Professional Documents

Culture Documents

What Is Taxation

Uploaded by

Jyasmine Aura V. Agustin0 ratings0% found this document useful (0 votes)

27 views4 pagesOriginal Title

What is taxation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views4 pagesWhat Is Taxation

Uploaded by

Jyasmine Aura V. AgustinCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

What Is Taxation?

Taxation is a term for when a taxing authority, usually a

government, levies or imposes a tax. The term "taxation" applies

to all types of involuntary levies, from income to capital gains

to estate taxes. Though taxation can be a noun or verb, it is

usually referred to as an act; the resulting revenue is usually

called "taxes."

ax systems have varied considerably across jurisdictions and

time. In most modern systems, taxation occurs on both

physical assets, such as property and specific events, such as a

sales transaction. The formulation of tax policies is one of the

most critical and contentious issues in modern politics.

A tax is a compulsory financial charge or some other

type of levy imposed on a taxpayer (an individual

or legal entity) by a governmental organization in order

to fund government spending and various public

expenditures.[2] A failure to pay, along with evasion of

or resistance to taxation, is punishable by law. Taxes

consist of direct or indirect taxes and may be paid in

money or as its labour equivalent. The first known

taxation took place in Ancient Egypt around 3000–

2800 BC.

Most countries have a tax system in place to pay for

public, common, or agreed national needs and

government functions. Some levy a flat percentage

rate of taxation on personal annual income, but

most scale taxes based on annual income amounts.

Most countries charge a tax on an

individual's income as well as on corporate income.

Countries or subunits often also impose wealth

taxes, inheritance taxes, estate taxes, gift

taxes, property taxes, sales taxes, payroll

taxes or tariffs.

In economic terms, taxation transfers wealth from

households or businesses to the government. This has

effects which can both increase and reduce economic

growth and economic welfare. Consequently, taxation

is a highly debated topic.

Taxation in the United States

The U.S. government was originally funded on very little direct

taxation. Instead, federal agencies assessed user fees for ports

and other government property. In times of need, the

government would decide to sell government assets

and bonds or issue an assessment to the states for services

rendered. In fact, Thomas Jefferson abolished direct taxation in

1802 after winning the presidency; only excise taxes remained,

which Congress repealed in 1817. Between 1817 and 1861, the

federal government collected no internal revenue.

An income tax of 3% was levied on high-income earners during

the Civil War. It was not until the Sixteenth Amendment was

ratified in 1913 that the federal government assessed taxes on

income as a regular revenue item. As of 2020, U.S. taxation

applies to items or activities ranging from income to cigarettes

to inheritances and even winning a Nobel Prize. In 2012, the

U.S. Supreme Court ruled that failure to purchase specific goods

or services, such as health insurance, was considered a tax and

not a fine.

Purposes and Justifications for Taxation

The most basic function of taxation is to fund government

expenditures. Varying justifications and explanations for taxes

have been offered throughout history. Early taxes were used to

support the ruling classes, raise armies, and build defenses.

Often, the authority to tax stemmed from divine or supranational

rights.

Later justifications have been offered across utilitarian,

economic, or moral considerations. Proponents of progressive

levels of taxation on high-income earners argue that taxes

encourage a more equitable society. Higher taxes on specific

products and services, such as tobacco or gasoline, have been

justified as a deterrent to consumption. Advocates of public

goods theory argue taxes may be necessary in cases in which the

private provision of public goods is considered sub-optimal,

such as with lighthouses or national defense.

Different Types of Taxation

As mentioned above, taxation applies to all different types of

levies. These can include (but are not limited to):

Income tax: Governments impose income taxes on

financial income generated by all entities within their

jurisdiction, including individuals and businesses.

Corporate tax: This type of tax is imposed on the profit of

a business.

Capital gains: A tax on capital gains is imposed on any

capital gains or profits made by people or businesses from

the sale of certain assets including stocks, bonds, or real

estate.

Property tax: A property tax is asses by a local

government and paid for by the owner of a property. This

tax is calculated based on property and land values.

Inheritance: A type of tax levied on individuals who

inherit the estate of a deceased person.

