeith Joshua GabiasonNo ratings yet

- Consolidation at The Date of Acquisition Problems Problem IDocument2 pagesConsolidation at The Date of Acquisition Problems Problem ISean Sanchez0% (1)

- CombinationDocument57 pagesCombinationGirl Lang Ako100% (1)

- Cash Flow Exercises Set 1Document3 pagesCash Flow Exercises Set 1chiong0% (1)

- Garlington Technologies IncDocument2 pagesGarlington Technologies IncRamarayo MotorNo ratings yet

- Accounting For Business CombinationsDocument5 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- Bus Com 12Document3 pagesBus Com 12Chabelita MijaresNo ratings yet

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- Review 2 Set K Problem 1Document3 pagesReview 2 Set K Problem 1Marinel AbrilNo ratings yet

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocument4 pagesACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.No ratings yet

- ABC CH1 SeatworkDocument3 pagesABC CH1 SeatworkMaurice AgbayaniNo ratings yet

- Bus Com 7Document5 pagesBus Com 7Chabelita MijaresNo ratings yet

- ReviewerDocument9 pagesReviewerMarielle JoyceNo ratings yet

- Subscription of SharesDocument8 pagesSubscription of SharesXingYang KiSadaNo ratings yet

- Midterm ExaminationDocument9 pagesMidterm ExaminationJohn Francis RosasNo ratings yet

- Revaluation Model, Impairment Loss, and Cash Generating UnitDocument6 pagesRevaluation Model, Impairment Loss, and Cash Generating UnitKlariza Paula Ng HuaNo ratings yet

- Shareholders EquityDocument6 pagesShareholders EquityDe Guzman Olchondra Kimberly100% (1)

- Prelim Quiz 1 Bus Com ANSWER KEYDocument3 pagesPrelim Quiz 1 Bus Com ANSWER KEYLois TesoroNo ratings yet

- 7th PYLON CUP Elimination Round SGVDocument8 pages7th PYLON CUP Elimination Round SGVrcaa04No ratings yet

- CFASDocument3 pagesCFASataydeyessaNo ratings yet

- Acctg 100C 25 PDFDocument2 pagesAcctg 100C 25 PDFQuid DamityNo ratings yet

- Quiz 1 - Midterm ReviewerDocument4 pagesQuiz 1 - Midterm ReviewerJack HererNo ratings yet

- Exercise 4 Shareholders EquityDocument9 pagesExercise 4 Shareholders EquityNimfa SantiagoNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- Chapter+3+Consolidation+at+aquisition+date+ PART+2Document16 pagesChapter+3+Consolidation+at+aquisition+date+ PART+2Christi ClarkNo ratings yet

- p1 & AP - IntangiblesDocument13 pagesp1 & AP - IntangiblesJolina Mancera100% (3)

- Statutory Merger Problem 1Document2 pagesStatutory Merger Problem 1Meleen TadenaNo ratings yet

- Audit of IntangiblesDocument5 pagesAudit of IntangiblesMae LaglivaNo ratings yet

- Adv. Accounting. Business Comb. MCQDocument13 pagesAdv. Accounting. Business Comb. MCQalmira garciaNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- Accounting For Business CombinationsDocument2 pagesAccounting For Business CombinationsJohn JackNo ratings yet

- Simulated Qualifying Exam ReviewerDocument10 pagesSimulated Qualifying Exam ReviewerJanina Frances Ruidera100% (1)

- FAR Refresher - With Answer Key - RefDocument8 pagesFAR Refresher - With Answer Key - RefsapilanfranceneNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Statement of CashflowDocument2 pagesStatement of CashflowAna Marie IllutNo ratings yet

- Sol ManDocument144 pagesSol ManShr Bn100% (1)

- Bus Com Handout 1 Bus CombinationDocument9 pagesBus Com Handout 1 Bus CombinationChristine RepuldaNo ratings yet

- Shareholders EquityDocument6 pagesShareholders EquityLhea VillanuevaNo ratings yet

- Advacc - Intercompany PDFDocument143 pagesAdvacc - Intercompany PDFGelyn CruzNo ratings yet

- AA 4101 Midterm With AnswersDocument9 pagesAA 4101 Midterm With AnswersAlyssa AnnNo ratings yet

- Use The Following Information For Question 1 and 2Document12 pagesUse The Following Information For Question 1 and 2Leah Mae NolascoNo ratings yet

- RTP May 16 GRP-1Document140 pagesRTP May 16 GRP-1Shakshi AgarwalNo ratings yet

- Business Combination 2Document3 pagesBusiness Combination 2Jamie RamosNo ratings yet

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- Corporate Liquidation Pproblems AfarDocument8 pagesCorporate Liquidation Pproblems AfarJhernel SuaverdezNo ratings yet

- Drill Problems - ConsolidationDocument6 pagesDrill Problems - Consolidationgun attaphanNo ratings yet

- PFRS 3 Business CombinationDocument3 pagesPFRS 3 Business CombinationRay Allen UyNo ratings yet

- Acc113 P1 QuizDocument5 pagesAcc113 P1 QuizEDELYN PoblacionNo ratings yet

- Cash and Receivable Management With SolutionsDocument3 pagesCash and Receivable Management With SolutionsRandy ManzanoNo ratings yet