Sales tax: A consumption tax imposed by a government on

the sale of goods and services. This can take the form of a

value-added tax (VAT), a goods and services tax (GST), a

state or provincial sales tax, or an excise tax.

https://www.investopedia.com/terms/t/taxation.asp#:~:text=Taxation%20is%20a%20term%20for,capital%20gains%20to%20estate%20taxes.

https://en.wikipedia.org/wiki/Tax

You might also like

- V Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetDocument3 pagesV Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetV_Krishna_AnaparthiNo ratings yet

- TaxationDocument82 pagesTaxationRiah M. De ChavezNo ratings yet

- ADVANCED FINANCIAL ACCOUNTING 1 Antonio J. DayagDocument14 pagesADVANCED FINANCIAL ACCOUNTING 1 Antonio J. Dayagcassy100% (6)

- Print VAT Registration - GOV - UkDocument11 pagesPrint VAT Registration - GOV - Uksiva kumarNo ratings yet

- Formation of MV and CD PartnershipDocument303 pagesFormation of MV and CD PartnershipRina Mae Sismar Lawi-an67% (3)

- Partnership Liquidation ExplainedDocument9 pagesPartnership Liquidation ExplainedGab Ignacio100% (1)

- Income Tax - Principles (Pat)Document44 pagesIncome Tax - Principles (Pat)Jeacy Mae GallegoNo ratings yet

- Accenture (Value Creation)Document5 pagesAccenture (Value Creation)Ravi SinghNo ratings yet

- By: By: BKG Gabay BKG Gabay RM Remotin, Jr. RM Remotin, Jr. Eam Uy Eam UyDocument20 pagesBy: By: BKG Gabay BKG Gabay RM Remotin, Jr. RM Remotin, Jr. Eam Uy Eam UyTine FNo ratings yet

- Statement 603021 37840886 23 08 2023 22 09 2023 2Document5 pagesStatement 603021 37840886 23 08 2023 22 09 2023 2danNo ratings yet

- Corporate LiquidationDocument6 pagesCorporate LiquidationWendelyn Tutor100% (1)

- II. Taxation and Revenue AdministrationDocument34 pagesII. Taxation and Revenue AdministrationMara Pancho100% (11)

- Philippine Tax SystemDocument11 pagesPhilippine Tax SystemHyacinth Eiram AmahanCarumba LagahidNo ratings yet

- In Voiceprint As PDFDocument2 pagesIn Voiceprint As PDFYuanningMa0% (1)

- Revised Taxation Reading MaterialsDocument38 pagesRevised Taxation Reading MaterialsNardsdel RiveraNo ratings yet

- Agreement Where de Vera Undertook To Buy Unit 211-2C of The Condominium ForDocument4 pagesAgreement Where de Vera Undertook To Buy Unit 211-2C of The Condominium ForErxha LadoNo ratings yet

- GAins TaxesDocument2 pagesGAins TaxesMiguel NaborNo ratings yet

- What Is Taxation?: Key TakeawaysDocument1 pageWhat Is Taxation?: Key TakeawaysFatima TawasilNo ratings yet

- Chapter No.-1 Meaning of Tax: OverviewDocument28 pagesChapter No.-1 Meaning of Tax: OverviewAnonymous 3W3153sx4ONo ratings yet

- TaxesrDocument2 pagesTaxesrSoumaya Taha YaafouryNo ratings yet

- Income TaxDocument31 pagesIncome TaxPriyanka BhojaneNo ratings yet

- Tax Management ExplainedDocument2 pagesTax Management ExplainedMICHELLE MILANANo ratings yet

- Taxation: Kinds of TaxesDocument7 pagesTaxation: Kinds of TaxesdanieNo ratings yet

- TaxationDocument20 pagesTaxationBernard OkpeNo ratings yet

- Piy ch06 01.pdf - 161160Document18 pagesPiy ch06 01.pdf - 161160Sorin IonescuNo ratings yet

- Concepts of Taxation: Economics Subject Teacher: Razel G. Taquiso Summer Class 2017Document5 pagesConcepts of Taxation: Economics Subject Teacher: Razel G. Taquiso Summer Class 2017Anonymous mfw5CNq4No ratings yet

- Purposes and Effects of Taxation: CorvéeDocument16 pagesPurposes and Effects of Taxation: CorvéeRuchi JatakiaNo ratings yet

- Revenue and Regulatory TaxDocument11 pagesRevenue and Regulatory TaxLaoMario100% (1)

- TaxationDocument34 pagesTaxationRizi AlconabaNo ratings yet

- Taxation, Imposition of Compulsory Levies On Individuals or Entities by Governments. Taxes AreDocument5 pagesTaxation, Imposition of Compulsory Levies On Individuals or Entities by Governments. Taxes AreIlly Zue Zaine GangosoNo ratings yet