- Adv AFARDocument145 pagesAdv AFARDvcLouisNo ratings yet

- SUMMER REVIEW SESSION NO.5 QUESTIONNAIRES (F1 and F2 ONLY)Document6 pagesSUMMER REVIEW SESSION NO.5 QUESTIONNAIRES (F1 and F2 ONLY)Aileen TorresNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- ACA Audit and Assurance Professional: Exam Preparation KitFrom EverandACA Audit and Assurance Professional: Exam Preparation KitNo ratings yet

- Enabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesFrom EverandEnabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesNo ratings yet

- Chapter 18Document3 pagesChapter 18regineNo ratings yet

- Enero - ACC 222 Exercise - FS AnalysisDocument4 pagesEnero - ACC 222 Exercise - FS AnalysisregineNo ratings yet

- Gefil 1 - Sim - SDL - PrelimDocument40 pagesGefil 1 - Sim - SDL - PrelimregineNo ratings yet

- WEEK 1-3 Documentation Techniques PDFDocument6 pagesWEEK 1-3 Documentation Techniques PDFregineNo ratings yet

- Other Strategies of Communication in The WorkplaceDocument6 pagesOther Strategies of Communication in The WorkplaceregineNo ratings yet

- Production Planning and ControlDocument30 pagesProduction Planning and ControlregineNo ratings yet

- Lesson Plan: Mixture ProblemsDocument9 pagesLesson Plan: Mixture ProblemsregineNo ratings yet

- CH 16Document23 pagesCH 16Ahmed Al EkamNo ratings yet

- Cpale Review TrackerDocument36 pagesCpale Review TrackerCarla Jean CuyosNo ratings yet

- IAS 16 NotesDocument2 pagesIAS 16 Notesshoaib jamshedNo ratings yet

- Financial Accounting - Chapter 4Document3 pagesFinancial Accounting - Chapter 4gjemiljesyla1No ratings yet

- Chap-5 Inventory Management FinalDocument55 pagesChap-5 Inventory Management Finalsushant chaudharyNo ratings yet

- Fabm 1 Module 2 Principles and ConceptsDocument10 pagesFabm 1 Module 2 Principles and ConceptsKISHA100% (1)

- Question 2 FR April 2022 Question 2 CaputDocument6 pagesQuestion 2 FR April 2022 Question 2 CaputLaud ListowellNo ratings yet

- Chapter 6 Types of Leverages-1Document23 pagesChapter 6 Types of Leverages-1Aejaz MohamedNo ratings yet

- 7.2 Bond ValuationDocument59 pages7.2 Bond ValuationAlperen KaragozNo ratings yet

- Unaudited 3m Condensed Combined Financial StatementsDocument40 pagesUnaudited 3m Condensed Combined Financial StatementsValtteri ItärantaNo ratings yet

- ACC Assignment 2Document8 pagesACC Assignment 2Saba AfzaalNo ratings yet

- Perhitungan The Mccloud Company T AccountsDocument3 pagesPerhitungan The Mccloud Company T AccountsLiliNo ratings yet

- 3.kingsun Financial Statement FinalDocument22 pages3.kingsun Financial Statement FinalDharamrajNo ratings yet

- Kamdhenu Foods LimitedDocument37 pagesKamdhenu Foods LimitedamitguptasidNo ratings yet

- CH20 Managerial AccountingDocument21 pagesCH20 Managerial AccountingAdilene AcostaNo ratings yet

- BFD Past Papers AnalysisDocument2 pagesBFD Past Papers AnalysisHamdan NawazNo ratings yet

- Ia CH 21-22 Quiz ExamDocument13 pagesIa CH 21-22 Quiz ExamAngelica Faye Bayani CastañedaNo ratings yet

- Impact of Dividend Policy On A Firm PerformanceDocument11 pagesImpact of Dividend Policy On A Firm PerformanceMuhammad AnasNo ratings yet

- Forecasting Revenue, Expenses - Scenario AnalysisDocument26 pagesForecasting Revenue, Expenses - Scenario AnalysisPREKSHA MALHOTRANo ratings yet

- Absorption and Marginal CostingDocument4 pagesAbsorption and Marginal CostingTrya SalsabillaNo ratings yet

- 28 - Swati Aggarwal - VedantaDocument11 pages28 - Swati Aggarwal - Vedantarajat_singlaNo ratings yet

- 06A Investment in Equity Securities (Financial Assets at FMV, Investment in Associates)Document6 pages06A Investment in Equity Securities (Financial Assets at FMV, Investment in Associates)randomlungs121223No ratings yet

- Financial Statement Analysis of Pakistan Tobacco CompanyDocument38 pagesFinancial Statement Analysis of Pakistan Tobacco CompanyNauman Rashid67% (3)

- Grace Fidelia - AKD (Pertemuan 11)Document6 pagesGrace Fidelia - AKD (Pertemuan 11)Grace FideliaNo ratings yet

- Record To Report Interview Questions and AnswersDocument14 pagesRecord To Report Interview Questions and Answersayushsadotra12314No ratings yet

- SheDocument2 pagesSheVel JuneNo ratings yet