- UNIT-2 Public Revenue: An Overview of PRDocument67 pagesUNIT-2 Public Revenue: An Overview of PRmelaNo ratings yet

- Business Law & TaxationDocument9 pagesBusiness Law & TaxationSabila SanjraniNo ratings yet

- Business Taxation Notes Income Tax NotesDocument39 pagesBusiness Taxation Notes Income Tax NotesvidhyaaravinthanNo ratings yet

- Law On Income TaxDocument10 pagesLaw On Income TaxJuliever EncarnacionNo ratings yet

- TaxationDocument21 pagesTaxationFOREVER FREENo ratings yet

- Introduction to TaxationDocument162 pagesIntroduction to TaxationKabahizi JoelNo ratings yet

- Concept of Taxation - NotesDocument2 pagesConcept of Taxation - Noteswagisha.w70No ratings yet

- Types of Taxes and Their ClassificationsDocument3 pagesTypes of Taxes and Their Classificationstere_aquinoluna828No ratings yet

- Purposes of TaxationDocument17 pagesPurposes of Taxationchi mmyNo ratings yet

- Taxation Powers and Principles ExplainedDocument19 pagesTaxation Powers and Principles ExplainedRia GayleNo ratings yet

- TaxationDocument5 pagesTaxationNameNo ratings yet

- 'Indirect Tax': Another WordDocument6 pages'Indirect Tax': Another WordJoy Prokash RoyNo ratings yet

- Purposes and EffectsDocument16 pagesPurposes and EffectsChelle OcampoNo ratings yet

- Basic Principles of Taxation: (Commissioner v. Pineda, 21 SCRA 105)Document6 pagesBasic Principles of Taxation: (Commissioner v. Pineda, 21 SCRA 105)dsndcwnnfnhNo ratings yet

- Legal Entity State: Government ActivityDocument3 pagesLegal Entity State: Government ActivityEunice Bucao BuesaNo ratings yet

- Purposes of Taxation: Taxation, Imposition of Compulsory Levies On Individuals or Entities by GovernmentsDocument12 pagesPurposes of Taxation: Taxation, Imposition of Compulsory Levies On Individuals or Entities by GovernmentsHsin Wua ChiNo ratings yet

- TaxationDocument18 pagesTaxationJaynalyn MonasterialNo ratings yet

- Taxation 1 MOA HOMEOWNERSDocument22 pagesTaxation 1 MOA HOMEOWNERSRaymundo CanindoNo ratings yet

- What Is Taxation?Document8 pagesWhat Is Taxation?GABRIELLA ANDREA TRESVALLESNo ratings yet

- Fiscal Policy Government Economic Policy International Trade Tariffs Governmental RevenueDocument5 pagesFiscal Policy Government Economic Policy International Trade Tariffs Governmental RevenueImran AliNo ratings yet

- TAXATIONDocument4 pagesTAXATIONByrence Aradanas BangsaliwNo ratings yet

- TaxationDocument3 pagesTaxationGirl Lang AkoNo ratings yet

- What Are TaxesDocument7 pagesWhat Are TaxesNasir AliNo ratings yet

- New Microsoft Word DocumentDocument6 pagesNew Microsoft Word DocumentMahendra TrivediNo ratings yet

- BBINCTAX2Document6 pagesBBINCTAX2Less BalesoroNo ratings yet

- Taxation ConceptsDocument20 pagesTaxation ConceptsRyndel CzarNo ratings yet

- HISTORY AND PURPOSES OF TAXATIONDocument14 pagesHISTORY AND PURPOSES OF TAXATIONVirona FernandoNo ratings yet

- Taxpayer (An Individual Or: Legal Entity StateDocument4 pagesTaxpayer (An Individual Or: Legal Entity StateSaurabh NandyNo ratings yet

- ResearchDocument11 pagesResearcha.2005kamalNo ratings yet

- TaxationDocument2 pagesTaxationShandy DavilaNo ratings yet

- Concepts of Taxation and Income TaxationDocument87 pagesConcepts of Taxation and Income TaxationEugene CejeroNo ratings yet

- TaxationDocument21 pagesTaxationmsjan019100% (1)

- PRINCIPLES OF TAXATION: PURPOSES, THEORIES AND PHILIPPINE TAXESDocument9 pagesPRINCIPLES OF TAXATION: PURPOSES, THEORIES AND PHILIPPINE TAXESVeronicaFranciscoNo ratings yet

- Group 3 ReportingDocument26 pagesGroup 3 ReportingBalontong, Marven Ceasar V.No ratings yet

- Understanding Taxation: Types of Taxes ExplainedDocument5 pagesUnderstanding Taxation: Types of Taxes ExplainedNeel ManushNo ratings yet

- What Are Taxes - en - Text For TranslationDocument1 pageWhat Are Taxes - en - Text For TranslationТеа ДимитроваNo ratings yet

- Introduction To Taxation (Continuation) 1Document3 pagesIntroduction To Taxation (Continuation) 1Jasmin Abigail MoradasNo ratings yet

- GROUP H TaxDocument34 pagesGROUP H Taxmn8y2bwcztNo ratings yet

- Word Eric It AssignDocument11 pagesWord Eric It Assigngatete samNo ratings yet

- Summary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookFrom EverandSummary: The Fair Tax Book: Review and Analysis of Neal Boortz and John Linder's BookNo ratings yet

- What Are The Four Types of Manufacturing ProcessesDocument1 pageWhat Are The Four Types of Manufacturing ProcessesJyasmine Aura V. AgustinNo ratings yet

- MINI PERFORMANCE TSKDocument5 pagesMINI PERFORMANCE TSKJyasmine Aura V. AgustinNo ratings yet

- Classify Animals According To Their Body Parts. 2. Describe The Functions of Each Body Part of AnimalsDocument3 pagesClassify Animals According To Their Body Parts. 2. Describe The Functions of Each Body Part of AnimalsJyasmine Aura V. AgustinNo ratings yet

- Kohlberg Dilemmas: Dilemma IDocument5 pagesKohlberg Dilemmas: Dilemma IkkNo ratings yet

- PERDocument1 pagePERJyasmine Aura V. AgustinNo ratings yet

- What Are The Techniques For Job SimplificationsDocument2 pagesWhat Are The Techniques For Job SimplificationsJyasmine Aura V. AgustinNo ratings yet

- MINI PERFORMANCE TSKDocument5 pagesMINI PERFORMANCE TSKJyasmine Aura V. AgustinNo ratings yet

- Home InventoryDocument1 pageHome InventoryJyasmine Aura V. AgustinNo ratings yet

- VisualizingDocument2 pagesVisualizingJyasmine Aura V. AgustinNo ratings yet

- This Study Resource Was: Use The Following Information For Questions 40 To 43Document9 pagesThis Study Resource Was: Use The Following Information For Questions 40 To 43Jyasmine Aura V. AgustinNo ratings yet

- How To Boost Job SatisfactionDocument3 pagesHow To Boost Job SatisfactionJyasmine Aura V. AgustinNo ratings yet

- Is Severance Pay Taxable?: Supreme Court RuledDocument1 pageIs Severance Pay Taxable?: Supreme Court RuledJyasmine Aura V. AgustinNo ratings yet

- How Do You Start A Business PlanDocument2 pagesHow Do You Start A Business PlanJyasmine Aura V. AgustinNo ratings yet

- How Can We Apply Work Simplification Techniques For Household TasksDocument1 pageHow Can We Apply Work Simplification Techniques For Household TasksJyasmine Aura V. AgustinNo ratings yet

- Do You Get Severance If Your Position Is EliminatedDocument3 pagesDo You Get Severance If Your Position Is EliminatedJyasmine Aura V. AgustinNo ratings yet

- This Study Resource Was: Use The Following Information For Questions 40 To 43Document9 pagesThis Study Resource Was: Use The Following Information For Questions 40 To 43Jyasmine Aura V. AgustinNo ratings yet

- 1 To 111 Thories 1 57Document34 pages1 To 111 Thories 1 57Jyasmine Aura V. AgustinNo ratings yet

- This Study Resource Was: Use The Following Information For Questions 40 To 43Document9 pagesThis Study Resource Was: Use The Following Information For Questions 40 To 43Jyasmine Aura V. AgustinNo ratings yet

- AsdDocument6 pagesAsdJyasmine Aura V. AgustinNo ratings yet

- The 19th Century World of Jose RizalDocument3 pagesThe 19th Century World of Jose RizalJyasmine Aura V. AgustinNo ratings yet

- CHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceDocument5 pagesCHAPTER 8-Revenue Recognition: Construction Contracts Multiple ChoiceJyasmine Aura V. AgustinNo ratings yet

- Partnership Liquidation: Skip To Main ContentDocument3 pagesPartnership Liquidation: Skip To Main ContentJyasmine Aura V. AgustinNo ratings yet

- COA Cirular 85-55-ADocument19 pagesCOA Cirular 85-55-AJesus Carlo Adalla QuirapNo ratings yet

- Educational Technology ChallengesDocument1 pageEducational Technology ChallengesJyasmine Aura V. AgustinNo ratings yet

- Quiz 7Document14 pagesQuiz 7Jyasmine Aura V. AgustinNo ratings yet

- Discuss The Importance of Investment in Increasing Economic GrowthDocument1 pageDiscuss The Importance of Investment in Increasing Economic GrowthJyasmine Aura V. AgustinNo ratings yet

- MBA Fee Structure 2021 2023Document1 pageMBA Fee Structure 2021 2023abhishNo ratings yet

- Certificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncDocument2 pagesCertificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncGuile Gabriel AlogNo ratings yet

- Using Derivatives: What Seniors Must KnowDocument4 pagesUsing Derivatives: What Seniors Must KnowMohammad Sameer AnsariNo ratings yet

- BF ASN InvestmentDocument1 pageBF ASN InvestmentkeuliseutinNo ratings yet

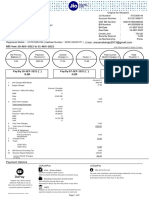

- Jio BillDocument1 pageJio BillNaveen Kumar SomasundarNo ratings yet

- Final Accounts of Banking Company (Lecture 01Document8 pagesFinal Accounts of Banking Company (Lecture 01akash gautamNo ratings yet

- State Bank of IndiaDocument1 pageState Bank of IndiaBala SundarNo ratings yet

- Invitation Letter ERI-CEFE Training LCAPDocument2 pagesInvitation Letter ERI-CEFE Training LCAPJoy VisitacionNo ratings yet

- Stock Market CrashDocument10 pagesStock Market Crashapi-710564150No ratings yet

- Case Study: Alibaba Group: April 2017Document14 pagesCase Study: Alibaba Group: April 2017Mustika ZakiahNo ratings yet

- 3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionDocument15 pages3.3.1 Functions That Are Integral To Business: Financial Reporting SolutionRITZ BROWNNo ratings yet

- 2 Discussion: This GradedDocument85 pages2 Discussion: This GradedkirinNo ratings yet

- Certificate of Creditable Tax Withheld at Source: Sta. Rosa Estate, Brgy. Macabling, Sta. Rosa City, LagunaDocument4 pagesCertificate of Creditable Tax Withheld at Source: Sta. Rosa Estate, Brgy. Macabling, Sta. Rosa City, Lagunaandrea mancaoNo ratings yet

- CB Annual Report 2012 FINALDocument76 pagesCB Annual Report 2012 FINALcrystalmckenzie941No ratings yet

- Nov Spotlight PDFDocument156 pagesNov Spotlight PDFRajat KandolaNo ratings yet

- Chapter-6 - Importing, Exporting and Trade Relations-1Document12 pagesChapter-6 - Importing, Exporting and Trade Relations-1Lysss EpssssNo ratings yet

- Annual Report 2017-2018Document166 pagesAnnual Report 2017-2018Abha SinghNo ratings yet

- YPFB TransporteDocument3 pagesYPFB TransporteCarlos RodriguezNo ratings yet

- Chapter 6 Test BankDocument14 pagesChapter 6 Test Bankrajalaxmi rajendranNo ratings yet

- Cutting and shaping equipment optimizationDocument9 pagesCutting and shaping equipment optimizationLuiz HenriqueNo ratings yet

- Lecture03 SlidesDocument50 pagesLecture03 Slidesaditya jainNo ratings yet

- PSBank Financial Results For The Year 2022 Press Release - PSE Material InformationDocument4 pagesPSBank Financial Results For The Year 2022 Press Release - PSE Material InformationElsa MendozaNo ratings yet

- Botswana: 2020 Annual Research: Key HighlightsDocument1 pageBotswana: 2020 Annual Research: Key HighlightsLisani DubeNo ratings yet

- The Key Success Factors of Availability Payment Scheme Implementation in The Palapa Ring Western Package PPP ProjectDocument9 pagesThe Key Success Factors of Availability Payment Scheme Implementation in The Palapa Ring Western Package PPP ProjectDimas PermanaNo ratings yet